17 min read

Procurement Category Management: Step-by-Step Guide with Examples

A clear, step-by-step guide to help you apply category management in your procurement process, with practical examples.

Category management isn’t just another procurement trend. It’s a way for companies to group similar goods or services (like IT infrastructure, facilities, or raw materials) and manage them holistically instead of handling every purchase in isolation.

With today’s growing cost pressures and increasingly complex supply chains, quick fixes no longer cut it. What procurement teams need is a clear view of their spend, tighter control, and a strategy that delivers lasting value—exactly what category management provides.

Read on to learn:

What is category management?

How to establish a category management system

Examples of categories and strategies

Why category management in procurement matters

How Precoro can help you establish a category management system

Frequently asked questions about category management services

What is category management?

Category Management (CM) is a strategic procurement approach that groups related purchases into categories to manage each as a strategic unit. Category management definition means looking beyond individual purchases. For example, instead of just buying pens when supplies run low, category managers ask: “What do we spend on office supplies company-wide?”

Categories typically fall into two main groups: direct and indirect spend. Direct spend includes goods and materials that go directly into your company’s products or services, such as raw materials, packaging, and components. On the other hand, indirect spend includes everything else that supports the business but doesn’t directly contribute to the final product. Examples include office supplies, IT infrastructure, and facilities.

Here are typical procurement categories:

- Office supplies and equipment

- IT hardware and software

- Facilities management (cleaning, security, maintenance)

- Professional services (consulting, legal, marketing)

- Raw materials and components

- Packaging and logistics

- Travel and fleet management

- Utilities and telecom

- MRO (maintenance, repair, operations)

How category management is different from traditional sourcing

Traditional sourcing usually concentrates on individual purchases or contracts. It aims to secure the best price for each deal but overlooks the product category as a whole. In contrast, procurement category management is a strategic approach that groups similar products or services together to get the most value, lower risk, and meet business goals.

Therefore, traditional sourcing is often reactive: a procurement manager reviews a purchase request, finds a supplier, negotiates terms, and moves on. It’s tactical and short-term. On the other hand, category management is proactive and long-term. It encourages procurement managers to ask questions like:

- What do we really need across the company in this area?

- Can we consolidate suppliers or standardize specifications?

- Where are we overspending or underleveraging our volume?

- Are there risks in our supply base that we haven’t addressed?

When you step back and examine whole categories, you consolidate purchasing, negotiate better prices, and build real partnerships with suppliers. Your procurement team stops putting out fires and instead focuses on projects that truly save money and solve problems. Rather than just saying, “Sure, we’ll order that,” they actively look for smarter ways to get what teams need.

