13 min read

Stay on Top of Business Finances with Budgeting and Budgetary Control

No matter the size or the market, controlling spending is a top priority for any business. Organizations have to maintain control over budgeted costs and actual spending to ensure stable growth and sustainable development.

What exactly is budgetary control, and how can it be applied in day-to-day business operations? Let’s look in detail at the concepts of budget and budgetary control. Keep reading to find out:

- What do budget, budgeting, and budgetary control mean?

- Why is budgetary control important?

- Types of budgets

- How to create a budget

- How to recognize a good budget

- Components of effective budgetary control

- The role of software in budgetary control

What Is a Budget and What Is Budgetary Control

The term “budget” refers to a coordinated financial plan. It includes an estimation of revenues and expenses and a description of financial resources set aside to carry out business-related activities over a specific future period of time.

Budgets are developed and re-evaluated on a regular basis – typically quarterly or yearly but sometimes once a month or every several years.

All kinds of entities, from small startups to large enterprises, have budgets prepared and analyzed regularly. In a way, a budget is a plan for the company’s future development.

An organization can function without controlling costs, but only up to a point. Sustainable growth is hardly possible without a budgetary control system.

The term “budget” is sometimes used interchangeably with the term “forecast,” and while they are indeed synonymous, they are not identical.

A financial forecast is simply a prediction of what can happen in the market that would affect the company, and it sometimes contains scenarios for dealing with possible scenarios. A budget, however, is a commitment to make the plan happen.

The act of preparing a budget is called “budgeting,” and the main goal of doing so is to plan a company’s spending and revenue according to business objectives

“Budgetary control” involves constantly comparing actual expenditure and revenue to the budget targets in order to reveal any discrepancies and deal with them if needed. Budgetary control should include a system for responsible individuals to either adapt the workflows to meet the anticipated budget, or to revise the original budget.

To be successful, the budgetary control process depends on adequate accounting records and trustworthy financial statements produced by the accounting department.

Organizations invest time and resources into creating, implementing, maintaining, and controlling budgets of separate departments as well as the master budget to ensure stability and predictability of the company’s operations.

Why Is Budgetary Control Important?

Thoughtful budgeting and thorough control allow individual departments, stakeholders, CFOs, and CEOs to allocate resources properly and ensure they are put to use in the most efficient ways.

Budgetary control has three main objectives:

- Planning – to avoid last-minute emergency spending and use scarce resources well;

- Coordinating – to stimulate cooperation between departments when it comes to creating budgets and spending within them;

- Controlling – to ensure the budget performs as planned or to make necessary changes for achieving that.

No business can be successful in the long run without a proper financial plan and actual cost control, even though different companies might approach budget control in their own way.

While large and well-established enterprises are mostly concerned with operational efficiency, they still have to maintain budget procedures and functional budgets for operational stability.

Smaller companies with scarce resources, on the other hand, often pay more attention to the initial planning; because they have less money to work with, they have to prioritize cost reduction from the outset and allocate available funds correctly.

Yet for organizations at any size, budgetary control encourages stakeholders to continuously compare budgets against actual figures and take appropriate action regarding discovered deviations.

Consistently checking the budget fulfillment is important for stakeholders to understand better where the planning gaps are and why cash leaks may happen. Therefore, they can create more accurate budget iterations to avoid financial losses and maximize profits.

Budgetary control helps companies stay afloat in the often cut-throat competition by harmonizing their financial strategies with organizational structure and personnel capabilities to create a realistic task load.

Team motivation also falls under budgetary control advantages. When the budget is tight, it’s a good incentive for employees to become creative and search for innovative solutions.

Types of Budgets

While numerous budget types exist, there are a couple that are used by all kinds of companies. We'll go over them here.

Operating Budget

The term “budget” is typically used in reference to the general operating budget that includes revenues and expenses in the core operations and reflects the organization’s plan for financing day-to-day operations.

