14 min read

What Is Spend Management and Why Is It Important?

To earn money, a business needs to spend money first. Raw materials, maintenance services, and qualified employees are just a few on the long list of typical company expenditures.

Spending must be planned and managed accordingly. Keep reading to find out more about:

- What is spend management?

- Types of expenditures to consider

- Difference between spend management and expense management

- Steps to build a spend management system

- Importance of spend management

- Challenges of spend management

- Risks of poor spend management

- Software for smooth spend management

- Frequently asked questions

What is Spend Management?

Spend management is a set of practices for controlling how a business spends money. Companies typically select supplementary software to help support this process, and the best practice management app can streamline these efforts.

Spend management allows for efficient sourcing and procurement, regulated expenses, timely registration of spontaneous purchases, and a reduction of fraud and errors.

As a comprehensive approach, spend management typically includes management of suppliers, categories, approval workflows, inventories, and documents. It's about tracking and analyzing business spending practices.

Types of Spending

Spend management deals with various types of business expenditures, from a startup’s first investments all the way to its regular business expenses.

Some of these are procurement and administrative costs, research and development expenditures, employee salaries and expenses, payments to vendors and suppliers, and outsourced services.

These purchases might be recurring or occasional, some might be planned, and others pop up in response to sudden changes. How can we differentiate between them?

To understand this spending better, let’s divide and conquer the different types of expenditures.

Managed vs. Unmanaged

Managed spend is any expenditure that’s happening under contract, meaning company representatives have been involved in sourcing, selecting, negotiating, and signing the contract. In other words, it happens within the company’s defined procurement cycle.

Unmanaged spend, on the other hand, happens outside of the procurement cycle. It includes purchases, often one-offs, that have been made without any contract or previous bidding and negotiation. Such spending usually stems from emergency situations and cannot be planned for.

Direct vs. Indirect

Direct spend, also called direct cost or direct procurement, involves purchases that are directly related to the production of a company’s final product or service.

Direct spend involves materials, goods, and services that a company needs in order to produce its own goods or services which are then sold to its customers.

Indirect spend, also known as indirect cost or indirect procurement, encompasses all other expenditures required for the business to run.

For instance, in a factory that produces wires, aluminum is used for manufacturing the final product, and therefore is a part of direct spend. But packaging material for shipping would be included in the indirect spend.

Operating vs. Non-operating

This category indicates whether the spending relates to the company’s core spending.

Operating costs are repeated expenses that stem from the day-to-day business operations. Both direct and indirect spend items can be included in this category.

These can be, for example, costs of raw materials for production. Administrative expenses for renting an office would also fall under this category, and so would marketing expenses for advertising the product. Any expense incurred from the day-to-day running of the company can be characterized as an operating cost.

Non-operating costs, however, are expenses that do not stem directly from the core business operations. These include, for example, interest charges and taxes.

Fixed vs. Variable

These terms indicate whether an expense fluctuates over time.

Fixed costs don't vary with the volume of goods produced or services provided. These are the expenses that must be paid regardless of the production volume. They usually don't apply directly to production. For example, office or warehouse rent, insurance, and employees' salaries.

Wages for contractors, on the other hand, would fall under variable costs. Variables are expenses that fluctuate based on how much the company produces and sells; accordingly, variables usually rise when production volume rises. Some other examples of such costs would be product expenses on raw materials and product packaging.

Spend Management vs. Expense Management

Though often used interchangeably, spend management and expense management are not exactly the same.

Expense management is a narrower term that deals specifically with individual employee spending, for example, travel expenses or business lunches. Expense management software is used to register, track, reimburse, and audit employee expenses in accordance with the company’s policies.

Spend management, on the other hand, is a broader term referring to the system for controlling the company’s total expenditures. It's a complex process that includes supply chain, procurement, invoice, and inventory management.

Spend management considers various types of expenses, such as inventory and equipment purchases, software subscriptions, logistic payments, full-time employee salaries, and so on. It also incorporates employee expenses.

Spend management stems from the big-picture approach to how the company spends money, and expenses are a part of it. Therefore, expense management is a sub-category of spend management.

