12 min read

What Is PPV? Purchase Price Variance Explained

What if we told you that you can drastically improve overall business profitability by looking at one specific procurement metric? Let’s take a look at purchase price variance.

PPV = (Actual Price − Standard Price) × Actual Quantity

Financial efficiency, cost savings, and profitability undoubtedly fall under the main priorities of upper management, regardless of a company’s industry. However, only 30% of CPOs claim they have achieved their cost-saving targets in 2023. One of the ways that procurement teams improve this figure is by tracking and improving the purchase price variance (PPV) metric.

In this article, we'll explain what PPV is, why it matters, and how tracking this metric can benefit your procurement processes. Keep reading to find out:

- What is purchase price variance?

- Why is purchase price variance important?

- Calculating PPV

- What PPV tells you

- Forecasting PPV

- Why does purchase price variance happen?

- Managing PPV

- Understand PPV – control costs

- Frequently asked questions

What Is Purchase Price Variance?

Purchase price variance is a financial metric used in procurement and supply chain management to assess the difference between the expected (also known as standard or baseline) cost of an item and its actual purchase cost. PPV measures the gap between what the company planned to pay for a product or service and what they actually paid.

Purchase price variance can be tracked for each separate purchase or for the total procurement spend over specific time periods – for instance, monthly, quarterly, or yearly. It's an important metric for tracking price fluctuations and, if used correctly, it provides vital insight into the effectiveness of cost-saving strategies. Purchase price variance can be positive or negative; positive means more was paid than initially expected, and negative means less was paid.

Why Is Purchase Price Variance Important?

Variations in the prices of purchased goods and services impact a company’s overall spend in the most obvious way. Thus, keeping track of PPV is an important part of managing business costs that should not be underestimated.

It’s a key focus for any executive; in fact, improving profit margins via cost reduction stays among the top priorities of the high-performing CPOs. According to Deloitte’s Annual Global Chief Procurement Officer Survey 2023, it’s highlighted as the number three priority by 71% of CPOs.

Stakeholders track purchase price variance to understand procurement spend and quantify its efficiency. This metric can be used for evaluating current performance as well as for financial forecasting.

Cost Control

Monitoring purchase price variance helps organizations identify cost overruns and underruns, allowing them to take corrective actions to control costs. By tracking PPV and combating discrepancies, managers can ensure that the actual spending aligns with the budgeted costs.

Generally speaking, this happens in two ways: by finding a better price option or by ensuring better estimations. In any case, managers who have a good understanding of the current PPV and its tendencies can make informed decisions to control expenses.

Budgeting and Planning

Purchase price variance is also a precise indicator of how accurate a company’s budgeting and financial planning are. When the company budget is created, the exact price for each purchase isn’t yet confirmed, so the procurement managers need to estimate as best they can. This estimate is then used as a standard price in the PPV formula.

After the company makes a purchase, procurement specialists can compare the actual cost against the budgeted cost. The smaller the variance of the purchase price, the more accurate the estimate was.

Supplier Evaluation

The purchase price variance number helps companies evaluate supplier performance. A consistent positive variance could indicate issues with a supplier's pricing accuracy. By analyzing PPV, procurement professionals can identify suppliers who fail to provide correct price estimations and deliver goods or services at higher costs.

At the same time, PPV helps identify suppliers who consistently deliver products at or below the expected cost. Minimizing orders from the former suppliers and maximizing from the latter can seriously improve the company’s cost efficiency and lead to long-term savings and improved profitability.

Calculating PPV

Purchasing professionals can calculate purchase price variance using a straightforward formula:

In the formula, Actual Price stands for the actual price paid by a company for a product or service. This number includes factors like taxes, shipping fees, and any additional charges that affect the actual unit cost.

Expected or Standard Price represents the budgeted price for the item before it has been bought. It’s a price that procurement professionals formulate during the budgeting process because they believe that’s what the company will pay. Standard price is typically estimated based on multiple factors: an average of historical prices (typically from the previous year until current pricing), current market conditions, and agreements with suppliers.

Quantity stands for the actual quantity purchased. It can be measured in any relevant units, like, pieces, minutes, kilograms, etc. PPV can vary based on the amount of items bought due to the possibility of volume discounts, so it's important to consider quantity when calculating the variance.

What PPV Tells You

Purchase price variance is expressed as a number and tells whether the company is doing a good job ensuring purchase cost-efficiency, or not. A positive PPV means that the actual price that the company paid is higher than their anticipated price A negative PPV, on the other hand, means that the actual cost is lower than the budgeted one.

