30 min read

Procurement Cost Reduction: How to Cut Costs Without Cutting Corners

Succeed in procurement cost reduction and don’t sacrifice the quality of your products or services. Discover strategies that actually work.

Rising costs, supply chain chaos, and economic swings put businesses under enormous pressure to protect their margins. According to McKinsey & Company, procurement accounts for 50% to 80% of a company’s cost base. That’s why organizations zero in on strategies to achieve procurement cost reduction.

The key thing to remember is that cost reduction in procurement isn’t just about slashing expenses. It cuts costs yet helps maintain product quality and smooth operations. This article will give you practical procurement cost-saving ideas and tips to avoid common pitfalls.

Scroll down to find out:

What is procurement cost reduction?

Risks of aggressive procurement cost-cutting on supply chain

Strategies for procurement savings without harming vendor partnerships

Types of costs in procurement

How to measure cost reduction in procurement

Frequently asked questions about procurement cost reduction

Final thoughts about procurement cost reduction

What is procurement cost reduction?

Procurement cost reduction is the tactic to slash expenses tied to buying goods and services. To achieve this, companies typically do the following:

- Improve the buying process.

- Negotiate better contract terms.

- Identify unnecessary spending.

The whole idea is to lower costs without compromising product quality and performance. When done right, procurement cost reduction brings these benefits:

- Bigger profits

Every dollar saved goes straight to the company’s profit. Afterward, this money can be used to develop new products, enhance the customer experience, update technology, or recruit new employees. - More efficient teams

Instead of making isolated purchases, teams work towards shared procurement goals. A strategic spending mindset helps them meet expectations and fosters accountability across departments and stakeholders. - Higher standards

Cost reduction sparks a fresh perspective on established processes. Typically, it reveals new opportunities to standardize and improve them. For instance, businesses might create approval workflows for new purchases and automate intake management.

Procurement cost reduction, cost avoidance, and cost savings: What’s the difference?

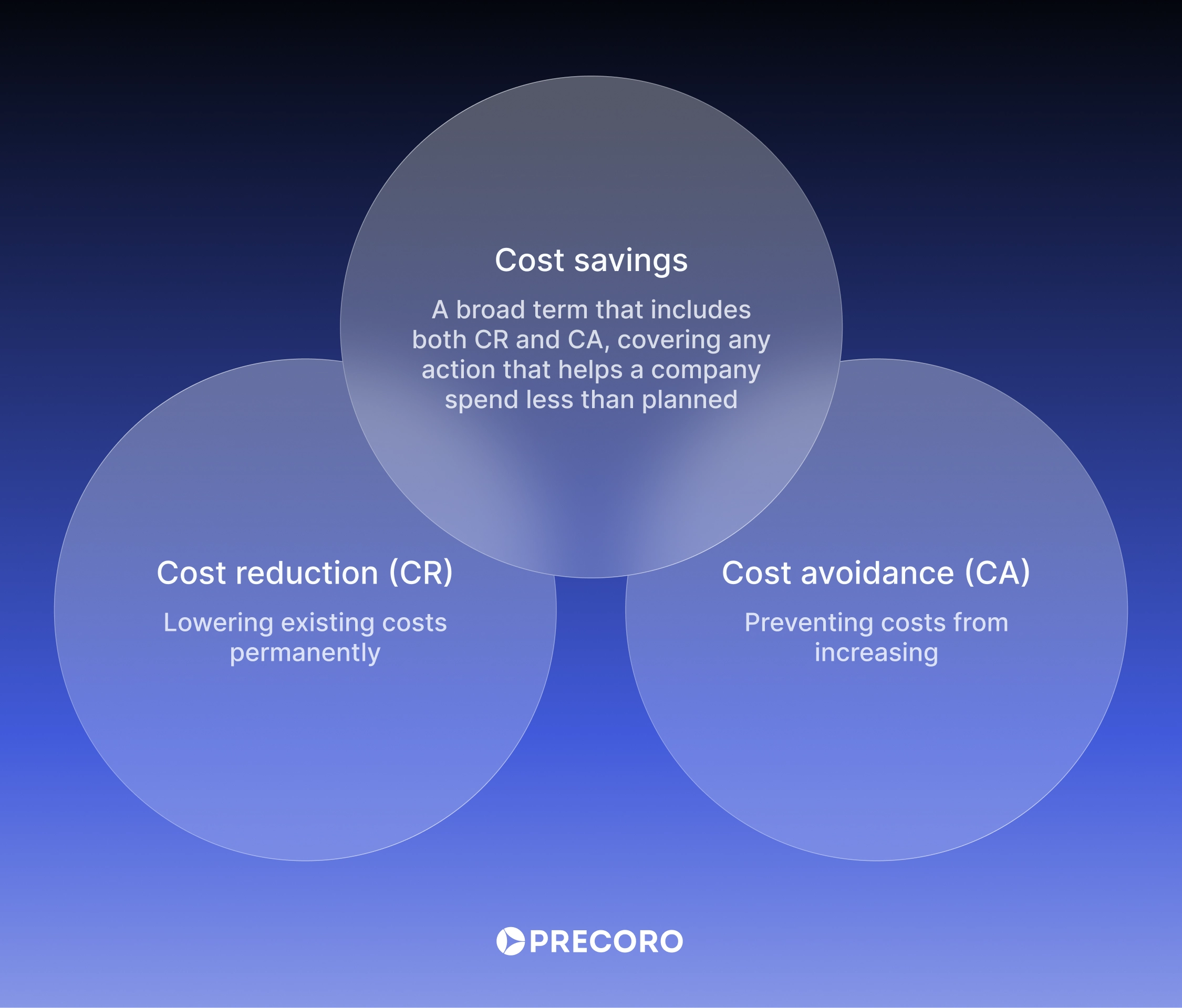

While procurement discussions sometimes blend cost reduction, cost avoidance, and cost savings, each term describes a unique cost management strategy.

