15 min read

Accounts Payable Outsourcing or In-House AP: Here’s What to Consider

Discover the benefits and drawbacks of accounts payable outsourcing and when in-house AP with automation is a better option.

Picture your company running smoothly, with seamless invoice processing, on-time payments, and strong relationships with preferred vendors. That’s the power of a well-managed accounts payable (AP) process. But what if handling those invoices, payments, and vendor interactions bog you down, stealing precious time and resources from the core business activities? That’s where accounts payable outsourcing can help.

Companies can lighten the load on their internal teams by entrusting AP tasks to a specialized provider. One of the most significant advantages of outsourcing accounts payable is cost savings. 57% of businesses say it’s their main reason for outsourcing, with labor costs reduced by up to 70%.

But is it always the best choice to outsource accounts payable? What are the alternatives? This article explores the pros and cons of outsourcing accounts payable and the key factors to consider when deciding whether to hand it off to a provider or keep it in-house with the help of AP automation software.

Scroll down to find out:

What is Accounts Payable Outsourcing?

The Advantages of Outsourcing Accounts Payable

Potential Challenges of Outsourcing Accounts Payable

Comparing Accounts Payable Outsourcing vs. Internal AP with Automation

Frequently Asked Questions

What is Accounts Payable Outsourcing?

Accounts payable outsourcing refers to partnering with third-party experts to manage some or all of your AP operations. Think of it as adding a skilled team to your back office without the hassle of hiring, training, and managing new staff.

After your internal team submits the required AP data, the provider steps in to manage critical tasks, including:

- Invoice Processing

The external team receives and reviews invoices, verifies details against purchase orders and receipts, resolves discrepancies, and ensures proper GL coding before routing documents for approval. They also manage exceptions, flag potential issues, and prepare invoices for timely payment. Therefore, accounts payable outsourcing helps businesses reduce errors and speeds up the entire invoice lifecycle.

- Vendor Management

While procurement managers focus on selecting and negotiating with vendors, your AP outsourcing partner can take care of the financial side of the relationship. They address payment discrepancies quickly and can keep vendors informed about payment statuses. Therefore, companies can maintain positive, productive relationships while freeing internal teams from the financial admin work involved in supplier management.

- Payment Disbursements

The AP outsourcing company can handle the entire payment process, from cutting checks to initiating wire transfers and managing digital payments. This ensures on-time payments, helping businesses avoid late fees and keep strong supplier relationships.

- AP Auditing & Compliance

While outsourcing can help streamline AP audits, choosing a provider who follows all legal and industry-specific regulations is essential. A reliable accounts payable outsourcing partner will maintain meticulous records, provide transparency during audits, and ensure adherence to compliance standards.

Depending on the company’s needs, it can transfer all or specific AP functions to an outsourcing team. For instance, a firm may choose to handle vendor communication internally while outsourcing tasks like PO invoice processing or preparing for audits.

Therefore, businesses can retain control over key processes while delegating repetitive tasks to the accounts payable outsourcing company. This approach frees up internal teams to focus on higher-level activities, such as financial analysis, strategic planning, and strengthening vendor relationships.

