14 min read

The Hidden 20%: Why Tail Spend Deserves a Spot in Procurement Strategy

Control tail spend with clear steps: set thresholds, consolidate suppliers, and provide buyers with practical tools.

Look closely at company purchase data, and you’ll see a familiar pattern: a handful of big contracts account for most of the spend, while the rest is scattered across thousands of small, one-off transactions. This “long tail” of spending, often called tail spend, might look harmless at first. After all, how much damage can a $200 software subscription, a last-minute catering order, or a one-time shipment really do?

However, even if a mid-sized company spends $10 million on indirect purchases, up to $2 million can be lost in tail spend. Get a handle on it, and 5-7% savings could put $100–140k back into the budget each year. Let’s explore how to turn these promising calculations into reality.

Scroll down to find out:

What is tail spend?

How does tail spend differ from indirect spend?

How does tail spend differ from maverick spend?

Why does tail spend management really matter?

Why we focus on the in-house approach with tail spend software

How to build a viable tail spend strategy

A decision tree for routing tail requests

Frequently asked questions about tail spend management

What is tail spend?

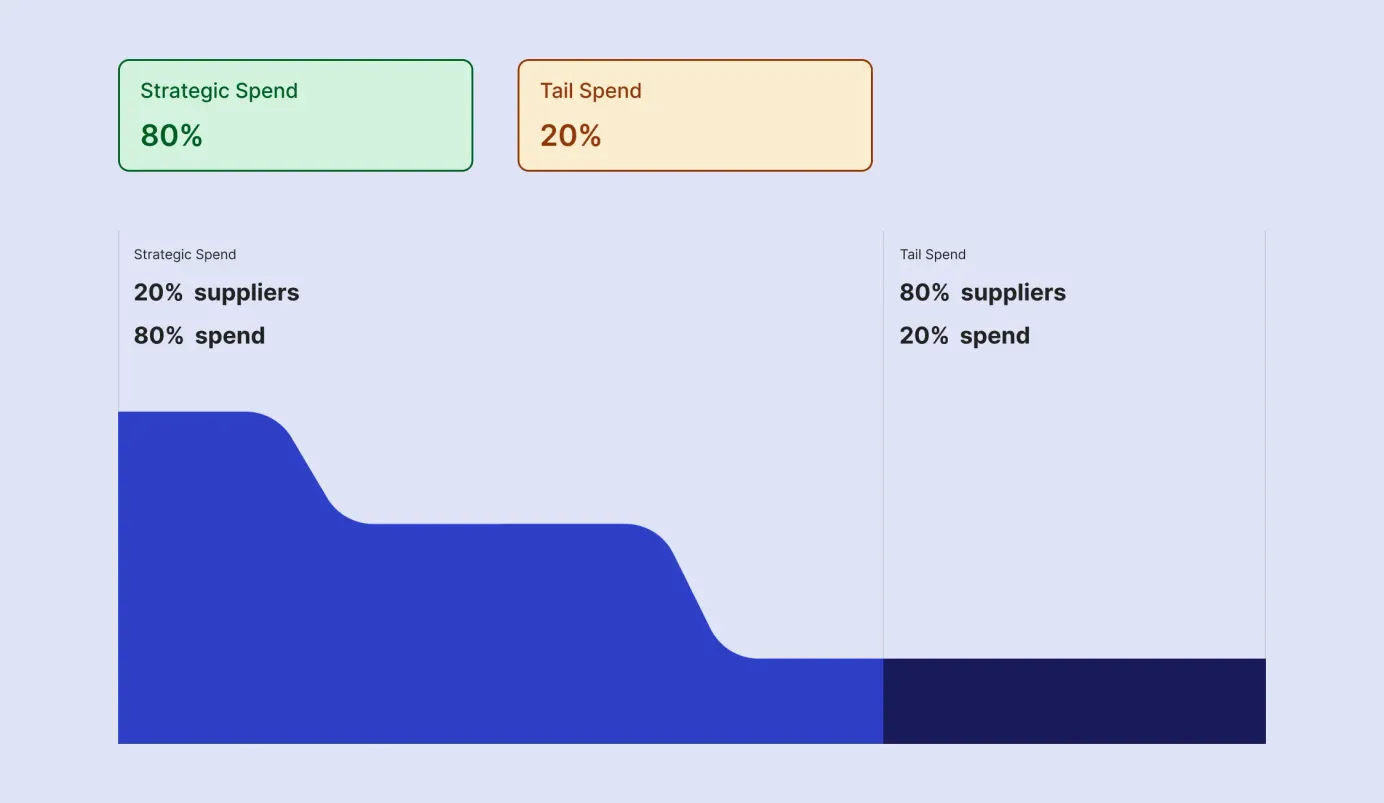

Tail spend is the “long tail” of purchasing: thousands of low-value, infrequent buys spread across many suppliers that individually look small but collectively add up. In procurement, it’s often framed with the Pareto 80/20 rule: roughly 80% of transactions account for only 20% of total spend. These transactions are usually lightly managed compared to strategic categories.