How to establish a category management system

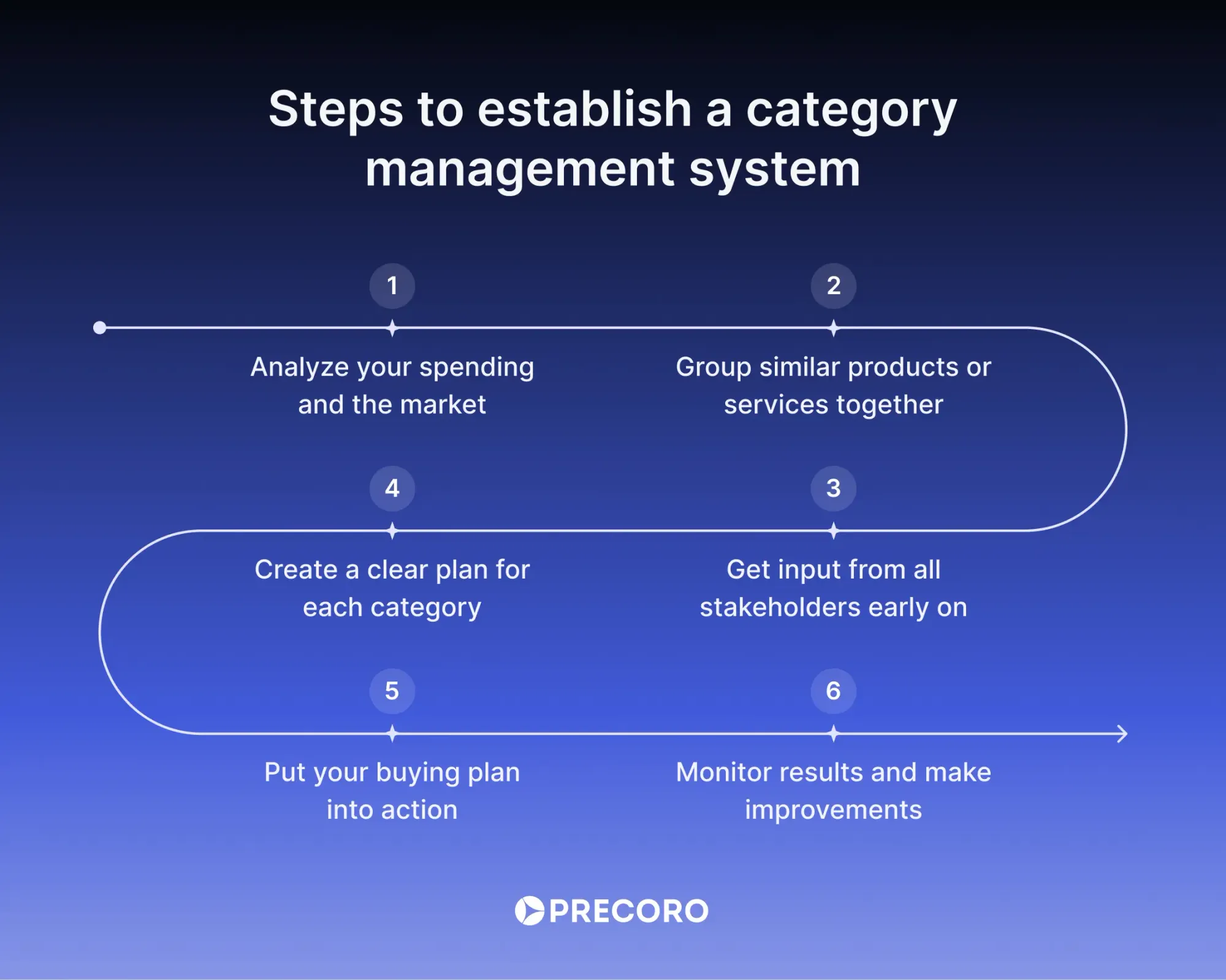

Category management in procurement is most effective when it follows a structured process. Start with an analysis of spending and the market. After this, segment categories to decide where to focus. Next, involve stakeholders to make sure plans match business needs.

Then, create and carry out a specific category strategy through sourcing and contract management. Finally, monitor performance and make ongoing improvements. This structure keeps the strategy effective and aligned with business goals.

Let’s break down each stage to see how your data can shape a strategy and how that strategy can drive meaningful results.

1. Spend and market analysis

You can’t manage what you can’t see. That’s why the first step in procurement category management is to gain full visibility into your spending and analyze the market context behind those purchases.

Start by digging into your own procurement data to find patterns and inefficiencies. The goal is to understand how much is being spent, where, with whom, and on what. To do that, consolidate data from all departments, locations, and systems, and then classify spend by supplier, category, cost center, and business unit.

Look for inefficiencies like:

- Duplicate or fragmented purchasing across different teams or sites.

- Maverick spend—purchases made outside contracts or approval workflows.

- High-cost drivers, such as low-volume purchases or overspecified items.

This step equips you with facts to challenge the status quo decisions and a clear view of opportunities to consolidate purchasing and renegotiate with suppliers. After that, you can shift focus to the external environment and examine the supplier market.

For a sound category management strategy, you need a strong grasp of the supplier landscape and market dynamics that influence your categories. Pay attention to the following:

- Supplier landscape: Who are the main players? How competitive is the market?