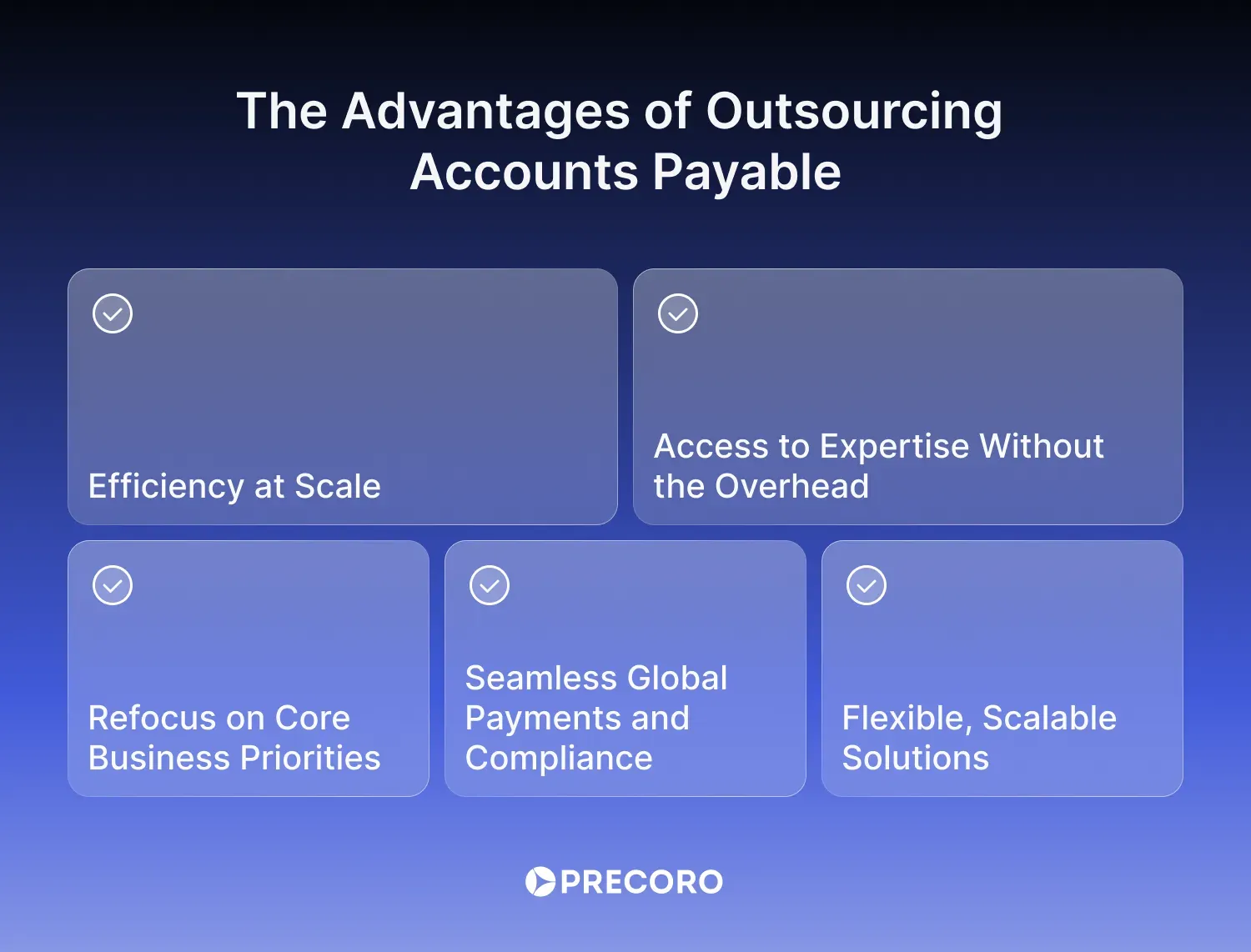

The Advantages of Outsourcing Accounts Payable

Outsourcing accounts payable services goes beyond mere task delegation. See how businesses can benefit from it.

Efficiency at Scale

Processing a ton of invoices can quickly become overwhelming, increasing the likelihood of errors, delays, or missed payments. However, account payable outsourcing providers are built to handle it all. With their skilled teams and automation tools, they can manage large volumes of transactions quickly and accurately. This means invoices get processed on time, vendors are paid promptly, and financial records stay spot-on.

Access to Expertise Without the Overhead

Managing AP in-house requires specialized knowledge and ongoing investment in hiring and training. Outsourcing accounts payable services provides instant access to experienced AP professionals who are well-versed in best practices, procurement compliance requirements, and industry-specific challenges. The best part is that companies can access all that without the added cost of maintaining an internal team.

Refocus on Core Business Priorities

Handling invoices, payments, and vendor management is highly important but doesn’t directly contribute to business growth. By choosing to outsource AP services, companies can free up their internal teams from these time-consuming tasks and focus on innovation, customer service, and expanding the business. This shift gives leadership and finance teams more time to make strategic decisions instead of getting stuck in operational bottlenecks.

Seamless Global Payments and Compliance

For companies working with international vendors, AP outsourcing simplifies multi-currency transactions, tax regulations, and compliance with foreign trade laws. A trusted provider ensures payments are processed accurately and in line with local regulations. As a result, there’s a lower risk of errors, penalties, and delays in cross-border payments.

