17 min read

Financial Forecasting: What It Is, Why It Matters, and How to Get It Right

Learn how businesses use financial forecasting to create future-proof strategies and embrace upcoming challenges.

The past few years have blindsided businesses with geopolitical events, market crashes, inflation spikes, and, most recently, tariffs. Even without those external factors, it only takes a surprise revenue dip or an unexpected price hike to derail a well-structured financial plan.

Financial forecasting has gone from a 'nice-to-have' to a must-have for procurement and financial planning teams. Although some executives are skeptical about forecasting, citing its unreliability and inaccuracy, a systematic approach to forecasting with realistic expectations can completely transform the fiscal year strategy.

In this article, we’ll discuss the finance forecasting definition, its benefits and challenges, and methods that will set your company up for success.

Scroll down to find out:

What is financial forecasting?

Budgeting vs. Financial planning vs. Financial forecasting

Types of financial forecasting

What a financial forecast includes

Methods for forecasting budgets

Pros of financial forecasting

Cons of financial forecasting

Frequently asked questions about financial forecasting

How Precoro helps companies forecast finances

What is financial forecasting?

Financial forecasting uses historical financial data, market research, and external factors to predict future financial outcomes for the company. Its goal is to determine how the business will develop financially, what factors influence this direction, and whether you can change it.

Forecasting involves analyzing revenue reports, sales data, cash flow, and expense statements. Down the road, these projections help plan budgets, reallocate resources, and make strategic decisions on expenses and investments based on procurement intelligence. The financial team relies on quantitative and qualitative methods, such as rolling forecasts, linear regression, and market trends, to create realistic and measurable forecasts.

Budgeting vs. Financial planning vs. Financial forecasting

We know the struggle—the terms ‘financial planning,’ ‘budgeting,’ and forecasting’ are often blurred together, even by seasoned experts. However, each of these practices brings something different to the table.

Budgeting is a detailed plan of the company’s expected income and expenses. It helps allocate resources for a specific period of time, usually monthly, quarterly, or annually.

On the other hand, financial planning means developing a long-term, often a 3- to 5-year-long strategy to achieve the business's financial goals—what it expects and wants to accomplish. A typical financial plan includes long-term and short-term objectives, strategies to reach them, and contingency plans for unexpected scenarios. Contrary to a budget, you don’t need to revise a financial plan every month or quarter—you can use it to track progress and update it semi-regularly.

Finally, what is financial forecasting? Financial forecasting is the process of estimating future financial outcomes, such as revenue and income, based on current and historical data. While a budget shows how finances should be allocated and a financial plan acts as a long-term procurement strategy, a forecast shows where the company is heading financially. It’s a reality check of sorts—with forecasts, companies can adjust their financial plans and rethink budgeting for the coming month.

Both budgeting and forecasting are crucial steps in a financial planning process. In fact, 94.8% of respondents in the KPMG survey on forecasting stated that planning, budgeting, and forecasting are all integrated within their organizations. Here’s everything you need to know about the differences.

Types of financial forecasting

Forecasting has specific focus areas for separate business needs. Here are the most common types of financial forecasting that companies use.

Cash flow forecasting

A cash flow forecast estimates a company's financial position over a specific period. It shows how much cash will come in (cash inflows) and go out (cash outflows) of a business and whether it’s enough to cover obligations such as vendor payments, loans, or rent. 82% of business failures come down to poor cash flow management, which is why a cash flow forecast is essential in any company.

Cash flow forecasting relies on:

- Opening balances: The current cash balance at the start of the accounting period

- Expected income for cash inflows: Sales, tax refunds, and grants

- Expense projections for cash outflows: Salaries, loans, liabilities, and taxes

Sales forecasting

Just like the name implies, sales forecasting estimates how much money the company expects to make from sales over a certain timeframe. Sales forecasts are based on current and past sales reports, the sales team’s performance, and current market conditions.

If the company is launching a new product, the team also considers the potential outcomes of its go-to-market (GTM) strategy, including marketing campaigns, distribution channels, and demand assumptions. An accurate sales forecast helps the team align inventory and production with customer demand.

Income forecasting

Also known as revenue forecasting, income forecasting estimates a company’s net income over a set timeframe based on past revenue and its growth rate.

Contrary to sales forecasts, which focus on income from product or service sales, income forecasts consider all revenue streams—including investments, grants, and partnerships—and deduct operating expenses, taxes, interest, and depreciation.

