13 min read

Track the Supply Chain Metrics that Really Matter

Would you say that you have a good understanding of your company’s supply chain strengths and weaknesses? How spot-on are your plans and estimates for the supply chain cycle?

According to McKinsey survey of global supply chain leaders, only 53% of respondents describe the quality of data in their supply chain planning systems as “sufficient” or “high.” Yet leaders with high-quality master data are 1.5x less likely to be affected by supply chain disruptions.

A transparent and well-controlled supply chain plays a crucial role in a company’s success. It’s much easier to ensure stable business growth when the flow of goods, materials, and services is efficient and timely.

To monitor supply chain performance, stakeholders of successful companies typically define supply chain metrics that are relevant to the given business and track these KPIs regularly.

In this article, we would like to discuss:

- General overview of supply chain metrics

- Inventory metrics

- Supply chain metrics regarding logistics

- Customer order fulfillment metrics

- General supply chain quality metrics

- FAQs

General Overview of Supply Chain Metrics

Supply chain metrics, often referred to as SCM, are numbers and ratios that a business tracks to evaluate supply chain performance. The right metrics can shed light on how cost-effective a company’s processes are when it comes to the flow of goods, both at the inbound stages of procurement and outbound all the way to the customer.

Supply chain metrics that are diligently collected, curated, and analyzed enable stakeholders to spot inefficiencies and recognize strengths within the established workflows. By setting benchmarks for metrics, analysts can recognize unsettling trends and take preventive measures on time. Such measures can include, for example, pushing for better supplier deals or adjusting the internal workflows.

Timely reactions help companies stay on top of their customers’ needs and meet their demands, ultimately leading to higher revenue.

