13 min read

Accounts Payable and Receivable – Two Sides of One Coin

Every business starts with spending and ends with earning. But is it always about the actual cash? Accounts payable and accounts receivable become part of the cash flow before any actual money reaches bank accounts. Let's see how.

We will look into the principles of working with accounts payable and accounts receivable and why they are so important for companies of all sizes in all fields of business.

Stay with us and read:

- What are accounts receivable, and how are they different from notes receivable?

- Accounts receivable process

- Accounts receivable and cash flow

- Dangers to be aware of with AR and benefits of actively managing them

- What are accounts payable, and how are they different from trade payables?

- Accounts payable process

- Accounts payable and cash flow

- Dangers to be aware of with AP and benefits of AP management

- Accounts payable vs. accounts receivable

- Recording AP and AR in the general ledger

- Automation of accounts receivable and payable

- Frequently asked questions

What are Accounts Receivable?

Accounts receivable, AR, or “receivables,”are claims for payment that a company expects to receive upon selling goods or services on credit. Receivables are relevant for sellers who extend credit lines to their customers and expect payments for goods sold or services rendered.

Most companies allow part of their sales to be made on credit. For instance, they might extend a credit line to certain customers that receive invoices periodically, rather than make separate payments for every transaction. Sometimes it becomes company policy to invoice all customers for the goods or services after the actual sales.

In other words, accounts receivable refers to the money that clients owe the company, and are recorded as current assets on the company's balance sheet.

Accounts receivables are mostly represented by outstanding invoices. Sellers typically expect AP to be reimbursed in a relatively short period of time, ranging from several days to several months.

Accounts receivable are part of accrual basis accounting in which business expenses and revenue are recorded when they happen, regardless of when the actual money is received or paid. In contrast, cash basis accounting recognizes revenue only once the actual cash payment is received, and recognizes expenses only after the money leaves the bank account.

Accounts Receivable vs. Notes Receivable

Notes receivable are another type of receivable. They’re similar to AR except for the payment deadline, which is longer for notes receivable. With notes receivable, sellers typically give buyers a year or more to pay for the purchase.

Notes receivable are commonly in the form of written agreements between buyers and sellers that the credited amount will be paid over a specified period of time; this payment might also include interest.

