10 min read

Five Foolproof Ways to Shorten the Cash Conversion Cycle

How do companies improve their cash flow and liquidity? By shortening the cash conversion cycle! There are five main tips you should know.

According to The J.P. Morgan Working Capital Index 2020, there is significant capital trapped in the form of working capital that can become a vital source of additional liquidity for corporations. But how can companies unlock this capital?

The answer lies in their cash conversion cycles. By learning how to calculate it and change it to their advantage, companies can accelerate cash inflow and free up money that would otherwise be tied up in inventory. Money that becomes available after all current liabilities are accounted for – or “released working capital” – can then be used for various purposes, such as covering operational expenses, investing in growth opportunities, or improving overall liquidity.

A well-managed cash conversion cycle contributes to liquidity and enhances a company's spend management. Let’s take a closer look at what the cash conversion cycle is and explore actionable tips for improving it.

Keep reading to find out about:

- What does the cash conversion cycle mean?

- How do you calculate the cash conversion cycle formula?

- How do you shorten the CCC?

- Frequently Asked Questions

What does the cash conversion cycle mean?

The cash conversion cycle (CCC), also called the net operating cycle, is a metric used to measure the efficiency of a company's cash management and liquidity. The cash conversion cycle is represented as a period of time that indicates how long it takes a business to turn its investments in inventory into money from customers.

In general, if a company has a long CCC, it indicates that it is either locking its resources in inventories or taking a very long time to collect payments from customers, which can lead to:

- Difficulties in fulfilling short-term obligations like paying suppliers and meeting operational expenses.

- Higher chance of heavy reliance on external financing sources, such as loans or credit lines.

- Lower profitability due to delays in the receipt of cash from sales.

- Negative impact on the company's stock price, credit rating, or ability to attract investment, as investors and creditors often assess the CCC.

The cash conversion cycle is a significant financial metric for retailers and manufacturing companies involved in buying and managing inventories and selling them to customers. All such businesses have a positive cash conversion cycle. However, software firms, insurance companies, and brokerage businesses have a negative cash conversion cycle because they realize sales without heavily relying on inventory.

For example, Shin and Tucci compared performance efficiency between Wal-Mart and its competitors and found that the company has significantly better ratios for days in inventory, inventory-sales ratio, and CCC. Wal-Mart maintains a negative CCC due to its practice of settling supplier payments after products are sold. This approach allows the company to leverage suppliers for inventory financing instead of relying heavily on conventional bank credit lines.

How do you calculate the cash conversion cycle formula?

The cash conversion cycle is calculated quarterly or yearly by adding the days inventory outstanding (DIO) to the days sales outstanding (DSO) and then subtracting the days payables outstanding (DPO). Thus, the cash conversion cycle formula is:

CCC = DIO + DSO - DPO

Let's look at what each component means:

- Days inventory outstanding measures the average number of days it takes for a company to sell its inventory. The formula is:

DIO = (average inventory / cost of goods sold) * 365

Where:

Average inventory is the average value of inventory over a specific period (for example, a year).

Cost of goods sold (COGS) is the total cost of producing or purchasing the goods sold during the same period.

- Days sales outstanding determines the average number of days it takes for a company to collect payments from its customers after a sale has been made. The formula is:

DSO = (average accounts receivable / total credit sales) * 365

Where:

Accounts receivable is the total amount of money owed to the company by its customers.

Total credit sales is the total value of sales made on credit during the same period.

- Days payable outstanding identifies the average number of days a company takes to pay its suppliers for the purchased goods and rendered services. The formula is:

DPO = (average accounts payable / total purchases) * 365

Where:

Accounts payable is the total amount the company owes to its suppliers.

Total purchases is the total value of purchases made on credit during the same period.

Suppose a hypothetical company has a DIO of 80 days, DSO of 35 days, and DPO of 40 days. Its cash conversion cycle is calculated in the following way:

CCC = 80 + 35 – 40 = 75 days

It's crucial to understand that there isn't a "standard" or "one size fits all" cash conversion cycle. Instead, it depends on aspects like the industry, supply chain dynamics, and business model. For instance, retail enterprises typically have shorter CCCs because of their high inventory turnover rates and rapid sales cycles. Conversely, industries with longer production lead times or complex supply chains tend to have longer CCCs.

