19 min read

Cost Control: A Key to Sustainable Budgeting

Explore the importance of cost control in your business. Learn practical strategies to manage your expenses and invest in lasting growth.

In light of today’s macroeconomic events, with inflation on the rise and unstable interest rates, businesses are focusing more than ever on driving savings and trimming costs. Companies are prioritizing growth and expansion for 2025, but they struggle to balance margin improvements with new investments. A recent survey by Boston Consulting Group found that respondents were able to meet only 48% of their cost-saving goals in 2024.

So, what’s the solution? How do you increase your company’s revenue while getting the most out of every dollar you spend? The answer is clear: cost control. A comprehensive strategy that combines both cost reduction and cost optimization isn’t just about cutting costs—it’s about spending smarter. This article explores the benefits and challenges of cost control and how procurement software can help bring your initiative to life.

Keep reading to learn:

- What Is Cost Control

- Differences Between Cost Control & Cost Management

- Differences Between Cost Control & Cost Reduction

- Types of Expenses Affected by Cost Control

- Benefits of Cost Control

- Cost Control Challenges & Solutions to Overcome Them

- KPIs for Cost Control

- Best Cost Control Strategies

- Frequently Asked Questions About Cost Control

Cost Control Meaning

Cost control, also known as expense control, refers to the practice of analyzing, monitoring, and optimizing expenses to make sure every dollar spent brings value to your business. Think of it as making your money work for you. Cost control also helps you mitigate the pitfalls of cost reduction and maintain product quality with reduced expenses.

By comparing your expenses against your expected budget, you can identify cost-saving opportunities, improve vendor relations, and remove unnecessary purchases. The cost control definition covers the following steps:

- Budget Planning

A well-defined budget serves as a foundation for cost control. Start by looking at past budgets and expense data to determine what worked and what could be improved.

But don’t dwell too much on historical information. Instead, justify each expense and identify its purpose. This process is called zero-based budgeting, one of the most effective cost-control methods. Finally, set measurable and attainable goals that your company can reach within a clear timeframe.

- Communication with Stakeholders

The responsible teams must clearly understand the budget limits and the desired outcomes for the company. Open communication secures buy-in from everyone involved and ensures all departments work toward the same goal. Schedule regular check-in meetings and stay open to questions, concerns, and suggestions.

- Spend Tracking

Next, procurement teams monitor expenses to identify any inconsistencies and discrepancies in their spending history, such as maverick spending, duplicate purchases, and budget overruns.

This process can be done manually or sped up with spend management software like Precoro, which automatically notifies users about over-budget purchase orders. Detecting such issues early on helps determine what measures to take and which gaps to fill.

- Budget Alignment with Spend

Now is the time to compare your company’s expenses to the planned budget. Focus on both overspending and underspending—they tell a different story. Overspending points to poor budget planning, potential scope creep (when the project’s scope changes after it begins), or unforeseen costs.

Underspending might seem like a win, but it’s also a symptom of underlying project issues, such as delays, missed growth opportunities, or even poor quality control.

- Corrective Actions

Once you’ve identified the issues, it’s time to fix them. The goal is simple: identify areas where costs spiral out of control and find ways to minimize them. To overcome these concerns, implement mitigation measures, including zero-based budgeting and variance analysis. Read more in-depth about cost-control solutions below.

Cost control isn’t a one-time fix. Repeating this process quarterly or annually helps identify the root cause behind cost overruns and inconsistencies with the baseline.

Cost Control vs. Cost Management

Both cost control and cost management deal with monitoring and optimizing expenses, so it’s no surprise that these terms are often confused. The main goal of cost control is to ensure the company’s expenses stay within the budget, increase profits, and highlight areas that require corrective action. Because the measures are implemented in response to issues found, cost control is reactive.

Cost management, on the other hand, is more proactive. It involves resource planning (people, equipment, and materials needed for a project), cost estimating (approximate cost), budgeting, and finally, controlling the costs.

Cost management spans the entire project, from start to finish, aiming to anticipate and prevent the challenges before they happen. While all team members contribute to cost management, accounting and procurement managers are usually in charge of cost control.