Cost reduction: lowering existing costs permanently

Cost reduction (CR) refers to actual, measurable decreases in procurement costs that result from strategic actions. These savings are reflected in financial statements because they reduce the baseline cost of operations.

For example, companies can negotiate a contract that reduces the per-unit price from $5 to $4.50 and achieve an immediate, lasting cost decrease.

Key characteristics of procurement cost reduction:

- Permanent decrease in procurement expenses.

- Direct impact on financial statements.

- Achieved through strategies like bulk purchasing, supplier consolidation, and procurement process automation.

Cost avoidance: Preventing cost increases

Cost avoidance (CA) means preventing cost increases. Rather than reducing current expenses, you minimize future spending. Since these savings come from avoiding extra costs, they don’t appear in the financial statements. However, procurement managers often report cost avoidance to executives and stakeholders.

Make no mistake: cost avoidance can make a significant difference in your long-term spending and prevent future financial risks, such as inflation or supply chain disruptions. A classic case of cost avoidance is locking in a multi-year contract at today’s prices to avoid paying higher prices due to future inflation.

Key characteristics of cost avoidance:

- Prevents price increases but doesn’t reduce current spending.

- Helps maintain financial stability over time.

- Achieved through strategies like long-term contracts and improved supplier negotiations.

Cost savings: The umbrella term

Cost savings is a broad term that covers both procurement cost reduction and cost avoidance. Essentially, it’s any action that helps a company spend less than it otherwise would have. However, procurement cost savings need to be carefully categorized to avoid misinterpretation.

If a procurement manager secures a lower cost for raw materials, that’s cost reduction. If they prevent an increase in material costs, that’s cost avoidance. Both contribute to overall sourcing cost savings.

Key characteristics of cost savings:

- A combination of cost reduction and cost avoidance.

- Used as a general term for financial improvements in procurement.

- Must be clearly categorized to avoid misleading reporting.

Scenarios to clarify cost reduction and cost avoidance

It can be tricky to spot the difference between procurement cost reduction and cost avoidance in real life. Let’s see how these concepts work with two examples:

Scenario 1

Imagine a company that buys an item for $12,000. When it’s time to sign a new contract, the supplier offers the same price again, but the procurement team manages to negotiate a $500 discount.

CR Calculation: $12,000 (current cost) - $11,500 (final price) = $500 CR

Since the proposed price wasn’t higher than the current cost, there is no avoided price increase. Therefore, cost avoidance = $0 in this scenario.

Scenario 2

Now, let’s imagine a different situation. A company currently buys a product for $12,000. The supplier increases the proposed price to $13,000, but the procurement team negotiates it down to $11,800.

CR Calculation: $12,000 (current cost) - $11,800 (final price) = $200 CR

CA Calculation: $13,000 (proposed price) - $12,000 (current cost) = $1,000 CA

Here, the procurement team secures cost reduction through a price cut and cost avoidance by preventing the $1,000 price hike.

Risks of aggressive procurement cost-cutting on supply chain

Cost reduction promises big rewards, but a misstep can lead to greater costs later. Gartner reports that only 43% of leaders achieve cost-saving targets in the first year of cost-reduction initiatives, and just 11% sustain those savings for three consecutive years. Here are some traps to avoid:

1. Compromising on product quality

One of the most common mistakes in procurement cost reduction efforts is focusing too much on cutting direct costs that influence the end product quality. For example, a company may find a new supplier with cheaper goods and skip the quality check. It’s a big mistake.

You may save a few bucks now, but those savings could come back to bite you later. Unhappy customers, product issues, and a damaged reputation can slowly drain your profits. Think beyond short-term cost cuts and consider the long-term impact on the company. Don’t risk it all for a quick win!

2. Balancing cost savings and supplier relationship management in procurement

When businesses focus too much on short-term cost cuts and forget about keeping strong supplier relationships, they risk more than just price changes. Long-term suppliers are your partners who understand what you need, deliver on time, and can offer flexibility when required.

That’s why it’s often better to work on procurement cost reduction with your trusted suppliers instead of jumping to new, untested ones. But also, don’t keep pushing them for lower prices all the time—doing that too often can wear down the trust and teamwork you’ve built. Keep in mind that strained relationships can result in late deliveries and reduced supplier flexibility when you need urgent orders.

3. Missing opportunities for process optimization

Sometimes, companies engage in procurement cost reduction without looking at internal processes that could hide real potential for savings. It’s tempting to just cut budgets across the board and enjoy a quick fix, but inefficiencies in procurement workflows will still persist.

Think about how you can achieve visibility into company-wide spending and enforce procurement policy to prevent uncontrolled purchases altogether. Implement supply chain optimization: consider ways to make it easier for employees to use negotiated procurement contracts and purchase from vetted vendors that offer favorable prices.

