15 min read

Procurement Intelligence: From Unstructured Data to Strategic Insights

Relying on old records is no longer enough. Learn how procurement intelligence helps develop a forward-looking strategy with real-time insights.

Procurement teams have to go through a massive amount of information every single day. When all purchase requests, invoices, and contracts are scattered between systems, it’s easy for important info to slip through the cracks.

That’s why more companies are adopting intelligent procurement. With automation tools and analytical techniques, teams can combine internal and external data to guide their purchasing strategies. Rather than reacting to problems as they come up, the company can plan ahead and act early.

In this article, you’ll learn what procurement intelligence is, its main types, proven best practices to get started, and how a platform like Precoro can help put your strategy into action.

Read on to find out:

What is procurement intelligence?

Procurement intelligence and procurement analytics: Know the difference

Subsets of procurement intelligence

8 best practices for intelligent procurement

Procurement intelligence techniques

Frequently asked questions about procurement intelligence

How Precoro can help

What is procurement intelligence?

Procurement intelligence refers to the structured collection and analysis of data, insights from which can later be used to guide strategic decisions. It turns fragmented information into findings that can support whatever action your company takes moving forward. Now your decisions don’t rely on gut feeling alone; they’re data- and evidence-based.

Advanced procurement business intelligence services rely on a few key technologies. AI and machine learning (ML) automatically collect company data and market findings, organize them, and flag patterns you might miss.

Predictive analytics and big data (massive datasets of unstructured information) can help forecast financial performance and market trends. Cloud procurement platforms centralize all company-wide info, which makes it easier to access and analyze.

