13 min read

GAAP for Accounts Payable: What It Is and Why It's Important

What are the Generally Accepted Accounting Principles and how can they increase transparency in the AP process? Explore the importance and fundamental rules of GAAP.

Accurate financial reporting is crucial for maintaining transparency, complying with laws and market regulations, and building trust in relationships with suppliers, creditors, and investors.

Around the world, governments and regulatory bodies have established guidelines for companies’ accounting departments to follow when it comes to bookkeeping. In the US, the Generally Accepted Accounting Principles, or GAAP, are typically used by both public and private institutions in the US to keep track of financial statements.

In fact, research shows that GAAP-compliant statements are instrumental in securing external equity capital for private firms, and they empower equity investors when it comes to monitoring their investments.

Let’s take a look at how following standardized guidelines can benefit companies and, specifically, their AP departments.

Keep reading to find out:

- What is GAAP?

- How is GAAP used for AP?

- What are the differences between GAAP and IFRS?

- The basis of GAAP

- Hierarchy of GAAP

- What are the challenges of GAAP?

- What practices can simplify GAAP compliance?

- Frequently asked questions

What is GAAP?

Generally Accepted Accounting Principles is a set of accounting standards, rules, and practices that stipulate how financial statements should be prepared and presented. The Financial Accounting Standards Board (FASB) created GAAP with the goal of improving the comparability, clarity, and consistency of financial information shared with stakeholders. The GAAP standard is composed of guidelines published by FASB, the U.S. Securities and Exchange Commission (SEC), and the American Institute of Certified Public Accountants (AICPA).

The FASB regularly updates GAAP. Additionally, the SEC, which is responsible for enforcing laws that protect against market manipulation, recognizes the GAAP standards for financial reporting and requires publicly traded and regulated companies to follow them.

GAAP helps policy boards regulate accounting within the business environment. As a result, it is simpler for investors to examine and glean valuable information from company financial statements. Adherence to GAAP simplifies the process of comparing financial data between different businesses.

While only publicly traded companies are legally obligated to follow GAAP, some private businesses also choose to meet the same standards in their financial statements. Uniformity in reporting and comprehensive disclosure of financial data improve investor confidence and credibility, increase the chances of obtaining favorable lending terms, and facilitate tax compliance.

Utilizing well-established accounting principles is especially important when there is a need to analyze and present data about payments and debts. According to Ardent Partners, 48% of AP leaders see improving AP reporting and data analytics as a strategic priority for 2023. GAAP can help with that, as it provides accountants with guidance on how to compile comprehensive and accurate financial statements. Thus, investors can be confident about their funding, top management can make informed financial decisions, and legal compliance can be met.

GAAP is used across organizations of different sizes and industries for carrying out various accounting functions:

- Producing financial statements, namely the balance sheet, income statement, and statement of cash flows.

- Revenue recognition from the sale of goods or services.

- Expense recognition with the matching principle, which requires expenses to be recognized in the same period as the related revenue.

- Measuring assets (like property and equipment) and liabilities (loans and obligations).

- Accounting policies and assumptions in areas such as inventory valuation methods, depreciation methods, and criteria for estimating fair value.

- Consolidation of financial statements and various business combinations, including acquisitions and mergers.

No matter what incentives drive a company's decision to maintain GAAP compliance, to do so they typically have to hire professional accountants who are trained in GAAP to conduct internal audits.

Meanwhile, it’s worth noting that GAAP is primarily used in the USA. Other countries have their own accounting principles or employ International Financial Reporting Standards (IFRS). The latter set, which is used on a wider scale globally, was developed and is maintained by the International Accounting Standards Board (IASB). We'll look into the differences between GAAP and IFRS later in the article.

How is GAAP used for AP?

One essential component of the financial cycle is Accounts Payable (AP), which refers to the amounts owed by an entity to its suppliers, vendors, and creditors for goods and services received. There are several key pain points in AP, including a lack of transparency and accountability in transactions, inaccurate or incomplete financial data, and unauthorized payments. GAAP helps accountants eliminate or, at least, effectively minimize them by creating a clear audit trail of all AP transactions and encouraging companies to use reliable approaches to presenting their expenses and liabilities.

