27 min read

The Definitive Guide to Cost Savings

The COVID-19 pandemic and then the full-scale Russian invasion of Ukraine have proved that, at any moment, seemingly perfect plans and financial projections can suddenly become unrealistic.

Recall how manufacturers had to limit their on-site staff due to coronavirus safety regulations; more recently, food production in Ukraine was disrupted, which in turn affected the sales channels of Ukrainian products and everyone around the world who uses or distributes them.

In situations like these, every cent matters. When faced with disrupted supply chains, unavailable staff, and closed facilities, businesses have to be extra conscious about their spending.

To prepare for possible disruptions and to stay cost-efficient in general, companies should be mindful about their spending at all times, and should avoid paying for the things that don’t contribute to business profitability.

Cost savings help a business to stay competitive in the market, boost cash flow, and improve the bottomline. This way executives and investors can ensure the business’s ability to survive adverse times.

However, achieving significant cost savings is not always easy — it requires a comprehensive approach to spend management that involves more than just cutting expenses. Sufficient cost savings are achieved by utilizing a rigorous spending analysis, identifying opportunities for improvement, preparing strategies to reduce expenses, and carefully implementing these strategies.

In this blog post, we'll go over everything you can do to reduce company expenses. Keep reading to find out:

- What cost saving means in business

- Why they are important

- Which steps to take to achieve cost savings

- Where to search for cost reduction opportunities

- How to reduce expenses across the organization

- Why monitoring cost cuts is important

- What challenges to be aware of when cutting costs

- Tips for successful execution of cost-saving strategies

- Frequently asked questions

What Are Cost Savings?

In business, the term “cost savings” refers to actions aimed at reducing the company’s expenses and increasing the bottomline. As the name implies, the key objective of these actions is to reduce expenses with minimal or no sacrifice of the product quality or performance level.

Cost-saving strategies require the involvement of savvy financial professionals who can plan and execute a realistic strategy. Companies can cut costs in various ways. For instance, they can do so by improving operational processes, making cost-efficient decisions on personnel, initiating work environment changes, upgrading technology, sourcing strategically, and so on. In other words, there are all kinds of changes to the existing setup that can contribute to lower costs.

Intentional cost savings are also called “hard savings,” for they are planned, regulated, and reflected in the financial strategies. So-called “soft savings,” on the other hand, come naturally through conscientious work and without intentional strategy.

Cost Saving and Cost Avoidance

Even though cost saving and cost avoidance are sometimes used interchangeably, it’s not exactly correct. Let’s see what the difference is here.

Cost saving is about finding an efficient way to keep the expenses on the books but reduce their monetary value. Let’s take office cleaning services as an example. If a company wanted to cut this cost, they could reduce daily cleaning frequency to weekly, search for a more affordable cleaning company, or consider cheaper detergents.

Cost avoidance strategy, however, means removing the expense completely from the budget – for instance, canceling cleaning services altogether. Cost avoidance also refers to avoiding an expense in the future. For example, to avoid costly equipment repairs in the future, a company might conduct intensive training for the manufacturing staff and prioritize teaching them how to use expensive equipment properly.

The Importance of Cost Reduction

For instance, a company might implement a short-term cost-saving strategy to overcome the consequences of turbulent COVID-19 years. Such measures might include terminating the office lease or firing part of the staff, with the intention of returning to the office and rehiring people as soon as the market conditions allow.

If the company expects stalled growth, a decrease in revenue, or a market downfall, stakeholders can react accordingly and focus on cost savings. This way, a business can sustain the profit margin and make it through the challenging period.

On the other hand, a company with a goal of increasing profitability without increasing the budget would pursue a long-term cost-saving strategy. For instance, they can focus on negotiating better deals with the suppliers.

Cost savings also allow companies to free up some cash and put funding elsewhere. For instance, if a business wants to finance new technologies or expand to a new market, instead of fundraising elsewhere, it can accumulate finances by reducing current costs.

Good cost-saving strategies help companies stay competitive and adjust to the newest industry developments. As a result of cost savings, a business can afford better pricing of the final product or service, market more aggressively, and attract more customers.

Proper oversight and optimization of day-to-day expenses can transform a struggling business into a profitable one. Sometimes, cost savings can make all the difference between profitability and loss.

