20 min read

How to Build a Spend Management Strategy That Works

Gain control, cut waste, and align procurement with business goals through a clear, effective spend management strategy.

To earn money, a business needs to spend money first. Raw materials, maintenance services, and salaries are just a few examples from the long list of typical company expenditures. Persistent margin pressure keeps cost reduction at the top of CPO agendas, with supply continuity and inflation management close behind.

Strategic spend management ties cost control to value—savings, resilience, and growth. Procurement alone typically accounts for more than 20% of total transformation impact, which is certainly a high leverage for change.

In this article, we’ll dive into what spend management is, why it’s more relevant now than ever, the differences between spend management vs. expense management, and how to create a spend management strategy.

Find out more about:

What is business spend management?

Spend management vs. expense management

How spend management ties into Scope 3

Types of spending

Reactive vs. proactive spend management

Cornerstones of strategic spend management

How to build strong spend management strategies

Common pitfalls in strategic spend management

Common misconceptions about strategic spend management

Frequently asked questions about strategic spend management

What is business spend management?

Strategic spend management is a set of practices that help organizations direct their money toward financial and strategic goals. It takes a full-cycle view of spending, covering everything from procurement to payment.

Business spend management covers planning, control, and optimization across every spend area: direct and indirect procurement, capex and opex, travel and expense, and SaaS/cloud subscriptions. Typically, to make it work, organizations opt for clear policies, defined processes, strong analytics, technology, and tight governance.

In practice, strategic spend management centers on core procurement practices: spend analysis, strategic sourcing, and supplier management. Together they maximize value, reduce risk, ensure compliance, and strengthen long-term financial health.

Spend management vs. expense management

Though often used interchangeably, spend management and expense management are not exactly the same.

Expense management is a narrower term that deals specifically with individual employee spending, for example, travel expenses or business lunches. Expense management software is used to register, track, reimburse, and audit employee expenses according to the company’s policies.

On the other hand, spend management is a broader term. It refers to how a company manages all outflows: inventory, equipment, software, logistics, full-time employee salaries, and, yes, even employee expenses.

In a nutshell, spend management is the big-picture approach to how the company spends money, and expenses are a part of it. Therefore, expense management is a sub-category of spend management in procurement.

How spend management ties into Scope 3

Interestingly, strategic spend management is not just about dollars but also about carbon. Each time your company buys, there’s likely a Scope 3 impact. Every product, material, or service you purchase comes with an emissions footprint from your suppliers: from raw material extraction to manufacturing to transport.

Since procurement controls spend categories and supplier choices, it also controls a big chunk of Scope 3. Moreover, regulators, such as the EU CSRD and the SEC, now require companies to report Scope 3 emissions as part of compliance.

Therefore, companies get a clearer view of both costs and emissions when they consolidate suppliers, standardize categories, and enforce compliance in one system. This setup lets procurement:

- Compare suppliers not just on price, but on carbon impact.

- Cut “waste spend” that often overlaps with waste emissions.

- Use structured data from purchase orders and contracts to fuel Scope 3 reporting.

A spend management strategy lets you link supplier choices to financial and environmental costs. It supports the adoption of sustainable procurement practices that help reduce waste, improve business resilience, and ensure compliance with regulations.