But here’s where it gets tricky: in practice, there’s no single definition of tail spend. Some organizations stick with the fixed 80/20 rule. Others set their own thresholds and define tail spend by criteria such as:

- Transaction value (for example, all purchases under $10,000).

- Frequency (items or suppliers used only once or twice a year).

- Category or type of spend (p-card purchases, SaaS subscriptions, ad-hoc services, or low-value statements of work).

This debate matters because your definition of tail spend shapes how you manage it. For example, a construction firm might include small tools and consumables in its tail, while a tech company may find that its “hidden tail” is really dozens of duplicate SaaS licenses purchased outside IT’s control.

Don’t get stuck chasing a universal definition. Instead, analyze your company’s spend data and decide what belongs in your tail. The goal is to shine a light on unmanaged spend, regardless of what it looks like in your company.

How does tail spend differ from indirect spend?

It’s easy to confuse tail spend with indirect spend, but they’re not the same.

Indirect spending covers all purchases that don’t directly contribute to the final product or service. Examples include office supplies, IT software, marketing services, and travel. These purchases are usually predictable, recurring, and managed through established contracts and procurement processes.

By contrast, tail spend includes portions of both direct and indirect spend. It consists of small, low-value, and low-frequency transactions that often fly under the radar and receive little attention from procurement teams. Think of indirect spend as the whole bucket of non-core purchases, while tail spend is the messy corner at the bottom—scattered, irregular, and easy to overlook.

For example, an annual SaaS contract with a major provider is indirect spend but not tail spend. After all, it’s high-value and strategically managed. On the other hand, that one-off $300 design tool subscription or ad-hoc printer repair order? That’s tail spend.

How does tail spend differ from maverick spend?

Tail spend and maverick spend also get mixed up, but they refer to different problems.

Maverick spend happens when employees bypass established procurement processes: they buy from unapproved suppliers, ignore negotiated contracts, or pay above-market rates. Essentially, it’s a violation, whether intentional or accidental, that directly undermines policies and budget controls.

On the other hand, tail spend isn’t inherently non-compliant. It refers to small, scattered purchases that don’t typically receive strategic attention. Some tail spend may be fully compliant (such as a low-value purchase from an approved vendor), while other instances may drift toward maverick behavior if controls aren’t in place.

A simple way to distinguish the two is: tail spend is small and unmanaged by nature, whereas maverick spend is off-policy or out-of-process, regardless of the purchase size.

For example, imagine ordering office chairs from your contracted supplier as a one-off $500 purchase. That’s tail spend: it’s small, irregular, and typically overlooked in procurement strategies, but it follows the rules. Ordering the same chairs from an unapproved vendor simply because it’s “easier” would be considered both tail and maverick spend, as it violates procurement policies.

