18 min read

The Role of Accounts Receivable vs. Accounts Payable

How well you manage accounts receivable vs. accounts payable can make or break your company’s cash flow and long-term financial health.

Cash flow is the lifeblood of any business, but managing it effectively requires a solid grasp of financial processes. A crucial part of this is knowing the difference between accounts receivable vs. accounts payable.

While both concepts deal with money flow, they serve distinct purposes that directly affect your company’s liquidity and overall financial health. We will examine the principles of working with payables and receivables and explore why they are important for business success.

Keep reading to find out:

What Is Accounts Receivable?

What Is Accounts Payable?

Main Differences Between Accounts Receivable vs. Accounts Payable

Common Challenges of Accounts Receivable vs. Accounts Payable

Best Practices of Accounts Receivable and Payable Management

Automation of Accounts Payable and Receivable Management

Frequently Asked Questions About Accounts Payable vs. Receivable

What Is Accounts Receivable?

Before exploring the differences between accounts receivable vs. accounts payable, let’s establish what each term means separately. Accounts receivable (AR), also known as receivables, refers to the money a company expects to receive after selling goods or services on credit. Many businesses offer credit terms: they allow customers to pay for products or services over time instead of at the point of sale.

These amounts are recorded as current assets on the balance sheet, as they represent payments the company expects to receive within a short period. Accounts receivable usually consist of the company’s unpaid invoices. Typically, businesses expect to collect payments within a set timeframe, which can range from a few days to several months.

Accounts receivable is part of accrual-basis accounting, where revenue is recorded when a sale is made (even if the customer hasn’t paid yet). Likewise, expenses are recorded when a company incurs them (even if the payment hasn’t been sent yet). In contrast, cash-basis accounting recognizes revenue only once the actual cash payment is received and expenses only after the money leaves the bank account.

There’s also another form of receivables called notes receivable. These represent amounts owed to the company with a longer payment deadline, typically a year or more. Unlike regular AR, notes receivable are often formalized through written agreements and usually involve interest on the outstanding balance.