If the revenue forecast shows that revenue is growing, but expenses are rising at an alarming rate, it’s a clear sign to decrease spending and focus on savings.

Budget forecasting

Budget forecasting refers to the process of evaluating the potential financial outcomes of the proposed budget if the company follows it to a tee. An accurate budget forecast helps analyze if the budget aligns with the current business goals. If you’ve ever compared actual costs against planned costs as part of procurement analysis, you’ve already used a budget forecast.

Financial teams often wonder how to do budget forecasting effectively. Start by comparing your upcoming budget with past performance metrics, such as past income, expenses, and spending patterns, then analyze how the budget will perform in real-world conditions.

For example, let’s imagine that the company set a budget of $70,000 for a Christmas marketing campaign. The budget forecast shows that last year’s Christmas promotions exceeded the set budget by nearly $10,000 due to higher advertising costs. Now, the team can readjust the budgeting and forecasting without cutting crucial expenses in the next quarter because of a sudden budget overrun.

What a financial forecast includes

While not every financial projection focuses on the same thing, most have common building blocks. Some of these elements mirror the ones you’ll find in a regular procurement or cost management process. The only difference? They focus on the future, not the past. The key components of a financial forecast include:

- An asset and liability statement, more commonly known as a balance sheet or a statement of financial position, is a projection of what the company expects to own (assets) and owe (liabilities) in the future. It also details equity, such as share capital and retained earnings.

- A profit and loss (P&L) statement, or an income statement, estimates the revenue and expenses of the business.

- Competitor positioning evaluates how your company’s competitors are positioned in the market now and how they might be positioned in the future. It involves a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of both your company and your competitors, as well as a thorough analysis of trends, customer behavior, and market share.

- Market research is one of the main sources of data for financial forecasts, especially those focused on sales and industry trends. Around 58% of organizations rely on market reports and competitive data for finance forecasting. A detailed analysis of the market can help predict customer demand, assess potential geopolitical and supply chain risks, and evaluate pricing patterns.

- Scenario analysis considers several “what-if” situations, such as a drop in sales and market shocks, to understand how each would impact your company. Although not all forecasts use scenario analysis, it’s vital for covering all the bases in your financial strategy.

