18 min read

Notes Payable vs. Accounts Payable | Key Differences, Impact, and Tips

Learn how to distinguish notes payable vs. accounts payable, assess their impact, and optimize management. Test your understanding with a quick quiz!

Every business, no matter its size, has financial obligations: money it owes to suppliers, lenders, or other entities. Two common types of liabilities that appear on a company’s balance sheet are notes payable vs. accounts payable. While both represent amounts owed, they serve different purposes, follow different repayment structures, and impact financial statements in distinct ways.

Understanding the differences between notes payable vs. accounts payable is crucial for managing cash flow, maintaining strong supplier relationships, and making informed financial decisions. This article will highlight the key distinctions between them, share best practices for managing these liabilities, and explain how to assess whether a company handles accounts vs. notes payable effectively.

Keep reading to learn:

What Is Accounts Payable?

What Is Notes Payable?

Differences Between Notes Payable vs. Accounts Payable

Examples of Accounts Payable vs. Notes Payable with Quiz Questions

Evaluating How Well a Company Manages Notes Payable vs. Accounts Payable

Expert Tips for Managing Notes Payable vs. Accounts Payable

Frequently Asked Questions About Notes Payable vs. Accounts Payable

What Is Accounts Payable?

With a solid grasp of accounts payable meaning, a company can avoid late payment penalties, strengthen supplier relationships, and improve cash flow management. Accounts payable (AP) refers to a company’s short-term obligations to suppliers and vendors for goods and services received on credit. Instead of paying immediately, businesses receive invoices and are expected to settle them within a specific period (usually 30 to 90 days).

Common examples of accounts payable include:

- Purchasing raw materials for production.

- Paying for utilities like electricity or the internet.

- Ordering office supplies on credit.

In large companies, managing accounts payable goes beyond just paying invoices. The AP team makes sure suppliers are set up right, invoices check out against POs and receipts, and payments go out on a schedule that keeps cash flow healthy. They also keep an eye on working capital to pay on time without affecting the company’s liquidity.

Key characteristics of accounts payable are:

- Non-collateralized credit: Suppliers extend credit without requiring collateral, relying instead on a company’s payment history and financial stability.

- Invoice-based obligations: Payments are made based on invoices rather than legally binding loan agreements.

- No interest (unless overdue): AP doesn’t typically accrue interest unless payments are delayed, which can lead to late payment fees.

- Recurring and essential for any business: Since companies regularly purchase materials and services, accounts payable is a constant, necessary part of operations.

The Business Impact of Accounts Payable

Proper AP management plays a crucial role in a company’s financial health:

Managing Cash Flow

Keeping track of outstanding payables helps businesses allocate cash wisely and avoid liquidity issues. Some companies offer longer payment terms to improve cash flow. They measure this with Days Payable Outstanding (DPO) — the average time it takes a business to pay its invoices. While suppliers may offer 30-day terms, actual DPO can extend beyond 40 or 50 days.

Creditworthiness

Consistently paying suppliers on time strengthens a company’s financial reputation, leading to better loan terms and stronger vendor relationships. It also opens the door to early payment discounts and priority service from key suppliers.

Cost of Goods Sold (COGS)

Since AP represents purchases made on credit, it directly influences COGS — the direct costs associated with the production of goods or services sold by a business. These costs typically include materials, labor, and overhead directly tied to production.

As a company makes payments to its key suppliers, these costs are recognized and factored into the COGS calculation. Timely payments ensure that businesses can accurately track their expenses, which helps in assessing profitability.

Discount Opportunities

Many suppliers offer early payment discounts (for example, “2/10 net 30,” meaning a 2% discount if paid within 10 days). Taking advantage of these incentives can reduce expenses and improve profit margins.

What Is Notes Payable?

A clear grasp of notes payable meaning is important when evaluating a company’s debt structure and overall financial strategy. Notes payable (NP) refers to a formal, written promise by a business to repay a specific amount of money by a set date, often with interest.