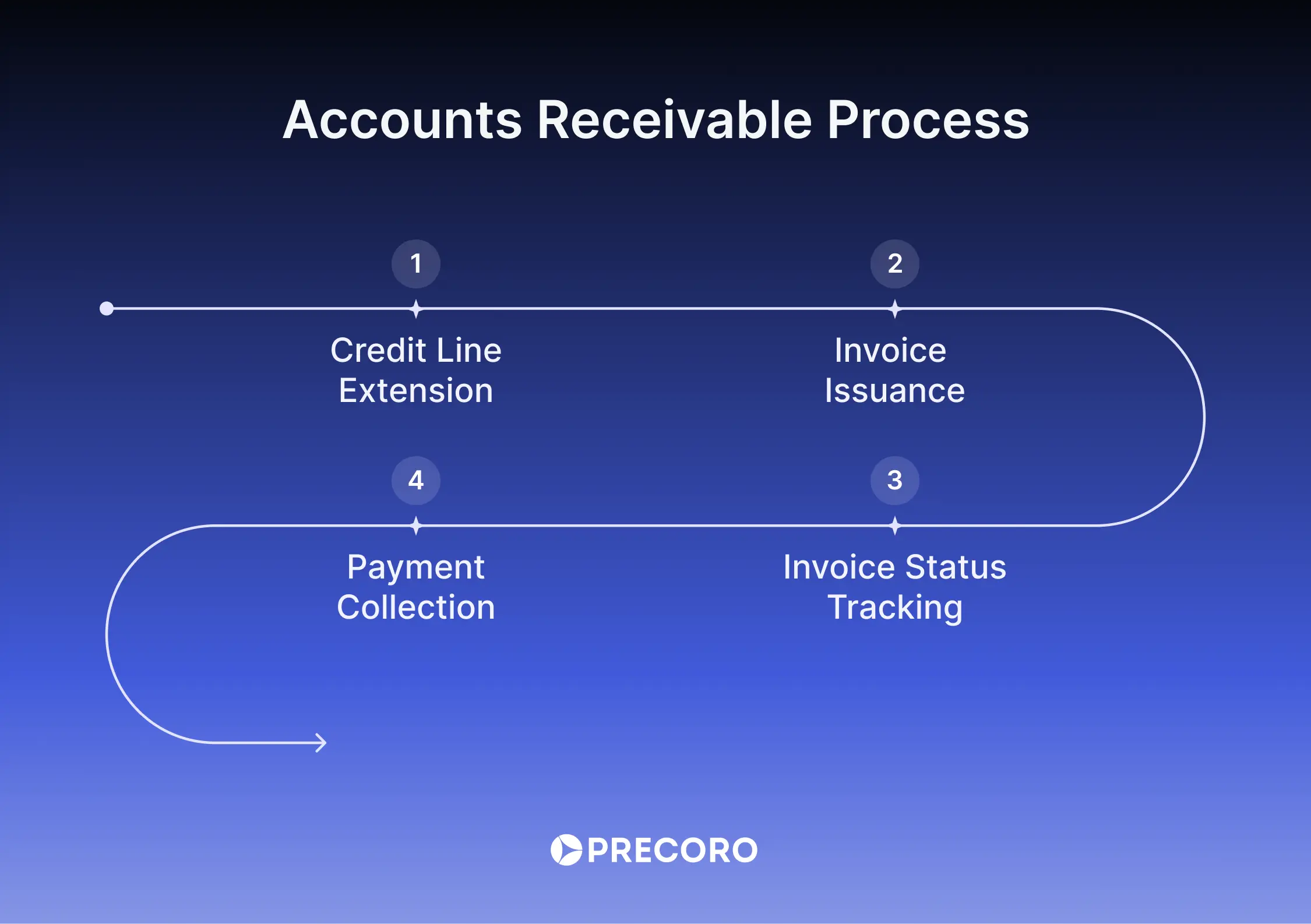

Accounts Receivable Process

Depending on a company’s size, there are designated specialists or a separate department that manages the accounts receivable cycle. The process includes the following steps:

- Credit Line Extension

Before any transaction, the company assesses the customer’s creditworthiness and sets a credit limit based on their financial stability and payment history. - Invoice Issuance

Once the company delivers goods or provides services, it promptly sends an invoice to the customer. - Invoice Status Tracking

Invoices are carefully monitored through regular checks. If a payment is late, an AR specialist sends a friendly reminder. If needed, follow-ups, like phone calls, are made to ensure everything stays on track. - Payment Collection

When the payment comes in, the AR team double-checks that it’s the right amount and updates the ledger, marking it as “paid.” If the contract allows, the company can charge a late fee when a payment is overdue.

Accounts Receivable and Cash Flow

Accounts receivable are recorded as liquid assets on a company’s balance sheet because the buyer is legally obligated to pay the debt. Receivables are part of a company’s working capital and can be used to measure its ability to cover short-term obligations. The longer receivables remain unpaid, the more difficult it is to allocate funds to manufacturing, business development, and other needs.

The AR specialists examine the stability and strength of accounts receivable through the following metrics:

- The accounts receivable turnover ratio measures how often the company collects payments to accounts receivable during an accounting period. For example, a turnover ratio of 8 means the company collects its receivables 8 times a year.

- Days sales outstanding (DSO) indicates how long it takes for the seller to collect payment after a sale. For instance, a DSO of 45 indicates that, on average, it takes the company 45 days to receive a customer payment.

What Is Accounts Payable?

Next, let’s take a closer look at the payable side of accounts receivable vs. accounts payable. Accounts payable (AP), also known as payables, refers to the money a business owes its vendors and suppliers for goods or services purchased on credit. Companies usually receive payment requests in the form of a supplier invoice. Accounts payable can also be considered short-term IOUs (informal “I owe you” documents that acknowledge debt).

Payables are listed as current liabilities on the company’s balance sheet. Typically, they are expected to be paid within a few days to a few months, depending on the agreed-upon credit terms with the supplier. The timely settlement of accounts payable is crucial to maintaining good vendor relationships, avoiding late fees, and ensuring smooth operations.

There is also a similar concept: trade payables. While they are often used interchangeably, accounts payable and trade payables don’t mean exactly the same thing. Accounts payable include all short-term obligations, such as office supplies and equipment, power and fuel, software licenses, other maintenance services, etc.

On the other hand, the term ‘trade payables’ specifically refers to money owed for inventory-related goods, such as raw materials, components for production, and packing materials. Therefore, trade payables fall under accounts payable obligations.

Another related concept is notes payable (NP), which represents amounts the company owes to lenders, banks, or other creditors through a formalized written promise to pay. It often comes with interest.