4. Increasing operational risks

Fast cost cuts in procurement might seem smart at first, but they can cause big problems later. For example, cutting inventory to save money could result in stockouts, delayed orders, backorders, and missed customer opportunities. The problems far outweigh any quick purchasing cost savings you might get!

Another thing to watch out for is choosing cheaper raw materials. While that might save you a bit upfront, it could result in lower product quality, more defects, or higher return rates. These problems can damage your brand and add extra costs to fix mistakes or replace products.

The bottom line is: don’t trade quick wins for long-term headaches. Instead, pursue a balanced approach to cost reduction. Focus on both savings and the long-term stability of your company.

Strategies for procurement savings without harming vendor partnerships

Strategies are overarching, long-term approaches that organizations use to achieve procurement cost reduction. They involve planning, policy development, and systematic changes to drive sustainable savings.

In contrast, cost reduction techniques in procurement are specific, tactical actions. These practical steps are applied daily to optimize spending and identify cost-saving opportunities. In essence, every cost-reduction strategy in procurement relies on well-executed techniques.

Below, we outline key strategies and the techniques that make them successful.

Gain full visibility with procurement centralization

Imagine trying to forecast financial market trends without historical data. That’s what procurement cost reduction feels like without clear visibility into your spending. You’re stumbling around, missing opportunities, and letting money slip through your fingers. Beware of scattered data and hidden purchases. To win, you need to see the entire picture.

A centralized procurement system acts as your guide. It consolidates all your spending data into a single, clear view. You can finally map your path to real, sustainable purchasing cost savings because you can actually see exactly what was purchased, where, when, by whom, and at what price.

Procurement cost reduction techniques:

- Implement a procurement centralization platform that consolidates all purchasing data into one clear view. This visibility allows you to monitor spending and control purchases as they happen.

- Appoint dedicated individuals or a team to oversee and approve purchases. They will act as gatekeepers to ensure that all orders meet the company’s criteria for cost-effectiveness and supplier compliance. Clear ownership in the approval process drives accountability. As a result, unauthorized purchases are less likely to happen.

Standardize purchasing through structured policies

One of the most effective ways to control procurement costs and achieve procurement cost reduction is to standardize purchases. Lack of standardization results in duplicate orders across departments, premium prices for unnecessary features, and uncontrolled spending. On the flip side, a well-structured procurement policy sets the foundation for streamlined purchasing, reduced waste, and consistent procurement practices across the organization.

Here’s how you can standardize procurement:

- Analyze purchasing behavior and assess where variances exist in products, suppliers, and processes across departments.

- Create a standardized product and supplier list to determine which items are approved for purchase based on cost, quality, and reliability.

- Establish clear approval workflows and set up a structured process for requisitioning, approving, and purchasing goods.

- Provide employees with a simple purchase requisition module within the procurement platform to bring the established procurement policy to life.

- Review your standardization practices regularly to ensure they still meet business needs. Plus, determine whether you can renegotiate supplier terms. and to determine whether supplier terms can be renegotiated.

Prevent maverick spending

Maverick spending refers to purchases made outside of established procurement processes. For example, employees may send a purchase order without proper approval or purchase outside negotiated supplier contracts.

At first glance, maverick spending might seem like a small issue—an individual buying a piece of equipment without following the formal process. But over time, these unauthorized purchases can accumulate. As a result, companies fail to take advantage of negotiated favorable prices and have less negotiating power when securing new contracts with preferred vendors.

Procurement cost reduction techniques:

- Сommunicate clear procurement guidelines to all departments and explain why these policies are in place and how they benefit the company as a whole.

- Encourage all employees to request all goods and services via one procurement software with set-up automated approval workflows.

- Choose procurement software with punchout catalogs that allow employees to request pre-approved items from trusted vendors. According to the Hackett Group’s 2025 Procurement and Purchase-to-Pay Advisory Spotlight Report, electronic catalogs are among the most effective solutions to address maverick and tail spending.

- Review procurement intelligence regularly to identify any off-contract purchases or spending that hasn’t been approved.

Implement category management

Purchases vary in complexity and cost. A one-size-fits-all strategy results in missed purchasing cost savings and inefficiencies. Category management refers to clustering similar purchases (e.g., office supplies, IT equipment, raw materials) and managing each category strategically. When companies group purchases, they can use increased negotiation power to secure superior pricing, service, and contract conditions.

Procurement cost reduction techniques:

- Reduce the number of suppliers in a category to increase purchasing power and negotiate volume discounts.

- Develop specific procurement strategies for each category based on its role in the business. For instance, high-volume, low-cost categories might benefit from bulk orders, while high-value, low-volume items might need more competitive tendering.

Here’s the reality: most procurement teams inherit requirements without questioning them. Engineering specifies “enterprise-grade.” Operations demand “expedited delivery” as default. Marketing insists on “premium materials.” Before you know it, you’ve artificially limited your supplier pool and inflated costs—not because you needed to, but because no one asked why.

Start with skepticism. Before grouping purchases into categories, question whether each specification is actually necessary:

- Do we need premium features?

In many cases, standard options already cover the day-to-day needs at a much lower cost. - Can we simplify technical specs?

Over-engineering limits suppliers and drives up prices unnecessarily. - Are there alternative products?

Different solutions might achieve the same outcome for less.

