11 min read

Procurement vs. Acquisition: Meaning, Scope, and Where the Overlap Is

Procurement vs. acquisition isn’t just terminology. Understand ownership, steps, tools, and how each process creates value in business or government.

In everyday business conversations, procurement and acquisition management are often used interchangeably. A manager talks about “acquiring a new system,” finance asks procurement to “handle the acquisition,” and legal refers to “acquisition rules” that sound nothing like the procurement process most companies actually run. Add public-sector terminology and M&A language into the mix, and the confusion only grows.

The reality is that procurement and acquisition overlap, but they’re not the same concept. In private companies, procurement usually refers to the structured, ongoing process of sourcing and buying goods and services. In the public sector, acquisition often describes a much broader, heavily regulated life cycle. And in corporate finance, acquisition means something else entirely: buying another company.

These distinctions aren’t just semantic. They affect who makes decisions, how risk is managed, which tools are used, and how fast organizations can act. This article breaks down procurement vs. acquisition in clear, practical terms.

Read on to find out:

Clear definitions of procurement vs. acquisition

Similarities and differences between acquisition and procurement

Corporate procurement frameworks (simplified walkthrough)

Public acquisition frameworks (simplified walkthrough)

Organizational structure and ownership in procurement vs. acquisition

Technology and data in procurement vs. acquisition

FAQs about procurement vs. acquisition

Procurement vs. acquisition in a nutshell

Centralized control for your procurement

Clear definitions of procurement vs. acquisition

Before comparing procurement and acquisition management, it’s important to recognize that these terms mean very different things depending on the context.

In everyday business operations, procurement describes how companies buy what they need to function. In government, acquisition covers a much broader process that includes, but isn’t limited to, procurement. And in corporate finance, acquisition refers to buying entire companies, not goods or services.

To keep these terms clear, here’s how they're defined in each context.

Procurement (business context)

Procurement is the structured, repeatable process an organization uses to identify needs, source suppliers, negotiate terms, purchase goods or services, and manage supplier performance. It’s an ongoing operational function focused on cost, compliance, and efficiency. Nearly half of CPOs worldwide (46%) reported that cost savings were their top priority for 2025 to ensure business continuity.

Acquisition (public sector context)

In the public sector, acquisition refers to a much broader life cycle than procurement. It includes everything from requirements planning and budgeting to bidding, contracting, performance management, and end-of-life disposal. Procurement is just one part of this larger process.

Acquisition (M&A context)

In mergers and acquisitions, an acquisition refers to the purchase of another company or its significant assets. Interestingly, global M&A activity increased by 10% in the first nine months of 2025, compared to the same period last year.

Acquisition here involves deal sourcing, valuation, due diligence, negotiation, and integration. Procurement only becomes relevant later, when it’s time to consolidate suppliers, clean up overlapping contracts, and reduce duplicate spending.

