16 min read

A Complete Guide to PO Invoice Processing: Misconceptions and Best Practices

Learn how to avoid PO invoice processing bottlenecks and get the most out of every invoice.

You can’t afford to treat invoice processing as an afterthought. As one of the final stages of procurement, it’s also the most vulnerable to errors, delays, and unapproved spend. Inefficient invoice management can cost you $10 or more per invoice, while 56% of AP teams spend 10 hours per week solely on invoices and supplier payments.

PO invoice processing connects the dots between all purchasing documents—the purchase order, the invoice, and the receipt—and structures scattered documents in one centralized trail. But it’s not a magic bullet. Without a defined policy, buy-in from stakeholders, and an AP automation tool, it’s just a PO number at the top of your document.

This guide breaks down what PO invoice processing really is, how it compares to handling non-PO invoices, and how to make it work in practice.

Read on to find out:

What is PO invoice processing?

What is a PO invoice?

What is a non-PO invoice?

Essential components of a PO invoice

Benefits of PO invoice processing

Risks of manual PO invoice processing

Steps of the PO invoice processing workflow

Best practices for PO invoice processing in accounts payable

Myth vs. reality of PO invoice processing

Frequently asked questions about PO invoice processing

What is PO invoice processing?

PO invoice processing consists of a set of steps to manage and ensure the accuracy of PO invoices—invoices with a matching purchase order. It involves cross-checking them with other related documents, including POs and delivery receipts. Solid invoice processing in accounts payable gives the team full confidence that everything they receive and are paying for matches what was ordered.

What is a PO invoice?

A PO invoice is tied to a related purchase order. When the accounts payable team receives such an invoice, they compare it to the PO. Instead of going in blindly, they can quickly verify if the invoice follows the company policy, the purchase was properly approved, and everything ordered is included.

Expenses that usually undergo the PO invoicing process are:

- Office supplies

- Manufacturing equipment

- Raw materials

- Facility maintenance

- Enterprise subscriptions

What is a non-PO invoice?

A non-PO invoice doesn’t have a matching purchase order. Such invoices are usually issued for indirect expenses like travel fees, subscriptions, or even utility bills. In such cases, a purchase order isn’t practical because these expenses were either unplanned, urgent, or recurring with a trusted vendor and a predictable cost.

Non-PO invoices usually cover the following expenses:

- Utilities

- Rent or lease payments

- Employee travel or expense reimbursements

- Subscriptions

- Low-cost spend, like impromptu courier services

Are PO invoices better than non-PO invoices?

In most cases, absolutely. Some expenses, like travel fees or utilities, don’t need a PO. The majority, however, gain structure and an additional layer of security when tied to a matching document.

PO invoices are typically approved upfront. The team already knows what was ordered and expects the cost, so by the time the invoice arrives, they only need to match it, confirm it with the PO, and send it off for final approval.

Non-PO invoices, on the other hand, are typically approved after the purchase happens. The AP team checks the details, confirms that the spend is compliant, and routes it to the right approvers. The absence of a PO doesn’t automatically mean the purchase is rogue, but the invoice does require a closer look.

Essential components of a PO invoice

A key to understanding what invoice processing is lies in the details of every document involved. A typical PO invoice tells both sides of the procurement transaction what exactly you’re buying, how much you’re paying, and when the payment is due. All details should match the original purchase order. A well-structured PO invoice template has to include:

- A matching PO number: A link that ties the invoice back to the original PO.

- Invoice number: A unique identifier of the document.

- Payment terms: How the supplier expects to be paid, with the due date of the invoice.

- Supplier and customer details: Names, addresses, and contact information.

- Line-item details: Ordered product or service, quantity, unit price, applicable taxes, discounts, and subtotals.

- Shipping information: The exact location and delivery date of the order.

- Applicable taxes: Any VAT, sales taxes, and other charges.

- Total amount: The final amount due.

- Issue date: When the document was submitted.

When every piece of information is there and easy to verify, a PO invoice becomes an invaluable asset in the accounts payable invoice processing.