This approach (sometimes called value engineering) opens the door to broader supplier competition and better pricing.

If you wonder what this looks like in practice, here are some examples.

Your IT category specifies enterprise monitors with 4K resolution and ergonomic stands. Review reveals most users need basic displays for email and spreadsheets. Switching a large share of employees to commercial-grade monitors can significantly reduce hardware costs without affecting day-to-day productivity.

Or, let’s say your operations team marks every order as “expedited delivery” because it’s been a standard procedure for years. Analysis shows only a fraction of orders actually need rush shipping. Removing unnecessary freight surcharges results in immediate savings on logistics costs.

The key here is to question specifications before you consolidate spending or negotiate contracts. Otherwise, you’re just getting better deals on things you’re overpaying for in the first place.

Consolidate purchases and suppliers

Sometimes, the easiest way to cut costs isn’t to negotiate harder—it’s to buy smarter. When departments or locations order separately, you’ll probably lose volume discounts and pile on extra admin work. Luckily, procurement centralization software can help you spot and avoid duplicate orders in no time.

When you consolidate purchases across the organization, you get two key advantages. First, you stop duplicate orders, so different employees aren’t accidentally overbuying or paying different prices for the same product. Second, you increase the company’s buying power, which makes it easier to score bulk discounts with suppliers.

Beyond cost reduction, this approach also simplifies vendor management. Fewer orders mean fewer invoices to review, fewer contracts to oversee, and less time spent on administrative tasks.

Procurement cost reduction techniques:

- Send Requests for Proposals (RFP) or Requests for Quotations (RFQ) to select the best option among your current suppliers that offer similar products. Maximize savings by offering greater volume or market share to the most competitive supplier.

- Use vendor rebates and tiered discounts. If you frequently purchase from the same vendors, check if they offer rebate programs based on order volume. Many suppliers provide tiered pricing models where bulk purchases result in purchasing cost savings. However, ensure you’re not over-ordering, as this can lead to storage issues or waste.

- Reduce freight and logistics costs. Where possible, consolidate shipments and coordinate delivery schedules at key locations (such as ports or distribution hubs).

Renegotiate supplier agreements

The Hackett Group 2024 Procurement Key Issues Report reveals that procurement teams aim for a 5% to 10% cost cut through supplier negotiations. For a company with an annual procurement spend of $100 million, this translates to potential savings of $5 million to $10 million. So, how can you achieve the same?

Identify your highest-spend suppliers and those with upcoming contract renewals (due within a year or two). Think of it as applying the Pareto principle or 80/20 rule. In this case, about 80% of your company’s spend is likely concentrated within just 20% of your supplier base.

Once you have visibility into company-wide expenses, you can approach your top suppliers with clear numbers: how much and how often you buy their products. Vendors are more likely to offer better pricing if they see you’re a valuable, informed customer.

Reach out, have direct conversations, and explain the need for cost reductions. Be transparent: point out that you value the relationship, but a tight budget requires quick savings. Let suppliers know that you need flexibility now, not just at renewal.

Some suppliers may not agree. Still, those who value lasting partnerships will find ways to help. In return, when they need flexibility in the future, be a trusted partner and reciprocate. This relationship-based approach often leads to meaningful procurement cost reduction without sacrificing service quality.

You can also find ways to save without a direct price reduction. Have you thought about value engineering? Are there early payment discounts that have not been fully used? Some suppliers also offer volume-based rebates without the need to aggressively renegotiate.

Procurement cost reduction techniques:

- Proactively engage with suppliers ahead of renewal periods and initiate cost-saving discussions before contracts expire.

- Use procurement data to show suppliers how much you’re buying. Let this data work for you in price negotiations.

- In addition to price reductions, negotiate for better payment terms, such as extended payment periods or early payment discounts.

- Offer marketing incentives for better pricing. For example, you could feature suppliers on your website, email newsletter, or customer portal. Think about banner ads, featured content, or co-branded promotions. It’s a win-win: you lower costs and strengthen supplier relationships.

- Watch out for contract over-spend. If a supplier initially charges $100 but slowly raises the price without a formal renegotiation, you probably overpay.

- Review and evaluate long-term supplier contracts regularly and renegotiate them when necessary, especially if the market changes.

Benchmark and replace uncompetitive suppliers

Renegotiation works until it doesn’t. Some suppliers simply can’t or won’t match market rates. Maybe they’ve gotten comfortable with your business, or their cost structure doesn’t allow better pricing. Either way, loyalty to underperforming suppliers costs you money.

Regularly benchmark your suppliers against market rates. For high-spend categories, do it every quarter.

Benchmark the following:

- Unit pricing

Compare your current rates to market averages from industry reports, RFQ responses from alternate suppliers, or procurement databases. - Service levels

Track delivery times, quality metrics, and responsiveness to issues. - Total cost of ownership

Identify hidden costs like expedited shipping fees, quality failures, or administrative burden.

When benchmarking reveals a significant gap between what you’re paying and market rates, it’s time for a direct conversation. Share the data and give the supplier a chance to match competitive pricing.

If they can’t or won’t, replace them. Sounds harsh, but if you’re spending millions annually with a supplier charging well above market, you’re leaving substantial savings on the table every year. That’s not loyalty, that’s waste.

Your suppliers should earn your business every contract period, not assume they have it forever. Competitive markets work both ways.