Procurement intelligence and procurement analytics: Know the difference

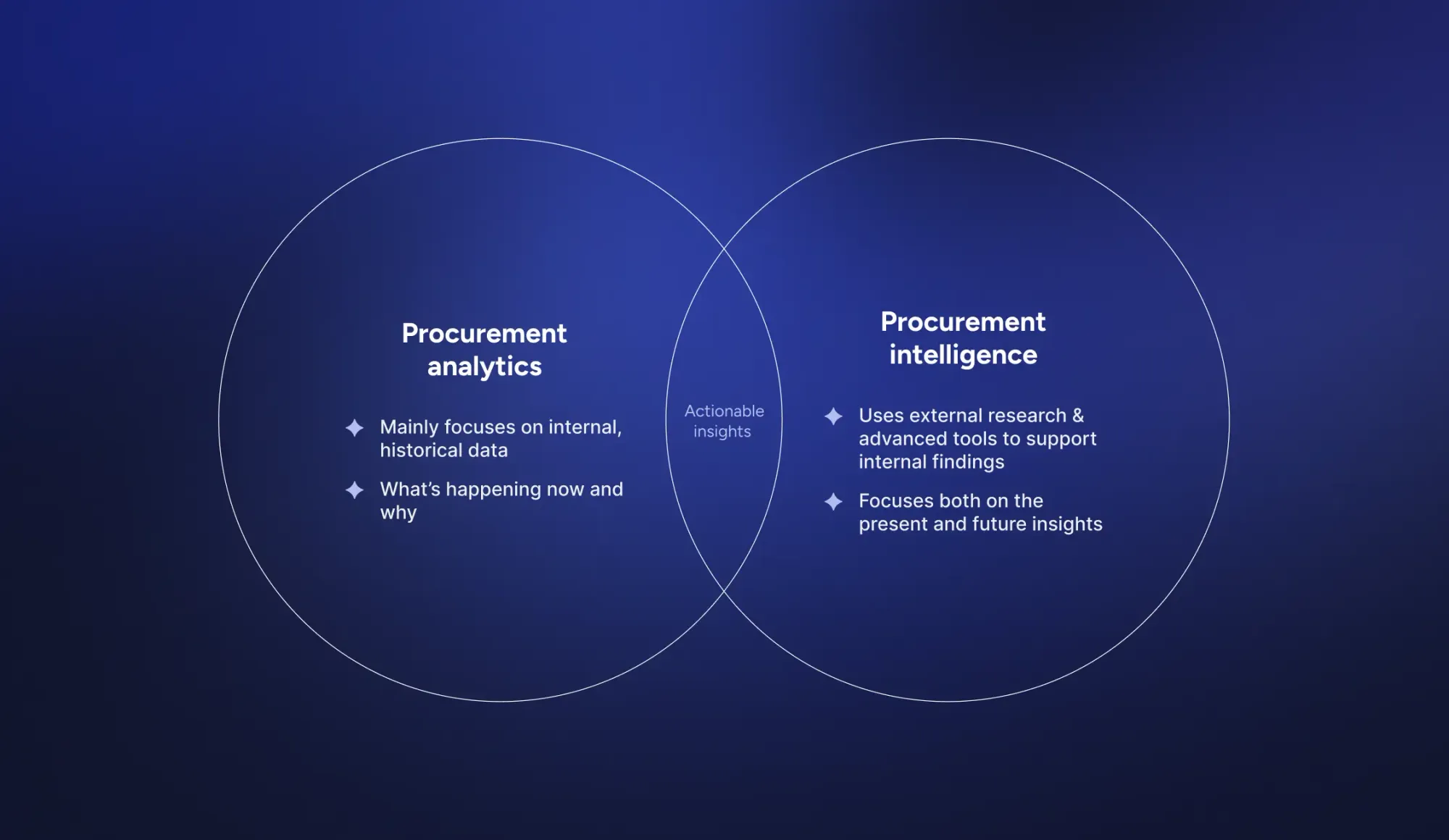

Both procurement intelligence and procurement analytics heavily rely on data. They have a similar end result—actionable insights you can use to improve your processes. Many use these terms interchangeably, but there’s a thin line that separates them.

Procurement analytics focuses on collecting, organizing, and analyzing purchasing data to understand what’s happening in your procurement process and why. The key types include:

- Descriptive analytics looks at historical data to show what happened (e.g., how much you spent last quarter).

- Diagnostic analytics digs into the reasons behind past results (e.g., why spend increased in a certain category).

- Predictive analytics uses past trends to forecast what might happen (e.g., how demand or price might increase).

- Prescriptive analytics suggests specific actions based on insights (e.g., recommends vendors based on cost or your strategy).

Procurement intelligence takes what procurement analytics does a step further. It’s a broader, more strategic approach that uses advanced analytics and external market data to predict trends, assess risks, and guide long-term decisions. While analytics focuses on what’s inside your organization, procurement intelligence zooms out to connect that internal data with what’s happening in the market as well.

In short, procurement analytics mainly focuses on historical data (what happened and why), while procurement intelligence builds on that and estimates likely future outcomes (what’s going to happen). One isn’t better than the other—procurement business intelligence is simply a broader concept that utilizes advanced tools and deeper external insights to guide decisions.

Subsets of procurement intelligence

Procurement intelligence covers a versatile range of data your teams can use to improve their processes. Let’s categorize intelligence based on its focus and the perspective it gives you. Here are the most common types you’ll likely encounter:

Market intelligence

Before changing the current processes, consider taking a look at what works and how other companies handle purchasing. Procurement market intelligence focuses on understanding what’s happening outside your company: in the industry, in the economy as a whole, and in your supply chain.

A strategic approach is what separates strategic and intelligent procurement from tactical. Instead of focusing only on short-term wins, you plan ahead and use lessons from other companies to create lasting benefits.

The core types of procurement market intelligence include:

- Market research: Industry reports and news on any market shifts.

- Commodity and pricing trends: Raw material rates and energy costs.

- Macroeconomic data: Inflation, interest rates, and currency volatility.

- Trade and logistics information: Import-export information and supply chain bottlenecks.

- Competitive intelligence: Sourcing strategies of rival companies.

- Supply market intelligence: Supply trends, average pricing, and vendor capabilities.

If you don’t know what’s happening in the market, suppliers call the shots. Without a clear idea of fair prices for raw materials, your company could end up paying more than necessary.

