14 min read

Expense Reports: A Comprehensive Guide

Sometimes, things just have to be paid here and now, so employees reach into their pockets to cover the work-related expenses with their own money. And that's okay, as long as the company reimburses that cost. For this to happen, expense reports must come into play.

Let's talk more about these reports. Global Business Travel Association released a study in which they assert that completing an expense report for a single-night hotel stay costs on average $58 and takes about 20 minutes. At the same time, one in five expense reports contains errors, which take another 18 minutes and $52 to correct.

Multiply that by however many expense reports your company usually processes, and the cost of reporting will most likely be quite significant. On top of this, it takes quite a lot of time, which could be better invested elsewhere.

However, we believe that with a good understanding of the expense reporting process and the proper workflow setup, a company can improve its spend management and accounts payable beyond the "average" level. In this guide, we'll go over the following aspect of expense reports:

- What is an expense report

- Who needs expense reports and why

- Types of expense reports

- Information in the expense reports

- How to create and process an expense report

- Tips for fast and easy reporting

- Frequently asked questions

What Is an Expense Report?

An expense report is a document that itemizes expenses incurred by employees while they perform their job duties and lists the details related to each expenditure. Expense reports tell accounting departments how much to reimburse employees for their purchases, but they also help companies track overall business spending.

The need for expense reports arises when:

- Employees spend their own money on behalf of the company and request reimbursement;

- Employees have a corporate card and must report and justify payments made with it.

Non-employees can also sometimes submit an expense report and request reimbursement. For instance, a project-based contractor of an interior design studio can require reimbursement for a business lunch with one of the studio’s customers.

What Do We Mean by Expenses

Expenses are costs incurred by a company in order to keep it running. Employee-incurred expenses can be anything they had to pay in order to fulfill job duties. Organizations typically distinguish expenses in several ways: by frequency, amount, and purpose.