The operating budget is a key instrument of management control that also governs a company’s EBITDA – earnings before interest, taxes, depreciation, and amortization – and estimates its profits. But to reign in the operating budget even tighter organizations can divide it into two parts: the revenue budget and the expense budget.

The sales budget describes anticipated income from selling the items or providing the services. The expenses budget, on the other hand, outlines all expenses that will be incurred during day-to-day operations.

Financial Budget

The financial budget defines where the company expects to get funds from and how to allocate them.

One type is a cash budget, also known as cash flow, that forecasts anticipated cash payments and receipts over a specific period of time. The projection period can be a year, quarter, month, week, or even a day, as long as it’s recurrent and makes sense in terms of how much and how often a company makes purchases.

Businesses use cash budgets to make sure they meet all cash obligations on time and to estimate the possibility of having excess cash to set aside as a surplus or to invest.

Another type of financial budget is a capital expenditure budget, which focuses on major assets such as new buildings, equipment, land, and so on. These assets are usually financed by investing large amounts of money acquired via long-term bonds and lending.

Such spending happens on a less frequent basis and requires long-term plans for repayment. When their long-term budgetary obligations are well-planned, companies can predict profits accurately and deal with interest payments accordingly.

Cash budgets are typically more important for new and growing businesses, which should pay special attention to available and anticipated funds to make sure they’re sufficient for sustainable growth. Capital budgets, on the other hand, play a bigger role in the more established organizations that want to expand and are ready to take on long-term obligations.

In Terms of the Bottom Line

When it comes to a company’s bottom line, budgets can be described as follows based on their final balance levels:

- Surplus – profits are anticipated after deducting all expenses from the company’s revenue;

- Balanced – revenues are expected to equal expenses, therefore not generating profits;

- Deficit – expenses are predicted to exceed the revenues, with the business possibly staying in the red.

In Terms of Flexibility

While some businesses still operate on annual plans and budgets, many choose to plan for shorter periods of time and re-evaluate more often.

In a modern competitive environment, budget flexibility plays a key role, and continuous forecasting becomes widely used across various industries. Businesses tend to budget on a quarterly or even a monthly basis to recognize trends and adjust to them more quickly.

This is especially important for new and smaller companies who have less money to work with and are still establishing themselves on the market. Flexible funds allow them to reevaluate and adjust their spending based on current sales and production rates.

Opposite to a flexible budget is a static budget, created for a longer time span – usually a year – and typically unchanged over the course of the budget period, regardless of external or internal developments.

Static budgets are more often used by well-established and larger enterprises that have sufficient resources and can afford some financial and reputational losses if they miss out on market trends.

In general, though, any company can use either type of budget, and each offers different insights to stakeholders and managers. Static budgets help managers evaluate the quality of initial planning and the expertise of professionals involved in budgeting, and flexible budgets allow for a deeper understanding of business operations.

In Terms of the Budgeting Process

There are also methods of budgeting based on the reasoning behind the budget itself. Depending on the purpose, this will result in budgets with different objectives.

Incremental

This is a simple and easily understandable budgeting approach that takes the last year’s budget and adds or subtracts a percentage from it. A budgeting committee bases that percentage on an estimate for inflation or sales growth, for example.

However, it’s possible that external factors will be missed due to their complexity or because they only influence specific budget items and cannot be simplified to one percentage across the budget.

Activity-based

Using this method, an organization defines the final goal – let’s say, a certain amount of revenue. The budget is then built with that goal in mind by asking several questions:

- What do we want to achieve?

- What steps do we need to take to do so?

- How much do those steps cost?

Then, the budget is developed by adding up the costs of individual actions.

Value-proposition

In this budgeting approach, items are included based on their value. The budgeting committee answers the following questions:

- Does this budget item bring value to the company itself and its customers?

- Is the item’s cost proportional to its value?

Zero-based

One of the most commonly used approaches, zero-based budgeting starts from scratch. The budgeting committee assumes that the budgets of all departments equal zero, and department heads or other responsible employees have to justify every expense.