- Pricing benchmarks: Are you overpaying compared to industry standards?

- Trends and innovations: What new technologies, services, or models could change the game?

- Risks and volatility: Think of supply chain disruptions, regulatory changes, inflation, or geopolitical shifts.

2. Category segmentation

You likely manage hundreds (if not thousands) of products and services. Some demand daily attention, while others require a lighter touch. That’s where category segmentation comes in: it helps procurement teams prioritize time and resources where they’ll have the biggest impact.

Here are three key angles to consider in category management procurement strategy:

- Strategic importance to the business: Is this category mission-critical? Does it directly impact operations, customers, or revenue?

- Spend size and complexity: What’s the total spend? How fragmented is it across suppliers or departments?

High-spend or highly fragmented categories often present big consolidation opportunities. - Supply market dynamics: Is the supply base competitive or concentrated? Are suppliers stable, or are there risks of disruption?

One of the most popular tools to guide your segmentation is the Kraljic Matrix, which classifies categories based on two dimensions:

- Impact on the business (low to high)

- Supply risk (low to high)

As a result, you can group your purchases into four types of categories:

The goal here is to avoid spreading your team too thin. You don’t need a robust strategy for every pen-and-paper order, but you do need one for anything that could stop operations or drain your budget.

3. Stakeholder engagement

Category management is not a solo sport. You can have the best data and supplier insights in the world, but if your internal teams aren’t on board, your strategy won’t land.

That means it’s best to engage stakeholders early and often. Don’t wait until the RFP is ready. Invite stakeholders in from the start—during spend analysis and segmentation—when their input can truly shape the strategy.

Stakeholders vary by category but typically include:

- Operations teams: Rely on goods or services to keep projects and daily work running smoothly.

- Finance: Focus on budgets, ROI, and financial risk management.

- End users: Actually use the products or services.

- IT, legal, and compliance: Ensure purchases meet technical, legal, and regulatory requirements.

Tailor your communication to engage stakeholders effectively. For finance, focus on numbers and risk. For end users, highlight how the category management strategy improves daily operations. Procurement should act as a translator between business needs and sourcing options.

Maintain regular communication with stakeholders throughout the process: share updates, collect feedback, and showcase early successes. This ongoing engagement builds trust and ensures your strategies are effective in real-world settings.

4. Category strategy development

At this stage, all your analysis and insights come together into a clear, actionable plan. A category strategy acts as your procurement playbook and outlines how you will source a specific category to create value. It aligns business goals with sourcing decisions, supplier selection, and contract terms.

First, define goals that reflect both overall business priorities and the unique needs of the category. Examples:

- Reduce the total cost of ownership, not just the unit price

- Improve delivery reliability or quality standards

- Encourage supplier innovation and flexibility

- Minimize supply chain risks and ensure compliance

Then, think of strategic levers. Every category is different, so choose tactics that match its complexity and importance. Common levers in a category management system are:

- Make vs. buy: Shift production or services in-house when it’s more efficient or cost-effective.

- Supplier consolidation: Work with fewer, more strategic suppliers to secure better terms and reduce administrative overhead.

- Dual or multi-sourcing: In high-risk categories, source from multiple suppliers to reduce the risk of disruptions.

- Long-term partnerships: Foster close collaboration in areas like IT, consulting, or specialized manufacturing, where mutual value is high.

- Framework agreements or blanket POs: Simplify recurring purchases across departments under a single agreement.

Revisit input from your stakeholders and ensure the strategy reflects their priorities. For instance, IT may value speed and compatibility over price, while legal may prioritize contractual risk mitigation. Your strategy needs to balance these perspectives.

Finally, a strong category management strategy should be written down and shared. Include:

- Objectives and success metrics

- Preferred supplier profile or sourcing model

- Key risks and mitigation actions

- Stakeholder roles

- Timeline and next steps

The more clearly you document and communicate your strategy, the smoother the execution phase will be.