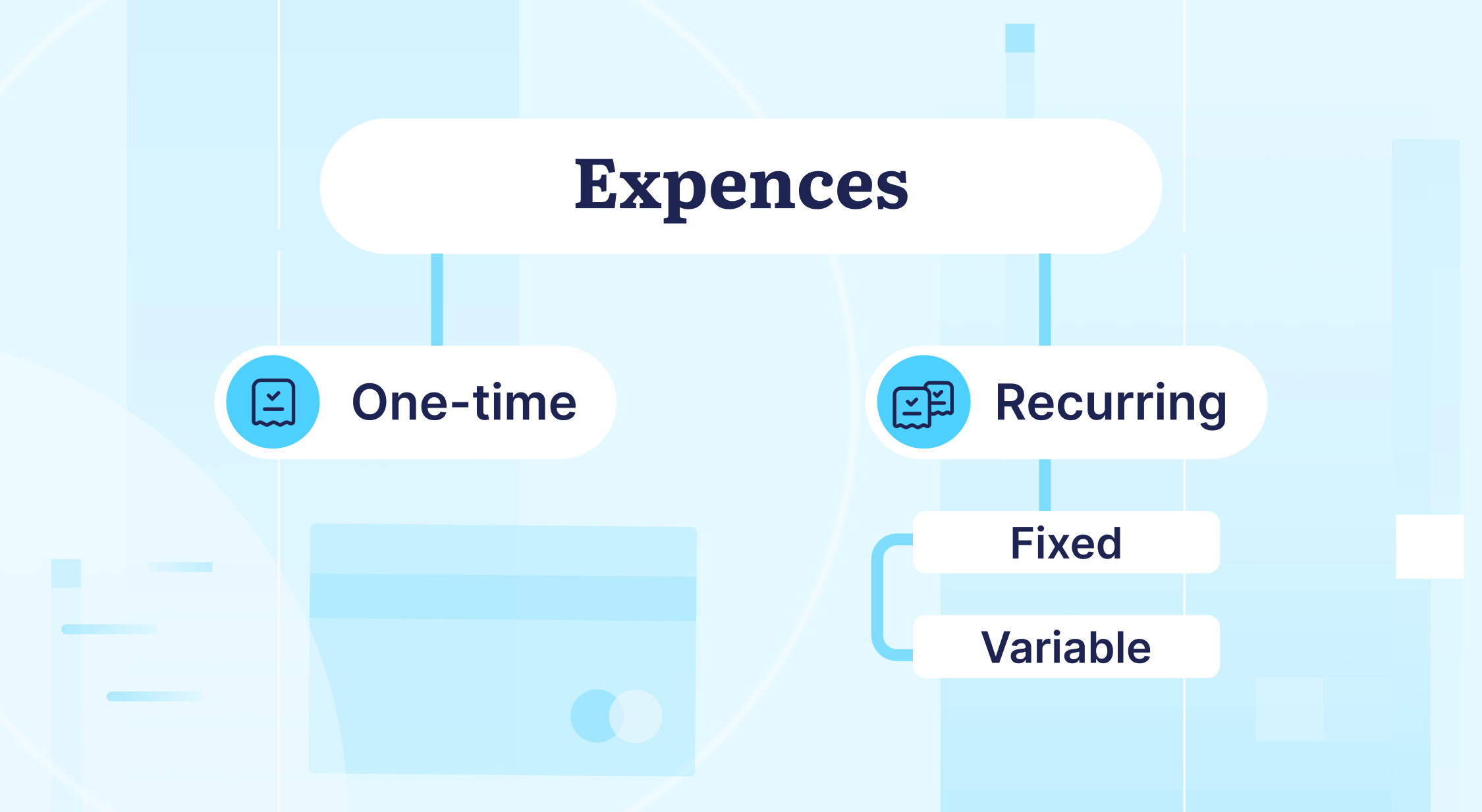

Frequency-wise, expenses can be one-time and recurring. A one-time expense is non-recurring. Examples of such payments include business lunches, events, or relocation costs. Sometimes, one-time expenses, such as emergency repairs, are also unforeseen. One-time charges are typically variable and depend on the specific situation.

On the other hand, many business expenses are ongoing and occur regularly — mostly weekly, monthly, quarterly, or annually. Such costs can include, for instance, insurance payments, rent, or office supplies. Recurring expenses can then be distinguished by the cost types:

- Fixed. Such payments typically remain the same whenever an employee buys goods or renders services. For instance, software subscriptions or insurance payments would be considered fixed expenses. They can change, but over more extended periods of time, when supplier contracts are renegotiated or renewed.

- Variable. Costs of such expenses differ from time to time. The cost typically depends on the number of purchased items or the complexity of provided services. Examples of such expenses include packaging materials or logged working hours of the company driver.

When it comes to purpose, there are many expense categories. While category management may vary for different businesses, there are some typical categories under which employees usually report expenses: business travel, car rentals, mileage when a personal vehicle is used for business, business meetings, office supplies, equipment, software, etc.

Who Needs Expense Reports and Why?

The process of recording, organizing, and documenting employee or contractor expenses is called the expense reporting process. It's a fundamentally important part of the company's financial strategy to achieve the estimated bottom line. Expense reports are essential for employees reporting payments and the organizations recording them.

Employees

An expense report is important for any employee who wants to get a reimbursement for purchases made on behalf of the business. Creating and submitting the report is usually the only way to receive back money that was paid out-of-pocket.

Employees also submit expense reports to justify payments with company-provided cards. Each company has spending policies for its employees and contractors, and every payment must fall within the allowed categories and limits. Employees must prove that an expense is in agreement with the company policies, and they typically do so by providing a receipt and listing on the expense report what kind of purchase it was.

Companies

At the same time, expense reports are indispensable to businesses, as they serve as a record to help companies track expenses of employees, which are essential for a comprehensive picture of the company's costs. Businesses use expense reports to:

- Reimburse employees;

- Understand what the company spends money on;

- Organize business expenses by department and categorize them;

- Maximize taxation efficiency and returns;

- Prepare for audit.