It’s safe to say that cost control is essentially a crucial part of cost management. Simply put, while cost control keeps expenses on track with the budget, cost management determines what the budget will be and where it should go. Here are the key differences between the two:

Cost Control vs. Cost Reduction

In an attempt to meet their saving goals, companies often fixate on trimming costs and unnecessary expenses. If carefully planned, cost reduction can help increase profits and promote more efficient use of resources.

Although cost reduction is important, it’s not a one-and-done solution and might not be the best option for everyone. In fact, 35% of the companies that cut their expenses in 2023 saw costs return. Moreover, approximately 27% of organizations reported that trimming costs actually hindered their business growth and operations.

While both methods aim to optimize costs and drive company savings, their approaches are different. Cost control monitors expenses and ensures they align with the established budget. Cost reduction, on the other hand, aims to lower costs through strategic decisions without decreasing product quality.

For example, the company wants to expand its product range, but launching new production could drain the budget for the existing product line. In that case, the organization could outsource or switch to a more affordable supplier to cut costs. In a way, cost reduction can serve as a corrective measure of cost control since companies often cut expenses after identifying unnecessary costs during the process.

Types of Expenses Affected by Cost Control

To control your costs, you must understand them. Most business expenses can be separated into several types, and each impacts business operations differently. Every type requires its own approach.

Direct Costs

True to their name, direct costs fall under the domain of direct procurement. These expenses can be linked directly to the production of your company’s products or services. Direct costs are easy to trace since they’re usually tied to a cost object: a specific product, a service, or even a department.

Examples of direct costs include:

- Materials used for product manufacturing

- Wages paid to employees

- Equipment used for production

- Shipping costs related to production or product sales

Indirect Costs

Indirect expenses, on the other hand, are handled under indirect procurement. Also known as overhead costs, they include expenses that support business operations. Such expenditures are more difficult to trace since they’re not directly linked to the company’s product or service.

Examples of indirect costs include:

- Warehouse or production building rent

- Computers and software

- Office supplies

- Travel expenses

- Wages paid to consultants and outsourced workers

Fixed Costs

Fixed expenses don’t change during a set period of time, often bound by a contractual agreement. They aren’t affected by the number of goods sold or produced by the company. Such costs are typically recurring and not directly related to product manufacturing.

Examples of fixed costs include:

- Lease and rent payments

- Property taxes

- Fixed labor costs

- Interest costs

Variable Costs

On the contrary, variable costs fluctuate based on the number of goods sold or produced. The more products the company sells, the higher the variable costs. They can be directly traced back to the company’s product or service, which usually makes these expenses direct. Nonetheless, variable costs are more difficult to calculate and budget due to their ever-changing nature.

Examples of variable costs include:

- Product shipping and delivery costs

- Raw materials and supplies

- Packaging

- Sales commissions

- Wages and overtime pay

Together, fixed and variable costs make up the total cost of your business.

Semi-variable Costs

Expenses that are partially fixed and partially variable fall under semi-variable costs. For example, while employees have a monthly salary, they may receive a sales commission based on their performance. The salary is fixed, while the commission varies depending on sales volume, which makes this expense semi-variable.

Other examples include:

- Electricity plan with usage upcharge

- Phone bills with usage upcharge

- Maintenance costs

- Overtime & commission pay

- Insurance with additional coverage

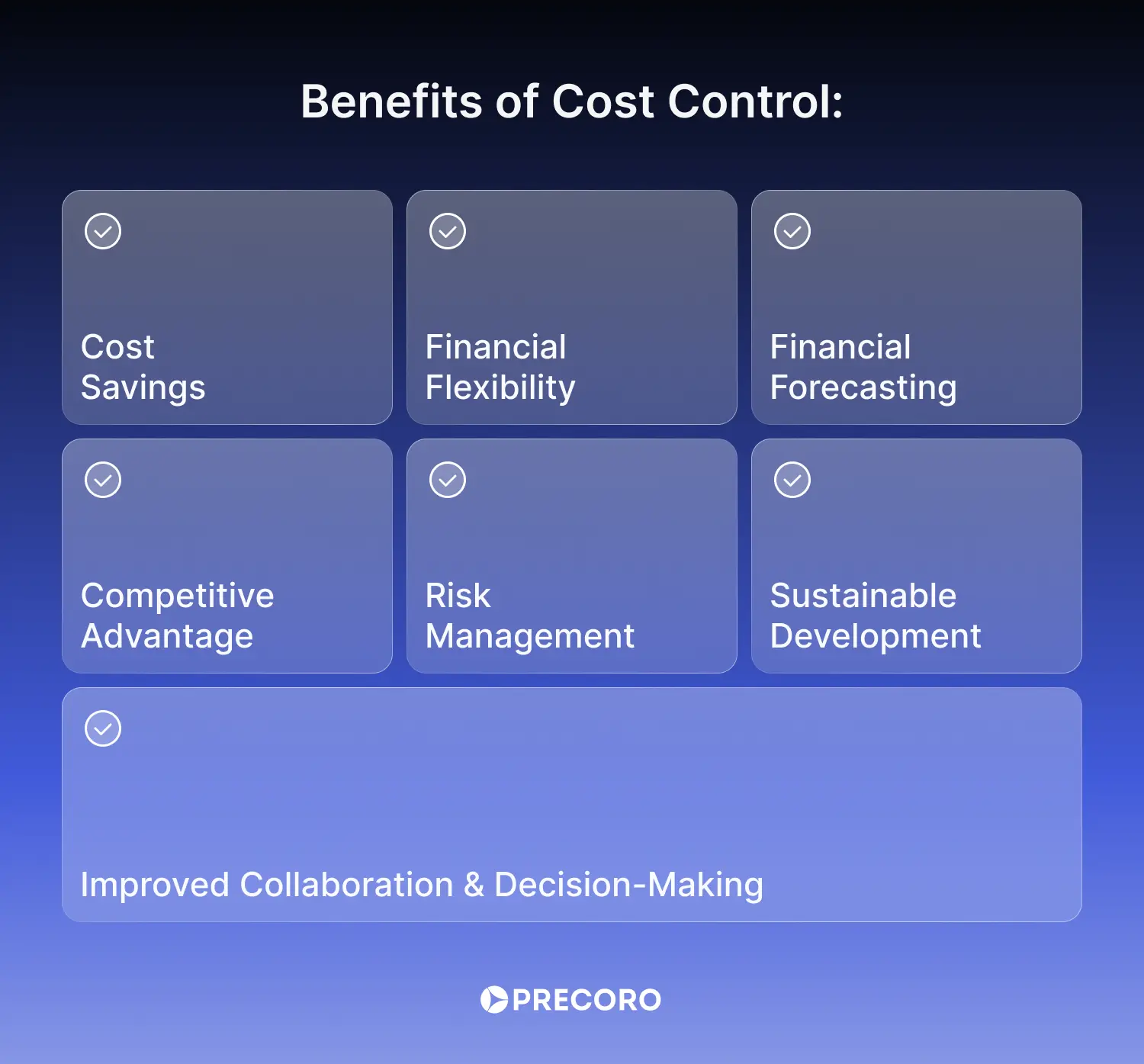

Benefits of Cost Control

The importance of cost control extends beyond financial profits and revenue. Gaining control over your expenses can go a long way in many areas of your business, from vendor management to operational efficiency.

When you manage your expenses, you can invest in what truly matters, like equipment upgrades, employee bonuses, or business expansion. Here’s why businesses focus on cost control:

• Cost Savings

Properly implemented cost-control strategies can help the company reduce spend leakages, find cost-saving opportunities, and spend less on low-priority needs, which, in turn, improves profitability. If your company overspends, cost control can detect cost variances.

Then, you can use this data to understand what decision you should make: negotiate with suppliers on discounts, change equipment, or stop production of a low-demand product. For example, if the company’s electricity bill keeps rising every month, consider switching to more cost-effective light sources like LEDs.

