12 min read

GL Codes in Expense Tracking: Importance, Examples, and Best Practices

GL codes help businesses accurately track every transaction and ensure error-free reports. Learn how to use them for efficient expense management.

Accounting and finance departments handle hundreds, if not thousands, of transactions every month. How do they ensure accurate tracking of company expenses? They rely on the general ledger to monitor every dollar spent.

At the core of this process is a well-structured general ledger (GL) coding system, which categorizes transactions across the company. It makes it easier for AP and finance teams to manage budgets, monitor spending trends, and ensure that financial records accurately reflect the company’s cash flow.

If you’re wondering what a GL code is in finance and accounting or how to implement GL coding effectively, this article is for you.

Keep reading to learn:

- What are GL codes?

- Benefits of accurate GL coding

- GL account code structure

- Common challenges associated with GL coding

- Automation of GL codes

- Frequently Asked Questions

What are GL codes?

A general ledger (GL) is a central repository of all financial transactions within an organization. It includes key accounts like assets, liabilities, revenue, expenses, and equity. The GL provides the foundation for preparing key financial statements like the balance sheet, income statement, and cash flow statement.

GL is especially useful for tracking expenses. Most organizations use multiple methods to pay their bills, such as checking accounts, credit cards, and lines of credit. The GL allows accountants to record all expenses in one place, making it easier to keep track of spending and quickly spot any mistakes or discrepancies in bank accounts.

What are GL codes, and how do they play into this? Companies using a general ledger assign each transaction a specific GL code to categorize and track their financial data with greater precision. These codes, typically made up of numbers and letters, represent specific types of transactions in the company’s chart of accounts.

General ledger account codes can be used to classify expenses by location, department, project, or inventory category. By organizing spending data in this way, businesses can easily analyze and compare expenses across teams, projects, and periods of time, gaining better insight into their financial activity.

Assigning GL codes is a key responsibility in the accounting department. It's important that everyone recording transactions follows the established GL structure and categories to ensure consistency and accuracy in financial reporting.

Benefits of accurate GL coding

Accurate GL coding ensures precise financial reporting and reduces errors during month-end close. It provides detailed visibility into spending, helping optimize costs, improve budgeting, and reduce risks like fraud. This clarity also supports better stakeholder confidence, tax compliance, and overall financial efficiency.

Risk reduction

When expenses are categorized incorrectly, companies may face missed compliance deadlines, misreporting, or costly audit complications. Properly coded expenses lower these risks by ensuring financial data is consistent, reliable, and compliant with regulatory standards.

Thus, organizations that accurately categorize their expenses reduce the likelihood of penalties from tax authorities and regulatory bodies. GL codes also provide clear audit trails, making it easier to resolve any discrepancies during internal or external audits.

Better budgeting

What GL coding is perfect for is giving businesses a granular breakdown of expenses, making it easier to compare actual spending against budgeted targets. Each department, project, or initiative can be closely monitored to ensure that spending aligns with financial goals. Such detailed understanding of past spending allows prompt adjustments of current expenditures and more accurate future budgeting.

For example, a company can see that one department is exceeding its budget while another is underspending resources. This data enables leadership to make strategic decisions, optimize resource distribution, and ensure that every dollar is being used effectively.

Enhanced stakeholder relationships

Stakeholders — investors, lenders, regulatory authorities, and internal teams — all benefit from proper GL coding because it fosters trust and credibility. External stakeholders like investors and lenders feel more confident when the financial data of the counterparty is clear, and that helps the business secure funding or maintain compliance with internal company policies.

Accurate data leads to better strategic decision-making for internal stakeholders, such as department heads or executives, overall business performance improvements, and everyone’s alignment with financial goals.

Increased efficiency

Accurate GL coding greatly improves the efficiency of financial processes. Month-end closings, reconciliations, and audits become smoother and faster when transactions are already properly categorized. Moreover, without the need to spend time fixing coding errors or searching for misplaced invoices, financial teams can focus more on strategic analysis.

Improved tax reporting

General ledger codes streamline tax reporting by correctly categorizing all tax-related expenses and revenues. Companies simplify the process of identifying tax-deductible expenses and preparing accurate tax filings by using GL codes, meaning they reduce the risk of missed deductions or tax filing errors. Clear tax reporting also enhances compliance with tax laws and regulations, helping businesses avoid costly penalties or legal complications.

