13 min read

Purchase Order vs. Invoice: Do You Need Both?

While some companies choose not to create POs for invoices, studies show this approach comes with considerable downsides.

According to research by Ardent Partners in 2023, over two-thirds of invoices are linked to a purchase order, indicating that about one-third of invoices are not. While it may be tempting to assume that skipping purchase order creation speeds up the procurement process, the study emphasizes the disadvantages of such an approach.

Invoices without purchase orders take longer to process, encounter more exceptions, and incur higher costs compared to invoices with purchase orders.

Let’s examine the differences between these documents, and further explore why it’s better to use both the purchase order and the invoice for effective procurement operations.

Keep reading about:

- What is a purchase order?

- What is an invoice?

- PO vs invoice — what is the difference?

- Downsides of invoice-only operations

- What are the benefits of using both purchase orders and invoices?

- Pitfalls of using more paperwork

- Smoothly incorporating POs and invoices

- Frequently asked questions

What is a purchase order?

A purchase order (PO) is a document issued by a buyer to a supplier or vendor to place an official request for goods or services. POs are usually issued by department or project managers, finance or accounting department members, or operations officers. It’s also common for a large company to have a separate procurement or purchasing department that specializes in managing all procurement activities, including PO creation.

The typical procurement process looks something like this: a person within a company needs a particular item. For instance, this might be a new computer or an office chair. The individual contacts their department head and/or designated person responsible for making orders. In small companies, this is sometimes done by an informal verbal request, while others opt to use formal internal documents called purchase requisitions to track and approve requests from employees. After the request is approved is when it can be converted into a purchase order.

Once the seller accepts the purchase order, it becomes a legally binding contract. Thus, the terms and conditions listed in the purchase order must be adhered to by both parties.