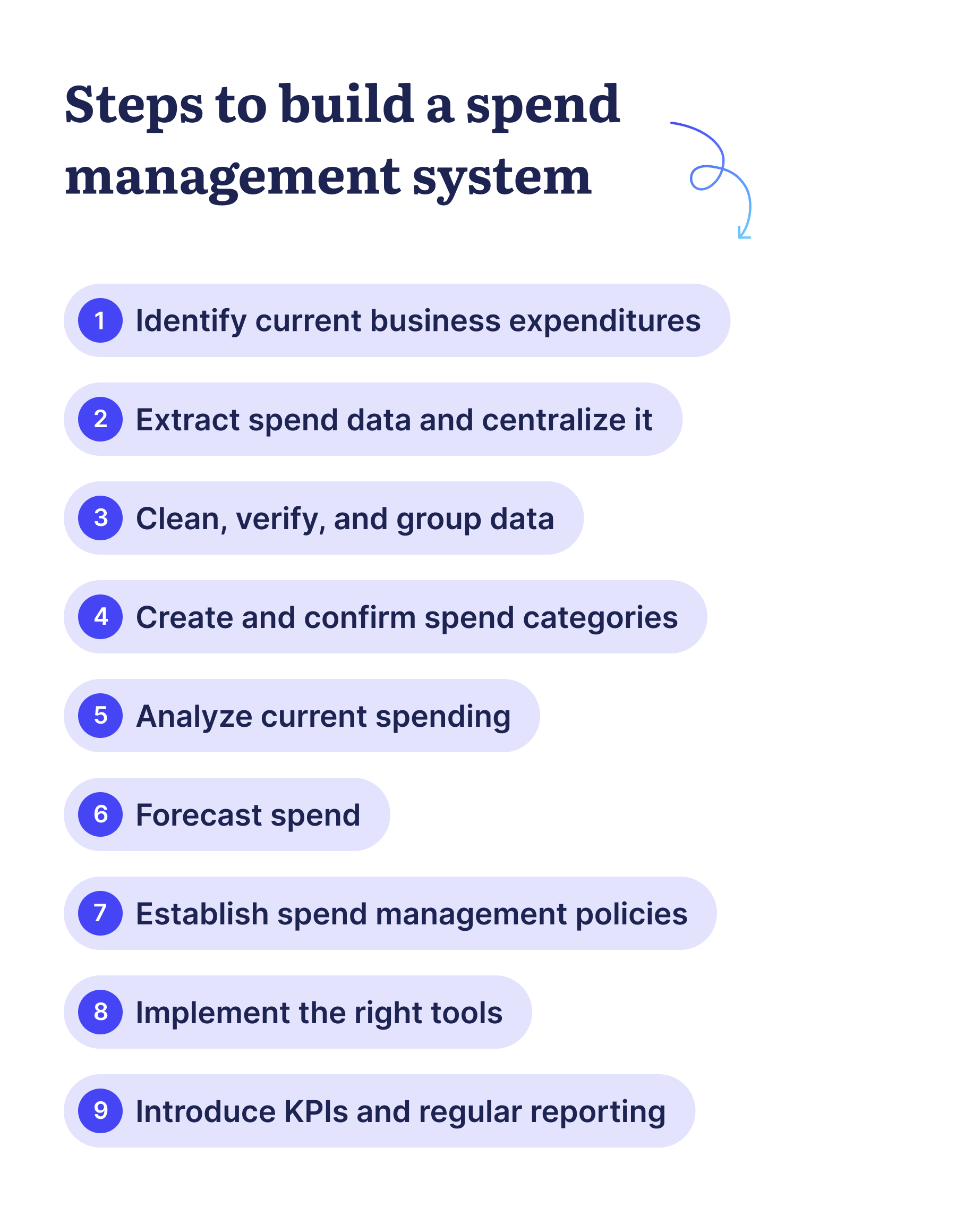

Steps to Build a Spend Management System

Each company adjusts its spend management process individually based on its industry, size, structure, and other specifics. An efficient spending strategy is grounded in the real-life spending data of the company.

There's no universal scenario applicable to every company, but the following 9-step process can serve as a starting point for building a custom spend management system.