Methods for forecasting budgets

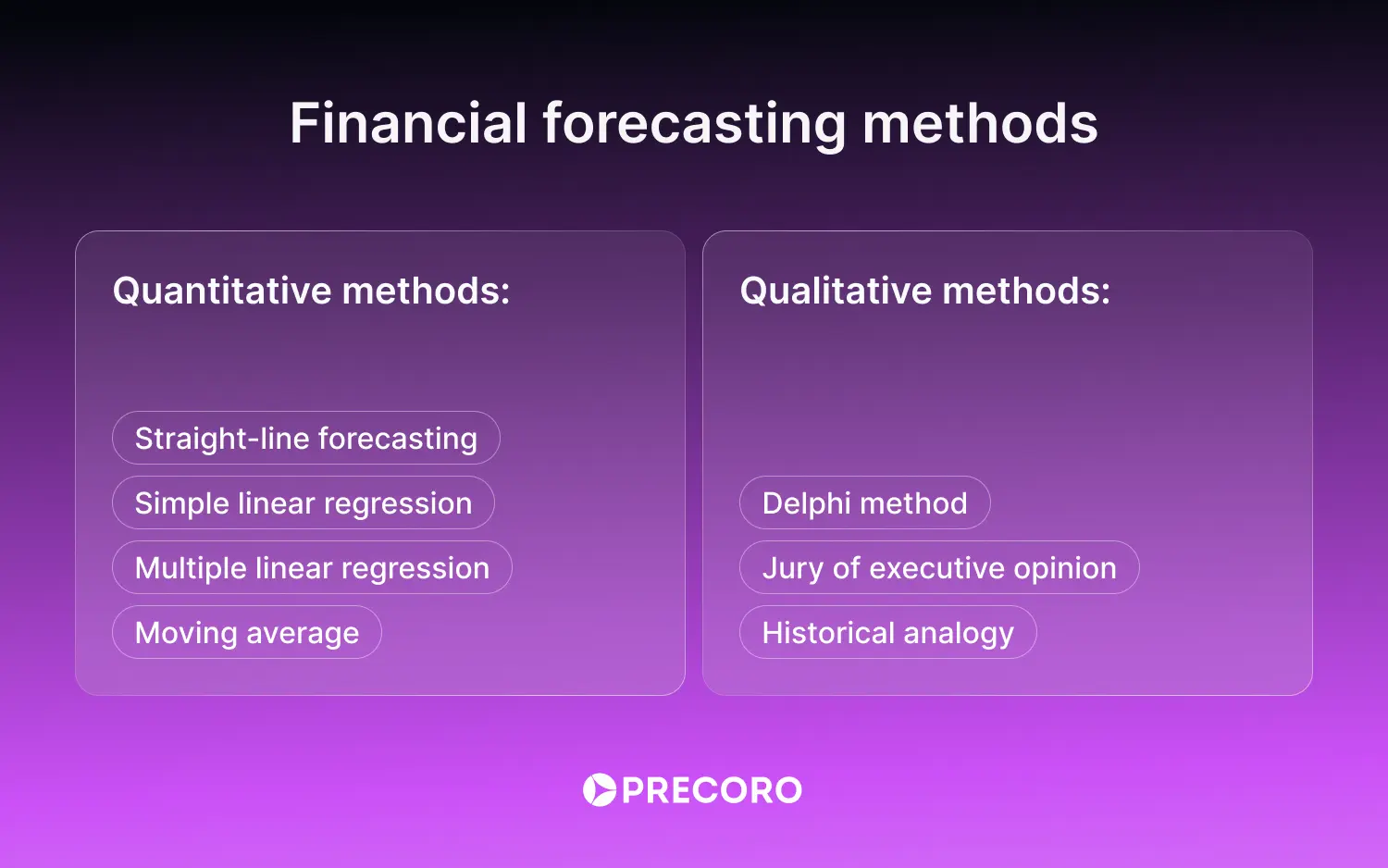

The forecasting method you choose can make or break your budget. Most methods either rely on historical data (quantitative methods) or research and expert knowledge (qualitative), with some picking from both sources (hybrid). Let’s break down the most common and effective tools businesses use for budgeting and forecasting.

Quantitative methods

Straight-line forecasting

Considered one of the simplest methods, straight-line forecasting assumes that the company will continue to grow at the same rate it did in the past.

Formula:

For example, the company earned $1,100,000 in 2024 compared to the 2023 revenue of $1,000,000—a 10% growth rate.

Then, according to the formula, the company is expected to earn $1,210,000 in 2025.

Calculation:

Pros: Simple, requires minimal data and tools.

Cons: Doesn’t consider market fluctuations, economic downturns, and industry shocks.

Best for: Companies in a stable market environment or businesses with a stable growth rate with minimal fluctuations.

Simple linear regression

A simple linear regression method models how an independent variable affects a dependable variable in the form of a trend line. This method is usually visualized in Excel or similar tools.

Formula:

For example, in a simple linear regression model, the company notices that the profit increases by $4,500 for every $15,000 increase in sales. Therefore, each dollar from a sale brings $0.3 in profit ($4,500 ÷ $15,000 = $0.3). Based on the provided formula, a forecasted $18,000 in sales will bring $5,400 in profit (assuming the intercept a = 0 for simplicity).

Calculation:

Pros: Helps identify the cause-and-effect relationship between two factors and is fairly simple.

Cons: Ignores other variables besides one and doesn’t consider complex variable relationships or real-case scenarios.

Best for: Small businesses with minimal data and product managers in need of quick, straightforward forecasts.

Multiple linear regression

Multiple linear regression is a more complex sibling of the simple linear regression model. This method uses two or more independent variables to predict the outcome, which is the dependent variable. For an accurate forecast, the team should understand which independent variables clearly impact the dependent one.

Formula:

In this formula, y is a forecasted value, i stands for the number of observations, x for the contributing variables, and β is the impact of each variable on the outcome. ϵ defines the error term or leftover difference.

For example, an e-commerce company wants to forecast monthly marketing expenses with three variables: number of new product launches, website traffic, and average cost-per-click (CPC).

Historical data shows that each product launch adds $12,000, every 1,000 visits add $1,800, and each $1 increase in CPC adds $25,000 to costs. With a baseline of $150,000, the company expects 3 product launches, 85,000 website visits, and a $1.80 CPC next month. Based on the formula, the company expects to allocate $384,000 for marketing.

Calculation:

Pros: Scalable, can include multiple variables, and provides a more comprehensive forecast.

Cons: Requires more expertise, knowledge, and complex tools, such as ERP software or other digital solutions; can be difficult to calculate if the cause-and-effect relations are unclear.

Best for: Businesses with the resources and skills to implement it and CFOs who need an analysis of what impacts what, not just a prediction.