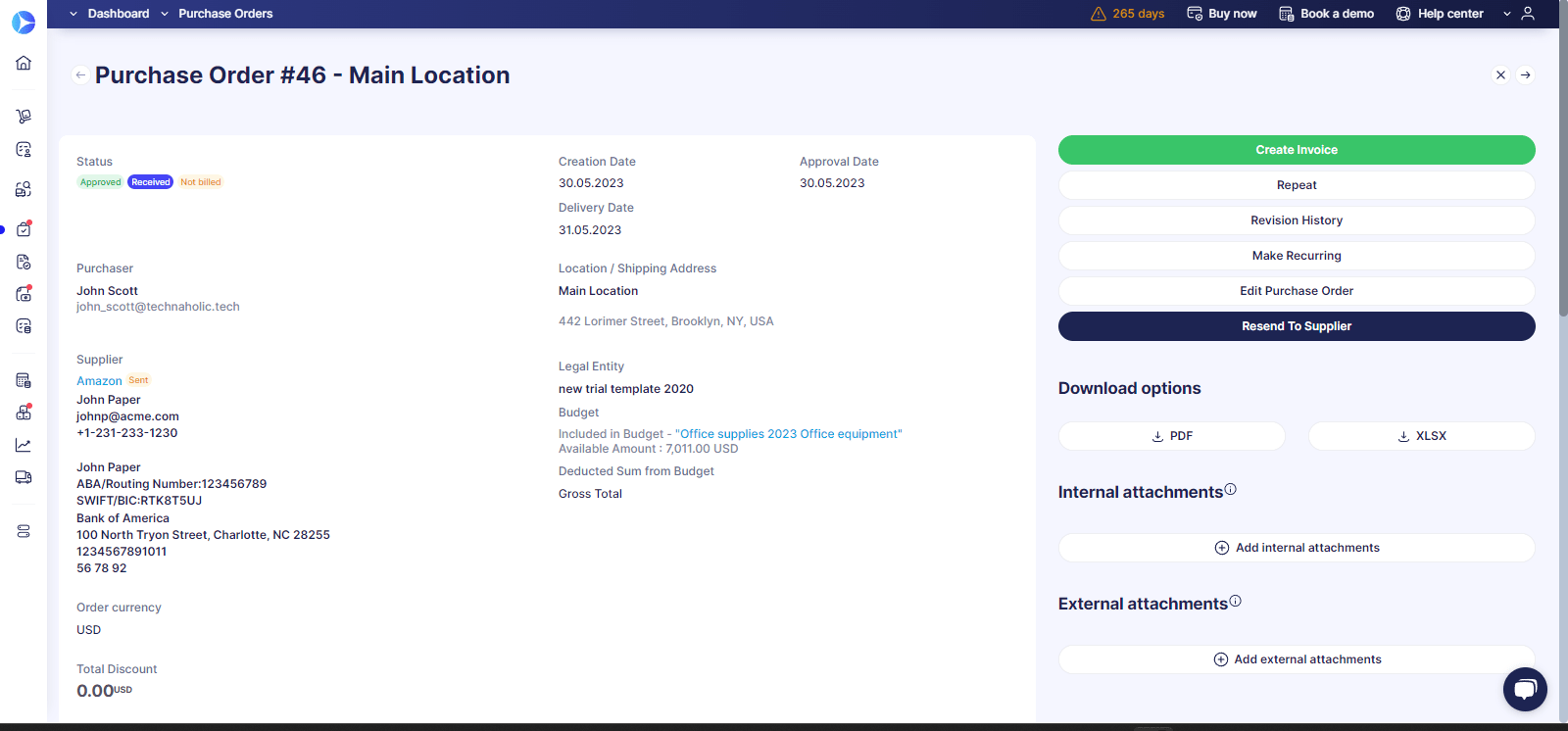

POs usually include the following details:

- PO number

- Creation date

- Expected delivery date

- Buyer’s contact information

- Vendor’s contact information

- Shipping address

- Item type

- Product number, model number, or SKU

- Order quantities

- Price of products or services

- Total amount due

- Payment terms

- Buyer’s signature

Companies have the option to choose from four main types of purchase orders based on their specific requirements:

- Standard Purchase Order (PO or SPO) is the most common type of purchase order, used for one-time purchases or those that are not expected to occur regularly.

- Blanket Purchase Order (BPO) is used for recurring purchases from a supplier with an agreed-upon price and at regular intervals.

- Planned Purchase Order (PPO) is also used for regular orders from a supplier with defined quantities and prices but no definite delivery dates, resulting in orders arriving at irregular intervals.

- Contract Purchase Order (CPO) is a document that outlines the terms and conditions under which POs will be issued in the future. This type of PO is commonly used for complex or high-value purchases.

What is an invoice?

An invoice (also called a sales invoice) is an official payment request issued by a supplier or vendor to a buyer. Invoices are usually created by finance or accounting team members, billing coordinators, or accounts receivable specialists. In small businesses, sales or service representatives or even business owners may be responsible for issuing invoices.

After a vendor approves a purchase order, they proceed with fulfilling the order by picking, packing, and shipping the items to the customer's specified location. After delivery (and sometimes before), the company generates an invoice that reflects the details of the fulfilled order and sends it to the buyer via email, mail, or through electronic invoicing methods. The buyer reviews the invoice, cross-references it with the corresponding purchase order, processes it for payment, and remits the payment to the vendor according to the agreed-upon terms.

It’s worth noting that, unlike a purchase order, an invoice can’t serve as a contract between two parties. Instead, it’s a one-sided business document that communicates the vendor's expectation for the buyer to make payment for provided goods or services.