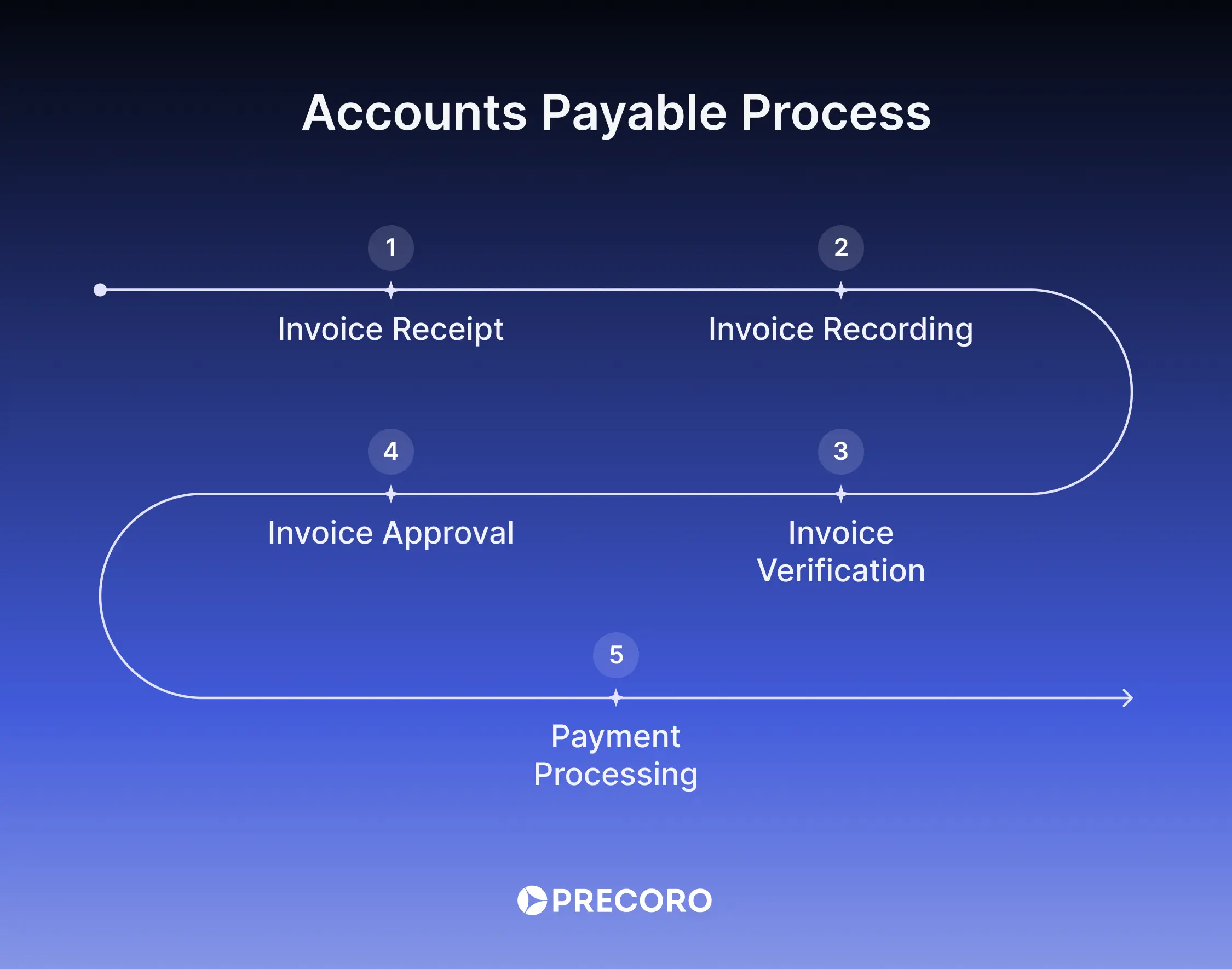

Accounts Payable Process

Similarly to accounts receivable, accounts payable can be maintained by one designated specialist or by an entire dedicated department. The steps of the AP process involve:

- Invoice Receipt

When goods or services are delivered, the supplier sends an invoice requesting payment. This marks the beginning of the accounts payable journey. - Invoice Recording

Once the invoice is in hand, it’s time to record it in the accounts payable ledger. Thanks to modern accounting software, this step can be automated with tools like invoice scanning and Optical Character Recognition (OCR). These technologies capture essential information—supplier names, amounts, payment terms—and input it directly into the system. - Invoice Verification

The invoice needs to be matched against the related purchase order (2-way matching) or both the purchase order and receipt (3-way matching). This step ensures that the business only pays for what was actually received and confirms the correct amounts. - Invoice Approval

The invoice is then sent through the approval process to a manager or a team member. The goal is to verify that the transaction is legitimate and that the amounts match what was agreed upon. - Payment Processing

Timely payments keep vendors happy, help the business maintain a strong credit profile, and take advantage of early payment discounts. Once payment is made, the entry in the accounts payable ledger is updated, marking the end of the cycle.

Accounts Payable and Cash Flow

Accounts payable funds are no longer available to a company, as they are owed to one or several suppliers. Therefore, this money is recorded under current liabilities on the company’s balance sheet. Current liabilities are short-term, with the payment due typically within one year.

Accounts payable fluctuations appear on the cash flow statement and represent an important figure for the company’s financial health analytics. An increase in AP means that the company buys more on credit than in cash. On the other hand, decreasing AP value indicates that the company pays its obligations faster than it makes new purchases on credit.

Companies can analyze the stability and strength of accounts payable with the following metrics:

- Days payable outstanding (DPO) measures how long it takes a company to pay its suppliers after receiving goods or services. For example, a DPO of 60 means the company takes, on average, 60 days to pay its suppliers.

- The current ratio assesses a company’s ability to cover its short-term obligations with its short-term assets. For instance, a current ratio of 2.5 means the company has $2.50 in assets for every $1 in liabilities, indicating good short-term financial health.

- The quick ratio (or acid-test ratio) is a more stringent measure that excludes inventory from the calculation to focus only on assets that can be quickly converted into cash. For example, a quick ratio of 1.2 means the company has $1.20 in liquid assets for every $1 in short-term liabilities, showing it can cover its obligations even without selling inventory.

Main Differences Between Accounts Receivable vs. Accounts Payable

Accounts payable vs. accounts receivable are two sides of the same transaction, but they serve opposite roles in a company’s financial management. Here are the main differences between the two.

1. Definition and Financial Classification

The difference between accounts payable vs. receivable starts with what they represent and how they are recorded on the balance sheet.

