22 min read

Accounts Payable Transformation Roadmap: Step-by-Step Guide

Follow this accounts payable transformation roadmap to standardize workflows, build a reliable forecast, and prevent margin leakage.

In the Accounts Payable Automation Trends 2025 report, AP teams pointed to messy and inconsistent processes as their biggest challenge. The issue now affects 78% of teams, up 14 points from 2024.

To address this challenge, companies are adopting an AP transformation roadmap. It’s often seen as “install automation, process faster, fix all errors.” In reality, though, accounts payable transformation is about rethinking how work flows and decisions are made.

Read on to find out:

What is an accounts payable transformation roadmap?

Balancing speed, control, and technology in AP transformation

Redesigning the invoice lifecycle

A step-by-step accounts payable transformation roadmap

Where to start the accounts payable transformation journey based on your priorities

Challenges to AP transformation

The role of AI and ML in accounts payable transformatio

FAQs about AP transformation roadmap

Key takeaways

What is an accounts payable transformation roadmap?

An accounts payable transformation roadmap is a practical plan for moving AP from a mostly manual, back-office function into a controlled, automated, data-driven payables operation. In plain terms: it’s the step-by-step path from “we process invoices” to “we control spend, pay correctly and on time, and use AP data to improve cash flow and reduce risk.”

Why accounts payable process transformation matters right now

- Lean finance teams are under increasing cost pressure: Finance is expected to do more with fewer people, so manual invoice handling and fragmented processes become a bottleneck fast.

- Compliance is getting stricter: Governments are pushing digital reporting and standardized e-invoicing, which forces process and system changes beyond just scanning invoices.

- Automation is shifting from OCR to touchless processing: The bar is moving toward straight-through processing (STP) with minimal human intervention. Modern AP benchmarks now focus on touchless rates, exception handling, and supplier self-service.

- Better AP is a working-capital lever: Faster, more accurate processing helps capture discounts, avoid late fees, prevent duplicate payments, and improve cash forecasting.

Balancing speed, control, and technology in AP transformation

AP teams often move quickly to automation, only to find that speed doesn’t solve underlying issues. In the following subsections, we’ll show how to think about efficiency versus control, and why the right approach to technology makes all the difference.

Efficiency vs. control: Why speed isn’t the real goal of the accounts payable transformation roadmap

Many AP transformations start with the same question: “How fast can we process invoices?” It’s a natural instinct since faster approvals mean fewer late payments, as well as happier vendors and suppliers. But over-optimizing for speed can create real problems:

- Duplicate payments: Rushing approvals increases the chance of paying the same invoice twice.

- Compliance risk: Policies and clean audit trails are more easily overlooked when speed is the priority.

- Audit findings: Small mistakes that slip through can turn into bigger problems later, drawing extra scrutiny and potential penalties.

Consider the alternative mindset: “How confidently can we pay the invoices we should, the way we should?” This approach to accounts payable process transformation shifts the focus from sheer throughput to controlled, accurate, and compliant payments. It’s the difference between moving quickly and moving wisely.

Efficiency vs. control in the accounts payable transformation roadmap

| When speed is the main goal | When control is the priority |

|---|---|

| Success is measured by how fast invoices move through the queue | Success is measured by how reliably invoices are approved and paid correctly |

| Approvers are pushed to “clear the backlog” | Approvals follow clear rules, thresholds, and assigned responsibilities |

| Invoices are approved with minimal checks to avoid delays | Invoices are automatically validated against POs and receipts |

| Duplicate or incorrect invoices slip through more easily | System checks catch duplicates, mismatches, and missing data early |

| Compliance is handled manually or after payment | Compliance requirements are embedded into workflows and audit trails |

| Audits uncover issues requiring time-consuming reconstruction | Audit trails are consistent, complete, and ready without extra work |

| AP teams spend time correcting errors and answering questions | AP teams focus on real exceptions and value-added tasks |

The better way to measure AP performance isn’t how many invoices you process per day, but how well you process them. Some meaningful metrics include:

- First-time-right (FTR) payments: How many invoices are processed and approved correctly without rework.

- Exception rates: How often invoices trigger errors or require manual intervention.

- Approval predictability: How consistent and reliable approval workflows are, even under peak volume.

- Audit outcomes: How easily you can demonstrate compliance during reviews.

Technology-led vs. process-led accounts payable digital transformation

Many AP initiatives stall not because of flawed technology, but because of the backwards approach. Organizations often start with a technology-led transformation: they implement software, digitize invoices and approvals, but keep the existing policies and workflows intact.

At first glance, this seems like progress. After all, invoices move faster through the system, and dashboards show increased throughput. But underneath the surface, other problems emerge:

- High exception volumes: Old approval rules, inconsistent coding, and unclear responsibilities generate errors that automation alone cannot resolve.

