19 min read

E-Invoicing Software Solutions and Tips on How to Select the Best One

E-invoicing is a cost-efficient and time-saving alternative to the manual process. Discover benefits and tips for implementation.

As the drawbacks of time-consuming and error-prone manual invoice processing become increasingly evident, a growing number of companies are turning to e-invoicing software as a more efficient alternative. With e-invoicing, the process of generating and distributing invoices is automated – meaning neither the vendor nor the buyer has to worry about data entry mistakes or unauthorized invoices.

This article explores some of the best e-invoicing software and key features to consider when choosing a reliable system. It also explains why adopting an e-invoicing solution could be one of the smartest decisions a company makes. Whether you’re a small business owner looking to streamline the invoicing process or a large corporation aiming to enhance compliance and reduce errors, understanding e-invoicing is key to staying ahead in a competitive market.

Keep reading to learn:

- What is e-invoicing?

- Common challenges of a traditional paper-based invoicing system

- What are the benefits of using an e-invoicing solution?

- How does e-invoicing work?

- The best e-invoicing software solutions

- Features to look for in e-invoicing software

- Tips for smooth selection of an e-invoicing solution

- Frequently Asked Questions

What is e-invoicing?

Electronic invoicing, also known as e-invoicing, is the automation of the invoicing process using a specialized e-invoicing platform. Suppliers or vendors can implement dedicated software to create and send invoices more efficiently, whereas their customers adopt such a tool to automatically match invoices with the related documents. Additionally, both parties can approve and track invoices faster and with more accuracy.

In the last few years, public entities in many European countries have been required to use e-invoices instead of manually processed documents. E-invoices are digitally formatted invoices that are transmitted electronically from suppliers to customers via specialized systems.

Typically, an e-invoice is delivered in a standardized format, such as XML or JSON, ensuring data consistency and facilitating seamless information exchange between sending and receiving parties. However, a standardized format isn’t always the case.

While some regulations, like the EU directive, mandate structured digital formats for e-invoices, others, like HMRC in the UK, also accept unstructured formats like PDF, which may require additional processing using optical character recognition (OCR).

Nevertheless, e-invoices should include everything required for a paper invoice:

- Invoice number

- Number of the related PO

- Issue date

- Payment due date

- Supplier’s name and address

- The customer’s name and address

- Item type

- Product number, model number, or SKU

- Quantities and prices of goods or services

- Total amount due

- Payment terms

- Taxes (if there are any)

- Discounts (if there are any)

There are several types of e-invoicing platforms, each with its own features and capabilities. Let’s explore the main ones:

I. Point-to-point connection

E-invoicing solutions employing a point-to-point connection utilize a direct connection between a buyer and a seller. It’s commonly used for EDI (Electronic Data Interchange) invoicing, which transfers highly standardized information in predefined XML data files.

This method requires both parties to have compatible systems for generating, sending, and receiving invoices. While point-to-point connection happens via a secure communication link and offers a direct and often efficient way to transmit invoices, it can become challenging to scale as the number of trading partners increases.

II. Network model

In the network model, businesses connect to a centralized e-invoicing platform where multiple buyers and sellers can exchange invoices. These systems often provide standardized formats, compliance checks, and value-added services such as invoice financing or dispute resolution.

The key benefit of tools utilizing the network model is uniformity, as all users exchange e-invoices in the same format. This model is also expected to become more popular among users due to easy scalability and the establishment of efficient networks between various suppliers and clients.

III. E-invoicing module as part of a comprehensive tool

Some procurement, accounting, and ERP software solutions incorporate e-invoicing functionality as part of their broader suite of modules. Typically, these platforms use invoices in PDF or XLSX formats.

For private businesses not mandated to utilize structured e-invoice formats, this type of e-invoicing software is the most advantageous choice for managing supplier invoices. This is because such tools allow companies to process comprehensive e-invoicing data in the same environment where they manage other key business processes. Companies can then tie their e-invoicing to the management of purchase orders, receipts, supplier relationships, and spend control, for example.

Below, we’ll focus more on the last type of e-invoicing software, as it centralizes all financial and procurement data in one secure and easy-to-manage place. We will also explore the benefits companies can gain from digitalizing their vendor invoices, even if they’re not yet required to by regulations.