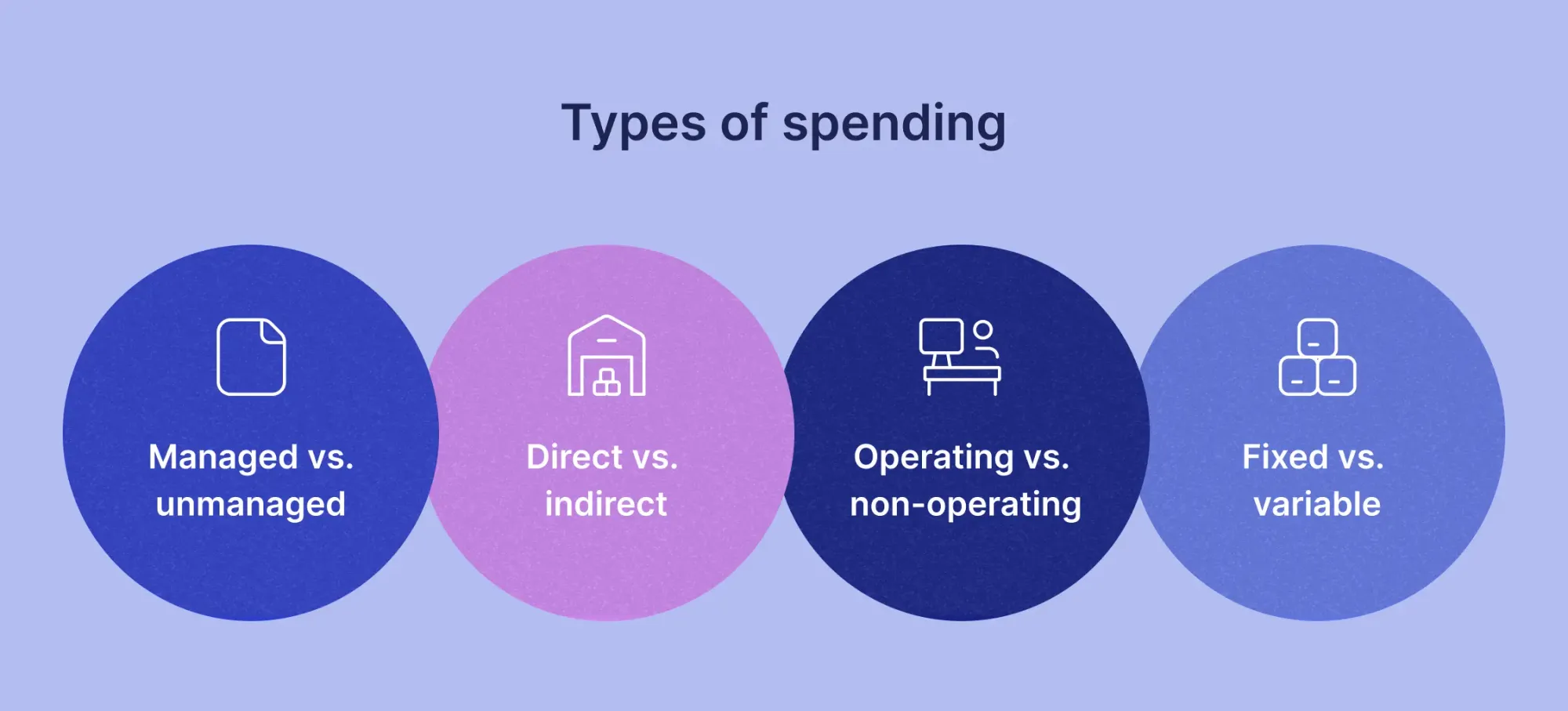

Types of spending

A spend management strategy must account for different types of business expenditures, from initial investments to recurring day-to-day costs. These include procurement and administrative expenses, R&D, salaries, employee reimbursements, vendor payments, and outsourced services. Some are planned and recurring, while others are occasional or triggered by unexpected needs.

To better understand and control spending, companies often group expenditures into several categories:

Managed vs. unmanaged

This classification shows whether spending is planned and controlled or happens outside formal processes.

Managed spend is any spend under a contract that company representatives have sourced, negotiated, and signed. In other words, it happens within the company’s defined procurement cycle.

Unmanaged spend refers to purchases made outside the procurement cycle, usually one-off transactions without contracts or prior bidding. Such spending comes either from emergency situations or from poor control over the process.

Direct vs. indirect

These terms indicate whether costs go straight into the final product or support the business in other ways.

Direct spending, also called direct cost or direct procurement, involves purchases that a company needs to produce its own goods or services, which it then sells to its customers.

Indirect spend, also known as indirect cost or indirect procurement, encompasses all other expenditures required for the business to run.

For instance, in a factory that produces wires, aluminum is used to manufacture the final product, and that’s why it’s a part of the direct spend management. However, packaging material for shipping would be included in the indirect spend.

Operating vs. non-operating

This classification shows whether a company’s spending is tied to its core operations.

Operating costs are the recurring expenses needed to keep the business running day to day. They can include both direct costs, like raw materials for production, and indirect costs, like office rent or marketing campaigns. In short, if an expense is part of running and growing the company’s regular operations, it’s considered operating.

Non-operating costs, on the other hand, are expenses that fall outside of everyday operations. These don’t come from producing goods or delivering services but still impact the company’s finances. Common examples are interest payments on loans or tax expenses

Fixed vs. variable

These terms indicate whether an expense fluctuates over time.

Fixed costs don’t vary with the volume of goods produced or services provided. These are expenses that must be paid regardless of the production volume. Examples include office or warehouse rent, insurance, and employee salaries.