Moving average

If you’re looking for a simple way to forecast future performance, the moving average method is a great place to start. Based on the available data from a set period, you can identify new patterns and seasonal spikes and plan for regular expenses.

While calculations are simple, budget forecasting requires accurate data. You can use Precoro to have up-to-date, reliable procurement records and ensure your forecasts are grounded in reality.

Formula:

For example, the procurement team wants to estimate lead time for monthly material orders. Based on the supplier’s delivery time—14 days in January, 23 in February, 19 in March, and 15 in April—the average lead time comes down to 18 days.

They now expect May’s order to arrive within this timeframe. From this point forward, the team can either renegotiate terms, explore alternative suppliers, or reconsider their production plans for the month.

Calculation:

Pros: Simple, great for short-term calculations.

Cons: Less effective for long-term forecasting, doesn’t consider variables.

Best for: Predictable processes, recurring expenses or operations, and short-term forecasting.

Qualitative methods

Delphi method

The Delphi method relies on the input from a panel of experts. One employee acts as a facilitator and passes the questions back and forth between the experts and the team. All responses are typically kept anonymous to prevent any bias.

The facilitator reports each round of expert responses to the team, who then ask follow-up questions. The process continues until the experts and the team agree on a realistic framework for forecasting budgets.

Pros: Prevents bias, offers diverse perspectives, doesn’t require meetings, gives room to change opinion on the subject.

Cons: Long response time, participants can drop out before the end, and the majority can sway the minority opinion.

Best for: Market research, risk assessment, product demand, and consumer behavior.

Jury of executive opinion

The jury of executive opinion method relies on insights from the experts in the company’s sales, finance, production, and procurement teams. Executives pool their experience to generate a forecast based on strategic goals and internal knowledge.

Unlike the Delphi method, discussions are often open and collaborative, with decisions based on consensus or majority opinion. This approach is often used along with quantitative approaches to ensure a well-rounded budget forecasting process.

Pros: Fosters collaboration, provides insights from internal experts, and is low-cost.

Cons: Subjective, no independent external perspective; forecast may be skewed by dominant voices in the team.

Best for: Expense forecasting, strategic meetings, and budget planning.

Pros of financial forecasting

When done right, financial forecasting can be extremely useful for both the procurement and finance teams. Consistent budgeting, forecasting, and planning can help your company avoid overspending and stay ahead of its competitors. Here are the key advantages you can expect.

• Growth opportunities

67.5% of respondents stated that the ability to identify growth opportunities is the key advantage of finance forecasting. An accurate forecast can help identify products or services that perform better, as well as revenue streams with an undiscovered profit potential in the market.

• Clear performance milestones

While you shouldn’t solely rely on forecasts for budget goals or sales performance, they’re a great benchmark. For example, if the forecast projects $2 million in revenue this year, teams can use it as a milestone and adjust strategies accordingly.

Additionally, CFOs can use a financial forecast to evaluate the performance of key departments. It’s a great way to assess what worked and what didn’t and then address slip-ups or problem areas.

• Complete financial overview

Financial forecasts expose vulnerabilities in spending and income. A budget forecast will show whether enough funds were allocated to essential expenses like rent or utilities, while an income forecast can project drops in revenue. The team can then adjust the budget before they’re hit with sudden budget overruns and develop a strategy to boost profit.

• Foreign currency management

If your company works with foreign currencies, cash flow forecasting helps anticipate foreign exchange (FX) fluctuations and foreign cash inflows and outflows. It also reduces the risk of trapped cash—a phenomenon when the business has money but can’t use it effectively because of poor exchange rates or bank limitations.

• Stronger stakeholder trust

The company’s executives can show a well-structured financial forecast with all potential income and expenses to investors, creditors, or existing shareholders. This document, typically known as earnings guidance, demonstrates that the company is credible and manages finances responsibly. Forecasts not only instill trust in investors but also give you standing in funding conversations and can be used to reassure stakeholders in trying times.

• Risk assessment

Financial forecasts help you spot potential risks early on. Supply chain delays, seasonal price hikes, or even a high churn rate won’t creep up on you anymore; instead, they’ll remain clearly visible. For example, an outlook on your cash flow in the next few months can help the company spot shortages and adjust spending before the time to pay liabilities is due.