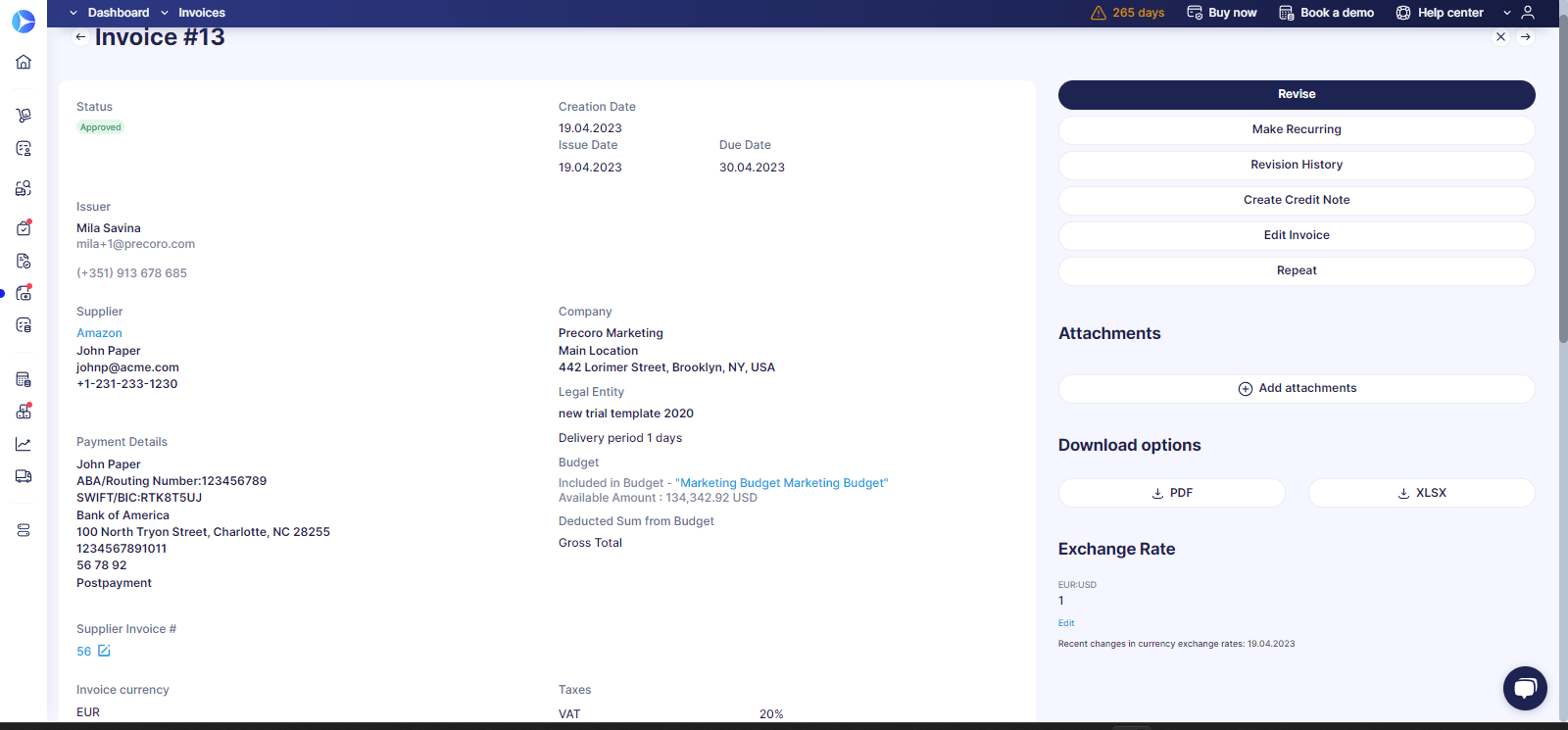

Invoices usually include the following details:

- Invoice number

- PO number

- Creation date

- Payment due date

- Buyer’s contact information

- Vendor’s contact information

- Item type

- Product number, model number, or SKU

- Quantity of goods or services

- Price of products or services

- Total amount due

- Payment terms

- Taxes (if there are any)

- Discounts (if there are any)

Vendors have a variety of invoice types to choose from, including:

- Standard invoice is the most common one and it acts as an official payment request for products or services provided.

- Pro forma invoice is sent before the products or services are rendered to let the buyer know what to expect from a purchase.Interim invoice is used for large projects to divide the total sum into multiple smaller payments sent throughout the project.

- Final invoice is very similar to the standard invoice but is usually used to charge for projects once they are completed.Recurring invoice is usually sent when requiring payments at regular intervals for services and subscriptions.

- Timesheet invoice is used to charge the buyer by the hour.Commercial invoice is sent to request payment from companies in other countries.Debit invoice is used to increase the charge that was mentioned in the initial invoice – for instance, in scenarios when the service provider ended up spending more time on an order than was expected.

- Credit invoice is also an amendment to a previously issued invoice but in that case, the vendor offers a discount or refund to the buyer.Mixed invoice is issued when the vendor needs to include both credit and debit charges on a bill.

- Past due invoice is sent as an additional reminder when the buyer misses the payment date.Expense report is an invoice submitted by the employee to the employer to get reimbursement for business-related expenses.

