5 min read

Procure-to-Pay Process: End-to-End Guide

Everything you wanted to know about P2P: definition, importance, process steps explained, automation, software solution must-haves, and best practices.

According to a Paystream 2018 Procurement Insights report, 80% of organizations still use manual or semi-digital tools to manage their procure-to-pay cycle.

Most organizations are using the procurement module integrated with their ERP or accounting software. This is similar to using a flashlight to crack a nut.

P2P bridges Finance, Procurement and the wider business and drives value into every corner.

What is Procure to Pay?

Procure to pay is abbreviated as P2P or p2p, just like peer-to-peer networking technology, so it’s easy to confuse those two.

When you hear people talking about p2p or procure to pay, they might refer to the buying process in general or have software solutions in mind that bring purchasing and accounts payable (AP) departments in sync through procurement automation.

Originally, p2p was a manual paper-based process digitalized step-by-step during the past few decades, and it's probably only the beginning.

Procure-to-Pay Definition

Procure to pay is considered a subdivision of the larger procurement process.

It links procurement to the financial department by providing visibility over the entire transaction lifecycle: from selecting goods and services to invoicing and payment.

In contrast to source-to-pay software, p2p mostly excludes need identification, sourcing, production planning, and forecasting stages characteristic for the supply chain management.

Purchase to Pay

Purchase to pay, also known as req to check, is too mostly used in the context of e-procurement applications, purchasing and payment modules of ERP systems.

Purchase to pay covers the processes of requisitioning, purchasing, receiving, paying and accounting for items, services, or products. Therefore, it connects procurement and invoicing processes.

Some sources use purchase-to-pay and procure-to-pay terms interchangeably, others note that, unlike the latter, purchase-to-pay also includes need identification, planning, and budgeting.

Procure to Pay Process

The P2P process’ main goal is to meet the company’s needs for goods and services at the right time and at reasonable prices.

These processes can differ widely from one company to another, and you can decide to digitize all or part of them.

Procure to Pay Process Steps

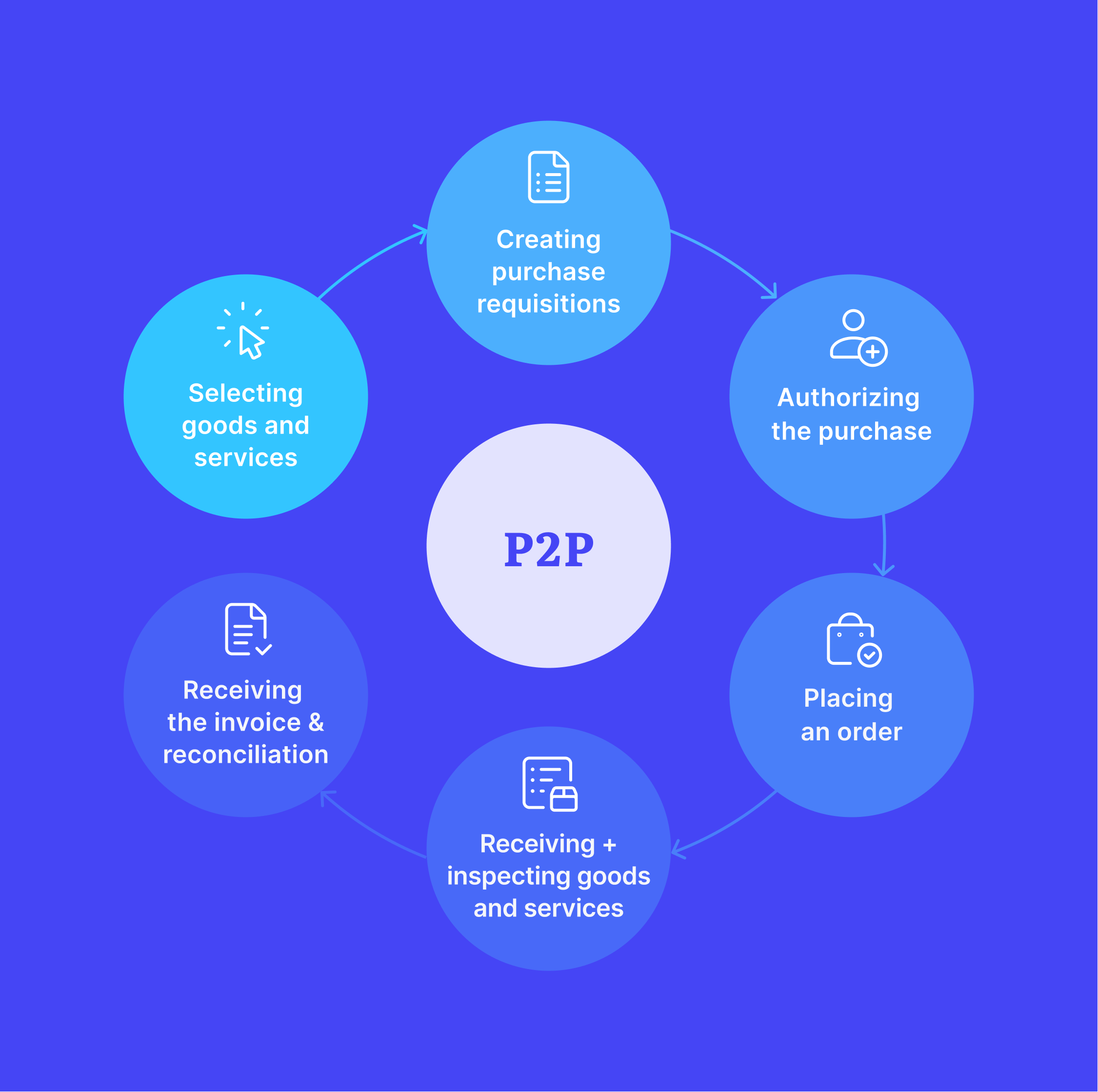

- Selecting goods and services

With previously established business needs in mind, employees decide on specifications for goods and terms of reference or statements of work for services. After that’s out of the way, they choose the required items from supplier catalogs or other available sources. - Creating purchase requisitions