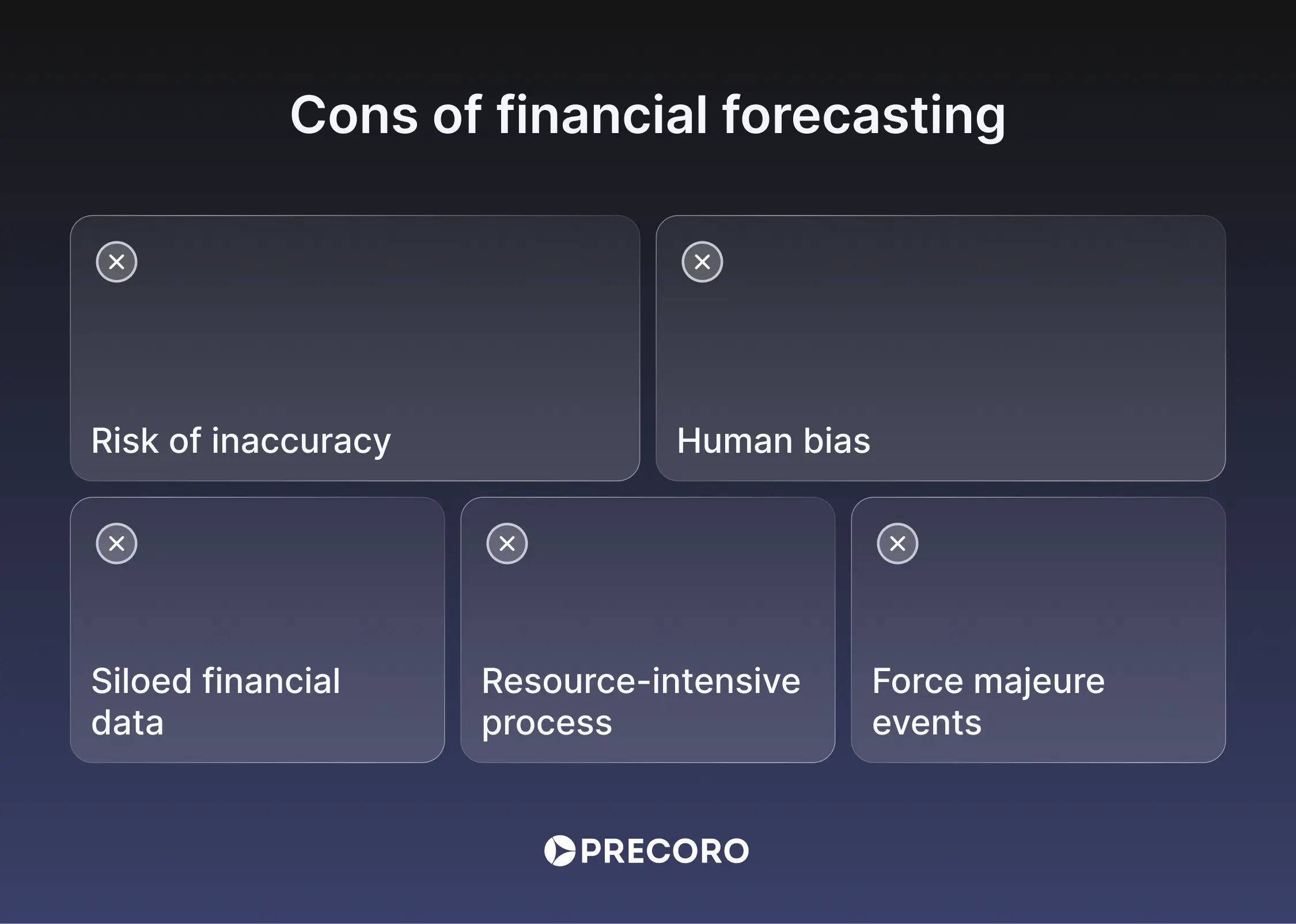

Cons of financial forecasting

Despite its numerous benefits, financial forecasting has its limitations, which you should address early on.

• Risk of inaccuracy

If your data is outdated or incomplete, you’re facing the risk of an unreliable forecast. Even one missed number can cause your company to deviate from the accurate forecast, which lowers the organization’s credibility in the eyes of investors.

Such errors can even affect share capital, with executives reporting a 6% decrease in share prices after an erroneous forecast. On the other hand, those who deviated from the forecast by no more than 5% experienced a share cost increase of up to 46%.

• Human bias

Companies base around 25% of forecasts on sole judgment without measurable evidence from systematic forecasts. Some teams intentionally underestimate numbers to appear as though they’ve outperformed later on. Others rely on wishful thinking and overly optimistic projections to attract investors or paint a better financial picture.