• Financial Flexibility

Lower expenses and more savings in your pocket give you more room to invest funds in new projects and allocate resources to areas that drive business goals. Not only that—if the company suddenly faces unexpected challenges (recession, supply chain disruptions, or equipment failure), it can quickly cover the cost with minimal damage. Financially flexible businesses are also more likely to take advantage of profitability opportunities.

• Financial Forecasting

Understanding your spending and your company’s budget limits helps you plan for the future and set attainable goals. With the added financial flexibility and savings, companies can prepare for future hurdles while having a clear picture of their potential revenue and available resources. When applied regularly, cost control can be a great tool to develop a long-term financial forecast.

• Competitive Advantage

Effective cost control can provide your company with a competitive edge. Cut expenses or negotiate better deals with suppliers to offer your customers lower prices or other incentives, such as free shipping or discounts. A proven track record of well-executed cost control could give you an upper hand over other companies in competitive industries like construction.

• Risk Management

Cost control gives you an entire overview of the company’s cost structure, where you can spot potential risks before they actually happen. Not only does this apply to external factors such as market conditions or economic downturns, but it also digs deeper into internal processes.

Here’s one of the cost-control examples. If you notice that machinery repair costs are increasing, you can change equipment or schedule regular maintenance checks to avoid expensive repairs.

• Improved Collaboration & Decision-Making

When implementing any company-wide cost-control solutions, departments and teams come together to align their perspectives and share ideas. Although collaboration might not be the main goal, cost control creates a platform for employees across departments to openly voice their concerns.

A second opinion can help you ensure that the cost control plan addresses all problem areas and fills all the gaps. Additionally, with more information on your hands, you can make an informed decision on which costs to reduce, invest, or reallocate.

• Sustainable Development

As your business expands, the need for comprehensive cost-control strategies will only grow. Besides focusing on the financial benefits, companies need to change and adapt their cost management as the market changes. When you understand where to cut costs and which resources to invest in, you create a strong foundation for a sustainable business model. If your every decision is well-informed and backed by cost-control data, your company is on the path to long-term success.