Companies usually obtain notes payable from financial institutions, banks, or even corporate lenders, such as parent companies or subsidiaries. In most cases, this funding helps cover major expenses or expansion efforts.

Common examples of notes payable are:

- A business securing a loan from a bank for expansion.

- Financing the purchase of expensive equipment through a loan.

- Borrowing capital from investors under structured repayment terms.

In bigger companies, handling notes payable involves more than just repayment. The team keeps an eye on loan agreements, ensures interest and principal get paid on time, and manages collateral if needed. They might also refinance or restructure debt to get better terms or free up cash flow.

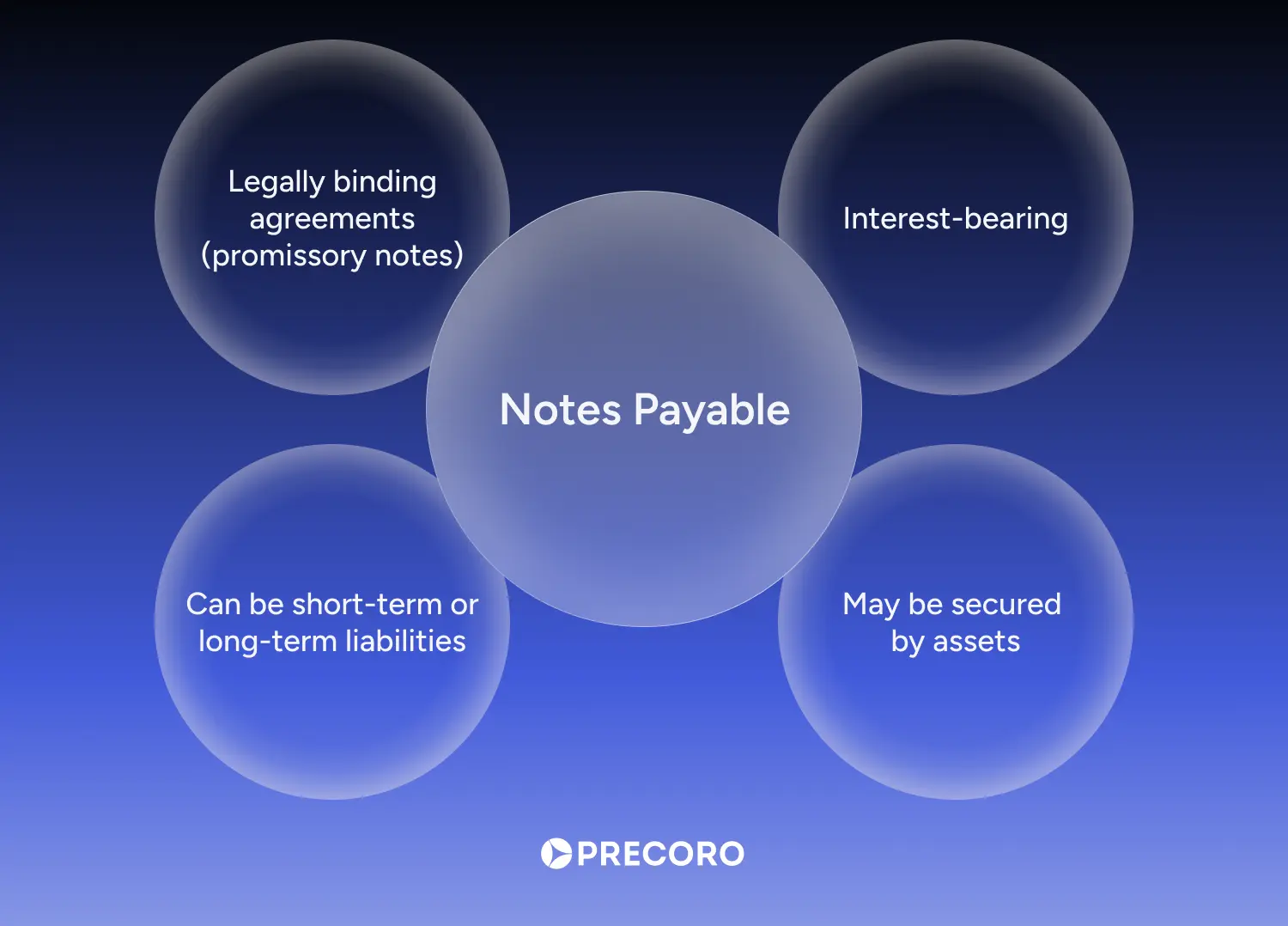

All these responsibilities stem from key characteristics of notes payable, which include:

- Formal contract: Notes payable are backed by legally binding agreements called promissory notes, which outline the specifics of the repayment terms.

- Interest-bearing: Along with the principal, businesses must pay interest, which adds to the overall repayment amount.

- Short-term or long-term: If the debt is due within a year, it’s classified as a current liability on the balance sheet; if it extends beyond a year, it’s recorded as a long-term liability.

- Security or collateral: In some cases, notes payable may be secured by assets, which can be claimed by the lender if the borrower defaults on repayment.

The Business Impact of Notes Payable

Notes payable play a significant role in a company’s financial health and long-term strategy. Since they usually involve large sums and interest payments, managing them effectively is essential for securing future growth opportunities.

Capital for Business Growth

Properly structured notes payable can provide businesses with the capital they need to grow without immediately depleting cash reserves. Notes payable are often used for strategic investments, such as:

- Expansion projects: Opening new locations, hiring staff, or scaling operations.