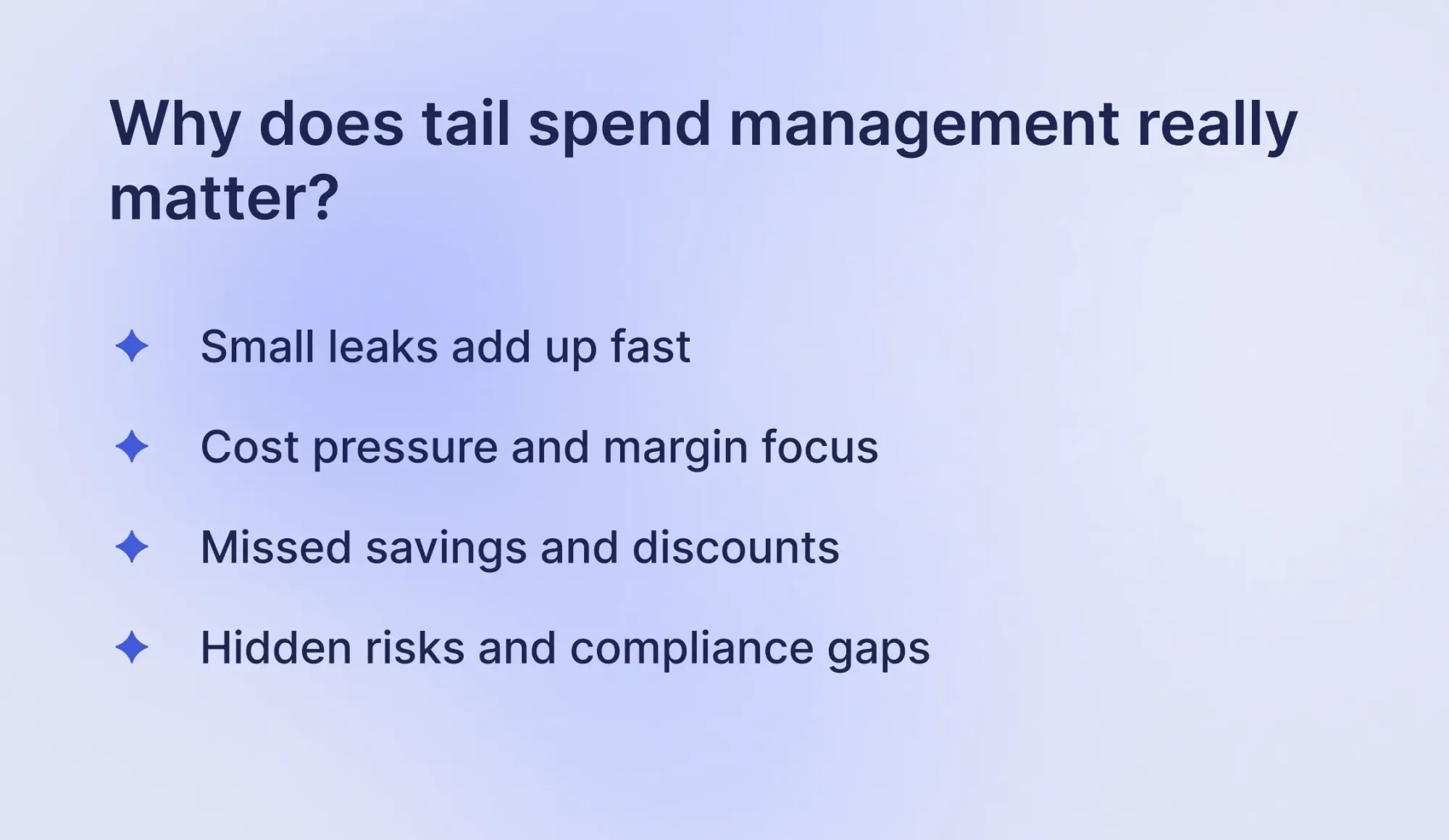

Why does tail spend management really matter?

At first glance, tail spend seems harmless. These are small, low-value purchases, so why bother? The problem is that together they can quietly become a multimillion-dollar leak. What seems like loose change in individual transactions can erode margins, create hidden risks, and consume valuable time.

Here’s why tail spend deserves your attention:

Small leaks add up fast

A $300 invoice here, a $500 subscription there—multiply that by hundreds of employees across multiple departments, and suddenly you’re looking at millions in untracked expenses. When tail spend often accounts for up to 80% of all transactions, a significant percentage of waste in this area can offset savings achieved in major contracts.

Cost pressure and margin focus

CFOs and CPOs are constantly under pressure to do more with less. The Hackett Group’s 2024 CPO Agenda highlights that cost efficiency and supply continuity are top priorities for procurement leaders. A tail spend management system gives procurement teams a chance to deliver quick wins, gain trust across the business, and set the stage for larger sourcing initiatives.

As tail spend consists of small, decentralized purchases, improvements usually don’t require major negotiations, contract restructuring, or cross-functional approvals like large strategic sourcing projects do. Quick wins can come from relatively simple actions: consolidate suppliers, enforce approval workflows, standardize low-value purchases, and introduce tail spend software.

Missed savings and discounts

When departments buy separately, companies often miss out on bulk discounts, volume pricing, or better contract terms. For example, one team might order computer desks from Supplier A, another buys the same model from Supplier B, and a third team purchases small IT accessories from a local vendor, all without coordination.