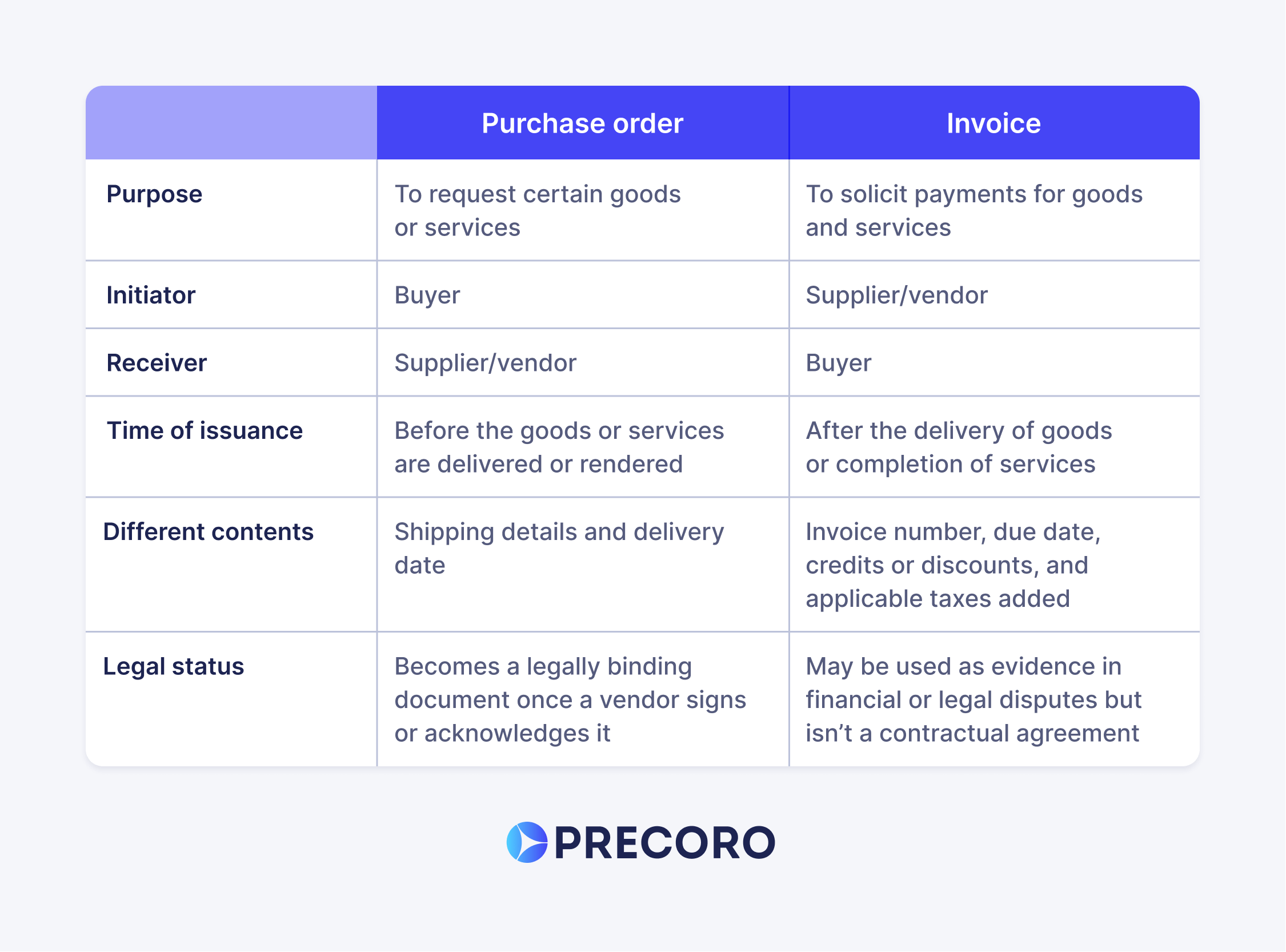

PO vs invoice — what is the difference?

Purchase orders and invoices share some similarities in terms of assisting companies in managing their purchasing processes and conveying crucial information about vendors, buyers, and ordered items. However, these documents have even more differences.

Purpose

Companies issue POs to request certain goods or services. Additionally, it serves as a contractual agreement between the buyer and vendor, specifying the terms of the transaction. On the other hand, firms issue invoices to solicit payments for their goods and services.

Initiators and receivers

A buyer sends a purchase order to a supplier or a vendor. Then, the vendor or supplier sends an invoice to the buyer.

Time of issuance

A purchase order is typically issued before the goods or services are delivered or rendered. An invoice, however, is usually generated after the delivery of goods or completion of services, as a way of requesting payment from the buyer based on the agreed-upon terms.

Different contents

There is unique information specific to each document:

- Purchase order — shipping details and delivery date.

- Invoice — invoice number (invoices also include PO numbers while purchase orders don’t contain invoice numbers), due date, credits or discounts, and applicable taxes added.

Legal status

A purchase order becomes a legally binding document once a vendor signs or acknowledges it, so both the buyer and the vendor are obliged to uphold its terms. On the contrary, an invoice is a document that communicates a payment request but cannot be used as a contract on its own. However, the legal enforceability of an invoice may depend on local laws and the specific terms and conditions outlined in the related agreements. In general, invoices can be used as evidence in financial or legal disputes.

Downsides of invoice-only operations

Some companies choose to skip purchase order creation to save time or simplify their purchasing process, especially when dealing with regular, low-value, or tail purchases. However, relying solely on invoices in the purchasing process can lead to several drawbacks:

Lack of control

PO invoice processing provides a structured framework for specifying and approving purchases, ensuring that the right items are requested at the agreed-upon terms. Without this initial control, there is a higher risk of errors, inconsistencies, and misunderstandings in the purchasing process. This can result in delays in payment, strained relationships with vendors, and potential legal issues.