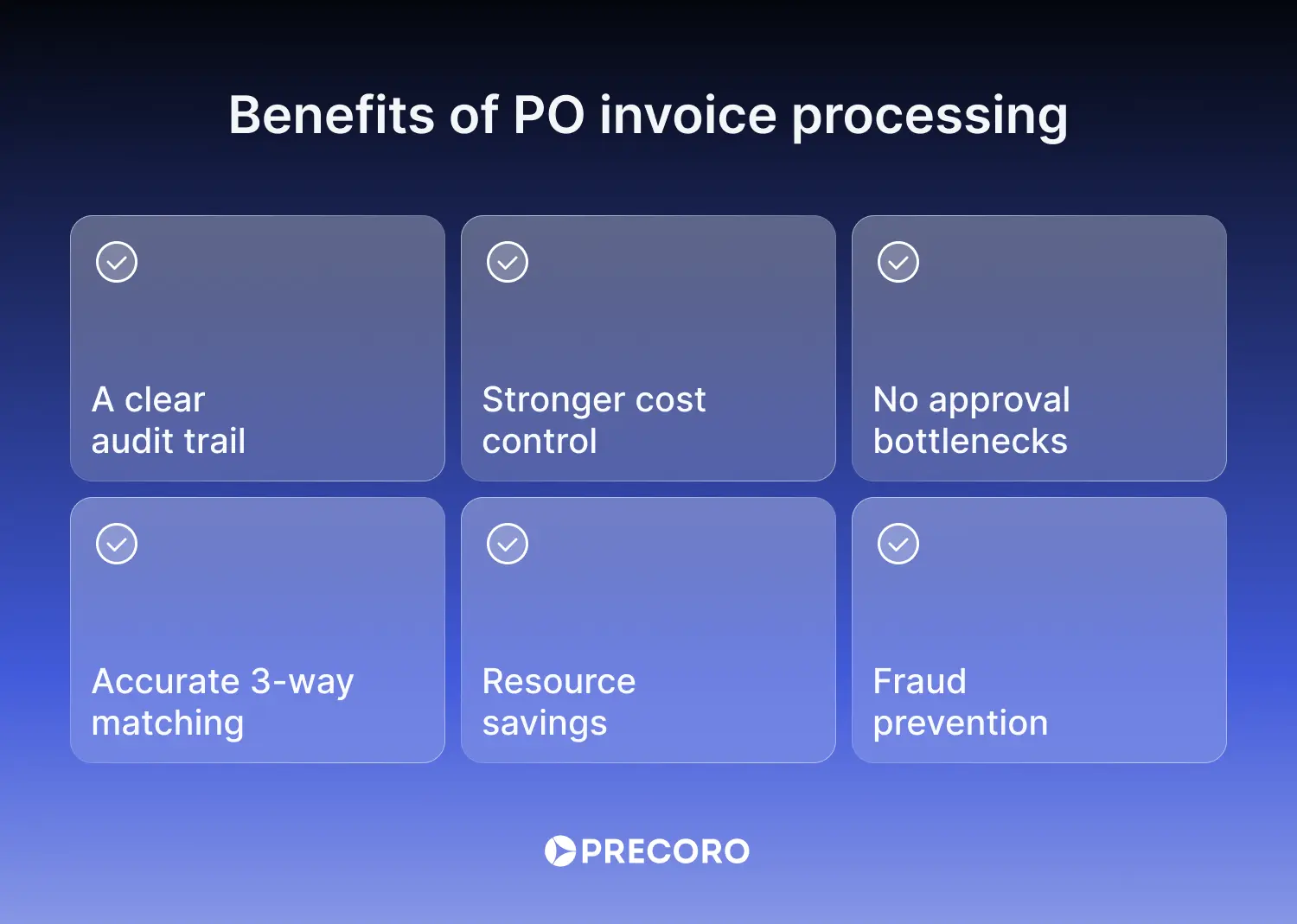

Benefits of PO invoice processing

When used properly, PO invoices can improve how the AP invoice processing runs at your company. Here are some benefits companies can take advantage of:

- A clear audit trail. The procurement team can always trace and verify what was ordered, received, and invoiced with the approved PO.

- Stronger cost control. Since the purchase was already approved through the PO, it’s already budgeted for. Your team won’t have to face a surprise off-contract expense or a budget overrun.