Thus, the best strategy for companies is to benchmark their cash conversion cycle against their historical performance and competitors in their industry. If they notice that their CCC is longer than that of their competitors, some optimization and improvements might be needed.

The European Journal of Accounting, Auditing and Finance Research released a study showing that 51.2% of the respondents from small and medium businesses said they “strongly agreed” that the duration of the company's CCC has a substantial influence on profitability, while 39.5% “agreed” on the same. When asked if shorter cash conversion cycles are better than longer ones, 39.5% of respondents “agreed,” while 46.5% of respondents “strongly agreed.”

The key takeaway? The shorter the cash conversion cycle, the better. A lower CCC implies that a company fulfills all payables on time and has a cash surplus to invest in other opportunities, and that's what all organizations strive to achieve.

How do you shorten the CCC?

As the business's cash conversion cycle is ultimately determined by inventory, sales, and payables, the secret to making it shorter lies in these factors. Let's dive into the most effective ways to reduce it.

1. Optimize inventory management

The longer it takes for a company to sell its inventory, the longer its CCC is. Thus, one of the most straightforward ways to reduce the cash conversion cycle is to turn over inventory faster. Usually, this involves implementing a just-in-time (JIT) inventory management method, where supplies are ordered as needed.

However, it's important to keep in mind that while JIT helps prevent overstocking, it can result in supply shortages when adopted hastily. The best practices for implementing the JIT method include:

- Conducting demand forecasting based on historical data, market trends, and clear communication with customers.

- Having several suppliers for critical components or materials to reduce the impact of a supply disruption from one source.

- Maintaining some safety stocks or buffer inventories (as a general guideline, the safety stock amount should be the amount of inventory used per day multiplied by the lead time in days).

- Regularly monitoring inventory levels.

Additionally, it may be helpful to consider that holding onto slow-moving inventory incurs additional costs such as storage, insurance, and potential obsolescence. Companies can free up cash by selling inventory, even if it means offering a discount.

2. Collect payment more quickly

How quickly the customers pay directly impacts the company's cash conversion cycle (remember days sales outstanding from the formula?). So, an effective strategy to shorten the CCC is to collect accounts receivable quickly. Here are some tips on how to optimize the cash collection process:

- Negotiate the shortest possible payment terms with the customers so they don't just slack off and miss due dates. You may even request upfront payments or deposits and start billing as soon as information comes in from sales.

- Offer a small discount as an incentive for early payments. For example, say 5% if a bill is paid within 10 instead of 30 days or a 3% discount if the customer pays within 30 days instead of 60.

- Keep credit terms for customers at 30 or fewer days. You can also offer improved credit terms to consumers who consistently pay in full and on time.

- Speed up the delivery times to increase customer trust, move your inventory quicker, and motivate clients to pay faster. You can also promise faster delivery, specifically for customers who pay their invoices in full and on time.

- Simplify your invoices to include only the necessary information and make them easy to follow and understand. That way, clients don't spend extra time processing and analyzing the invoices.

Remember to maintain control of past-due receivables because the likelihood of recovering them decreases over time. Ensure you have a procedure to monitor unpaid bills and immediately follow up on unpaid customer invoices.

3. Don't pay your invoices right away

While prompt client payments are important, adopting the same urgency for vendor payments might not serve your financial interests. Meeting payment deadlines is crucial, but avoid settling invoices early, especially when there are no incentives to do so. To extend your DPO and effectively shorten your cash conversion cycle, consider these strategies:

- Align your payment schedule with invoice due dates, ensuring payments are made as close to the deadline as possible.

- Negotiate extended payment terms with suppliers.

- Implement a robust invoice approval process to prevent any unnecessary delays.

- Leverage early payment discounts only when they genuinely benefit your cash flow.

The J.P. Morgan Working Capital Index 2020 has shown that in 53% of all studied companies that shortened their CCC, 67% did so thanks to improving their DPO. Interestingly, larger corporations demonstrated stronger DPO due to their heightened bargaining influence, which allowed them to pay suppliers later.