GL account code structure

The structure of a general ledger account code is critical for accurately identifying and categorizing transactions. While every company takes a different approach, GL codes are typically composed of several segments, each representing different aspects of the transaction.

- Account type

A good practice in GL coding is to assign each transaction a specific code based on the chart of accounts. Think of it like a precise address: it guides the transaction to the right place in your financial records.

The first segment represents the nature of the transaction, such as whether it’s an asset, liability, equity, revenue, or expense. Within each main category, there are sub-categories that provide more specificity. For example:

1000 – Assets

- 1100: Cash

- 1200: Accounts receivable

- 1300: Inventory

2000 – Liabilities

- 2100: Accounts payable

- 2200: Loans

3000 – Equity

- 3100: Shareholder equity

- 3200: Retained earnings

4000 – Revenues

- 4100: Sales revenue

- 4200: Service revenue

5000 – Expenses

- 5100: IT and software expenses (such as software purchases, maintenance, licensing)

- 5200: Office expenses (for example, office supplies, rent, utilities)

- 5300: Marketing and advertising (like campaign costs, digital ads)

- 5400: Employee compensation (for instance, salaries, bonuses)

- 5500: Travel and entertainment (including business trips, client dinners, and more)

- Department or cost center

This segment designates the department or cost center responsible for the transaction, helping to allocate costs appropriately across the organization. Example codes include:

- 01 – Sales

- 02 – Human Resources

- 03 – IT

- 04 – Marketing

- Location or region

This segment tracks the location of the transaction and is relevant for organizations operating in multiple regions:

- 001 – Headquarters

- 002 – Spanish branch

- 003 – German branch

- Project or product code

This segment identifies specific projects or products associated with the transaction. For instance:

- PRJ001 – New product development

- PRJ002 – Marketing campaign

- Custom segments

Some organizations may add custom segments to their GL code structure to capture additional data relevant to their specific operations. For instance, these segments might track:

- Customer codes (for customer-specific expenses)

- Contract numbers (to link expenses to specific agreements)

- Event codes (to track costs associated with company events)