Flexible, Scalable Solutions

Businesses with fluctuating AP volumes (whether from seasonal spikes or project-based work) can benefit from the flexibility of outsourcing. Unlike an in-house team with fixed capacity, an AP provider can adjust the level of service as needed. This means efficient processing during peak periods and cost reduction when operations slow down.

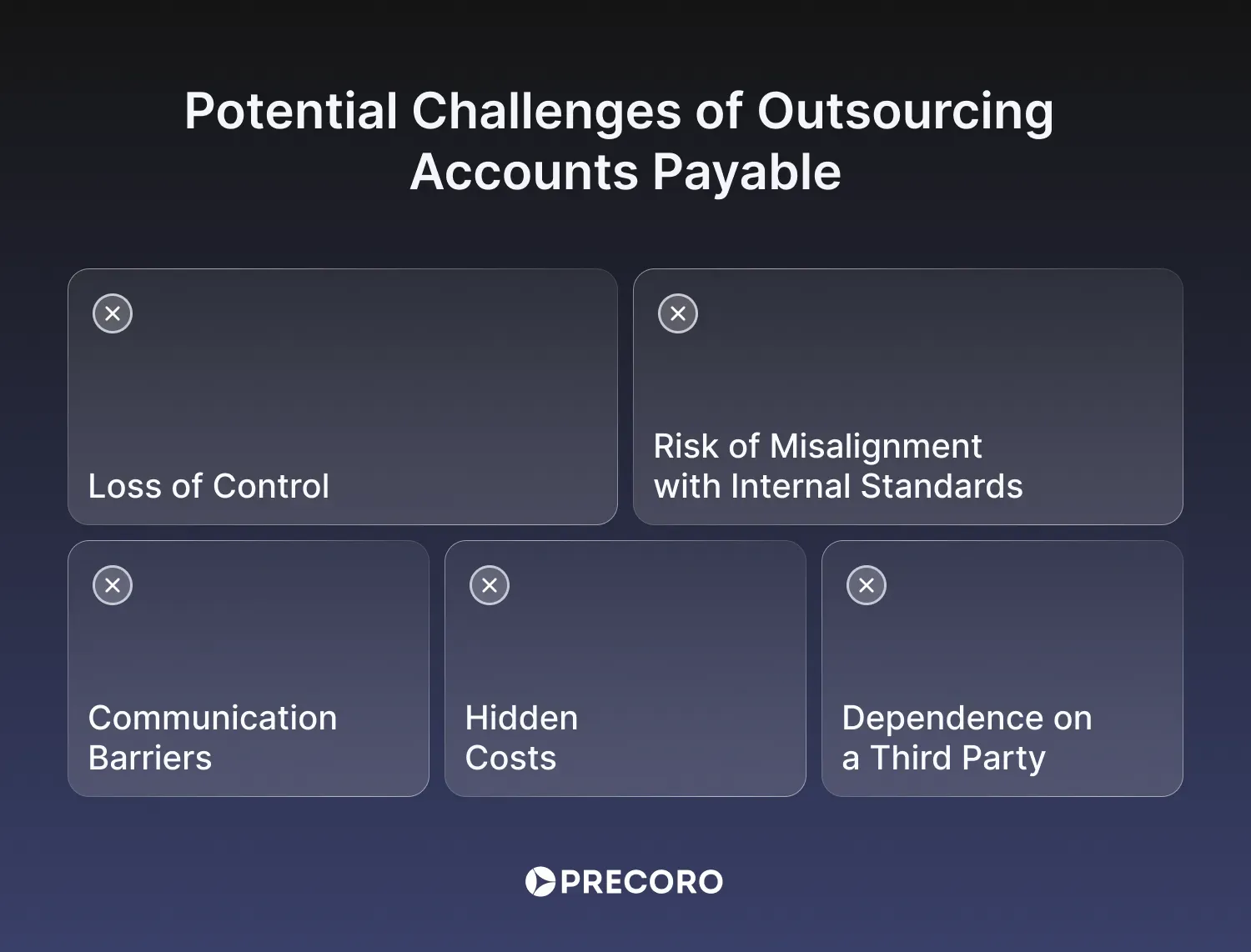

Potential Challenges of Outsourcing Accounts Payable

While outsourcing accounts payable has numerous advantages, businesses must be aware of these challenges and carefully weigh the risks before making a decision.

