9 min read

Open Invoice: Everything You Need to Know

As a business owner, an accountant, an employee of the finance department, or even a salesperson negotiating the contracts, you will eventually come across the term “open invoice.” This is true whether you are part of the buying company or the vendor.

For any business that cares about financial stability, it’s vital to understand open invoices, the role they play, and how to process them smoothly. In this article, we’ll delve into the nitty-gritty details of open invoices, including:

- What is an open invoice?

- How to process invoices from open to closed

- Types of outstanding invoices

- The role and importance of an open invoice

- Typical challenges with open invoices

- The best practices for managing open invoices

- Frequently asked questions

What Is an Open Invoice?

In the simplest of terms, an open invoice is an invoice that has not been paid yet. In other words, it’s a document sent from the supplier to the customer outlining a list of goods or services provided and the amount that is due. Open invoices are common for businesses that conduct credit-based transactions.

Like any other invoice, an open invoice must include the following information:

- Invoice number

- Invoice issue date

- PO number, if relevant

- Information about the payee and recipient (usually names, addresses, and registration numbers)

- Price and number of items

- Total due

- Payment due date

- Payment method (some companies might also include a direct link or QR code for payment)

Additional information, such as deposit or installment payment information, comments, visuals, and others can also be included.

An invoice is considered open from the moment it has been issued until it’s fully processed and paid. If an invoice isn’t paid by the due date, it is typically considered past-due.

The time limit for paying depends on the contract terms. For instance, “net 30” stated in the contract means the customer has 30 days to pay the invoice.