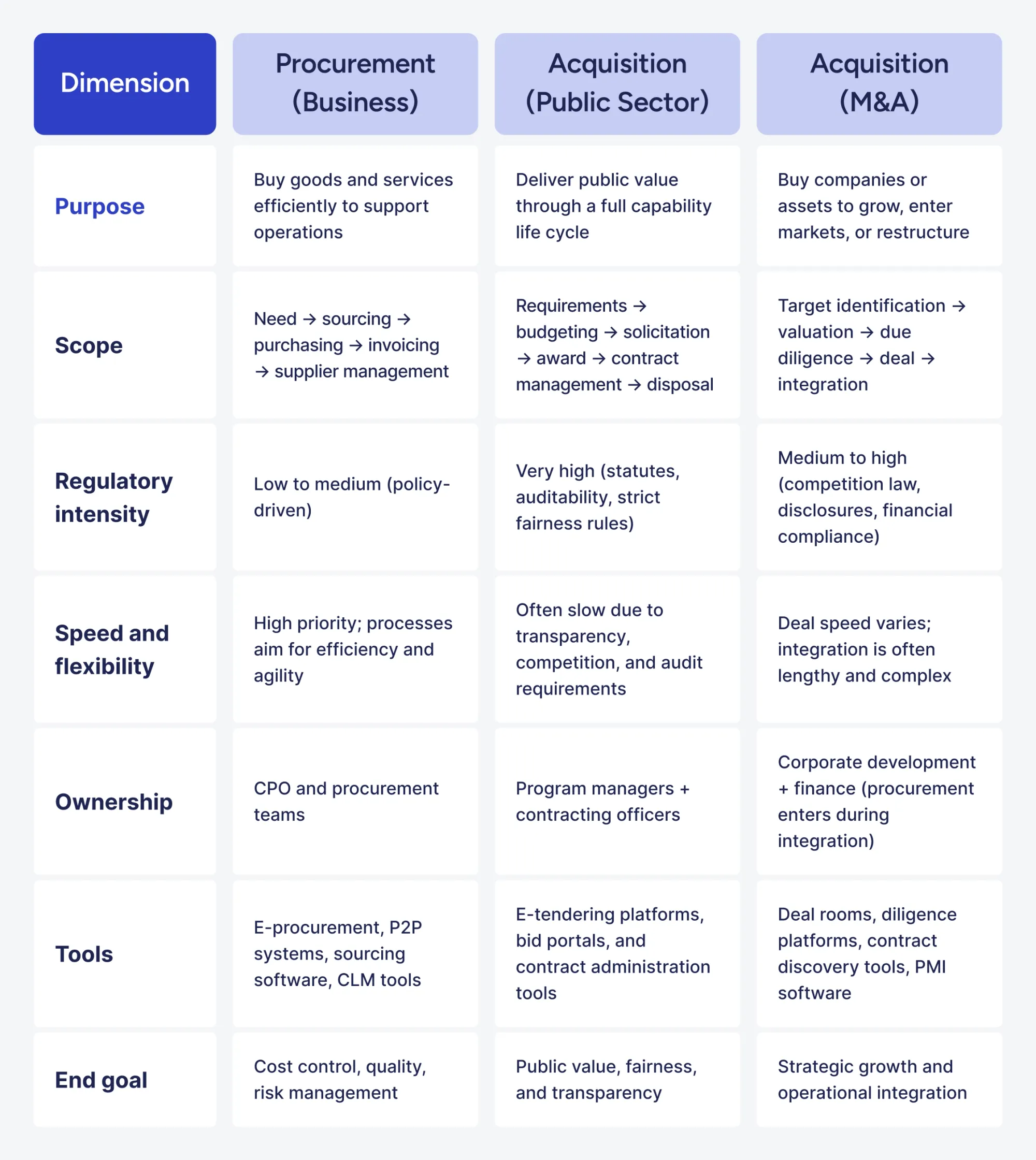

Similarities and differences between acquisition and procurement

Although acquisition and procurement are often used interchangeably, they only overlap in a few foundational ways. All three contexts (business procurement, public-sector acquisition, and M&A) share a common idea: an organization obtains value from outside. However, beyond that, the processes, goals, timelines, and governance models appear quite different.

Where they overlap

- All involve obtaining external value.

Whether it’s buying goods and services, acquiring public-sector capabilities, or purchasing entire companies, each process brings something external into the organization. - All require governance, risk management, and financial control.

Approvals, budgets, controls, and accountability matter in every context, even if the specific rules differ. - All rely on contracts, suppliers (vendors), and performance measurement.

Procurement manages vendors, public agencies manage contractors, and M&A teams inherit supplier portfolios and contractual obligations.

Where they diverge

The real differences between procurement and acquisition become clear when we compare purpose, scope, regulation, tools, ownership, and outcomes. Here’s a structured breakdown:

The easiest way to separate acquisition vs. procurement is to look at how they’re used across sectors. The language shifts depending on whether you’re in a commercially driven private environment or a regulated public one. Here’s how the terminology breaks down in practice:

Private sector

In the private sector, the dominant term is procurement. Here, the focus is operational, as teams aim to reduce costs, improve supplier performance, manage risk, and keep the organization running smoothly. Companies prioritize speed, efficiency, and commercial outcomes over formal procedures, and regulatory pressure is far lower than in the public sector.

When the term “acquisition” appears in private industry, it almost always refers to mergers and acquisitions (M&A)—the process of buying companies or assets. Outside of that context, businesses rarely use “acquisition” to describe purchasing goods or services.

Public sector

In government and defense, “acquisition” is a formal, regulated term that refers to a full life cycle that covers not only purchasing, but also requirements definition, budgeting, competitive solicitation, contracting, program management, and end-of-life disposal.