Limited visibility

POs provide a clear record of purchases, which helps track and manage inventory levels and budgeting. The absence of purchase orders makes it challenging to have a comprehensive overview of completed and upcoming orders, leading to difficulties in effectively monitoring and controlling cash flow.

Higher processing time and costs

Invoices without POs often require additional time and effort for processing and increase administrative burden as a buyer has to determine whether the price, quantities and the goods or services themselves correspond to what was initially requested. In addition, the absence of predefined terms and specifications can lead to more manual intervention, back-and-forth communication, and reconciliations to ensure accuracy in the payment process.

Increased risk of fraud

POs serve as a control mechanism to prevent unauthorized or fraudulent purchases. Without them, there is a higher chance of getting charged for unapproved orders or issuing payments for duplicate or even fraudulent invoices. All because there’s no prior official document with such key information as the delivery terms, prices, and quantity of ordered items to refer back to.

More complicated invoicing for the vendor or supplier

The absence of a purchase order presents challenges for the supplier in validating the agreed-upon terms, quantities, and prices. As a result, the invoicing process becomes more complex, necessitating additional communication and clarification between the supplier and the buyer.

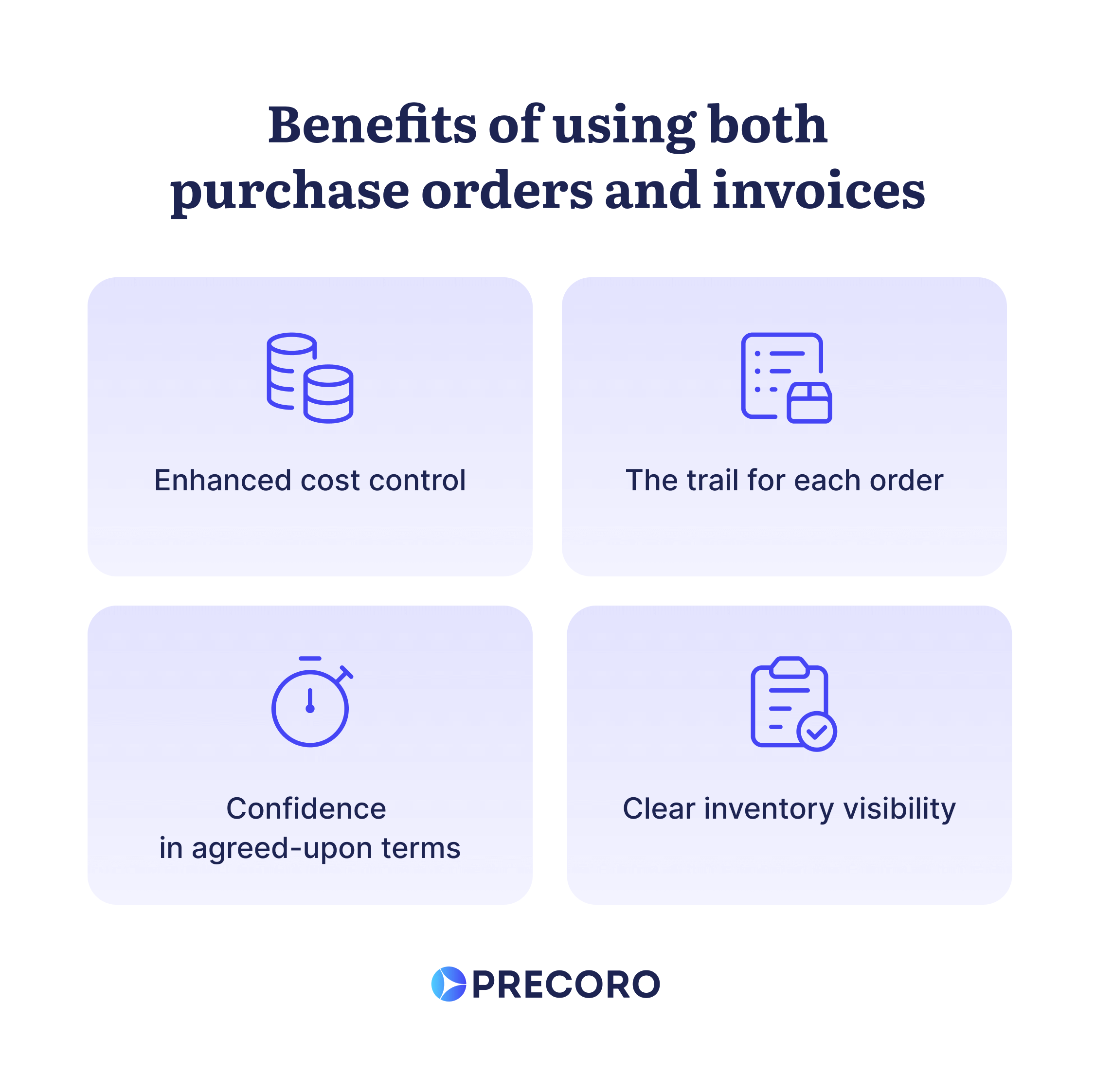

What are the benefits of using both purchase orders and invoices?