Negative variance means financial savings, but it would be a somewhat simplistic approach to assess performance based on PPV alone. Stakeholders should not be striving to reach negative PPV no matter what; rather, they should take into consideration the external factors as well and rather evaluate if the company did the best it could in the current circumstances.

After all, price volatility is sometimes out of the buying company’s hands. By focusing too much on the PPV metric, stakeholders might distort their other performance KPIs

Forecasting PPV

While purchase price variance is a historical indicator used to assess transactions that have already happened, it can be predicted ahead of time, too. PPV can be forecasted even though there’s no way to be sure how markets and prices are going to evolve over the years.

PPV forecasting helps companies evaluate how possible price changes can affect their future cost of goods sold and gross margin. It can also highlight the future financial risks for the business. This is especially true for manufacturing companies that need to plan direct material purchases carefully, as their profitability is highly dependent on the cost of raw materials.

Business stakeholders can prepare PPV forecasts by analyzing historical pricing data, finding the price development patterns, and applying them to the current market situation. It also pays off to estimate for the best and the worst possible scenarios so that businesses can be prepared for anything.

The procurement team can calculate forecasted PPV with a formula similar to that for historical PPV:

Forecasted Price stands for the price the business expects to pay for the goods or services. When coming up with this number, specialists should consider all possible scenarios that could affect the final cost — for instance, different delivery options.

Estimated Standard Price represents the expectations for the standard purchase price of the goods and services at the given moment on the given market. To find this number, analysts ought to consider market conditions and inflation.

Forecasted Quantity is the volume of goods or services that the company plans to buy. Depending on the actual production needs, the quantity can be altered and that can result in qualifying or not for special offers. Forecasted quantity usually results from the expected market demand, production planning, and historical quantities.

Since there are numerous factors that can influence the prices of goods and services, purchase price variance is never one fixed number, but rather a range of possible values, some being more or less likely than others.

Why Does Purchase Price Variance Happen?

As we’ve mentioned before, some reasons for the PPV are internal and others are out of the company’s control. Procurement specialists have to understand all internal and external factors in order to recognize patterns of purchase price variances and take appropriate actions to either minimize the occurrence of unfavorable PPVs or maximize the favorable ones.