Because taxpayer money is involved, the emphasis falls on strict compliance, fairness, transparency, and measurable public value. Procurement is only one phase within this much broader acquisition structure, and every step is governed by statutes, auditability requirements, and competitive bidding rules.

However, according to the recent OECD report, only about 38% of countries have regular reporting templates for public contracting authorities, and just 23% provide them for suppliers. As a result, systematic evaluation and transparency are more challenging, yet remain vital.

Now, let’s take a closer look at the specific steps in both procurement and acquisition management.

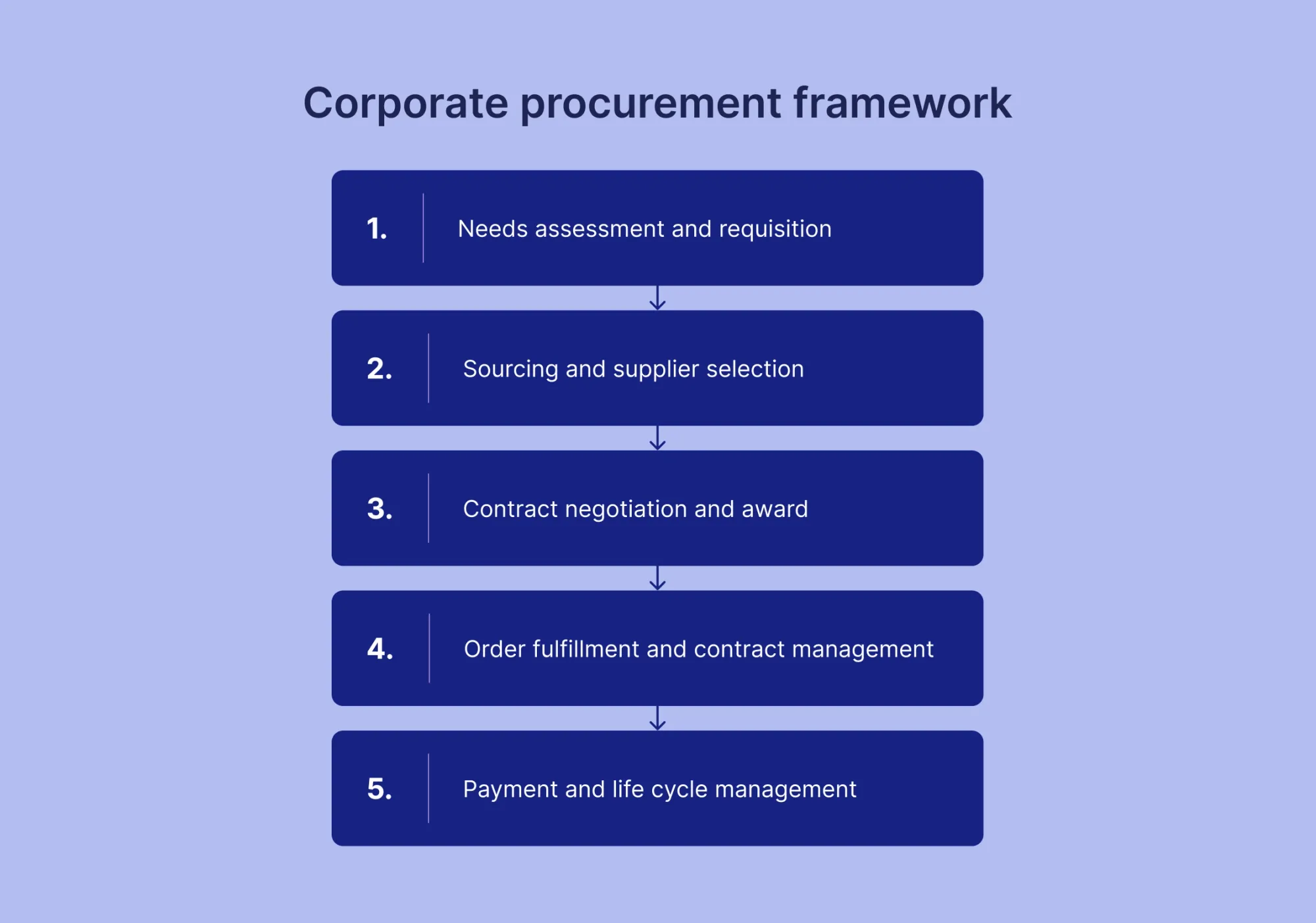

Corporate procurement frameworks (simplified walkthrough)

Corporate procurement is an operational function that acquires goods, services, and capabilities, with a focus on cost control, risk management, and support for business objectives. While processes vary by company size and industry, the typical corporate procurement cycle includes the following stages:

1. Needs assessment and requisition

Business units or centralized procurement teams identify operational requirements and specify goods, services, or capabilities needed. Employees submit requests through internal systems, and finance or managers check the budgets to make sure the funds are ready before any purchase goes through.