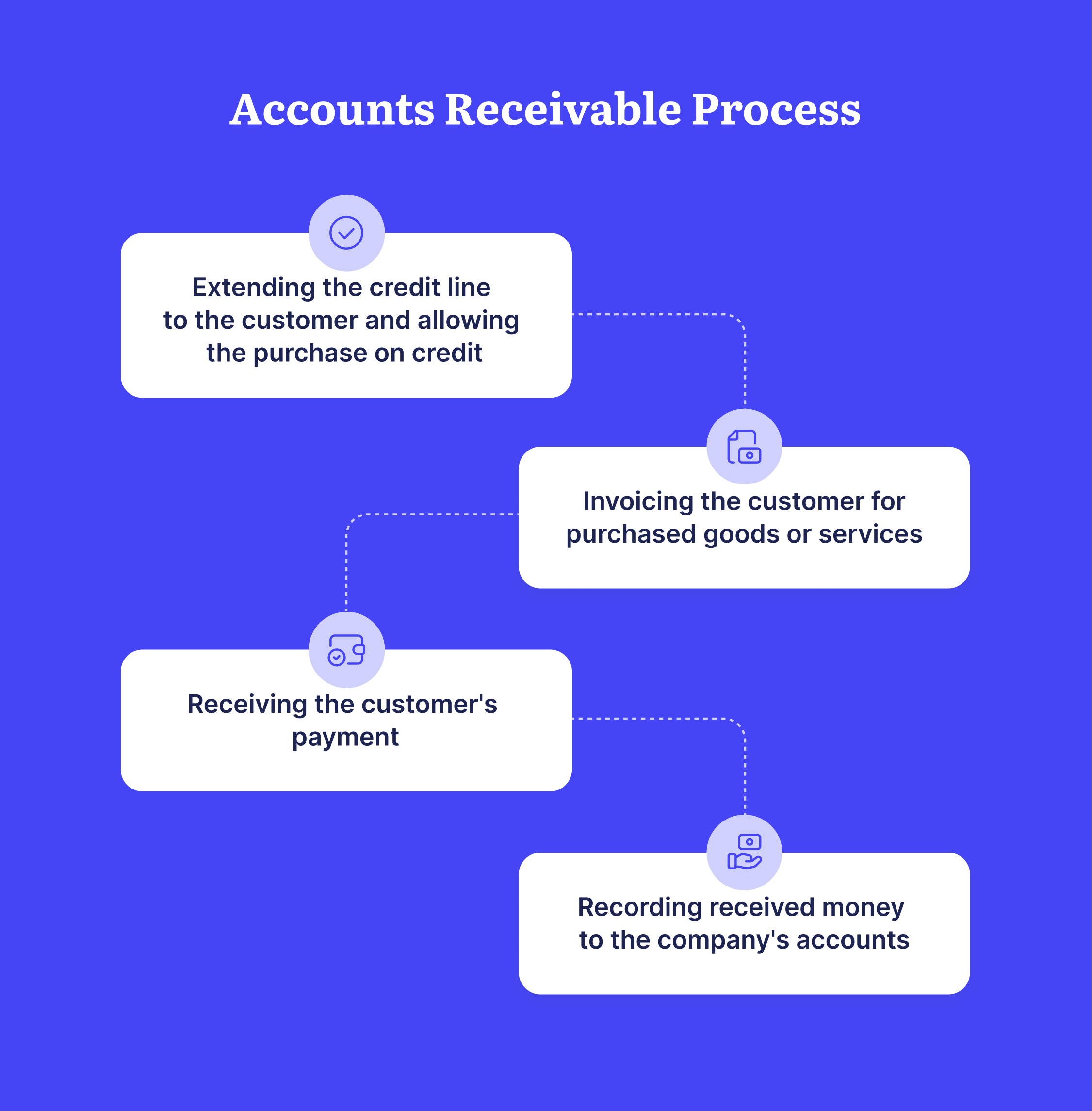

Accounts Receivable Process

Depending on the company's size, there are designated specialists or a separate accounts receivable department to navigate through the so-called order-to-cash cycle.

The accounts receivable cycle includes the following steps:

- Extending the credit line to the customer and allowing the purchase on credit

- Invoicing the customer for purchased goods or services

- Receiving the customer's payment

- Recording received money to the company's accounts

Sometimes, if the customer doesn't follow through with agreed payment terms and doesn't pay the invoice on time, an extra step is added after sending the invoice.

In this step, the AR manager asks designated employees or hires a special agency to communicate with the customer about payment demands and possible late fees, and to make sure the customer pays.

Accounts Receivable and Cash Flow

Accounts receivable are recorded as liquid assets on a company's balance sheet because the buyer has a legal obligation to pay the debt. Receivables are part of a company's working capital and can be used to measure its ability to cover short-term obligations.

Receiving payments typically is a high priority for companies because this is where the cash flow comes from to cover business needs. The longer receivables remain unpaid, the more difficult it is to allocate funds to manufacturing, business development, and other needs.

The stability and strength of accounts receivable are typically analyzed by the following:

- The accounts receivable turnover ratio. This measures how many times the company has collected payments to accounts receivable during an accounting period.

- Days sales outstanding (DSO). This indicates how long it takes on average for the seller to collect payment after a sale.

Dangers to Be Aware of with Accounts Receivable

Since it's a common practice to deliver goods and provide services before receiving payments for them, there’s also, unfortunately, a risk that payments will never be received. When it becomes apparent that the buyer won't pay an account, it has to be written off as a bad debt expense.

Companies with experience will often estimate their expected bad debts in advance to prevent having too many accounts receivable on their balance sheet. Excessive accounts receivable may lead to insufficient cash flow and slower sales because it’s an indication that customers have exhausted their credits.

Companies with too many accounts receivable but little working capital can face liquidity problems and risk default by an inability to make a payment on a debt or the associated interest. Therefore, when selling on credit, cash flow management becomes a top priority to avoid running out of working capital.

Benefits of Active Accounts Receivable Management

By thoroughly managing receivables, companies benefit in several ways:

- Shorter order-to-cash cycle

- Reduced AR processing costs

- Controlled cash flow

- Ensuring customers pay purchases faster means more sales

- Good relationships with customers

What are Accounts Payable

The terms accounts payable, AP, or “payables,” all refer to the money a business owes vendors and suppliers for goods or services purchased on credit. When the company receives the payment demand – usually in the form of an invoice – for purchased goods or services, they record the anticipated payment as an account payable.

An account payable is typically expected to be paid within several days to several months and is recorded in the company's balance sheet as a current liability.

In other words, accounts payable refers to the total value of all outstanding payments represented by unpaid invoices or other written agreements. Payables can also be thought of as short-term IOUs (informal "I owe you" documents, acknowledging debt).