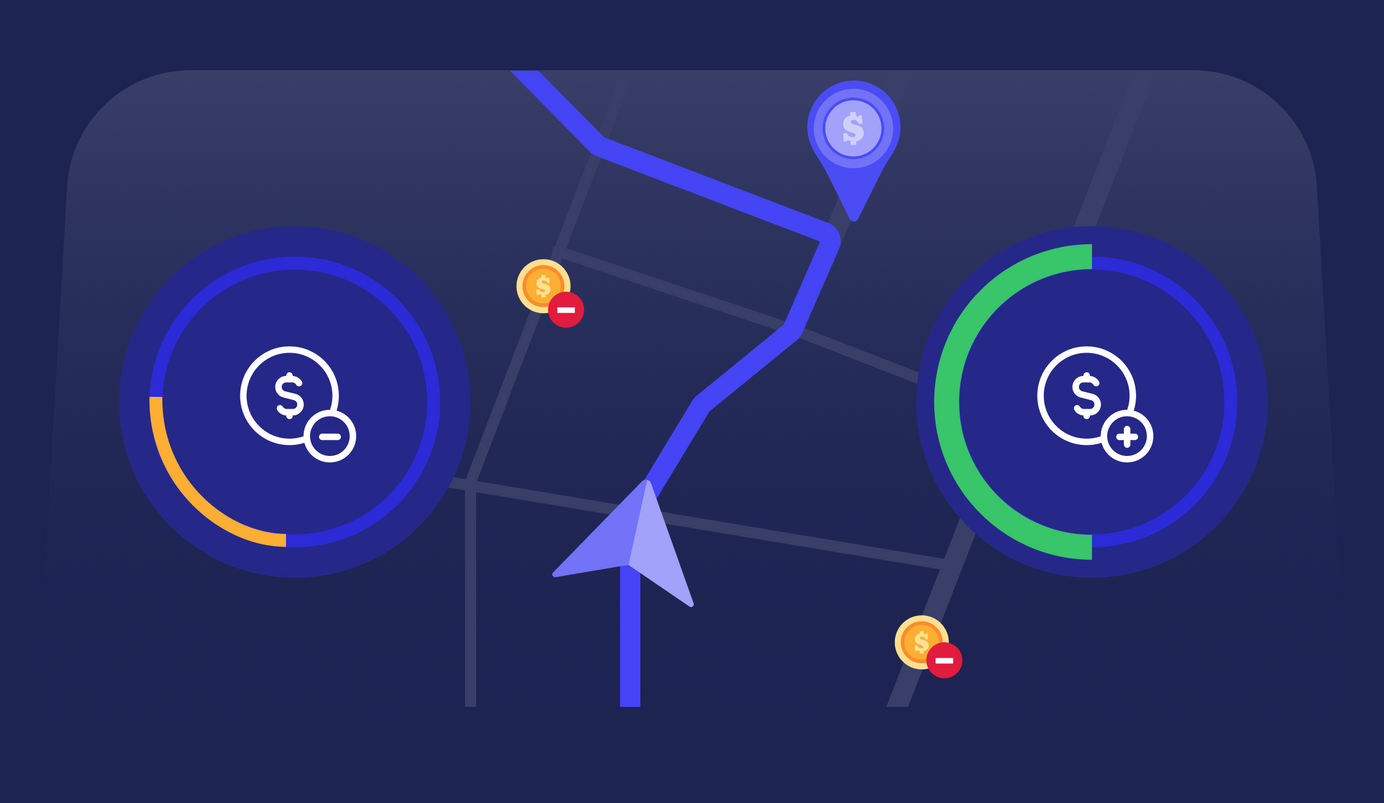

Achieving Cost-Savings Step by Step

Not every cost-saving technique or template is applicable to every business. Nevertheless, there are some typical steps any company can follow to implement cost savings.

1. Consider Long-term Strategic Goals

Before deciding on the best course for day-to-day actions, consider the business model and long-term objectives. Examples of business objectives would be expanding to three new markets or, on the contrary, scaling down. The company might be pursuing diversification of manufacturing facilities or the introduction of a new line of products. Or maybe business owners just want to maintain their current market presence and financial stability.

Along with defining goals, decision makers have to decide how much they are willing to increase or reduce the budget. This depends on the company’s minimum operating budget and profitability expectations.

The budget has to be realistic and mathematically achievable based on the actual spending data. Otherwise, the employees might not be able to meet the management's demands. Finally, executives need to establish milestones for measuring progress.

2. Gather and Evaluate Spending Data

Consolidate all available data and financial statements and prepare a full list of company expenses. Make a snapshot of the current budget state. Specialized software, especially with AI capabilities, makes this process much easier by providing answers almost instantly.

Share the data with colleagues who can provide useful insights, such as upper level managers and hands-on department heads. They can offer valuable feedback on the data, as they are more familiar with the realities of purchasing habits. Such “democratization” of data allows cost analysts to gauge first-hand insights that are not always directly available to upper management.

Be thoughtful not to make the conversation hostile. Employees should be given the opportunity to explain their spending needs so that a solution can be found that suits both teams and budgets.

Take your time and ask employees if they can come up with the source of spending inefficiencies. Encourage and reward staff for thinking of ways to avoid wasting more money in their field of work.

3. Pinpoint Potential Cost Saving Opportunities

With complete and transparent data at hand and after hearing the insights of the staff, finance specialists can compare real expenses to their budgeted levels and analyze and categorize the costs. Benchmarks for evaluating spending levels can be internal (between departments) or external (between competitors in the market.)