2. Sourcing and supplier selection

Procurement teams conduct market research, identify potential suppliers, and evaluate them based on criteria such as price, quality, delivery, and compliance. For larger organizations, formal RFPs or RFQs may be used to ensure competitive selection. Supplier due diligence, including financial stability and risk assessment, is often part of this stage.

3. Contract negotiation and award

Once a supplier is chosen, procurement teams negotiate terms, pricing, and service levels. They formalize contracts to protect the company, clarify responsibilities, and establish performance expectations. Teams maintain documentation and approvals to ensure internal accountability.

4. Order fulfillment and contract management

After the contract is in place, procurement monitors supplier performance, issues purchase orders (POs), tracks deliveries, and ensures compliance with contract terms. For high-value or complex purchases, ongoing supplier relationship management and performance reviews help address issues and achieve better outcomes.

5. Payment and life cycle management

The accounts payable team processes invoices and makes payments in line with agreed terms. Procurement also oversees supplier performance reviews, renegotiates contracts, and manages the offboarding or replacement of suppliers to maintain operational efficiency and cost control.

Key characteristics of corporate procurement include:

- Operational efficiency: Processes prioritize speed, cost control, and alignment with business needs.

- Flexibility: Depending on the organization, procurement can adapt to changing company-wide requirements and the needs of local business units.

- Governance and compliance: Internal policies, approvals, and controls ensure accountability and reduce risk.

- Supplier management: Teams focus on performance monitoring, relationship management, and contract optimization to create value over time.

Public acquisition frameworks (simplified walkthrough)

Public-sector acquisition operates within formal frameworks designed to ensure competition, transparency, and fairness. While each country or agency may have its own detailed rules, the typical process includes several key stages:

1. Requirements and planning

First, agencies clearly document the need for a capability, such as an IT system, infrastructure project, specialized equipment, or services. The process also involves securing a budget, usually through legislative or executive approval cycles. This stage ensures that the acquisition aligns with strategic goals and available funding before moving forward.

2. Solicitation

Once requirements are defined, agencies issue public notices, such as Requests for Proposal (RFPs), Requests for Quotation (RFQs), or Invitations for Bid (IFBs). All qualified suppliers can compete, and the evaluation criteria are published in advance and applied consistently. This step is crucial to maintaining fairness, transparency, and defensibility of the process.

3. Contract award

Contracts are awarded in an auditable and defensible manner. Agencies may face protests or appeals from unsuccessful bidders, so complete documentation and adherence to rules are essential. These controls support accountability and protect the public interest.

4. Contract administration

After a contract award, agencies monitor supplier performance through milestone-based payments, progress tracking, amendments, and audits. Compliance, documentation, and reporting ensure that contractual obligations are met and public resources are used appropriately.

5. Life cycle and disposal

For physical assets such as vehicles, IT systems, or specialized equipment, agencies oversee maintenance, upgrades, and eventual replacement or disposal. This step ensures that public investments continue to deliver value over time and align with long-term strategic objectives.

Key characteristics of public-sector acquisition include:

- High regulatory burden: Every step is closely governed by laws, policies, and audit requirements.

- Longer timelines: Extensive planning, approvals, and competitive processes extend the acquisition cycle.

- Standardized processes: Procedures are formalized to ensure consistency and fairness.

- Emphasis on fairness and public accountability: Transparency and defensibility help protect taxpayer resources and reinforce public trust.

Organizational structure and ownership in procurement vs. acquisition

Knowing who “owns” procurement vs. acquisition helps clarify responsibilities and how decisions get made. Ownership varies depending on whether we’re talking about corporate procurement, public-sector acquisition, or M&A, but some patterns are consistent.

