12 min read

Month-End Close Tips and Checklist: For Newbies to Experienced Closers

Would you say that your company did better last month than the one before? Do you have a plan for improving next month? To understand if they’re making progress with long-term goals, finance teams undergo regular month-end closes.

Let’s discuss how the month-end close process can benefit your company and how to make the most of it. Keep reading for the following:

- What is the month-end close process?

- Why is this process important?

- Steps of the month-end close process

- Key things to check while closing the month

- Challenges to expect during the month-end close

- Frequently asked questions

What is the month-end close process?

The month-end close is when companies finalize their financial statements at the end of each month. It is typically finished within 10 days of the end of the month – for instance, a deadline for May closing might be June 10th.

A month-end close process includes reviewing accounting journal entries, reconciling accounts, creating financial statements, and finalizing the accounting data for the month. The main goal of the month-end process is to ensure that the balance numbers are correct before closing the books, as no changes can be made after that. Accurate reports are crucial for effective spend management, helping organizations monitor and control their financial activities.

Why is this process important?

While it may feel redundant to repeat this process every 30 or so days, it’s important for every business that wants to think of the big picture. By conducting monthly check-ups, companies keep track of their financial health and can make informed business decisions.

These also improve a company’s financial health by helping it stay proactive in cash flow management and planning. With a record of monthly statuses, businesses can more easily identify discrepancies in their accounts and address any issues more quickly.

Regular monthly checks also simplify the year-end process. Reporting based on month-end closes can make both yearly report preparation and tax filing much simpler. Monthly reports also streamline yearly audits by reducing the time, effort, and expenses required to complete the audit.

In addition, they contribute to the overall efficiency of processes within the company. Regular checkups serve as opportunities for managers and accountants to polish their communication and workflows and to find the most efficient ways of exchanging information.

When closing the books, accountants can discover mistakes, double entries, or omitted numbers, either by accident or in an attempt to cover up fraud. This gives them a chance to correct these errors before they become a bigger deal.

Finally, month-end closing provides potential investors or creditors with immediate insights into the company’s financial health and overall performance.