Common challenges of a traditional paper-based invoicing system

Software for e-invoicing emerged as a viable alternative to a paper-based invoicing process, which presents several challenges that can affect invoicing efficiency and accuracy in organizations across different industries, whether it's a construction business, renewable energy sector, hospitality, healthcare or other industries.

Here’s a closer look at the common issues associated with paper invoicing:

Manual data entry errors

Human errors in data entry are almost inevitable, especially with the growing volume of documents. These mistakes can include simple misspellings, incorrect item codes, or duplicate entries. Such errors lead to inaccurate financial records, payment delays, and disputes between vendors and their clients.

Moreover, because paper invoices must be shipped or mailed, there’s always a risk that they might be lost or sent to the wrong address. Procurement managers and AP specialists can often identify and correct these errors, but doing so requires extra administrative effort and time.

Delays in internal invoice approvals

The approval process for paper invoices often involves multiple physical handoffs between departments, which can cause significant delays. Invoices may sit on desks for days, waiting for review and approval. These approval bottlenecks slow down the payment process, potentially leading to late payments and disruptions in vendor relationships.

Limited visibility

Stakeholders involved in the manual invoicing process often lack real-time visibility into the status and progress of invoices. This affects both suppliers and receiving companies. Suppliers may struggle to determine whether their invoices have been approved for payment by the client. Meanwhile, stakeholders in the receiving company might not have a clear view of where related documents are located and the current statuses of invoices.

Time-consuming task processing

Businesses using paper invoices will realize that a large amount of time is spent handling and entering data, especially as the company grows and has to process a larger number of invoices. Moreover, invoice recipients must manually cross-check them with the corresponding purchase orders (POs) and receipts. When performed manually, this three-way matching process consumes significant time.

Increased risk of fraud

The lack of real-time visibility and centralized tracking increases the risk of fraudulent activities going unnoticed. For instance, duplicate invoices might be submitted for payment, inflated charges could go unchecked, or entirely fictitious invoices might be approved.

Procurement managers and accounts payable staff can perform three-way matching manually. However, without a robust e-invoicing solution, it becomes challenging to cross-reference the growing number of invoices with the related POs and receipts and verify invoice details, making it easier for fraudulent claims to slip through.

As organizations increasingly notice the weak spots in their invoicing processes, the need to adopt e-invoicing software becomes apparent.

What are the benefits of using an e-invoicing solution?

Let’s see what benefits companies can reap from adopting reliable e-invoicing software.

Increased accuracy

E-invoicing software solutions minimize the risk of errors that often occur with manual data entry, as it’s possible to choose data from drop-down menus. Moreover, since invoices can be generated from POs, many fields are automatically pre-filled. Additionally, some e-invoicing platforms use optical character recognition (OCR) to automatically extract data from invoices and help companies process invoices from their suppliers.

Streamlined approvals

E-invoicing solutions help companies automate invoice routing. In practice, this means that invoices are automatically sent to the appropriate stakeholders based on predefined rules, such as department or spending limits. Moreover, e-invoicing software sends real-time notifications to approvers when an invoice is ready for review. Automated approvals eliminate manual handoffs and ensure that invoices are reviewed and approved promptly.

Tracking and traceability

Software for e-invoicing typically provides visibility into the status of each invoice, allowing users to track its progress through the approval and payment processes. Additionally, dashboards and reports can highlight any delays while also providing insights into spending and vendor data. As a result, stakeholders can efficiently monitor progress and make data-driven forecasts.

Time savings

E-invoicing saves time for all parties involved in the transaction. For suppliers, it reduces the time spent on data entry. E-invoicing software solutions offer users templates for simplified document creation, and some systems even let suppliers create invoices from POs and send them through the approval pipeline.

In addition, automation simplifies invoice reconciliation for customers. The best e-invoicing software automatically cross-references invoices with related POs to identify discrepancies between product quantity, price, or payment terms. Moreover, the company receives instant notifications when a discrepancy is detected, saving time on processing fraudulent or duplicated invoices.

