9 min read

Everything You Need to Know About the Early Payment Discount

For every $1 billion spent on POs, there are about 3 million dollars in early payment discounts left unclaimed. Read on to discover how to qualify for and negotiate a discount.

What is an Early Payment Discount

An early payment discount (EPD), also often referred to as a prompt payment discount or a cash discount, is an agreement between the seller and the buyer that allows the buyer to pay less than the invoice amount due under the condition that they pay sooner.

Negotiations over EPD can be initiated by any of the two parties, both of which can benefit from it.

Read more about early payment discount programs, their advantages, and their implementation:

- Discount rate formula and how to calculate it

- Types of early payment discounts

- Why are prompt payment discounts important

- Supply chain finance or dynamic discounting program?

- What to keep in mind while negotiating a discount

- Pitfalls of early payment discounts

- Five steps to secure an early payment discount

Calculating the Early Payment Discount

EPD is calculated as a percentage of the total cost. Typically, a formula like 2% 10 net 30 is used, where 2% stands for the discount rate if the invoice is paid within the first 10 days (discount period) and the invoice reaches maturity in 30 days.

Early Payment Discount amount = Invoice total amount * (1 - Discount %)

Let’s say you are purchasing five laptops for $1299 each. If you receive an invoice for $6495 with an EDP condition stated as 2% 10 net 30 and pay on the third day, then you’d pay:

$6495 * (1-0.02) = $6365.1

That may not seem like a large amount at first glance, but across multiple invoices throughout the month, quarter, or year, EPDs can add up to substantial cost savings.

Early Payment Discount Types

As with any agreement, the early payment discount terms are negotiated on a partner-to-partner or even case-by-case basis.

There are three main types of EPDs, which can be applied based on the parties’ needs and capacities.

Fixed

A fixed EPD is a non-flexible addition to the standard payment terms of an invoice. Discounts can be claimed only under specified conditions or not at all.

With 2% 10 net 30 as a fixed EPD, no discount will be applied if the invoice is paid on the 11th day.

For vendors, there’s a risk of customers not paying early but still applying the early payment discount. These situations do occur and may lead to complicated bargaining and loss of buyer credibility.

Customers, on the other hand, might miss a chance to apply EPD due to invoice processing delays.

Dynamic

Dynamic discounting is an early payment program that allows for flexibility in business transactions and efficient response to supply and demand.

It's a bit more complex and typically uses a sliding scale model. The customer benefits from a bigger discount the sooner they pay, but with each day they wait, the size of the potential discount is less.

Meanwhile, with dynamic discounting, neither buyer nor seller is limited by a fixed discount rate and time frame. Dynamic EPD stems from the annual percentage rate (APR), which is acceptable for the buyer.

For example, if the APR is 20%, and the seller wants to get paid in 15 days, then a 0.8% discount will suffice:

(20% APR / 360 days) x 15 days = .055 x 15 = 0.8% discount

Tiered

Tiered EPD falls somewhere in between fixed and dynamic. It’s more suitable for medium and small businesses that do not use sliding scale dynamic discounting but want to leave room for discount adjustments.

With tiered EPD, there are several discount periods. While fixed EPD is a question of “yes” or “no,” the tiered variant is decided based on predefined options relating to "when" and "how much."

For example, the vendor can offer three tiers: 2% 10 net 30, 1% 15 net 30 and 0.5% 20 net 30. The customer evaluates their own capacity to process the invoice and approve the payment, then pays according to one of the terms.