- User workarounds (“shadow AP”): Teams bypass the system, email invoices, or process them manually because the new tool doesn’t fit the way they work.

- Limited ROI: Faster processing doesn’t translate into fewer errors, better controls, or actionable insights.

The alternative is a process-led accounts payable transformation, where technology supports clearly defined, consistent ways of working:

- Standardized invoice intake: Everyone submits invoices in a consistent format and channel.

- Clear invoice categories: Each type of invoice has defined rules for coding, approval, and exceptions.

- Defined exception paths: Outliers are handled systematically, with visibility and accountability.

- Governance before automation: Policies, roles, and controls are clarified before introducing software.

This approach flips the equation: instead of automating chaos, the company automates a well-designed process. Technology then amplifies the benefits of good practices and makes approvals faster, errors less frequent, and reporting more reliable.

Technology-led vs. process-led accounts payable digital transformation

| Technology-led transformation | Process-led transformation |

|---|---|

| Start by implementing software | Start by defining how AP should work |

| Existing policies and workflows remain unchanged | Policies, roles, and controls are clarified first |

| Invoices move faster, but problems persist | Invoices move predictably and correctly |

| High exception volumes caused by unclear rules and coding | Fewer exceptions due to standardized rules and categories |

| Users create workarounds (emails, manual processing, “shadow AP”) | Users follow the system because it matches real workflows |

| Automation highlights issues but can’t fix them | Automation reinforces well-designed processes |

Redesigning the invoice lifecycle

An accounts payable transformation roadmap doesn’t work when only individual stages are automated. Meaningful changes happen when you step back and redesign the entire invoice lifecycle, from the moment an invoice enters the organization to the moment it becomes usable financial insight. An end-to-end view of the process helps teams spot bottlenecks, reduce rework, and build workflows that can handle growth without breaking.

A typical invoice lifecycle includes the following stages:

Intake

Invoices arrive through many channels: email, paper mail, supplier portals, or EDI. When intake isn’t standardized, invoices get lost, duplicated, or delayed before processing even begins.

Validation

Invoices are checked for basic accuracy and compliance—correct supplier details, amounts, tax data, and alignment with contracts or policies. Manual validation slows everything down and increases the risk of missed errors.

Coding

Invoices are assigned the correct GL accounts, cost centers, projects, or departments. When coding is poorly guided, results vary by user, creating inconsistencies that ripple into reporting and audits.

Approvals

Invoices move through approval workflows for sign-off. Overly complex approval chains, unclear ownership, or “approve everything” rules create delays and frustration for both AP and approvers.

Matching

Invoices are matched against purchase orders, receipts, or contracts. Missing data or inconsistent references turn routine invoices into exceptions that require time-consuming investigation.

Payment

Approved invoices are scheduled and paid. Errors or delays here directly affect cash flow, discount capture, and supplier trust.

Reconciliation

Payments are posted to the general ledger and checked for accuracy. Discrepancies at this stage often trace back to earlier lifecycle issues, not payment execution itself.

Reporting

Invoice data is used for visibility into spend, accruals, and cash forecasting. If earlier stages weren’t standardized and accurate, reporting becomes reactive and unreliable.

Each step reinforces the next one. That’s why when you fix approval routing without addressing intake, or automate matching without improving coding, bottlenecks simply move elsewhere. Only by looking at the accounts payable process transformation as a complete system can you reduce friction, enforce controls, and achieve true efficiency.