- No approval bottlenecks. The PO was already approved, so invoices don’t have to go through the entire approval process from scratch. The team only needs to confirm that the invoice matches the original order and receipt.

- Accurate 3-way matching. Some invoice processing systems support automatic 3-way matching, which alerts the team to any discrepancies.

- Resource savings. Automating purchase invoice processing saves time and reduces the manual workload involved in matching and approval. The company spends less money on fixing costly mistakes while employees dedicate their time to more strategic tasks.

- Fraud prevention. When every invoice can be traced back to a PO, it’s much easier to spot duplicate or fraudulent invoices.

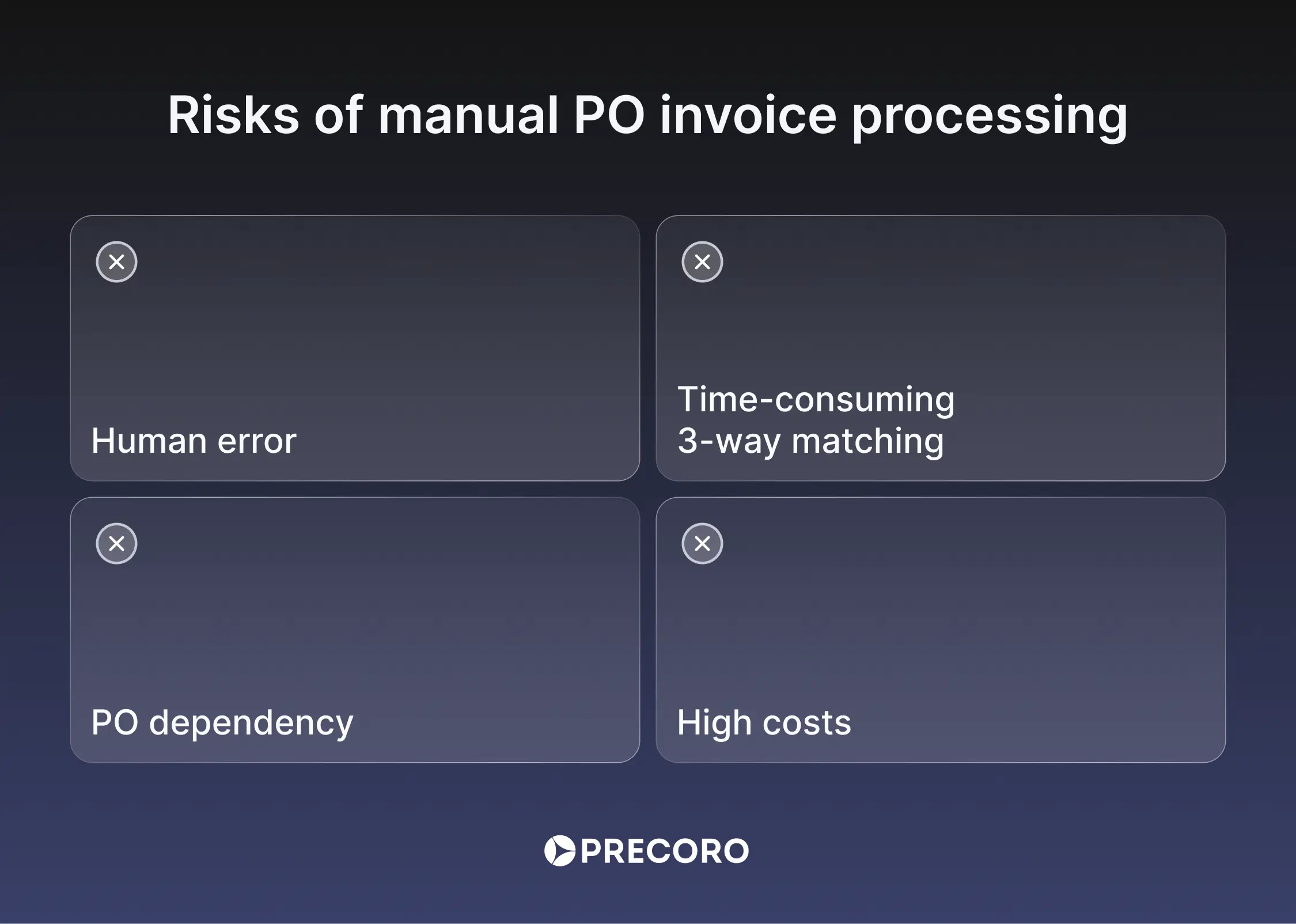

Why manual PO invoice processing falls short

While purchase invoice processing with POs helps prevent fraud, curb maverick spend, and control costs, it delivers the best results when automated. Numbers back this up—almost 100% of leading companies process their POs electronically.

The weaknesses of PO invoice processing in accounts payable really shine through once the burden of paperwork falls on the shoulders of the AP team. Here’s why manual vendor invoice processing is more of a problem than you’d expect:

- Human error. Manual data entry leaves too much room for error. Even one wrong digit or missed approval step can skew the entire transaction.

- Time-consuming 3-way matching. Three-way matching is a lifesaver when done by the invoice processing system. Manual though? A complete timesink, especially without a centralized system. If POs are stored in one software and invoices in another, just switching between tabs or devices slows the entire process by hours.

- PO dependency. Invoices rely on POs for accuracy. A typo or incomplete info in the PO carries over to the invoice, and the team has to scramble to fix both documents.

- High costs. Manual PO invoicing can cost as much as $10.89 per invoice. An automated process can save you up to 84%, lowering the cost to $1.77. For a company with 300 invoices per month, it’s a choice between $3,267 and $531.

Even with automated processes, companies should still keep a few things in mind:

- Not a one-size-fits-all solution. Not all purchase invoice processing needs a PO. Urgent purchases or expenses with their own formal documentation may not fit into the PO invoice processing workflow.

- Integration challenges. Companies that rely on legacy ERP systems or other outdated tools need to pick a solution that smoothly integrates with them without disrupting AP invoice processing.