Individually, each order seems minor, but together, they represent significant unclaimed savings. Over a year, these small, uncoordinated purchases can easily add up to tens of thousands of dollars. Procurement centralization lets purchasing managers negotiate better deals, consolidate suppliers, and capture bulk discounts for each product category.

Hidden risks and compliance gaps

Tail spend frequently gets overlooked. Purchases can come from unvetted or high-risk suppliers, bypass established approval workflows, or fall outside company compliance policies. As a result, a company is exposed to multiple risks: duplicate payments, invoice errors, vendor fraud, or even regulatory and ESG compliance gaps.

Beyond financial implications, unmanaged tail spend can strain internal teams and reduce overall visibility into business expenditures. Addressing these risks ensures both cost control and stronger governance across the organization.

Why we focus on the in-house approach with tail spend software

Some companies turn to tail spend management providers or marketplaces to reduce the manual workload of chasing small purchases. These partners typically act as intermediaries: they run quick spot buys, consolidate many small invoices into a single one, and provide access to a broad supplier base under clear guardrails. A few tail spend management companies also offer basic reporting or analytics to show where the money goes.

This approach can be useful if procurement is overstretched and the main priority is speed and simplicity, but it comes with trade-offs. When you rely on tail spend management providers, you give up some control. Supplier options are usually limited to the provider’s own network, which may not align with your preferred vendors or quality standards. It’s also harder to enforce your own policies and approval steps when purchases happen on someone else’s platform.

On top of that, provider fees and margins can add hidden costs over time, and finance teams often get only high-level summaries instead of detailed reporting. Additionally, because purchases are spread across the provider’s channels, your leverage to bundle spend and negotiate better pricing weakens.

That’s why other organizations choose an in-house approach with tail spend software or with the help of tail spend management consulting. These options keep control, compliance, and reporting fully in your hands, while small, low-value requests move automatically through the necessary procurement steps.

That’s why in the following sections we focus on what you can do within your organization and how tail spend management software companies can help.