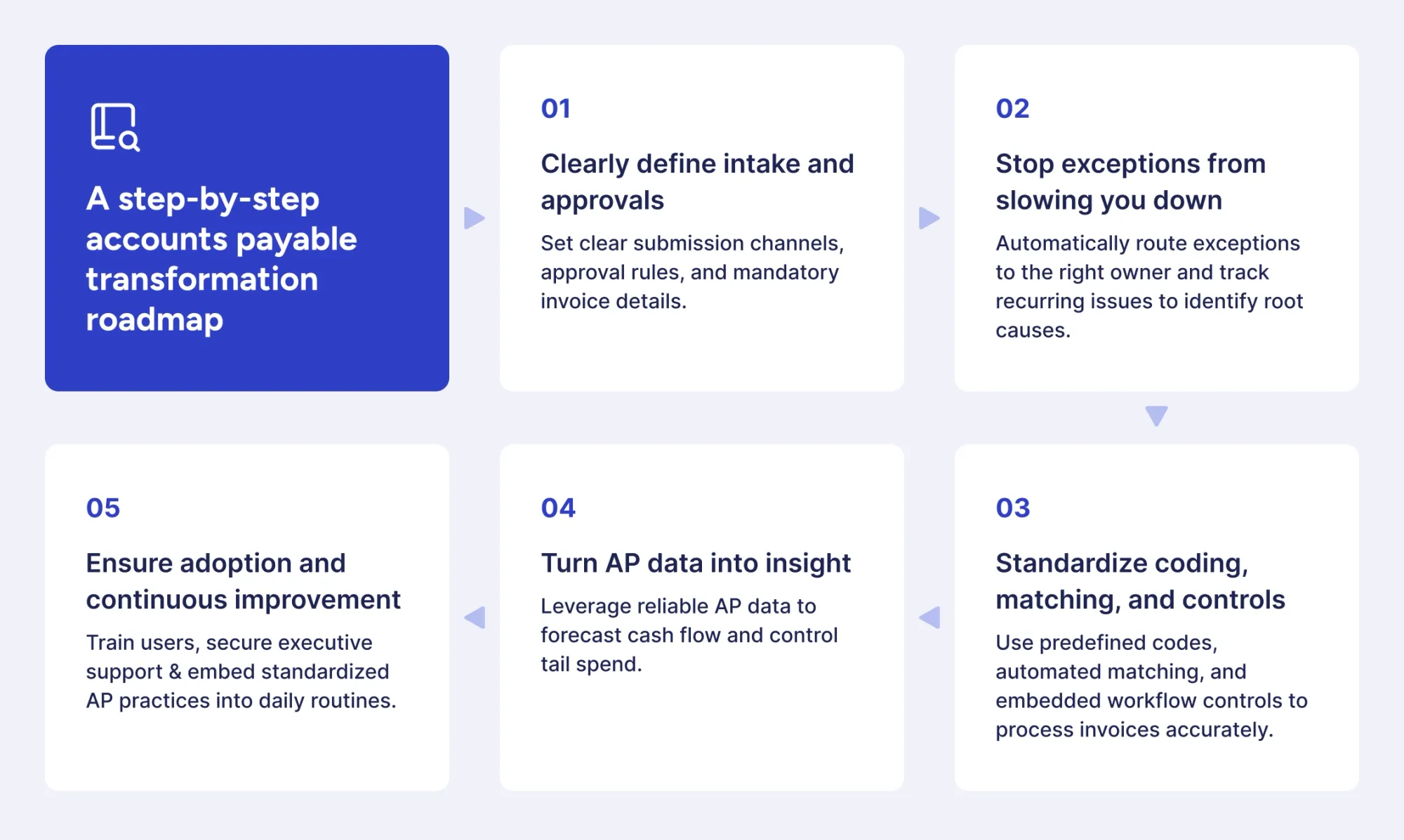

A step-by-step accounts payable transformation roadmap

AP transformation is a journey. Teams that succeed follow a clear, step-by-step progression and fix the foundation first before adding speed, automation, and insight.

Step 1: Clearly define intake and approvals

The moment an invoice enters AP, the process either sets up efficiency or chaos. When invoices arrive through multiple channels and lack consistent information or clear approval rules, the AP team spends more time correcting errors than processing payments. Standardized intake and approvals create a predictable foundation for the next steps in the accounts payable transformation roadmap.

What to do:

1. Standardize submission channels

- Decide on a limited set of accepted channels: email, a supplier portal, or EDI.

- Communicate the rules clearly to all suppliers. Avoid “mixed-mode” submissions that require AP to track invoices in multiple places.

- Consider using a centralized portal or automation tool (for example, Precoro) as the single source of truth for invoices and supplier communication.

2. Define clear approval rules

- Map out who needs to approve which type of invoice (PO, non-PO, recurring, ad hoc) and set approval thresholds.

- Make sure approval responsibilities are unambiguous and consistently applied across departments.

- Automate workflow wherever possible to reduce delays and manual follow-ups.

3. Require complete information upfront

- Set mandatory fields like PO numbers, supplier details, tax information, and project or cost codes.

- Communicate these requirements to suppliers, and consider using templates or structured submission forms.

- Return incomplete invoices immediately rather than fixing them internally. This practice reinforces good intake habits and gradually reduces low-quality submissions.

Think of AP as a gatekeeper rather than a repair shop. Early intervention prevents errors from traveling downstream. While it may feel strict at first, suppliers quickly adapt, and the volume of problematic invoices drops. A clean, standardized intake not only speeds approvals but also reduces exceptions and improves data quality for the entire accounts payable process transformation.

Step 2: Stop exceptions from slowing you down

Most AP time and effort is spent on exceptions: the invoices that don’t match expectations and require someone to step in, investigate, and make a decision. This is where teams struggle the most and where the accounts payable transformation roadmap creates the biggest return.

What to do:

1. Route exceptions to the right owner

Not every problem belongs to AP. Pricing discrepancies often fall under procurement, missing receipts under operations, and supplier errors are sent back to the vendor. Use automated workflow rules to route each exception directly to the person who can resolve it. This way, AP retains visibility and control but is no longer the bottleneck.

2. Track and analyze patterns

Instead of just fixing individual invoices, collect data on exceptions.

- Repeated issues with the same suppliers often point to contract or PO accuracy problems.