- Major asset purchases: Acquiring equipment, vehicles, or technology that requires large upfront costs.

- Working capital needs: Covering short-term cash flow gaps or funding long-term initiatives.

Impact on Financial Statements

Interest costs on notes payable can cut into profitability, especially if debt levels climb too high. Since lenders and investors closely watch financial ratios like debt-to-equity, a heavy debt load can make it harder to secure future financing.

Cash Flow and Liquidity Considerations

Notes payable have predictable but inflexible repayment schedules. Businesses must plan cash flow carefully to ensure they meet obligations without financial strain. Some notes require balloon payments (a large lump sum at the end of the term), which can create financial pressure.

Timing debt repayments alongside revenue cycles is crucial. If a company’s cash inflows don’t align with repayment schedules, it could face liquidity issues.

Creditworthiness and Borrowing Power

Lenders and investors closely monitor how businesses manage their notes payable. When a company reliably meets its debt commitments, it strengthens its credit profile, which leads to:

- Better interest rates on future loans.

- Higher borrowing limits.

- More favorable terms from suppliers and financial institutions.

Missing payments can trigger late fees, damage credit scores, and even lead to legal action. In cases where notes are secured by assets, default could result in the loss of valuable business property.

Cost Considerations and Strategic Benefits

Instead of selling shares to raise capital (which dilutes ownership), companies often prefer notes payable as a way to fund expansion while retaining control. However, excessive debt can become a burden if not managed properly.

Taking on debt through notes payable can be a smart move if the return on investment (ROI) from the borrowed funds outweighs the interest costs. Businesses must carefully assess whether financing will generate sufficient revenue to justify the liability.