Track supplier performance systematically

Here’s how most procurement teams manage suppliers: wait until something breaks, then scramble to fix it. A shipment arrives two weeks late. Quality issues shut down production. Invoice disputes pile up. Only then does anyone ask whether this supplier is actually performing.

This approach costs you more than the immediate problem. You’re constantly firefighting instead of preventing issues in the first place.

Continuous performance tracking is what actually works.

Monitor the metrics that matter:

- Delivery performance (on-time rates, lead time consistency)

- Quality (defect rates, returns)

- Responsiveness (how fast suppliers fix problems)

- Cost stability (price creep, unexpected fees)

Set minimum standards in your contracts, like 95% on-time delivery, sub-2% defect rates, and 24-hour response times.

Also, try to tie performance to consequences via service-level agreements. The result of this can be two-fold:

- Suppliers that consistently meet target goals get preferred status, better payment terms, or more volume.

- Suppliers who miss targets face penalties or reduced business.

Make the rules clear upfront so nobody’s surprised when you enforce them.

Use systems that can track vendor performance automatically. Spreadsheets tend to break once there’s a need to manage dozens of suppliers across many categories. Procurement platforms with supplier portals provide real-time visibility into delivery data, quality reports, and invoice accuracy with extensive centralization. Better systems flag declining performance before it becomes a crisis.

Run quarterly business reviews where you share performance scorecards with each supplier. Ensure that high performers get recognition and deeper partnerships, while underperformers get 90-day improvement plans with specific targets. This is how the guesswork about where suppliers stand and what needs to change becomes obsolete.

However, none of this matters if you don’t act on the data. Companies often track everything and do nothing. Set hard thresholds—three late deliveries trigger a formal review, and two bad quarters start replacement conversations. Otherwise, you’re just collecting reports nobody reads.

These measures help you ensure that suppliers meet the standards you enforce, not the ones you mention once during contract signing and never bring up again.

Monitor supplier risk across multiple dimensions

Here’s how supplier risk usually gets handled: procurement evaluates vendors during selection, checks a few boxes, signs the contract, and moves on. Twelve months later, a key supplier’s credit rating tanks and they file for bankruptcy. Or new tariffs double your costs overnight. Or labor violations surface and customers start asking questions. Nobody saw it coming because nobody was looking.

Risk assessment isn’t something you do once and forget. Markets shift, financial situations deteriorate, and regulations change. What looked stable six months ago can become a crisis today.

What actually needs monitoring:

- Financial stability. Track credit ratings, debt levels, and bankruptcy indicators before suppliers fail, not after.

- Geopolitical factors. Pay attention to political instability, trade restrictions, and regulatory changes in regions where your suppliers operate.

- Operational vulnerabilities. Be mindful of single-facility setups, capacity constraints, and dependencies on sole-source components.

- ESG compliance. Consider environmental violations, labor issues, and governance problems that create legal and reputational risks.

Risk monitoring platforms flag changes as they happen: a supplier’s credit rating drops two levels, trade policies shift in their country, and compliance databases show new violations. You get alerts in time to respond instead of discovering problems when shipments stop arriving.

What can you do with early warnings? Qualify alternatives before you desperately need them and build inventory buffers for critical items. It’s also important to demand corrective action plans with deadlines.

The alternative is crisis management. Production halts because a vendor collapsed. Material costs spike from tariffs you didn’t see coming. PR nightmares erupt over supplier labor practices. These happen constantly to companies that check supplier risks once during onboarding and never look again.

Continuous monitoring means acting before disruptions hit, not scrambling after they’ve already cost you money.

Source strategically

When you need to find a new supplier, don’t just choose the cheapest one on the market. Invite multiple vendors to bid for contracts.

Procurement cost reduction techniques:

- Use a well-structured RFP process to lock in the best deals and prompt suppliers to offer more competitive rates or added value.

- Factor in quality, lead times, reliability, and total cost of ownership (including maintenance, logistics, and hidden fees) to ensure you’re making the best long-term choice.

Once you’ve pinpointed the right supplier and signed a procurement contract, foster a strong bond. This way, you’ll enjoy better service, priority support, and more flexibility in times of need. Plus, long-term partnerships often unlock cost savings beyond the initial contract terms.

Many companies revisit contracts every 3-5 years, depending on value and risk, to ensure they’re still competitive. If your contracts fall within that range, work with the internal teams who use those agreements to assess whether they still meet business needs.

In some cases, industries that were once niche become more competitive over time. As more suppliers enter the market, prices tend to drop, allowing for renegotiation of existing contracts or better terms through competitive bidding.

Although purchase consolidation leads to sourcing cost savings, excessive reliance on a single supplier is risky and can result in supply chain disruptions. That’s why it’s better to take a balanced approach and prepare a list of backup suppliers for critical materials.

Evaluate global sourcing and supplier diversity

Most procurement teams default to local suppliers due to the same time zone, familiar regulations, and straightforward logistics. It’s convenient, sure. However, it’s often more expensive than comparable suppliers in other markets.

The case for global sourcing isn’t complicated: there are lower labor costs in some regions and specialized manufacturing capabilities you can’t find domestically. Moreover, suppliers with excess capacity are often willing to compete aggressively on price. The real question is when the cost savings justify dealing with longer lead times, quality verification challenges, and currency risks.

When to source globally:

- High-volume standardized items. You need components or raw materials with clear specs that don’t require constant back-and-forth.