- Frequent approval delays usually signal overly complex approval rules.

- Coding errors tend to highlight unclear guidance or missing defaults.

Use dashboards to spot recurring trends and track resolution times.

3. Address root causes

Repeated issues signal systemic problems. Common root causes include unclear contract terms, incomplete POs, missing coding guidance, or inconsistent supplier instructions. Fix these upstream issues to reduce the volume of exceptions over time, instead of forcing teams to address the same problems again and again.

Step 3: Standardize coding, matching, and controls

Once invoices are coming in cleanly and exceptions are under control, the next step in the accounts payable transformation roadmap is to ensure every invoice is processed consistently and accurately. Without standardization, even advanced automation just magnifies mistakes instead of reducing them.

What to do:

1. Use guided coding and defaults

- Set up predefined GL accounts, cost centers, project codes, and departments for different invoice types.

- Where possible, automate coding based on supplier, PO, or invoice category.

- Provide clear guidance on manual coding when invoices fall outside standard scenarios.

2. Define matching rules clearly

- Establish exact rules for matching invoices to POs, receipts, or contracts (Precoro performs three-way matching automatically).

- For non-PO invoices, define thresholds and approval requirements to prevent bottlenecks.

3. Embed controls in workflows

- Incorporate approvals, compliance checks, and validations directly into automated workflows.

- Ensure policies for tax, VAT, spend limits, and segregation of duties are applied consistently.

- Make controls transparent so approvers and auditors can see they’re being enforced without manual intervention.

Avoid ad hoc overrides. Let automation enforce rules for your accounts payable digital transformation consistently. Standardized coding and matching build a foundation for reporting, analytics, and strategic insights.

Step 4: Turn AP data into insight

Once intake, approvals, coding, and invoice reconciliation are standardized, AP becomes a strategic source of financial insight. With consistent and accurate AP processes in place, you get trustworthy information. Teams can spot trends, plan cash needs in advance, and make better decisions for finance and procurement.

What to do:

1. Forecast liabilities and accruals accurately

- Track approved and pending invoices consistently for accurate payment timing predictions.

- Incorporate expected exceptions and approvals in the forecast for a realistic view.

2. Gain visibility into non-PO and tail spend

- Track off-contract purchases and small recurring expenses that often go unnoticed through a centralized procurement platform.

- Identify opportunities to consolidate vendors and negotiate better terms.

3. Analyze recurring issues to identify bottlenecks or process gaps

- Track approval timelines and workloads to balance staffing and prevent delays.

- Evaluate supplier performance with scorecards based on timeliness, invoice quality, and compliance to guide procurement decisions.

Use a system that offers a real-time view of exceptions and invoice statuses. That way, you can act proactively without waiting for monthly reports to spot issues.

Step 5: Ensure adoption and continuous improvement

Even the smartest AP system and most carefully designed processes won’t deliver results if people don’t use them consistently. Adoption is what turns the accounts payable process transformation from a project into a lasting capability.

What to do:

1. Provide targeted training for every role

Use short, focused sessions and real examples from your own invoices—it sticks better than long, generic training.

- AP staff need hands-on instruction on new workflows, approvals, and exception handling.

- Managers and approvers should understand how to review and approve invoices efficiently within the system.

- Suppliers benefit from guidance on the correct invoice submission through the chosen channels.

2. Secure visible executive support

Leadership must communicate that the accounts payable transformation roadmap is a strategic priority, not just a back-office upgrade. It’s also important to recognize and award teams that make the effort to follow the new process, so the change feels supported, not forced.

3. Make data your feedback loop

- Track metrics like exception rates, approval times, and payment accuracy regularly.

- Review recurring issues, bottlenecks, or supplier errors to identify where workflows, rules, or training need adjustment.

- Treat every exception as an opportunity to improve the accounts payable process transformation, not just a problem to fix.

4. Embed AP practices into daily routines

Make compliance, coding, approvals, and exception handling a natural part of everyday work, rather than last-minute tasks. An AP automation system like Precoro can help make this happen by:

- Guiding users through each step: Automated workflows enforce approval rules, coding defaults, and validation checks so nothing is skipped.

- Highlighting exceptions in real time: The system shows pending approvals, duplicate invoices, and discrepancies from three-way matching.

- Tracking behaviors automatically: The platform logs approvals, coding decisions, and complete audit trails for each invoice, helping teams stay consistent and auditors see everything clearly.

Over time, these built-in practices become habits. Teams spend less time fixing mistakes and more time focusing on forecasting and supplier relationships, while the system consistently applies compliance and controls.