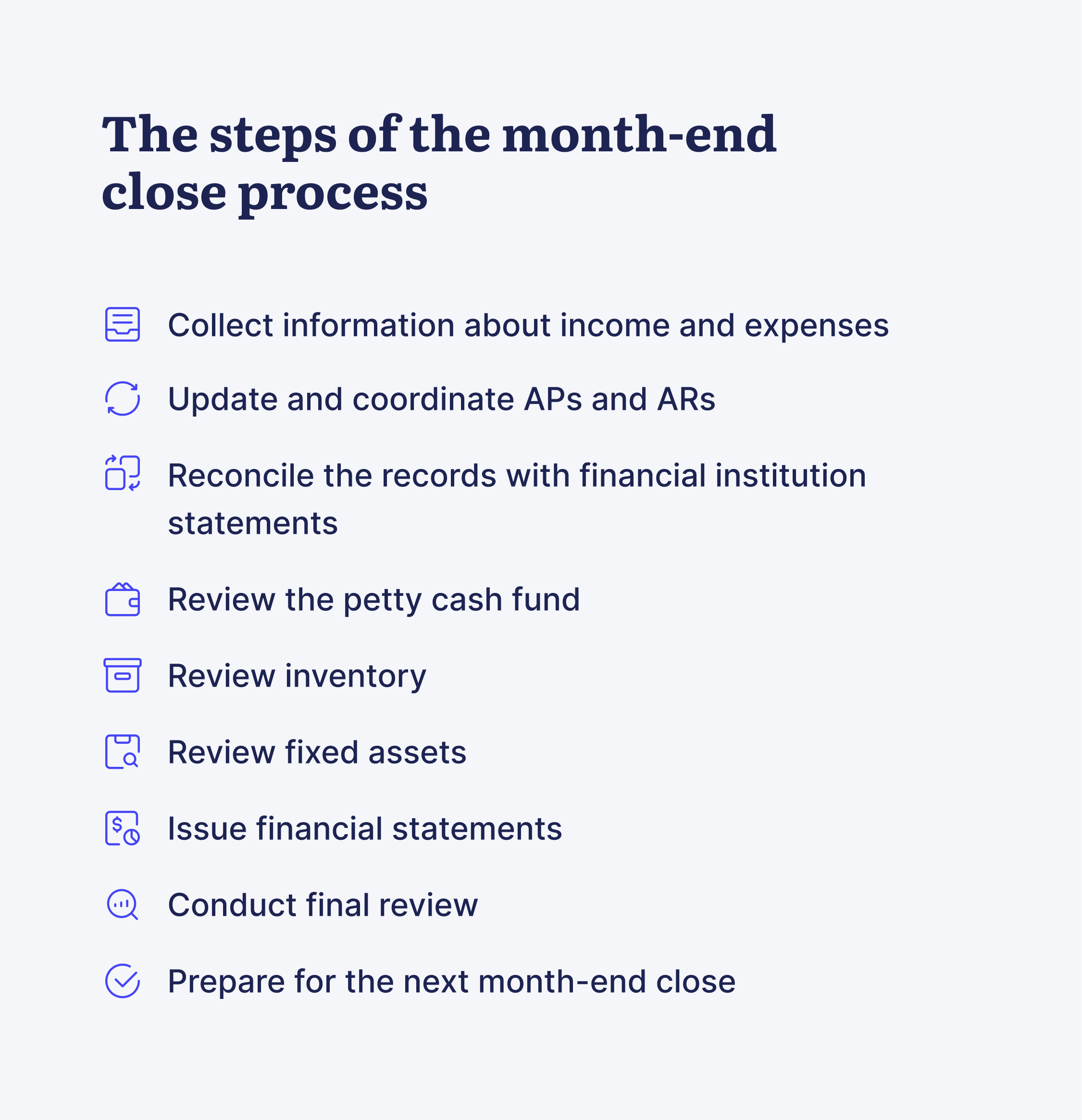

Steps of the month-end process

1. Collect information about income and expenses

The month-end close process starts with collecting information and cleaning it. Relevant information is identified on the income statements (such as accounts receivable), expense statements (for instance accounts payable), unregistered invoices, bank statements, insurance bills, fixed assets, inventory levels, general ledger, and petty cash statements.

A dedicated accountant or a financial team will use the data to check whether all financial obligations were fulfilled for the month and to issue financial statements.

To make this step easier at the end of the month, the best practice is to record transactions right away when they happen. By the end of the month it will be impossible to remember everything that happened for the past 30 days.

Key income sources to check and review include:

- Sales revenue

- Rental income

- Investment interest

- Debt repayments

Of course, depending on your company’s industry, there might be other sources.

As a part of this step, it’s a good idea to double-check if invoices for all the transactions made within the month have been sent out. If there are any transactions the company hasn’t sent invoices for, they should be issued during the month-close process. This way, invoices are included in the month in which transactions took place – and money is received in a timely manner.

Next, check key expenses, such as:

- Payments to suppliers

- Utility bills

- Payroll

- Insurance payments

- Travel expenses

- Loan interest

Once income and expense data is collected, organize it and ensure there are no duplicates. Gathering comprehensive information in the first step helps save time and minimize mistakes later in the process.

2. Update and coordinate APs and ARs

Next, review accounts receivable and check if all the payments are made within the agreed credit terms. Generate an aged debtors report (this can usually be generated within the accounting software) and follow up with the customers who did not make payments by the due date.

It’s important to ensure all the discounts and extensions are accounted for, and then recognize the bad debt which will not be paid.

Also, review accounts payable to check whether invoices are being paid on time Register all the overdue invoices, check them for mistakes and duplicates, and see if there is a pattern explaining why payments are not being made on time.

3. Reconcile the records with financial institution statements

All accounts on the balance sheet should be reconciled with the relevant bank statements. Check all of the account types the company might use, including:

- Checking

- Saving

- Loan

- Credit

- Money transfer services

Check the ending balances for all the relevant bank accounts against the balance sheet, then go through the history of deposits and withdrawals to check for discrepancies. Look out for suspicious activity, unexpected bank charges, and uncleared transactions.

If there are any discrepancies, adjust journal entries so that the cash book matches the real account statements.

4. Review the petty cash fund

The petty cash fund might seem like a minor amount within the balance sheet, but all transactions must be considered in order to keep the company’s financial data clean. While petty cash transactions might seem to be insignificant during one month, if left unaccounted for, they might add up to greater discrepancies at the end of the year.

Compare the petty cash balance at the end of the month to the beginning of the month and reconcile receipts to cover the difference. It is a good idea to check the petty cash fund weekly, as these small payments might go unnoticed next to the large transactions and can slow down the month-end close later.