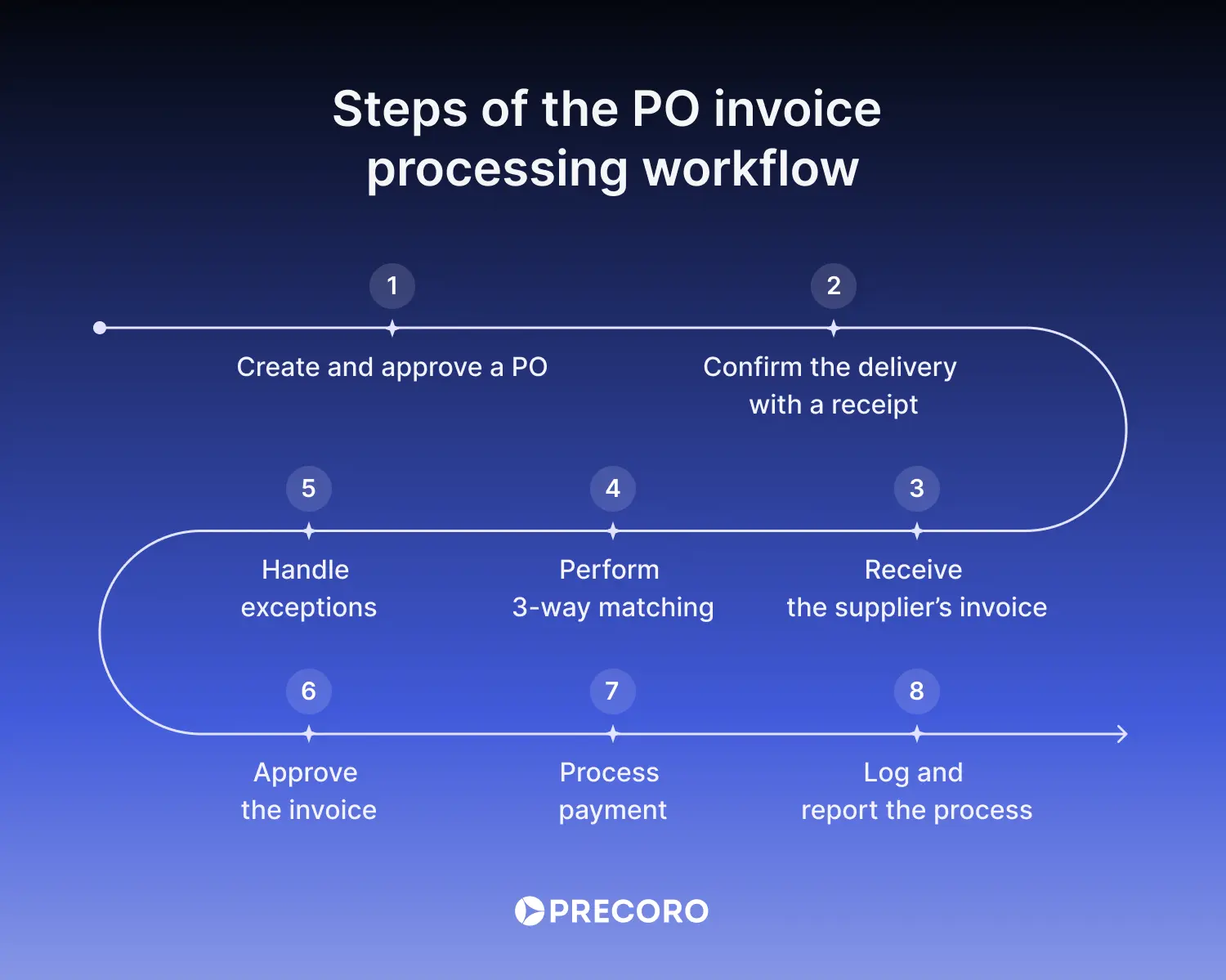

Steps of the PO invoice processing workflow

The most effective accounts payable invoice processing starts long before the invoice lands in your inbox. It begins with a clear, approved purchase order, which outlines what was ordered, at what price, and from whom. Once the order is delivered, a warehouse or an office manager confirms the receipt with the Goods Received Note (GRN) or a delivery receipt.

Then, the supplier submits an invoice with the matching PO number. The AP team compares it against the PO and the receipt for any discrepancies. If something doesn’t line up, they handle the exceptions and route the document for final approval and payment.

Here’s a deeper breakdown of each phase in the PO invoice processing workflow:

1. Create and approve a PO

The buyer creates a PO that outlines what they plan to purchase, along with cost, quantity, supplier, and any delivery details. The document can be generated from the existing purchase requisition (PR) in the purchase order software or from scratch.

Common types of purchase orders you can create are:

- Standard POs for one-off purchases with a fixed price and quantity.

- Blanket POs for recurring purchases or orders with multiple shipments.

- Contract POs for long-term agreements that outline terms and conditions.

- Planned POs for expected purchases with an unspecified delivery date.

After the PO is filled out, it’s submitted for approval. Once all designated approvers sign off, you can send the PO to the supplier.

2. Confirm the delivery with a receipt