Accounts Payable vs. Trade Payables

The terms accounts payable and trade payables are often used interchangeably. They indeed refer to similar claims, but don’t mean exactly the same thing.

Accounts payable include all short-term obligations, such as office supplies and equipment, power and fuel, software licenses, other maintenance services, etc.

The term trade payables refers to money credited for purchasing inventory-related goods; this might be, for example, raw materials or components for production, packing materials, etc. Trade payables fall under accounts payable obligations, therefore many companies do not differentiate and refer to both types as accounts payable.

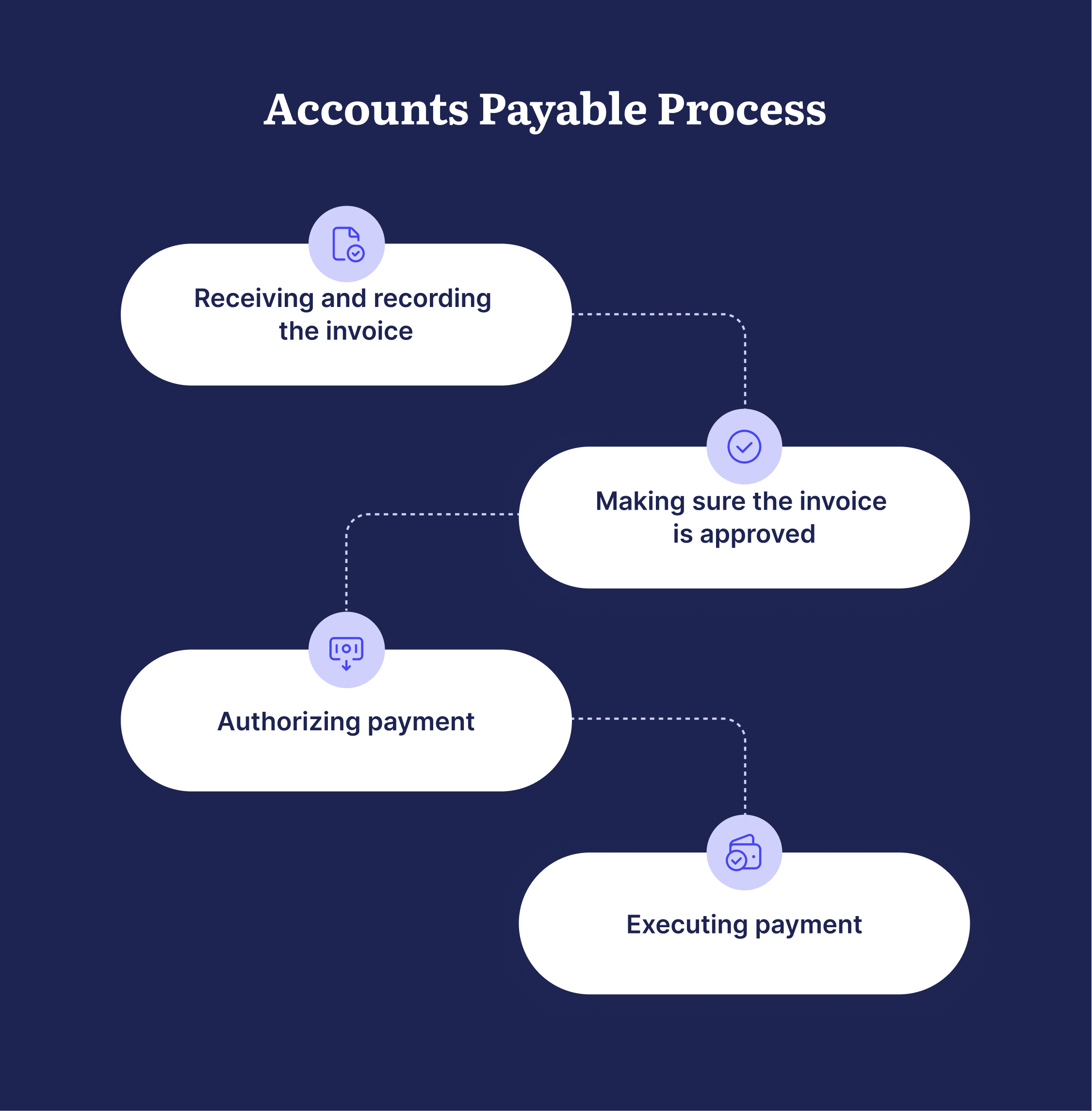

Accounts Payable Process

Similarly to accounts receivable, accounts payable can be maintained by one designated specialist or by the whole dedicated department depending on the size and complexity of the company.