Accrual Reporting

GAAP requires organizations to use accrual accounting, which means that expenses must be recorded when incurred, regardless of when the actual payment is made. In the context of AP, this means that accountants match revenues with related expenses in the same accounting period. Such an approach provides a more accurate representation of a company's financial position and performance compared to cash basis accounting. The reason for this is that accrual reporting reflects the actual timing of business activities and allows for a more meaningful analysis of profitability and financial ratios compared to a cash-based approach.

Expense Classification

GAAP requires companies to apply consistent classification methods, without changing them between financial periods. Under the protocol, expenses are classified by both their nature (e.g., office supplies, rent, utilities) and their function (e.g., cost of goods sold, selling, and administrative expenses). The nature-of expense classification provides insights into the types of expenses incurred, while the functional classification presents expenses based on their role within the operations of the business.

Additionally, GAAP states that companies must use the materiality principle which means that all expenses that impact a company's financials and are reasonably likely to influence investors' decision-making (material expenses) must be recorded.

Financial Statement Disclosures

Under GAAP, companies are required to disclose the balances of their accounts payable in the financial statements. This includes the total amount owed to vendors, suppliers, and creditors for goods and services received. Additionally, GAAP requires that trade payables be disclosed separately from non-trade payables. Trade payables typically refer to amounts owed for purchases of inventory or other goods and services directly related to the company's core operations. Non-trade payables encompass other obligations, such as taxes payable, employee-related payables, or amounts owed to landlords.

Companies are also required to provide specific disclosures for significant or unusual AP transactions. This could include explanations or additional information about large or complex payables, such as significant vendor contracts, long-term payables, or financing arrangements related to AP.

Internal Controls

Internal controls are policies and procedures implemented by a company to ensure the reliability of financial reporting, safeguard assets, and prevent fraudulent activities. Although GAAP does not provide specific guidelines solely dedicated to internal controls over the accounts payable process, it emphasizes the importance of maintaining effective internal controls throughout the entire financial reporting process, including AP. Under GAAP, maintaining controls requires:

- Segregation of duties, which means assigning different functions – authorizing purchases, receiving goods, approving invoices, and making payments – to different individuals. This helps prevent conflicts of interest as well as errors and irregularities.

- Saving and organizing documents and records for AP transactions, such as purchase orders, receipts, vendor invoices, and payment records. Such documentation provides evidence of the legitimacy and accuracy of transactions.

- Periodic financial reporting and analysis, including reconciling vendor statements, verifying accounts payable balances, and performing periodic reviews to identify and resolve any discrepancies.

- A system of controls for detecting and preventing fraud in the AP process. This may include measures such as regular fraud risk assessments, anti-fraud training for employees, and the establishment of reporting mechanisms for potential fraudulent activities.

What are the differences between GAAP and IFRS?

We've already mentioned that Generally Accepted Accounting Principles are used specifically in the United States. Most other countries, including members of the European Union, Japan, India, Singapore, Australia, and Canada, instead implement International Financial Reporting Standards in their accounting.

The first striking difference between the two systems is that GAAP is a rules-based set of standards while IFRS is considered more of a principles-based standard. In practice, this distinction means that GAAP tends to have more extensive and specific requirements, while IFRS provides a broader framework that lets accountants add explanatory documents to the financial statements.

Here we've prepared a visual comparison of some differences that exist between GAAP and IFRS and that influence the AP process:

It's important to note that since 2007, foreign corporations with US registrations don't need to reconcile their financial reports according to GAAP if they already adhere to IFRS. This decision is a result of continuous collaboration between the International Accounting Standards Board (IASB), an organization responsible for developing and issuing IFRS, and the Financial Accounting Standards Board. Since 2002 they have been cooperating to unify IFRS and GAAP into one global standard. Nevertheless, the two systems still have plenty of differences. Some companies, especially American ones that are traded internationally, may implement dual reporting, using both methods when preparing financial statements.

The basis of GAAP

GAAP standards are built upon a foundation of 10 main principles, according to which more guidelines are specified. Let's explore them:

Principle of Regularity: Accountants are required to strictly adhere to the rules and regulations of GAAP and cannot overlook or modify any of the guidelines.

Principle of Consistency: Financial documentation should be consistent over time. Accountants use the same accounting standards and practices for all accounting periods. If there are any changes, they must be clearly explained and justified in the footnotes of the financial statements.