Identify current business expenditures

The spend management process starts with identifying the company's expenditures. It's best to collect documentation such as purchase requisitions, purchase orders, receipts, supplier invoices, paychecks, etc. to discern: What is the company paying for?

Extract spend data and centralize it

Get as much information about the expenditures as possible, for example, prices, names, delivery terms, types of goods and services, payment terms, etc.

Such data can be found in documents, in emails, an accounting system, or even on printed hard copies. However, for the sake of safety and accessibility, it's better to gather and digitize expenditure data to store it in one safe place.

Clean, verify, and group data

Just collecting data isn't enough; it needs to be processed in order to make sense. That means removing duplicates, ensuring that data is recorded in a single currency and in one format, correcting possible spelling mistakes, verifying suppliers' and employees' names, etc.

It's a good idea to have the department heads and other responsible professionals confirm that the clean data is legit.

Clean and transparent data is then ready for further analysis. It’s a good idea to search for as many regularities and exceptions as possible. With this step, it will become obvious that some expenditures fall under the same category in regard to purpose, department, and nature of payment, and can therefore be grouped together.

Create and confirm spend categories

It’s now possible to define spending categories. Categories are created based on existing data and are helpful in planning for future payments. Spend categories are unique for each business but can include, for example, supplier contracting, raw materials procurement, advertising expenses, salaries, office supplies, etc.

It's a good idea to confirm spending categories with department heads and other stakeholders.

Analyze current spending

Next, cleaned and categorized data can be analyzed to determine how a company spends money. What is the largest spending category? How many payments are made monthly? How fast are invoices and payments processed? Are business lunches paying off? Has the company qualified for any discounts?

Answering some of these questions is a good start, and then there's no limit to the depth of analysis.

Forecast spend

With an understanding of current expenditures, it’s possible to plan future ones. It's useful to prepare short- and long-term forecasts, bearing in mind that the long-term ones might require a review over time.

Does the current spending tempo take your business where it needs to be? Can you meet business goals with lower funds, or are further investments required? How is the market looking, and are there any changes that might affect your business?

These and other questions help finance teams forecast spending based on current cash flow. Improving forecasts over time is also a part of the spend management strategy.

Establish spend management policies

Knowing what current spending looks like and having prepared a forecast for how it should look in the future, it's now time to find the ways to arrive from point A to point B.

Establish spend management policies for procurement and employee expenses. Those policies should be clear so that everyone in the organization understands procedures and avoids making obvious mistakes.

Implement the right tools

People are more likely to follow the established workflows and comply with the policies if it's easy to do so.

There’s a much higher chance that employees will submit reports, requests, orders, receipts, and other documents on time if they can do so via a user-friendly platform. With the right tools, employees can submit, review, edit and confirm documents immediately, often even on the go.

Introduce KPIs and regular reporting

When expenditures are divided into different categories and recorded thoroughly and on time in the centralized database, they can be analyzed at any given moment.

Spend managers measure a company’s performance with KPIs based on specific business goals and objectives. Regarding procurement, there are many KPIs to consider, with four main groups: cost-saving, quality, delivery, and inventory KPIs.

KPIs are important for strategic sessions at the end of a defined period, for example, as part of an annual report. But also, with interim reporting managers can recognize flaws in the system and adjust workflows on the go.

Finally, regular reporting guarantees better accountability, as everyone involved is ready to have their work progress evaluated continuously.

Why Spend Management Is Important

Spend management is among the top priorities for companies that approach business strategically and plan to drive business growth.

Without a clear understanding of their expenses, companies risk running out of cash and facing serious problems. A spend management system, however, helps to avoid this and drives up a company’s profits by eliminating excessive expenditures, reducing costs, and identifying cost-saving opportunities. Organizations can then redirect finances towards business growth and development.

Spend management is important to companies of all sizes across various industries, as it provides control levers and transparency, both of which are needed in order to do business efficiently. Well-managed expenses provide security and stability to the stakeholders.

Here are a few of the key benefits of spend management.

Accurate and centralized financial data for spending insights

Having a proper spend management system implemented also means having well-arranged data. After all, in order to manage expenses they must primarily be documented.

Information is usually extracted, aggregated, and organized in one centralized software database. Real-life spending data from across departments is the most trustworthy source of how the company really spends.

