10 min read

5 Ways to Improve Finance Operations for SMBs

Small and midsize businesses are, while fragile, also in a perfect spot for growth. The durability and chances of success of an SMB often depends on the efficiency of its finance department, so let's talk about some of the strategies to improve finance operations for such companies.

As mentioned in Forbes Advisor, recent data from the U.S. Small Business Administration reveals that approximately 33.3 million businesses in the United States qualify as small businesses, making up 99.9% of all U.S. businesses and employing around 61.6 million people. In the EU, small and midsize enterprises represent 99% of businesses and employ nearly 100 million people. Such companies are, indeed, the backbone of economies, as they are often referred to.

Yet only about 80% of SMBs survive the first year, about 70% make it through the second year, and just around 50% of such businesses survive the fifth year. The survival rates depend on country, industry, and current market conditions, but these general trends are observed globally. One of the key factors influencing these statistics is financial management.

Managing financial operations is important for every business, but it can be absolutely crucial for small and midsize businesses. SMBs often face challenges like limited resources and financial constraints. They have to navigate the nuances of market dynamics on tight budgets and be extremely conscious of every dollar spent. This doesn't necessarily mean that SMBs have to cut all of their costs as low as possible, but they do have to be extra conscious about financial operations.

In this article, we'll explore 5 effective strategies that SMBs can implement to gain control over their financial operations and improve them. Keep reading to find out more:

- What are finance operations?

- What is financial operations management?

- Finance operations activities

- 5 strategies for efficient finance management

- FAQs

What Are Finance Operations?

Finance operations, also known as financial operations or FinOps, are activities and systems necessary for processing and tracking financial resources and transactions. These activities and systems are crucial for ensuring an organization’s financial health and durability, planning efficiently, achieving strategic objectives, and creating long-term business value.

What Is Financial Operations Management?

Finance operations are typically managed by the finance department. Some small and midsize businesses don’t have a separate finance department but dedicated employees who undertake the task of managing FinOps.

Finance operations management refers to overseeing and optimizing the various activities within an organization's finance department. It considers both daily operations and strategic initiatives — from overseeing accounting procedures and data analysis to financial forecasting and budgeting.

Management of the company's financial operations requires strong leadership, experience, analytical skills, a deep hands-on understanding of financial principles, and familiarity with the best practices the company has already adopted.

Areas of Finance Operations

Finance operations include a wide range of activities, including but not limited to the following:

Accounting and Bookkeeping

First and foremost, financial operations include recording transactions as journal entries, maintaining accurate records in the general ledgers, and preparing financial statements like balance sheets or income statements. Those responsible must also define controls and conduct internal audits to identify potential errors and prevent intentional fraud.

Accounts Payable (AP) and Receivable (AR)

A big part of financial operations is keeping track of what the company expects to pay – its liabilities – and what it expects to receive. These are known as accounts payable (AP) and accounts receivable (AR), and managing them is an important aspect of finance operations.

Accounts payable are payments the company owes, typically to suppliers, vendors, and creditors. The AP department processes invoices, verifying the accuracy of bills, and making timely payments to optimize cash flow while maintaining good relationships with suppliers.

Accounts receivable include incoming money the company will receive from customers, clients, or other entities. Operations within the AR department include invoicing customers, tracking outstanding payments, following up on overdue invoices, and managing collections to ensure timely payments.

Payroll

Another component of the financial operations is payroll, the process of administering payments to employees for the job they do.

It is a big part of regularly incurred costs for any company, and a dedicated team of accounting professionals is typically responsible for carrying out this function. Payroll doesn’t include only issuing the paychecks, but also keeping track of worked hours, vacations, sick leave and time off, available benefits, tax withholdings etc. To simplify the process, many businesses use tools to generate professional pay stubs, ensuring accuracy and compliance with tax requirements.

Treasury Management

This agenda of finance involves cash flow management and managing the company's assets while ensuring the organization’s liquidity.