Reduced risks

E-invoicing solutions implement role-based access controls to restrict access to invoice data. Only authorized personnel can view, approve, or modify invoices, reducing the risk of unauthorized changes and maintaining the integrity of the invoicing process. In addition, e-invoicing software that offers integrations with other systems helps to ensure that invoice data is accurately synchronized across platforms and no data is distorted during transfer.

Some tools even offer automatic three-way matching. Not only it saves teams’ time, but also ensures no duplicate or fraudulent invoices accidentally slip in. Any discrepancies between the documents are flagged for review, allowing for prompt correction before payment is processed. This robust verification process safeguards companies against overpayments and financial losses.

Cost efficiency

One of the primary ways in which e-invoicing lowers the overall cost of invoicing is by eliminating expenses related to paper, printing, and postage for companies using paper invoices. However, it goes further than that, as the best e-invoicing software also reduces labor costs related to manual tasks, leading to substantial cost savings over time. In fact, it is estimated that switching to e-invoicing saves up to 80% of the total costs associated with manual invoicing.

Improved cash flow

Automated invoice validation helps clients not only reduce the administrative overhead, but also settle payments more quickly. As a result, organizations capitalize on early payment discounts. At the same time, early payments allow suppliers to reduce their Days Sales Outstanding (DSO) and improve their cash conversion cycle.

Simplified tax audits

E-invoicing software solutions help stakeholders quickly locate invoices by providing centralized, searchable repositories where documents are securely stored. This eliminates the need to sift through physical paperwork or navigate disorganized file systems, making it easy to find specific invoices using various search criteria such as due date, vendor name, or involved budget.

Moreover, with an e-invoicing solution, it’s possible to track every action taken on an invoice, including data entry, approvals, adjustments, and tax applications. This level of transparency enhances accountability and helps companies ensure that all steps in the invoicing process are compliant with organizational policies and that the correct tax rates are applied.

Environmental friendliness

E-invoicing aligns with broader sustainability goals by promoting eco-friendly business practices. This significant reduction in paper use lowers waste and helps conserve natural resources by minimizing the need for paper production and disposal.

Moreover, software for e-invoicing not only eliminates the need for paper and ink but also reduces carbon emissions from transportation and postal services. By transitioning to digital invoicing, companies significantly cut their carbon footprint, contributing to more sustainable and eco-friendly operations.