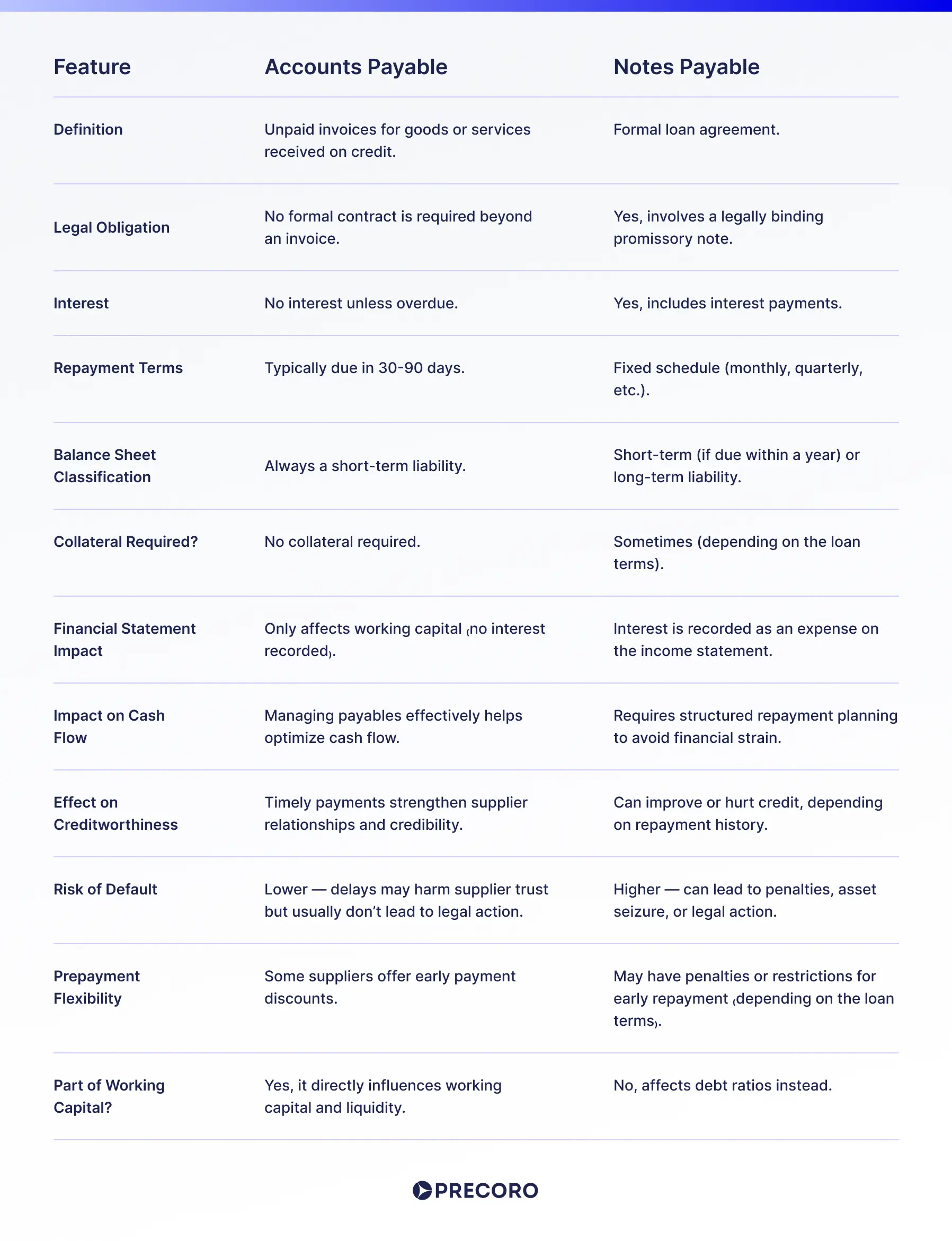

Differences Between Notes Payable vs. Accounts Payable

Accounts payable and notes payable are both financial obligations, but they differ in structure, repayment terms, and impact on financial health. Understanding the distinctions between accounts payable vs. notes payable is crucial for businesses to manage liabilities effectively and maintain strong financial standing.

Type of Obligation

The first difference between notes payable vs. accounts payable lies in the nature of the obligation. For accounts payable, a company receives goods or services and owes money to suppliers for them, usually based on the invoice terms.

On the other hand, for notes payable, a company receives money (usually from financial institutions, banks, or subsidiaries) and owes money that must be repaid according to the terms of a formal agreement. This is typically seen in financing arrangements or loans.