4. Improve your vendor management

Enhancing your supply chain's operational efficiency is critical to shortening lead times and boosting inventory turnover rates. A surefire strategy to slash your cash conversion cycle involves fine-tuning your production processes through reliable partners. Consider this: if you can count on a vendor to deliver as promised, the lag time between inventory arrival and its sale diminishes. This is especially critical for just-in-time inventory management, where early ordering is minimal.

It's also crucial to highlight the role of financially robust suppliers as your safeguard against supply chain disruptions that could otherwise chip away at your revenue streams. Thus, carefully evaluate vendor financial health and stability before signing a contract. Moreover, give proper attention to nurturing open communication. Your expectations concerning deliveries and payment terms should be transparently communicated to suppliers.

5. Implement specialized software

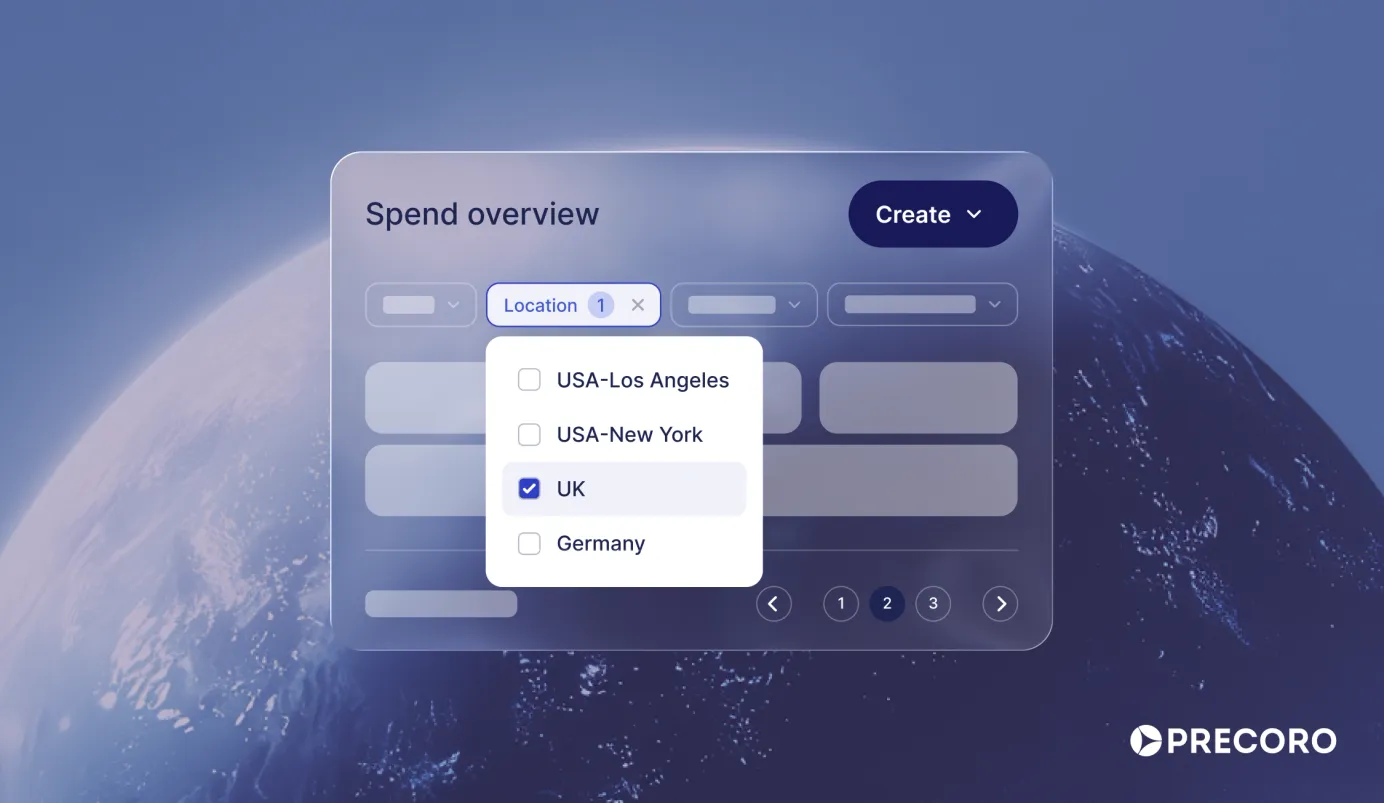

Embracing technology offers a strategic advantage in effectively shortening the cash conversion cycle. While choosing the right software solution for your company, make sure it has the following helpful capabilities:

- Inventory management with seamless tracking of stock levels and orders in real time. This dynamic visibility ensures that you maintain optimal product availability without falling into the trap of overstocking.

- A feature for supplier management that lets companies store contracts and supplier details. Ideally, it should also let suppliers directly access the tool in order to communicate, attach documents, and provide their item catalogs.

- Accurate and comprehensive reporting that provides visibility into orders, suppliers, payments, and other procurement facets. By swiftly identifying bottlenecks and inefficiencies, you can make data-based decisions about optimizing procurement.

- Prevention of human errors. Features like 3-way matching, dropdown document fields, and item catalogs to choose from eliminate inaccuracies when creating procurement documents and placing orders.

You may choose to implement different types of technology in your stack, such as online payment systems, supplier relationship management software, inventory management apps, and so on. Or you can go for purchasing software that carries out a number of these functions while specifically performing key procurement activities.

Frequently Asked Questions

What is a good metric for the cash conversion cycle?

What constitutes a "good" CCC can vary by industry, company size, and business model. However, generally speaking, a good cash conversion cycle is as short as possible. It indicates that a company efficiently manages its cash flow by quickly converting its investments in inventory and resources into cash received from customers.

Why is it useful to know how long the cash conversion cycle is?

Knowing the duration of the cash conversion cycle is valuable because it helps companies assess their working capital efficiency, liquidity, inventory management, and supplier and customer relationships. Monitoring the cycle helps companies make sound decisions about inventory levels, production schedules, pricing strategies, and sales goals and also makes it easier to align them with the company's financial objectives.

What does the cash conversion cycle depend on?

The CCC depends on the interplay of three key components:

- Days inventory outstanding (DIO): How quickly a company sells its inventory.

- Days sales outstanding (DSO): How long it takes to collect customer payments after a sale.

- Days payables outstanding (DPO): How long it takes for the company to pay its suppliers.

How does the cash conversion cycle affect cash flow?

A shorter cash conversion cycle streamlines cash flow, enhancing the company's ability to cover expenses, plunge into investments, and meet financial obligations. Conversely, a longer cycle ties up cash in inventory and receivables, potentially leading to liquidity challenges.

Does lowering CCC increase profitability?

A lower CCC indicates that the company converts its investments into cash more rapidly, thus increasing profitability. Firstly, it means a company releases money that remains locked in inventory. Secondly, a more efficient cash conversion process reduces the need for external funding through loans or credit lines to pay for operating costs. This leads to lower interest costs and financial charges.

Calculate and adjust your cash conversion cycle

A cash conversion cycle (CCC) measures how quickly companies convert inventory into a cash return. The short cash conversion cycle is associated with better cash flow management and financial performance. Service providers and online businesses can even achieve a negative cash conversion cycle, meaning their capital isn't tied up in physical inventory at all.

Companies usually calculate CCC once per quarter or annually, and the cash conversion cycle formula is:

Days inventory outstanding (DIO) + days sales outstanding (DSO) - days payable outstanding (DPO).To get the full picture, it's advisable for organizations to compare their current CCC to their past performance and against competitor performance.

If such comparisons reveal an unnecessarily long cash conversion cycle, companies should take measures to shorten it. The best ways to achieve a good cash conversion cycle are:

- Effectively implementing a just-in-time (JIT) inventory management.

- Providing clients with incentives to pay early.

- Negotiating extended payment terms with suppliers.

- Establishing strong relationships with vetted suppliers.

- Implementing a helpful tool like purchasing software.