Loss of Control

One of the biggest concerns of outsourcing accounts payable is losing direct involvement in the process. AP impacts a company’s financial health and vendor relationships, so having control over it is key.

With an in-house team, you can directly access the AP process and quickly address issues or make payment decisions. If there’s a problem with an invoice or a vendor dispute, you can easily step in and resolve it. However, outsourcing accounts payable services introduces a layer of separation.

While providers offer reports and communication channels, it’s not the same as having your team right there to provide immediate updates or adjust processes on the fly. This lack of control can cause frustration, especially when you need quick insights into your AP operations or when issues arise that require swift action.

Risk of Misalignment with Internal Standards

Another great risk when outsourcing accounts payable services is the potential misalignment between your internal standards and the provider’s processes. Even if the provider is experienced and efficient, they may not fully understand the nuances of your company or industry. For example, complex invoicing requirements (e.g., special payment terms with certain vendors or specific tax codes) might not be handled as you expect without clear, ongoing communication and input from your side.

Given that AP outsourcing providers manage accounts for multiple clients, they can approach your accounts payable tasks with a “one-size-fits-all” model. This can create inefficiencies, such as overlooking crucial approval steps or applying payment terms that don’t align with your contracts.

Communication Barriers

Communication can be a real challenge when outsourcing AP to providers in different time zones or locations. Delays or misunderstandings can significantly slow down the AP process. This is especially true for time-sensitive tasks like payments. If your outsourced team is overseas, language barriers, cultural differences, and varying business hours can make things even trickier.

Hidden Costs

A key reason many businesses choose to outsource accounts payable is to reduce costs. However, it’s important to be mindful of potential hidden fees that could offset those savings. What initially seems like an attractive outsourcing agreement can quickly lose its appeal if unexpected charges arise. These fees might include:

- Transaction-Based Payments

While the base service fee might seem reasonable, some providers charge per transaction. These costs can add up quickly, especially if you have a high volume of invoices or payments.

- Exception Handling

Invoices that fall outside of the standard process (those with discrepancies or requiring special approvals) often incur additional fees for “exception handling.” They can be difficult to predict and tend to add up quickly if your AP process has many exceptions.

- Data Storage and Retrieval

Some accounts payable outsourcing companies may charge fees for storing your AP data and for retrieving it when needed. These costs might not be noticeable initially but can become significant over time.

- Support Fees

Typically, basic support is included, yet extensive requests often come with extra fees.

- Currency Exchange

When dealing with international vendors, be aware of potential currency exchange fees. They can vary depending on the provider and the exchange rates.

Dependence on a Third Party

In the long run, relying on an external provider can be risky. What happens if your account payable outsourcing partner faces financial struggles, experiences high employee turnover, or even goes out of business? These scenarios can disrupt your AP process, leading to delayed payments, strained vendor relationships, and administrative headaches.

As time goes on, your AP outsourcing provider may change their pricing or service terms. If these changes are significant, you could end up paying more for the same services or having to adapt to new ways of working. This can be tricky, especially if you’re tied to a long-term contract.

Additionally, as you become more reliant on the provider’s systems and processes, switching to a different outsourcing company or bringing the AP function back in-house can become increasingly difficult and expensive. This “vendor lock-in” limits your options and makes your company more vulnerable to price increases or changes in service quality.