- Weak domestic competition. Certain product categories are dominated by a few local suppliers with little pricing pressure.

- Predictable demand. You can plan inventory around longer shipping windows.

However, with global sourcing, lead times stretch from days to weeks. Quality control requires stricter inspection protocols or third-party audits. Currency fluctuations can wipe out your savings if you’re not hedging. Additionally, IP protections depend heavily on which country you’re dealing with.

Test global sourcing on non-critical categories first. Learn the logistics headaches with lower-risk spend before moving strategic categories offshore.

Supplier diversity operates on different logic. Rather than pure cost optimization, these programs deliberately include suppliers owned by women, minorities, veterans, or small businesses. Some companies pursue this approach for corporate responsibility. Others recognize that diverse supplier bases create more competition and reduce dependence on entrenched vendors.

Government contracts increasingly require supplier diversity targets. Beyond compliance, diverse suppliers often deliver better service, as they’re more motivated to earn repeat orders than established players that take your business for granted.

Set diversity targets that match reality. Mandating substantial diverse spend in categories where qualified diverse suppliers barely exist just creates frustration. Focus on categories where they can actually compete.

Both approaches—global sourcing and supplier diversity—challenge the default of buying from whoever’s most convenient. Done strategically, they cut costs and strengthen supply chains. Done just as checkbox exercises, they just add administrative work.

Consider outsourcing non-core procurement categories

Your procurement team shouldn’t spend equal time on janitorial contracts and strategic supplier partnerships. Yet most do. Non-core categories—facilities management, security, temporary staffing, office supplies—consume resources without delivering strategic advantage.

That’s why it’s often best to outsource low-complexity, high-volume categories to specialized providers.

What you gain:

- Better pricing. Providers aggregate demand across multiple clients, securing rates individual companies can’t match.

- Specialized expertise. They know market rates and supplier capabilities without your team investing months learning them.

- Less admin work. Your team doesn’t have to deal with vendor disputes, invoicing, and performance tracking.

When to outsource:

High volume + Low complexity + Low strategic value = Outsource. Examples are janitorial services, corporate travel, MRO supplies.

High complexity + High strategic value = Keep in-house. Examples include pharmaceutical raw materials or core technology vendors that need direct management.

Shared services can be an alternative. Centralize categories across business units before going external. For example, let one team handle all IT equipment purchases company-wide. This way, you get volume consolidation without losing control to a third party.

As outsourced providers won’t always align with your priorities, set clear SLAs and conduct quarterly reviews. Be ready to bring categories back in-house if they underdeliver.

Use spend analysis and dashboards

Spend analysis is a powerful way to track, evaluate, and understand how and where money is being spent across your organization. Dashboards are visual tools that make spend analysis come to life.

Procurement dashboards provide a comprehensive, at-a-glance view of procurement information. This data helps you spot patterns that could go unnoticed, such as duplicate orders, similar purchases from different vendors, or overpayments for items.

Modern procurement platforms take spend analysis further with automation and AI-powered insights. Instead of manually categorizing thousands of transactions, you can rely on these systems to do it automatically across suppliers, departments, and product types. As a result, patterns surface immediately rather than weeks later during quarterly reviews.

Here are AI-powered capabilities that deliver results:

- Anomaly detection flags unusual spending patterns in real time, like suppliers charging significantly more than last quarter or purchases that violate procurement policies before invoices get paid.

- Predictive analytics forecasts spending trends and identifies contracts expiring in the next quarter, giving you time to negotiate instead of scrambling at renewal.

- Contract lifecycle management monitors every agreement, sends alerts before expirations, routes renewals through workflows automatically, and centralizes contracts in searchable databases.

- Automated workflows handle routine purchase requests and approvals without manual intervention.

What does this look like in practice? Your dashboard shows company-wide spending at the top level. Drill into office supplies and you spot costs rising in one region. Click further and discover they’re ordering premium items when standard versions would work. The time needed to identify the problem drops from weeks to minutes.

Moreover, these systems typically integrate with your ERP and financial platforms, pulling data automatically rather than forcing exports and manual uploads between tools. When someone submits a purchase request that exceeds category budgets, the workflow flags it immediately with clear explanations—no approval delays, no budget surprises later.

Implementation matters. Roll out new platforms gradually, starting with one high-spend category before expanding company-wide. Train teams on the tools and ensure integration with existing systems, or you’ll end up with expensive software that doesn’t fit daily workflows.

Procurement cost reduction techniques:

- Use spend analysis tools to break down purchases by supplier, department, and product category. It’ll help you spot trends and inefficiencies in your spending.

- Rely on dashboards to monitor who is buying what, from whom, and at what price. So you could make informed decisions on supplier selection, bulk purchasing, and other cost-reduction tactics.

- Regularly review spend data and adjust procurement strategies accordingly to check if purchases are still aligned with company goals.

Automate contract lifecycle management

Here’s what happens without contract management systems: you negotiate a great rate, sign the agreement, and file it away. Six months later, someone asks “What pricing did we agree to with this supplier?” and the hunt for truth begins through all the email archives, shared drives, and someone’s desktop folder. By the time you find it, the renewal date has already passed and the contract is renewed automatically at last year’s inflated rates.

Contract lifecycle management platforms are supposed to track agreements from creation through renewal to save you from the chaos of scattered documents and missed deadlines.