Zero-based budgeting is an effective way to review the state of company finances and approve only the expenses that are absolutely necessary. It’s the most time-consuming approach, but at the same time, it allows the budget to remain minimal and keeps it from spiraling out of control.

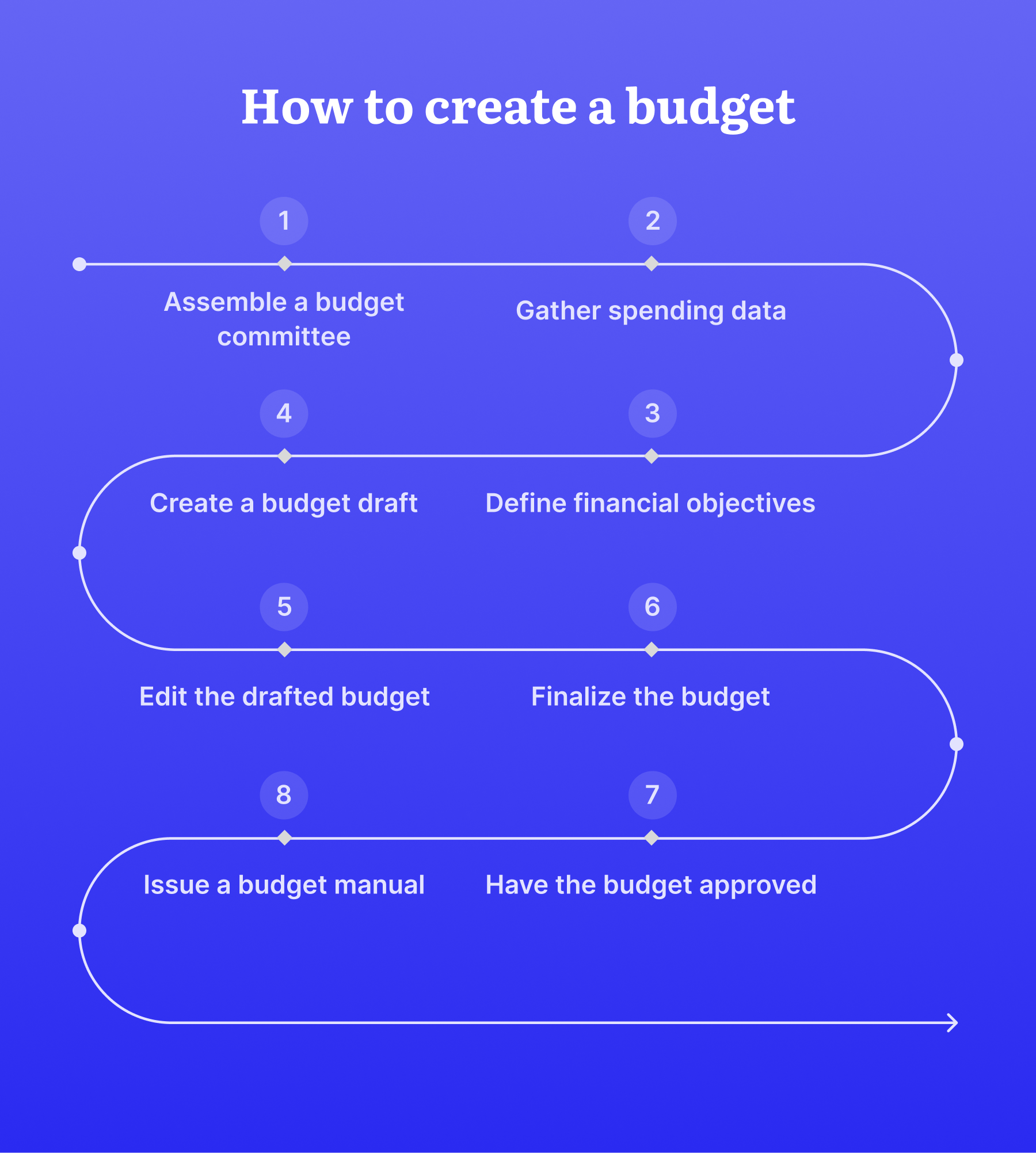

How to Create a Budget

The process of budget creation is typically managed by a chief financial officer and finance department, with department heads also providing their input.