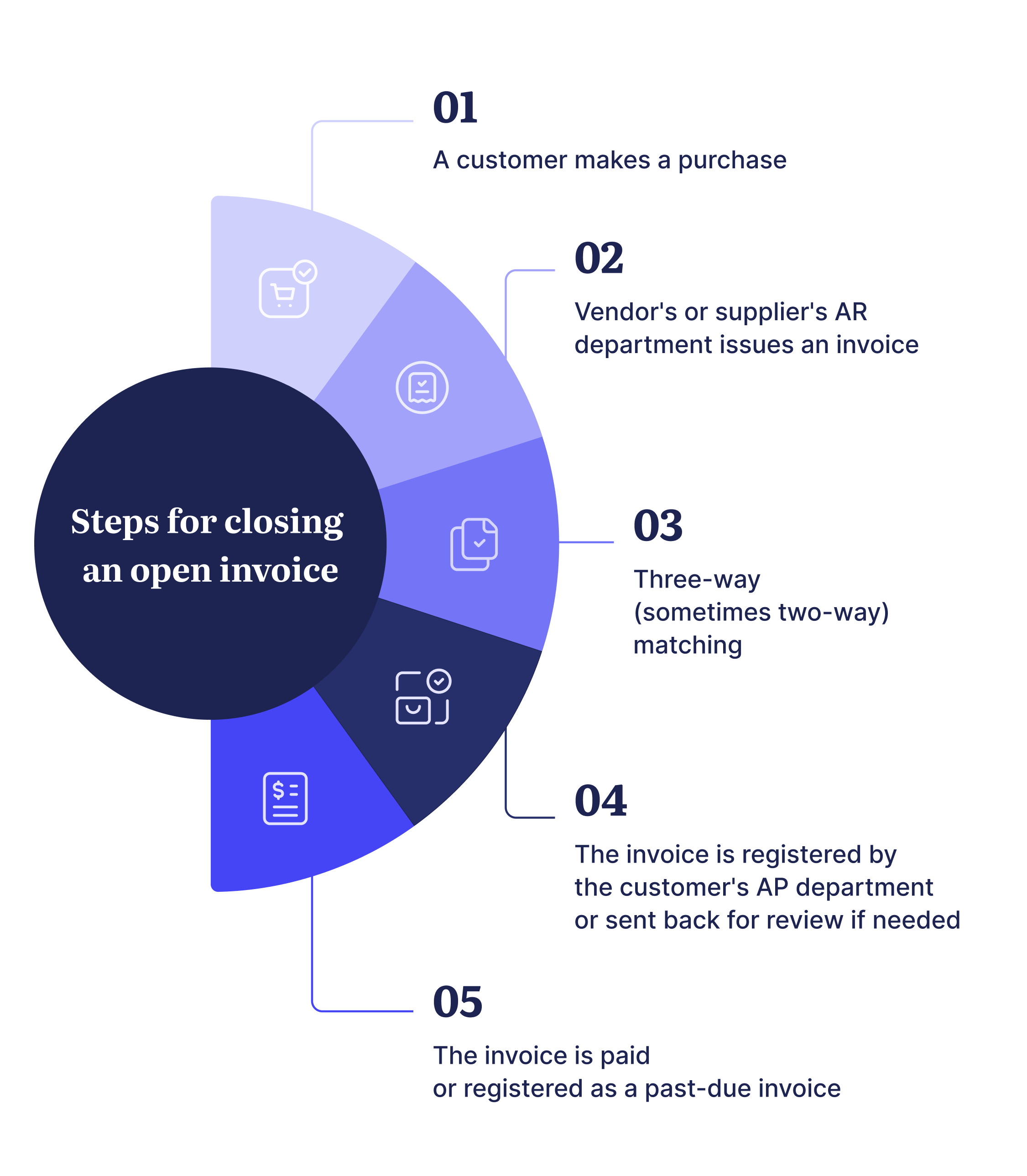

How to Go from an Open to a Closed Invoice

Depending on the business specifics, companies might follow slightly different procedures while processing open invoices. But the overall stages will typically look as follows.

Issuing

The invoicing process begins when the seller’s accounts payable department sends an open invoice to the client. This typically happens once a purchase order is received and filled – meaning once the buyer receives the goods or services from the seller.

Matching

Upon receiving the invoice, the customer’s accounting department conducts three-way matching of the purchase order, the receipt, and the invoice. If they have not requested that a receipt be issued, they might carry out two-way matching instead using just the PO and invoice. The purpose of PO invoice processing is to make sure that the invoice is accurate by answering the following questions:

- What did we order?

- What did we receive?

- What are we expected to pay for?

The invoice matching process is vital for validating that there are no mistakes or duplicates in documents and that all requirements of the purchase order are fulfilled.

If any discrepancies are discovered during the matching process, the customer’s accounting department should return the invoice to the vendor and request a review. If there are no issues, the invoice is registered by the customer in the accounts payable as an open invoice.