Some costs can appear relatively high compared to the budgeted benchmarks, but at the same time justifiable by the substantial returns on investment that they offer. Other expenses might not be so high, but are absolutely unnecessary. The sum of the latter can present a noticeable opportunity for savings. That’s why it’s important to review the numbers in the context of the company’s budget and market conditions.

Special attention should be given to maverick spend, a common pain point for many businesses and often a key source of spending inefficiencies. Goods or services purchased outside of the defined spending policy are practically impossible to budget in advance and control.

The finance team should pinpoint cost reduction opportunities and prioritize them by, for instance, urgency, importance, or ease of doing. Decision makers can then determine which expenses they want to prioritize first.

4. Develop a Cost Reduction Strategy

The finance team, procurement team, project managers, and department heads develop an estimation of future costs and a cost-saving strategy based on the processed data and business needs. It’s also helpful to consider historic attempts at cost saving.

Rather than reinventing the wheel, the finance team can review previously adopted cost-cutting strategies, adjust them where it’s needed, and apply them when possible. The following questions will help finance teams create a customized cost-reduction program:

- Is there a way to achieve business goals by spending less or spending more efficiently?

- What can we do about inefficient spending? Can we eliminate or reduce it?

- What solutions can we propose for each department?

- What are the possible side effects of the proposed changes?

- Which solutions should we implement first?

Plan a gradual implementation, as trying to introduce all the changes at once can be overwhelming for staff and difficult to manage. A step-by-step implementation of the cost-saving strategy allows the finance team to measure the impact of each individual change before moving on to the next one.

After deciding what should be done and when, it’s time to determine who will carry out each step. Part of the cost-saving strategy is assigning the staff roles and responsibilities: who will implement changes in each department and monitor the progress.

5. Get Everyone on Board

Disclose the plan for reducing expenses to the organizational leadership and be ready to respond to any questions they might have. The intention here is to create a communication-friendly atmosphere; involving employees early on helps bolster morale and openness.

Cost reduction is a team effort that depends heavily on the cooperation between executives, management, and other staff. One of the biggest challenges lies in convincing employees that cost savings, which might directly affect them, are indeed important. Disclosure can help build a culture of responsibility, where everyone plays their role in cost savings.

6. Implement, Monitor, and Improve Cost-Saving Strategy

Monitor the progress and record company savings regularly; do not postpone it till the end-of-year closure. Compare real savings against original expectations to see whether saving benchmarks are met and whether your organization follows a saving schedule.

If this is not the case, the cost reduction team can adjust the strategy in time to maximize its effectiveness. Cost saving is never an “introduce and let it be” process but one requiring continuous improvements.

Identifying Cost Savings Opportunities

Cost-saving strategy for each company depends on its products or services, structure, and budget. In general, company costs can be divided into the following categories:

- Essential costs that keep the key operations running.

- Positive costs contributing towards business growth and expansion.

- Negative costs that do not contribute to growth and in a way are a waste of resources.

- Distinguishing costs that make the company stand out from the competition in the market.

Within these four categories, cost-saving analysts then delineate specific expenditures. They evaluate the history of spending and assess the current budget in order to get a holistic overview of the organization’s spending.

Analysts search for the areas where the business can improve return on every dollar spent, preferably without compromising quality. While methodologies and anticipated results vary depending on the business, the main areas in which to look for cost-saving opportunities are often the same.

Supply Chain

Optimizing an organization's supply chain management is a great way to reduce expenses. Determine if there’s a way to do so by answering the following questions:

- What are the goods or services your company purchases the most of?

- What is the average price for these items on the market?

- How does the price you pay per item compare to the market average?

- Is there a way to negotiate a better price with your current suppliers?

- Is it possible to establish vendor relations that offer better deals?

Inventory

Adjusting inventory levels can also contribute to cost savings. Analyze what’s in your stock and determine if it can be optimized.

- Is your inventory optimized? Do you have enough raw materials to cover production needs and enough ready-to-sell items to meet the customers’ demands?

- Do you overstock? Is your stock obsolete?

- Is it possible to reduce inventory levels without risking the shortage?

Procurement

Procurement, if not managed well, might be another area where businesses lose money. To see what can be done to optimize the costs — of the procurement process itself and purchased items — consider the following:

- Are requesting and purchasing workflows clear?

- How many employees are involved in the procure-to-pay cycle?

- Do you have contracted suppliers?

- What is the percentage of maverick spend compared to the total of company purchases?

- Are you utilizing discounts such as bulk or early payment discounts?

Marketing

Marketing is crucial for any business, especially one aspiring to grow. However, it can also be quite expensive. Determine how cost-efficient your marketing efforts are. Consider using free and premium templates to create stunning graphics, social media posts, and more, ensuring your brand stands out while keeping costs in check.

Good questions to ask yourself while examining cost efficiency are:

- What’s the average cost per lead (CPL) in your current setup?

- Which marketing channels are you using?

- How many of those leads convert to opportunities and new clients?

Energy

Energy bills also constitute quite a large part of an organization’s expenses. One light left on overnight might not seem like a big deal, but when multiplied by thousands… Think about the daily practices that could be improved.