The role of an AP specialist or department is to support precise and timely financial administration within the company and to manage the end-to-end AP process each step of the way. These tasks are included:

- Receiving and recording the invoice

- Making sure the invoice is approved

- Authorizing payment

- Executing payment

The accounts payable team plays a crucial role in the company's financial management as it ensures that only legitimate vendor invoices and bills are paid – and on time.

An AP specialist or team’s primary responsibility is to register requests for payment and conduct three-way matching to ensure those requests are legit. The accounts payable department typically operates with three main document types to complete the order-to-pay process: purchase orders, receiving reports, and supplier invoices.

With invoice management practices and three-way matching in place, the AP team can save an organization a great deal of time and money by ensuring all checks are fast and thorough.

Every accounts payable department is unique in design depending on the company's needs, but several general roles need to be represented in the AP team.

One person can take on several roles, or, on the contrary, there can be several specialists for the same role. Specific roles might be inter-departmental and named differently, but the core responsibilities are as listed:

- A data entry specialist registers invoices upon receiving them: they input invoice details into the relevant spreadsheet, accounting system, ERP, or any other system in place.

- A payment processing specialist ensures invoices are approved by the relevant responsible people and paid on time.

- A vendor and supplier management specialist works with the database of partners and does what's needed to maintain good supplier relationships.

- An accounts payable manager coordinates the team and implements operational strategies to ensure efficient AP team cooperation.

Accounts Payable and Cash Flow

Accounts payable funds are no longer available to a company, as they are owed to one or several suppliers, so this money is recorded under current liabilities on the company's balance sheet. Current liabilities are short-term, with the payment due typically within one year.

Accounts payable fluctuations appear on the cash flow statement and represent an important figure for the company's financial health analytics. An increase of AP means that the company is buying more on credit than in cash; decreasing AP value indicates that the company pays its obligations faster than it makes new purchases on credit.

A company's accounts payable significantly influences cash flow and liquidity. Short-term liquidity can be evaluated by the Days Payable Outstanding (DPO) index, a ratio that represents how fast the company pays its suppliers and indicates how well the business can clear short-term debts.

Possible Risks of Accounts Payable

An inefficient accounts payable process poses a risk to cash flow stability and liquidity. The volume of AP and the quality of their processing are important factors that can allow companies to manipulate the cash flow.

The company's management can increase cash reserves by extending AP repayment periods. However, that short-term solution requires careful consideration, as it may influence the company's credibility with suppliers.

While the sale terms can be adjusted once or twice, such manipulations on a regular basis can cause serious deterioration of future relationships with suppliers.

As with any component of business operations, when handled manually via spreadsheets, phone calls, emails, or physical mailing, the accounts payable process is at risk of human error. In such settings, there's a risk of unintentional mistakes or intentional fraud, business email compromise, missed communication, late payments, and missed early-bird opportunities.

Benefits of Accounts Payable Management

It's important to implement internal controls, processing workflows, and verification methods to avoid making wrong payments or paying fraudulent invoices, and to protect the company's cash assets. A comprehensive, transparent, and efficient accounts payable process is key to maintaining the company's bottom line.

With accounts payable managed and processed in accordance with clear guidelines, managers can streamline document processing and help ensure the payment deadlines are met.

Analyzing current payment and spending patterns brings to light unnecessary expenses and helps companies focus on long-term business goals and company growth, thereby improving the company's bottom-line.