Employee and contractor expenses on behalf of the company constitute a large part of the total business expenses. By monitoring expense reports, the finance team and upper management can analyze different spending categories company-wide and by department. In doing so, they can get a realistic picture of how much the company really spends on certain activities.

With this information at hand, businesses can compare actual versus budgeted expenses and adjust spending accordingly. Budgets already include costs, usually based on previous expense history, but it's essential to tune the plans to reality. Management can decrease or increase allocated budgets by filtering out unnecessary costs or, alternatively, allowing employees to spend more.

Expense reports are also crucial for categorizing expenditures in preparation for taxation. Many expenses are tax deductible, so the financial team can use this documentation to identify categories of business expenditures and see which ones qualify for tax relief. Various countries have different categories of expenses they use in their tax forms, so hiring a tax advisor might be a good idea.

To save time in the future and qualify for tax deductions, the finance team can configure expense report templates using tax-form spending categories. That way, a business will be able to process expenses for taxation purposes much easier, faster, and with little to no omissions.

Expense reports are used by all kinds of companies. With hundreds of employees, mid-size and large businesses process thousands of expense reports annually. Smaller companies have significantly fewer employees and, therefore, fewer payments in general. But more of these expenses tend to be covered out of employees' pockets. Therefore, submitting reports is even more important for smaller businesses.

Types of Expense Reports

Each organization should customize expense report templates to resemble the business structure and spending needs. But there are a few types of expense reports that businesses will typically use. Let’s go over them.