Some organizations adopt a top-down approach, with budget estimation starting with the CFO or top-level management setting the constraints. Other companies go for a bottom-up approach, developing initial budgets solely on insights from different departments.

Below is a generalized outline of the budgeting process. Depending on the size or structure of an organization, their process will look somewhat different.

- Assemble a budget committee that will be responsible for creating a budget from the beginning all the way to approval. Such a team should typically consist of the CFO, financial specialists, department heads, and other stakeholders.

- Gather spending data from past periods. If possible, go back at least 2-3 budgeting periods, meaning 2-3 months, quarters, or years, depending on the budgeting frequency. Awareness of the company’s performance in the past reveals opportunities for improvement in the future.

- Define financial objectives that the business is trying to achieve and develop specific goals for separate departments.

- Create a budget draft by establishing assumptions for the upcoming budgeting period – usually a quarter or a year, but can also be a week, a month, half a year, or even several years. Address specific factors that can influence potential revenues and expenses, project sales trends and cost expectancies, and assess market risks.

- Edit the drafted budget. The preliminary budget should be subjected to revision by the budgeting team. If needed, external consultants can be involved.

- Finalize the budget by accepting reasonable suggestions and denying the irrelevant ones after discussion by the budget committee.

- Have the budget approved by the top management, CFO, and the board of directors, if relevant.

- Issue a budget manual with explanations of budget figures, forecast for income and spending, assumptions about the market, and supplier relationship guidelines. This report should be shared with anyone responsible for revenue streams and expenditures within the organization.

How to Recognize a Good Budget

Every organization is unique; it is, of course, impossible to create a universal budget. It is, however, possible to define the qualities of a good budget.

Inclusive

It’s a good idea to involve as many people as needed across departments and hear what they have to say about past budget periods and expected numbers for the next one. Responsible budgeting officers can then accumulate and analyze the information gathered and develop the budget based upon it.

Comprehensive

When the budget includes insights from every department and embraces the whole organization, there’s a higher chance of preparing a realistic financial estimation.

Based on standards

Budgets based on an organization's quality and performance standards are more likely to be efficient and meet business objectives.

Up-to-date

A good budget is based on recent information, often submitted by the responsible employees directly into the database used to plan the budget. It’s then processed and readily available for future use.

Accurate

It’s important to make sure that budget data is accurate and reflects the real situation, and that there are no errors due to stale data or missing information.

Adaptive

A business benefits from being able to increase and reduce budget items to reflect the current market situation.

Available for feedback

Ideally, the budget should be available for relevant employees to look at and provide feedback, which can then be incorporated into the next iteration.

Integrated

When there is one platform for centralized storing and managing of a company’s financial data, it can be used by all departments. This way, companies prevent the appearance of multiple databases in different departments and ensure data synchronicity for accurate budgeting and reporting.

Customizable

Not everyone in the company needs to see every budget figure, but most need to have access to at least some numbers. A good budget should be customizable so that every relevant employee can access the data they need without having to spend time searching through everything.

Clear

A good budget is prepared and presented in a way that is easy for employees to understand without having to ask their manager or IT personnel for help deciphering.

Components of Effective Budgetary Control

Creating and approving a budget is only half of the job. The next step is to implement budgetary control.

This means that responsible users, such as financial department specialists, department heads, project managers, and others, should monitor progress continuously within their scope of responsibility and make sure that incoming funds and spending adhere to the budget.

The budgetary control workflow looks something like this:

- Develop the budgets for identified budget centers, usually departments. Detailed budgets should be made available to responsible employees so that everyone is on the same page about what has been planned.