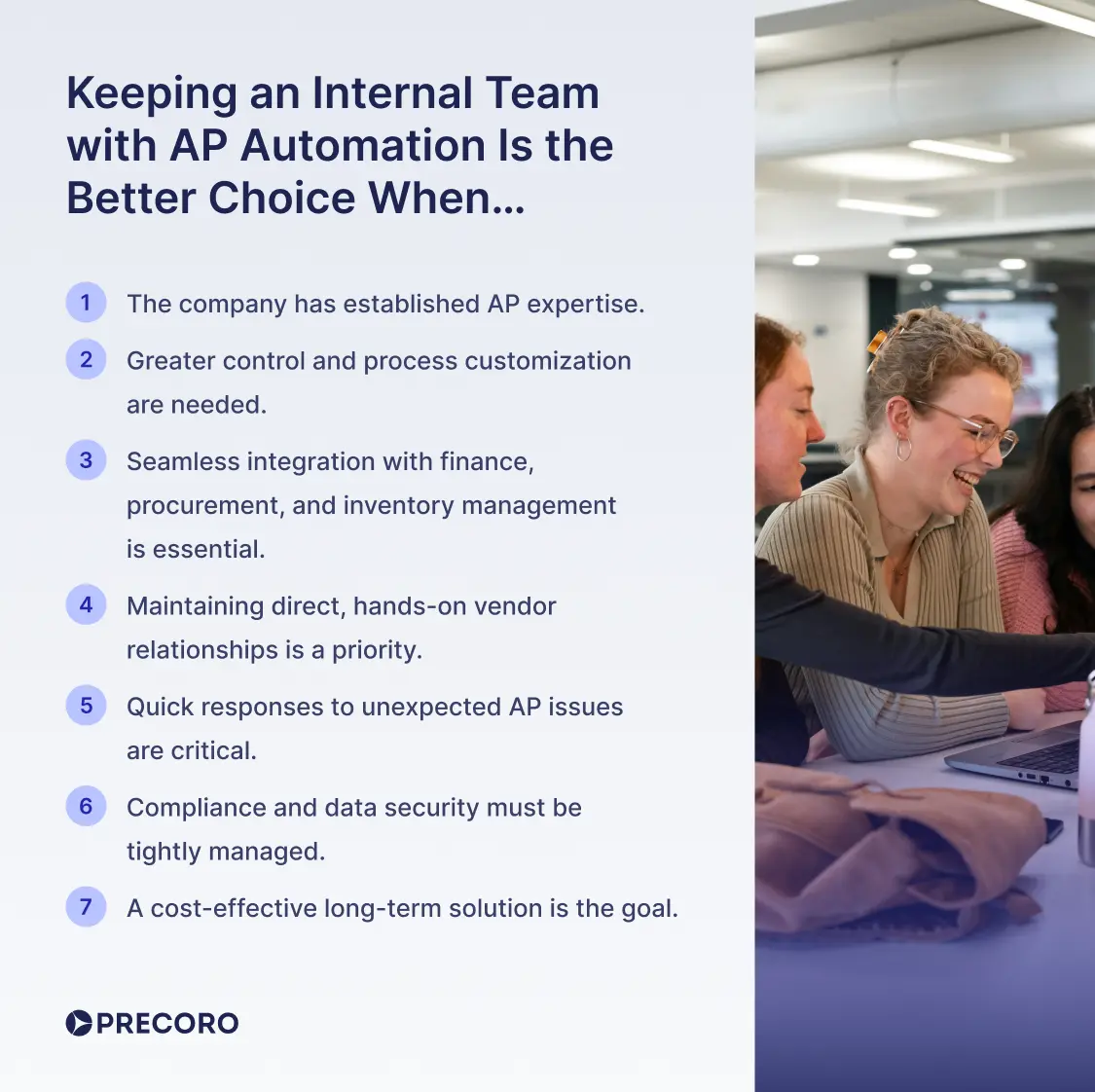

When an Internal Team + AP Automation Is the Better Choice

Pairing internal specialists with AP automation software is a strategic move for businesses with established AP resources. It offers superior control over company-wide expenses, adaptable processes, and demonstrable cost savings. Here’s when organizations are better off keeping AP in-house rather than turning to accounts payable outsourcing.

Established Internal Expertise

If your company has experienced AP specialists who understand your operations inside and out, automation can take their efficiency to the next level. Instead of wasting time on manual invoice entry and verification, they can offload repetitive tasks to the software while maintaining full visibility over the AP process. As a result, your team can focus on high-impact work like financial analysis and cash flow forecasting.