- What are the main components of the monthly electricity and energy bills?

- Which of these items are indispensable as they are, and which can be reduced?

- Does the company have energy-saving recommendations? Do employees follow them?

Implementing Strategies for Cost Savings

Cost reduction is a business strategy. It’s not a one-step deal but a continuous planned effort. It’s better to avoid changing spending policies on the spot and ad hoc, as it might generate a lot of chaos and very little results. Employees should closely follow the plan originally determined by the cost-saving team and reduce expenses according to the timelines for each cost-saving initiative.

Negotiating Better Prices

The first and most obvious way to cut costs is to buy cheaper. Check if your suppliers and contracts can offer better price-to-value.

Re-evaluate suppliers

Businesses without a systematic supplier management system lack an overview of the supplier and vendor network and tend to overpay, miss discount opportunities, or have nothing to leverage during negotiations.

As a part of the cost-saving initiative, businesses evaluate if their contracted suppliers still meet their expectations. Spend analysts or procurement professionals can identify which vendors and suppliers bring the most value to the business and which might be underperforming.

Renegotiate contracts

Supply chain managers can renegotiate supplier contracts to get better prices and reduce purchasing costs. However, it’s important to remember: buying cheaper shouldn’t come at the price of the end product’s quality.

Contract negotiations require a deep understanding of the supplier’s pricing structure, market conditions, and offers from the competition. Start by identifying the vendors that offer the best value for money on the market and compare them to the offer of your contracted supplier. If you find the current contract inadequate, initiate a discussion about aligning contract prices with market prices.

Inquire about bulk and early payment discounts and ensure they are included in writing when possible. Build long-term relationships with your suppliers and commit to them in order to get better prices in exchange for confidence in long-term cooperation. It’s also helpful to consider suppliers’ priorities in terms of business sustainability — you might negotiate better prices on this common ground.

Optimizing Inventory

Stocking levels

Businesses with optimal inventory levels minimize the risk of stock obsolescence and reduce storage costs. Be careful not to overdo it by cutting down the stock, as a lack of inventory can result in operational hold-ups and failing customers’ demand.

Calculate the minimum level of stock you absolutely must have available in the warehouse and how quickly you can replenish it in case of an unexpected rise in demand. Based on that, you can implement just-in-time inventory practices.

Inventory management

To improve inventory flexibility – that is, being able to increase and reduce the stock on demand without risking sabotaging the sales – businesses can invest in inventory management. A dedicated professional finds a balance for stock levels, ensuring there is sufficient stock available without paying for an inventory larger than needed. For instance, an inventory manager should make sure that raw materials needed for producing a seasonal product are not sitting unused in stock throughout the year.

Additionally, organizations implement software that streamline inventory management. Digitalization makes it easy to track inventory levels, monitor stock turnover rates, and identify slow-moving items.

Evaluating Operative Processes

There are several ways to cut the costs of operative processes. Let’s touch on some of them.

Back office costs

The back office is responsible for processing documents; here, it’s often true that time equals money. A typical example of a wasteful cost would be paying employees for extra working hours that had to be put in due to flawed workflows.

Other inefficiencies that the finance team should work to eliminate are fines for late payments or missed opportunities for early payment discounts. Finally, maverick spending or mistaken payments also often happen due to the gaps in administrative processes.

All these issues can be eliminated or at least minimized by creating step-by-step guides for processing each type of document and communicating them to the team. Everyone involved should be on the same page about their tasks and responsibilities.

Another positive step is implementing software to automate routine tasks where possible. Software makes an extraordinary difference in the speed and precision of administrative tasks. With automation tools, organizations can eliminate the need to forward numerous emails with documents or even pass hard copies from person to person. Instead, everything can be confirmed online within seconds.

Interdepartmental Communication

Smooth communication between departments saves both time and money. By discussing similar processes, employees from different departments can avoid duplicating the tasks. They should also make sure that the workload is spread evenly, and cooperate with colleagues from different departments to work in synergy.

Businesses can also maximize purchasing power and minimize redundancies by combining the needs of several departments and placing a bulk purchase order. Organization will save money on delivery and maybe qualify for bulk discounts.