5. Implementation and sourcing

This is where category management strategy turns into action. You’ve done the groundwork—now it’s time to source the right suppliers, lock in the right terms, and make the strategy real. This stage is critical. Even the best category strategy won’t deliver value unless it’s executed effectively.

First, choose the most effective sourcing method for the category and business goals. For example:

- RFI (Request for Information): Use when you need to learn more about the supplier landscape before committing.

- RFP (Request for Proposal): Use when the category is complex or high-value, and you want detailed offers and creative solutions.

- RFQ (Request for Quotation): Use when specifications are clear and price is the main differentiator.

Not every category needs a full-blown RFP. The approach should match the complexity, risk, and strategic importance of the spend. Also, don’t forget to involve stakeholders when reviewing proposals—they’ll bring practical insights to help assess the fit for the category management services.

Once you’ve reviewed supplier responses and chosen the best bids, it’s time to negotiate. Use this stage to not just drive down the price but, more importantly, ensure a strong, long-term fit. Focus areas include:

- Total cost of ownership (TCO) instead of just unit price

- Volume-based discounts or rebates

- Service levels tied to clear performance metrics

- Flexibility in case of demand shifts or supply chain disruptions

Every contract should go beyond just price and delivery terms. It should clearly define success through KPIs, such as on-time delivery, defect rates, or cost savings. For service-based categories, include Service Level Agreements (SLAs) that outline performance expectations and specify remedies if those expectations aren’t met.

A solid governance plan is also essential. It details how to review performance, escalate issues, and resolve them over the life of the contract. Clear contracts reduce future headaches and make performance management much easier.

6. Performance tracking and continuous improvement

Procurement category management doesn’t end with a signed contract. Success depends on how well strategies are monitored, adapted, and improved over time.

Too often, procurement teams spend months crafting a category strategy only to set it and forget it. But market conditions change. Business needs evolve. Suppliers either perform or don’t. That’s why continuous tracking and refinement are essential.

A proactive supplier management process keeps expectations aligned and prevents issues from festering. Use tools like:

- Scorecards to evaluate delivery performance, quality, pricing accuracy, and responsiveness.

- Quarterly business reviews (QBRs) to discuss performance, resolve issues, and explore improvements.

- Feedback loops from internal stakeholders to catch on-the-ground problems early.

To make these reviews meaningful, use KPIs that directly reflect your goals for each category. Some of the most important metrics include:

- Cost savings or cost avoidance

- On-time delivery rates

- Defect or return rates

- Contract compliance

- Sustainability metrics (where relevant)

After analyzing performance and reviewing initial results, use those insights to adjust your category management strategy. Ask yourself: “What’s working? What’s not?” Performance data isn’t just for reporting; it’s your guide to continuous improvement.

For example, you might decide to shift volumes to better-performing suppliers, revisit SLAs, or renegotiate pricing based on real-world outcomes. You might also introduce new KPIs that reflect emerging business priorities or update your sourcing approach to align with market changes. This ongoing refinement helps keep your category strategy relevant and effective.

Examples of categories and strategies

Procurement category management isn’t a one-size-fits-all approach: different categories call for different strategies depending on what’s being purchased, how critical it is, and how the supplier market behaves. Below are a few common examples to illustrate how category management strategies can vary:

Facilities management

Typical strategy: Consolidate suppliers and standardize SLAs.

Facilities management is a common procurement category that covers services like cleaning, maintenance, and security across various sites. Many organizations work with multiple vendors to support these operations, which can lead to fragmented management and inconsistent service levels.

A strategic category management approach aims to consolidate suppliers under fewer contracts, secure better pricing, and deliver more consistent service across all locations. Standardizing SLAs is a key part of this strategy, as it sets clear, uniform expectations regardless of the site. This approach works best for industries with multiple branches or locations, such as retail chains, logistics companies, and corporate office networks.