Treasury management may involve cash forecasting, monitoring cash flows, and investing excess cash. It also includes investment planning and managing relationships with banks and other financial institutions. Financial risk assessment and mitigation is another activity that falls under treasury management. These risks are typically related to foreign exchange, interest rates, and liquidity.

Financial Planning and Analysis (FP&A)

Finance operations also require analyzing past and current financial performance, forecasting future balances, and developing budgets that align with business objectives. This is also known as FP&A. As a part of FP&A, the finance team prepares documents such as income statements, balance sheets, and cash flow statements.

Financial analysis is vital for assessing an SMB's health and making informed business decisions. The finance department provides insights and recommendations to the stakeholders to support decision-making at both operational and strategic levels. Most importantly, they have to ensure the accuracy and integrity of financial data in order to base future financial planning on it.

Budgeting and Forecasting

Finance operations managers are also responsible for developing objectives for the finance department and overseeing how they are implemented. These objectives should align with the overall goals of the organization, so finance managers need to have a good understanding of operational processes and cross-departmental dependencies within the company.

By working closely with other departments, finance can get a holistic understanding of the company’s goals and capabilities, and managers can set realistic financial targets, allocate resources effectively, and define relevant key performance indicators (KPIs).

Financial Compliance and Regulatory Reporting

Another agenda that falls under financial operations includes preparing and filing financial reports with regulatory authorities and ensuring compliance with accounting standards (such as Generally Accepted Accounting Principles, or GAAP).

Finance operations managers ensure compliance with financial regulations, accounting standards, and internal policies and procedures. They oversee regulatory reporting requirements, such as filings with government agencies and regulatory bodies, and ensure that the organization operates within legal and ethical guidelines.

Financial Performance Analysis

The finance department also regularly provides stakeholders with recent data to evaluate the company’s profitability and efficiency. Financial performance analysis is required to benchmark the company against the competition on the market and evaluate whether internal organizational benchmarks are met.

Performance criteria and benchmarks are unique for every industry and market. Finance management strives to follow the general market tendencies and competition in order to notice any trend or disruptions in time and adjust proactively. By following the newest technology developments, financial specialists can also visualize several potential future scenarios of market development and ensure that the business is prepared for them.

Process Improvement

Last but not least is a financial operations agenda that is not always obvious, but nevertheless important for the overall company’s performance: process improvement. The financial success of an organization depends greatly on the efficiency of internal processes. Clear, transparent, and error-proof workflows are key for maximizing operational cost efficiency and minimizing financial losses.

As a part of their workload, finance operations managers search for ways to streamline processes within the financial department. This may involve different approaches and priorities based on the company’s size and industry. For instance, SMBs might need to prioritize minimizing employee headcount while maintaining the production tempo. Some objectives, however, are usually relevant for financial teams of all types of businesses. For instance, enhancing data accuracy and increasing productivity.

Finance operations play a crucial role in the long-term success of SMBs. With accurate finance data, companies can ensure compliance with business regulations and adjust their spending to the market reality. With well-managed FinOps, businesses can not only minimize potential financial risks, but they can also identify opportunities for cost-efficient business development and growth. This is important for ensuring the financial health and sustainability of the business.