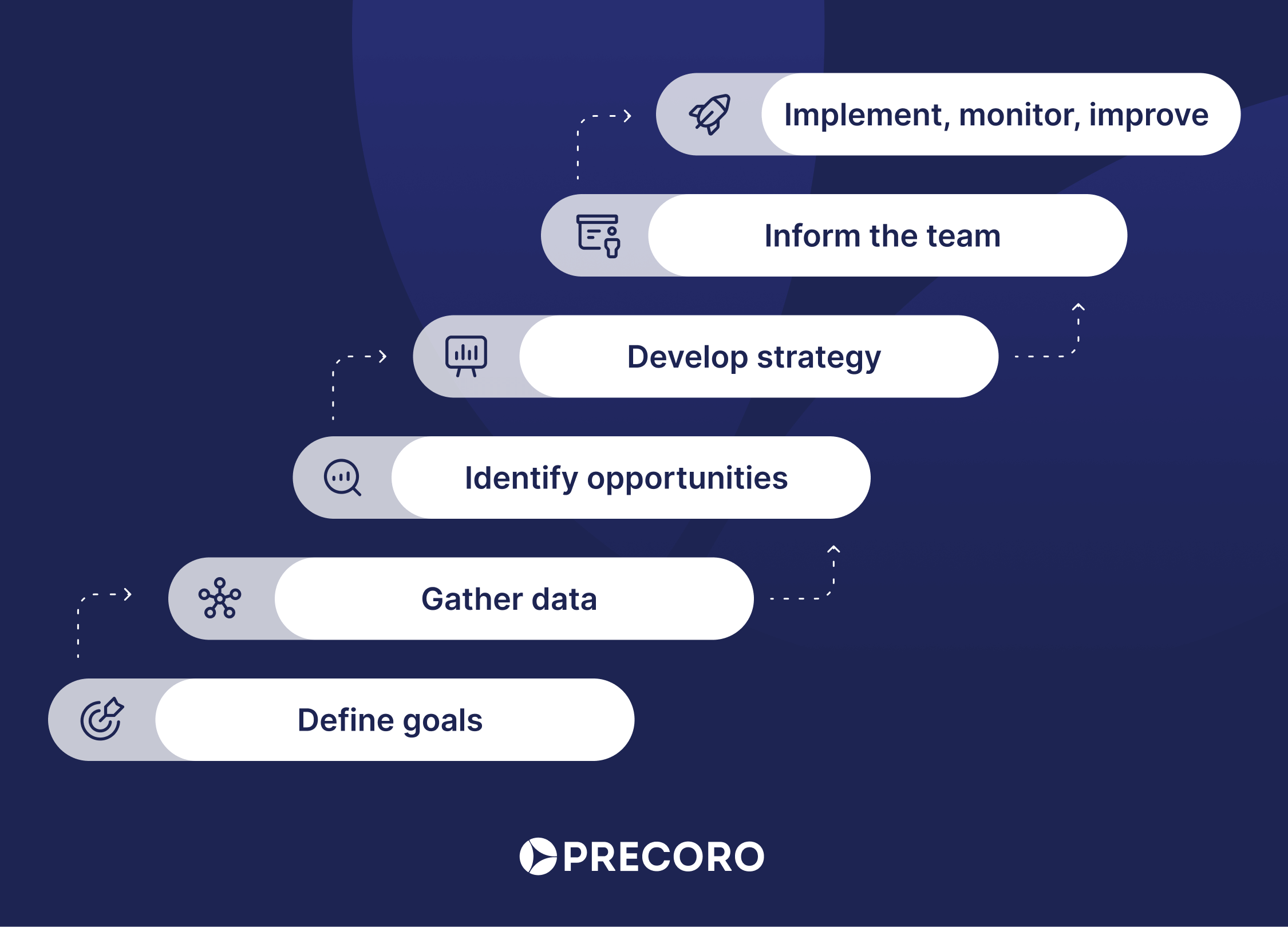

Streamlining Procurement Processes

How you purchase is just as important as what you purchase. Streamlining procurement processes can help organizations reduce the time it takes to complete purchases, minimize manual errors, improve supplier relationships, and as a result lower purchasing costs. Organizations that prioritize cost savings and efficiency often choose to implement procurement software to automate the P2P cycle and centralize purchasing.

Maverick spend

Reducing maverick spend is another proven way to save costs. Unapproved spending is difficult to categorize, analyze, and manage. That’s why organizations should negotiate contracts with suppliers for goods and services as often as possible.

With ongoing contracts in place, managers can instruct employees to purchase from the contracted suppliers, so that optimal prices and sale terms are used instead of unvetted options. Another factor in decreasing maverick spend is implementing transparent requesting, approving, ordering, and payment workflows. This way, buying outside of the contracts would only occur in exceptional cases.

Shipping logistics

Companies can reduce transportation costs by improving logistics and shipping processes. Consider whether a different shipping method to receive and post goods would be more cost-efficient and if it guarantees the same delivery quality and speed.

If you are purchasing relatively small volumes of goods, consider sharing the delivery costs with another business. If you do need to purchase a lot at a time, search for the optimal delivery services — meaning they will guarantee delivery conditions such as speed and price that are satisfactory for your budget and needs.

Consolidation

Another way to reduce costs is to combine purchases required by different departments. Even if the departments don’t realize there’s a way to combine purchase orders, procurement professionals should notify them of such a possibility. By consolidating purchases across the organization, a company can benefit from favorable delivery terms, discounts, special offers, and so on.

Marketing

To reduce marketing costs, businesses should focus on the channels proven to be effective that bring the most cost-efficient leads. Identify which marketing tactics require the smallest investment and bring in the most customers and revenue for their price, and focus your efforts on them.