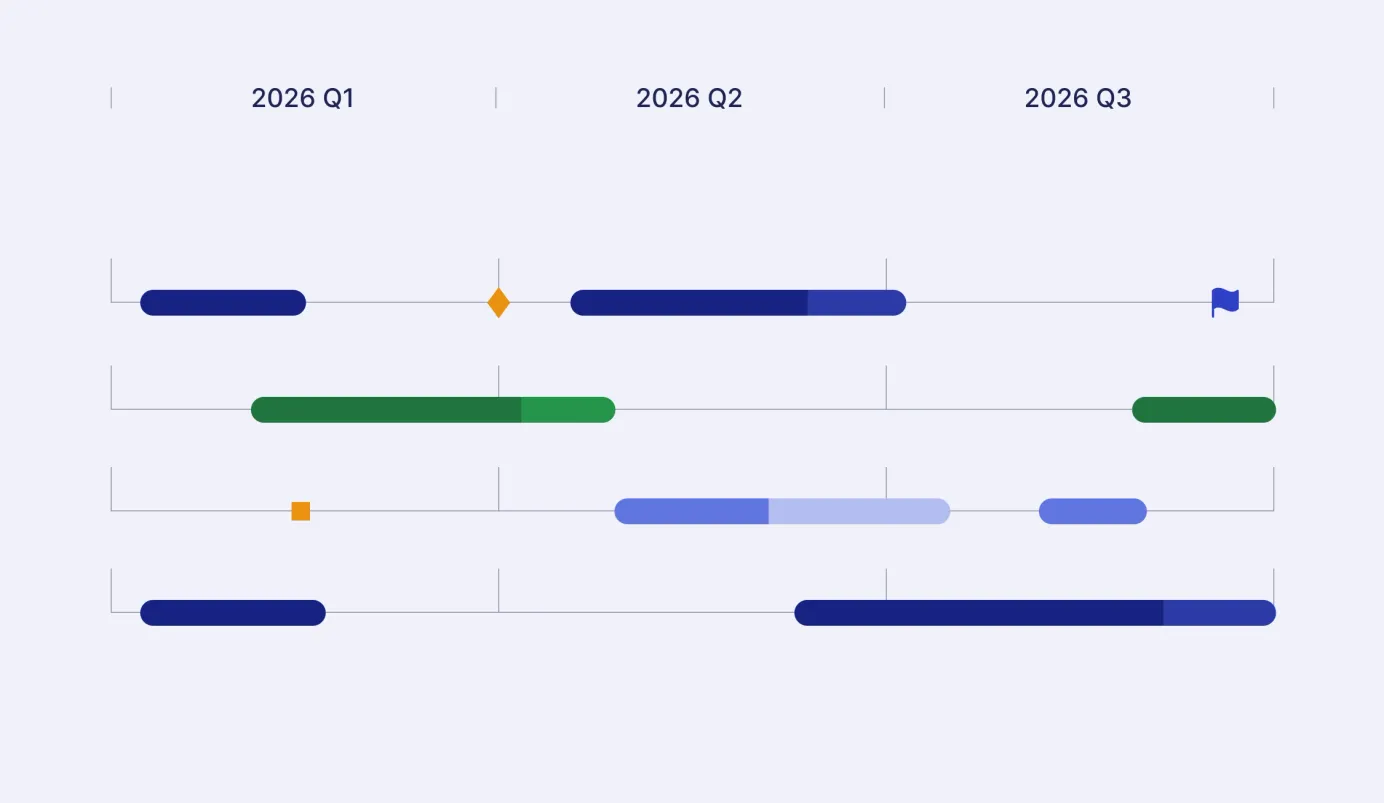

Where to start the accounts payable transformation journey based on your priorities

Every company has different pain points in AP. While the full accounts payable transformation roadmap follows a logical progression, you don’t always have to start at Step 1. Depending on your organization’s priorities, you can focus first on the areas that create the biggest impact.

Here’s how you can approach transformation depending on what matters most to your team:

Speed and touchless processing—Focus on PO-backed invoices first

If your goal is faster processing and fewer manual touches, begin the accounts payable transformation with invoices that are tied to purchase orders. Set up automatic three-way matching and approval thresholds so routine, low-risk invoices move straight through without manual review. This step alone can remove a large chunk of AP’s daily workload.

Don’t leave invoices without POs to ad hoc handling. Route them through predefined paths based on spend category, cost center, or amount, with guided coding and clear approval rules. That way, even non-PO invoices follow a predictable flow instead of bouncing between inboxes.

Reducing supplier inquiries—Focus on transparency and communication

If your AP team spends a large part of the day answering “Did you receive my invoice?” or “When will I be paid?”, the real issue isn’t responsiveness but a lack of visibility.

Start by giving suppliers a single place to submit invoices and check their status. An AP system with a supplier portal like Precoro that shows whether an invoice is received, under review, approved, or scheduled for payment removes the need for back-and-forth emails. Automated status notifications handle most updates before suppliers even think to ask.

Pair this with a clearly communicated payment calendar (for example, weekly or bi-weekly payment runs). When suppliers know how and when payments are processed, uncertainty drops.