Variable costs, on the other hand, change depending on how much the company produces or sells. Examples include wages for contractors, raw materials, and product packaging.

Reactive vs. proactive spend management

The difference between a weak and a strong spend management strategy often comes down to mindset. Reactive organizations rush to buy when issues come up. Proactive ones, however, foresee needs, plan ahead, and match spending with long-term goals. The first approach may feel faster, but it drives up costs and risk. The second requires more structure upfront, but it delivers visibility, control, and sustainable savings.

So what does this look like in practice?

Reactive spend management

Reactive spend management means businesses deal with spending issues as they come up. They don’t have a plan or system to manage costs ahead of time. In this approach, procurement decisions are often made in response to immediate needs or problems, which can lead to inefficiencies and missed opportunities.

Key characteristics include:

- Unplanned purchases: Often based on urgent needs or last-minute requests. For example, to avoid delays, a department may skip the procurement process and purchase from an unapproved vendor.

- Lack of visibility: Spend isn’t tracked comprehensively, and it’s hard to see the full picture of where money is being spent and if there’s any waste.

- Higher costs: Without strategic planning, organizations may miss out on bulk discounts or favorable payment terms. Uncoordinated purchasing also leads to duplicate or redundant orders, driving up costs.

- Compliance risks: Reactive management often involves bypassing policies and contracts. It leads to non-compliance with vendor agreements or regulatory requirements.

For example, a company orders office supplies in bulk, only to realize that another department ordered the same supplies just a month earlier. As a result, the company wastes money on duplicates and misses out on volume discounts from consolidated orders.

Proactive spend management

Proactive spend management, on the other hand, focuses on planning and making informed decisions based on data and strategy. In this approach, organizations continuously monitor, analyze, and optimize spending to align it with broader business goals.

Key characteristics include:

- Strategic planning: Spend is planned and managed through defined procurement strategies that consider long-term goals, supplier relationships, and overall cost efficiency.

- Full visibility: Companies use tools and systems to track every dollar spent across departments, so no purchases are made without justification.

- Cost optimization: By analyzing spending patterns, businesses can identify opportunities for bulk purchasing, negotiate better terms, and get rid of unnecessary costs.

- Compliance assurance: With well-defined processes and tools in place, procurement aligns with company policies, industry regulations, and sustainability goals.

For instance, a business uses a centralized procurement platform where it can track all purchase orders across departments. Procurement managers regularly review spending patterns, consolidate purchases, and negotiate with suppliers for better terms. As a result, each purchase aligns with the company’s overall cost-saving strategy.