CLM systems provide the following:

- Standardized creation. Pre-approved templates save you from starting over, while automated workflows keep contracts moving through finance, legal, and category managers without version control chaos.

- Centralized repository. Every agreement lives in one searchable database tagged by supplier, category, expiration date, and key terms—no more hunting through file shares.

- Proactive monitoring. Systems track renewal windows, price adjustment triggers, and performance milestones, sending alerts instead of letting critical contracts expire unnoticed.

- Unfavorable term detection. Notifications inform about contracts with above-market price escalators, auto-renewal clauses without review periods, or outdated volume commitments you no longer need.

The value isn’t just in staying organized: you can lock in savings before they slip away. Contracts that would auto-renew at inflated rates get renegotiated. Terms that no longer make sense get updated before they cause problems. Compliance requirements get monitored systematically, not just uncovered during audits.

Integration with procurement platforms means contract terms flow directly into purchase orders. When buyers create POs, the system validates pricing, quantities, and delivery terms against signed agreements, flagging discrepancies before anything ships. You’re not just storing contracts—you’re enforcing them.

Start with high-value contracts or your most complex categories. Get the workflows right with a manageable number of agreements before expanding to your entire portfolio. Rolling out everything at once creates change management problems that derail adoption.

Contract management isn’t about administrative tidiness. It’s about making sure the savings you negotiate in contracts actually stick instead of leaking out through auto-renewals, forgotten terms, and scattered documentation that nobody can find when it matters.

Types of costs in procurement

In procurement, costs fall into two main categories: direct and indirect. Direct costs are those directly tied to producing the company’s final product or service, like raw materials or components needed for manufacturing. On the other hand, indirect costs are the expenses that support internal operations but aren’t tied to product development itself. They include office supplies, IT services, administrative support, and more.

But here’s the thing: the true cost of procurement isn’t always as simple as the price you see on a product’s label. In reality, multiple factors contribute to what a company ends up paying. Let’s take a deeper dive into these different costs to help you make more informed decisions about cost-reduction strategies in procurement.

1. Base cost

The base cost, or the per-item cost, is the core expense in any procurement transaction. It represents the price paid for each good or service acquired. Oftentimes, this cost is the most significant and the most difficult to reduce. To lower the base cost, procurement managers group purchases and obtain volume discounts.

2. Transportation costs

Transportation costs are tied to the movement of goods from suppliers to your organization. These costs can include:

- Freight charges

These costs typically apply to large shipments transported via truck, rail, ship, or air cargo. They’re calculated based on weight, volume, distance, and fuel surcharges. - Shipping fees

Charges related to the process of preparing goods for shipment, including packaging, handling, insurance, and documentation needed for delivery. - Delivery expenses

These are final-mile costs that cover special handling, urgent delivery choices, and specialized equipment for unloading.

To lower these expenses, procurement teams can consolidate shipments, negotiate long-term contracts with carriers, or optimize delivery schedules to reduce rush shipping costs.

3. Closing costs

When you outsource inventory or engage in third-party transactions, closing costs can add up. They include:

- Brokerage fees

These are charges paid to intermediaries (brokers) who facilitate the buying or selling process, particularly when dealing with international transactions or complex deals. - Legal costs

Fees associated with hiring legal advisors to draft, review, or negotiate contracts. These professionals ensure that all terms are legally sound and protect your organization from potential risks. - Commissions

Payments made to agents or intermediaries who assist in finalizing agreements, typically based on a percentage of the deal value or other arrangements.

To minimize closing costs, use standardized contract templates for routine deals. Additionally, negotiate flat-fee arrangements instead of hourly billing when possible. Flat-fee arrangements provide a clear, predictable cost for legal services without unexpected charges that vary based on the time spent on each task.

4. Taxes and duties

Taxes and duties are substantial costs that must be considered in international procurement. These include import tariffs, value-added tax (VAT), goods and services tax (GST), and other customs-related fees. Companies require in-house expertise or the use of brokers who specialize in customs processes to manage these costs. If you don’t account for these charges early on, you might face surprise costs and procurement compliance headaches down the line. That’s why it’s important to include them in your procurement strategy from the start.

5. Negotiation costs

The negotiation process with suppliers can incur hidden expenses that add up quickly. These costs go beyond the price of the goods or services and can include:

- Research costs

The time spent identifying potential suppliers, evaluating options, and preparing for negotiations. - Travel expenses

If in-person meetings or site visits are required, travel costs can significantly increase procurement expenses. - Contract finalization

The time and effort required to finalize terms and agreements, including legal fees or extra administrative work.

To reduce these costs, procurement teams can establish clear goals before entering negotiations to avoid unnecessary back-and-forth and reduce the overall time spent. It’s also a good idea to use data analytics to quickly identify the best suppliers and avoid excessive time spent on supplier evaluation.

How to measure cost reduction in procurement

When you implement procurement cost-reduction strategies, the next step is to track and present changes to the management. Here’s what you need to demonstrate the financial impact of procurement cost savings ideas.

1. Define a baseline for comparison

Procurement cost reduction makes sense only when there’s a clear benchmark to compare. Set a baseline cost through the following analysis:

- Historical spending

What was the cost of a product or service before implementing changes? - Previous contract pricing

What were the agreed-upon rates in past supplier agreements? - Market prices

How do costs compare to industry benchmarks?