Principle of Sincerity: Accountants must report favorable and unfavorable aspects of companies' financial positions, providing accurate, transparent, and impartial information in financial records.

Principle of Permanence of Methods: Accountants should select reporting methods and stick to them, without changing them unless there is a valid reason to do so. This provides continuity in the financial reporting process and facilitates meaningful comparisons over time.

Principle of Non-Compensation: Assets, liabilities, revenues, and expenses should be recognized separately and without attempts to compensate a debt with an asset or expenses with revenues.

Principle of Prudence: Accountants report financial data based on facts and actual numbers; they should not try to influence financial information by speculation.

Principle of Continuity: When preparing financial statements, accountants assume that the business will continue to operate in the foreseeable future.

Principle of Periodicity: Accountants report financial data in the relevant accounting period without stretching timelines or numbers to influence performance.

Principle of Materiality: Accountants must rely on material facts and fully disclose all financial information relevant to financial statement stakeholders.

Principle of Utmost Good Faith: all parties involved in financial reporting are expected to act honestly, trustworthy, and in good faith.

Hierarchy of GAAP

Because there are so many principles, rules, and procedures involved in GAAP, to make it easier for companies there is a four-level framework that ranks them by authority. The GAAP hierarchy helps companies identify which standards are most relevant for different accounting scenarios. Accountants are advised to consult sources at the top of the hierarchy first and continue down the hierarchy to locate the regulation that applies to their task. The hierarchy goes as follows:

- Statements from FASB Accounting Standards Codification, SEC rules and interpretive releases, and AICPA research bulletins and opinions.

- FASB Technical Bulletins and AICPA Industry Audit and Accounting Guides and Statements of Position that have been cleared by FASB.

- Practice Bulletins issued by the AICPA Accounting Standards Executive Committee, positions taken by the FASB Emerging Issues Task Force (EITF), and subjects covered in Appendix D of EITF Abstracts.

- FASB implementation guides, AICPA Accounting Interpretations, AICPA Industry Audit, and Accounting Guides and Statements of Position not cleared by the FASB. This level also includes commonly accepted accounting practices that are followed in general or within the relevant industry.