The supplier receives the purchase order and delivers goods or services. Some orders require delivery to multiple locations. During this stage, the team checks whether all items were delivered and are in good condition. If everything lines up, the employee creates a Goods Received Note to confirm the order was successfully fulfilled.

3. Receive the supplier’s invoice

After the delivery, the supplier submits an invoice. Ideally, the document should always have a corresponding PO number to easily connect the dots between the invoice, receipt, and the original purchase order.

At this point, purchase invoice processing finally begins. The AP team logs the invoice into their internal system and kicks off the approval process. If your software supports AI-powered OCR for invoice capture, even better. For instance, Precoro uses Google AI OCR with contextual layout understanding, which prefills required fields and generates a ready-to-use invoice.

4. Perform 3-way matching

After the invoice is logged into the system, either manually or with invoice processing system, the most important step begins—three-way matching. It ensures that all relevant documents—the invoice, the purchase order, and the receipt—tell the same story.

The AP department first checks that the invoice references a valid, relevant purchase order. All details, from vendor address to quantity of items ordered, should match in both documents. Then, the team reviews the packing slip or the delivery receipt to confirm that the delivery went as planned: nothing is missing, and everything is in good condition. Besides accounts payable, invoice processing involves other teams, including procurement, inventory, and the suppliers themselves.