Enhanced cost control

By creating and approving POs, companies can effectively prevent duplicate orders and unnecessary subscriptions. This is achieved by identifying and consolidating requests for similar purchases across departments or from the same supplier, streamlining the procurement process, or even enabling volume discounts. In addition, when an invoice is received, it can be cross-checked against the corresponding purchase order to ensure that it is not a duplicate. This helps avoid unnecessary payments and ensures accurate financial management.

The trail for each order

A purchase order can help you track the status of the order, from the time it is placed until it is delivered by referencing the purchase order number. Thus, the requester and approvers from the buyer’s company can stay in the loop about their purchases.

Confidence in agreed-upon terms

Purchase orders provide stability and help avoid cost overruns. They serve as proof of the agreed-upon pricing, protecting the buyer’s accounts payable in case the supplier changes the prices later. Additionally, a purchase order acts as a legally binding document between the buyer and the seller, ensuring both parties are clear on transaction terms and are obliged to adhere to them.

Clear inventory visibility

POs assist in effective inventory management by providing visibility into the purchases, so companies can effectively determine when they made certain orders and when they should replenish stock. As a result, purchase order management facilitates reordering, prevents overstocking, and ensures timely delivery. POs also minimize losses and maintain efficient business operations by preventing duplicate orders.

More paperwork — more problems?

Those considering adding PO creation to their purchasing activities might be wondering: isn't double the paperwork double the work? Indeed, if paperwork and processes are all done manually, any increase in tasks – whether from a more thorough workflow or due to a scaling company – can drastically add to employee workload. Regardless of how your procurement process is set up, it’s an excellent idea to implement an automated solution, which can address the following challenges:

- Lots of documents to manage: Growing companies face the increasing volume of paperwork, which leads to high risk of document misplacement or loss, time-consuming retrieving and reconstruction of records, and delays or errors in both payments and reporting

- Hard to check who ordered what: When a new invoice comes in, designated people have to go through various POs trying to find the one with the corresponding PO number or, if there’s no central repository of all purchase orders, have to go around the office trying to find the person who ordered the item(s).

- Difficulty in identifying discrepancies: Team members have to manually check each invoice and reconcile it with a related PO. When there’s a high workload, some discrepancies may go unnoticed, leading to payment errors and further disputes.

- Time-consuming approvals: In a manual approval process, a requester comes to each of the approvers so they could check and sign the document. This approach can result in delays and bottlenecks when approvers face tight schedules, business trips, or the need to work remotely.