More real-time spend visibility

Spend management allows for real-time expense tracking. With established purchasing guidelines, clear requesting and approval workflows, and the right tools, procurement managers can follow spending activities and recognize potential problematic issues on time.

That helps reduce maverick spend and improve both the bottom line and cash flow.

Improving cash flow

With a spend management system in place, managers can ensure stable cash flow by processing accounts payable and accounts receivable on time. By estimating amounts to pay and to receive, responsible managers can prepare for it and guarantee required cash at the company’s disposal, thus reducing the need to borrow money.

Recognizing saving opportunities

Additionally, spend management helps protect companies from cash leaks and inefficiencies in the spending process. Finance teams can identify weak spots in the current setup and suggest ways to eliminate them.

For instance, approval bottlenecks and delays in recording invoices can result in late payment penalties or missed early payment discounts. But with well-managed spending, administrative tasks will go quickly and won’t block other tasks.

Clear spending policies lead to increased productivity

Spend management enables the discovery and elimination of inefficiencies that would otherwise prolong work processes. Whether it’s a workflow with unnecessary approval steps, issuing a purchase order well above the budget limit, or a suboptimal choice of delivery company – once discovered, it can be improved with the help of purchase order software.

Companies create spending guidelines and approval workflows to tailor purchasing and paying processes to their current structure and business objectives.

Better sourcing opportunities

By analyzing all the costs involved in sourcing and procurement, responsible specialists can find the most suitable offers on the market.

The strategic sourcing process itself isn't free, therefore spend management includes reviewing the cost of contracting the vendor and maintaining that relationship. It also takes into account prices of the vendor's products or services and their delivery.

With all that information available, supply chain managers can identify and select suppliers who yield the most value.

Numbers and facts allow organizations to take an advantageous stand and earn trust in negotiations with suppliers. This results in better offers, which, if locked by the negotiating manager, contribute to improving the company’s bottom line.

Later, having spend under control helps improve supplier relationships, as a company can prove itself as a trustworthy partner for suppliers and vendors.

Better risk management

Spend management reveals weak spots in procuring and purchasing processes, helps to identify possible risks, and to find ways to minimize the probability of their occurrence.

For instance, perhaps there's one department which always pays late. Maybe the market price for a specific commodity is progressively increasing. Or, it’s possible that someone is approving expenses that are well over the limit.

If risky situations or behaviors are recognized on time, managers can take necessary steps to deal with them.

Challenges of Spend Management

Like any complex process, spend management involves certain challenges. It takes will, effort, and time to design and implement a good system.

Aggregating data is a time-consuming process

Aggregating and organizing data can be a tedious and time-consuming process. Going through the chunks of often confusing and, at first sight, unclear information can be exhausting and require many hours of work by a dedicated data analyst.

Selecting the right software to process data can also become a challenge, especially when it’s the first technological solution they’ve implemented. To find a fitting software, company representatives might need to test several of them or even refer to external consultants for help.

Categorizing expenditures can be complicated

Organizing company spending into categories requires a deep understanding of the business structure and department specifics. It needs to be done by an individual with the proper qualifications, otherwise expenses might end up incorrectly classified.

Category management can be exhausting, especially when it requires researching the needs of particular business units or employees. It might take even longer to go through all expenditures, determine their purposes, and group them.

Managing relationships with vendors and suppliers is sometimes overlooked

Spend management isn’t always about the numbers. To get the best deals and see them happen, employees need to apply their analytical and communication skills to build good relationships with vendors.

It might be challenging to enter negotiations with vendors and suppliers, as it requires a comprehensive knowledge of the market and substantial time for preparation. Some companies choose to hire consulting firms to prepare negotiation pitches.

And even then, work doesn’t end once the deal is closed – supplier management is an ongoing process. Companies that do not invest in maintaining good relationships with their suppliers eventually lose them to the competition.

What Are the Risks of Poor Spend Management?

Managing spending is key for financial stability, but it’s not just about whether or not it’s done – quality is important, too. While efficient management can enable companies to significantly improve their bottom line, poorly organized spend management results in more problems than benefits.