IT software and services

Typical strategy: Build strategic partnerships and negotiate volume discounts.

IT software and services are ideal candidates for a category management approach focused on building strategic partnerships and negotiating volume discounts. Rather than buying licenses on an ad hoc basis, procurement can centralize software purchases across departments. This consolidation enables the negotiation of enterprise agreements with major vendors such as Microsoft, SAP, or cybersecurity providers.

These partnerships often yield benefits beyond pricing, such as priority support, access to vendor roadmaps, and tailored service bundles. Additionally, such an approach helps curb the rise of “shadow IT” and ensures teams use vetted tools that meet internal security and compliance standards. It’s particularly valuable for fast-growing or tech-reliant organizations like fintech firms, healthcare providers, and SaaS companies.

Raw materials

Typical strategy: Dual sourcing, hedging, and forward contracts.

Raw material procurement greatly benefits from strategies like dual sourcing, hedging, and forward contracts. Dual sourcing helps reduce reliance on a single supplier or geographic region. If one vendor has issues, you have a backup, so your operations don’t grind to a halt.

Additionally, tools like hedging and forward contracts let you lock in prices ahead of time and protect you from sudden price hikes in the market. These tactics are particularly effective in sectors where raw material costs significantly impact margins, such as construction, manufacturing, and food production.

Industry differences: why context matters

Approaches to category management in procurement vary not just by product type but also by industry.

In healthcare, the focus is often on compliance, traceability, and supplier qualifications. Supply continuity is vital not just for operations but for patient care, so healthcare organizations often prioritize dual sourcing, inventory buffers, and long-term contracts with proven suppliers.

In construction, flexibility and speed are key. Local sourcing and availability often outweigh cost savings. That’s why construction companies emphasize securing local suppliers with fast delivery over long-term contracts.

In logistics or retail, strategies focus on standardization and cost control across locations, especially in categories like packaging, uniforms, or cleaning services. To achieve the best results, firms consolidate suppliers, establish strict SLAs, and use volume discounts to ensure consistency and savings throughout the entire network.

Remember, a category management strategy requires you to build a plan for the context, not follow a set formula.

Why category management in procurement matters

When done well, category management helps teams move beyond bargain hunting and start building smarter, more resilient, and more efficient supply strategies.

Here’s why it matters:

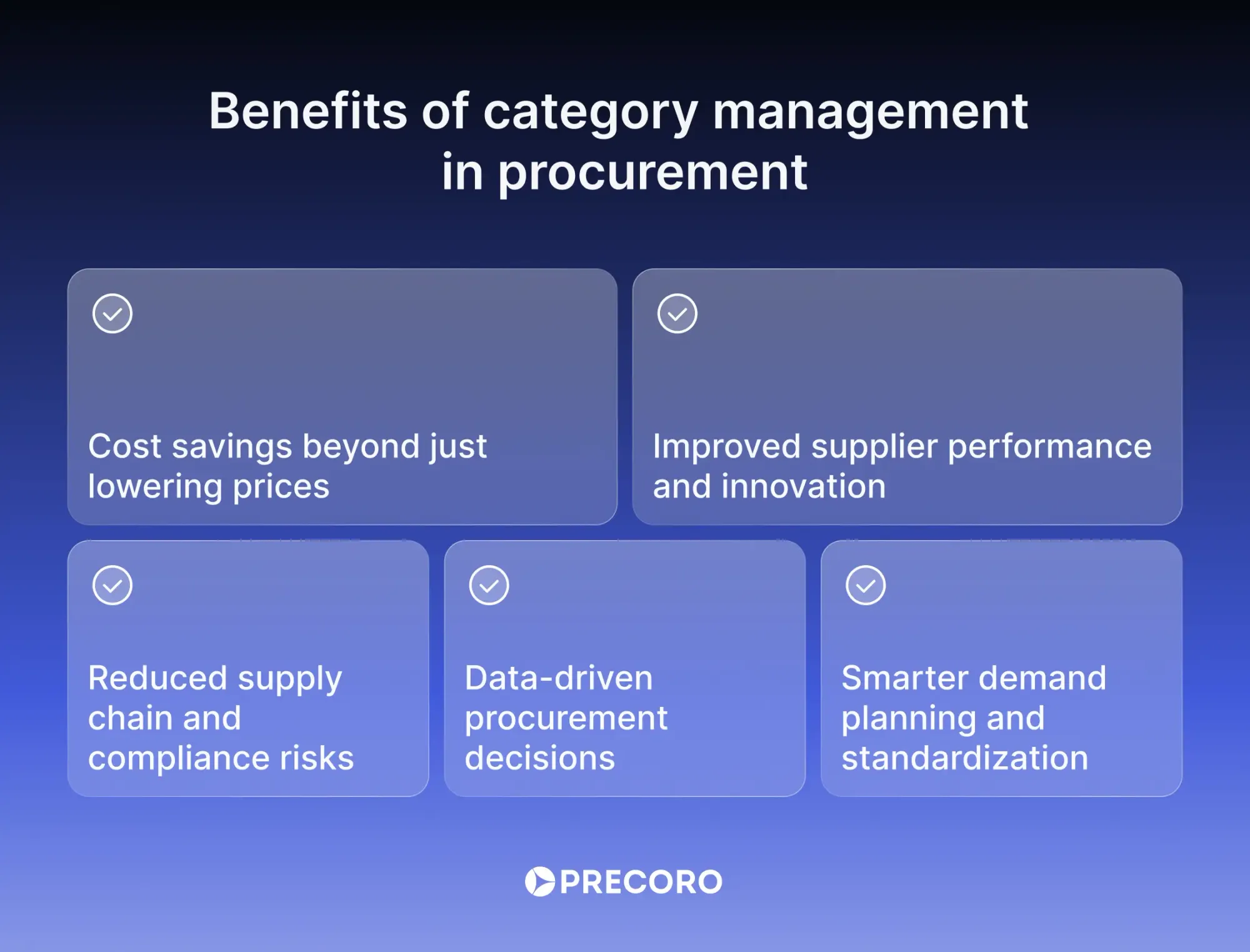

Cost savings beyond price cuts

Procurement category management aggregates spend across departments instead of letting each team buy on its own. By funneling similar products or services through a handful of preferred suppliers, you secure better pricing, tighter quality control, and friendlier terms (such as longer payment windows or rebate tiers).

You also cut invoice and contract-handling costs. McKinsey found that a 1% reduction in the cost of goods sold via category strategies can lift EBITDA (a standard of measurement banks use to judge a business’s performance) by more than 18%, so even small wins pay big dividends.

Better supplier performance and innovation

Rather than jumping from one low-bid vendor to the next, category management encourages long-term supplier relationships based on trust and mutual goals. With fewer suppliers per category, the category manager becomes a single point of contact who can prevent conflicting messages and build credibility.

Clear KPIs and joint business reviews turn vendors into partners: they share process improvements and co-develop new features because they see committed, long-term volume. Fewer contracts also mean less administrative drag for the procurement team.

Reduced risk

When you see the whole category—suppliers, volumes, and contract terms—it’s easier to spot concentration risks, compliance gaps, or looming capacity shortages early. You can dual-source critical items, insert robust SLAs, and set escalation paths before trouble surfaces. Consolidated contracts simplify audit trails, while category-level scorecards keep governance consistent across locations.

More informed procurement

Good category management analysis starts with listening. It’s not about what procurement thinks the business needs—it’s about asking the people in finance, operations, or IT what actually matters. It may be faster service, tighter budgets, better compliance, or something else. When you build your sourcing strategy around that, teams feel heard and are less likely to go off-contract.

Category managers then act like focused experts on a specific area of spending. They take real feedback from the field, turn it into sourcing requirements, and keep refining to ensure that what’s bought actually works for the people using it.