Overreliance on past assumptions can also cost you money or clients. In any case, the result is the same: an inaccurate and incomplete forecast that doesn’t show the company’s true financial position.

• Siloed financial data

The key to good financial forecasting is collaboration. The forecast will most likely miss crucial information if teams don't share financial data. For example, if procurement logs expenses in spreadsheets that finance can’t access, those expenses might not be included in future budgeting and forecasting.

Procurement software like Precoro can fix this problem with a centralized hub for all data, from purchase orders to invoices, and an easy reporting function just a click away.

• Resource-intensive process

Good forecasting requires time, skills, tools, and money. Small businesses may struggle to keep forecasts updated and, in turn, won’t find them useful. Manual processes are often to blame—a staggering 96% of companies still use spreadsheets for finance forecasting, with 40% using them as the only tool. The result? Long days spent entering massive amounts of data, errors in calculations or spelling, and incorrect forecasts with no valuable insights.

• Force majeure events

Circumstances outside your control can completely skew your forecast, no matter how accurate and precise it is. For example, recently imposed trade tariffs forced numerous companies across the globe to readjust their financial forecasts.

Frequently asked questions about financial forecasting

Key types of finance forecasting include:

- Cash flow forecasting: Projects how much cash will come in and go out of your business over a given period to ensure the company has enough liquidity to cover upcoming obligations.

- Sales forecasting: Estimates how much profit the company will make from selling its products or services alone.

- Income or revenue forecasting: Projects how much money the company expects to earn from all revenue streams based on past sales, current position, and market research.

- Budgeting forecasting: Evaluates the potential financial outcomes of the proposed budget. Budget projections forecast the income and expenses of the company—information that the finance team can then use to adjust the budget.

Financial forecasting focuses on predicting what will happen based on current and historical data. Financial planning is about creating a long-term strategy to meet financial goals and may include forecasts, budgets, investments, and contingency plans.

Forecasting estimates future financial outcomes. Modeling drives the forecast—often, it’s a structured calculation tool (usually in Excel) used to create the projection itself. Financial modeling is the basis for the majority of quantitative forecasting methods.

Yes, absolutely! In fact, forecasts might be the tipping point that convinces potential investors to fund your company. Consistent forecasting helps investors understand how realistic the potential growth of your company is and whether it’s prepared for risks.

Both simple linear regression and moving average models are simple to calculate and don’t require any additional tools or expert knowledge. Although quite limited, these methods can provide a quick projection of sales, expenses, revenue, and timelines.

Yes, and many businesses still do, especially new and small ones. Excel provides a solid framework for many quantitative budgeting and forecasting methods. However, as your company grows, Excel gets harder to scale, more time-consuming, and prone to errors. When that time comes, switch to dedicated software that stores all your spending insights in one place.

How Precoro helps companies forecast finances

The right tools can work as your trustworthy partners in the forecasting journey. So can Precoro—the procurement platform centralizes financial data and automates procurement processes that can take hours to complete. Here’s how Precoro helps teams navigate how to do budget projections:

- Track spend in real-time.

See where your money is going across departments, locations, and subsidiaries. Precoro’s intuitive dashboards show all purchase orders, requests, and expenses in one place. - Transfer data from your other tools.

Integrate Precoro with your existing tools to ensure all data stays accurate when your team is forecasting budgets. The platform easily connects with ERP systems, BI tools, and accounting software. - Control budgets with ease.

Create separate budgets for each department, project, and location, and receive alerts once expenses approach the spending limit. - Compare budget spend with actual costs.

Quickly spot budget leakages and back up your financial forecast with a detailed Budget vs. Actual report. See how much was actually spent compared to the planned budget and adjust future forecasts based on this information. - Export data for forecasting.

Precoro lets you download structured financial data sorted by item, document, custom fields, and supplier. Need to monitor changes made to catalogs or contracts? Run a revision history report to make sure everything is on track. - Tailor reports with custom fields and filters.

Use over 120+ custom fields and 20+ filters to create custom reports focused on what matters at the moment. - Automate time-consuming processes.

Let Precoro do the heavy lifting. With parallel approval workflows, AI-powered OCR for invoice processing, and automated 3-way matching, Precoro can save your company up to 260 hours a week on invoice and PO management.

Forecasting doesn’t have to be complicated and uncertain. While it’s not fortune-telling, the right approach helps your team make predictions as close to reality as it gets. And with today’s tools like Precoro, you don’t have to guess your next step. Instead, your team can move with confidence, not doubt.