2. Use procurement analytics

To accurately measure the cost reduction in purchasing, use centralized procurement dashboards and reports. It’s incredibly beneficial because you can easily access the following data in one platform:

- Spending across entities and departments

- Purchases by supplier and category

- Who is buying what and at what cost

- Frequency and volume of purchases

- Compliance with negotiated contracts

These insights help ensure that procurement cost savings are sustained and not offset by inefficiencies elsewhere.

3. Use key metrics to track cost reduction

Several metrics help quantify procurement cost reductions:

Unit cost savings

This metric measures the difference in price per unit before and after renegotiation or strategic sourcing.

Formula: (Old price – New price) × Quantity Purchased

Example: A company buys 1,000 office chairs at $50 per unit. After negotiating with a new supplier, the price drops to $45 per unit.

Calculation: ($50 - $45) × 1,000 = $5,000 in unit cost savings.

Total spend reduction

This metric reflects the overall decrease in procurement expenses over a specific period.

Formula: Previous Spend – Current Spend

Example: A large company spent $5,000,000 on procurement in the previous fiscal year. After implementing cost-saving measures, this year’s spending dropped to $4,500,000.

Calculation: $5,000,000 – $4,500,000 = $500,000 in total spend reduction.

Cost reduction percentage

This metric shows the percentage decrease in procurement spending compared to the previous period.

Formula: [(Previous Cost – New Cost) / Previous Cost] × 100

Example: Let’s use the previous example: a company spent $5,000,000 on procurement last year and reduced it to $4,500,000 this year.

Calculation: [(5,000,000 – 4,500,000) / 5,000,000] × 100 = 10% reduction.

Process cost savings

This refers to reduced operational costs from procurement automation or efficiency improvements (for example, lower administrative costs from fewer manual approvals). This metric is the least straightforward, but it can help measure the efficiency and ROI of automation investments.

Formula: Time saved × Hourly rate

Example: Let’s say a company automates approvals and cuts the time spent on them from 15 hours to just 2 hours per week (with the average employee’s time costing around $30 per hour).

Calculation: 2 hours saved × $30 per hour = $60 saved per week.

4. Track savings over time

Procurement cost reduction isn’t something you do once and forget about. It takes ongoing attention to make sure the savings stick and keep getting better over time. Regular tracking and reporting help identify which strategies deliver sustained savings and where it’s best to make adjustments. The key components to track include:

- Short-term savings

These reflect immediate cost savings from negotiated price reductions or one-time supplier discounts. It’s important to capture these early wins but also ensure they don’t overshadow a long-term strategy. - Long-term impact

This includes savings from ongoing initiatives like supplier consolidation. At first, the long-term benefits—like lower total ownership costs, better terms, and improved service—might not be obvious. However, they can lead to lasting savings over time. - Performance trends

Regularly analyze the effectiveness of cost-saving initiatives over time to identify patterns or shifts in spending behavior and adjust procurement cost-reduction strategies. For example, you can renegotiate contracts, find new vendors, or scale successful strategies to other procurement areas. - Trend comparisons

Track cost reduction against historical spending and benchmark performance against industry standards to ensure the company remains competitive.

Frequently asked questions about procurement cost reduction

Cost reduction in procurement is the process of systematically lowering procurement costs. For example, a company might reduce unit costs for office supplies by consolidating purchases and buying in bulk.

Cost control is the practice of keeping expenses aligned with a predetermined budget. It involves ongoing monitoring and active management of expenses to prevent overspending. The goal of cost reduction is to achieve lasting cost decreases through strategies like procurement centralization, contract renegotiation, and strategic sourcing.

The cost reduction process typically involves:

- Procurement spend analysis to evaluate current supplier performance and historical spending.

- Strategy development to establish a procurement policy, set up clear approval workflows, and reduce waste.

- Plan implementation to centralize procurement activities, identify redundant purchases, and renegotiate supplier contracts.

- Tracking of savings, compliance, and operational efficiency to ensure ongoing cost reduction.

- Strategy adjustments (if needed) based on new insights and market changes.

There’s no universal formula, but here’s a simple way to measure it: Cost Reduction (%) = [(Previous Cost – New Cost) / Previous Cost] × 100.

Cost reduction focuses on reducing expenses in a sustainable way. It involves process optimization and negotiation of better terms. Cost cutting is often more immediate and drastic. It involves minimizing expenses in areas that may impact product quality, operations, or employee morale (for example, laying off employees or purchasing worse materials).

The principle of cost reduction is to lower procurement costs through strategic actions that don’t sacrifice product quality or process efficiency. The idea is to consolidate purchases, cut waste, and negotiate more favorable deals with suppliers to achieve lasting procurement cost savings.

Cost savings include both one-time and ongoing savings from any cost-control effort. Cost reduction is a long-term strategy focused on permanently lowering costs.

Final thoughts about procurement cost reduction

Don’t mistake procurement cost reduction for sudden, panicked cuts. True savings come from waste elimination, strategic negotiation, and purchase consolidation. And let’s not forget that strong relationships with your suppliers help keep quality and reliability high even with cost cuts.

The real magic happens when you see cost reduction as an ongoing effort, not just a one-time fix. To discover opportunities for new savings, you can conduct regular contract reviews, track spending trends, and ensure the procurement policy aligns with business needs. The goal is to make a real financial impact without creating unnecessary risks or hiccups.