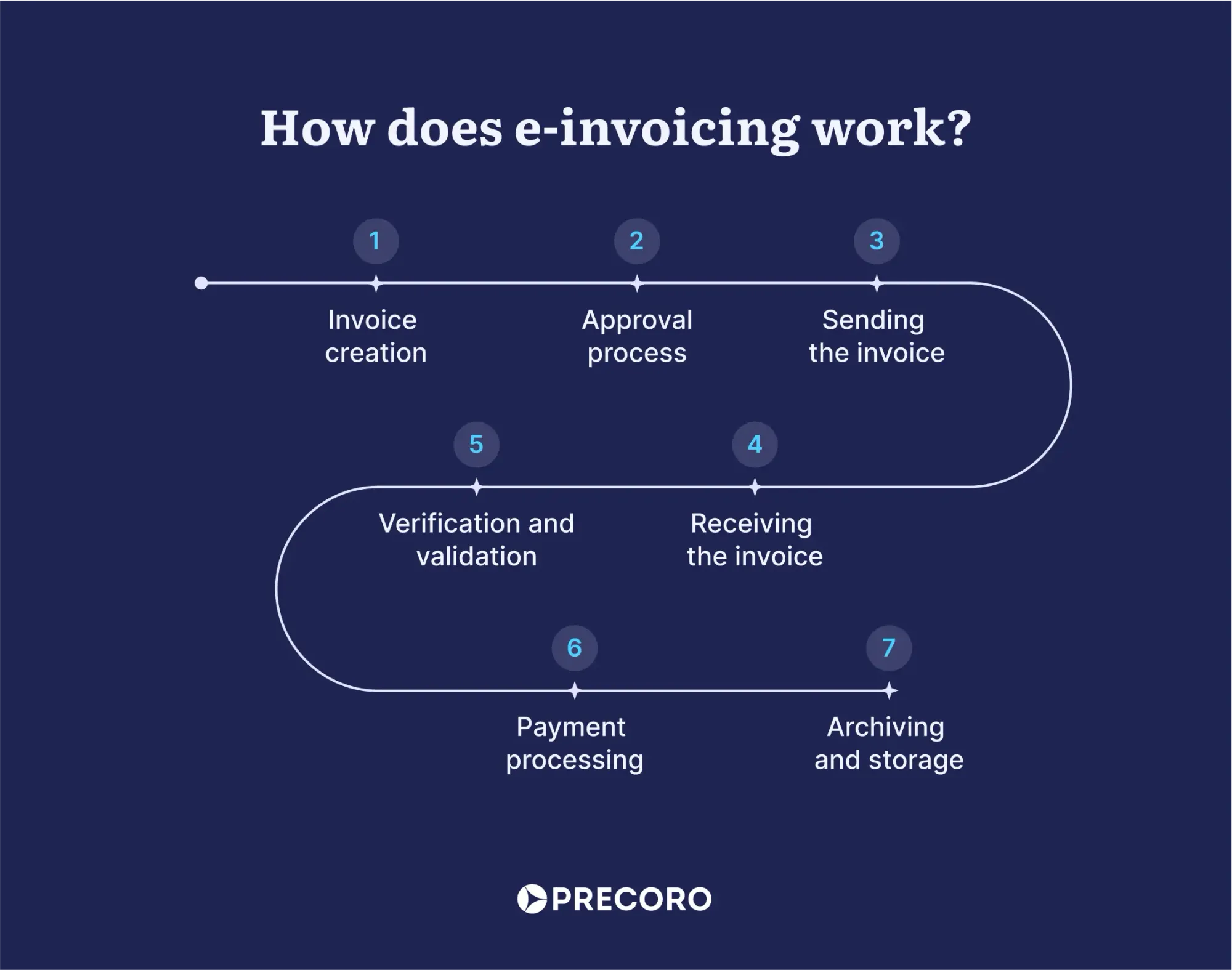

How does e-invoicing work?

Specific steps within the e-invoicing procedures may differ depending on the needs of all involved parties. However, the general frame is applicable to all types of businesses across various sectors. Here are the steps involved in the e-invoicing process:

Invoice creation:

- The supplier generates an electronic invoice using the e-invoicing software. They input relevant details such as invoice number, date, item descriptions, quantities, prices, taxes, and buyer information in the document template. Moreover, some e-invoicing solutions allow suppliers to convert the received purchase orders into ready-made invoices.

Approval process:

- If necessary, the invoice may be routed through an approval workflow, where the designated supplier’s personnel review and approve it electronically.

Transmission:

- Once validated and approved by the seller, the e-invoice is electronically transmitted to the buyer’s e-invoicing solution.

- Alternatively, the supplier may send the e-invoice via email or upload it to an e-invoicing network model platform for the buyer to access.

Receiving on the client’s end:

- The buyer receives the invoice in the e-invoicing software and notifies the stakeholders.

Verification and validation:

- Upon registering the invoice, the buyer processes it and matches it against the corresponding PO and receipt to ensure accuracy and compliance.

- When the three-way matching is done in the e-invoicing software, the system flags any discrepancies or exceptions for further review or resolution by authorized personnel.

Payment processing:

- Once validated, the invoice is scheduled for payment according to agreed-upon terms.

Archiving and storing:

- After payment, the e-invoice is archived within the e-invoicing software, which serves as a secure storage repository for record-keeping and audit purposes.

The best e-invoicing software solutions

To help you find the right fit, we’ve put together a list of the best e-invoicing software solutions.

Precoro

Precoro is a comprehensive procurement software that offers a feature-laden invoice management module and easy-to-use AI capabilities. Users can do the following in the tool:

- Create invoices from scratch or from purchase orders.

- Attach documents to generate pre-filled supplier invoices using AI-enhanced OCR technology and minimize manual data entry.

- Add tax rates, therefore simplifying compliance with specific country regulations and reducing manual calculations.