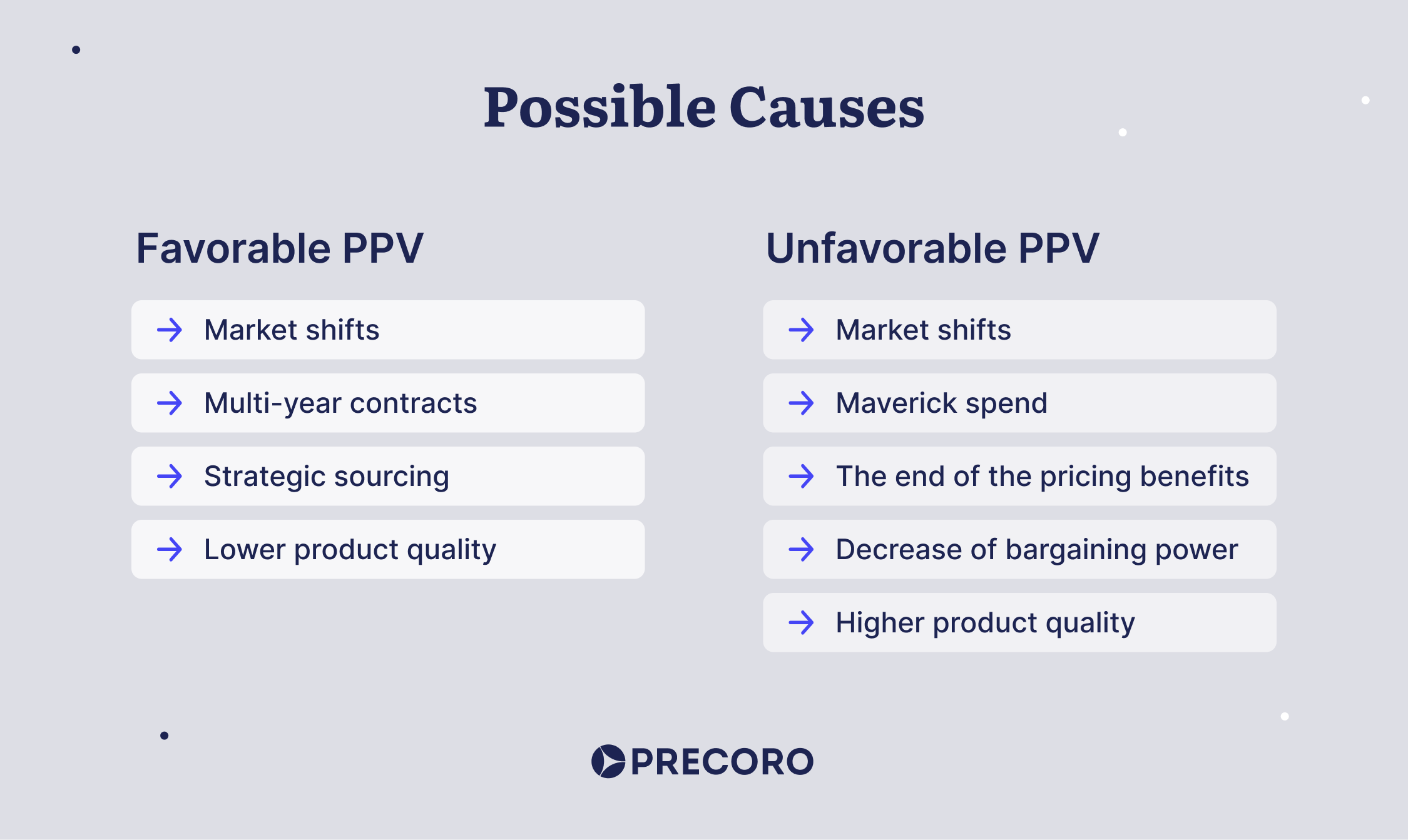

Possible Causes of Negative or “Favorable” PPV

There are several typical reasons for a negative PPV. Some variation depends on the decisions made by finance, procurement, or management teams, while PPV can also vary due to external circumstances out of staff’s control.

Strategic sourcing is one of the most important causes of a favorable price variance. When procurement managers are strategic about supplier research and screening, there is a much higher chance of signing a contract with a vendor that guarantees a good offer and reliable conditions.

Strategic sourcing takes into account not only the immediate benefits of the offer (usually a lower price) but also considers the big-picture gains, such as discounting opportunities or delivery methods. For instance, choosing a supplier with flexible delivery capacities gives a purchasing team opportunities to consolidate orders, and can result in reduced overall shipping costs, lower total cost per unit, and therefore a favorable PPV.

Multi-year contracts also help ensure a favorable purchase price variance. In the case of such contracts, a company can negotiate a better multi-year pricing deal by guaranteeing to place repeated orders.

By committing to purchasing larger volumes of items over the defined period, the procurement department can typically expect a reduced price per unit. For instance, a company might agree to purchase marketing consultancy services for 3 years with a 10% discount after the first year.

Market shifts are a key external factor that companies should consider when budgeting. The market price of some raw materials or services might drop due to factors outside of the company’s control, allowing them to purchase more – or perhaps reflecting a lower average quality available. Let’s remember, for example, how the prices for travel services dropped during and immediately after the COVID-19 crisis.

Lower product quality is also a reason for a lower actual price and, possibly, a favorable PPV. If the purchasing company is ok with the lower quality alternative, they can proceed with the order and reap the benefits of negative PPV.

What Causes Positive or “Unfavorable” PPV

A positive variance means the company spent more than it expected to, which can result in financial losses. It’s important to realize that positive variance doesn’t always mean there’s an issue with procurement management. An unfavorable PPV can simply mean the markets are shifting or supply chain disruptions are causing delays.

Market shifts are among the main reasons for unfavorable price variance. Supply chain disruptions and inflation can cause the costs of materials, goods, and services to go up. Actually, 59% of CPOs surveyed by Deloitte cited inflation as their top organizational risk.

These increased prices are outside of the purchasing company’s control, and sometimes outside of even the supplier’s control. Securing volume discounts, negotiating special deals, and maintaining strong supplier relationships can help minimize the negative effect of price fluctuations.

Maverick spend can also lead to unfavorable purchase price variances. When procurement and finance departments don’t implement necessary control practices, they face the risk of employees making unapproved purchases in the company’s name that cost more than what was budgeted. Such purchases often include the most readily available items that are selected based on their delivery speed rather than on cost efficiency.

The end of special pricing benefits can also lead to purchase price variance. This might mean that the initial contract has expired and the new one doesn’t offer discounts, or that the selling company stopped offering certain discounts altogether. These price fluctuations are often caused by the changes in the suppliers’ internal policies, so the buying company might not know to account for them while preparing budgets.

Decrease of bargaining power can also result in unfavorable PPV. For instance, when a new buyer with a higher purchasing power enters the market of the scarce goods, it means there is more demand for the same goods. The supplier might not need to offer favorable purchasing conditions that it offered previously, which can lead to higher prices.