5. Review inventory

Count the relevant items in your inventory and compare the number against the books of records. Monitoring inventory on a regular basis helps avoid over- and understocking, which are both counterproductive.

Overstocking traps capital in the inventory unnecessarily and might never be monetized. On the other hand, with understocking, companies risks production delays or even outages.

Update inventory in the books to reflect the real count and analyze the inventory management practices by answering the following questions:

- Are we maintaining sufficient inventory levels?

- How often do we have to order?

- Are we purchasing at good prices?

- Are our storage methods effective?

End-of-month inventory reviews can reveal useful trends such as seasonal variations and help better prepare for the whole fiscal year.

6. Review fixed assets

The next step of the process is assessing fixed assets. They might be physical (for example, buildings, equipment, and vehicles) or intangible (like trademarks, patents, and brand names).

Fixed assets aren’t easily converted to cash, but they do generate monthly expenses while their value depreciates. Depreciation costs should be documented under expenses.

While reviewing fixed assets, follow these steps:

- Make sure all purchases and sales of fixed assets are recorded

- Record maintenance expenses

- Account for the changes in the value of the assets over time: depreciation and amortization

7. Issue financial statements

With all the accounts reviewed, it’s time to prepare financial statements to reflect the cash flow, profitability, and value of the organization. These statements include:

- Balance sheet

- Income statement (P&L)

- Cash flow statement

Compare the statements to make sure there are no discrepancies. If you have accounting software, generate these reports automatically to avoid manual work, minimize mistakes, and save time.

These financial statements provide insights into the efficiency of investment, budgeting precision, and possible reasons for overspending.

8. Conduct final review

Final review should be entrusted to someone who was not involved in the previous steps of the month-end close process. This might be, for instance, top management or certified public accountants. They can provide fresh insights into the data and possibly notice mistakes and omissions missed by someone working with the data for some time.

Ask the reviewers to go over the following:

- General ledger

- Financial statements (mentioned in the previous step)

Once the month is closed, no more journal entries should be made for that month. Therefore, it’s important to double-check all statements before closing the month in order to make sure that financial information is accurate.

9. Prepare for the next month-end close

Finally, evaluate how the month-end close process went. Reviewing the effectiveness of procedures helps decision makers identify strengths and weaknesses in the month-end close, draw conclusions about what can be improved, and take corrective actions.

Ask the following questions about the month’s performance:

- Are there any problems that require immediate attention?

- Did everything go as planned? Were there any failures?

- Did anything slow down the month-end close?

- Can you streamline some of the process steps?

- Is the business making progress towards its long-term goals?

By looking back on the most recent month-end close process and comparing it to the previous periods, organizations can justify changes and implement their findings right away. Such corrective actions are inherent to effective financial planning and they help with risk mitigation.

Key things to check

The whole process of monthly reviews can be overwhelming, so we have prepared a concise checklist for you to go over before closing the books.

Financial accounting and the month-end close process go beyond recording transactions. They cover the whole spectrum of company finances: income cash, bank loans, expenses, savings, and so on. Since the process requires aggregating information from various sources, it might be helpful to have a list of records to check.

- Cash. Make sure to check that the cash balance matches the relevant bank statements. If there are any undeposited funds from the previous month, deposit them. Adjust the records for any outstanding checks.

- Inventory. Count your inventory, note the changes from the beginning of the month, and document expired inventory.

- Fixed assets. Document the depreciation and amortization of fixed assets, and record maintenance expenses.

- Expenses. Record and check all the company’s expenses, and double-check them against the bank statements.

- Accounts receivable. Check the status of issued invoices and due payments, record past due balances, and write off bad debts.

- Accounts payable. Confirm the payments you made to the suppliers and check if there are any overdue invoices.

- Notes payable to the banks. Calculate the cost of monthly interest to the bank and document loan amortization payments.

- Payroll. Calculate employee payroll and other reimbursements.

- Accrued taxes. Record accumulated taxes for the given period, including those applied to sales, property, and payroll.

Challenges to expect during the month-end close

Month-end closing process has its challenges that every accounting team should be prepared to tackle. By recognizing these challenges, accountants and managers can mobilize resources to prevent unpleasant situations or at least minimize their impact.

Messy data

Lack of centralized and coherent data can jinx the month-end process from the start. If the financial documents required for the check are stored in different places, it might be difficult to aggregate the information quickly.