Purchase requisitions are formal requests for goods or services (including subcontracts and consignments), necessary for business operations. Each document has a requisition number, which helps identify where it came from. The requestor fills out the information on the purchase, making sure it meets the administrative requirements, and submits the PR for approval. - Authorizing the purchase

Team leads, department heads, procurement officers, or upper management (the approval chain depends on the organization’s structure) then review and either authorize, reject, or send the requisition back to the initiator for correction. The decision mostly relies on need evaluation and available budget. - Placing an order

Normally, the requester would create a purchase order from the approved requisition and send it to the chosen vendor. If supplier confirms the order the PO will become a legally binding contract. But if the purchase is one-time, from unmanaged spend category, or of low value, the employee may perform a spot buy.

NOTE that there may be a separate approval workflow for purchase orders in some organizations to ensure compliance and specification accuracy. - Receiving + inspecting goods and services

Upon delivery, the buyer should examine the products or check services to evaluate the supplier performance. Quality, delivery times, the Total Cost of Ownership, and other parameters specified in the PO must comply with the contract terms for the goods receipt to be approved by the buyer. - Receiving the invoice & reconciliation

When the responsible employee approves the goods and services receipt, it’s time for a 3-way match between the PO, the receipt, and the invoice. If there are no discrepancies in the purchase invoice processing, the invoice goes through the approval route and lands in the finance department for payment. In case of any mismatch, the company rejects the invoice back to the supplier with an explanation.

Procure to Pay Cycle

The Procure-to-pay cycle means repeated sequential stages executed in a strict order that make up the end-to-end procurement process.

Procure to pay workflow covers three main aspects of the larger procurement lifecycle: requisitioning, purchasing, and payment.

Procure to pay cycle isn’t designed to speed up the vendor payment process, as clearing invoices faster affects the timing of the company’s cash flow and prevents them from holding on to their cash for as long as possible.

Procure to Pay Best Practices

The consequences of using archaic procure-to-pay software, or worse, no solution at all, will ultimately damage an organization’s bottom line.

In order to survive the competition, organizations need to move away from their traditional approach and embrace digital.

Procure-to-pay best practices include:

- Scalable software that adapts to your current needs and grows with your team;

- Robust technology with a single point of contact (e.g., Supplier Portal);

- Integration with ERP systems and accounting software;

- Simplification of item selection (by means of Punch-Out catalogs, e-catalogs, and APIs);

- Support from upper management;

- Centralized acquisition channels;

- Scan-and-capture service;

- Multi-enterprise network.

Procure-to-pay Solution

A procure-to-pay solution is an integrated electronic system that automates the aforementioned process by allowing employees to browse supplier catalogs and initiate purchases.

The software then compares the requests with the company’s workflow-based rules like who’s making the PR, the cost of purchase, chart of accounts, etc.

Next, the system routes the requisition through the approval chain, notifying each approver in line, ideally including the option of mobile approvals.

Once the request is approved, the system creates a respective PO. And when the invoice arrives, the p2p solution matches it against the purchase order, receipt, and contract terms.

Procure-to-pay systems are recognized by the UK’s economic and finance ministry, HM Treasury, as essential tools for proper implementation of Resource Accounting and Budgeting.

Automated p2p software solutions are capable of capturing and controlling both PO and non-PO spending, capital, credit card, and reimbursable spending.

They serve as internal spending controls for finance departments, providing them visibility into the responsible vendors, sources and initiators of spending.

Must-have features of a procure-to-pay software are:

- Catalogs from preferred suppliers for easy item selection

- Purchase requisitions sent from requestors to managers for approval

- Approval workflow for managers to verify the purchase requisition

- Purchase order flow that starts with an approved purchase request

- Invoices automatically matched with POs and receipts

- Budget Management dashboard with real-time insights and clear reports

The Importance of Procure-to-Pay (P2P) for Businesses

Most organizations should have a centralized formal p2p process in place, as well as qualified staff to oversee acquisition activities.

Challenges in the Procure-to-Pay Process

- Time-consuming processing an abnormal amount of entries by hand

- Insufficient data governance and quality to support decision-making

- Lack of visibility over purchasing commitments until invoicing

- Employees making purchases without proper authorization

- Purchases made from various non-preferred sources

- Low employee satisfaction and productivity

- Siloed internal communication

- Wrongly attributed costs

Key Benefits of Procure-to-Pay

- A collaborative process that allows teams to concentrate on value-added strategic tasks;

- Valuable analytics for better-informed budgeting decisions of the executive team;

- Cost-saving opportunities like reduced labor costs and early payment discounts;

- Time-saving straight-through document processing without error-prone manual intervention;

- Mitigation of fraud, supplier non-conformance, and non-compliance risks;

- Streamlined approval workflows with timely alerts and on-the-go access;

- Deep insights into the company’s cash flow and financial commitments;

- Increased visibility, accuracy, control, and efficiency in procurement;

- Compliance with contracts, purchasing policies, and procedures;

- Reduced paperwork and disorganization in accounts payable;

- Engaging and optimized buyer experience with item catalogs;

- Healthier supplier relationships that attract strategic vendors;

- Prevention of redundant, maverick, and fraudulent spending;

- Complete audit trail.

Bottom line is, digitalizing your procurement process with procure-to-pay software solutions can strengthen compliance and control among vendors, contracts, regulations, buyers, and accounts payable.