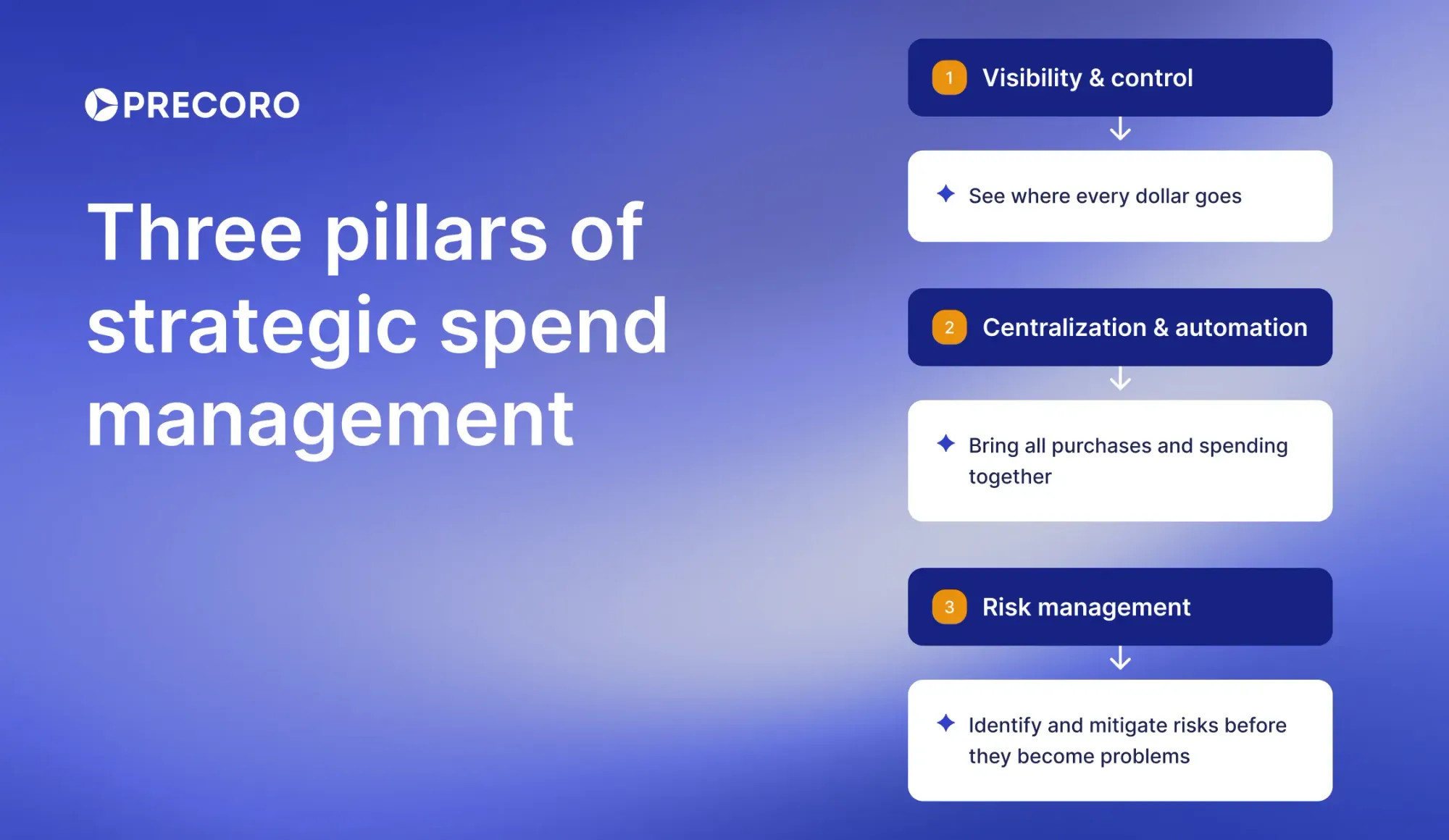

Cornerstones of strategic spend management

A strong spend management strategy isn’t just about tracking invoices or cutting costs. It’s built on three core pillars: visibility and control, centralization and automation, and risk management. Let’s explore each one and how it impacts the spend management definition.

1. Visibility & control

Before you can manage spending effectively, you must know exactly where every dollar goes across departments, locations, and projects. Visibility and control mean that you have full transparency into every purchase, no matter who’s making it or where it’s coming from. Without it, you risk unnecessary spending, missed savings, and even compliance issues.

If you don’t have a complete view of your purchases, employees may buy items that are already in stock, order from unapproved suppliers, or spend more than necessary. This kind of off-the-radar buying (known as maverick spending) is a real problem for businesses trying to stay on budget. Here are a few ways to avoid it:

Track spend in real time

If you only look at spending after the money is gone, it’s too late to correct mistakes. Real-time visibility lets you catch duplicate orders, overspending, and non-compliant purchases before they drain your budget and weaken your spend management strategy.

Use a digital spend management system or procurement software that records every order as it happens. You could track all purchases and see spending across teams and suppliers in one place. This way, issues can be flagged instantly, not discovered months later in a financial audit.

Set clear rules

Without guidelines, employees will buy based on convenience, not company priorities. Clear rules ensure every purchase supports your spend management strategy and fits your budget.

Define approval workflows (who signs off, at what amounts), create preferred supplier lists, and set category-specific budgets. Then, embed these rules in your purchasing tool to make them easy to follow. For example, software could automatically route requests and purchase orders to the right approvers.

Have regular check-ins

Even with the best systems in place, spending habits drift over time. Regular reviews help you spot patterns, identify waste, and ensure your strategy is still on track. Schedule monthly or quarterly audits where you review spend data, check policy compliance, and compare actual spend against budgets.

Share these findings with department heads to drive accountability and collaboration. Over time, these check-ins also give you the data you need for better forecasting and supplier negotiations.

2. Centralization & automation

Once you know where the money goes, the next step is to ensure everyone is on the same page with the demand spend management playbook. Without centralization, different teams often order the same items from different suppliers, pay different prices, or miss out on bulk discounts. It’s messy, costly, and hard to manage.