Avoiding duplicate payments and errors—Focus on controls and validations

When duplicate payments and errors keep slipping through, the real solution is to build smarter safeguards into your AP system, not just add more manual checks. Start by using AP software that automatically flags potential duplicates based on invoice number, supplier, amount, and date range before an invoice reaches payment.

For PO-backed invoices, rely on automated two- or three-way matching to catch price or quantity mismatches early, not after payment. For non-PO invoices, require structured coding and approvals so nothing bypasses review.

Vendor and bank details should never be changed solely via email. Use verification workflows that require confirmation and approval before updates take effect.

Compliance and regulatory readiness—Focus on e-invoicing and structured data

In many markets today, e‑invoicing isn’t just a future possibility; it’s becoming an official requirement. In fact, more than 80% of countries are implementing or planning structured e‑invoicing mandates, especially in Europe and Asia‑Pacific.

The EU’s VAT in the Digital Age (ViDA) initiative requires that, by 2030, all cross‑border B2B invoices must be structured and machine-readable (for example, using the EN 16931 standard). Several EU countries are already enforcing their own e‑invoicing rules.

In practice, this means invoices can’t just be sent as PDFs. Instead, they arrive in a structured, machine-readable format that your AP system can process automatically. If e-invoicing is a priority in your accounts payable transformation roadmap, choose a system that enables you to:

- Receive supplier invoices pre-filled with key data (invoice numbers, amounts, tax codes, PO references, and supplier details) so there’s no need for manual entry.

- Validate invoices automatically against contracts, POs, and tax rules before they reach AP staff. Missing fields, incorrect totals, or compliance issues are flagged instantly.

- Maintain a complete digital audit trail, logging every invoice, approval, exception, and payment without extra manual work.

- Meet regulatory requirements smoothly, such as EU mandates for structured e‑invoices or real-time VAT reporting, without last-minute scanning, reformatting, or workarounds.

For example, Precoro already supports e-invoicing in France, Germany, Belgium, and Mexico, with more countries planned for the future.