Another challenge might be unmatching data formats coming from disparate sources, if registered by different employees and especially if information processing procedures are not standardized.

Human error

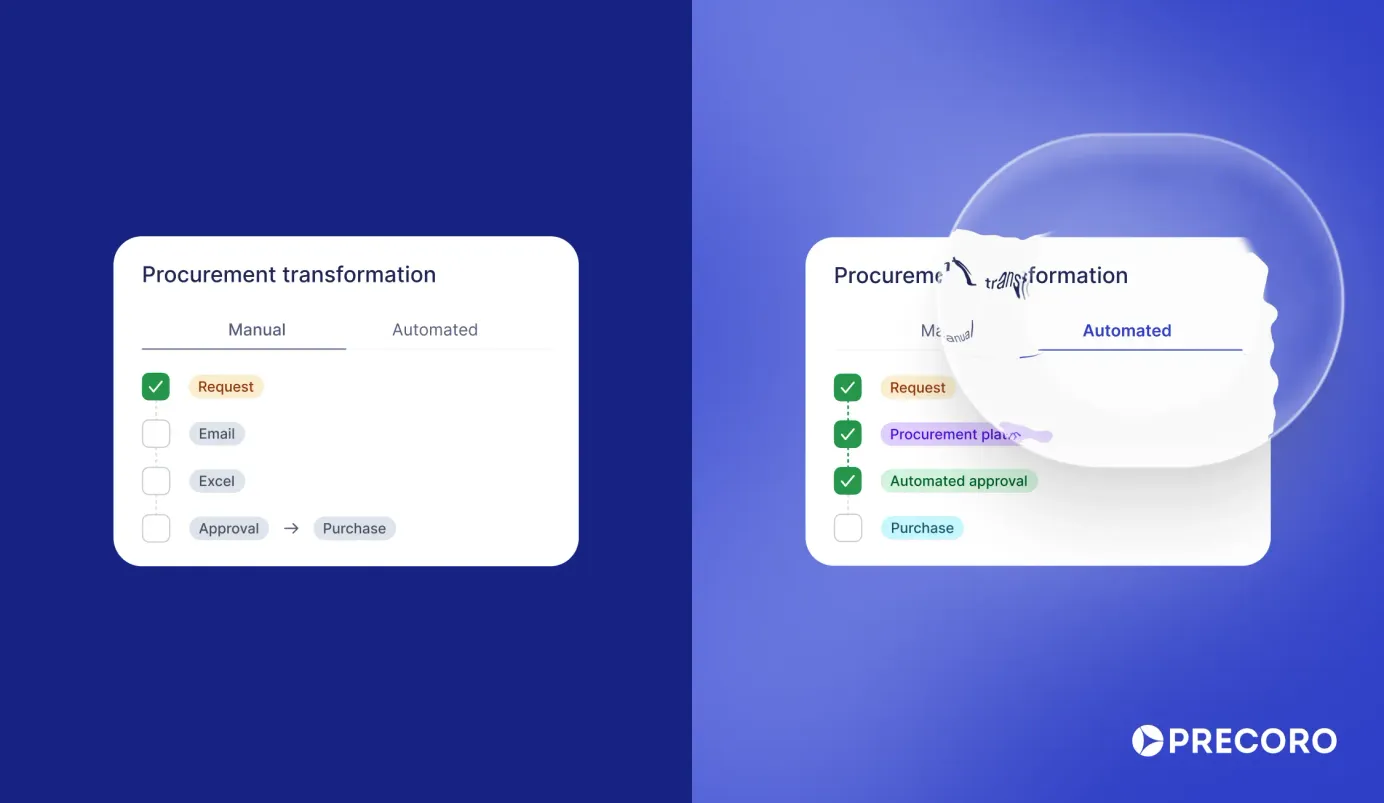

If transactions are registered manually via spreadsheets, there will most likely be mistakes, double entries, or omissions in the entries. Even experienced professionals can be mistaken once in a while or get overwhelmed with large volumes of information to process during peak-season.

If team members submit information to the financial department via spreadsheets or by email and then an accountant then has to manually upload it into the accounting system, there are a lot of openings for errors to be made.

Finding automation solutions that can transfer data to the accounting system can be a game-changer. For instance, the majority of modern procurement tools support integrations with accounting software. They can automatically carry numbers from the earliest procurement steps to the final accounting ones with minimal human intervention.