A company’s procurement department isn’t the only group that will feel the effects of bad spend management; the negative consequences can spread to various departments, especially those which depend on materials or services to operate.

Operational disorganization

One of the first problems of poor spend management is that it can leave company expenditures and employee actions disorganized and misaligned. This results in multiple people working on the same task simultaneously – a waste of resources – or, on the flip side, no-one tackling an issue or task that needs to be handled.

Increased Costs

Poor spend management causes suboptimal workflows, unclear guidelines, and insufficient control. These ultimately contribute to increased procurement costs and higher expenses in general.

For instance, the organization might miss out on early-bird deals or even miss payment deadlines, the latter of which will result in incurred fees. Poor spend management can also lead to mistakes or even falling victim to fraud, both of which cost companies money.

Meanwhile, when companies don’t understand how to efficiently tackle their own needs and processes, they end up hiring extra hands to deal with tasks, which is a long-term drain on company funds.

Low efficiency

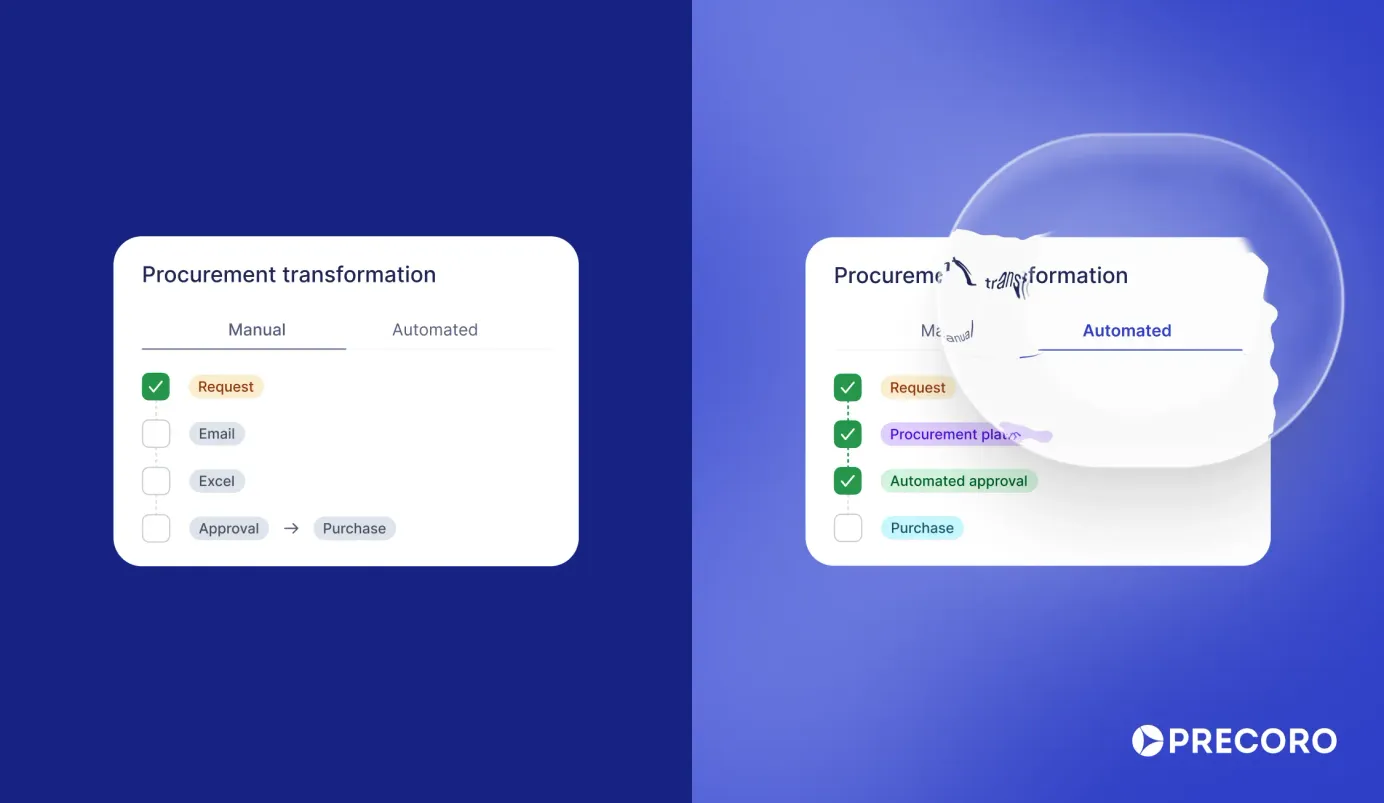

A poor spend management system usually doesn’t incorporate software solutions and relies solely on manual processes. This becomes very demanding on employees, who process expenditures via emails, phone calls, or even traditional letters.