There are many options, including traditional media, social media, email campaigns, paid personal promotions, conferences and exhibitions, and so on. Depending on the ages and areas of interest of the target audience, particular channels may be more or less efficient.

Nowadays, one of the most cost efficient ways to reach your target audience is to leverage social media. This is because, being digital, it’s easy to quickly adjust social media budgets in real time and reroute the finances to the most effective campaigns.

Some businesses also turn to alternative advertising methods such as customer and employee referral programs and networking. These methods often rely on a referral system, which not only promotes word-of-mouth marketing that is well-trusted by consumers, but also requires minimal financial investments.

Going Green and Energy Efficiency

Organizations can significantly reduce energy costs by making even small changes to their daily routines – for example, start switching off lights and electronic appliances when not in use, especially overnight. In addition to being more cost-efficient, such choices come with the added social benefit of sustainability.

Another green initiative to reduce waste and save money is going paperless by digitizing documents and communication. While some employees might not consider their personal use of materials such as paper to be significant, they might think differently if they knew the company-wide consumption numbers.

If possible, you can also consider switching electricity and heating suppliers. It might not always be an option, especially in a rented office. But if there’s a better player on the energy market you can sign up with, then it could make a big difference to cost-saving efforts.

Making the workplace more energy-efficient often requires considerable investments up front – for instance, when physically installing new appliances. But these costs are justified by greater savings that come later.

Optimizing Mandatory Payments

Even obligatory payments can sometimes be reviewed to improve their cost efficiency. It’s mostly done with guidance from financial professionals.

Insurance rates

Companies can search for ways to reduce insurance rates. Start by checking the list of all of the company’s insurance plans to ensure there are no redundant or duplicated policies. As a part of a cost-saving strategy, executives might decide to keep only the legally required minimum of insurance policies.

Company representatives can also negotiate cost reductions with insurance providers. It’s a good idea to compare current insurance rates to the market average and, if there are more favorable options, ask the insurance provider to match a lower rate. Another possibility is to consolidate all insurance policies under one provider and ask for a bulk discount.

Tax savings

A tax consultant can help companies maximize their tax benefits. It’s better to refer to a professional advisor as taxation is quite a delicate matter, and procedural nuances are not always obvious. Employees of the company’s internal finance team might overlook some opportunities for tax savings or returns – or worse, accidentally commit violations and get fined – unless they specialize in tax law. Hiring a consultant will be an additional cost, but savings might be worth it.

Reconsidering Production

As a part of the cost-saving strategy, companies can reevaluate their own products and services. Start with the questions:

- Do our customers use this product or service? Do they want it?

- Can we offer the same (or higher) quality after decreasing production costs?

- How is the competition handling this product or service?

Lucrativity

You might discover that some products or services are simply not worth it anymore. Their production cost might be too high to cover, considering the market price. Or, customer demand might have simply changed — for example, due to the emergence of better alternatives.

If there’s a product line that costs more in production than it returns in sales, then it might be time to think about calling it off. However, don’t rush. Consider the role of such a product or service when it comes to your company’s brand name. Even if some products aren’t as lucrative as they used to be, if they are still an integral component of the brand, canceling them may seriously damage business.

On the other hand, some products or services can be especially lucrative. In such a case, it might be a good idea to ramp up the production of them for some period for higher income.

Quality

Another way to save the cost is to alter the product quality. By doing so, a company can reduce production expenses. If a company is just developing a new product, it can be designed and engineered with the cost in mind from the start.

It is, however, important to consider whether customers will accept the changed product and how this adjustment may impact the demand. Organizations should implement strict controls for product quality to avoid loss of sales. When adjusting quality levels, it’s especially important to recognize in time if the quality level gets too low.

Equipment

Investing in proper equipment can also contribute to long-term cost savings. Good equipment can make an enormous difference in the production cycle; for example, it can reduce the usage rate of raw materials and increase the production speed.

Equipment doesn’t necessarily have to be new or of the latest technology. Used equipment, as long as it’s in good condition and meets production goals, can be more than enough. It’s also cheaper to purchase.

Recycling

If the company generates material waste during the production cycle, it’s worth considering if another organization could recycle and reuse it. Reselling these materials can turn waste into profit.

Reviewing Subscriptions

Subscriptions are often overlooked. A single subscription might not seem like a large expense, but if there are a lot of unused subscriptions, they can add up to a substantial sum of money.

Some companies don’t even have an idea of how many software licenses and other subscriptions they have or whether all of them are actually needed and used to the fullest. Writing down a comprehensive list of all the subscriptions, reviewing their costs and use, removing duplicates, and rationalizing all the licenses might considerably lower a company’s spending.

Optimizing Space

While spacious offices or large warehouses are necessary for some companies, others just keep them out of habit. As a result, some businesses end up locked into a long-term rent agreement with little room to re-negotiate. If the space under the rent agreement isn’t used to the fullest, it’s a waste of resources.