Paying

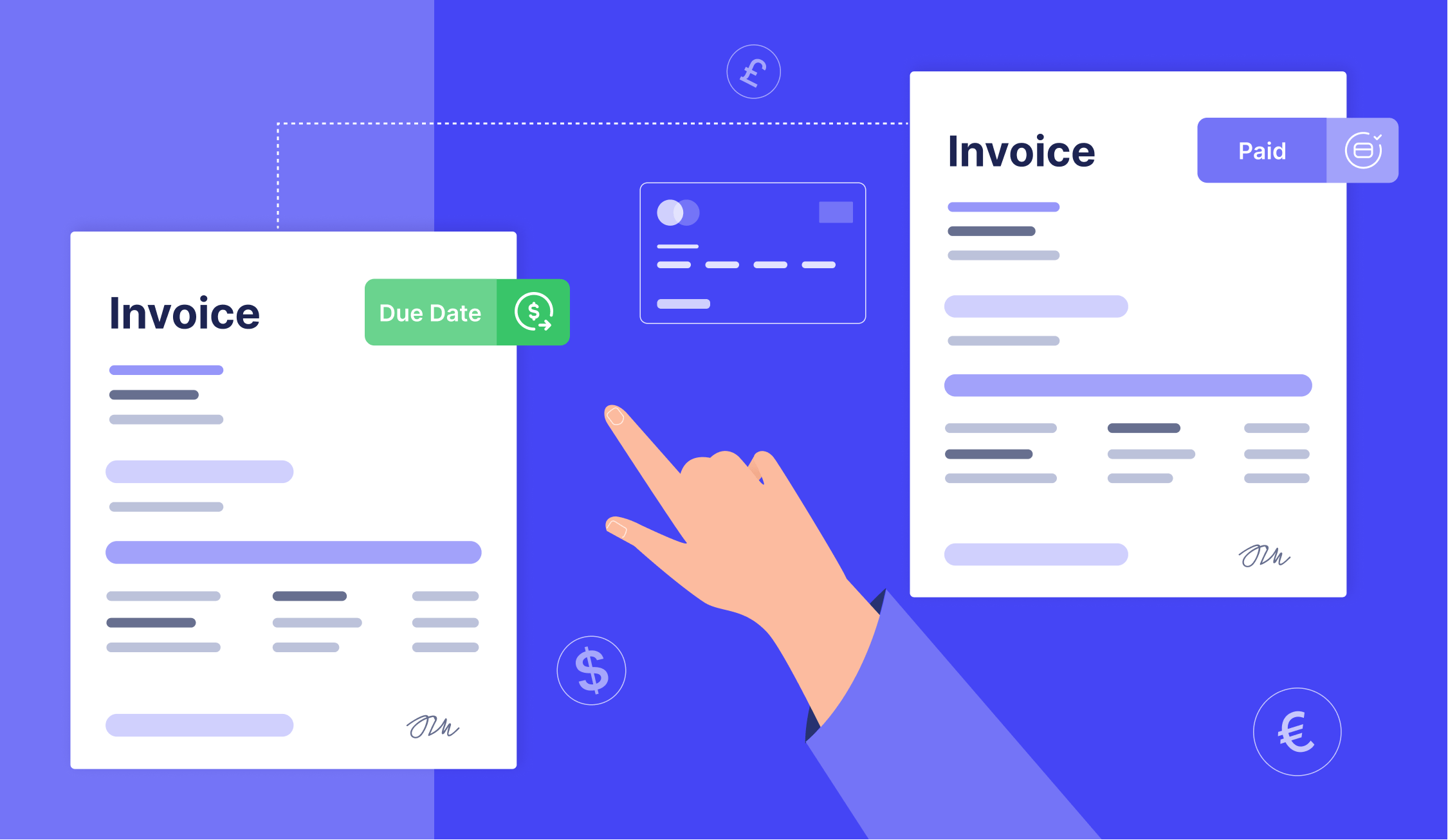

Finally, the invoice should be paid within the established time frame – in other words, before the due date stated on it. When the customer makes the payment and the supplier receives it, the open invoice becomes a closed invoice and is prepared for reconciliation and future audit.

For the seller, an open invoice is registered as the account receivable. For the customer, the buyer, an open invoice is registered in the accounts payable account.

If the invoice isn’t paid on time, it is considered past-due. In such cases, the supplier may send reminders, demand a late fee, involve a collection agency, or even take legal action to collect the debt.

On the other hand, if a customer pays the invoice immediately, they might qualify for an early payment discount. This is up to the supplier to establish. Typical early payment discount conditions would be expressed in a formula 2/10 net 30. This means that the client will receive a 2% discount if they pay within ten days after the invoice is issued, assuming that the invoice is due in 30 days.

Types of Outstanding Invoices

An open invoice can be a result of various circumstances, including agreement on delayed payment, disputes over payment, transaction issues, or simply inability to pay immediately after issuance.

Offline pending payments (also known as manual)

A payment can be initiated manually via a selected method — in cash, with a check, or via bank transfer — but stay stuck on the “pending” step. To complete the payment and change the invoice status to closed, a member of the payee finance team should manually confirm payment’s arrival to the recipient.

Online pending payments (also known as automated)

Instead of manually, the payment process can also be initiated using invoice automation software. If the amount is not immediately transferred to the vendor’s account, it becomes a pending payment. The invoice is still considered open until the payment goes through.

Incomplete payments

These payments were not completed successfully despite receiving an invoice. The reason for this usually lies on the customer’s side: inputting incorrect payment details, insufficient funds, payment limits, etc. However, it can also be a vendor’s fault if they provide misleading information, for instance, incorrect bank details.

Partial payments

By agreement or by accident, the buyer might pay for their purchase in stages. This would result in 1 or more open invoices until the purchase is paid in full. Here are some scenarios which might lead to partial payments:

- The vendor and the customer agreed to cover the price of the purchase in several installments.

- It takes time for the supplier to process and fulfill the order. If the supplier needs to secure funds in order to initiate the purchase order processing, they might ask for part of the total amount to be paid immediately after placing the order. The rest is paid upon delivering the order in full.

- The final total value of the goods or services is difficult to estimate from the beginning, so the payments are made bit by bit.

The Role and Importance of an Open Invoice

Tracking open invoices is an essential aspect of managing cash flow for both selling and buying parties. This way, businesses can record the necessary information, such as the amounts owed, the due dates, and any applicable late fees or early payment discount opportunities. With this data, companies can ensure stable and predictable cash flow.

Buyers must keep track of all open invoices in order to prevent missing payments or accumulation of debt; sellers must do so in order to accurately estimate the total of incoming payments they can expect. This contributes significantly to a healthy financial outlook for the business and plays a vital role in long-term success.

On the other hand, unpaid invoices can accumulate and lead to cash flow problems, impacting a company's ability to plan other payments when they are behind on the current ones. Poor management of open invoices can damage the company’s supplier relationships and affect future business opportunities.

Challenges in Processing Open Invoices

The finance team should be aware of the challenges it might face while managing open invoices, and it should be prepared to minimize risks to prevent possible adverse effects.

One challenge that both buying and selling parties might face is having too many open invoices. This can happen if limited employees are overwhelmed with the amount they have to process within a specific time frame. The resulting delay can lead to cash flow issues, such as a deficit of cash for suppliers or significant debt with possible insolvency for buying customers.