The final step is to cross-check the price. Does the invoice price match the PO? Are the unit prices the same on all documents? Are there any partial payments, discounts, or other terms that the supplier included?

While three-way matching is considered a golden standard of invoice processing in accounts payable, other alternatives exist:

- Two-way matching, which compares just the PO and invoice.

- Four-way matching, which includes an inspection report from someone who personally reviewed the delivery.

5. Handle exceptions

Discrepancies are inevitable, especially if the accounts payable invoice processing is fully manual. Some of the common issues that surface during 3-way matching include:

- Incomplete deliveries

- Missing receipts

- Duplicate invoices

- Incorrect unit prices or total

- Wrong tax amounts

Whatever the issue, now is the moment to act, not after the payment has already been processed.

Mismatch management isn’t rocket science, but it does require a clear course of action for different cases. You need a clear escalation path for each situation—people you can involve when things go wrong. Additionally, have a direct communication channel with the vendor since some mistakes, like misplaced items or taxes, can only be resolved with their help.

Finally, document the fix and link it to the invoice for future reference. If this issue pops up again, you have a clear example to follow.

6. Approve the invoice

At this phase, the invoice moves to the final approval stage. Because the PO and receipt have already been reviewed, this step is usually quick. That’s exactly the whole point of PO invoice processing. A well-structured, agile workflow with all teams working like clockwork makes final approval easy, not a bottleneck before payment.

Typically, the AP team that conducted three-way matching signs off on an invoice, together with the procurement team. The PO, on the other hand, is approved by the procurement department, company heads, or budget owners. The PO approval authorizes the transaction itself, while the invoice approval confirms that the company got what it ordered.

7. Process payment

At this stage, the invoice is ready for payment. In accounts payable invoice processing, the timing depends on the supplier’s negotiated payment terms and your internal compliance policies. Generally, payment terms can be separated into prepayment and postpayment. However, some suppliers might break down these conditions into other types, such as:

- Net terms (Net 30, Net 60): The buyer must pay within a set number of days after the invoice date.

- Cash with Order (CWO): The buyer must pay when placing the order.

- Cash on Delivery (COD): The buyer must pay when the order is delivered.

- End of Month payment (EOM): The buyer must pay by the end of the month.

You can pay the agreed-upon amount through any negotiated method, whether it’s a bank transfer or an online invoice payment processing platform. Don’t forget to mark the invoice as “Paid” in whichever system you use, whether it’s a spreadsheet or an online procurement system.

8. Log and report the process

Each stage of accounts payable invoice processing should be documented. The best way is to automate it with a tool that logs every step while you’re busy with other work.

If someone asks six months later why this payment happened, you shouldn’t have to dig through email chains or scattered spreadsheets. Attach all relevant files to the invoice to ensure any future reviewers have full context. A transparent paper trail protects your company during audits and helps course-correct any disputes or potential issues in invoice payment processing.