Manual dependence increases the chance of human errors or even fraud, especially when employees become overloaded due to busy times or understaffing. Ultimately the result can be loss of profit, legal repercussions, or even bankruptcy.

Lack of transparency

Poorly organized spend management also leads to a lack of transparency. Without structured workflows and centralized data, responsible employees are not immediately aware of what is going on with the expenditure, and, therefore, cannot react promptly.

It’s hardly possible to hold someone accountable for mistakes or intentional fraud when employees' actions are untraceable.

Isolated information

Without an integrated company-wide spend management system and data centralization tool, each department might handle information in a different way and unintentionally keep it isolated from the rest of the company.

Such data silos pose a threat to informational integrity and safety within the company and make data accessibility highly dependent on specific employees with access to storage systems.

Poor Supply Chain Management

When an unprofessional spend management system doesn't pay enough attention to the supply chain, a company will most likely end up with inadequate deals, unfavorable terms, or unreliable vendors and delivery options. These, in turn, lead to an increase in procurement costs.

Software for Smooth Spend Management

Managing expenditures is easier and more efficient with dedicated software. Spend management software is a one-stop shop for requesting, recording, tracking, and paying all the company's expenses.

Such software allows employees to collaborate on purchases and payments, and to streamline time-consuming, day-to-day tasks by automating them. This way, businesses can cut costs pertaining to the administrative process and ultimately save money.

With a dedicated spend management solution, it only takes minutes to initiate the procurement cycle or register an expense and, in most cases, it can be done on the go from anywhere.

Implementing spend management software allows everyone involved to access centralized data according to user permissions, which ultimately helps create a cost-conscious culture. Employees who track the purchasing process will be able to see the big picture and will be empowered to search for saving opportunities.

There are numerous spend management software solutions available on the market. And while no two are identical, all tools should offer the basic set of features:

- Capabilities to aggregate data and safely store it

- Real-time tracking of expenditures

- Real-time collaboration on documents

- Easy document recording and matching

- Customizable payment options

- Request and approval automation

- Notifications – in-app or via external channels

- Reports and analytics

Sophisticated spend management solutions also offer API integrations with other solutions, for example, accounting software or ERP platforms.

When selecting a software solution, managers need to evaluate options for user-friendliness. It might take some time for employees to learn how to request, record, and track expenses and purchases. Thus, the software acceptance rate might depend on how simple it is to onboard and in everyday use.

Frequently Asked Questions

A spend management system helps drive up a company’s profits by eliminating excessive expenditures and reducing costs. Spend management provides control levers and transparency, both of which are needed in order to do business efficiently and ensure security and stability.

Business expenditures can be broken up into various types, which include: managed and unmanaged, direct and indirect, operating and non-operating, fixed and variable.

In Conclusion

Spend management is a set of practices that companies introduce to control how money is spent.

The term is often used interchangeably with expense management, however these are not the same. While expense management deals specifically with registering, tracking, and reimbursing employee expenses, spend management is a broader concept.

Spend management encompasses employee expenses, but also sourcing and procurement, spontaneous spendings, reporting and analytics, and forecasting of company expenditures.

An effective spend management system is rooted in the company’s real-life spending and is adjusted to the specific industry, size, structure, and business needs.

Spend management is among top priorities for companies that approach business strategically, as it helps predict and eliminate excessive expenditures, reduces costs, and drives up the company’s profits.

Managing expenditures is easier and more efficient with dedicated software, as it enables collaborations on purchases and payments and speeds up many day-to-day tasks by automating them. Spend management software also serves as a safe, centralized database with convenient access to company information.