By bringing all purchasing activity under one system, you can negotiate better deals, reduce mistakes, and simplify the process. Automation then takes over the repetitive tasks, like routing approvals or matching invoices, so the process runs faster and with fewer errors. Here are some best practices:

Consolidate purchases

When all purchasing flows through one spending management system, you can spot and combine similar orders from different departments or locations. Order consolidation means fewer transactions, stronger bargaining power with suppliers, and better chances of securing volume discounts. It also cuts down on duplicated shipping fees and reduces administrative work.

When all purchase requisitions are in one place, you can easily merge identical or overlapping requests from several departments. Over time, this practice leads to more standardized purchasing patterns and stronger vendor relationships.

Automate the repetitive tasks

We all know that spend management for businesses involves endless manual tasks like entering supplier invoices, matching them with POs and receipts, or chasing approvals. Overall, they eat up time and make your processes prone to mistakes. Automation (especially with AI) reduces human error and frees your team to focus on strategic activities.

You could use a system with AI-powered OCR that reads a supplier invoice, creates it in the system automatically, and matches it to the related documents. Precoro does that and goes a step further to also scan and create receipts for expense reimbursements through its mobile app. An AI assistant then speeds up data extraction and analysis of your purchase orders and invoices, so your team spends less time on manual work.

Better forecasting

Without a clear view of past and current spend, planning for future needs becomes guesswork. Poor forecasting often leads to overordering (tying up cash in excess stock) or underordering (causing stockouts and delays).

With centralized data, however, it’s easy to analyze purchasing trends over time. Look at seasonal patterns, recurring orders, and supplier lead times to build more accurate forecasts. Then, use these insights to negotiate better terms with suppliers, avoid last-minute purchases, and keep inventory levels just right.

3. Risk management

The final pillar of spend management strategies, risk management, is about protecting your company from unexpected challenges. Suppliers can fail, prices can spike, and supply chains can be disrupted—any of which can throw budgets and operations off course.

If you rely on a single supplier for a critical product, a problem on their end could cause delays or sudden cost increases. Risk management helps you anticipate these challenges, spread your exposure, and keep spending under control even when the market changes.

Don’t rely on one supplier

It’s risky when you depend on a single supplier for critical materials or services. If they fail (due to bankruptcy, production issues, or logistics problems), your operations could grind to a halt, causing delays and higher costs.

Identify key products or services and ensure you have at least one alternative supplier for each. Here, the procurement system comes in handy to help you monitor orders and maintain approved supplier and item catalogs. Also, try to diversify across regions when you can; this way, you won’t be vulnerable to local disruptions.

Check supplier health

A supplier’s financial or operational instability can directly affect your delivery timelines, quality, and pricing. Being unaware of these risks may result in unexpected disruptions or cost increases.

Keep an eye on supplier financial reports, credit scores, and news updates. Above all, prioritize regular check-ins with key suppliers to protect your demand spend management strategy.

Plan for inflation and price fluctuations

Costs for materials, services, and shipping can rise unexpectedly because of inflation, market volatility, or global events. To avoid budget shocks, build flexibility into contracts with price adjustment clauses, fixed-term pricing, or hedging strategies.

Where possible, use bulk purchasing or long-term agreements to lock in favorable rates. Additionally, regularly monitor market trends so you can anticipate changes and adjust your procurement strategy proactively.