Category intelligence

Category intelligence zooms in on a specific category of spend and gives you information on what affects each area of procurement. Category managers can make the most out of it: instead of relying on outdated assumptions and predictions, they can back up their strategies with real data on market movements.

In many ways, data in the category intelligence is similar to market intelligence, just more targeted towards a specific category. While market intelligence gives you a bigger picture, category intelligence can narrow it down specifically to what matters most.

For example, you noticed that the IT hardware you use has a relatively short lifespan. To solve this, you turn to procurement business intelligence services and identify IT hardware upgrades that could make your equipment last longer.

Supplier intelligence

Supplier intelligence gives you a clear picture of the companies you rely on. It shows how they’re performing and how dependable and compliant they are. The focus here isn’t just on the lowest prices but on ethics, reliability, and social responsibility.

If a supplier has been late on deliveries two quarters in a row, that’s a warning sign. On the flip side, a vendor with consistent performance over the year could become a long-term strategic partner. When collecting supplier intelligence, focus on:

- Financial health: How financially stable are they? Is there a risk of bankruptcy?

- Performance: Are they delivering on time? Are the orders always complete? Do they stick to the negotiated contract terms?

- Risk factors: Are there any vulnerabilities and potential disruptions in the supply chain? How can they impact your vendor relationship?

- New opportunities: Can you turn to any alternative suppliers for a more cost-effective or efficient turnaround?

Spend intelligence (spend analytics)

Spend intelligence gives you a clear view of how much your company is spending, what you’re spending on, and who you’re buying from. Often, organizations are surprised to learn just how fragmented their procurement spend really is. And no wonder—if spending is managed by each department or location separately, it’s easy for off-contract purchases or budget overruns to slip through unnoticed.

Customer intelligence or buying intelligence

Customer intelligence directly links procurement to the needs of the end customer, whether that’s an internal team or external buyers. This type of intelligence focuses on how many users or customers will want to buy the product, what they’ll expect, and what other requirements they may have.

Having procurement business intelligence is especially useful when demand shifts quickly. For example, if sales see a spike in interest for a certain product, customer intelligence helps procurement plan sourcing and purchases early enough to avoid stockouts or delays.

Pricing intelligence

Pricing intelligence is about knowing whether the prices you’re paying or planning to pay are competitive and realistic. Key datapoints include current supplier pricing, historical cost trends, market indexes, and even competitor benchmarks.

With this information, you can walk into negotiations with confidence and avoid overpaying due to outdated rates or a lack of market transparency. For example, if you're sourcing packaging materials and pricing intelligence shows that rates have dropped industry-wide, you’re in a better position to renegotiate contracts.