- Record the actual performance. There should be a clear procedure, followed by everyone involved. An accounting system is an important factor in recording actual income and expenditures. It helps keep the books in order and serves as the primary source for further budget data.

- Compare the budget with the actual performance. It’s a good practice to introduce organization-wide or departmental guidelines and establish a frequency for checking the progress, define tolerance limits, and assign responsible employees.

- Record and investigate any discrepancies. If deviations have occurred, nothing can be done to rectify past damages, but with proper analysis, the same discrepancies can be avoided in the future. Organizations can investigate what happened and assign people to keep track of the problematic budget items in the future.

Take corrective action. When budget goals are not met, inconsistencies are addressed, highlighted, and measured. The ones that exceed the tolerance limit should be prioritized when it comes to taking corrective actions. Responsible specialists can either adjust spending to fall within the budget or alter the budget to reflect the reality of the current situation.

There should be clear guidelines for an employee to take upon discovering the deviations. Steps will vary depending on the industry, company size, and structure; some discrepancies can be dealt with within the department, others have to be brought up to the top management, and some are actually impossible to control.

To make it easier for employees and to avoid misunderstandings, the budgeting team should provide answers to the following questions:

- Whom should managers notify upon discoveringdiscrepancies that don’t fall within the tolerance limit?

- Should they interfere immediately or wait for the top management’s decision?

- How should certain discrepancies be dealt with: by changing the spending or altering the budget?

- Consider the experience with discrepancies in the future budgeting process. This way, the budgeting team can approach creating the next budget from a stronger standpoint.

The Role of Software in Budgetary Control

The modern business environment is dynamic and full of competition. Managerial decisions have to be fast and rely on proven data, so various managerial tools have evolved to satisfy this need.

Software applications have become a necessity for financial planning and reporting. Numerous solutions have emerged to facilitate the recording of expenditures and revenue and to streamline their control.