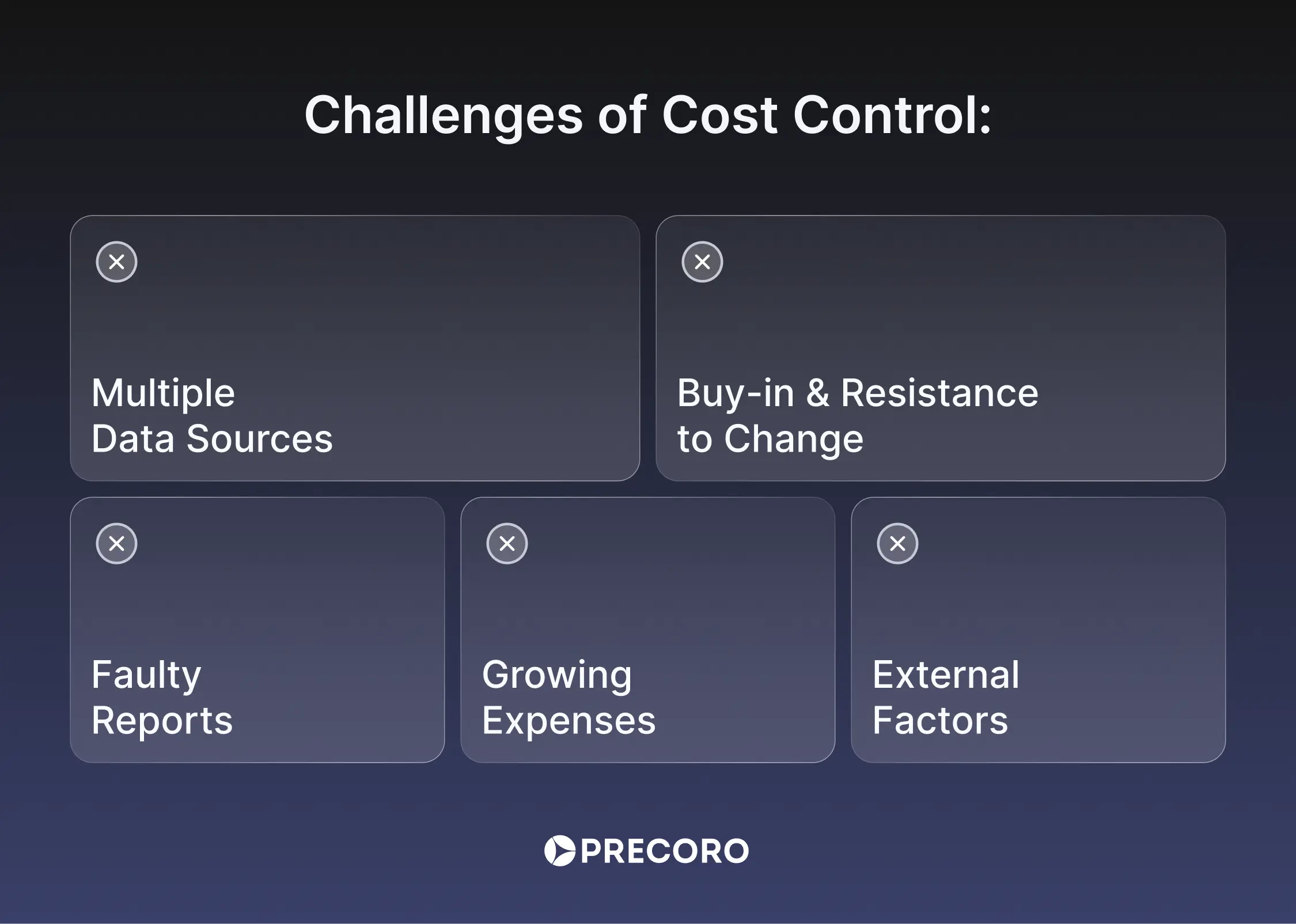

Cost Control Challenges and Solutions to Overcome Them

Cost control can be tricky to implement, especially for companies without a clear budget or a spend management system. Here are some of the common challenges businesses face in the cost control process, along with solutions to tackle them.

• Multiple Data Sources

Financial data is often scattered across different platforms and tools used by the company, be it accounting software like Quickbooks or simple spreadsheets in Excel. Data collection can quickly turn into a cumbersome, time-consuming process. Without all information in one place, cost control results might be inaccurate and riddled with errors.

Solution: Implement procurement software that centralizes information from multiple data sources into one dashboard. For example, Precoro allows users to set up data transfer with ERP, accounting, and business tools. This feature significantly reduces the time spent on organizing this information and helps get a clear picture of the company’s spend.

• Buy-in & Resistance to Change

When it comes to company-wide cost control, the number of stakeholders can seem overwhelming. Communicating the procurement strategy to all parties involved is always necessary. However, too many opinions can quickly fog your vision of the goals you want to achieve.

Additionally, some stakeholders might not agree with the plan. Moreover, if you change any business operations, your efforts may be met with resistance that can slow down the progress of cost control management.

Solution: Keep stakeholders informed of all cost control updates from start to finish. Schedule Q&A sessions where you share the benefits and challenges of cost control, both supported by data and analysis of your company’s spend. Additionally, offer training and onboarding for employees who struggle with new changes.

• Faulty Reports

Financial records and spending data form the backbone of cost control. Reports should provide precise numbers, dates, and names, all of which are crucial to establishing proper control over your finances. If the company still relies on manual data entry and keeps all of its data in a spreadsheet, there’s a high chance of mistakes.

Real-world examples, from corporate giants like Kodak and JP Morgan to regular state workers, show how costly spreadsheet mistakes can be, sometimes resulting in a staggering $10 billion.

Solution: Switch to an automated accounts payable platform that pulls in data from invoices and purchase orders and generates reports. Platforms like Precoro use 3-way matching to detect any inconsistencies between documents. Plus, you can create visual charts, preset reports, and custom reports in Precoro and present the data in an easily digestible format through its integration with Power BI.