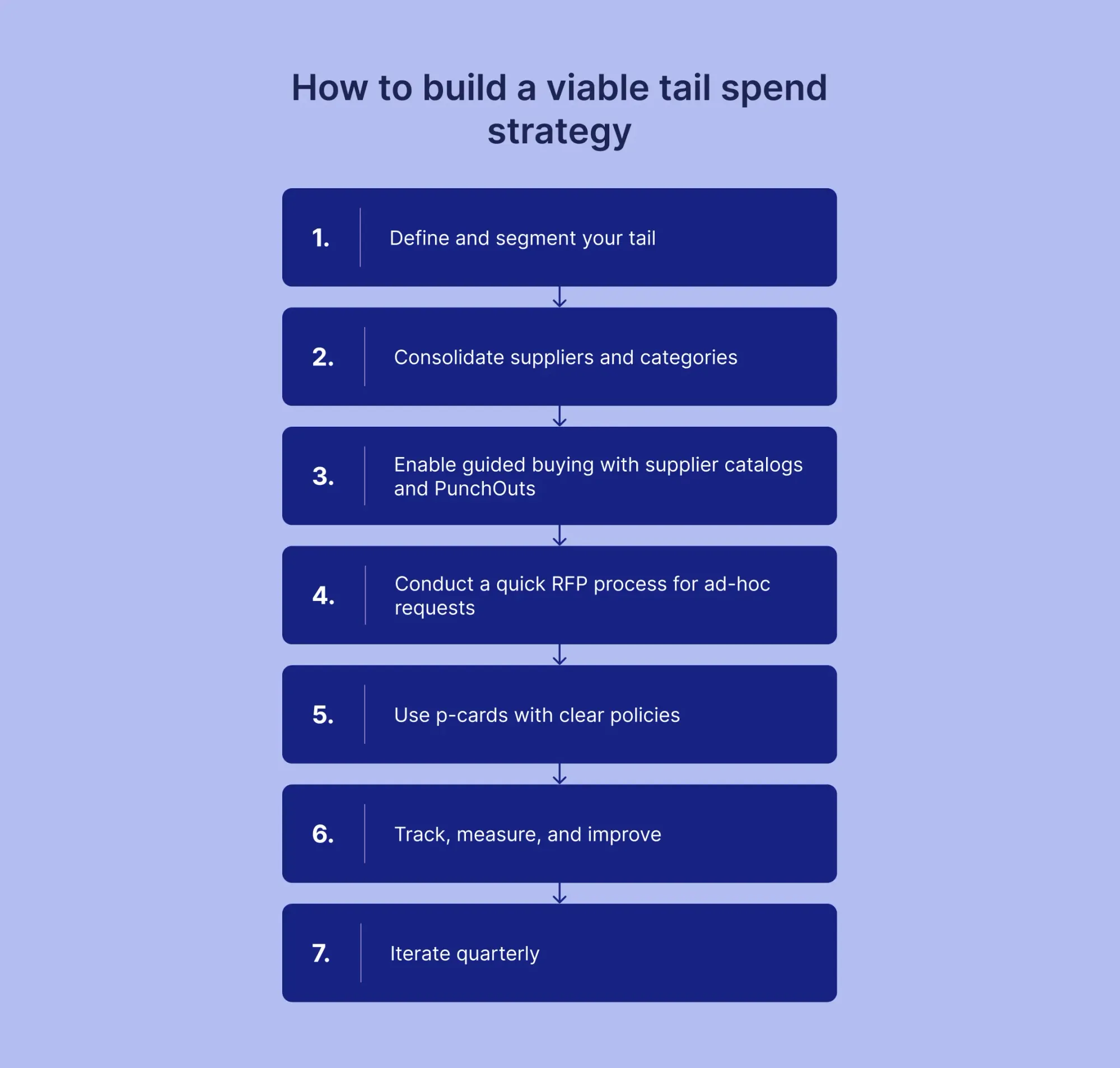

How to build a viable tail spend strategy

The best way to tackle tail spend is to create a system that guides purchases through proper workflows, so they’re handled efficiently, consistently, and at the best value. As CIPS highlights, procurement teams need to focus on the stakeholder buying experience, make compliance easy, and put tools in place to monitor and improve purchasing behaviors.

A good tail spend management system combines visibility, smart processes, and technology. Here’s a step-by-step framework you can adapt:

1. Define and segment your tail

The first step is to clearly define what counts as tail spend in your company. Use historical spend data to set thresholds that reflect your organization’s size, industry, and risk tolerance. You can focus on the following:

- Small purchases below a set threshold (for example, under $10k per order)

- Infrequent suppliers, used only once or twice a year

- Non-strategic categories, outside your main supplier agreements

2. Consolidate suppliers and categories

Too many small suppliers increase costs and administrative work. Consolidate spend with fewer, preferred vendors. For example, if three suppliers provide maintenance parts, select one or two and use your increased buying power to negotiate better pricing or terms.

Next, organize your preferred suppliers into catalogs by category (for example, IT hardware, office supplies, safety gear, and more). This way, employees will always know exactly where to order each type of item.

3. Enable guided buying with supplier catalogs and PunchOuts

Make it simple for employees to follow the rules and buy from approved suppliers. The most effective way to minimize off-contract spending is to integrate supplier and item catalogs directly into your procurement system or tail spend software.

Choose a system with PunchOut catalogs so employees can access a supplier’s online store (like Amazon Business, Staples, or Home Depot) directly from your procurement platform. Employees shop as usual, and their carts flow back into the tool for approval, budget review, and processing.

Moreover, the right software guides requesters step by step. You can be confident that they complete all required fields, select the correct budget, and automatically submit requests through the approval workflow.

4. Conduct a quick RFP process for ad-hoc requests

Not every purchase fits neatly into a catalog, and some requests still require a mini-sourcing process. With a tool like Precoro, you can issue an RFP to find the best offer and rest assured that all requests go through approved workflows, budgets are assigned correctly, and every transaction has a complete audit trail.

5. Use p-cards with clear policies

For minor, routine purchases outside a catalog, employees can move fast with procurement cards. Just make sure to establish a few compliance rules:

- Set clear limits: Define maximum transaction amounts to prevent overspending (for example, under $500 per purchase).

- Approve categories: Specify which types of purchases are allowed, such as minor IT accessories, cleaning supplies, or low-value maintenance items.

- Maintain visibility: Ensure all transactions feed directly into your accounting system so every expense is tracked, auditable, and included in spend reporting.

This approach balances speed for employees with control and transparency for the company.

6. Track, measure, and improve

You can’t manage what you don’t measure. To make your tail spend strategy effective, regularly monitor key metrics and use the data to guide improvements. Important KPIs include:

- Percentage of tail spend under management: How much of your tail spend is going through approved workflows, catalogs, or p-cards.