Higher product quality offered by the supplying company can cause the price of goods to go up, thereby affecting PPV. The buying company then has to consider whether the upgrade is worth the cost hike or if it’s time to look for an alternative.

Managing PPV

Managing purchase price variance isn’t the most straightforward process, and stakeholders need to consider all the factors that might affect it. For instance, a company can achieve a favorable PPV by ordering a large bulk of products from the vendor and qualifying for a quantity discount. But if the company orders more than it can use in time, the business will face the risk of excess inventory and growing storage expenses.

Thus, reducing the price-per-item is not the most critical factor for obtaining favorable PPV. Here are some other ways to balance PPV metrics.

Regular Monitoring

Implement regular reporting and continuously monitor PPV to catch discrepancies as soon as possible. Document transparency and easy access to purchasing data let purchasing managers achieve better spending visibility. The sooner the purchasing team identifies a significant variance, the quicker they can take corrective action.

Spend Control

Establish company-wide spend practices and implement approval workflows to achieve purchase visibility and get tail spend and maverick spend under control. When everyone involved in the purchasing process is aware of the approval steps, it’s easier to ensure that employees purchase the required items from authorized suppliers.

Effective Communication

Set up a system for clear communication between the procurement and finance teams. Collaboration between these teams is crucial for maintaining accurate cost estimations and preventing discrepancies before placing orders. It’s also helpful to introduce unified templates and common terminology for employees who will create documents.

Make sure employees of all relevant departments are aware of the procurement workflow, and have a system that keeps them up to date with their documents. This way, everyone involved in processing and paying for orders will be aware of the price developments at any given moment.

Negotiation

Negotiate with suppliers to secure favorable and stable pricing terms. Regular reviews of supplier contracts and maximizing offers like volume discounts can lead to favorable purchase price variances.

Supplier Performance Reviews

Conduct regular reviews of supplier performance, and use purchase price variance as a metric to assess supplier consistency. By evaluating supplier performance in relation to PPV, you can make data-driven decisions about whether to extend or renegotiate contracts.

Attention to Logistics

Delivery and storage costs constitute a substantial part of the total purchase cost. These components are often overlooked as the procurement team focuses on finding the items at the best price.

Companies should plan ahead, consider the delivery routes, and prepare to mitigate any shipping risks. Plus, they should strive to keep inventory at the optimal level; overstocking adds to the overall item price due to storage costs, while emergency purchases can be costly due to express shipping.

Software Implementation

Implementing procurement software can significantly improve transaction efficiency, supplier management, and data accessibility. Procurement software serves as a centralized platform for managing all procurement-related data, including pricing agreements and purchase orders.

With accurate and up-to-date data readily available, it's easier to calculate standard costs and track actual costs. Such software enables real-time monitoring of purchasing activities and actual prices, and can alert users when there are significant deviations in pricing.

With the use of specialized software, companies can automate procurement workflows by setting up steps and specific users that will be responsible for each stage. By sending all procurement paperwork through the preset approval workflows, companies can ensure that each document meets all requirements before going to the next stage, and the price is approved before any order is made.

Three-way matching is also easier within a digital solution, which speeds up the process of comparing POs, invoices, and receipts, and minimizes errors. This ultimately allows procurement teams to discover any unfavorable pricing in time to fix it – before it’s been approved and paid.

Procurement software also makes it easier to work with the numbers — that is, to centralize purchasing and supplier data, to access historical data, and to generate reports. Contact us at Precoro to learn how procurement software can streamline your purchasing experience and maximize favorable purchase price variances.

Understand PPV – Control Costs

Understanding and managing purchase price variance is essential for controlling costs, evaluating suppliers, and improving profitability. By keeping a close eye on PPV and taking appropriate actions, the procurement team can optimize procurement management and ensure that cost-efficiency is prioritized while planning purchases and placing orders.

Effective PPV management requires vigilance, continuous data analysis, and collaboration across different departments. By consistently monitoring and analyzing this financial metric, the procurement team can make informed decisions that lead to cost savings and increased profitability.

Frequently Asked Questions

In purchasing, PPV stands for purchase price variance. It’s a financial metric used in procurement and supply chain management to assess the difference between the expected cost of an item and its actual purchase cost.

PPV measures the gap between what a company planned to pay for a product or service and what they actually paid. Purchase price variance can be tracked for each separate purchase or for the total procurement spend over specific time periods.

Purchase price variance can be calculated using a straightforward formula: PPV = (Actual Price — Expected or Standard Price) x Actual Quantity.