Accounts Receivable (AR): The money a company is owed by its customers for goods or services provided on credit. AR is recorded as an asset on the balance sheet since it represents incoming cash.

Accounts Payable (AP): The money a company owes suppliers or vendors for goods and services received but not yet paid for. AP is recorded as a liability on the balance sheet, as it represents outgoing cash obligations.

2. Role in Business Operations

Another key distinction between accounts payable vs. accounts receivable lies in their respective roles within the business.

AR (Incoming Funds): Businesses extend credit to customers, expecting payment within a defined period. Efficient AR management ensures timely collections, which supports cash flow and operational funding.

AP (Outgoing Payments): Companies purchase goods and services from suppliers to obtain resources needed for production and operations. Proper AP management helps avoid late fees and maintain good supplier relationships.

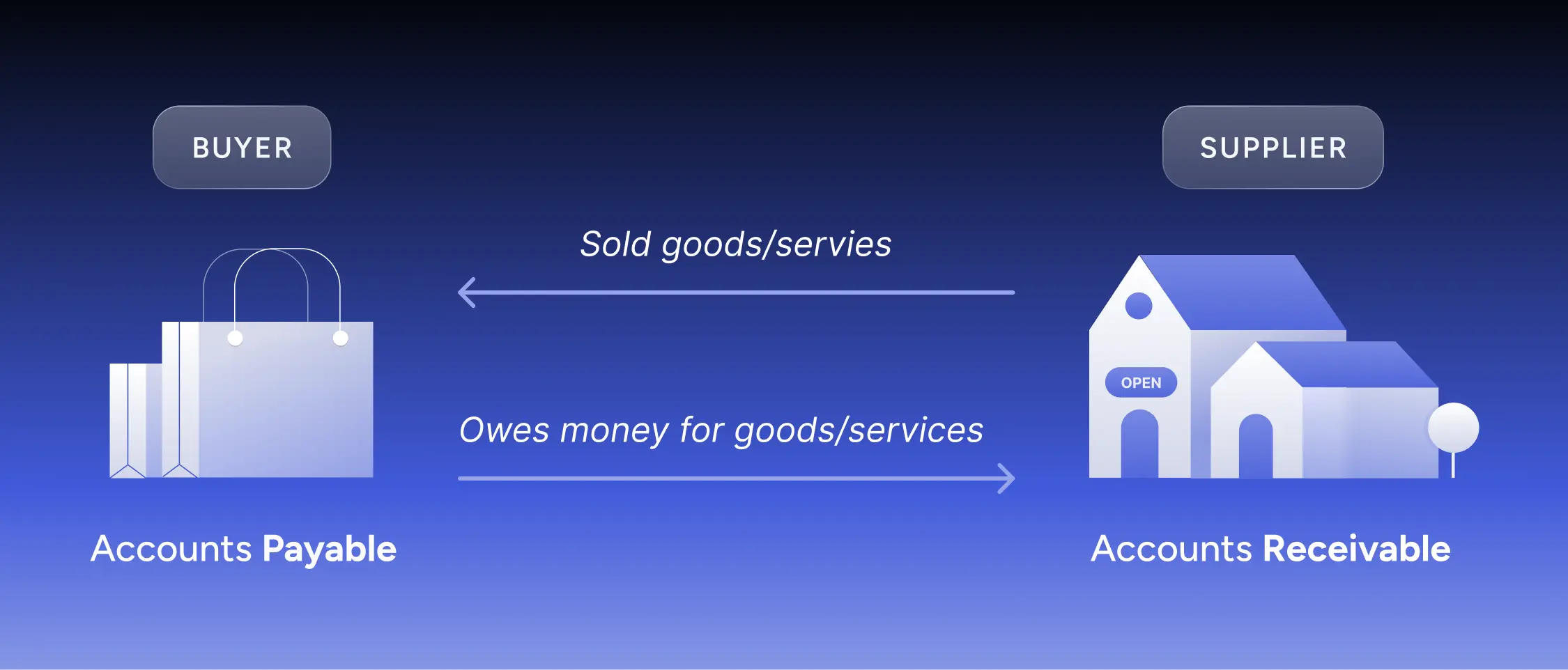

3. Business Perspective: Seller vs. Buyer

The difference between accounts receivable vs. accounts payable also depends on whether a company acts as a seller or a buyer.

As a Seller (AR): When a business sells products or services on credit, it records the expected payment as accounts receivable.

As a Buyer (AP): When a business purchases materials, services, or inventory on credit, it records the amount owed as accounts payable.

4. Impact on Cash Flow and Financial Health

Accounts receivable and payable management deeply affect a company’s financial health.

- If a business collects receivables too slowly while payables are due quickly, it may face a cash crunch.

- Conversely, delaying supplier payments excessively can damage relationships and lead to penalties.

Auditors, lenders, and investors closely examine both AR and AP as indicators of financial health. Excessive accounts receivable may signal collection issues, while high accounts payable may indicate liquidity risks.

Basically, accounts payable vs. receivable are two sides of the same coin. The same amount of money for the same goods or services is recorded as accounts receivable by the seller and accounts payable by the buyer.