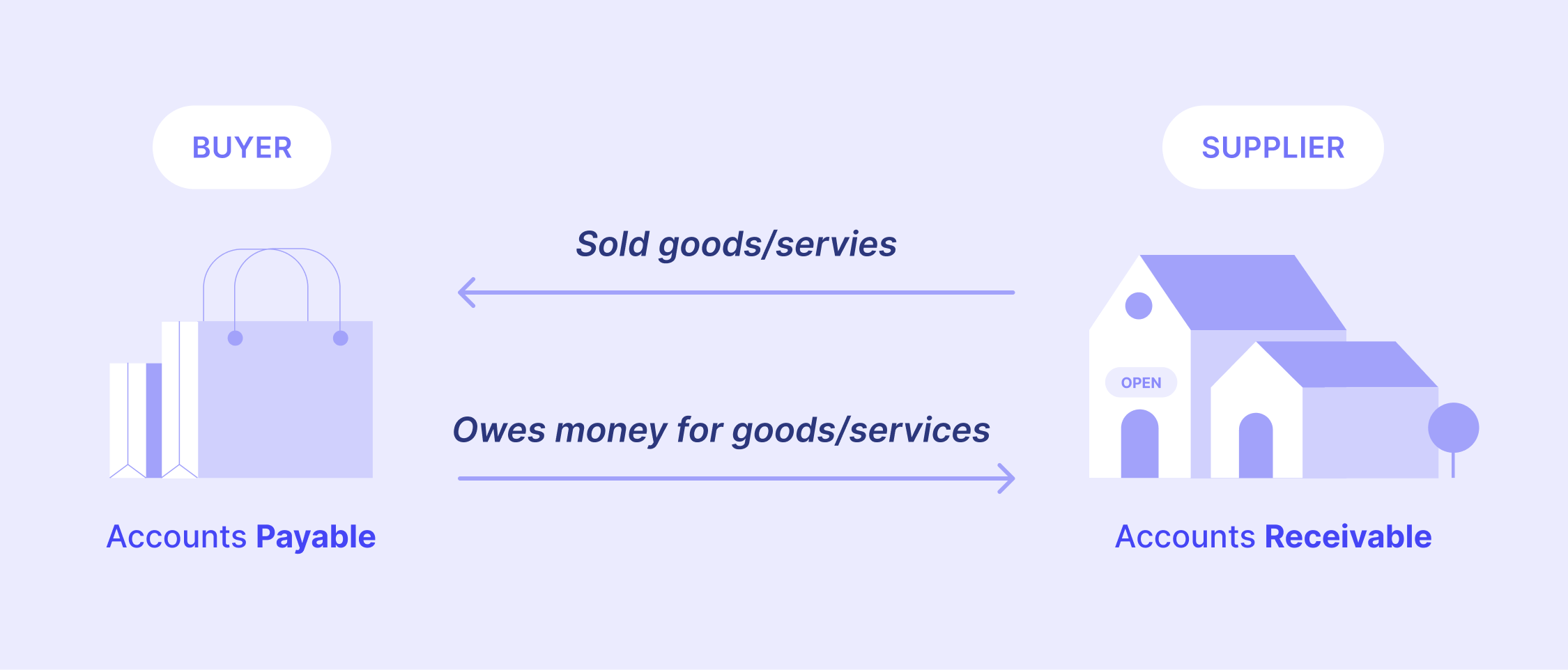

Accounts Payable vs. Accounts Receivable

Basically, these terms are two sides of the same coin. The same amount of money for the same goods or services is recorded as accounts receivable by the seller and as accounts payable by the buyer.

Accounts receivable are assets, as expected customer payments; accounts payable are liabilities, as money owed to another business.

Every company has to buy certain goods and services from other companies in order to function and produce their own product or service. This is the essence of doing business.

Many organizations end up dealing with both sides of this coin: they record accounts receivable as sellers (selling to consumers or to businesses buying on credit) and record accounts payable (buying business-essential goods).

Both accounts payable and accounts receivable are essential financial management levers for the stable growth of a company. If there’s an imbalance it can result in a shortage of ready-to-use cash and ultimately destabilize the business.

Companies need to understand how much money they need to pay to their suppliers and how much money customers owe in order to effectively regulate the amount of cash available for production and business development.

Auditors and potential investors examine accounts payable and accounts receivable to evaluate the company's financial health before proceeding with any deal.

How to Record Accounts Receivable and Accounts Payable in the General Ledger

As mentioned earlier, in the accrual accounting method, records of unpaid expenses and incoming money are placeholders for actual cash events. The company might not have paid or received actual money, but already operates with the amounts as assets or liabilities.

Accrual method is easily applicable within the modern-day double-entry bookkeeping concept, in which every entry in the general ledger always has an offsetting debit or credit.

Debited amounts represent assets, while credited amounts represent liabilities. In the end, after balancing debit and credit, we should always get zero – the sum of all debits should equal the sum of all credits.

Let's say manufacturing company A buys a metal melting furnace from vendor company B. The AP department of company A receives an invoice for the furnace for $500 and has to do two things:

- Credit $500 to accounts payable – because buyer A now owes this $500 to seller B.

- Debit $500 to material assets – because buyer A acquired equipment worth $500.

At the same time, company B does the counterpart of this:

- Credits $500 to material assets – because they now have $500 less in available equipment.

- Debits $500 for an account receivable – because they expect a payment of $500 from the buyer for the purchased equipment.