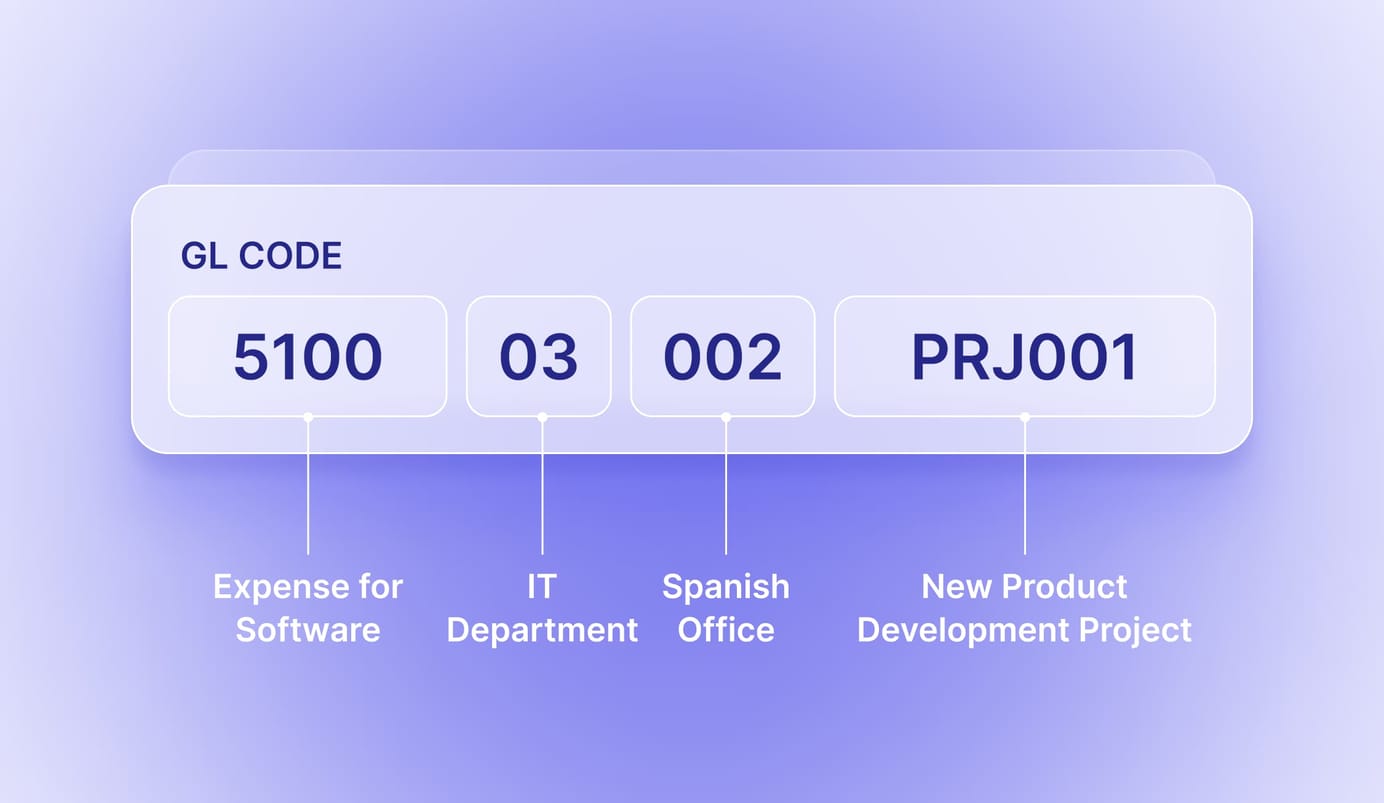

Here are a few GL code examples based on the abovementioned GL account code structure:

- GL сode: 5200-02-001

This code represents a rent expense (5200) incurred by the HR department (02) at the headquarters location (001).

- GL сode: 5100-03-002-PRJ001

It represents an expense for software (5100) purchased by the IT department (03) at the Spanish office (002) for a new product development project (PRJ001).

- GL сode: 5300-04-003-PRJ002

This GL code tracks marketing expenses (5300) incurred by the marketing department (04) at the German office (003) for a specific marketing campaign (PRJ002).

Common challenges associated with GL coding

After establishing what GL codes’ benefits and possible structure are, let’s look at potential problems. Assigning and analyzing GL codes can be challenging, especially when done manually for organizations with a high volume of transactions. Common issues include:

Unreliable spreadsheets

Many organizations still rely on manual spreadsheet systems to track GL codes. While this approach may seem cost-efficient and straightforward at first, it is also cumbersome and error-prone. When multiple team members work on the same spreadsheet, it’s easy to lose track of the latest version. This leads to inconsistent updates, untracked changes, or duplicated files and often results in outdated or incorrect financial records.

In addition, as a business grows, managing complex financial data manually becomes increasingly difficult. Spreadsheets struggle to handle the large datasets or advanced categorization needed for high-volume GL coding. As a result, finance and AP teams face data loss.

Time-consuming data entry

A major challenge associated with GL coding is the time-consuming nature of manual data entry. Accountants and finance teams can spend hours on manual input and then have to sift through lengthy spreadsheets to ensure that every expense is coded correctly. Instead, they could be focusing on high-value tasks like financial analysis or strategic planning.

Even small mistakes can lead to significant discrepancies, making data entry even more tedious to process. Delayed data entry can lead to bottlenecks, especially during month-end or year-end close, slowing down financial reporting and reconciliation processes.

Error-prone processes

Manual GL coding is highly susceptible to errors, which can have significant consequences for a business. These mistakes often arise from common issues like:

- Misclassification of expenses: A simple error in assigning the wrong GL code to a transaction distorts financial reports, leading to inaccurate expense tracking and budgeting.

- Data entry mistakes: Typos, incorrect figures, or even misplaced digits can result in substantial discrepancies. These errors may go unnoticed until audits or financial reviews, making corrections time-consuming and costly.

Error-prone processes not only reduce the accuracy of financial data but can also increase the risk of compliance violations, audit issues, and poor decision-making.

Inconsistent coding practices

It is a common challenge of the manual approach that seriously impacts the accuracy of financial data. When there are no strict, standardized guidelines or automated systems in place, different departments and locations may categorize the same expense differently. For example, one employee might categorize a software subscription as an “IT expense,” while another might place it under “Operating Expenses,” leading to discrepancies in how costs are tracked and analyzed.

When expenses are not categorized uniformly, management might draw incorrect conclusions about spending patterns and performance, which can lead to flawed decision-making. In addition, inconsistent coding practices make audits more complex, increase the likelihood of errors being flagged, and may lead to additional scrutiny or penalties if discrepancies are discovered.