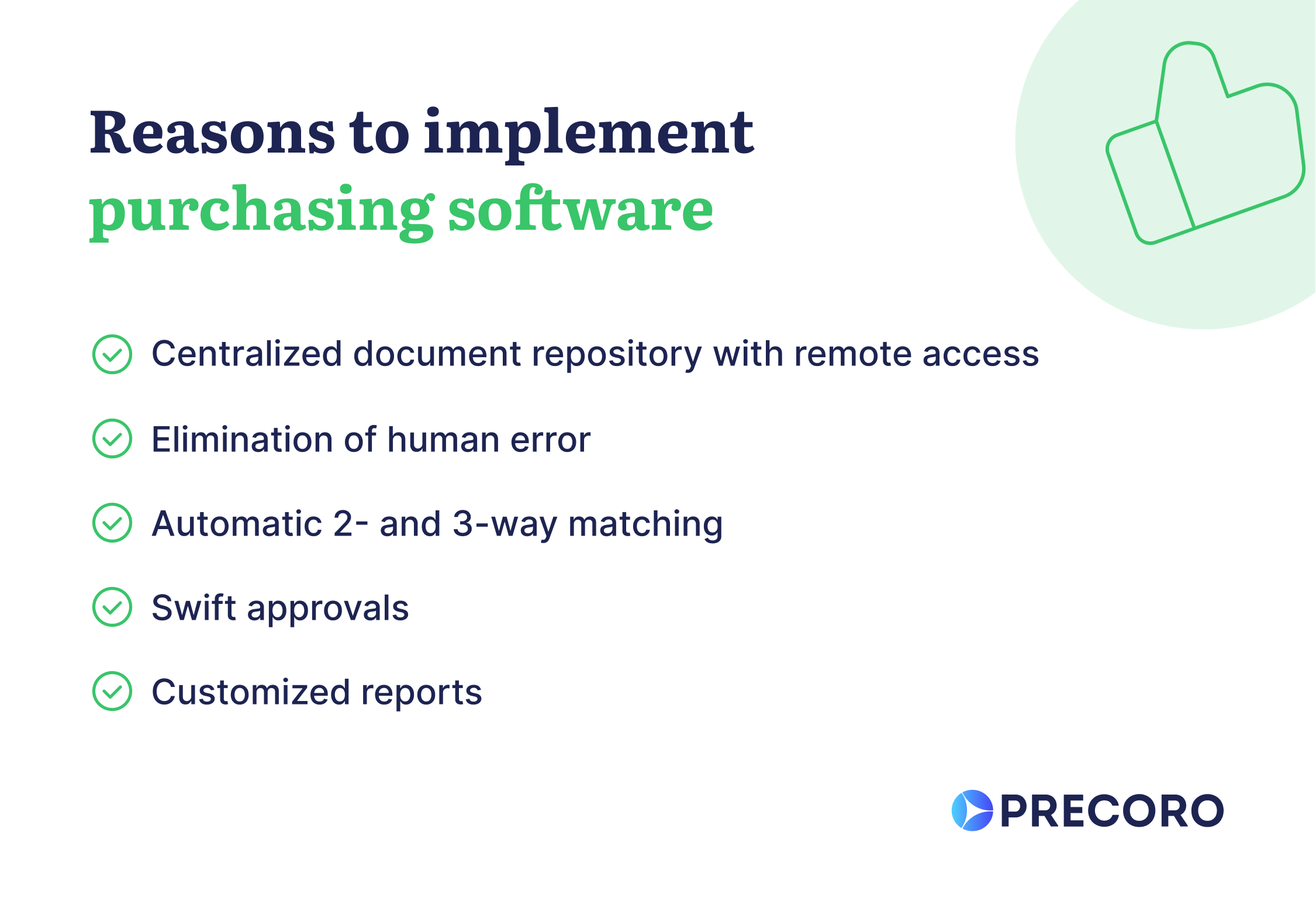

Smoothly incorporate POs and invoices

As highlighted by Procurement Tactics, there is a growing trend toward implementing technology and digitizing operations in 2023. This data is not surprising, considering companies overcome the challenges associated with purchase order and invoice management by adopting specialized purchasing software. An example of such software is Precoro, which streamlines the document creation and approval process by providing the following benefits:

Centralized document repository with remote access

Precoro centralizes and helps companies manage all POs, invoices, and associated documents like receipts and contracts. This means information about purchased items, vendor details, issued payments, and purchase approval history can be quickly accessed from any place and at any time given there’s an internet connection.

Elimination of human error

Precoro saves companies’ time and prevents mistakes by simplifying document creation. Procurement documents are easy to fill in with drop-down menus and item and supplier catalogs to choose from. Additionally, the system notifies the users when they try to pay for the same invoice twice, eliminating the risk of duplicate payments. Companies can also set budget limits within the software to ensure that purchase orders do not exceed the allocated budget.

Automatic 2- and 3-way matching

The system takes care of the mismatches in procurement documents early on with the discrepancy tracking. In practice, this means that the user will be promptly notified in case prices, items, or quantities differ in purchase order and an invoice, saving time for the resolution of disputes.

Swift approvals

Appointed approvers receive notifications in the system and via email when there's a document waiting for them. In addition, the system allows users to quickly filter out the documents so they can easily find pending POs and invoices. In addition, approval workflows for each document are fully customizable and can involve multiple steps.