Smarter demand planning and standardization

When you group and check spending by category, you start to see who’s buying what, where, when, and for how much. That makes it easier to spot off-contract purchases or unnecessary variations. Say ten departments are ordering slightly different laptops for the same type of job—you can standardize the specs, simplify support, and cut costs.

You’ll also spot patterns like seasonal spikes or duplicate items, which help you plan ahead, buy in bulk, and avoid last-minute orders. The result is fewer rush orders, smaller inventories, and lower total costs.

How Precoro can help you establish a category management system

The average category strategy takes 42 weeks to create, not including implementation. But there are ways to make the process quicker and more painless. Precoro can turn category management from a paperwork exercise into a clear, value-driving process. Here’s how procurement automation helps:

Centralized spend visibility

Precoro is a procurement centralization and automation platform that shows every request and order across all teams, projects, and locations. You see where the money goes, which categories cost the most, and where teams place similar orders separately. This complete visibility makes it easy to combine purchases, avoid waste, and adjust budgets before they run off track.

Smart category structuring

Custom fields let you group similar products or services into logical categories. Categories can reflect exactly how your business buys—whether it’s raw materials by grade, IT by license type, or facilities by site. That’s how you build strategies against real-world buying patterns, not generic templates.

GL codes for financial clarity and alignment

Precoro supports GL code mapping, which links each purchase to its correct accounting line. Therefore, every transaction is properly categorized from a financial perspective, so procurement and finance speak the same language. GL codes also improve audit readiness and help category managers track how spending impacts the bottom line.

Built-in analytics and insights

Ready-made dashboards and custom reports simplify category management analysis. They show your expenses, top suppliers, and average cycle times—plus, you can compare spending across categories. With all this data available in just a few clicks, you quickly spot high-spend areas, maverick purchases, or opportunities for volume discounts.

Precoro helps procurement teams move beyond busywork by bringing spend data, category structures, supplier insights, and approval workflows into one intuitive platform. You spend less time on manual tasks and more time shaping category strategies that cut costs, reduce risk, and drive innovation.

Frequently asked questions about category management services

Category management is a strategic approach to procurement in which goods and services are grouped into categories based on how they’re used, sourced, or managed. Instead of handling purchases one by one, procurement teams build long-term strategies for entire categories to drive cost savings, reduce risks, and improve supplier performance.

Key skills include:

- Analytical thinking (to assess spend and supplier data)

- Market and product knowledge (to compare supplier offerings and track market changes)

- Negotiation and communication (to build strong supplier relationships and engage stakeholders)

- Strategic planning (to design and implement effective category strategies)

- Project management (to lead sourcing events and contract rollouts)

Procurement is the broader function responsible for sourcing goods and services. Category management is a strategic method within procurement that focuses on specific spend groups, like IT, marketing, or logistics, with long-term goals in mind. In short, procurement buys and category management plans how to buy smarter.

A project manager oversees the planning and execution of specific projects with defined start and end dates, like launching a new product or opening a facility. A category manager handles categories of spend on an ongoing basis and focuses on strategy, supplier relationships, and continuous improvement.

Category management in a nutshell

The category management definition promotes a proactive, strategic approach to procurement that groups similar goods or services and manages them holistically based on spend, risk, and business impact. While cost reduction is a core benefit, procurement category management doesn’t just save money. It also improves supplier performance, reduces risk, enhances compliance, and aligns procurement with business goals.

The approach to category management procurement strategy is structured but flexible. It typically includes six stages: spend and market analysis, category segmentation, stakeholder engagement, strategy development, implementation, and continuous improvement. Strategic tools like the Kraljic Matrix and spend analytics help teams prioritize efforts and identify areas where procurement can drive the most value.

Technology makes category management in procurement way easier. Tools like Precoro help you quickly see what you’re spending, consolidate buying, and track orders without the usual mess of spreadsheets and endless emails. But a category management system isn’t a one-and-done fix. It’s a continuous process of analyzing results and making adjustments along the way.