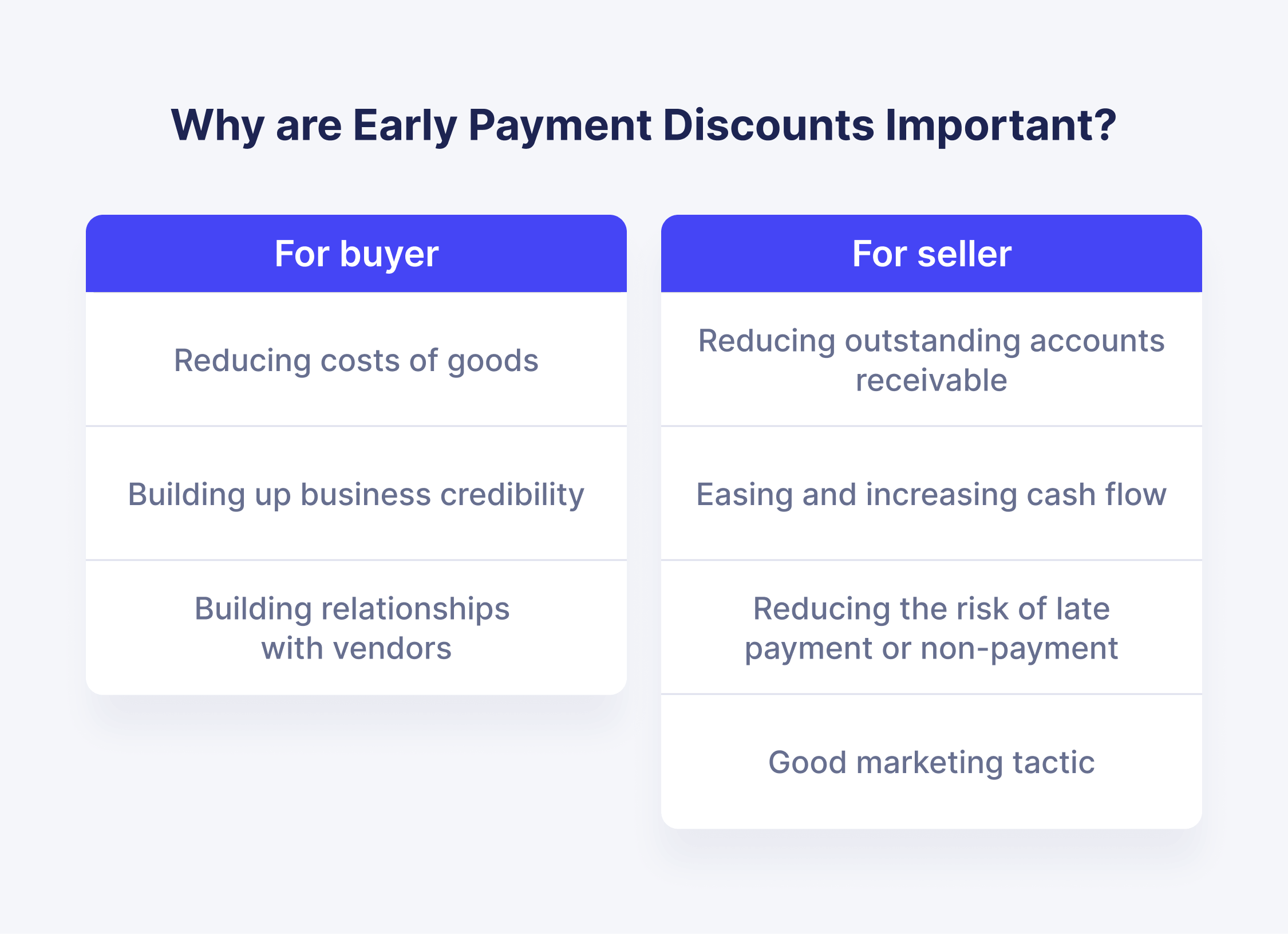

Why are Early Payment Discounts Important?

A prompt payment discount is a way to save money that doesn’t require the business to do anything except what they’re already doing – paying vendors.

At the same time, sellers can achieve more flexibility when introducing EPDs to ease cash flow problems.

It’s a question of partnership and negotiations, and if managed correctly, a win-win situation for both parties. Let’s delve a little deeper into the specific advantages for each party.

Cash discount for the buyer

For the customer, the first and most obvious benefit of an EPD is reduced cost of the goods being purchased.

For example, a 2% discount on a $100,000 invoice makes $2000 in savings and improves the company’s bottom line.

However, the buyer should be absolutely sure of their capacity to pay earlier. Causing a budget overdraft to qualify for the early pay discounts can result in fines elsewhere. Such penalties may negate the benefits of an EPD.

Beyond the financial benefits, qualifying for early payment discounts and actually paying the invoices early can significantly improve the business credit score as a trusted payee, which helps the buyer build up business credibility.

Paying ahead of invoice maturity is also beneficial for building relationships with vendors and might result in more successful deals in the future.

The seller’s benefits

By offering an EPD, the vendor reduces the outstanding accounts receivable, thereby speeding up the cash conversion cycle (CCC).

The early payment is an advantage for the seller because it helps ease and increase cash flow, enabling them to access extra working capital that can be immediately reinvested towards business growth.

Additionally, by granting the customer an EPD, the vendor increases their chances of receiving payment on time and reduces the risk of late payment or non-payment. The earlier the customer gets the incentive to pay, the smaller the risk.

Finally, an early payment discount is a good marketing tactic, as customers with expensive invoices are more likely to accept the seller’s offer. Typically, customers tend to favor sellers that offer discounts and will continue to do business with them.

Supply Chain Finance or Dynamic Discounting Program?

For a buyer, though, does it make more sense to apply EPD or choose more traditional supply chain finance? Both are ways to offer early customer payments to the supplier.

Supply chain finance (also reverse factoring) is one of the traditional financing methods when a bank acts as an intermediary and pays an invoice on behalf of a buyer in compliance with the early pay discounts.