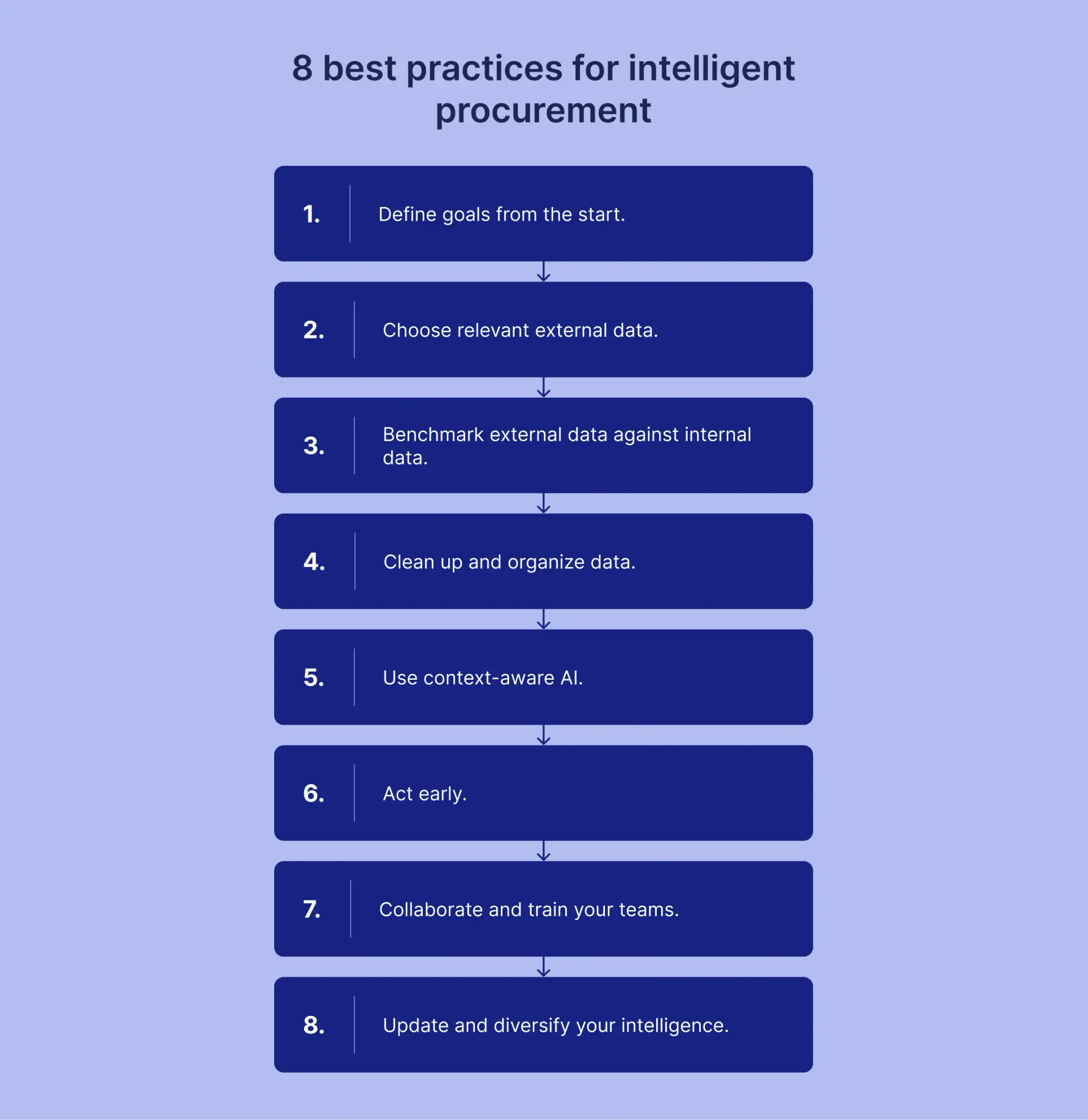

8 best practices for intelligent procurement

Getting insights from procurement information takes more than just dumping it all into a single database. Since data is at the core of the entire process, it has to be carefully sifted through. Inaccurate records cost companies over $600 billion annually. Here are some methods to make the most of your data.

1. Define goals from the start.

Start with the basics first and ask yourself and all stakeholders what exactly you want to achieve with the analysis. The goals differ for each company: some want a shorter lead time, others need to cut costs on specific expenses.

Once you define the goals of intelligent procurement, you can pick and choose whatever data you need without wasting time on insights you’ll never use. Narrow down your objectives and make them SMART (Specific, Measurable, Achievable, Relevant, Time-bound). As your priorities change, move the goalposts and focus your efforts there.

2. Choose relevant external data.

It’s tempting to try to keep up with everything happening in the market. It can make you feel like an expert and give your team a sense of knowing every corner of the industry. But if you only analyze it for the sake of analyzing and can’t apply your findings to actual procurement scenarios, there’s really no point. Data can only help if you tie it directly to your specific case.

For example, if the news is buzzing about new trade tariffs, think about how they may impact your contracts. If a natural disaster hits one of your supply chain centers, consider how much shipment delays will cost you and what alternative suppliers or routes you can use.

3. Benchmark external data against internal data.

Relevant external data has to add context to internal data, not confuse you. It has to act as a benchmark against which you can compare the company’s performance. Look for answers to the following questions:

- Do we source from suppliers that meet industry standards?