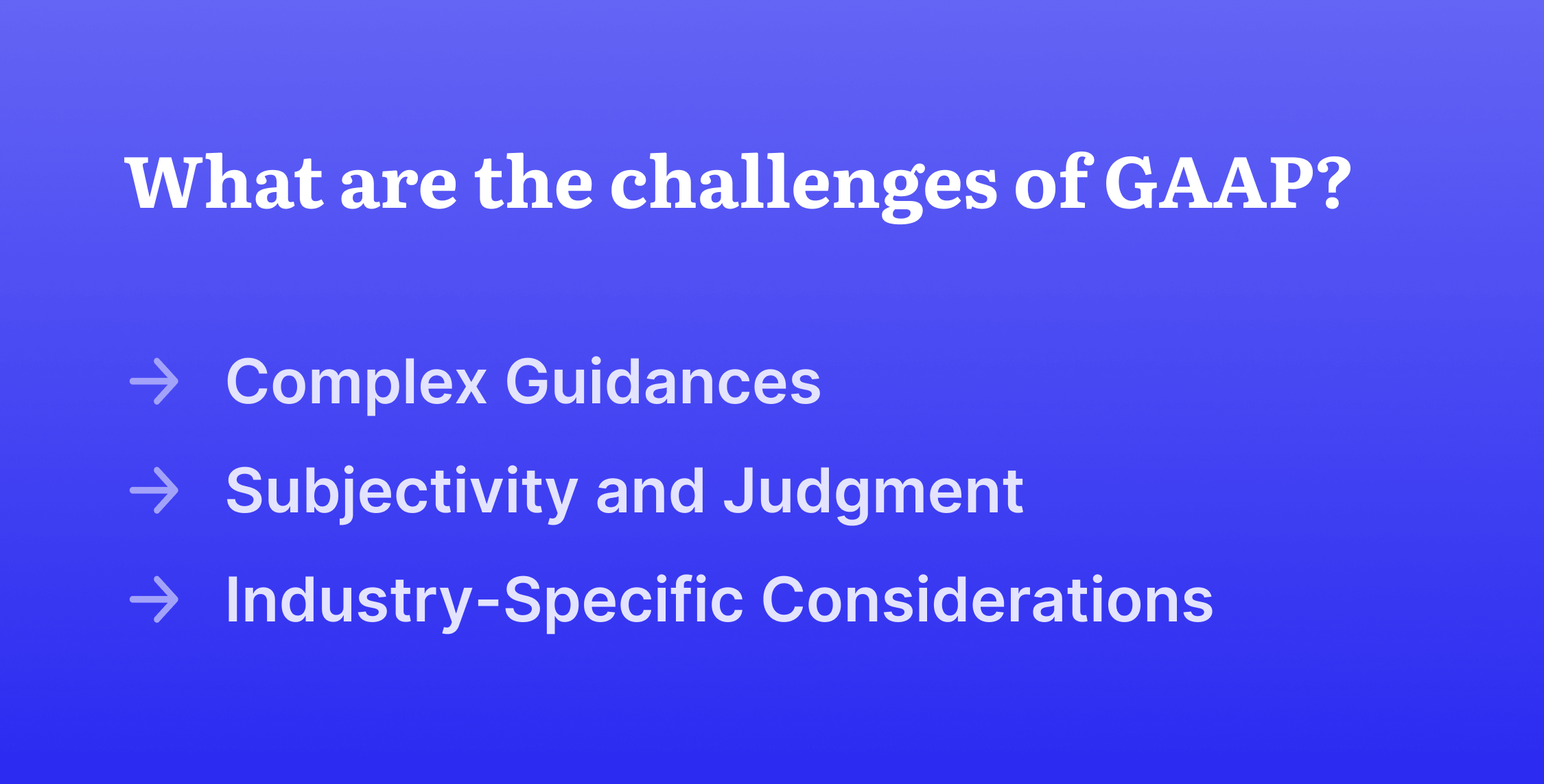

What are the challenges of GAAP?

Navigating and adhering to GAAP while managing the AP process can be quite complicated for organizations due to the following factors:

Complex Guidances

The extensive rules, guidelines, and regulations combined with having to consider the hierarchy make GAAP confusing to navigate. As a result, it’s possible for accounting departments to make mistakes when trying to follow this protocol. For example, if a company purchases equipment, determining whether it should be classified as a capital expenditure (recorded as an asset) or an expense (recorded as a cost) can be complex. Misclassifying expenses can lead to inaccurate financial statements, which can affect business decisions.

Subjectivity and Judgment

Even though GAAP’s detailed rules and guidelines limit how the system can be interpreted, there are still areas within GAAP where professional judgment is necessary. For instance, there is some flexibility when determining the appropriate accounting treatment for complex transactions or when choosing which specific accounting policies to apply. Accountants must use their expertise to assess the financial impact and exact estimations of certain transactions or events. There is some potential for variability, however, depending on how different individuals would approach a given requirement. For example, it may be complicated for companies to manage the procurement of inventory, which impacts the cost of goods sold (COGS) and inventory valuation. Choosing the correct inventory valuation method, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), and consistently applying it in accordance with GAAP guidelines requires a thorough evaluation of available approaches. This, in turn, can impact the consistency and comparability of financial reporting.

Industry-Specific Considerations

Adapting GAAP to address the specific needs and complexities of diverse industries may require additional industry-specific guidance or interpretation. For example:

- Industries such as software, construction, real estate, and telecommunications often have complex revenue recognition requirements.

- Industries that deal with specialized or perishable inventory, such as retail, manufacturing, and agriculture, face challenges in accurately valuing their inventory.

- The insurance industry has specific accounting challenges related to the recognition, measurement, and disclosure of insurance contracts.

- Companies involved in the extraction of natural resources, such as mining, oil and gas, and forestry, must account for exploration and development costs, reserves estimation, asset impairment, and revenue recognition.

To address this and much more, the FASB collaborates with industry experts and stakeholders to develop guidance with additional clarification and specific accounting requirements for industries that have unique transactions or reporting considerations. Nevertheless, tailoring GAAP to a specific industry is a time-consuming process.

What practices can simplify GAAP compliance?