Desire for Control and Customization

Some businesses like to keep the reins firmly in their hands when it comes to accounts payable. With an internal team and AP automation software, you get the freedom to tailor the system to fit your unique business needs.

Whether it’s customizing approval workflows or tweaking vendor payment terms, you can shape the process to work exactly the way your company does without having to adapt to a third-party provider’s rules. This also means you can make real-time adjustments and improvements whenever necessary, unlike the limited control that comes with outsourcing accounts payable services.

High-Level Integration with Other Business Functions

When your accounts payable process requires close integration with other departments like finance, procurement, or inventory management, keeping it in-house with AP automation is the most effective choice. AP automation tools can seamlessly connect with other internal systems, allowing smooth data sharing and coordination between teams.

For instance, invoices added to the procurement software can be automatically transferred to the accounting system, ensuring accuracy and preventing errors. This integration helps departments collaborate in real time, making it easier to spot discrepancies, adjust payment schedules, and maintain consistency across processes.

Vendor Relationships and Negotiations

If your company relies on strong, direct vendor relationships, keeping AP in-house is the better choice. Your internal team is likely to have better, long-term rapport with key suppliers and vendors and an established supplier management lifecycle.

Having direct control over invoices and payments enables a company to maintain these relationships and respond more effectively to vendor queries, concerns, or disputes. Moreover, when an internal AP team has greater visibility into invoice processing, they can better support procurement managers in negotiating more favorable terms with suppliers.

Rapid Response to Unexpected Issues

When an urgent issue arises, time is often of the essence. If a problem isn’t resolved quickly, it could cause a ripple effect throughout the business, impacting liquidity, vendor relationships, and overall operational efficiency. In-house AP teams with automation tools can resolve issues swiftly, ensuring that payments are made on time, vendors are happy, and business operations run smoothly.

Accounts payable outsourcing providers, especially those with less flexible approaches or slower response times, may not be able to mitigate disruptions in the same way. Additionally, they may not have the authority to make decisions on your company’s behalf and may require approvals from higher-ups, causing delays. This can result in strained supplier relationships and even potential legal or financial penalties that could harm your organization.

Compliance and Security Needs

Compliance and data security are top priorities for businesses, especially those operating in highly regulated industries like healthcare, finance, or government. By keeping the AP process in-house and utilizing reliable AP automation software, you retain full control over how sensitive financial data is managed. This ensures compliance with important regulations (such as HIPAA, SOC 2, GDPR, and CCPA) and your internal security protocols, reducing the risk of violations and penalties.

Cost-Effectiveness in the Long Term

AP automation might require a bit more investment upfront, but for businesses with steady or predictable transaction volumes, the long-term payoff is well worth it. Once it’s set up, an AP system streamlines repetitive tasks and reduces errors in invoice processing.

This leads to a more efficient process, lower operational costs, and fewer costly mistakes. In fact, companies using AP automation report an 81% drop in processing costs and a 73% boost in invoice processing speed.

Comparing Accounts Payable Outsourcing vs. Internal AP with Automation

Businesses must weigh several factors when deciding between accounts payable outsourcing and maintaining an internal AP team with automation.

Cost Comparison

Outsourcing accounts payable services typically follows a variable pricing model, with companies paying either a monthly or yearly fee or a per-transaction charge. The monthly or yearly payment structure can provide predictable costs, making it ideal for businesses with high transaction volumes. However, while the pricing might seem straightforward, there could be hidden fees for additional services or support, making it more expensive than expected. Therefore, for companies with complex AP needs, those costs can add up quickly.

On the other hand, relying on an internal team with AP automation software does come with higher initial costs (mainly for the software setup and training). However, once the AP automation system is fully implemented, the ongoing costs tend to be lower compared to outsourcing. This is because the software takes over many of the repetitive tasks that would otherwise require additional staff or external service providers. So, in the long run, it’s a cost-effective solution.

Scalability

Account payable outsourcing tends to be more scalable in the short term because the service provider can easily adjust to increases or decreases in transaction volumes. There’s no need to hire additional staff or overload internal resources; the outsourcing partner can simply ramp up or down as needed.