- Set up customizable invoice approval workflows and ensure that each approver is notified when a document awaits them. Systems that provide approval thresholds are invaluable, considering that lengthy invoice and payment approval times were a top hurdle that slowed down the AP teams in 2023

- Keep track of the invoice status to see if it has been approved, rejected, paid (partially or in total), under revision, and more.

- Use multiple currencies for international suppliers.

- Enjoy automatic 2- and 3-way matching to reconcile invoices with the related POs and receipts.

- Generate real-time invoicing reports to plan the finance strategy thoughtfully.

What makes Precoro one of the best e-invoicing software is its ability to manage more than just invoicing. It also handles POs, receipts, suppliers, and budgets, providing comprehensive coverage of the entire procurement process.

Xero

Xero is an accounting tool that helps companies smoothly automate invoicing. In addition, it offers a number of features beyond invoicing, like bank reconciliation and expense tracking. Xero is especially popular among freelancers and small businesses.

With key features for invoicing, the tool enables users to:

- Schedule recurring invoices for convenient processing and time efficiency.

- Reconcile bank transactions.

- Automate payment reminders to speed up customer payments through tailored emails.

- Accept online payments via debit/credit cards or PayPal directly from the invoice for improved cash flow.

- Generate and send invoices instantly from your phone or tablet.

- Keep track of your finances with the chart of accounts.

However, keep in mind that Xero may be a little difficult for non-tech-savvy users to navigate. Plus, companies can only enter five bills and send quotes and 20 invoices on the starter plan.

QuickBooks

QuickBooks is an easy-to-use accounting system. It provides comprehensive invoice management features, like abilities to:

- Create custom invoices.

- Turn estimates into invoices in just a click.

- Track invoice statuses.

- Split the amount for bigger projects with progress invoicing.

- Send automatic reminders and follow up on overdue invoices.

- Add VAT, discounts, shipping, billable expenses, payment details, and more.

QuickBooks is best suited for small businesses.

NetSuite

NetSuite is a cloud-based Enterprise Resource Planning (ERP) system. It offers an integrated set of tools to manage accounting, supply chain, inventory, order management, and more.

In terms of invoice management, NetSuite enables users to:

- Receive and enter invoices from suppliers.

- Convert a purchase order into a bill without rekeying the data.

- Automatically match incoming vendor invoices against their corresponding POs and goods receipts.

NetSuite is a good solution for managing multiple processes within one program. However, it can be challenging to customize and requires some training sessions to grasp the system’s functionality.

Wave

Wave is an e-invoicing software solution with a free version. It is a user-friendly platform suitable for small businesses, freelancers, and entrepreneurs. Wave’s users can:

- Generate personalized invoices, estimates, and receipts swiftly.

- Send automatic payment reminders for timely payments.

- Accelerate payments by accepting credit cards, often settled within two days.

- Keep tabs on income, expenses, and receipts through scanning tools and bank connections.

However, Wave offers limited support (no live or phone options), and it’s not tailored for growing businesses.

Features to look for in e-invoicing software

When it comes to software for e-invoicing, there are numerous tools to choose from. How do companies select the right one to match their workflows and requirements? While it’s important for the tool to provide functionality for invoice creation, approvals, validation, and tracking, we’ve also outlined other key features necessary to make sure you choose the best e-invoicing software for your organization.

Cloud-based accessibility

Cloud-based e-invoicing software solutions enable real-time collaboration among team members, regardless of their location. Multiple stakeholders can view, edit, approve, or comment on invoices simultaneously, reducing delays associated with locally stored digital files. Additionally, with a cloud-based e-invoicing platform, updates and maintenance are handled by the service provider and take the burden off the company’s IT department and resources.

User-friendly interface

A user-friendly interface allows users to quickly learn and navigate the e-invoicing solution without extensive training. This is especially important for companies with diverse teams who may have varying levels of technical proficiency.

An e-invoicing solution with a user-friendly interface helps streamline workflows by organizing tasks logically and providing clear, easy-to-follow steps for each process. In addition, a well-organized layout with clear visuals, such as charts, graphs, and progress bars, can help employees quickly understand the statuses of invoices and other financial documents.