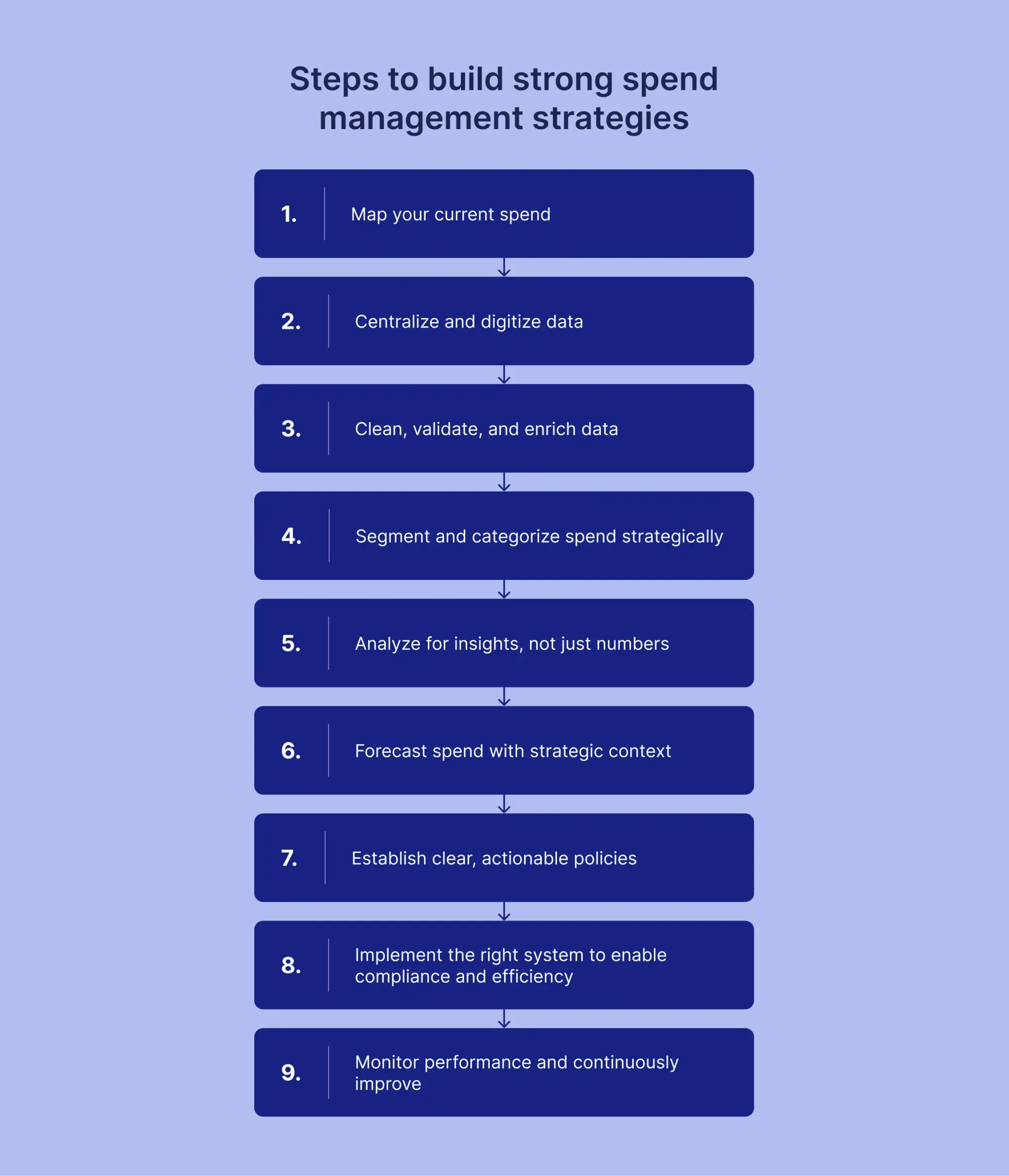

How to build strong spend management strategies

At its core, spend management definition centers on careful analysis before taking action. There is no one-size-fits-all approach since every company has a unique situation determined by its size, industry, structure, location, and more. However, the following 9-step process can serve as a starting point for building a custom spend management strategy.

1. Map your current spend

The spend management process starts with identifying the company’s expenditures. Go beyond invoices and receipts and pay attention to who is buying, what is being purchased, from what suppliers, and why. Identify major cost drivers, recurring expenses, and one-off purchases.

2. Centralize and digitize data

Spend data often lives in multiple systems, spreadsheets, and emails. Bring it together in a single, accessible, and secure procurement platform. Digitizing and centralizing spend makes it easier to analyze patterns, spot inefficiencies, and identify opportunities for consolidation and savings.

3. Clean, validate, and enrich data

Raw data alone isn’t enough. Remove duplicates, correct errors, standardize currencies, and verify supplier and employee information. Collaborate with department heads to ensure accuracy. Only clean, validated data can support meaningful insights and reliable decisions for spend management in procurement.

4. Segment and categorize spend strategically

Group expenditures not only by type (like raw materials, marketing, IT, or salaries) but also by business impact, risk, and savings potential. To do this, ask questions such as:

- Which spending affects core operations the most?

- Which suppliers or categories carry the highest risk?

- Where can we consolidate purchases or negotiate better terms?

This approach to the spend management process highlights the areas where strategic actions will deliver the greatest value.

5. Analyze for insights, not just numbers

Dive into the data to answer critical questions: Which suppliers provide the best value? Are there opportunities to consolidate orders? Where is spending unmanaged or inefficient? Look for patterns, exceptions, and areas where strategic sourcing can reduce costs or increase performance.