• Growing Expenses of Cost Control

Some cost control initiatives, such as employee training or new cloud-based procurement software, require an upfront investment. Solutions that can save you money in the long run might be even more expensive than what you currently use.

Additionally, as the company grows, it needs more resources to handle its cost control processes. Specifically, it requires additional funding, more employees, specialized tools, and, most importantly, time.

Solution: Start small with expense control initiatives that give you immediate results. For example, you can set clear budgets to put the teams on a path to well-managed finances. When investing in new software, focus on scalable solutions with differential pricing models. Let a small team use the tool first and gather their feedback. If the results are positive, you can switch to a more extensive plan.

• External Factors

Even if you develop a steady cost-control plan, factors outside the company’s control can disrupt it. A survey found that 40% of executives feel unprepared for the market disruptions of 2025. And it’s no surprise—industry swings, currency fluctuations, and sudden price increases can throw your cost management system off balance. Global geopolitical events and natural disasters are particularly devastating since businesses are often hit with unexpected costs during these trying times.

Solution: When developing a cost control system, think of ways to make your business financially flexible. The simplest option is to create a contingency plan and build a cash reserve, which you can use to cover unforeseen expenses. Stay up to date with global and industry news and adjust cost control measures accordingly.

KPIs for Cost Control

Key Performance Indicators (KPIs) are quantifiable metrics used to measure a company’s progress toward certain goals over a set period of time. KPIs vary across different aspects of the business: for example, click-through rate (CTR) is widely used in marketing, while the manufacturing sector focuses on metrics like energy cost per unit.

Cost control has its own set of commonly used metrics, some of which are:

- Cost variance measures the difference between the budgeted costs and the actual costs spent on a project.

- Cost of goods sold (COGS), also known as cost of sales, tracks all expenses directly tied to the production of goods sold by the company. COGS includes all direct costs (materials, labor, and shipping fees) but excludes indirect costs (marketing, rent, and utilities).

- Cost performance index (CPI) measures the cost efficiency of your project by comparing its earned value (EV) and actual costs (AC). For example, if the project is 60% completed with a total budget of $100,000, the earned value is $60,000 (0.6 x $100,000 = $60,000). The company has already spent $70,000. CPI is calculated by dividing EV by AC ($60,000 / $70,000 = 0.8). CPI under 1.0 points at a budget overrun.

- Target net income is the profit the company hopes to earn in a set period of time. It’s one of the main goal metrics in a cost control system and is measured by subtracting fixed and variable costs from sales.

- Return on investment (ROI) measures how well the investment performed. To calculate this metric, divide the value of the investment by the cost of the investment.

- Cost per unit refers to the production cost of one item. Related to COGS, it’s measured by dividing the total production costs by the number of units.

- Gross profit margin demonstrates revenue made by the company after deducting business costs. It’s calculated by subtracting COGS from net sales (without discounts and returns).

With the right KPIs, you can see the results of your cost control strategy turn into concrete numbers that show exactly how much money you’re losing, saving, and investing. Armed with this information, you can identify the problem areas and apply cost-control methods to tackle them.