The customer then pays the invoice on its due date, but not to the supplier directly. Instead, they pay the bank according to pre-negotiated credit terms, which include a bank fee.

Also known as commercial-based lending, this method gives buyers the advantage of prompt payment discounts without the extra task of having to pay early.

By contrast, using dynamic discounting, the customer can put their unutilized cash towards securing a discount by making an early payment directly to the supplier.

They have to have the money ready earlier and complete the logistical tasks of doing so, but they don’t pay an added fee to a third party like they do with commercial-based lending.

There’s no single answer to which financing method is better, especially in today's fast-paced world.

Each business should evaluate the current economic climate and the current state of their own finances and then decide on a sustainable solution.

Negotiating an Early Payment Discount

Both the buyer and the seller should consider the state of the market before requesting or offering early payment discounts. There are several criteria to consider.

What is the standard in the industry?

There’s usually a generally acceptable set of discount terms for each particular industry. Consider how vendor-customer relationships usually work in your industry before beginning the negotiation process.

What does competition offer?

What do suppliers in your market segment offer, and what do customers ask for?

Do your research and prepare an offer that fits the margins of acceptable discount rates and payment conditions. Doing so will significantly increase the probability of reaching an understanding.

What is the buyer’s payment history?

How trustworthy is the buyer in the seller’s eyes? Consider it while negotiating an EPD.

If it’s your first time requesting the early payment discount, be aware that the seller might start carefully and the first offer might not be as generous as you’d prefer.

Pitfalls of Early Payment Discounts

Not every opportunity for an early payment discount is used successfully – for internal or external reasons.

- Tight margins. If the goods or services are being sold only just above cost, offering any discount might be difficult. Tight profit margins significantly limit the flexibility of tiered and dynamic cash discounts because the supplier needs to ensure a profit.

- Unclear terms and lack of visibility in the contract. The terms of the prompt payment discount should ideally be written down and signed by both parties (buyer and seller) to avoid any misunderstandings.

For example, the customer and vendor might initially disagree on what day 0 is. While the vendor might count from the invoice issue date, the customer might start the clock only once the invoice has been received and registered by the accounts payable department. - Lack of visibility in the invoice approval process. When roles and responsibilities in the approval flow are unclear, there’s a high chance of mistakes and omissions – invoices are misplaced, approved, or declined mistakenly.

- Slow approval flow. An overly long approval cycle can cause a delay when processing and paying an invoice, leading to a missed opportunity for an EPD.

- Extra work. Managing early payment discounts requires an additional agenda and, therefore, more work. When carried out manually, an EPD can become a severe obstacle and lead to teams feeling understaffed.