- Number of active suppliers: Fewer suppliers usually mean lower costs, stronger negotiation leverage, and simpler administration.

- Compliance with preferred suppliers: Measure how often employees use approved vendors versus off-contract options.

- Cycle time for small purchases: Track how long it takes to complete routine requests, from submission to approval and payment.

7. Iterate quarterly

A tail spend management system isn’t something you can set and forget. Every quarter, review your thresholds, supplier list, and exceptions to ensure they still match the company’s needs. Consolidate vendors where possible, prune recurring exceptions, and adjust approval workflows or catalogs as spending patterns evolve.

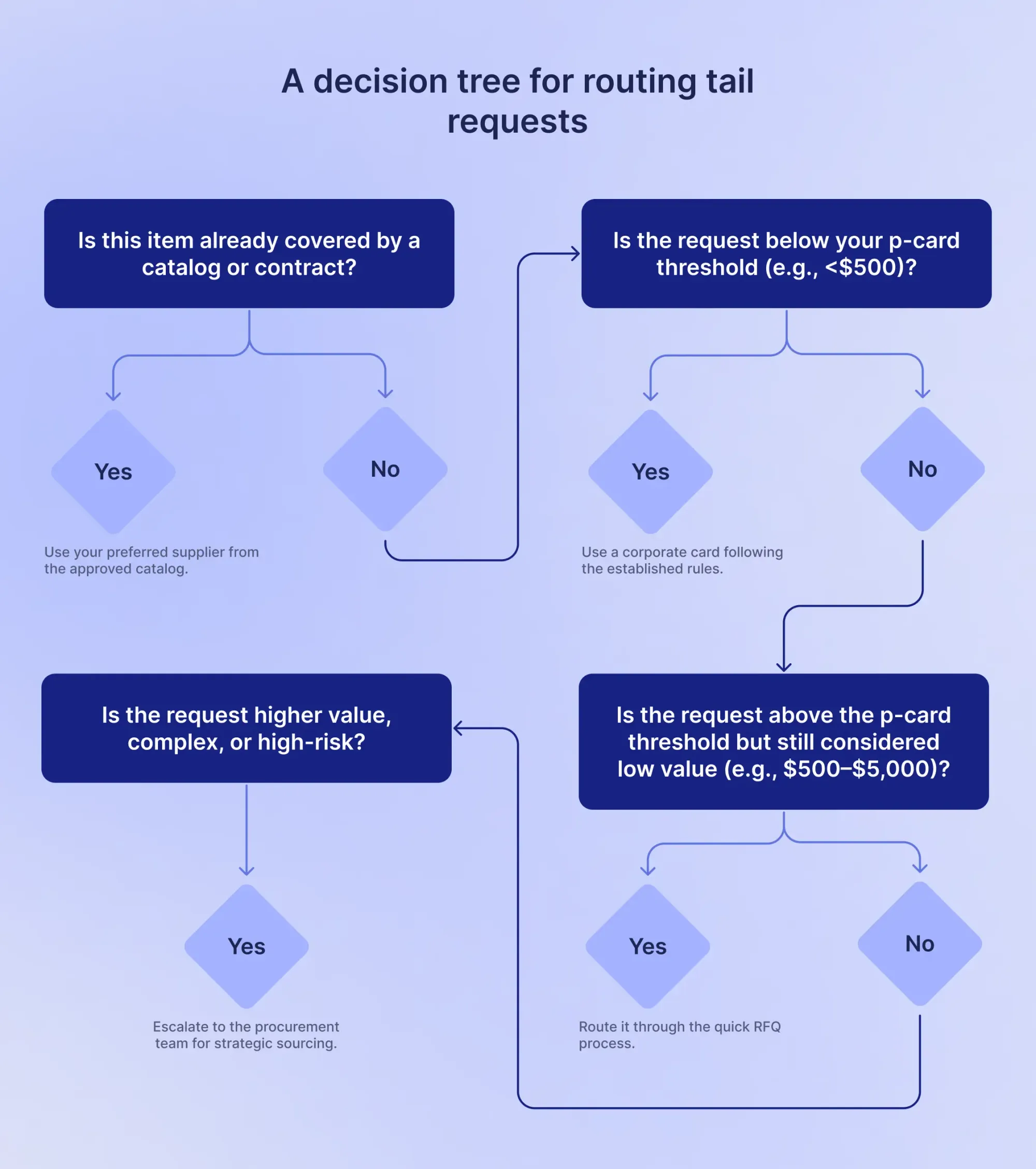

A decision tree for routing tail requests

One of the toughest parts of tail spend management is deciding where each purchase should go. A $200 office chair doesn’t need the same process as a $7,000 software license or an urgent repair. A decision tree provides a simple framework that guides employees and procurement teams toward the right buying channel every time.