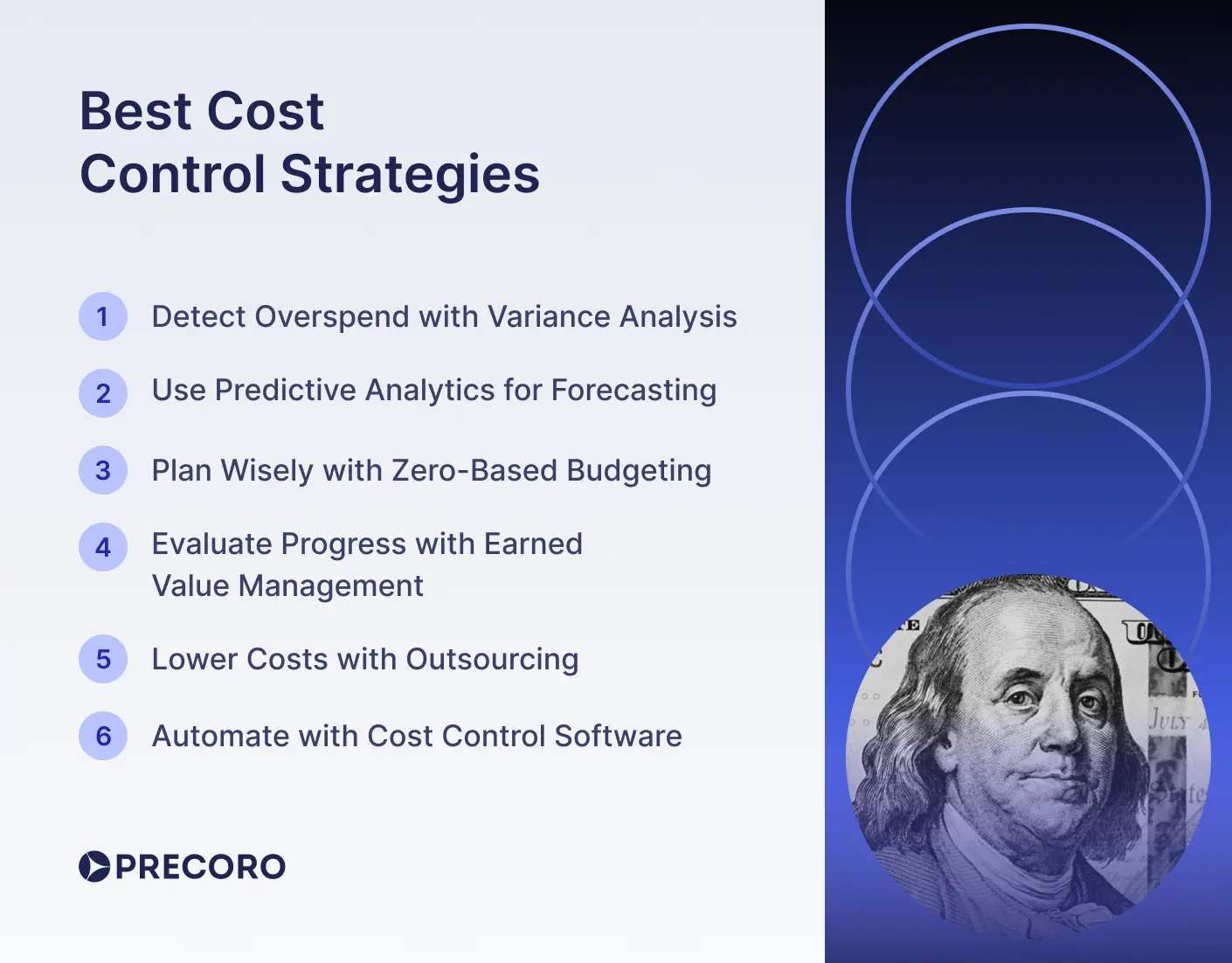

Best Cost Control Strategies

Managing your expenses to your company’s benefit can be daunting. However, companies can use different cost-control methods to improve their cash flow and financial stability. Besides cost reduction, consider adding the following techniques to your cost control arsenal.

Detect Overspend with Variance Analysis

Variance analysis, a commonly used cost accounting tool, compares the budgeted costs against the actual ones. Based on the analysis data, companies can identify areas of financial discrepancies, explore potential root causes, and develop a solution.

For best results, variance analysis should be conducted regularly, either monthly or quarterly. This frequency helps detect and eliminate any financial inconsistencies early on.

Use Predictive Analytics for Forecasting

Financial forecasting is a crucial part of expense control, as it helps predict potential price hikes or market trends. Predictive analytics does just that—you can use historical data to identify patterns and challenges affecting your costs.

For example, if the supplier has increased the prices for materials during peak production season, the company can negotiate a fixed-rate deal or prepare the budget ahead of time.

Plan Wisely with Zero-Based Budgeting

Zero-based budgeting, or ZBB for short, refers to the type of budgeting where every expense has to be justified for each new period. The budget essentially starts from $0 and is built around the monetary needs of the company for that period, be it a year or a month.