When the payment happens, accountants in both parties adjust the records. The accountant of manufacturing company A will record the following:

- $500 credit to the cash account to reflect that the money was paid.

- $500 debit to accounts payable because the debt towards the vendor company B has been closed.

The accountant of company B will record this:

- $500 credit for an account receivable to reflect that the buyer's debt is closed.

- $500 debit to the cash account because the money has been received.

Automation of Accounts Receivable and Payable

Software automates most repetitive manual tasks that would otherwise require many working hours by dedicated AP and AR teams.

The goal for the accounts receivable team is to collect money as soon as possible at the least possible processing cost while maintaining good relationships with the customers.

For the accounts payable team, the objective is to pay debts at the earliest possibility in order to take advantage of early payment discounts and to uphold a reputation as a trustworthy buyer, the latter of which lets the company negotiate better contract terms or a credit line extension in the future.

Whether we're talking about accounts receivable or payable, management is time-sensitive and, at the same time, requires meticulous processing of documents. When time is short, there's a high risk of human mistakes, especially if managing accounts manually.

By "manually," we mean, for example, obtaining documents via post or email, recording them in spreadsheets and clarifying details over the phone, making payments in cash checks, and so on.

Sometimes, when AP teams become overwhelmed with tasks, companies end up hiring dedicated collection agencies or external accountants to work on AR and AP.

However, this adds significant additional expenses and would most likely be a short-time solution; such a setting is extremely difficult to scale up with business growth, as expenses for the external specialists would grow exponentially.

Technology-based solutions, on the other hand, are easily scalable, are able to process documents quickly and reliably, and come in so many different options and packages that pricing can usually be adjusted to companies’ current needs.

For example, accounting automation software allows AR professionals to generate invoices, record payments, and match them in seconds without needing to read through all invoices and bank statements to ensure they correspond.

Such solutions also allow AR teams to get invaluable insights into their accounts. For instance, they can see at a glance the current status of every transaction and receive notifications with a call-to-action when intervention is needed; software can also generate various reports and, of course, centralize all documents in one repository to ensure not a single invoice is misplaced.

Modern AP teams also strive to automate accounts payable for the sake of process optimization. Software like Precoro, for instance, allows accounts payable departments receive, record, match, verify and pay invoices almost instantly.

Automation software helps AP teams recognize fraudulent invoices, assign responsibilities clearly across the team, and build an efficient and cost-effective procure-to-pay process that enables short DPO.

By implementing automation tools, companies minimize the need for human intervention to carry out otherwise repetitive tasks like entering invoice data and matching it across documents. In turn, they’ll see a significant acceleration of transaction processing and a decrease in the average cost of doing so.

With automation tools in place, accounts receivable and accounts payable departments can expend less resources on low-value, routine tasks without risking productivity and are able to focus more on strategic development.

Frequently Asked Questions

These two terms are like two sides of the same coin. Accounts receivable, or “receivables,” are claims for payment that a company expects to receive upon selling goods or services on credit. Accounts payable, or “payables,” refer to the money a business owes vendors and suppliers for goods or services purchased on credit. The same amount of money for the same goods or services is recorded as accounts receivable by the seller and as accounts payable by the buyer.

The accounts receivable cycle includes 4 steps: extending the credit line to the customer and allowing the purchase on credit; invoicing the customer for purchased goods or services; receiving the customer's payment; and recording received money to the company's accounts.

The accounts payable department has to do 4 tasks to manage the end-to-end AP process: receive and record the invoice; make sure the invoice is approved; authorize payment; and execute payment.

To Sum It Up

Accounts payable and accounts receivable are terms from accrual accounting that refer to the amounts of money for goods sold on credit that are not yet paid for. The two terms are two sides of the same coin.

Accounts payable refer to the money the buying company owes to its vendors and suppliers for the goods acquired on credit. These purchases are recorded in the company balance as liabilities that must be paid.

On the other hand, accounts receivable are funds that the selling company expects to receive for goods sold on credit to buyers. These amounts are recorded on the balance sheet as assets.

Accounts payable and accounts receivable are important figures in the company's cash flow that indicate its capacity to fund the business needs. Both incoming and spent funds are crucial for stable growth. When revenue and expenses are balanced, the company can plan and strategize with both feet on the ground, seize growth opportunities, and build quality relationships with business partners.

Companies typically expect to close both APs and ARs within several days to several months. To do so efficiently and on-time, more and more businesses choose to implement automation tools. Dedicated software helps streamline the processes within AP and AR departments to drive cost-efficiency, avoid mistakes, and enable scalability.