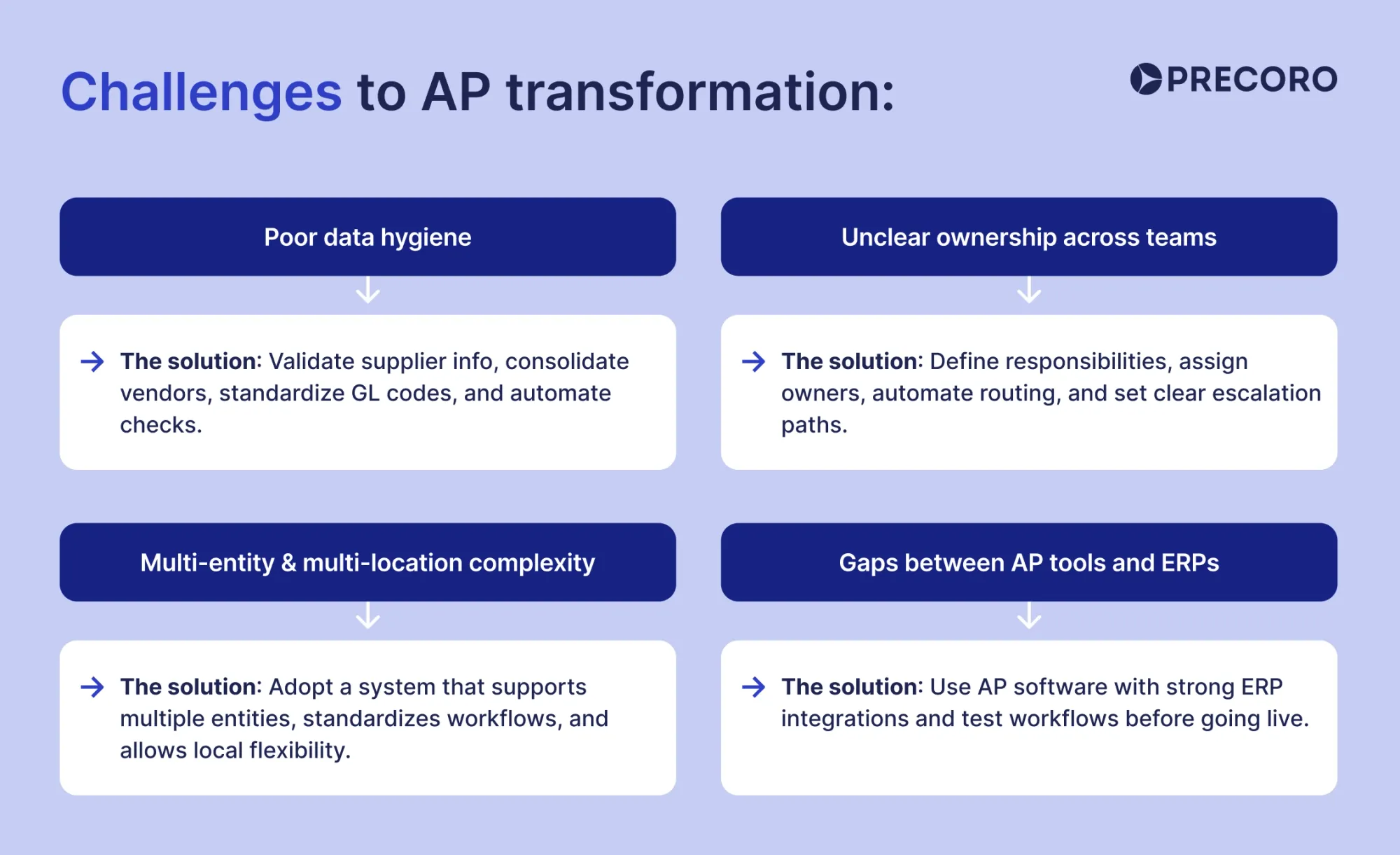

Challenges to AP transformation

Even with a strong accounts payable transformation roadmap and automation tools, AP teams can run into roadblocks. These challenges reflect practical, real-world issues that go beyond workflow design and compliance.

Poor data hygiene across systems

Old or inconsistent vendor records, duplicate supplier accounts, and mismatched GL codes can undermine automation. For example, auto-matching may fail if invoices reference the wrong supplier ID or PO, and reconciliation turns into a headache when coding defaults assign expenses incorrectly. As a result, reporting and analytics hide exceptions or misrepresent spend.

The solution: Start your accounts payable transformation with a data cleanup initiative:

- Consolidate duplicate vendors and standardize naming conventions.

- Align GL accounts, cost centers, and project codes across systems.

- Validate supplier tax IDs, bank details, and contact information.

- Ensure continuous data accuracy with automated checks for duplicates or missing fields.

Unclear ownership across teams

Accounts payable process transformation spans multiple teams, including finance, procurement, operations, and sometimes IT. Without clearly defined responsibilities, delays are inevitable: invoices can get stuck because no one knows who should resolve issues, and supplier records may go outdated if it’s unclear who’s responsible for updates.

The solution: Define roles and responsibilities upfront:

- Assign a single owner for each type of task (e.g., supplier updates, PO exceptions, approvals for invoices above a certain threshold).

- Document workflows so everyone knows who acts on what, and at what stage.

- Automate routing wherever possible, so the system enforces ownership and reduces ambiguity. Tools like Precoro let you set multi-level approval workflows, define approval deadlines, and see exactly where bottlenecks happen.

- Set escalation paths for stalled approvals or unresolved exceptions.

Multi-entity or multi-location complexity

Companies operating across multiple subsidiaries, offices, or currencies face unique challenges in AP. Duplicate vendor records can appear across entities, approval hierarchies may differ by location, and tax rules often vary by jurisdiction. Even with a strong AP system, these differences can create errors, delays, or inconsistent reporting if not addressed.

The solution: Adopt a system that supports multi-entity management. For example, in Precoro you can switch between legal entities or locations within a single account.

- Maintain a centralized supplier database to prevent duplicates and conflicting information, but allow each location to add local-specific details (like branch contacts or local tax IDs) without overwriting the global record.

- Standardize core approval workflows and thresholds across the organization for consistency, but give local teams the ability to add additional approvals or modify routing for regional regulations or operational needs.

- Configure your system to manage currency conversion, VAT/GST, and country-specific tax rules per entity.

- Before rolling out changes organization-wide, test new workflows in one or two locations. Gather feedback from local AP staff to fine-tune rules, thresholds, and approval paths before scaling globally.

Gaps between AP tools and ERPs

Many organizations attempt to add AP automation on top of an ERP that wasn’t built for modern AP workflows. This can create friction if systems speak different “languages”—for example, mismatched data formats, missing APIs, or inconsistent coding rules. Without proper integration, automation often breaks down, forcing teams into manual fixes and workarounds that slow progress along the accounts payable transformation roadmap.

The solution: Prioritize an AP automation tool that offers integrations with your other systems.

- Map how your ERP handles suppliers, invoices, and approvals before layering automation (identify where fields, codes, or workflows differ).

- Test rules, matching, and validation in a sandbox environment to ensure automation behaves as expected before going live.

- Use a system that logs every transaction and change across platforms to maintain auditability and visibility.

This way, AP automation doesn’t just sit on top of your ERP, but complements it, enforces consistency, and actually reduces manual work rather than creating new steps.

The role of AI and ML in accounts payable transformation

As AI and machine learning (ML) are on the rise, let’s explore how they can reduce manual work and make AP processes more efficient.