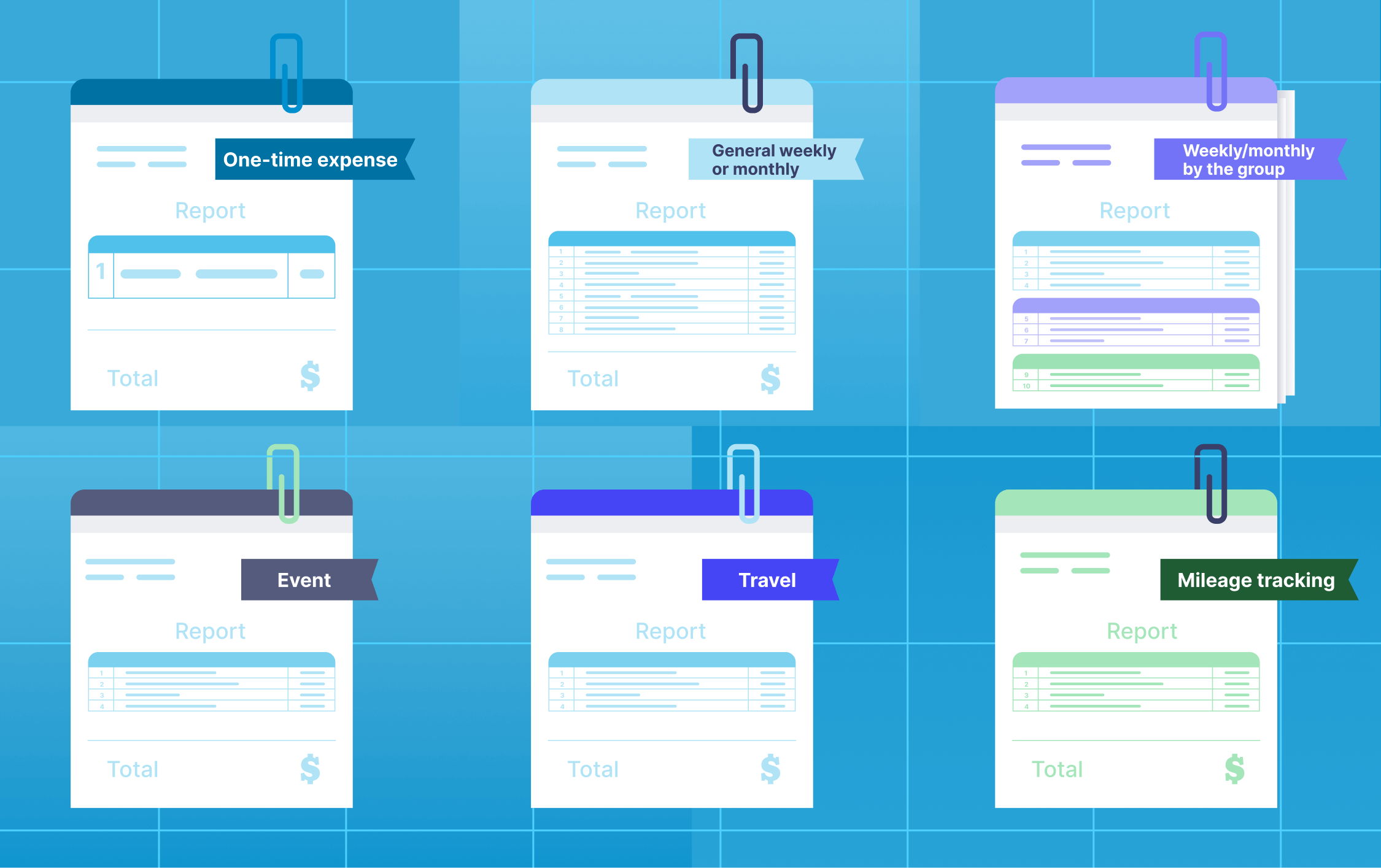

One-time expense report

The most basic expense report contains information about a one-time payment situation. It’s used by employees who don’t regularly incur any expenses in the company name but have a rare occasion where they need to do so.

General weekly or monthly expense reports

Many companies will have employees submit a regular expense report on a weekly or monthly basis. It includes all business expenses incurred by the employee during this time frame. In such a report, costs can be grouped by categories, departments, client accounts, projects, etc.

Weekly or monthly expense report by the selected group

Such a report includes all the expenses that happened in a given week or month but filtered by one selected criteria: category, department, client account, project, etc.

Event expense report

This kind of report contains expenses an employee had to incur in order to organize and hold a specific event. Expenses included in this type of report aren’t limited by any timeframe other than the event’s duration.

Travel expense report

This type of report is for tracking expenses during a business trip. Such a report usually includes standard categories of travel related expenses, such as airfare, accommodation, on-the-ground transportation, and meals.

Mileage tracking report

This type of report is a little different from the rest; it’s relevant when an employee requests reimbursement for business rides they made with their own vehicle. Such reports require specific information, such as odometer readings, total distance traveled, purpose, and destinations.

Information in the Expense Reports

You may notice that expense reports are very different from company to company: some are very detailed, and others might look like a mere formality. A company’s spending and reporting policies make a great deal of difference when it comes to what goes on expense reports. While some information is mandatory, other data is optional or even omitted.

Here’s what you might see on an expense report:

- Contact information of the expense initiator includes data about an employee or contractor submitting the report, such as name, department, and personal ID number (if relevant).

- Contact information of the company representative. This might be the manager responsible for processing the report, an accounts payable team member, or anyone else assigned to do the job of receiving and reviewing expense reports.

- Goods or services purchased and their quantity. This usually includes the name of the item or service and its quantity: in pieces, kilograms, hours, or any other relevant unit of measurement.

- A description of the expense. A brief description helps the reviewer understand why employees or contractors had to cover the cost out of their pocket and the purpose of the expense.

- The price per piece and total cost of the expenditure. An absolutely must-have of any expense report is the price paid for the items, including information about tax applications.

- Applied budget (if relevant). If the expense happened within a defined budget, employees or contractors must state that in the expense report. This way, they ensure that the AP team considers the budget limits during the approval process. Otherwise, an expense might be considered over-budget and unnecessary, and reimbursement might be declined.

- Expense category. It should be clear from the report under which cost category each expenditure falls. Also, categorizing expenses is crucial for processing them by the AP team and recording them in the general ledger.