Therefore, payables and receivables are essential financial management levers for a company’s stable growth. An imbalance can result in a shortage of ready-to-use cash and ultimately destabilize the business.

How to Record Accounts Payable vs. Receivable in the General Ledger

As mentioned earlier, the accrual accounting method records unpaid expenses and incoming payments as entries for actual transactions. The company may not have paid or received any money, yet it already recognizes the amounts as assets or liabilities.

The accrual method is easily applicable within the modern double-entry bookkeeping concept, in which every entry in the general ledger always has an offsetting debit or credit. It’s fundamental for understanding accounts receivable vs. accounts payable. Debited amounts represent assets, while credited amounts represent liabilities. In the end, after balancing debit and credit, we should always get zero: the sum of all debits should equal the sum of all credits.

Let’s look at how recording accounts payable vs. accounts receivable looks in practice. Suppose manufacturing Company A buys a metal melting furnace from vendor Company B. The accounting department of Company A receives an invoice for the $500 furnace and has to do two things:

- Debit $500 to Equipment/Fixed Assets → Because the furnace is a capital asset acquired.

- Credit $500 to Accounts Payable (AP) → Because Company A now owes $500 to Company B.

At the same time, Company B does the counterpart of this:

- Debit $500 to Accounts Receivable (AR) → Because Company B expects a payment of $500 from Company A.

- Credit $500 to Revenue/Sales → Because the sale of the furnace is revenue earned.

When the payment happens, accountants from both parties adjust the records. The accountant of Company A will record the following:

- Debit $500 to Accounts Payable (AP) → Because the liability (debt to Company B) is now settled.

- Credit $500 to Cash → Because Company A has paid the amount.

The accountant of Company B will record this:

- Debit $500 to Cash → Because Company B has received the payment.

- Credit $500 to Accounts Receivable (AR) → Because the buyer’s debt is now closed.

Using general ledger (GL) codes is an efficient way to record transactions for accounts payable and receivable management. GL codes are numerical identifiers assigned to specific accounts in a company’s chart of accounts. They ensure consistency, accuracy, and a streamlined approach to financial reporting.

Common Challenges of Accounts Receivable vs. Accounts Payable

Accounts receivable and payable management each come with their own set of challenges. Whether a company needs to track overdue customer payments or ensure timely supplier payments, balancing both sides of the ledger requires careful attention. Let’s explore the common pitfalls businesses face when managing AR vs. AP and how they can impact financial operations.

Dangers to Be Aware of with Accounts Receivable

Accounts receivable is a vital part of business cash flow, but it comes with its share of potential issues.

- Slow-Paying Customers

When clients take too long to pay their invoices, they hinder the business’s ability to cover expenses and invest in growth. This delay can lead to missed opportunities or, in worse cases, an inability to meet financial obligations. - High Outstanding Balances

A large amount of outstanding receivables can be a red flag. It may suggest that the company is either extending too much credit or that customers are not paying on time. - Improper Tracking and Poor Collection Practices

If accounts receivable are not managed and tracked properly, businesses risk losing track of overdue payments. Without consistent follow-ups, customers may forget about unpaid invoices and further delay payments. - Bad Debt

When it becomes apparent that the buyer won’t pay an account, it has to be written off as a bad debt expense. Bad debt not only hurts cash flow but also lowers overall profitability.

Dangers to Be Aware of with Accounts Payable

When managing accounts payable, it’s crucial to stay vigilant and avoid common pitfalls that can lead to a lack of liquidity or damage supplier relationships. Watch out for these issues:

- Late Payments and Penalties

Missing payment deadlines can lead to costly penalties, damaged vendor relationships, and even supply chain disruptions. Late payments may also harm your company’s credit rating, making it harder to secure favorable terms in the future. - Cash Flow Issues

If payables aren’t tracked properly, you might end up paying bills you can’t afford, leading to financial strain. - Fraud Risks

Without strict controls, accounts payable processes can become a target for fraud. Fake invoices or unauthorized payments can slip through the cracks, draining corporate funds. In 2022, the ACFE’s Report to the Nations found that organizations typically lose 5% of their annual revenues to fraud, with a median loss of $117,000 before detection. - Overlooking Discounts

Many suppliers offer early payment discounts. Failing to take advantage of these can mean missed savings and unnecessary expenses.

Best Practices of Accounts Receivable and Payable Management

Effective accounts payable and receivable management is crucial for maintaining a healthy cash flow and financial stability. While AR ensures the timely collection of customer payments, AP helps businesses manage their obligations to suppliers.

Striking the right balance between the two prevents cash shortages, improves vendor relationships, and strengthens overall financial health. Below are key best practices for optimizing accounts receivable vs. accounts payable.