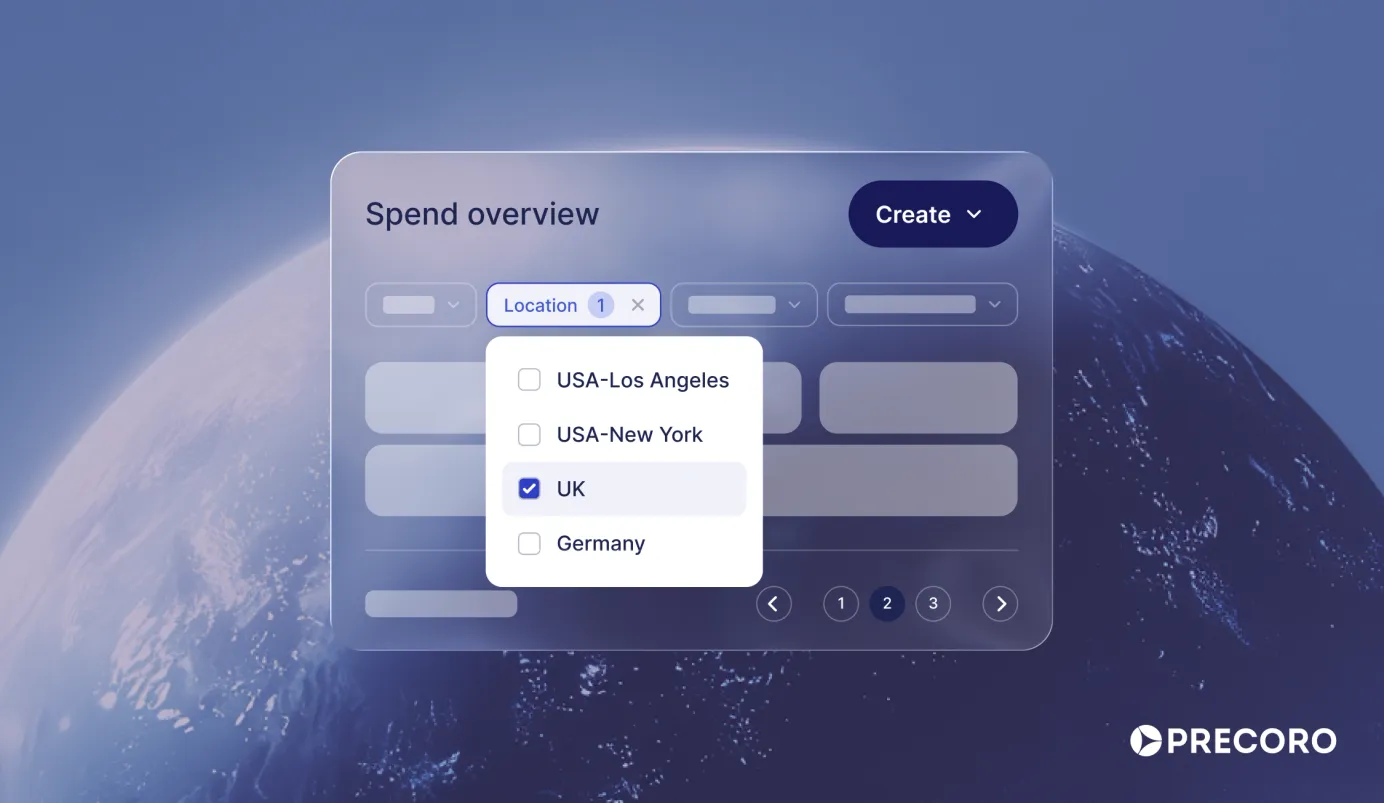

Customized reports

Precoro users can build individualized reports on purchase orders and invoices using different fields related to general, supplier, company, and item data. In addition, it’s possible to generate reports on budgets, inventory, expenses, and payments to assist businesses in identifying their spending patterns.

Frequently Asked Questions

The buyer creates the purchase order to request goods or services from the vendor or supplier.

The supplier or vendor creates the invoice to request payment from the buyer for goods and services delivered.

Purchase order comes first and is created before the goods or services are provided while the invoice is usually sent after they have been rendered.

If there are discrepancies between a PO and an invoice, it is common for the buyer's company to contact the supplier to collaboratively find a suitable solution. This may involve adjusting and reissuing the invoice, issuing a credit or debit note, or updating the PO to reflect any changes in the invoice.

A purchase order (PO) number is a unique alphanumeric identifier assigned to a specific purchase order within a company's procurement system. It serves as a reference number that helps track and identify the order's status.

A purchase order becomes a legally binding contract after the supplier or vendor accepts the order.

Invoices vs. purchase orders: don’t choose one document — use both

While some companies choose to conduct their purchasing process without issuing a purchase order, this approach proves to be ineffective and risk-prone. Without POs, companies face challenges in inventory management, cost control, and swift invoice processing. In addition, there’s a higher risk of unauthorized orders, duplicate payments, and fraudulent invoices.

While implementing both purchase orders and invoices, a company can track the order throughout the whole purchasing process, effectively control expenses, manage inventory, and ensure that the terms of cooperation are clear to both the buyer and the vendor. Managing POs and invoices manually is quite daunting, especially when an organization starts to grow, so don’t hesitate to use specialized purchase order software to quickly generate and securely manage procurement documents. You can book a demo with Precoro to see how purchasing becomes easier with a well-established system.