In private companies, procurement is owned by the Chief Procurement Officer (CPO) and their team. Procurement teams handle the full cycle: they identify what’s needed, find suppliers, negotiate contracts, and keep an eye on supplier performance. While finance, legal, and operations are involved, the CPO usually has the final say on policies, compliance, and strategic sourcing decisions.

In the public sector, acquisition is more spread out. Different teams own different parts of the process: program managers oversee planning, finance handles budgeting, legal ensures compliance, and operations manages delivery. This shared ownership supports accountability, fairness, and transparency at every step.

In M&A, acquisitions are usually led by corporate development, finance, and legal. These teams handle everything from sourcing and valuing targets to due diligence and negotiating the deal. Procurement typically comes in later to consolidate suppliers, renegotiate contracts, and align purchasing processes after the deal closes. In other words, procurement plays a supporting role during the integration process.

Technology and data in procurement vs. acquisition

Technology is at the heart of modern acquisition and procurement, but the tools and their purpose vary depending on the context.

In corporate procurement, technology focuses on making everyday processes faster and more transparent. Tools like e-procurement platforms, purchase-to-pay (P2P) systems, sourcing software, contract management solutions, and supplier portals help automate approvals, unify supplier data, and give real-time insights into spend. One of the most effective approaches is to centralize all procurement activities in a single platform, like Precoro.

In the public sector, acquisition systems focus on transparency, fairness, and compliance. Platforms support solicitation, bid management, contract administration, and performance tracking. Unlike corporate procurement systems, which prioritize speed and efficiency, public acquisition platforms are designed to ensure that every decision is transparent, auditable, and above board.

In M&A, technology plays a different role. Tools are used for due diligence, contract discovery, and post-merger integration. They help teams review contracts, uncover risks, and identify where suppliers or agreements can be consolidated after a deal. In this context, procurement tech is less about day-to-day buying and more about supporting the integration of two companies and capturing value from the merger.

In all cases, whether it’s procurement vs. acquisition, technology and data give organizations a way to see what’s happening, stay in control, and make informed decisions. Procurement platforms provide the day-to-day visibility into spend and suppliers, while acquisition systems add a broader layer of governance.

Answers to common questions about procurement vs. acquisition

Procurement refers to the ongoing, structured process of buying goods or services for a business. Acquisition is a broader term that depends on the context. In the public sector, it covers the full life cycle of acquiring a specific asset, service, or system, from planning and budgeting to contracting and life cycle management. In the private sector, acquisition refers to M&A, or buying companies and major assets.

No. While acquisition in a corporate M&A context does mean buying companies or significant assets, in the public sector, it’s much broader. It includes planning, solicitation, contracting, and life cycle management of a specific asset, service, or system, not just the purchase itself.

Not exactly. Procurement encompasses purchasing, but also involves needs identification, supplier selection, contract negotiation, supplier performance management, and compliance governance. It’s an ongoing, structured function that supports operational efficiency and cost control.

Ownership in acquisition vs. procurement depends on the context. Procurement is typically owned by a Chief Procurement Officer (CPO) or a dedicated team. Public-sector acquisition responsibilities are distributed across program managers, finance, legal, and contracting officers. In M&A, corporate development, finance, and legal lead the acquisition, with procurement involved later during the integration to consolidate suppliers and rationalize contracts.

Procurement vs. acquisition in a nutshell

Procurement and acquisition may sound interchangeable, but they serve very different purposes depending on the context. In the private sector, procurement is the day-to-day engine that keeps operations running—focused on cost control, efficiency, and supplier performance. In the public sector, acquisition is a far broader and highly regulated life cycle that spans from requirements planning to disposal. And in corporate finance, acquisition refers to something else entirely: buying companies and integrating them.

Understanding differences between procurement vs. acquisition isn’t about semantics—it’s about clarity. It helps organizations assign ownership, set the right expectations, choose the right tools, and design processes that actually work. Once you separate the terminology and see how each function operates, it becomes much easier to manage risk, improve outcomes, and communicate clearly across teams, sectors, and stakeholders.

Centralized control for your procurement

If your organization operates in multiple locations or manages a mix of operational buying, capital projects, or post-merger integration, a single source of truth makes the difference between clarity and chaos. Precoro brings purchase requests, approvals, POs, supplier data, contracts, invoices, and budgets into one unified workflow.