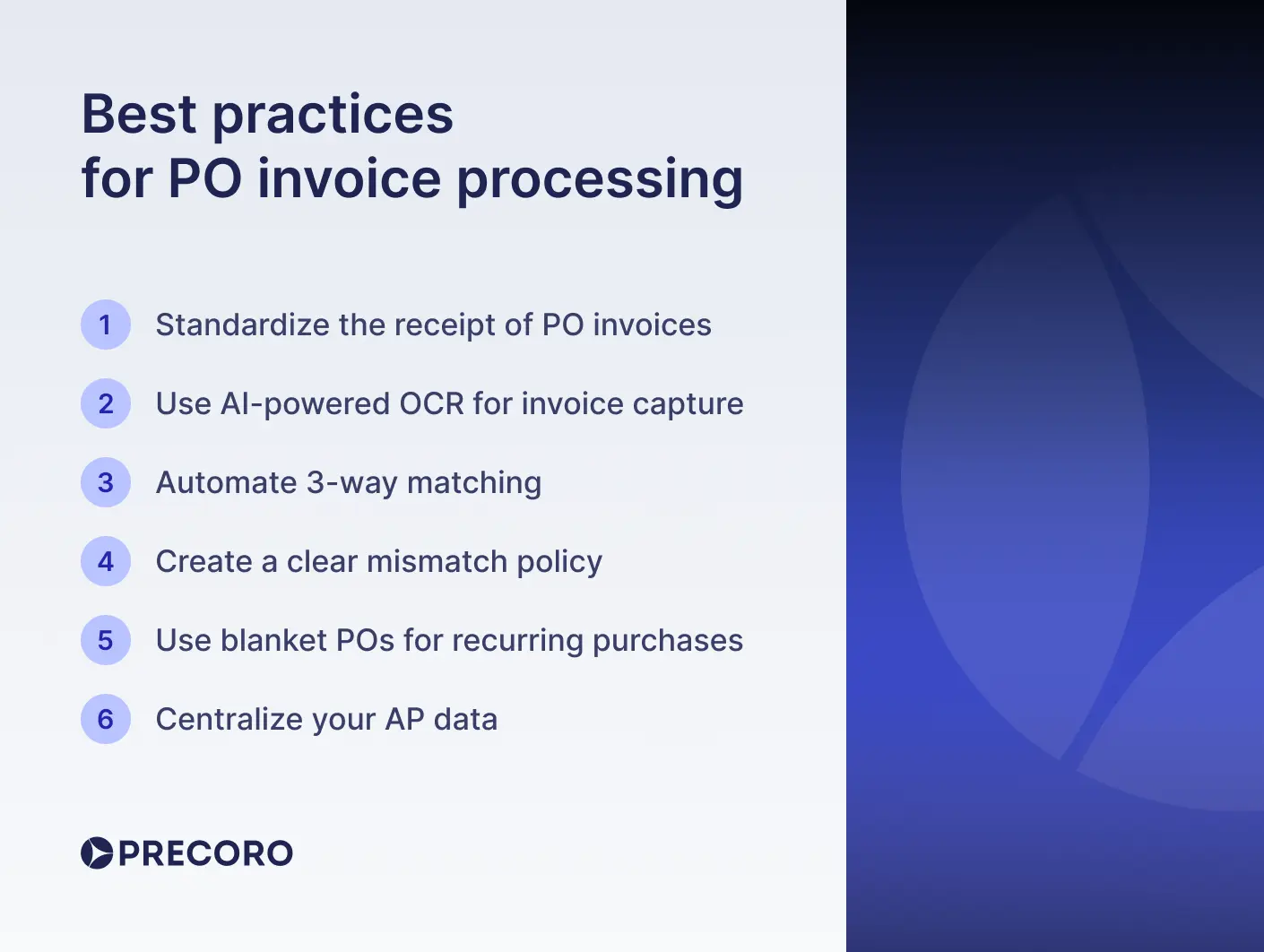

Best practices for PO invoice processing in accounts payable

Building a functional purchase invoice processing strategy takes time. But once it’s set up, the payoff is worth it. Let’s take a look at some ways your company can improve accounts payable invoice processing:

- Standardize the receipt of PO invoices.

Some vendors forget to include a PO number, which means you now have to follow up—something that could drag on for days. Invest in a solution that lets suppliers submit invoices in the format you need. Precoro, for instance, has the Supplier Portal, where vendors can manage incoming POs, submit invoices, and communicate with your team directly on the platform.

- Use AI-powered OCR for invoice capture.

Replace manual data entry with OCR to speed up invoice capture. OCR extracts the key details from the invoice and creates a ready-to-use document directly in your system. For example, Precoro uses Google AI-powered OCR, which has a contextual understanding of invoice layout. If needed, you can request additional human review for extra accuracy.

- Automate 3-way matching.

Invest in AP invoice processing tools to quickly cross-check documents. Instead of wasting time on manual review, such solutions flag discrepancies and prevent the invoice from going through unless the issue is resolved.

- Create a clear mismatch policy with examples.

When the issue comes up, resolve it and document it. Attach supporting files and link them to the invoice so your team can reference them if the same error happens again. For recurring issues, outline clear accounts payable invoice processing guidelines and actions to take.