- Are we more or less resilient to supply chain disruptions than others in our sector?

- Are we paying more than the market average?

If your answers indicate that you’re underperforming, it's time to renegotiate terms with the supplier or look for gaps in your processes. Found out that you’re paying 20% more for raw materials from a local supplier than your competitors who outsource globally? Consider switching to nearshoring or international options. Pro tip: choose procurement software that supports functionality for sourcing from anywhere, from Saudi Arabia to Thailand.

If you’re overperforming, it’s not an excuse to relax. Identify what exactly makes you stronger: does shipping for your critical supplies cost you less than the market average? Determine why it’s cheaper, and try to implement a similar strategy in your other supplier relationships.

4. Clean up and organize data.

Inconsistent data immediately makes your entire analysis unreliable. Standardize formats, units, PO and PR numbers, and supplier names across your internal systems to combat this risk. If you can, make sure your external data follows a similar structure.

Whether your team is going through data manually or using procurement software, it’s much easier to catch a pattern if all documents are standardized and in the same place. Even a small difference in something simple like lead time could skew the analysis (for example, if you track it in hours but the market report records it in days).

5. Use context-aware AI.

Procurement artificial intelligence that can detect patterns and understand context is a big advantage here. For example, Precoro partnered with Google AI to automate invoice capture: OCR processes the documents, fills in the fields based on context, and generates ready-to-use invoices. You have complete documents on your hands and more time to focus on strategic tasks.

While a human has to spend days gathering and analyzing massive datasets (and gets tired in the process), AI can handle the same work in minutes. For example, AI might detect that your lead time often increases during a holiday season and suggest sourcing from one more supplier to compensate for the delay or ordering before the season hits. The key is to choose tools that understand procurement context and can navigate both external and internal data, so recommendations are relevant and not generic.

6. Act early.

If you want to make the most out of procurement intelligence, don’t let it sit on your computer screen. That’s the benefit of predictive analytics: you can anticipate and prevent risks before they damage your processes. Even if the changes are small, they can save you a lot of headaches in the long run.

If procurement business intelligence services indicate that the costs are set to rise due to bad weather in the region you’re sourcing from, secure your contracts now to avoid price increases. If you’re seeing an uptick in maverick spend incidents among employees, implement strict protocols or procurement software that could help minimize them.

7. Collaborate and train your teams.

Data silos can quickly undo the progress you’ve made. Bring in other departments to share their perspectives and data, and keep everyone informed. For example, sales could share their demand forecasts to help the procurement team analyze existing supplier terms.

Additionally, if employees haven’t previously dealt with procurement intelligence, make sure they have guidance and support. Ask more experienced team members to conduct training on how to read crucial data like market reports or vendor scorecards.

8. Update and diversify your intelligence.

Market and industry shocks happen fast and stem entirely from factors you can’t control, like the global economy, weather, and geopolitical situation. To monitor any shifts, set a goal for yourself to update data regularly and look for information from different resources.

Don’t rely on a single report from a purchase intelligence platform—cross-check it with your other sources. You don’t need to spend hours reading market reports: subscribe to an industry newsletter or follow the news to spot shifts early. For real-time updates, consider investing in tools like Bloomberg Terminal.

Procurement intelligence techniques

The data itself is important, but so are the ways you approach and analyze it. The realm of data analysis has no shortage of tools to turn unstructured information into meaningful insights. Here are some methods you can use to make intelligent procurement more effective.

- Should-cost model

The should-cost model estimates what a product or service should cost by breaking it down into its components, including raw materials, labor, overhead, logistics, and profit margins. Armed with these numbers, you’re not going into supplier negotiations blind. You can actively spot when supplier prices don’t align with the market estimates.

- Will-cost model

While the should-cost model reflects what the supplies should cost, the will-cost model indicates how much you’ll actually pay for them. This approach takes into account inflation, price increases, and demand levels and automatically assumes the cost will surge. The will-cost model helps plan your supply chain transactions ahead of time and avoid paying more than you need.