Another challenge for suppliers is that it takes significant time and resources to collect overdue payments. Vendors typically have to make some readjustments on their own side when invoices aren’t paid on time; this might include rescheduling payment with an extension to give the buyer more time to pay, depending on their circumstance. Thus, it’s important that they are aware of this risk and have the resources to manage accordingly.

If an open invoice is overdue and sellers need the money immediately, they might employ a third-party collection service – also known as an invoice discounting service – that lends them the owed amount on an invoice. In return, the service requests a percentage of the invoice once the customer has paid. This is essentially a credit line for selling companies and, while it can help them in the short-term, it can eat into long-term profits.

Therefore, vendors might impose fines upon their customers for overdue invoices in order to cover this agency fee and any other costs incurred as a result of receiving a late invoice payment.

One more issue that buyers should be aware of is the risk of overdrafting credit lines. Sellers open them as a show of trust and readiness to fulfill the buyers’ purchase orders without receiving payments for each PO immediately. Although some suppliers grant their buyers credit lines, this privilege should not be abused.

Unfortunately, buyers are sometimes tempted to accumulate open invoices and max out granted credit lines or even go into overdraft. Repeated delays in payment can sabotage such cooperation, prompting suppliers to withdraw the credit offer or stop accepting the purchase orders altogether.

Finally, processing open invoices manually is a challenge in and of itself. Manual data entry, especially if using paper-based documents, significantly increases the risk of errors due to human factors, such as typos in the names and numbers or mismatching and misplacing documents. All these can significantly prolong the open invoice clearing.

Best Practices for Managing Outstanding Invoices

Finance and sales staff can take some specific measures to make managing open invoices easier, more transparent, and less prone to mistakes.

Communicate well with suppliers

Set clear payment terms and ensure that both parties are familiar with and agree on them. This will help to ensure payments are made on time and will help parties avoid payment disputes in the future.

Negotiate flexible contracts

Prioritize contracts that allow multiple payment methods (cash, check, bank transfer) and leave a possibility for payment schedule flexibility. One of the best ways to maintain a positive relationship with suppliers is to pay invoices on time. If the buyer anticipates that it will be challenging to pay the whole amount on time, they should negotiate for a custom payment schedule that works for both parties.

Maintain accurate records

All purchase orders, receipts, invoices, payments, and outstanding debts should be carefully recorded and easily accessible. This way, it’s easier to conduct three-way (or two-way) matching, identify discrepancies, and ensure correct payments.

Regularly review open invoices and follow up with suppliers

Routine review should be conducted by both parties, as it helps identify any issues early on and take corrective action. For instance, such inspections can reveal that some invoices are due soon but lack payment details or that their statuses are incorrect due to failed matching. If noticed in time, potential problems can be prevented.

Consider using automation solutions

Various software options on the market can be combined to design efficient purchasing and invoicing processes. Dedicated procurement software such as Precoro helps streamline the P2P cycle and proves especially helpful for document matching. Integrating Precoro with accounting software, such as QuickBooks, also simplifies the processes of recording and matching invoices, decreases document processing time, minimizes errors, and reduces administrative costs.

See Precoro in action. Book a demo today!

Frequently asked questions

In the simplest of terms, an open invoice is one that has not yet been paid. It’s a document sent from the supplier to the customer outlining a list of goods or services provided and the amount that is due. Open invoices are common for businesses that conduct credit-based transactions.

An invoice is considered open from the moment it is issued until it’s fully processed and paid. When the customer makes the payment and the supplier receives it, the open invoice becomes a closed one.

Tracking open invoices is important for managing cash flow for both selling and buying parties. Businesses can use open invoices to record amounts owed, the due dates, and any applicable late fees or early payment discount opportunities. With this data, companies can ensure stable and predictable cash flow.

Conclusion

An open invoice is an invoice sent from the vendor or supplier to the buyer that has not been paid yet. An invoice is considered open from the moment it is issued until the point where it is fully processed and paid.

Staying on top of open invoice management helps buyers maintain healthy cash flow and positive relationships with suppliers. At the same time, suppliers can retain business profitability by ensuring that invoices are paid on time and in full.

Practices for efficient management of outstanding invoices include transparent invoicing processes, open communication between suppliers and customers, accurate record-keeping, and regular reviews of progress.

Following these practices for processing open invoices helps both parties ensure timely payments and avoid financial losses, such as late fines for the buyers and collection agency fees for the suppliers. Investing time and resources in managing open invoices can lead to a more prosperous business.