6. Forecast spend with strategic context

Look at past spending, upcoming business plans, and market trends to predict short- and long-term expenses. You can act before problems appear:

- Plan purchases ahead of time: Identify what you need each month or quarter to place orders at the best prices and avoid rushed, costly purchases.

- Optimize supplier negotiations: Use forecasted volumes and timing to secure bulk discounts, favorable payment terms, or early deals.

- Prevent cash crunches: Schedule payments and allocate budgets for large or recurring expenses without straining other operations.

- Support business goals: Align spending with company priorities to invest in high-impact projects while controlling low-value discretionary costs.

7. Establish clear, actionable policies

Create clear policies to guide employees and support your strategic procurement spend management goals. Specify approval limits, preferred suppliers, contract rules, and procedures for one-off purchases. Clear policies prevent rogue spending, reduce errors, and let employees make fast, informed decisions without micromanagement.

8. Implement the right system to enable compliance and efficiency

Manual processes and scattered data slow you down and leave money on the table. A good spend management platform brings all projects, locations, and teams onto the same page. Everything flows through one structured spending management process, so approvals are faster, policies are followed automatically, and nothing slips through the cracks.

As a result, you can see exactly where money is going, avoid duplicate orders, and consolidate purchases. Teams spend less time chasing paperwork and more time making smart decisions that save money and support business goals.

A system like Precoro ties everything together—requests, purchase orders, invoices, receipts, budgets, vendors, and approvals—so compliance happens naturally, processes stay consistent, and collaboration across departments just flows. In short, it keeps spending under control without slowing anyone down.

9. Monitor performance and continuously improve

Spending management is an ongoing effort, not a one-time project. Continuous monitoring ensures accountability, identifies new opportunities, and helps the spend management strategy evolve with the business.

Measure the effectiveness of your spend strategy with KPIs tied to cost savings, supplier performance, compliance, and operational efficiency.

Common pitfalls in strategic spend management

Even the best spend management strategy hits roadblocks if you don’t address common challenges head-on. Below, we break down the top issues procurement teams face and practical ways to overcome them.

Maverick spending

Maverick spending occurs when employees bypass the official procurement process. Examples include buying from unapproved vendors, off-contract orders, or urgent requests that skip the company’s approval workflows. This behavior undercuts strategic spend management and can result in increased supplier risks, compliance violations, and missed opportunities for volume discounts.

However, you can easily stop off-contract purchases by funneling all orders through a single platform where approved suppliers and workflows are enforced. Combine this with automated approval routing and short training sessions to show teams the real cost of bypassing procedures. The goal is to make the “right way” faster, easier, and more transparent than shortcuts.

Fragmented supplier management

When supplier information is scattered across spreadsheets, emails, or separate systems, it’s easy to lose track of contracts, performance metrics, or renewal dates. Consolidate all supplier data in one centralized spend management business platform. Track contracts, certifications, and performance in real time so you can spot underperforming vendors, renegotiate terms, and reduce risk. The key here is having a single source of truth for supplier decisions.

Lack of system integration

One department may use Excel spreadsheets to track purchases, another adopt a cloud-based platform, and finance only rely on an ERP system. This lack of integration means the company cannot see a comprehensive overview of its procurement activities, which is a key point in the spend management definition.

Break down silos by linking your procurement, finance, and ERP systems through native or custom integrations. Make sure all departments use the same tools and formats for data. This way, stakeholders will have a real-time, complete view of spending, avoid duplicate purchases, and spot savings opportunities before they slip away.

Common misconceptions about strategic spend management

Spend management is a powerful tool for businesses, but there are some myths that can make it seem more limited—or more complicated—than it actually is. Let’s clear up a few of the most common misconceptions.

“Spend management in procurement is just about cutting costs.”

It’s easy to assume that the goal of spend management is simply to cut costs. However, strategic spend management goes beyond just cost reduction.

- Total Cost of Ownership (TCO): Instead of focusing only on the sticker price, TCO considers all costs associated with a purchase, including delivery, storage, maintenance, and disposal. This broad view helps companies pick suppliers and solutions that are cheaper over the long term, not just upfront.

- Demand shaping: This approach is about influencing what and when the company buys. For example, a procurement manager can coordinate purchases across departments or adjust order timing to reduce rush orders, prevent overstocking, and improve supplier negotiations.