One way to avoid this is to find flexible rental agreements which allow tenants to terminate the lease or increase the space on short notice. However, that isn’t always possible, especially with larger spaces. Another way to optimize costs is to sublet unused spaces or share meeting rooms with neighboring companies for a fee.

Sometimes, it’s just better to relocate, especially if the current location has increased in price and isn’t sustainable for the company’s budget anymore. The typical case of such a move would be leaving the office on the central street and moving into facilities in a more affordable location

Finally, companies can consider letting employees work remotely. Working remotely can be challenging, especially when it comes to communicating and monitoring progress, and can also be more difficult for the HR department. But these hiccups are usually worth the long-term benefits.

By letting employees do remote work or hybrid work, businesses can save money by renting less office space — or none at all, depending on the size of the company. Surveys also show that remote workers are happier, which lets them perform their tasks more efficiently.

Optimizing Personnel

To save costs, companies can also optimize resources spent on employees and the work environment. Some might argue that this is the trickiest area for cost savings, as it requires decision makers to not only understand company finances but also to possess strong communication and interpersonal skills.

Reducing costs in this area doesn’t necessarily mean firing people, but rather optimizing their work and cutting some associated costs, such as the ones mentioned below.

It’s important not to sacrifice company morale, so managers in the process of cutting costs should communicate with employees to make sure they understand the reasoning behind the cuts.

Perks and benefits

The first and most obvious way to eliminate costs connected with employees is to cut extras. For instance, they might cancel free lunches, paid training, team-building outings, gym memberships, corporate discounts, etc. This is, of course, a measure that is typically unpopular with employees, so companies who choose this path should be sure to clearly communicate to employees why the decision was made so that everybody is on the same page.

Travels

Many businesses choose to cut back on travel costs when they have to reduce expenses. Recent years affected by the COVID-19 pandemic have successfully proved that many in-person meetings are just as productive when done virtually as calls or video chats. To avoid paying for tickets and hotels, many businesses just opt for teleconference meetings.

If travel is really necessary, such as attendance of an important conference or exhibition, organizations can limit the number of people going and purchase economy class tickets only. Companies can also lower the per diem for traveling employees.

Outsourcing and contracting

By outsourcing certain tasks, companies can avoid fixed costs like insurance, stock options, salaries, etc. Outsourcing the work can be especially helpful for companies with fluctuating or seasonal workloads.

Hiring third party companies or seasonal contractors can lower costs in the long term, because employers don’t have to keep such workers on the clock year round. However, before hiring it’s important to make sure that the outsourced workers are indeed qualified and will perform at a required level.

Productivity

Productivity is a highly valued quality for any employee. And while a lot of this comes down to internal motivation, organizations can also establish certain frameworks to encourage staff to perform to the best of their ability.

To foster a conscientious and productive work environment, managers should:

- Set clear expectations and define progress milestones.

- Assign tasks to be done according to daily and weekly schedules, and encourage employees to adhere to them.

- Reduce meetings to just the key ones. Instead, use other channels to share information, such as email digests.

- When setting meetings, make it clear that everyone is expected to arrive on time, stick to the agenda, and finish as planned.

- Give employees the opportunity to offer feedback and suggestions for further productivity enhancement.

- Minimize distractions, like social networks on work computers.

- Track time for various work activities.

- Replace unproductive employees.

Training

Companies might be losing out when employees are not maximizing their potential and skills. Managers can assess the current efficiency of employees and suggest requalification training. Investing in employees will pay off in the long term when people reach their peak productivity.

Salaries

In tough financial situations, when there’s a choice between cutting wages and letting people go, the majority of employees would probably opt for a salary reduction. But to reach this consensus, there has to be an open dialog and transparency between employees and management.

Managers should explain why they have to cut the salaries and when they expect to return to the previous wage levels or even increase them in the future. It would also be a good idea to check in with employees from time to time to update on current progress and financial outlooks influencing employees’ personal finances.

Digitizing

Technologies allow companies to minimize manual interventions, and therefore:

- Greatly reduce human mistakes, which can be expensive, and

- Significantly speed up all operations.

Both of these factors contribute to minimizing financial losses and maximizing income. Companies should consider implementing procurement software for P2P cycle optimization, supplier and vendor relationship management, and spend visibility.

More spending visibility means more savings, as organizations can limit maverick spending and reveal potential weak spots in financial planning. Real-time data availability allows the finance team to intervene in time and fix any issues before they get out of hand. Removing data silos, getting full visibility, and minimizing maverick spending are all safe ways to save costs.

According to Gartner’s poll of CFOs in July 2022, 66% said they planned to increase investment in digital technology in the next 12 months. And while implementing new technology might have a significant upfront cost, it pays off in the long run – which, in some cases, isn’t even so long. For instance, with Precoro, businesses can achieve their first return on investment in under 8 months.

Modern procurement software can be integrated with other solutions to take it a step further. Disparate data might challenge the workflows and lead to several employees doing the same, redundant work, but within an integrated ecosystem data is moved automatically and the whole process is easy, transparent, and fast — from placing a purchase request to sending the payment.