- Text mining

Text mining essentially transforms unstructured data into a structured format, which is easier to analyze and comprehend. Around 80% of all business data is unstructured—that is, pure unformatted text. Text mining uses AI and natural language processing (NLP) to detect patterns and key terms in the midst of all this data. Qualitative analysis tools like MAXQDA and NVivo help you organize and analyze unstructured data.

- Scenario planning

Scenario planning is about exploring “what if” situations and preparing for the worst before it happens. It gives you the chance to act early and reduce risks before they escalate. What happens if oil prices increase by 20%? Or if your vendor delays delivery by two weeks? Scenario planning helps you build flexible sourcing strategies to cushion the fall if anything goes wrong.

- Cost benchmarking

Cost benchmarking is the process of analyzing your Cost of Goods Sold (COGS) and comparing it against your industry peers. Having these numbers laid out in front of you can be useful if executives feel like the entire production and supply chain lifecycle costs too much.

If your competitors are getting a better deal or saving more, it's time to rethink where these savings could’ve come from. And if you’re on the same level, this data can help reassure stakeholders and investors that you’re keeping up or even ahead of other companies.

- Price monitoring

Price monitoring is a relatively simple method that you’re probably already using in your day-to-day life. Track price movements in specific spend categories, like packaging or IT services, so you can buy at the right time or lock in favorable terms before costs rise. Consider using automation tools to get notifications when prices change.

Frequently asked questions about procurement intelligence

No. AI can automate and speed up data collection, spot patterns, and even predict risks, yet only humans can provide strategic thinking and relationship-building skills. Treat AI as an assistant that handles the time-consuming, repetitive tasks, so your team can focus on decisions that need human input.

Purchase intelligence is the informed approach to buying based on accurate and up-to-date data. It examines your spend, suppliers, and market trends so you can create a clear and informed policy for how and when you purchase.

These concepts are often used interchangeably, but they have different purposes. Procurement intelligence is about insights. Its goal is to gather, organize, and analyze internal and external data to guide your future purchasing decisions. The main purpose of procurement automation is efficiency. Companies use a procurement automation solution to speed up and simplify processes. Finally, procurement transformation reshapes the entire procurement strategy. It aims to make the process more strategic and, in turn, uses both intelligence and automation to achieve that.

Procurement automation tools often use AI to deal with manual and time-consuming tasks like data entry. AI can pull in data from multiple sources, clean it up, and highlight patterns or risks you might miss. It can predict price spikes, identify unreliable suppliers, or suggest alternative sourcing options, all in real time.

A way to informed decision-making

Procurement intelligence applies data analytics, AI, and market information to turn spending data into practical insights. It helps organizations make more informed, strategic sourcing and purchasing decisions—reducing costs, managing risk, and strengthening supplier relationships. Unlike basic reporting, procurement intelligence supports more predictive and proactive approaches by highlighting supplier performance, market and pricing trends, and overall spending patterns. With this visibility, procurement teams can negotiate more effectively, address risks earlier, and improve efficiency across the procurement process.

How Precoro can help

Data alone won’t fix a broken process. Without structure and a centralized approach to handling data, procurement teams risk wasting time on insights they can’t use. Purchase intelligence works best when it’s centralized within a single system like Precoro. With a purchase intelligence platform, you:

- Unify processes across locations. Every location, department, and business unit works in the same structured workflow. You see exactly who’s buying what and from whom.

- Automate manual work. Automated requests, approvals, and AI-powered invoice capture free up your team’s time for analysis, negotiation, and strategic sourcing.

- Consolidate purchases for better deals. When all purchases are logged in a single platform, you see exactly where you’re spending more and can renegotiate terms with suppliers.

- Speed up approvals without losing control. Role-based access, guided request forms, and built-in budgets speed up request processing and keep your team compliant with spending limits and policies.

- Keep vendors organized. Centralized vendor database with onboarding, PunchOut catalogs, and contracts ensures your team buys only from approved, pre-vetted suppliers.

- Get instant, actionable insights. Built-in reporting and integration with your other systems give you real-time visibility across the board.