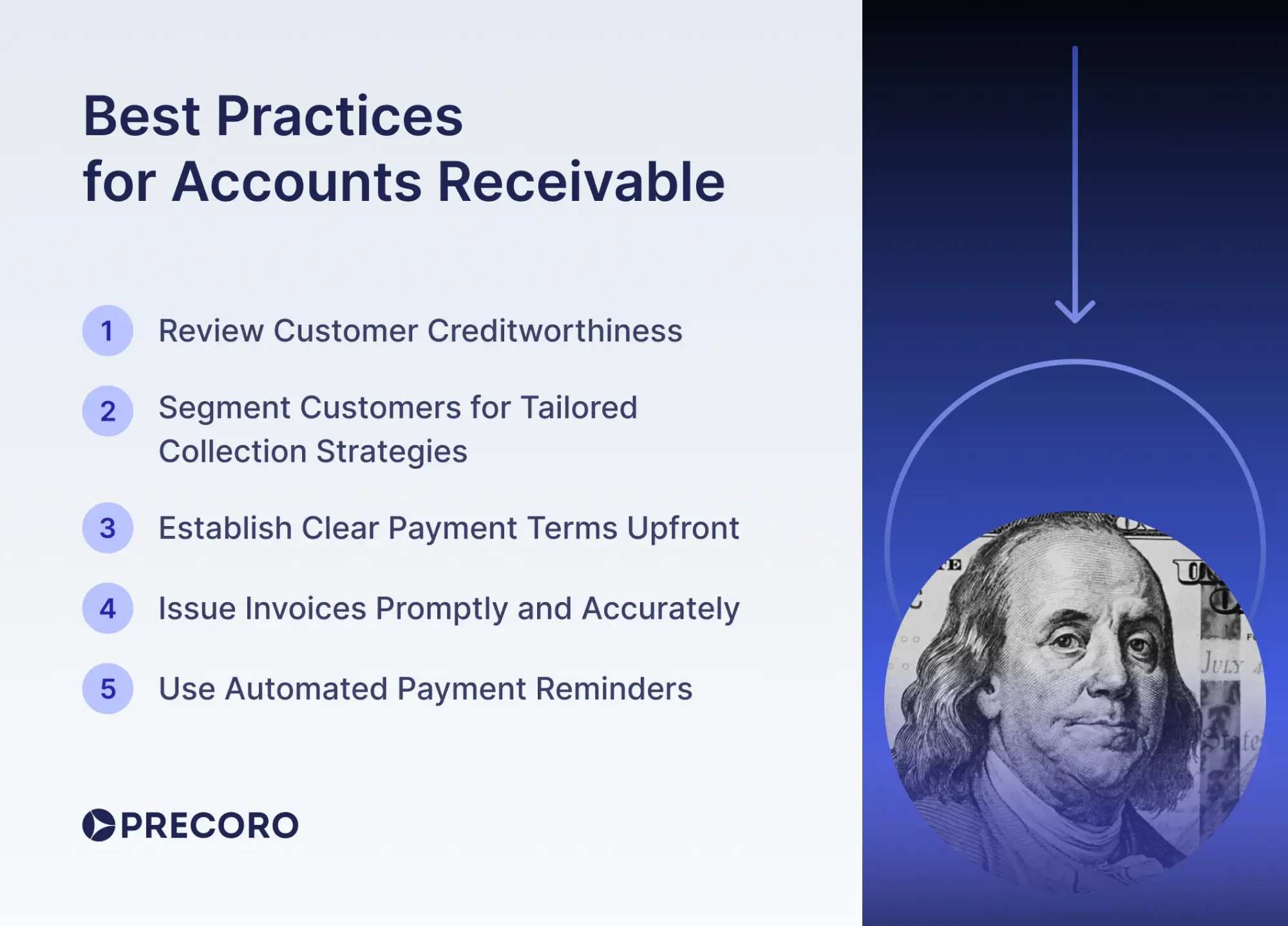

AR Best Practices

Strong accounts receivable management keeps cash flow predictable and minimizes the risk of delayed payments from customers. Here are the steps to achieve those benefits.

Review Customer Creditworthiness

Before offering credit to customers, it’s essential to review their payment history with other businesses. A customer’s track record of paying previous debts can provide insight into their reliability. For a more thorough assessment, you can run a credit check using services that offer detailed reports on the customer’s credit score, outstanding debts, and payment history. A high credit score generally suggests financial responsibility, while a poor score or history of late payments can signal potential risks.

Segment Customers for Tailored Collection Strategies

Not all customers present the same level of risk or reliability when regarding payments. That’s why you might want to customize your collection strategy to reflect each customer’s history and relationship with your business.

Long-standing and reliable customers may deserve more flexible terms to reward loyalty and maintain a positive relationship. Offering extended payment time or flexible plans can strengthen trust. High-value customers may also benefit from a personalized follow-up approach, such as phone calls or direct communication, to discuss overdue invoices.

New customers or those still establishing a payment history might require more caution on your part. They may not have enough of a track record to justify extended credit. Therefore, stricter collection practices—such as requiring deposits or upfront payments—can help protect your business from the risk of non-payment.

Establish Clear Payment Terms Upfront

Set clear and transparent payment terms at the start of a business relationship to prevent misunderstandings later. Define payment due dates and acceptable payment methods. It’s also advisable to negotiate late payment fees in advance, as they encourage customers to meet payment deadlines.