- Use blanket POs for recurring purchases.

For subscriptions, orders with multiple shipments, and other recurring orders, create a single blanket PO that covers a specific time period and reference it in all future invoices. Seems like a simple fix, but it’ll help you avoid hours spent on admin tasks for purchases you know will be ordered again.

- Centralize your AP data.

Keep all POs, invoices, receipts, approvals, and other procurement intelligence in one platform. If you’re using an accounting or ERP tool, consider investing in a procurement centralization platform that integrates with your existing systems. When finance, procurement, and AP work with the same data, there’s no risk of data silos and duplicate payments.

Myth vs. reality of PO invoice processing

If you’re still relying on old assumptions someone told you a decade ago, it’s time for a refresh. PO invoice processing is often dismissed based on outdated beliefs and the fear of change. Here are a few common misconceptions and where PO invoicing really stands.

Myth 1: Small businesses don’t need purchase orders

Reality: Small businesses feel the impact of errors even more. One incorrect invoice or off-contract purchase can throw off your entire monthly budget. Simply adding a PO to an invoice already helps make your accounts payable invoice processing more visible and transparent.

Myth 2: You can’t invoice without a PO

Reality: You can and often should skip POs for things like rent, utilities, or emergency expenses. These expenses are often better handled through a direct invoicing process, provided you review and approve them with care.

It’s all about the purchase type. Monthly rent bills? No PO needed. Ordering raw materials from a vendor you have a contract with? Create a PO for a transparent audit trail that confirms both sides hold up their end of the bargain.

Myth 3: POs are only for physical goods

Reality: Services, subscriptions, and even freelance hours should still be covered by purchase orders. A PO helps clearly define the scope, cost, and terms of work, so invoices don’t spiral beyond what’s expected.

Myth 4: PO invoicing is too expensive to automate

Reality: The cost of errors, missed approvals, and maverick spend is much higher. Although e-invoicing tools often require an upfront investment and onboarding time, the effort quickly pays off with cost savings and saved labor hours.

Procurement automation can free up time spent on manual 3-way matching, while modern online invoice payment processing tools help schedule and make payments in seconds with no technical or coding experience.

Myth 5: Non-PO invoices are less important

Reality: What is a non-PO invoice? Non-PO invoices often cover indirect or tail spend—expenses that are often considered low-value. Despite that, they still carry just as much weight as the ones with PO. Ignoring non-PO invoices can snowball into spend leakages and budget overruns during invoice payment processing.

Frequently asked questions about PO invoice processing

The purchase order (PO) always comes first in the accounts payable invoice processing. It’s the buyer’s request for goods or services, created and approved before the purchase happens. Once the vendor delivers the order, they send the invoice referencing the PO.

Invoice processing involves receiving, approving, managing, and paying supplier invoices. PO invoice processing is a subtype of the broader process where the invoice is matched against a purchase order and receipt. Not all invoices have POs, which is the key difference between the two practices.

PO invoice processing is the workflow used to validate and pay invoices that have a corresponding purchase order. It involves cross-checking the invoice against the original PO and delivery receipt to confirm that all details match before payment leaves the company’s bank account.

To process a PO invoice, compare it to the matching purchase order and the delivery receipt. If all documents contain the same information, approve it for payment. To process a non-PO invoice, the AP team has to confirm that the purchase was compliant, within budget, and properly received. Since there’s no PO, you need to route the invoice to the relevant stakeholders, who will review and approve it.

Yes. A single blanket PO can be tied to multiple invoices, especially for large orders, partial shipments, or recurring services. In these cases, each invoice references the same PO number but reflects only part of the entire order.

Key takeaways

Invoice processing in accounts payable should be a priority, with PO invoices working as building blocks of a structured workflow. A consistent automated process helps you locate who made the purchase, spot issues with delivered goods, and create a clear paper trail for each transaction. Manual PO invoice processing, on the other hand, often falls short. It’s slower, costs more, and is more prone to human error.

Investing in the invoicing process means investing in a tool that works for everyone: requesters, approvers, finance, and vendors. An AP automation platform like Precoro can guide you every step of the way and make vendor invoice processing not just a formality but a useful tool that works for you.