Instead of tailoring the past budget, the organization bases each cost on its current business goals. Additionally, ZBB shows how the company’s resources are allocated.

Evaluate Progress with Earned Value Management

Earned Value Management (EVM) tracks a project’s progress and alignment with its scope, budget, and timeline. EVM focuses on three metrics, two of which we already mentioned: Earned Value (EV), Actual Costs (AC), and Planned Value (PV).

While earned value refers to actual work completed, planned value is the work that should have been completed by a set time. These metrics help companies identify budget overruns early on and take action to prevent any more damage.

Lower Costs with Outsourcing

Employing external specialists to take on non-strategic tasks is a common practice in cost control management. Outsourcing often turns out to be more cost-effective than hiring a full-time employee for each position because outsourced workers don’t require the same benefits, salaries, or training.

Some companies choose to outsource from cheaper wage markets, lowering their labor expenses. This practice also reduces indirect spending, such as costs for office supplies or equipment.

Automate with Cost Control Software

Companies that are still using spreadsheets or outdated spend management systems may be overlooking the benefits of automated procurement software.

Here’s how cost control software can help your business:

- Automate repetitive tasks.

Such tools help organizations handle repetitive, time-consuming tasks, like creating purchase orders or financial reports. Cost control software also handles invoice capturing with OCR, saving the company precious time and effort. - Detect unnecessary spend.

Simple, customizable reports give you a clear picture of where your money goes. These insights help you track and review all purchases across the company. Moreover, tools like Precoro detect duplicate invoices and alert your team before any spend leakage occurs. - Find discrepancies in documents.

Automated tools often use 3-way matching and compare invoices, purchase orders, and receipts to ensure the accuracy of purchasing documents. - Get the most out of your contracts.

With all your supplier info in cost control software, you can track vendor performance and compare prices. Based on this information, you can negotiate better deals like bulk pricing or discounts. - Speed up approval processes.

Procurement platforms allow users to set up automated approval workflows, so you don’t have to contact each employee individually for approval. The software routes the needed document to designated approvers, with each person having complete visibility into the process.

Frequently Asked Questions About Cost Control

Cost control, also known as expense control, is the process of analyzing, monitoring, and optimizing expenses to stay within the set budget and increase profits.

A cost-control strategy usually consists of the following steps: budget planning, communication with stakeholders, spend tracking, budget alignment with expenses, and corrective actions to mitigate any financial shortcomings, like overspending or maverick spending.

Cost control helps businesses keep their expenses within the established budget, avoid overruns, and identify spend leakages. Additionally, the results may guide you toward cost-saving opportunities and a contingency plan for your business. The money saved can then be re-invested or reallocated to high-priority tasks.

Expense control benefits include cost-saving opportunities, better risk management, more financial flexibility and forecasting, competitive advantage on the market, and improved decision-making and collaboration. On the other hand, cost control comes with its own set of challenges, including upfront costs, resistance to change, implementation difficulties, and scaling as the business grows.

Zero-based budgeting is one of the proven cost-control solutions but has a high barrier to entry. The company creates the budget from scratch and has to justify every expense, weighing whether it aligns with the current business goals and needs. Cost control software, on the other hand, has an immediate impact on business operations and is fairly easy to implement, with many tools being plug-and-play. With such solutions, you can track expenses, automate repetitive tasks, and get better supplier deals.

Cost control focuses on keeping expenses within the budget limit, while cost management involves multiple processes, including resource planning, budgeting, and cost estimation. Cost control is essentially a step in the cost management process.

Cost control typically involves monitoring the expenses while keeping resource levels the same. On the other hand, cost reduction focuses on trimming costs, often in response to financial challenges.

Why Controlling Costs Is Important

With the ever-changing market, cost control became not just a way to increase profits and stay within budget. It’s a competitive advantage that can help your business get a head start in the game. Moreover, with external factors having more and more impact on businesses, cost control is a survival strategy that ensures long-term business growth.

Cost control goes beyond cost reduction and cost savings. By optimizing your expenses, you can reallocate resources to areas that truly matter, invest in new technology for your business, and branch out to different markets.