Customization options

Every business has unique invoicing requirements, from specific approval workflows to unique reports. E-invoicing software with advanced customization options allows companies to adapt the platform to their existing processes rather than forcing them to conform to a one-size-fits-all solution.

With customizable e-invoicing platforms like Precoro, organizations can configure multi-level approvals, assign specific roles and permissions, define rules for different types of invoices through custom fields and forms, and even create custom reports.

High-level security

High-level security is one of the most sought-after features in e-invoicing solutions because it helps to safeguard business invoicing details and handle all data within regulatory standards. Strong data protection mechanisms are implemented to prevent threats like theft of information, fraud, and unauthorized access, which can have serious financial and reputational consequences for companies.

The best e-invoicing software offers multi-factor authentication and SSO capabilities. Strict adherence to major compliance standards, such as GDPR, UK GDPR, SOC 2 Type II, CCPA, and HIPAA is also helpful to ensure the utmost data safety. Precoro provides all of the above-mentioned security measures.

Robust integrations

Robust integrations enable seamless connectivity between the e-invoicing platform and other business systems. Effective integration capabilities ensure that data flows smoothly across different departments and applications in real time, enhancing overall efficiency and accuracy in financial management.

Moreover, integrating an e-invoicing solution with other financial systems allows for consolidated reporting and analytics. Thus, when implementing a procurement tool with an invoice management module, make sure it integrates with your accounting, ERP, and other business systems like Slack or Power BI. For example, Precoro integrates with Xero, Quickbooks, NetSuite, and more.

Comprehensive process coverage

Comprehensive process coverage in e-invoicing software solutions means the platform can handle not just the invoicing process but also integrate other crucial financial and procurement activities, such as purchase orders, receipts, supplier management, and budget tracking. This holistic approach ensures that all related processes are interconnected within a unified solution.

By adopting e-invoicing platforms that encompass multiple processes, companies can achieve significant cost savings. These integrated solutions are more cost-effective than using multiple standalone systems. In addition, they are more scalable and stay useful as the company grows.

Reporting capabilities

It’s important that e-invoicing software solutions provide access to up-to-date reports on invoice statuses, incurred expenses, involved suppliers, and payment details. This visibility helps companies understand their current cash flow state, make more accurate financial forecasts, and plan for future expenses more effectively.

Additionally, with advanced reporting capabilities, financial controllers can quickly identify issues, such as recurring late payments or high volumes of disputed invoices, and take proactive steps to address them. This ability to act on current and historical information enables better strategic planning and resource allocation.

Tips for smooth selection of an e-invoicing solution

Selecting the best e-invoicing software for the company requires a careful and strategic approach to ensure the solution aligns with your organization’s specific needs and objectives. Here are some tips to help guide you through this decision-making process.

Map out your ideal invoicing process

To ensure a smooth implementation of an e-invoicing solution, involve key stakeholders in mapping out your ideal invoicing process. Start by working closely with the accounts payable (AP) team to document the current workflow and identify the areas for improvement. Think about how to handle different types of invoices, like standard, recurring, and internal ones. Also, plan how to handle any discrepancies between invoices and related documents, and consider how invoice management might differ across departments or cost levels.

Careful planning helps the person selecting the software for e-invoicing understand which features are necessary. For instance, they might discover that the invoicing process requires seamless integration with the existing ERP system for smooth data flow. Additionally, they may find that the AP team struggles with detecting duplicate invoices, which could lead to overpayments, so the e-invoicing software solution should include built-in three-way matching.

Prioritize feature suitability

To ensure a smooth implementation of an e-invoicing solution, it’s crucial for a designated person to pinpoint the must-have features identified during the process mapping phase. They may include:

- Multi-currency for international operations.

- Customizable invoice templates with custom forms and custom fields.

- Configurable approval workflows based on invoice amounts, departments, or other criteria.

- Automated three-way matching to prevent payment of fraudulent or erroneous invoices.

- Real-time reporting on invoice statuses, payment cycles, and financial performance,

- Integration with ERP and accounting systems to ensure smooth data flow and reduce the need for manual data entry.

- Tax management to automatically calculate and apply appropriate taxes and ensure compliance with local, regional, and international tax regulations.