Monitoring and Evaluating Cost Savings

The key to ensuring the long-term effectiveness of a cost-saving strategy is regularly reviewing and optimizing it. While the end of the year is a perfect time to step back and review, it’s not always enough. You’ll see better results with continuous year-round monitoring and adjustment of the strategy. To do so, track expenses and measure the cost-saving progress against the initial goals.

By recognizing what works well and which plans prove unrealistic, finance specialists can consult stakeholders and improve cost-saving strategies as needed. It's also important to communicate your interim cost savings results to key stakeholders, such as investors, managers, employees, and customers, in order to demonstrate your commitment to efficiency and profitability.

Stay Aware of Possible Complications

Gartner reports that fewer than half (43%) of leaders actually achieve the level of savings they set out to in the first year of cost reduction. Cost-saving strategies fail because they are unrealistic, too ambitious, or don’t receive the necessary support from the leadership and employees.

Messy implementation of the cost-cutting strategy might also ruin an otherwise perfect plan. Reducing every possible expense or accidentally cutting a critical cost might have a negative impact on a company’s internal operations and end up costing the business more in the long run.

It’s also crucial to be aware of how cost-cutting initiatives might influence the quality of products or services. Sometimes, customers are willing to compromise on the quality, but on other occasions, it’s a no-go. Businesses make sure not to overdo it by cutting costs in order to keep the client base.

Poorly planned cost reduction can also frustrate employees and cause labor shortages. If staff are not well-equipped to handle their tasks under restrictions or with fewer resources, they might decide to search for another employment.

Tips to Reduce Costs Efficiently

Reducing expenses isn't an easy or enjoyable process. Several practices can help your finance team plan and execute a cost-saving strategy most efficiently.

Cut Fat, Not Muscles

To start with, it’s important to focus on where and how expenses have to be reduced rather than on how much can be cut. Cutting too many costs in the wrong area might inhibit company growth and seriously damage the quality of end products or services. It’s better to determine any weak spots and reduce inefficient expenses by 100% rather than cut 30% across all areas.

From Big to Small

Do not get stuck on the small cuts, even if they are fairly obvious. It’s easy to see the snacks next to the coffee machine and decide that they have to go, and indeed, you might save a few thousand dollars per year. However, if there’s an inefficient marketing campaign running that consumes hundreds of thousands of dollars per year, the choice of what to deal with is pretty obvious.

Open Communication

Cost-saving measures can be unpleasant, so discussing their importance with employees and hearing their concerns in return is imperative. Upper management and the team in charge of cost reduction should communicate the company objectives and financial state directly to employees. If cost cuttings make sense, staff is more likely to meet the finance team halfway — even if the saving measures might be unpleasant or reduce employees’ financial comfort.

Look for Alternatives

Before eliminating an expense completely, consider whether there’s a more cost-efficient alternative. For instance, instead of terminating the office lease completely to save on rent, consider letting some employees work from home and subletting the extra office space until the company finances are in better shape.

Of course, there’s not always an alternative to be found, especially if we are talking about a strategic, long-term initiative to eliminate some costs completely. But in many cases, there are ways to deal with a short-term crisis before getting back on track.

Prepare for the Unexpected

There’s no guarantee that cost savings will happen as anticipated. Therefore, the cost reduction team should adjust plans to meet the savings goal even if setbacks happen. For instance, if the cost reduction target is to save 5%, it’s better to aim for 10% to make sure there is some buffer.

Conclusion

Achieving cost savings requires a comprehensive approach that involves identifying spending inefficiencies, implementing strategies to optimize such expenses, and monitoring progress.

Following the steps outlined in this article, you can find ways to streamline spending, minimize the company's expenses, and improve the bottom line. By taking a strategic approach to cost savings, you can achieve financial flexibility and adjust to market fluctuations, therefore ensuring business profitability and long-term success.

Frequently Asked Questions

The term “cost saving” refers to the steps taken to reduce the company’s expenses and increase the bottomline. Intentional cost savings, which are planned, regulated, and reflected in the financial strategies, are also called “hard savings.” Savings that come naturally, without intentional strategy, are called “soft savings.”

The key objective of cost-saving practices is to reduce the company expenses with minimal or no sacrifice of the product quality or performance level.

Companies can cut costs in various ways. For example, costs can be reduced by improving operational processes, making cost-efficient decisions about personnel, initiating work environment changes, upgrading technology, sourcing strategically, and so on.

Cost saving is about finding an efficient way to keep the expenses on the books but reduce their monetary value. Cost avoidance, however, refers to removing expenses completely from the budget.

Cost saving measures can help businesses sustain their profit margin and make it through challenging periods. Cost saving also helps to increase profitability without increasing the budget, or it can free up some cash in order to put funding elsewhere. Good cost-saving strategies also help companies stay competitive and adjust to the newest industry developments.