Foster professional expertise

Organizations that intend to operate in the US should consider employing knowledgeable accounting professionals with expertise in GAAP. Their skill sets and experience can help them navigate complex accounting issues, interpret standards correctly, and ensure compliance. Additionally, companies can provide ongoing training and pay for GAAP courses for their existing accounting and financial staff. These practices will enhance their understanding of GAAP principles and help them follow relevant updates.

Engage with external professionals

Companies who are new to GAAP should consider seeking the assistance of certified accounting firms, consultants, or auditors who are knowledgeable about GAAP. These individuals can provide guidance on GAAP compliance, offer specialized expertise for complex accounting issues, conduct audits, and assist with financial statement preparation.

Join industry associations and networks

Joining industry associations and networks can provide companies with access to resources, educational materials, and networking opportunities focused on GAAP compliance within their specific industry. These associations usually offer guidance documents, forums for discussions, and educational events to help members stay informed about industry-specific GAAP considerations.

Harness useful technologies

Utilizing accounting software specifically designed to help organizations comply with GAAP can streamline financial reporting processes and help ensure adherence to the standards. These software solutions often come with built-in GAAP templates, automated calculations, and features that facilitate accurate and consistent financial reporting.

Additionally, there are AP automation software solutions that can assist companies with GAAP compliance. Let's take Precoro as an example and consider how exactly it can help organizations:

- Eliminates manual data entry errors and reduces the risk of discrepancies, which is essential for adhering to GAAP principles of accuracy and reliability.

- Maintains a comprehensive audit trail of all AP transactions, including invoices, purchase orders, and payment records. This documentation is crucial for supporting financial statements and demonstrating compliance with GAAP's disclosure requirements.

- Enables approval workflows and segregation of duties controls, which are vital for establishing strong internal controls over the AP process and aligning with GAAP's principle of internal control over financial reporting.

- Generates detailed reports and analytics on AP activities, such as expenses and invoices. These insights facilitate financial analysis, budgeting, and forecasting, supporting informed decision-making and compliance with GAAP's principle of transparency and disclosure.

- Seamlessly integrates with popular accounting systems, such as QuickBooks Online and Xero. This integration ensures the accurate transfer of AP data into the general ledger, promoting consistency and integrity in financial reporting as required by GAAP.

- Is a trusted e-procurement software for Japan, Sweden, Poland, Belgium and other countries across the globe.

If you would like to see firsthand how AP automation software can benefit your company, don't hesitate to book a demo of Precoro.

Frequently Asked Questions

What is GAAP in simple words?

GAAP, or Generally Accepted Accounting Principles, is a set of accounting standards and guidelines used in the United States to prepare and present financial statements. Publicly traded companies must comply with it, while private companies may follow it to improve their credibility.

When was GAAP first established?

Generally Accepted Accounting Principles were first established by the Securities and Exchange Commission (SEC) in the Securities Act of 1933 and the Securities Exchange Act of 1934. It has been continually updated since then.

Why were GAAP principles created?

GAAP was a response to the Stock Market Crash of 1929 and the Great Depression. The principles were created to provide a framework that would improve the comparability and transparency of financial statements, thereby helping to maintain trust in the financial markets.

What is the difference between IFRS and GAAP?

International Financial Reporting Standards (IFRS) is a principles-based accounting framework that is used globally. Generally Accepted Accounting Principles (GAAP) is a rules-based set of standards used in the United States.

Key takeaways for AP teams using GAAP

GAAP provides a comprehensive framework that governs various aspects of financial reporting, including that of the accounts payable (AP) bookkeeping process. GAAP specifies the way in which financial departments thoroughly and accurately record all of the liabilities that arise from a company's outstanding obligations to its vendors and suppliers. These records are usually in the form of invoices received for goods or services received but not yet paid for.

The main GAAP requirements for AP are:

utilizing accrual reporting instead of the cash-based approach

classifying expenses by their nature or function

fully disclosing the balances of the accounts payable in the financial statements

establishing a system of internal controls for detecting and preventing fraud and errors in documentation

Accountants must be attentive and thorough when it comes to applying GAAP standards, which are complex and leave room for subjective interpretation and industry-specific considerations. However, there are several ways in which companies may simplify their journey with GAAP compliance, namely outsourcing financial reporting to certified accounting firms, hiring accounting professionals with expertise in GAAP, joining industry associations and networks, and utilizing specialized accounting software.