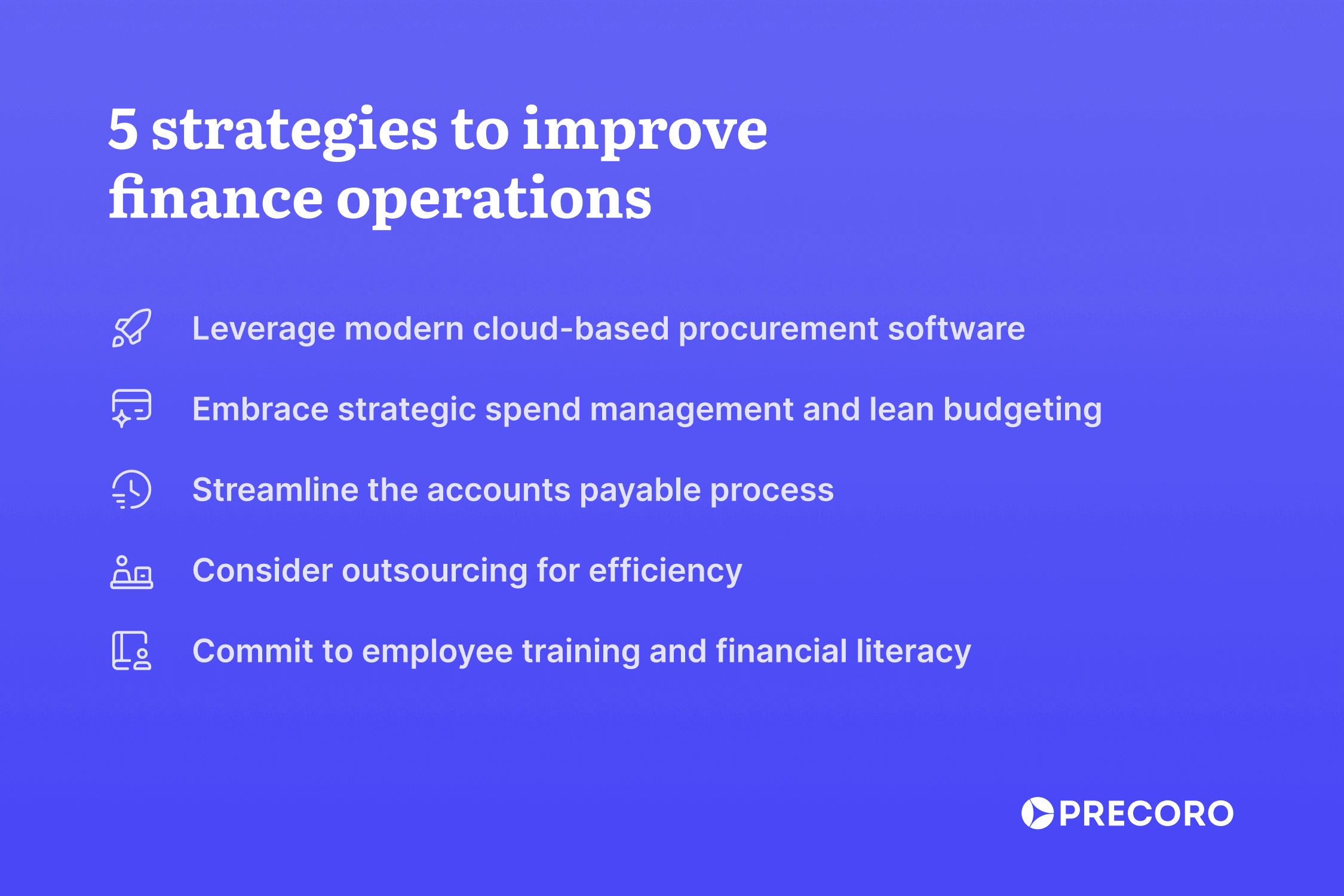

Consider These Five Strategies

Let's look at some strategies that CFOs and other stakeholders of small and medium businesses can introduce to improve their finance operations.

Leverage Modern Cloud-Based Procurement Software

One of the most impactful ways for SMBs to improve their overall financial operations is by optimizing their procurement process. After all, purchases are a large part of company finances.

By implementing cloud-based procurement software, SMBs can centralize their purchasing processes and data on one secure platform and thereby improve visibility of overall finances. A key feature of procurement tools is that they let departments set budget limitations and ensure they are met. Software also lets companies automate their purchasing processes, from issuing purchase requisitions all the way to approving invoices, in order to reduce manual errors, speed up timelines, and see better spend patterns.

Furthermore, cloud-based procurement software enables SMBs to leverage data for analytics and gain useful insights into spending patterns, supplier and vendor performance, and cost-efficiency of procurement processes. By harnessing the power of data-driven insights, SMBs can prepare more accurate financial projections and purchasing plans, and therefore negotiate better deals with their vendors and suppliers.