- Design-to-value: This term means reviewing products or services to remove unnecessary costs without affecting quality. For instance, a company can simplify a component or service specification to lower procurement costs while maintaining value for the business.

- Working-capital levers: Consider how adjusting payment terms or taking advantage of dynamic discounts can free up cash. If you pay suppliers early in exchange for discounts or strategic payment stretching, you can improve cash flow and cost control.

“Software alone will fix it.”

Tools can make life easier, but they aren’t a silver bullet. A procurement platform only delivers value if your foundation is solid: accurate data, clear policies, and team adoption. Without these, even the best procurement spend management software will fail to prevent overspending or inefficiencies.

To get results, focus on the following:

- Guided intake forms: Ensure purchase requests include all necessary details and follow company rules.

- Approval workflows: Make sure every request passes through the right hands before money moves.

- Change management and training: Equip employees to use the system consistently and correctly.

- User-friendly solution: Choose a platform that’s intuitive and easy to use. If employees struggle with the tool, they won’t use it, and all your spend management processes and policies will be irrelevant.

In other words, technology amplifies your spend management strategy, but it doesn’t replace it.

“Tail spend is too small to matter.”

Many companies overlook tail spend—the small, infrequent purchases that individually seem minor but collectively create a lot of noise. Tail spend often follows the Pareto principle: roughly 80% of transactions account for only 20% of total spend. Even so, unmanaged tail spend adds complexity, inefficiency, and hidden costs. Companies can take charge and save money with purchase consolidation, clear guidelines, and the help of digital buying channels.

The same goes for SaaS sprawl. Every extra, unused software subscription quietly eats your budget. Keep an eye on overlaps, clean out unused licenses, and manage contracts properly. Tame your tail spend and SaaS subscriptions, and you’ll free up cash and make procurement less of a headache.

“Scope 3 emissions reporting is optional.”

Not quite. Scope 3 covers emissions across your entire value chain, from suppliers to upstream activities. Don’t miss a bit, since it’s becoming a standard practice, especially with rules like the EU CSRD stated in FY2024.

Even where regulations are less strict, investors and stakeholders increasingly expect companies to report on climate-related risks tied to suppliers. Skipping Scope 3 doesn’t just jeopardize compliance—it’s also a missed chance to reduce risk and make procurement more sustainable.

Frequently asked questions about strategic spend management

Spend management refers to the process of tracking, controlling, and optimizing all business expenditures to ensure money is spent efficiently. The goal is to reduce costs, improve value, and align spending with company objectives.

A spend management platform is software that helps businesses automate their procurement processes and shed light on all business expenses. It helps companies track, analyze, and control spending and ensure better visibility, compliance, and cost efficiency.

Both. Finance sets the guardrails (budgets, compliance, and reporting), while procurement runs the day-to-day processes (sourcing, approvals, and supplier management). The best spend management strategies come to life when finance and procurement work together, not in silos.

Ask yourself:

- Do we know exactly where our money goes?

- Can we see spending by category, supplier, and department in real time?

- Are purchases following policy, or do we still see maverick buying?

- Have we reduced manual work and approval delays?

If the answer is “no” to most of these questions, there’s room to improve.

Make compliance the easy choice. Complicated forms and slow approvals push people to bypass the system. Use guided intake for requests, clear workflows, and a user-friendly platform that feels like a help, not a hurdle. Pair that with clear communication about why policies exist (savings, speed, and risk control), and adoption improves.

To build effective spend management, procurement should start with visibility. Gather and clean your spend data to see who spends what, with which suppliers, and on which categories. Without this foundation, it’s impossible to spot leaks, negotiate better deals, or set realistic policies.

Strategic spend management in a nutshell

A strong spend management strategy gives organizations more than just cost savings. It creates visibility into every category, supplier, and department, so leaders can guide decisions with confidence instead of relying on guesswork. With the right policies and processes in place, spending becomes something you shape proactively rather than chase after.

What makes a strategy effective is the balance of people, processes, and technology. Finance and procurement provide clear guardrails, employees get tools that make compliance straightforward, and leadership gains data they can trust. When the spend management procurement system feels simple and helpful, teams adopt it naturally, and the benefits—smoother operations, smarter use of resources, and long-term savings—follow.

Bring order to the chaos of scattered purchasing. Precoro helps you manage spend across every team and location in one smooth, structured process. Enjoy complete visibility into requests, approvals, vendors, purchases, and expense reimbursements.