Additionally, make it easy for customers to pay by offering various payment methods such as bank transfers, credit card payments, or online platforms like PayPal. The more convenient you make the payment process, the faster you’ll receive funds.

Issue Invoices Promptly and Accurately

Timely and accurate invoicing is critical for maintaining a smooth cash flow. Send invoices as soon as the goods or services are delivered, and ensure they are clear, complete, and error-free. Incorrect invoices require follow-ups and may lead to delayed payments, so double-check details like prices, quantities, and payment instructions before sending.

Use Automated Payment Reminders

Automate payment reminders to save time and reduce manual effort. Set up a system that sends scheduled email notifications to customers about upcoming or overdue payments. These automated nudges encourage customers to prioritize your invoices and reduce the chances of forgotten payments.

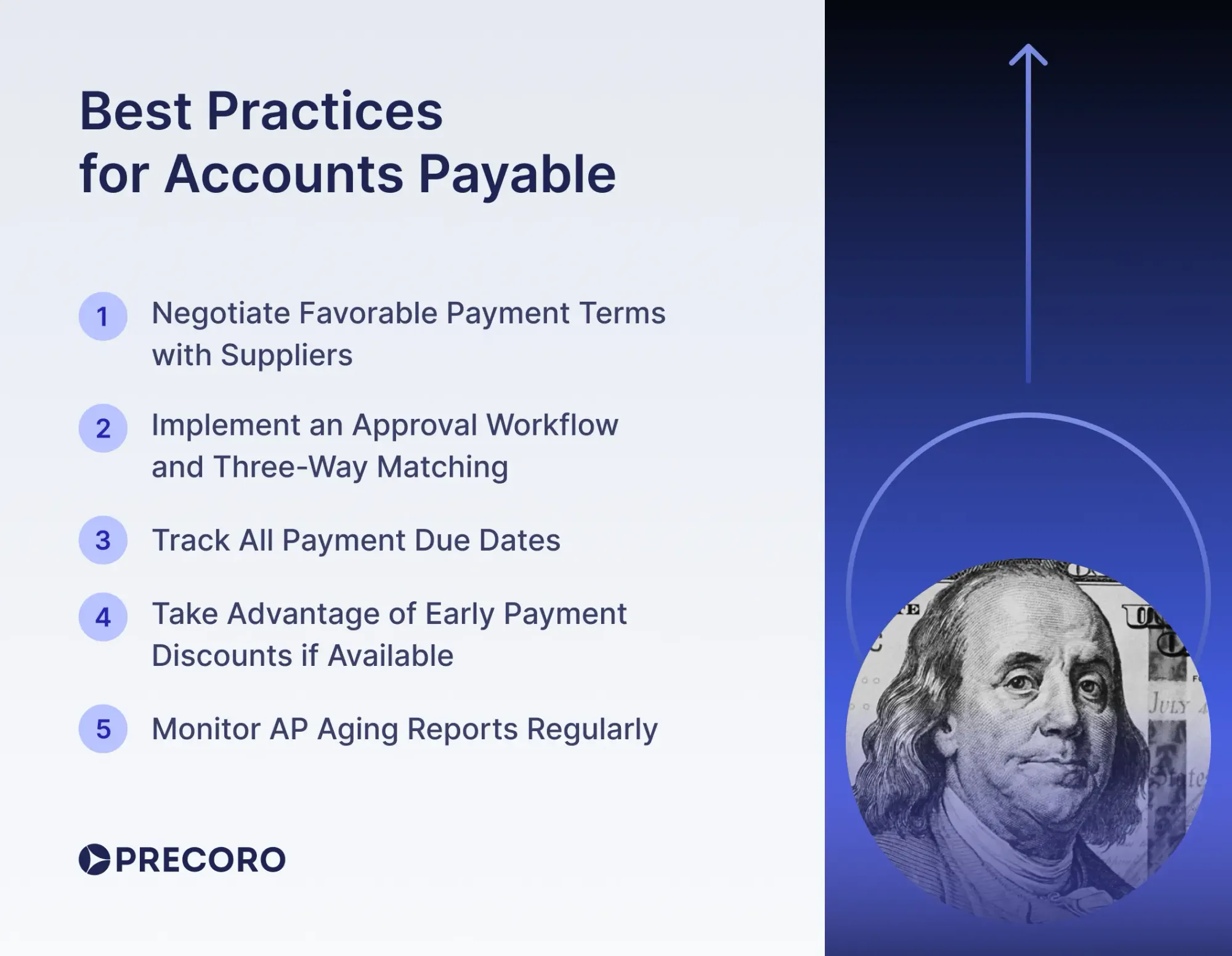

AP Best Practices

Now, let’s explore key strategies to streamline your accounts payable processes and strengthen supplier relationships.

Negotiate Favorable Payment Terms with Suppliers

If you’re a high-volume customer or have a long-standing relationship with a supplier, use this leverage to ask suppliers if they can extend payment terms. For example, instead of paying in 30 days, request 45 or 60 days. This gives you more time to manage your cash flow before payment is due.

If you need more time to pay, negotiate a payment plan that works for both parties. For instance, instead of paying the full invoice at once, you could break it into smaller, manageable payments over a few months. After negotiating the terms, ensure that all agreements are documented in writing so that you and your suppliers are on the same page about payment expectations.