- Identification and flagging of duplicate invoices to prevent overpayments and ensure the integrity of financial records.

- An easy-to-navigate interface that minimizes the learning curve and enhances user adoption across the organization.

It may also be useful to go beyond invoice processing and choose a solution like Precoro that offers modules to manage purchase requisitions, purchase orders, receipts, suppliers, expenses, and inventory.

Compare costs and ROI

Once a list of software providers with the necessary functionality for the smooth invoicing and procurement processes is compiled, compare the costs with the potential return on investment (ROI). Start by evaluating the initial costs of the software for e-invoicing, including the pricing plan that meets all requirements, possible setup charges, and any customization or integration work needed to align the system with the existing workflows.

Then, assess the potential benefits and calculate the expected ROI of the potential e-invoicing solutions. Benefits to consider include time savings from automating data entry and approval workflows, reduced error rates, improved cash flow due to faster invoice processing, and enhanced compliance with regulatory requirements.

This data can be gathered by comparing your processes with those of companies that already use e-invoicing platforms. Additionally, it’s helpful to request performance data from software providers on their users’ outcomes.

Don’t forget to factor in indirect benefits such as improved supplier relationships from quicker payments and better audit readiness due to a digital record-keeping system. Plus, software for e-invoicing can reduce costs associated with late fees, disputes, or fines for non-compliance. Finally, your company might benefit from early payment discounts offered by suppliers, further boosting ROI.

Leverage software vendor support

To ensure a smooth implementation of an e-invoicing solution, fully use the support services provided by the software vendor. The best e-invoicing software providers offer comprehensive onboarding assistance, including training sessions, technical support, and resources like a Knowledge base and video tutorials.

It’s a good practice to engage with the vendor early in the process to understand the full range of support options available. By leveraging vendor support, you can minimize the risk of implementation setbacks, ensure a faster transition to the new system, and maximize the benefits of your chosen e-invoicing software solution.

Frequently Asked Questions

Electronic invoicing, or e-invoicing, is the automated digital processing and exchange of invoices between suppliers and customers. It involves the creation and management of electronic invoices in unstructured (PDF) or structured data formats (like XML or JSON).

An e-invoicing software solution is a system that facilitates creating, delivering, verifying, approving, and processing digital invoices. It can operate as a point-to-point connection between the buyer and seller, as part of a network model connecting multiple buyers and sellers, or as one of the modules within a broader procurement, ERP, or accounting system.

Electronic invoicing involves using specialized e-invoicing solutions to create an invoice using templates and transmit it electronically to the recipient. The recipient’s system can automatically verify the invoice, send it through the approval workflow, and store it, streamlining the invoicing workflow and reducing manual errors. Additionally, the e-invoicing platform provides stakeholders with visibility into all stages of invoice processing.

A smart approach to choosing software for e-invoicing

E-invoicing software eliminates time-consuming, error-prone, and costly manual invoicing procedures. It automates the creation, approval, distribution, verification, and storage of electronic invoices. The adoption of e-invoicing can be beneficial for businesses of all sizes. Both large and small organizations will experience almost immediate cost savings, reduced paperwork, faster invoice processing, and improved accuracy. Additional advantages include the ability to track invoice status and document history.

With e-invoicing systems, suppliers can automate the creation of invoices from the POs, eliminate the need for manual data entry, and enjoy quicker cash turnover as a result of faster invoice processing. Meanwhile, businesses using software for e-invoicing can streamline labor-intensive processes, like approving invoices and matching them to purchase orders and receipts.

Companies can transition to e-invoicing through a point-to-point connection or a network model. Alternatively, organizations can also adopt a system with an invoice automation module, such as procurement, ERP, or accounting systems. Procurement software seamlessly integrates invoicing into other procurement activities. Thus, in one system, users can manage and track purchase orders, receipts, expenses, suppliers, and inventory.

To choose the best e-invoicing software for your company, follow these key steps:

- Analyze the pain points in the manual approach and map out the ideal invoicing process.

- Prioritize systems with features that can cover the needs of the predefined invoicing process.

- Compare costs and ROI of the potential software for e-invoicing.

- Explore the vendor’s support options and make the most out of them to simplify the implementation process across the company.