- A client, department, or project to which the expense should be charged (if relevant). Some companies may need additional grouping of the expenses. For instance, larger organizations might separate expenses by the departments they should be charged to. In some cases, there can also be a client's account to which the company would charge the expenses. For instance, an attorney would submit to their law firm a report with a reimbursable expense for the lunch with the client.

- A vendor or supplier. It might be necessary to provide the name of the seller from which the specific item was purchased or whose services were rendered.

- A timeline. There are several dates relevant for the expense reports: the date the expense happened (it should correspond with the date on the receipt), the date when the report was submitted, and the expected day of payment (especially if the payment deadline isn't set in stone by the company policy).

- Payment information for each expenditure. This part includes information about how payment was made — by cash, credit card, check, etc.

- Receipts or other payment confirmations. Companies typically require receipts to verify the purchase information in the expense report before reimbursing employees. In some cases, such as for small purchases, they may waive this requirement.

- The subtotal of expenses by categories, departments, or accounts. Depending on the organization's need for further financial or procurement analysis, expenses might be grouped so that subtotals can be calculated separately.

- The total of all expenses.

- The amount of cash advances paid to the employee (if relevant).

- The total due for reimbursement.

- Notes. Additional notes might be added for each expense at the discretion of an employee or if explanation is required by the company.

- Signature. An expense report should be confirmed with the signatures of the employee submitting it (confirming the accuracy of the provided information) and by their manager (after verifying the report).

How to Create and Process a Business Expenses Report

Creating an expense report is rather simple. If an employee has all the information prepared and the report templates are comprehensive and easy to work with, it should take no more than a few minutes.