Implement an Approval Workflow and Three-Way Matching

Create a formal approval process for invoices to ensure accurate and legitimate payments. Multiple levels of review help prevent errors or fraudulent activities. This approval process should be swift to avoid payment delays.

Additionally, accurate payments rely on a process known as three-way matching. This involves comparing the purchase order, invoice, and receipt to verify the transaction’s legitimacy and identify any discrepancies. By carefully reconciling these documents before payment, companies safeguard their finances against duplicate payments and fraudulent invoices.

Track All Payment Due Dates

Effective management of invoice due dates is fundamental to financial stability. Use a centralized system to keep a clear record of upcoming payment deadlines and avoid the stress of last-minute payments. Furthermore, consistently adhering to payment schedules is a direct defense against incurring costly late payment fees. Consider setting up automated reminders within your chosen system to ensure no deadline is overlooked.

Take Advantage of Early Payment Discounts if Available

Many suppliers offer discounts for early payments (for example, 2% off if paid within 10 days). These discounts may seem small, but they can add up over time and improve your bottom line. When possible, take advantage of these offers and prioritize payments to suppliers that provide such discounts.

Monitor AP Aging Reports Regularly

An aging report breaks down unpaid invoices based on how long they’ve been outstanding, typically grouping them into time buckets such as 0-30 days, 31-60 days, 61-90 days, and 90+ days. Monitor this report to maintain sufficient cash flow for upcoming payments and prevent potential shortages.

Automation of Accounts Payable and Receivable Management

Specialized tools simplify repetitive manual tasks, save time for AP and AR teams, and reduce errors in accounts receivable and payable management. For accounts receivable, the goal is to collect payments quickly and maintain customer relationships. For accounts payable, the objective is to pay invoices timely, seize early payment discounts where possible, and build a reputation as a reliable payer.

Manual processes, including tracking invoices through email or spreadsheets, are not only time-consuming but also contribute to errors in accounts receivable and payable management. When AP and AR teams are overwhelmed, companies often hire external agencies or accountants, which increases costs and makes it difficult to scale as the business grows.

According to the 2023 Infosys research, manual invoice processing can cost between $12 and $35, a figure that escalates with exceptions and outliers. Automation can reduce this cost to as little as $5 per invoice.

Additionally, technology-based solutions offer scalability, speed, and accuracy. For example, AR automation software can generate invoices and provide real-time transaction updates with minimal human input.

Similarly, AP automation software, like Precoro, enables AP departments to quickly receive, verify, approve, and pay invoices while detecting fraudulent activity. The platform uses Google’s AI for Optical Character Recognition (OCR) so that invoice data is captured correctly and processed faster. Additionally, Precoro offers automatic three-way matching to ensure consistency and accuracy before payments are made.

Frequently Asked Questions About Accounts Payable vs. Receivable

Accounts Receivable (AR) represents money customers owe a company for goods or services. It’s considered an asset because it reflects future income. Accounts Payable (AP) represents money a company owes to suppliers or vendors for goods or services purchased. It’s considered a liability because it reflects obligations the company must pay.

Yes, accounts receivable vs. accounts payable should generally be segregated to maintain clear distinctions between incoming and outgoing transactions and reduce the risk of errors or manipulation. This separation also allows for better financial controls, streamlined reporting, and protection against potential conflicts of interest.

Generally, a higher AR is better for the company because it indicates more money is coming in, which is vital for cash flow. However, higher AP could be beneficial if it reflects an effective use of supplier credit to delay payments without risking supplier relationships.

AR Days (Accounts Receivable Days) measure the average number of days a company takes to collect customer payments. A lower number indicates faster collection. AP Days (Accounts Payable Days) measure the average number of days a company takes to pay its suppliers. A higher number indicates that a company is delaying payments to conserve cash.

Both accounts receivable and payable management have their challenges. AP can be challenging due to the need to manage transactions with multiple suppliers, ensure accurate payments, and prevent fraud. On the other hand, AR involves collecting customer payments, which can be delayed or disputed.

Accounts Receivable vs. Accounts Payable in a Nutshell

Accounts payable and accounts receivable are terms from accrual accounting that refer to the amounts of money for goods sold on credit that have yet to be paid for. These terms are two sides of the same coin.

Accounts payable refer to the money the buying company owes its vendors and suppliers for the goods acquired on credit. These purchases are recorded in the company balance sheet as liabilities that must be paid. On the other hand, accounts receivable are funds the selling company expects to receive for goods sold on credit. These amounts are recorded on the balance sheet as assets.

Both incoming and spent funds are crucial for stable growth, which is why proper accounts receivable and payable management is so important. When revenue and expenses are balanced, the company can plan and strategize with both feet on the ground, seize growth opportunities, and build quality relationships with business partners.

Companies typically expect to close both APs and ARs within several days to several months. More and more businesses implement procurement automation tools to do so efficiently and on time. Dedicated software helps automate key tasks like invoice capture, approval workflows, and 3-way matching while cutting processing costs.