Automated invoice capture and classification

Invoices arrive in many formats: PDFs, scanned paper, emails, or e-invoices. AI can automatically extract key information, including invoice numbers, dates, amounts, tax, PO numbers, and supplier details, without manual entry. For example, Precoro uses AI-powered OCR to accurately pre-fill invoices in the system, no user action required.

ML can also recognize invoice types (PO-backed, non-PO, recurring) and suggest GL accounts, cost centers, or projects based on historical patterns.

Smarter matching and exception handling

ML analyzes historical invoice data to predict which invoices might fail PO matching or trigger exceptions. It allows systems to route potential problem invoices to the correct owner, prioritize high-risk cases, and process low-risk ones automatically.

Fraud and duplicate detection

ML identifies unusual patterns that could indicate duplicate invoices, incorrect vendor details, or potential fraud. For example, it can:

- Detect duplicates even with minor differences in dates or invoice numbers

- Flag invoices outside normal ranges or unexpected changes in bank details

Predictive analytics and autonomous insights

AI can turn AP data into actionable intelligence:

- Forecast cash outflows by analyzing pending invoices, approvals, and payment terms

- Spot opportunities for early payment discounts

- Track supplier behavior trends, like recurring errors or late submissions

Reality check: AI isn’t fully autonomous (yet)

AI can automate a large share of routine work and simplify accounts payable digital transformation, but fully autonomous accounts payable (where systems approve everything without human involvement) is still unrealistic. Today’s AI is strongest at handling volume, spotting patterns, and highlighting risks, while decisions involving contracts, judgment calls, or unusual scenarios still need people.

In practice, AI and ML create real value in AP by reshaping everyday work:

- They take over high-volume, repetitive tasks, reducing manual entry and processing errors.

- They surface the right exceptions, so AP teams spend time reviewing meaningful issues instead of every invoice.

- They provide forward-looking insights to help finance and procurement anticipate cash needs, supplier issues, and potential savings.

In practice, AI and ML make AP more efficient and predictable—not fully autonomous, but far easier to manage at scale.

Frequently asked questions about the accounts payable transformation roadmap

Start with invoice intake and approvals. Standardize where invoices enter the system, what information must be captured, and who is responsible for approvals. Clear rules here reduce errors and prevent bottlenecks downstream. Once intake and approvals are controlled, move on to matching to ensure invoices align with purchase orders and receipts. Payments should be optimized last, as they rely on upstream accuracy and process discipline.

Not necessarily. ERP systems can support your accounts payable transformation journey if they can handle invoice intake, rule-based workflows, supplier communications, exception management, and reporting without manual workarounds. If your ERP struggles with these functions, consider adding a dedicated AP automation layer. For example, Precoro offers an AP module with its own pricing plan and integrates with a wide range of ERPs and accounting tools.

Non-PO invoices lack the built-in checks, as they aren’t linked to the approved purchase orders. Best practice is to create a separate non-PO workflow:

- Segment invoices by type: recurring, contract-based, or ad hoc.

- Require key information upfront (vendor, amount, department, purpose).

- Use guided coding to ensure accurate GL assignment.

- Apply approval thresholds where low-risk non-PO invoices flow through a simplified workflow (still logged, coded, and approved, but faster), while the high-risk or unusual invoices trigger a full, multi-step review.

Touchless processing depends on invoice type and complexity. For PO invoices, 60–80% touchless is achievable for most teams. For overall invoices (including non-PO), 40–60% touchless is realistic. Instead of chasing a perfect 100%, focus on reducing exceptions, improving accuracy, and making approvals predictable.

Focus on metrics that let you track outcomes, such as reduced exceptions, fewer duplicate or incorrect payments, faster approval times, improved discount capture, and more accurate accruals and cash forecasts. You can also monitor supplier inquiries and audit findings as qualitative indicators of smoother, more controlled AP operations.

Key takeaways

Accounts payable transformation is a journey, not a one-time project. The companies that succeed focus first on building a solid foundation: standardized invoice intake, clear approval rules, consistent coding, and embedded controls.

Once processes are reliable, AP can move from reactive execution to proactive insight and forecast cash needs, track supplier performance, and spot bottlenecks before they cause problems. AI and ML handle routine tasks, highlight exceptions, and provide predictive intelligence, but human control remains essential for complex approvals and unusual invoices.

Adoption is the final piece: even the smartest system delivers limited value if people don’t follow it consistently. Role-specific training, executive support, and daily habits that reinforce compliance, coding, and exception handling turn transformation into lasting capability.

Ultimately, technology is just one part of the accounts payable transformation roadmap. The real driver is creating predictable, transparent, and efficient processes that empower teams and strengthen financial control.

Ready for digital transformation in accounts payable?

Software alone won’t fix broken processes, but the right system makes good practices stick. With Precoro, you can centralize all invoices, simplify communication with vendors, resolve exceptions early, and spot potential fraud in no time. Set up your workflows once, and let Precoro automatically enforce them, while you retain full control.