With internal AP and procurement automation, scalability depends on your team’s size and the capabilities of the automation software. With Precoro, for example, it’s easy to set up new users, more complex approval workflows, or advanced features like AI-enhanced OCR for fast invoice registration. However, for businesses anticipating rapid growth, the scalability of in-house AP may be slower than outsourcing.

Control and Customization

At some point, outsourcing accounts payable becomes a trade-off: you gain efficiency but sacrifice some control over your processes. While many providers offer some level of customization, you’re typically limited in how much you can adjust the workflow to suit your company’s needs.

When changes are necessary, they typically require negotiation with the provider, which may not happen as quickly as you’d like. This lack of agility can be a challenge, particularly for businesses with evolving or specialized requirements that demand regular updates or rapid modifications to the process.

With internal AP teams and automation, you maintain complete control over the process. It’s fairly easy to customize workflows, approval processes, and reporting to match your specific business requirements. Internal teams also have the flexibility to adjust processes quickly in response to changes in the business environment.

Speed and Efficiency

Accounts payable outsourcing can quickly address inefficiencies by bringing in specialized expertise and proven processes. This is especially beneficial for businesses that need immediate relief or want to quickly streamline their AP functions without the time and effort for building an internal system.

With AP automation, the speed and efficiency depend on how well the system is set up. Once the software is implemented and workflows are optimized, automation significantly speeds up the AP process by reducing manual work and accelerating approval times. However, the initial setup phase can take time and resources, which might delay seeing the full benefits of efficiency.

Data Security and Compliance

When it comes to security and compliance, accounts payable outsourcing can introduce some risks. While many outsourcing providers have strong security measures in place, there’s always that little worry about third-party vulnerabilities or compliance issues, especially with cross-border transactions.

Keeping AP in-house with automation gives businesses more control. You can implement your own security protocols, ensure sensitive data is handled according to your policies, and stay on top of industry-specific regulations. The risk of data breaches or non-compliance is lower since the data stays within your company’s infrastructure.

Frequently Asked Questions

Yes, many businesses choose to outsource accounts payable to third-party service providers. Outsourcing AP allows businesses to offload time-consuming administrative duties and gain access to specialized expertise without the need for in-house resources. It’s particularly beneficial for companies with high transaction volumes and limited internal capabilities.

Businesses outsource accounting to:

- Save costs by avoiding the expense of hiring, training, and maintaining an internal team.

- Gain access to specialized knowledge and efficient management of financial processes.

- Free up internal resources to concentrate on core business activities.

- Scale financial operations easily as the business grows without adding staff.

- Reduce risks related to taxes, audits, and financial reporting

Outsourcing is a great way to save time and reduce the workload on internal teams. However, this convenience comes with certain risks. They include data security concerns, lack of internal control over the financial operations, and potential provider instability.

The cost of outsourcing accounts payable services varies widely depending on factors like the complexity of the business’s AP needs, the volume of transactions, the scope of services required, and the provider chosen. Some outsourcing firms charge per transaction, while others may offer monthly or annual pricing packages. On average, businesses can expect to pay anywhere from a few hundred to several thousand dollars monthly for AP outsourcing services.

Is Accounts Payable Outsourcing the Answer to Your Needs?

In the end, whether you choose to outsource AP services or keep them in-house with automation comes down to what’s most important for your company. Consider factors like your budget, how much control you want over the process, scalability, and your data security needs. Each option has its benefits, so it’s about finding the right fit for your priorities.

Accounts payable outsourcing is great when businesses need quick, scalable solutions. It’s particularly beneficial for those facing high transaction volumes, limited internal resources, and global vendor networks. By outsourcing, businesses can quickly adapt to fluctuating workloads, reduce the strain on in-house teams, and ensure smooth operations without the need to invest in additional staff or infrastructure.

Maintaining an in-house accounts payable team with AP automation software allows businesses to tailor the process to their needs and make real-time adjustments. In the long run, it’s also more cost-effective for companies with stable transaction volumes, as the upfront costs of software and setup quickly pay off through lower operational expenses.

Accounts payable automation is a great fit for businesses with internal expertise or those that require seamless integration with other departments. Moreover, for companies in highly regulated industries, AP automation offers enhanced control over sensitive financial data and can ensure compliance with stringent security standards.