Formality and Legal Structure

Accounts payable are less formal. They arise from routine business transactions, where suppliers extend credit with the expectation of payment based on an invoice. No separate contract is required beyond standard purchase terms.

Notes payable involve a legally binding promissory note, which outlines repayment terms, interest, and sometimes collateral. This makes them a more formal borrowing agreement.

Interest, Repayment, and Cost Considerations

When comparing accounts payable vs. notes payable, a key difference is that accounts payable don’t include interest unless payments are overdue. Additionally, some suppliers offer early payment discounts, allowing businesses to save costs by settling invoices ahead of schedule.

On the other hand, notes payable always include interest payments, which are recorded as interest expense on the income statement. Repayment follows a structured schedule, often with monthly or quarterly installments.

Collateral and Risk

The risks tied to accounts payable vs. notes payable also differ. Accounts payable are unsecured, meaning they don’t require collateral. However, failing to pay suppliers on time can strain relationships and impact a company’s creditworthiness.

Depending on the loan terms, notes payable may require collateral (such as equipment or assets). If the borrower defaults, the lender has legal grounds to claim assets.

Financial Statement Classification

Notes payable vs. accounts payable are typically listed in separate categories on the balance sheet. Accounts payable are always short-term liabilities, directly influencing working capital and cash flow management. Proper handling of accounts payable ensures businesses have sufficient liquidity for daily operations.

Notes payable can be classified as short-term (due within 12 months) or long-term liabilities on the balance sheet. Since they often involve large sums, they affect a company’s debt ratios and ability to secure future financing.

Business Process Differences

When comparing notes payable vs. accounts payable, it’s important to recognize their different roles in financial management. Accounts payable management involves supplier onboarding, invoice verification, and three-way matching (comparing purchase orders, goods receipts, and invoices). It is closely tied to a company’s procurement function and operational efficiency.

Notes payable transactions involve structured lending agreements with defined payment terms and amortization schedules. Businesses must ensure timely repayments to avoid penalties or damage to their credit standing.

Here’s a side-by-side comparison of notes payable vs. accounts payable for easy reference.

Examples of Accounts Payable vs. Notes Payable with Quiz Questions

Do you want to test your understanding of the key differences between notes payable and accounts payable? We’ve put together a short set of examples and quiz questions to help you understand and distinguish these two liabilities in real situations. Let’s dive in and put your knowledge to the test!

Instructions: For each example, identify whether it is accounts payable vs. notes payable.

1. A company orders inventory on credit and agrees to pay within 60 days, with no interest unless late.

2. A business borrows $100,000 from a bank and signs a contract to repay the loan over 3 years at a 6% annual interest rate.

3. A company buys office furniture on credit and agrees to pay within 30 days, with no formal agreement in place.

4. A company incurs a bill for internet and phone services, payable in 30 days, with no formal loan or interest involved.

5. A construction company borrows funds from a private lender to finance a major project and agrees to pay the loan back over 10 years, with interest.

Evaluating How Well a Company Manages Notes Payable vs. Accounts Payable

Assessing how well a company manages its notes payable vs. accounts payable is crucial for understanding its financial health and long-term stability. Poorly managed liabilities lead to cash flow issues, higher borrowing costs, and even financial distress. By analyzing key financial metrics and overall debt strategy, businesses can determine whether their approaches to accounts vs. notes payable support growth or pose a risk.

For Accounts Payable

Effective accounts payable management ensures that a company maintains good supplier relationships, avoids late fees, and optimizes cash flow. There are several metrics that help assess whether the business is striking the right balance between meeting obligations and preserving liquidity.

Days Payable Outstanding (DPO)

What it is: DPO measures the average number of days it takes for a company to pay its invoices.

Why it matters: A high DPO means the company is delaying payments to suppliers, which could signal cash flow problems or financial strain. On the other hand, if DPO is too low, the company may be missing opportunities to optimize cash flow and use available funds more strategically.