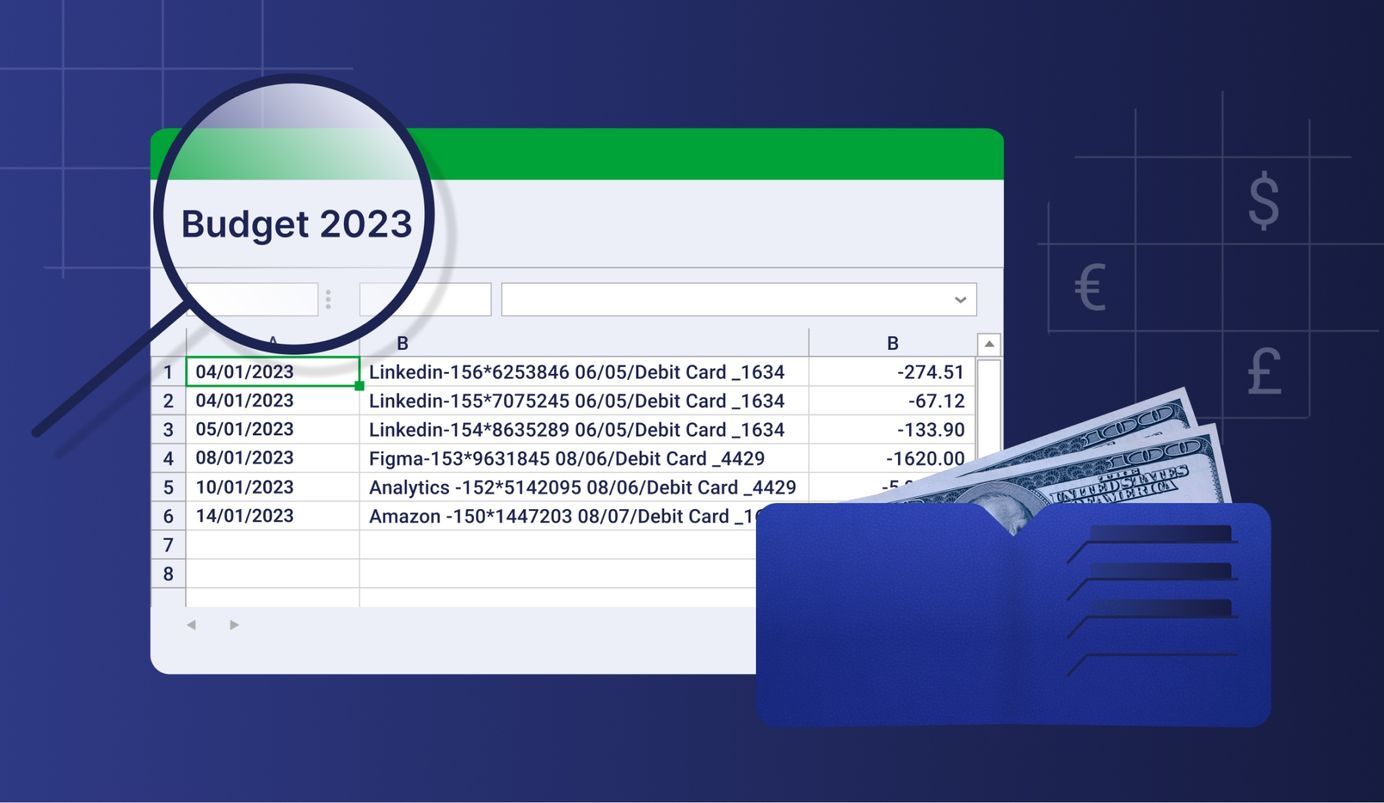

Microsoft Excel, for example, is a popular tool that is widely used across companies of all sizes. However, it’s prone to input errors, especially when individuals from different departments collaborate on the same report simultaneously.

A spreadsheet can hold only some amount of data before it becomes cumbersome to use, and there’s a risk of losing data and having to go through the exhausting process of restoring it. Finally, it’s difficult to hold anyone accountable for mistakes made in the spreadsheet.

Budgeting information is expensive in terms of time and effort dedicated to recording and analyzing, so processing it inefficiently or misplacing it would be a significant waste of resources.

But with dedicated software solutions designed for specific aspects of business operations, budgetary control becomes easier and more reliable. For instance, procurement software like Precoro has features that make it indispensable for spend management.

It lets companies set up departmental budgets and notifications for when the limit is about to be reached. It’s also possible to forbid purchases that are outside of the budget, essentially preventing discrepancies before they even happen.

With all data stored safely in the cloud, there’s no risk of losing spend information. Moreover, when data is in the system, responsible users can easily process it into custom reports to search for any discrepancies.

Precoro also offers out-of-the-box integration with the accounting tool QuickBooks and has open API available to anyone who needs a custom integration.

There’s more to it, so if you are looking to streamline company spendings for better budgetary control, talk to our team and find out how Precoro can be of use.

Conclusion

Budgeting and budgetary control are important for any organization that aspires to manage finances well and spend rationally.

Budgeting is a process of creating budgets for company departments and aggregating them into one master budget. The budgeting process happens on a regular basis and always works with the future, looking to produce an estimate of revenues and expenditures for the next budget period. It’s usually an estimate for the quarter or a year, but can also be for as long as several years or as little as a month.

After a budget is developed and approved, responsible employees conduct budgetary control – periodically, or even continuously. The objective of this is to compare the actual results to the anticipated ones and, if any discrepancies are found, either correct spending patterns or re-evaluate the budget.

In today’s dynamic business environment, companies are constantly looking for ways to recognize market trends promptly and to streamline their internal processes, including budgeting and budgetary control. Numerous software solutions have emerged to assist businesses to do just that.

For example, Precoro procurement software allows organizations to control purchasing and act swiftly upon any deviations from the budget. Contact us to find out how purchasing software can benefit your business.