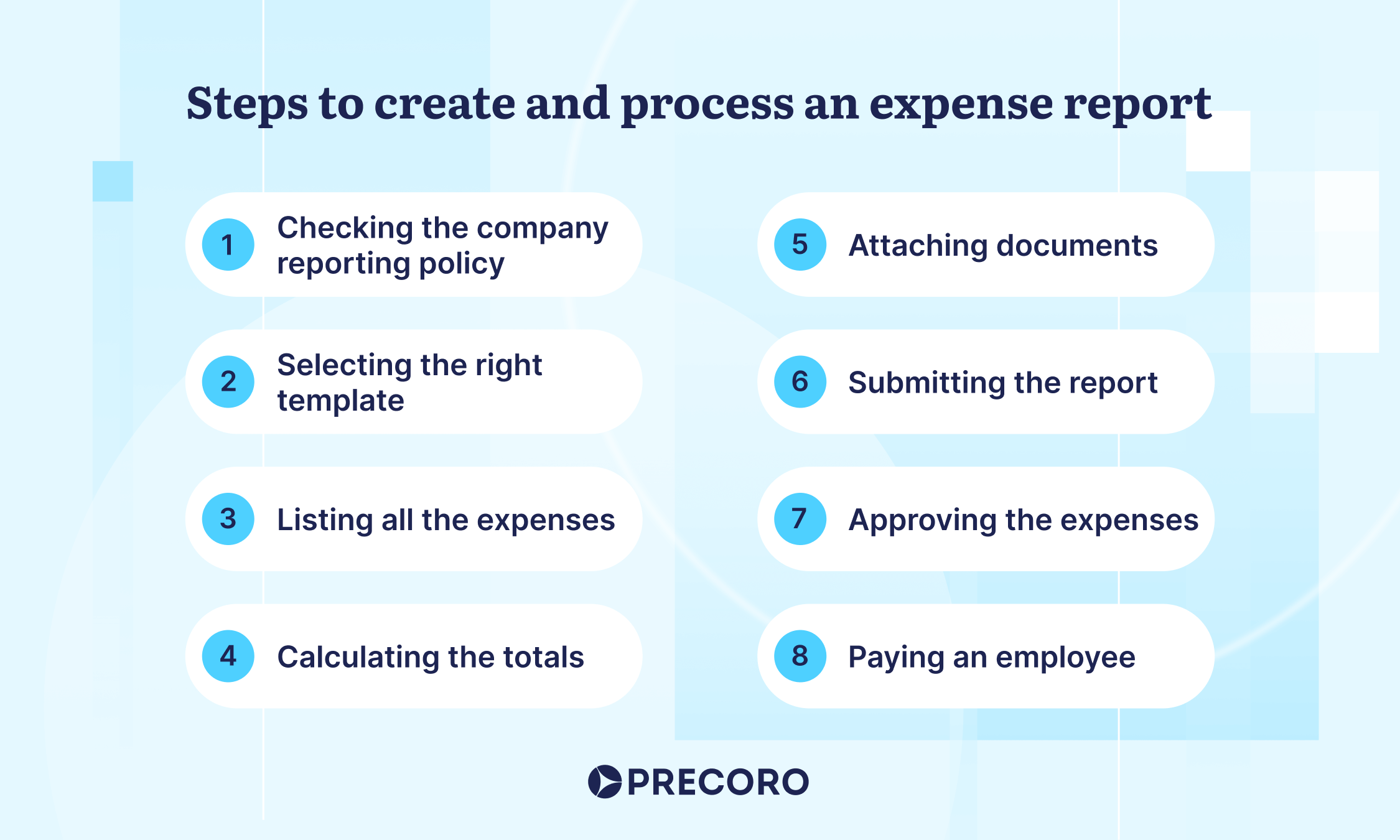

Checking the company reporting policy

Employees should start by checking company instructions regarding:

- which report template to use,

- which documents to attach,

- which program to use, and

- where to send or upload the completed report.

An organization might set specific rules that influence how employees should submit expense reports. For example, a company policy might state a threshold (let’s say, $30) for reimbursing without proof of payment. If that’s the case, employees can request repayments for expenses under $30 without providing a receipt.

In addition to this, receipts might be unnecessary when the expenses are paid with a company card. However, employees almost always have to justify expenses by submitting the reports.

Selecting the right template

Companies normally have expense report templates saved as spreadsheets or configured in the software they use for purchasing or accounting activities.

Preparing reports in spreadsheets runs smoothly when businesses are small, but the more expenses a company processes, the more complicated it becomes for its finance team to navigate all the spreadsheets. Therefore, many companies switch to software as soon as they start growing. The finance team can then configure templates directly in the software, which also can typically prefill some information to save time.

Listing all the expenses

Employees include all relevant goods and services and fill in all the necessary information. It's necessary to group and order expenses as the template requires: by the date, amount, purpose, etc.

Calculating the totals

The next step is to calculate subtotals for the grouped expenses, if relevant, and then the general total of all the expenses in the report. Employees will see which totals are required in each template. In some cases, templates are configured to add up the costs automatically.

Attaching documents

If required, employees attach all necessary payment receipts. Depending on the company reporting policy, they can be original documents or photocopies; depending on the organization's tools, attachments are submitted in hard copy or electronically.

Submitting the report

An employee submits an expense report to the accounts payable department. Then, their AP team prints the report, sends it by email, or saves it in the software, depending on the organization's workflow. Expenses are recorded as accounts payable that the company must pay upon approval.

Approving the expenses

The expense report then goes through the checks and approvals. The responsible manager or AP team member reviews the submitted report to see if the provided information is valid and sufficient and compares the data with the bank statements or receipts.

If everything is fine, the report is approved. In some cases (for instance, for higher amounts), the expense report might go through several levels of approval. If any expenses aren't approved, the AP team returns the report to the employee for revision and correction.

Paying an employee

Finally, after the expenses are approved, the company issues the reimbursement payment. After this is done, the company can record those expenses as business costs.

Tips for Creating Expense Reports Quickly and Easily

Creating and submitting an expense report is a pretty straightforward process. Still, it can become overwhelming when the number of payments grows or if the person responsible for creating them has to do it for more and more people. The following two things help keep the reporting process as smooth as possible.