Automation of GL codes

To overcome these challenges, many organizations are turning to automated GL coding systems. Below are five key ways procurement automation enhances the usage of general ledger account codes:

Automatic coding rules

With AP automation, employees don’t have to manually enter the appropriate general ledger account code for each transaction. Instead, finance or AP teams can set up a structured list of GL codes to categorize different types of expenses. For instance, in procurement software like Precoro, it’s possible to create item catalogs with predefined GL codes so that when a new purchase is requested, it’s already tied to a specific general ledger code.

This approach saves time and ensures greater accuracy, reducing the risk of human errors. Employees no longer need to memorize complex GL coding structures or manually input codes, which significantly improves efficiency.

Consistency across departments

Finance teams can set up and maintain a centralized system for GL codes. This prevents any individual department from introducing its own coding practices or deviating from the company-wide standards. This way, the finance team ensures coherence in financial data across the organization.

When all departments use the same general ledger codes, the finance team no longer has to spend time reconciling or correcting inconsistencies between them. Automated systems ensure that each transaction is properly categorized from the start. Additionally, by applying consistent GL codes across departments, businesses can easily compare expenses across different teams, projects, or regions.

Real-time reporting

One of the most significant advantages of automation is real-time visibility and reporting. This aligns with the AP teams’ drive to improve reporting and analytics so that they could serve as a “hub” of intelligence for the rest of the enterprise.

In Precoro, as new purchases or expense reimbursements occur, they are immediately recorded in the system. This provides companies with up-to-date financial data, allowing them to monitor spending in real time.

Moreover, automation reduces the time required to compile financial statements, enabling finance teams to identify trends or anomalies in spending early on. Instead of waiting until month-end or year-end closure, management can review financial performance on a daily or weekly basis, helping to make timely and informed decisions.

Absolute readiness for audits

Clear, easily accessible record of all coded transactions makes audits smoother and more efficient. External auditors can access the automated audit trail to verify the accuracy of financial data without having to search through paper documents or spreadsheets.

Moreover, automated solutions such as Precoro log information about every stage of the transaction process, including who initiated the transaction, when it was approved, and any subsequent changes. This allows businesses to trace expenses back to their source and understand the full history of how they were coded.

Scalability

Automation makes GL coding scalable, ensuring that even as transaction volumes increase, employees can add items from the catalogs with the appropriate GL codes without the need for manual intervention.

As new departments, cost centers, or projects are introduced, automated systems like Precoro can quickly be updated with new coding rules to accommodate these changes. This flexibility ensures that businesses can scale their operations without overburdening the finance team with manual data entry tasks.

Frequently Asked Questions

In accounting, a GL code is a specific identifier assigned to a transaction within the general ledger. It helps categorize financial transactions, allowing accountants to record and organize financial data accurately.

In finance, a GL code serves a similar purpose as in accounting: it categorizes financial transactions in the general ledger. These codes facilitate tracking and analyzing financial activities, helping organizations manage their budgets and financial reporting effectively.

A general ledger code is typically a combination of numbers and sometimes letters, representing various information segments, such as the account type, department, and location. A GL code example is 5000-02-001.

There is no universal standard for GL codes, as they vary by organization. However, many businesses use a similar structure based on categories like assets, liabilities, revenue, and expenses.

A GL account number is the numeric part of a GL code that represents a specific type of account, such as cash, accounts receivable, or rent expenses.

An employee GL code is used to categorize transactions related to payroll, salaries, or employee benefits in the general ledger.

Use GL codes efficiently

It’s hard to overstate the importance of general ledger codes in finance and accounting. They ensure accurate financial reporting, facilitate compliance with regulations, and support effective budgeting and forecasting. However, a real game changer is the automation of GL coding with a comprehensive accounting or procurement system.

Manual GL entry takes time and often leads to errors. Automating the coding process solves these issues and brings several clear benefits:

- Less manual work frees up the accounting team to focus on more important tasks

- Fewer errors reduce the time spent fixing mistakes in the GL

- Faster and simpler transaction coding speeds up processing

- Better visibility into financial data improves spend analysis and decision-making

- Easier expense tracking across projects, vendors, and categories leads to more accurate budgets and forecasts

Ready to simplify GL coding with Precoro?