How to calculate:

DPO = (Accounts Payable / Cost of Goods Sold) * 365Companies should aim for a balanced DPO — long enough to preserve cash flow but short enough to maintain strong supplier relationships. For a mid-sized company, a realistic DPO typically ranges from 30 to 60 days, depending on industry norms and supplier agreements.

Enterprises with greater negotiating power often extend DPO to 60 to 90 days or more, especially in industries like retail and manufacturing. However, pushing it too far can strain supplier relationships and impact supply chain reliability.

Accounts Payable Turnover Ratio

What it is: This ratio shows how many times a company pays off its accounts payable within a given period (usually a year).

Why it matters: A higher ratio indicates that a company efficiently manages its payables and promptly pays off debts. A lower ratio might indicate delayed payments or poor vendor management.

How to calculate:

Accounts Payable Turnover Ratio = Net Credit Purchases / Average Accounts PayableAim for a higher turnover ratio to ensure that the company is handling payables efficiently without overextending payment terms. Late AP payments damage relationships and may incur late fees, as they disrupt suppliers’ cash management.

According to a QuickBooks survey, 72% of mid-sized suppliers said late invoice payments hindered their growth. Additionally, 65% of businesses reported spending nearly 14 hours chasing late payments.

Early Payment Discounts Utilized

What it is: This measures the percentage of early payment discounts taken advantage of.

Why it matters: Suppliers often offer early payment discounts to incentivize faster payments. By taking advantage of these discounts, a company can reduce costs and generate better returns than it might earn from holding cash or short-term investments.

How to calculate:

Early Payment Discounts Used = (Early Discounts Taken / Total Discounts Available) * 100When cash reserves allow it, companies should aim to capture these discounts to improve profitability and cash flow management.

Invoice Processing Time

What it is: The average time it takes to process an invoice from receipt to payment.

Why it matters: Delays in processing invoices could lead to missed payments, late fees, and strained relationships with vendors. A quicker processing time indicates efficiency in the AP process.

How to calculate:

Invoice Processing Time = Total Processing Time / Number of InvoicesThe quicker the processing, the better the AP management. Look to streamline invoice workflows and automate AP operations where possible.

For Notes Payable (NP)

When it comes to managing notes payable, it’s all about balancing bigger debts and keeping things on track with formal agreements. In this section, we’ll dive into the key metrics that help businesses stay on top of their notes payable.

Debt-to-Equity Ratio

What it is: This ratio helps determine how much debt, including notes payable, a company is carrying in relation to its equity.

Why it matters: A high debt-to-equity ratio suggests the company is relying heavily on debt, which could be risky, especially if interest rates rise or cash flow becomes unstable. A lower ratio indicates lower financial risk.

How to calculate:

Debt-to-Equity Ratio = Total Debt / Shareholder’s EquityCompanies should aim for a balanced debt-to-equity ratio that indicates they’re not over-leveraged while still using debt if necessary to fuel growth. The 1:1 ratio is a good rule of thumb, which means the company has an equal amount of debt and equity. However, what’s considered “balanced” can vary by industry. For example, capital-intensive industries like utilities might have higher ratios, while tech or service companies lean towards lower ratios.

Interest Coverage Ratio

What it is: This ratio measures a company’s ability to pay interest on its outstanding debt (including notes payable).

Why it matters: A higher interest coverage ratio indicates the company is generating enough income to cover its interest payments easily. A low ratio could indicate financial strain and difficulty managing debt.

How to calculate:

Interest Coverage Ratio = EBIT / Interest ExpenseAim for an interest coverage ratio of 3 or higher to ensure the company can comfortably meet its debt obligations.

Refinancing and Repayment Timeliness

What it is: This measures whether the company is refinancing or repaying its notes payable on time, as agreed upon in the terms of the notes.

Why it matters: Failing to meet these deadlines could indicate poor management of long-term debt and negatively affect credit ratings.

How to calculate:

On-Time Repayment Ratio = (Number of Timely Payments / Total Payments Due) * 100Ensure notes payable are paid on time, or seek refinancing options if necessary to avoid defaults or unfavorable terms.