Start by asking a few practical questions:

Is the item already covered by a catalog or contract?

If yes, buyers can choose from established item or supplier catalogs in the tail spend software. Examples include printer toner, office snacks, routine safety gear, or standardized marketing materials like business cards or flyers. This way, purchases are made from vetted suppliers at favorable prices.

If not, is the request below your p-card limit (for example, <$500)?

If yes, employees can use a corporate card with clear limits and automatic reporting. It could cover purchases like a team lunch for a client visit or a one-off office chair. This approach allows employees to act quickly without waiting for approvals but still keeps spend visible.

Is the request above the p-card threshold but still considered low value (e.g., $500–$5,000)?

For purchases that are too large for a corporate card but not strategic enough for a full procurement review, route them through a quick RFP process in your procurement software. In Precoro, it’s easy to send requests to multiple suppliers, collect responses, and choose the best option based on price, delivery time, or other criteria. For example, you could use this approach to procure replacement parts for office equipment or specialized tools for a small maintenance project.

Is the request high-value, complex, or high-risk?

When a purchase involves a large amount of money, multiple stakeholders, or potential operational or compliance risks, escalate it to the procurement team for a full review. Procurement can negotiate pricing and contract terms, vet suppliers, ensure compliance with internal policies and regulatory requirements, and assess risk factors such as vendor reliability or security standards. Examples include a multi-month consulting engagement, specialized equipment, or machinery with significant cost or operational impact.

Frequently asked questions about tail spend management

Tail spend refers to small, scattered purchases that don’t get much attention on their own. Examples include a one-off $250 software subscription bought by a single team, or a $400 emergency order of office chairs from a local vendor. Individually, each purchase looks minor, but across hundreds of employees and multiple departments, these “small” buys can add up to millions of dollars annually.

Strategic spend covers the high-value, high-impact categories that the procurement team manages closely. Think multimillion-dollar contracts with raw material suppliers or IT infrastructure vendors. Tail spend, on the other hand, is the low-value, infrequent, or fragmented spend that typically flies under the radar. It’s often unmanaged, spread across many suppliers, and seen as too small to prioritize—but collectively, it carries real financial and compliance risks.

Tail spend analysis is the process of digging into your company’s small, fragmented purchases to uncover patterns, risks, and opportunities. Procurement teams analyze invoices, supplier lists, and transaction data to:

- Identify duplicate suppliers and redundant purchases.

- Spot maverick spending outside approved channels.

- Find opportunities to consolidate suppliers and negotiate better terms.

- Flag risky or non-compliant vendors hiding in the long tail.

Tail spend management software simplifies the processing of small, scattered purchases. Instead of tracking every low-value invoice manually, the system helps you:

- Automate purchasing with guided intake, supplier and item catalogs, RFQs, and automatic approval workflows.

- See all spending in one place and track company-wide purchases in real time.

- Keep compliance natural. Rules and policies are built into the system, so employees follow the right process without reminders.

- Scale smoothly as teams can buy what they need quickly, while procurement keeps control.

Tail spend recap

Tail spend may look insignificant at the transaction level, but when left unmanaged, it can quietly drain millions in missed savings and hidden risks. As a result, harmless small purchases across departments can snowball into a major blind spot in procurement.

The key to tail spend management isn’t obsessing over every minor transaction. Instead, build clear, structured routes for all purchases and define the right approaches for both large and small buys. Tools like supplier catalogs, p-cards, and tail spend software let employees get what they need quickly while keeping spending visible and controlled.

A practical framework makes the difference. Start with tail spend analysis to define what belongs in the tail, then consolidate suppliers, enable guided buying, and automate spot buys. Regularly measure KPIs and adjust your strategy if needed. This approach balances speed for users with control for procurement and finance.

Looking for a user-friendly tail spend software?

Automation alone can’t fix tail spend; procurement centralization makes it manageable. Precoro organizes all requests, approvals, purchases, budgets, and invoices so everyone follows the rules and finance always knows what’s happening.