Finally, modern procurement software like Precoro is flexible and scalable, allowing SMBs to adapt their workflows to changing business needs while growing. With the ability to add modules when needed, Precoro is easily scalable as the organization grows, which means there's no need to invest in complicated software upfront.

Embrace Strategic Spend Management and Lean Budgeting

Strategic spend management is crucial for any organization's financial operations. As for SMBs, approaching spending strategically allows room for variation in business strategies, and the ability to quickly implement changes when needed.

By analyzing their spending patterns and identifying areas for improvement, SMBs can maximize their purchasing efficiency and minimize unnecessary expenses. Some strategic spend management practices include consolidating suppliers, renegotiating contracts regularly, and adopting cost-saving initiatives such as bulk purchasing or inventory optimization.

Another way to strategize spending is to implement lean budgeting, which prioritizes expenditures that are essential for the business to continue operating. To do so, SMBs have to continuously scrutinize their expenses and eliminate anything that doesn't contribute to the company's growth. Accordingly, with lean budgeting, funds can be flexibly reallocated to areas with high business value and returns.

Streamline the Accounts Payable Process

Every type of business, from the smallest startup to a well-established corporation, has to process accounts payable. From receiving and recording the invoice to issuing the payment, every step of the AP process can be quite time-consuming if executed manually.

By automating the AP process, SMBs can digitize invoice processing, automate approval workflows, and implement payment schedules. These practices help businesses avoid late payment penalties, build good relationships with suppliers, and potentially negotiate better deals in the future. Additionally, AP process automation reduces the risk of duplicate invoices and provides real-time visibility into invoice status and payment history, enabling companies to track expenses and manage cash flow more efficiently.

Consider Outsourcing for Efficiency

When it comes to SMBs, it can make sense to outsource some of the tasks. Handling all operational tasks inhouse can stretch resources of a smaller company thin, while bringing no real additional value.

By outsourcing non-core financial operations, for instance tax preparation, compliance auditing, or payroll, businesses can benefit from professional expertise without paying for the full-time staff. In the case of SMBs, outsourcing some of the finance activities can help dedicate resources to those that drive revenue.

Commit to Employee Training and Financial Literacy

Providing training for employees is crucial for improving efficiency of financial operations, especially in SMBs with a small number of employees. This is because many SMBs lack dedicated finance teams and rely on multifunctional specialists to manage financial tasks. By investing in comprehensive training programs and learning resources for employees, smaller organizations can empower their finance employees with the knowledge and skills they need to effectively manage the various tasks of finance operations.

Financial literacy training can cover various topics, such as budgeting, financial analysis, risk management, regulations and compliance etc. By dedicating time and resources to the employees' financial literacy, companies can foster a culture of loyalty and a growth-oriented work environment. Ultimately, this will bring long-lasting benefits, such as creative cost-saving solutions, operational accountability, greater transparency, and general understanding of financial success.

Good Finances, Better Longevity

Improving finance operations is essential for SMBs looking to ensure sustainable growth and stability in a competitive business environment. From core financial operations like bookkeeping and accounting and all the way to complex budgeting forecasting, SMBs can benefit greatly by ensuring that every process is as efficient as possible. It's relevant for organizations across different industries, whether it's a construction business, renewable energy sector, hospitality, healthcare or other industries.

To optimize their financial operations and position themselves for long-term success, SMBs can consider implementing dedicated tools like e-procurement software, embracing strategic spend management and lean budgeting, and focus on streamlining accounts payable. In some cases, they can outsource some finance operations to avoid draining internal resources. And finally, SMBs should invest in employee training for the most professional outcome when it comes to financial operations.

FAQs

Finance operations refer to activities and systems necessary for processing and tracking a company’s financial resources and transactions. These activities and systems are crucial for ensuring an organization’s financial health and durability, planning efficiently, achieving strategic objectives, and creating long-term business value.

The financial operations manager oversees and optimizes the various activities within an organization's finance department, including both daily operations and strategic initiatives — from overseeing accounting procedures and data analysis to financial forecasting and budgeting.