Cash Flow to Debt Ratio

What it is: This ratio measures the company’s ability to cover its debt payments (including notes payable) with its operating cash flow.

Why it matters: A higher ratio shows a better ability to manage debt without compromising liquidity, while a low ratio can signal potential liquidity issues.

How to calculate:

Cash Flow to Debt Ratio = Operating Cash Flow / Total DebtA higher ratio is preferred because it shows the company is generating enough cash flow to cover its debt obligations, which indicates strong cash flow management and the ability to service debt. Ideally, companies aim for a ratio of 0.2 or higher, but this can vary depending on the industry and the company’s specific financial strategy.

Expert Tips for Managing Notes Payable vs. Accounts Payable

Financial stability hinges on the proper handling of both accounts payable vs. notes payable. A high AP balance may signal poor cash flow management, making it harder to secure favorable supplier terms. On the other hand, missed NP payments can lead to default, legal consequences, and additional interest costs.

Lenders assess these obligations differently. AP reflects short-term liquidity, while NP affects long-term debt obligations and creditworthiness. Proper management of notes payable vs. accounts payable can strengthen financial health and prevent unnecessary risks.

Advanced Accounts Payable Tips

These actions turn the AP function from an operational task to a strategic lever that can boost profitability and financial health.

1. Use Dynamic Discounting

Go beyond fixed early payment discounts by negotiating dynamic discounting terms with your suppliers. This approach offers a sliding scale of discounts based on when you pay, often allowing for better deals than traditional early payment terms. For example, a company might get a 2% discount if it pays in 10 days but 1.5% if it pays in 20 days.

While dynamic discounting depends on supplier flexibility, it can be negotiated by discussing cash flow needs. Focus on mutual benefits, like getting faster payments in return for bigger discounts. Suppliers who understand your payment cycles may be more inclined to offer this, which can improve both your profitability and supplier relationships.

2. Leverage Cash Flow Forecasting in AP

Predictive financial forecasting helps companies make smarter decisions about when to schedule payments, improving cash flow management. By anticipating revenue dips, organizations can avoid piling up invoices during slower periods, all while maintaining good supplier relationships.

This approach lets AP teams schedule payments to align with higher liquidity periods. For instance, when a retail company forecasts strong sales for Q4, it might extend payment schedules into Q1. This strategy helps effectively manage accounts payable during slower revenue months.

3. Automate Dispute Resolution with AP Software

Invoice discrepancies and errors are one of the primary causes of delayed payments. To mitigate this issue, many businesses turn to AP automation software, which quickly catches mismatches between purchase orders, invoices, and receipts. Automating a three-way matching process eliminates the need for time-consuming manual checks, reduces human errors, and speeds up the resolution of disputes.

Quickly resolving disputes helps companies avoid costly payment delays, keep supplier relationships strong, and lighten the admin load. It’s especially valuable in industries with high invoice volumes and frequent discrepancies. A PYMNTS report reveals that 73% of executives from mid-sized businesses view automation, especially with AI-enhanced features, as a key factor in improving cash flow, as well as driving savings and growth.

4. Centralize Supplier Data for Better Negotiations

The better the data you have, the better your negotiation power. By centralizing and maintaining detailed supplier information (such as payment terms, historical performance, and pricing structures), you can avoid last-minute scrambling to find details or track payment histories.

You can leverage understanding a supplier’s payment flexibility and historical reliability to negotiate better credit terms or discount arrangements. Additionally, you might find that a supplier is willing to offer a longer payment term during seasonal dips in demand or provide additional discounts for consistently on-time payments.

Advanced Notes Payable Tips

These strategies help companies manage and optimize their notes payable in ways that can reduce financial costs, increase flexibility, and align with long-term growth plans.

1. Use Debt Covenants to Your Advantage

Debt covenants are typically included in loan agreements and require companies to maintain specific financial ratios (like debt-to-equity ratios, interest coverage, etc.) or meet certain performance targets. While debt covenants seem restrictive, they can serve as an important tool for financial discipline and proactive management.