Digital solutions help to smooth the month-end closing process and help accounting teams make forecasts for the following month.

Closing speed

Another challenge to be aware of is the consistency of checking the numbers and producing the monthly financial statements. If accounts are not reconciled continuously when transactions happen, it can become quite time-consuming to go over the whole month and issue a statement at the end.

A manual month-end close process makes it take even longer – as does not having a structured procedure. Monthly financial statements should be done while they are still relevant. Their information becomes obsolete quite quickly, as the company moves on to the next month.

However, higher speed of issuing statements shouldn’t be achieved at the cost of information quality. Conducting a month-end closure in a hurry can result in problematic reports that will have very little added value, especially if used for the year-end close.

If your financial statements are repeatedly delayed, it’s worth considering how to streamline the steps of the closing process rather than just hurrying up and closing the month at any cost. If you find the deadline for releasing financial statements unrealistic, then consider adjusting the timeline or the workflow to rid of the process bottlenecks.

Following the same schedule for issuing financial statements is important, as it helps to better plan your organization’s financial activities. Therefore, set a realistic timeline for the month-end close process instead of giving a positive but unattainable deadline.

Lack of automation

A higher number of mistakes and delays can result from dependence on slow, error-prone manual processes. Lack of procurement automation increases the chances of such mistakes, which in turn delays approvals.

In addition to that, companies that do not automate their work can find themselves highly dependable on the physical presence of employees at the office at the same time. That might be an issue with the focus shifted towards work environment flexibility.

By utilizing AP automation software that automates work processes across departments, organization can ensure:

- Structured and coherent data

- Clear workflows

- Employees accountability

- Trustworthy reporting

- Higher speed of information processing

From collecting data to sharing the financial statements, automation can speed up the month-end close process dramatically and ensure higher accuracy of information, therefore allowing stakeholders to gain better control over the company’s financial health.

Unstructured closing process

If there is no clear workflow and division of duties, the month-end close might be inefficient and unnecessarily time-consuming. Depending on the size of the company, closing the month might involve many employees and departments. Therefore, uncoordinated work of everyone involved and lack of proper training might become an issue.

Without clear responsibilities and workflows, employees might also search for shortcuts to close the months quickly but not carefully, resulting in unbalanced books.

The month-end closing process should typically follow the same standardized steps and approval workflows to ensure consistent results. Since it’s a routine activity, organizations will most likely encounter the same roadblocks repeatedly. If these problems are noted down by the responsible employees, they can be addressed and fixed in time.

For instance, if the accounting department has to spend hours reorganizing excel spreadsheets submitted by the employees, maybe it’s time to look for software integrations that will transfer data automatically.

Staffing issues

The month-end close process can also face obstacles if an accounting team is understaffed or if present staff lacks sufficient training. While many bottlenecks can be neutralized by introducing automation solutions, employee skills are still crucial for configuring an efficient process.

Even if an organization lacks the resources to employ more professionals, training or retraining present staff might be a viable option for improving the performance of the month-end close.

Let’s recapitulate

The month-end close process is a necessary, routine practice that includes reviewing financial information from the last month and ends with issuing financial statements. After the month is closed, no changes can be made to the month’s numbers.

Month-end financial statements are invaluable sources of information about a company's financial health that help stakeholders make informed business decisions. When closing the books, accountants can discover crucial mistakes and have a chance to correct the errors before they become a bigger deal.

Regular monthly checks also simplify the year-end closure, tax filing, and yearly audits, as well as provide potential investors or creditors with immediate insights into the company’s performance.

During the monthly closures accountants and financial teams analyze various financial operations and aggregate information from many sources, which can make the whole process overwhelming. Having a checklist for the month-end close can help to ensure that nothing is missed and that all the key steps have been checked.

Frequently Asked Questions

The month-end close includes reviewing accounting journal entries, reconciling accounts, creating financial statements, and finalizing the accounting data for the month. The main goal of this procedure is to ensure that numbers are correct before closing the books.

There are several steps companies should take to complete the month-end close process: collect information about income and expenses, update and coordinate APs and ARs, reconcile the records with financial statements, review the petty cash fund, inventory, and fixed assets, issue financial statements, and then conduct a final review and prepare for the next month-end close.

Since the month-end process requires aggregating information from various sources, it’s helpful to have a list of records to check. These records include: cash, inventory, fixed assets, expenses, accounts receivable, accounts payable, notes payable to the banks, payroll, and accrued taxes.