Standardize the Templates

Using a suitable template is important for creating an expense report because it helps employees discern which information is required without having to check back with management or accounting.

The type of template an employee will use in each situation depends on the kind of expenses they have to report. For instance, interior designers might use a one-time expense report to get reimbursed for construction materials, while sales representatives are more likely to report weekly expenses for regular business lunches.

The first step towards creating a report template is to identify the types of expenses that employees typically incur. After that, the finance team can create templates for each type of expense report and standardize them to match currencies and formats, add the company's design, etc.

All employees and contractors should use the standard expense report templates that are provided by the company's finance team. Employees can also ask the finance team to adjust the templates if needed.

By preparing standard templates, an organization can avoid misunderstandings and speed up the reporting process. The AP team can also configure integrations with the accounting software when they know exactly what information they will receive and the format.

Implement Software

Another way to streamline the expense reporting process is to start using software for AP automation, expense management, or procurement.

An expense report can be prepared in many formats: as a Word document, Excel spreadsheet, or even written by hand. However, the most efficient, fast, and error-proof way is to create expense reports with dedicated software. Many companies start with simple Excel spreadsheets and eventually upgrade to a software solution.

The software helps businesses streamline expense reporting by building optimal processes for submitting, recording, and approving expenses. With the Expense Module in Precoro, for instance, employees can submit an expense report in several clicks.

With automation solutions, employees can select from preset templates that include pre-filled information about the company, budgets, items, and other data, instead of entering it manually every time. Such software also usually allows the configuration of budgets, so employees can confirm whether their spending complies with the company limits.

Another significant benefit is that the expense report is instantly available to the managers and accounts payable team, who can initiate the approval process as soon as the employee enters the information into the system. The approval process then follows the steps the company has configured, so each relevant user of the software receives a notification when it’s their turn to take action.

Finally, most modern procurement, AP automation, or expense management software support integrations with accounting systems — for instance, QuickBooks and Xero. This way, data can be merged and processed without human intervention. For instance, an employee can submit an expense report in their procurement management software, and within seconds it will appear in the accounting system.

When creating expense reports in spreadsheets becomes too overwhelming and complicated, introducing software solutions can be just the trick an organization needs. In addition to everything mentioned above, going paperless and implementing digital solutions has other benefits:

- There's no additional cost of labor to process physical reports.

- The approval cycle is more time-efficient.

- Employees can upload receipts instead of filing away the hard copies.

- There’s a much lower risk of losing reports or receipts.

- Organizations can reduce the cost of office supplies and save employees time.

Frequently Asked Questions

An expense report can be used by employees who want to be reimbursed for purchases made on behalf of the business or to justify payments with company-provided cards. At the same time, expense reports are indispensable to businesses that want to track employee expenses, reimburse them, understand what the company spends money on, organize business expenses by department and categorize them, maximize taxation efficiency and returns, and prepare for audits.

A company’s spending and reporting policies can influence what goes into expense reports. Key information typically includes contact information of the relevant employee and the manager responsible for approval, goods and services purchased, their description and price, vendor information, purchase date, total due, and signatures of the employee and their manager.

There are a few types of expense reports that businesses typically use: one-time expense reports, reports on weekly or monthly expenses, categorized monthly expenses, event expense reports, travel expense reports, and mileage tracking reports.

To Sum Up

Expense reports are crucial for businesses that care about spending transparency and relationships with their employees. Such reports allow employees to request reimbursement for expenses made in the scope of their work that they had to pay for with their own money or the company card.

By analyzing expense reports, businesses can track business spending, compare costs to what was budgeted, and adjust the next spending forecast. Organizations can also find expenses to minimize or avoid altogether in order to cut company costs.

It's essential for companies to implement clear reporting policies and procedures, provide user-friendly tools, and encourage employees to follow established workflows. By doing so, companies can maximize reporting accuracy and speed while minimizing errors and costs.