Structuring debt covenants around key financial metrics, like maintaining a low debt-to-equity ratio during growth, helps ensure financial discipline and risk control. This approach prevents over-leveraging, keeps debt levels manageable, and supports long-term stability. It encourages regular monitoring of finances, helping the company stay on track for sustainable growth and easier access to favorable financing terms in the future. These could include lower interest rates, better repayment schedules, or higher credit limits.

2. Consider Securitizing Debt to Reduce Interest Rates

If your company has a lot of receivables or inventory, consider securitizing debt by using these assets as collateral. This can be a strategic move for companies with substantial receivables but not enough liquid cash, as it helps them secure lower-cost financing. Turning the receivables into securitized assets can lower your interest rates, as lenders will have a more secure way to recoup their investment in the event of a default.

3. Explore Synthetic Debt Arrangements

Synthetic debt refers to financial instruments like interest rate swaps or total return swaps, which allow businesses to take on financing without increasing their formal debt load. Companies may choose synthetic debt for its better terms and greater flexibility. This option is particularly appealing in unstable markets or when businesses seek to optimize their financial setup.

4. Time Refinancing with Growth or Acquisition Milestones

Timing refinancing with key milestones, such as business growth or acquisitions, can be an effective strategy to secure better financing terms. Lenders typically view companies with increasing revenue, improved business models, or new acquisition targets as lower-risk borrowers.

Refinancing during key growth milestones allows businesses to take advantage of better rates, extend repayment terms, or access higher borrowing limits, all of which can improve financial flexibility. Waiting until the business is on firmer financial ground (after a major acquisition, for instance) also reduces the risk of refinancing during times of volatility or uncertainty.

Frequently Asked Questions About Notes Payable vs. Accounts Payable

Accounts payable refers to the money a business owes to its suppliers or vendors for goods or services it has received but hasn’t paid for yet. It’s a short-term liability on the company’s balance sheet.

Notes payable is a formal, written promise that a business will pay a specific amount of money by a certain date, typically to banks, financial institutions, or corporate lenders. These are often used for larger loans or financing arrangements and typically involve interest.

The main differences between notes payable vs. accounts payable lie in their formality, interest, and terms. Notes payable is a formal, written agreement made with lenders, whereas accounts payable is generally represented by a supplier invoice. In terms of interest, notes payable often come with interest charges, while accounts payable typically don’t unless payments are delayed. Additionally, notes payable can be either short-term or long-term, whereas accounts payable is a short-term liability, typically due within a year.

Accounts payable is a liability. It represents money that a company owes and needs to pay to others.

No, notes payable are liabilities (money you owe to lenders, such as banks or financial institutions), while notes receivable are assets (money owed to the company by customers, borrowers, or business partners).

It is notes payable if there is a written agreement or promissory note that outlines a specific amount to be paid on a specific date, usually with interest.

A business taking out a loan to buy equipment and signing a promissory note to repay the loan over three years, with interest, is an example of notes payable.

Notes payable is a credit entry. When the company borrows money (through notes payable), it increases its liabilities, which are recorded as a credit.

Key Takeaways on Notes Payable vs. Accounts Payable

Accounts payable represents the money a company owes to suppliers for goods or services received on credit. It is a short-term liability that typically arises from routine business transactions, such as purchasing inventory or services.

On the other hand, notes payable refers to a written promise to repay a lender a specific amount by a certain date. It often involves larger sums, interest rates, and structured payment terms, making it a more formal and long-term liability.

To effectively manage both notes payable vs. accounts payable, financial teams need a clear view of where the corporate money is going. Accounts payable software offers the tools to track, analyze, and manage purchases and expenses, ensuring better control and smarter decision-making. With the right platform in place, businesses can ensure timely payments, optimize cash flow, and even leverage early payment discounts to improve profitability.