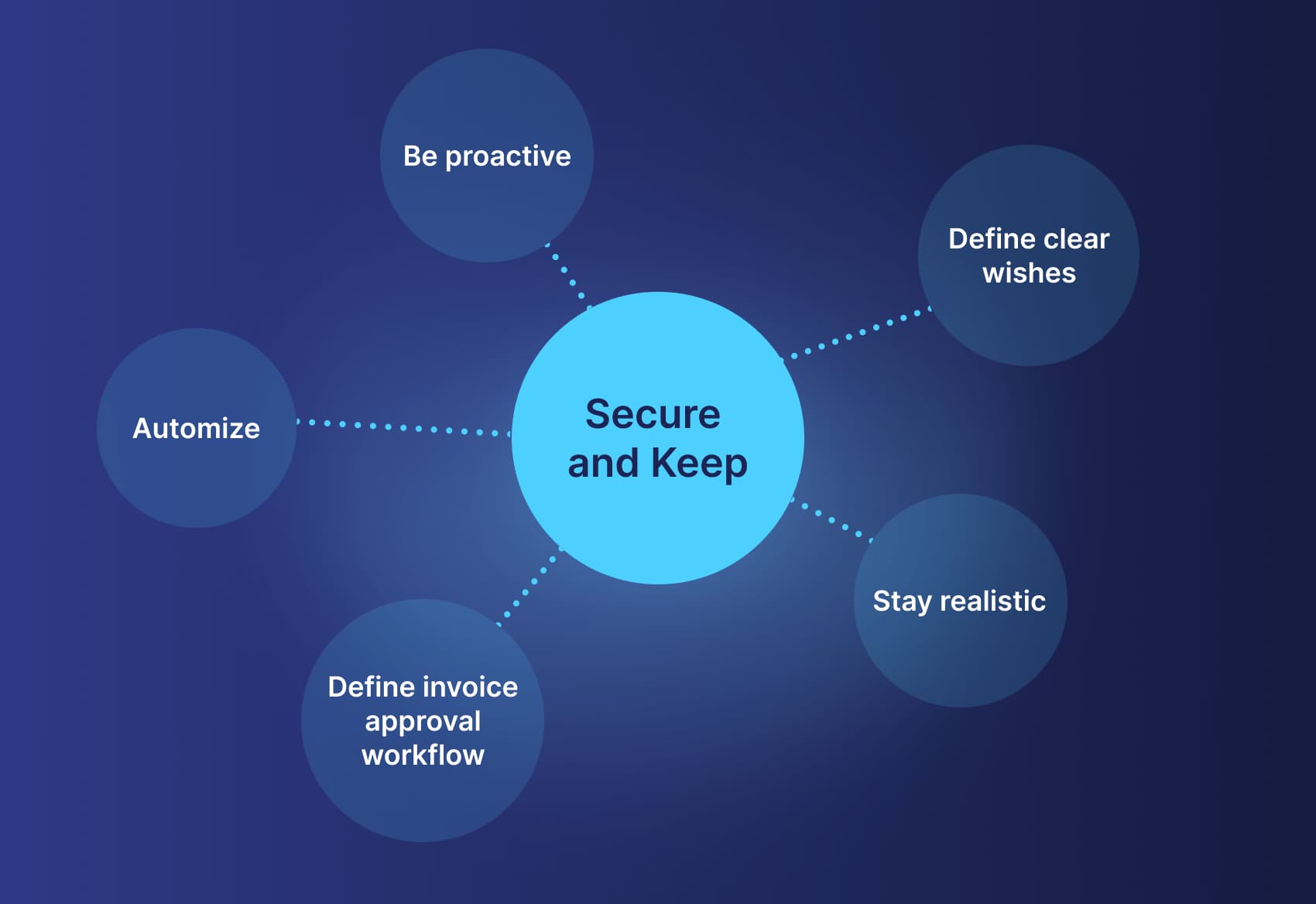

Five Steps to Secure a Prompt Payment Discount

- Be proactive. Don’t sit back and expect the counterparty to come up with an EPD offer. Reach out and, if you believe it’s appropriate, make an offer.

Define clear wishes. Come up with a specific proposal for a discount and stick to it. Define the terms acceptable for you and decide how much you’re willing to deviate.

Payment terms, including the EPD, should be clear from the invoice, which is a legally binding document.

Stay realistic. To negotiate wisely and increase the chances of reaching an agreement, understand the counterparty’s financial and structural background as much as possible. Meanwhile, keep your expectations realistic.

Typical EPDs are:

- 1 or 2%,

- on 10th to 15th days,

- of 30 to 60 net days.

Define invoice approval workflow. Each company’s approval workflow is unique based on the size and business needs.

Everyone involved in a transaction should be aware of their role and deadlines – whether it is a simple one-step confirmation or a complex workflow involving several departments.

Both seller and buyer should have invoice issue/approval workflows defined internally and then clearly communicate them externally.

What should an invoice contain? When is day 0? Who receives the invoice on the buyer's side and conducts three-way matching

A sample invoice should be created (or generated if you’re already using procurement software) and everyone involved should be consulted in order to avoid future misunderstandings.

Automize. Managing early payment discounts accounts for up to 27% of all procurement employee tasks, adding up to a substantial number of working hours.

Early payment discounts require quick action. However, it can take up to 20-21 days to process an invoice manually. Furthermore, manual processing comes with the risk of lost data or missed opportunities.

Implementing a software solution will free your team from countless spreadsheets and risk of inconsistent information, and will also streamline invoice processing.

Automation tools shorten invoice processing time to 3-4 days, which is invaluable when time is an asset.

FAQs

The seller can indeed decide to offer discounts, and they are often the side to initiate. However, the buyer can also request an EPD.

Not exactly. It’s up to the involved parties to decide on the terms for the EPD. However, there is a suggested 2% discount if an invoice with thirty days maturity is paid within ten days. It's usually stated as 2% 10 net 30. Each company then adjusts the offer to its needs.

This has to be confirmed between the seller and the buyer and, ideally, also put down in writing. It might be the day of issue on the vendor's side or the day it was received and registered by the customer. Discounting terms should be clearly stated in the contract, on the invoice, or in any other legally recognized format.

To sum up

An early payment discount is an opportunity for the buyer to pay less and for the seller to speed up the cash flow.

Both seller and buyer can initiate negotiations about the early payment discount, and both parties can benefit from it.

There are three early payment discount types: fixed, tiered, and dynamic discounting. They mainly differ in the flexibility of the discount rate and payment day.

A typical prompt payment discount is 2% 10 net 30, where a buyer can pay 2% less if an invoice with 30 days maturity is paid within 10 days.

With early payment discounts, timing is essential, and therefore companies strive to implement automation solutions to streamline invoice processing.