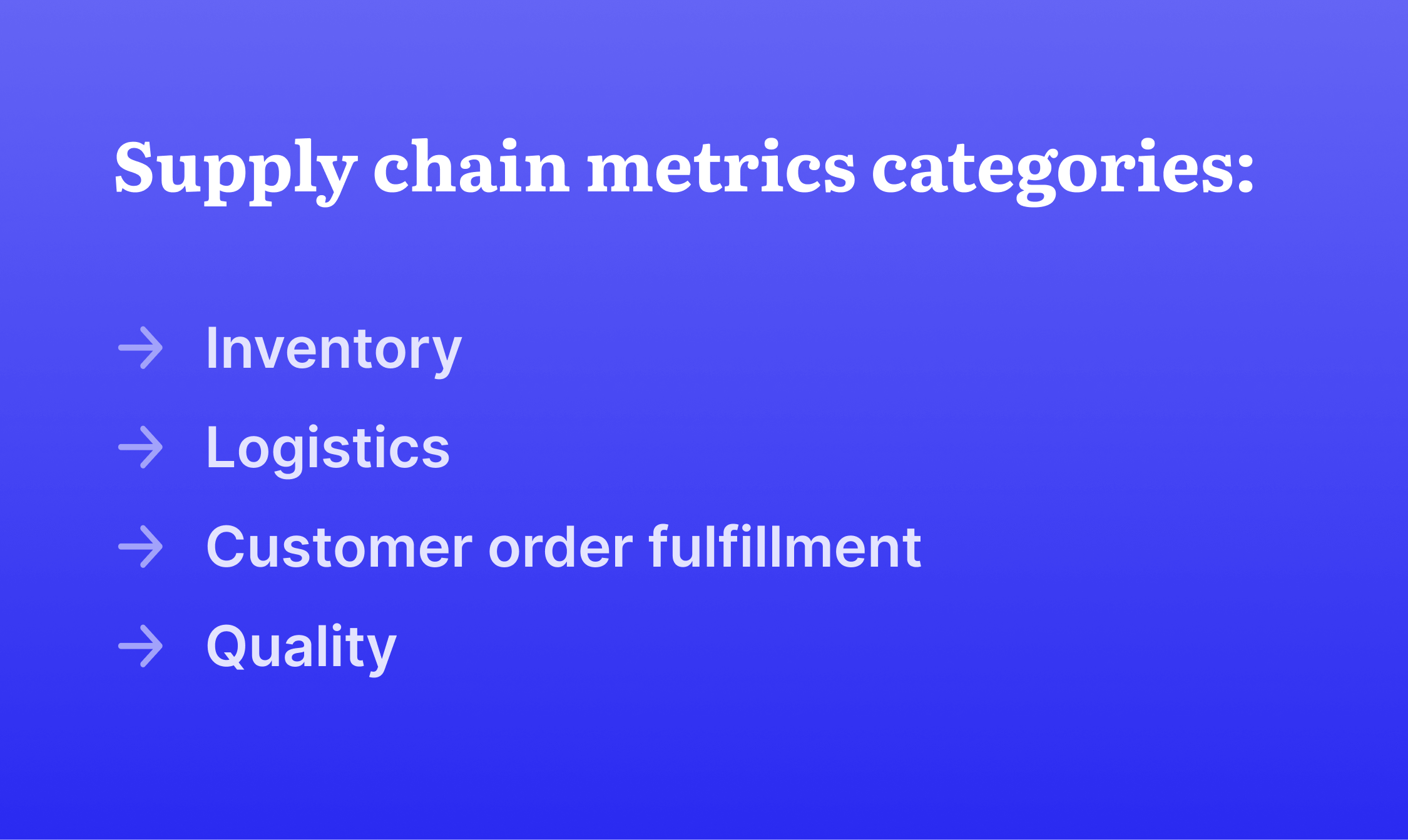

There are numerous supply chain metrics that a company can choose to track. In this article, we are covering key metrics, divided into the following categories based on the supply chain step they refer to:

- Inventory

- Logistics

- Customer order fulfillment

- Quality

Inventory Metrics

A company’s inventory encompasses raw materials used for production, as well as the produced goods available for sale. Inventory is one of the most important assets of any company, as it’s the basis for generating revenue.

Let’s look at the metrics that can help clarify how well inventory is managed within the company’s supply chain.

Days inventory outstanding (DIO)

This metric reflects how long it will take you to run out of the supply stock if it isn’t replenished. As the name implies, the metric is expressed as a number of days calculated in the following way:

(average inventory / cost of goods sold) x period lengthBy analyzing the DIO, organizations can estimate how long production can continue with the current supply levels, so that procurement managers can plan to order additional supplies. This way, companies can avoid any stock-based issues and delays.

The level of supply in stock, which should be maintained to ensure production stability, is called a PAR level, standing for the “periodic automatic replacement” level. It’s defined for each company based on its production and sales volumes.

Days payable outstanding (DPO)

This metric describes how many days on average it takes a company to pay the invoices of the suppliers, vendors, or financiers. It is calculated as:

(accounts payable x days in the accounting period) / cost of goods soldA higher value of DPO means that the company takes time to pay its bills and therefore retains cash for longer to cover the operational expenses.

However, if a DPO is much higher than the acceptable average on the market, it might mean that the company is unable to pay its bills on time. This can be a warning signal for the stakeholders to look into the cash flow.

Inventory-to-sales

This metric compares inventory in stock prepared for sale to the actual quantity of sold items. The relation is expressed as a ratio of average inventory divided by the net sales over a period of time.

Keeping a tab on this metric helps to determine a sufficient range of stocking levels to meet the sales needs, face unexpected market disruptions, and at the same time avoid unnecessary items piling up.

Continuous analysis of the inventory-to-sales ratio can also highlight the need to improve inventory turnover.

Inventory turnover

This is an important metric that reflects the number of times the entire inventory is sold during a defined period of time. It’s a ratio of the cost of goods sold divided by the average inventory.

(The average inventory stands for the average value of inventory over two or more time periods.)

The standard for inventory turnover varies across industries and depends on customer habits, therefore the ideal metric depends on the context of a particular market. A high inventory turnover signals there is a high demand for products and they are sold quickly, while a low inventory turnover might indicate excess stock due to poor planning or low sales.

Inventory turnover can be improved by investing in professional sales forecasting, with the purpose of analyzing the market to ensure the business meets its requirements and demands.

Inventory accuracy

This metric compares the inventory records to the actual physical inventory in stock, including both raw supplies and finished items. Inventory accuracy is calculated as a ratio of database inventory count divided by physical inventory count.

Inventory accuracy should be estimated periodically to evaluate whether records can be trusted. With an understanding of record accuracy and possible deviations, companies can better maintain the database and avoid overstocking or stock outages.

A 100% inventory accuracy is very difficult to achieve in the real world. According to DCL Logistics, an ideal to strive for is 95% to 99% depending on the variety of items. For a more accurate inventory, businesses can create custom naming and labeling systems and implement specialized software for inventory management automation. This helps eliminate manual data entry, minimizes human error, and makes searching for items easier.

Metrics on Supply Chain Logistics

The movement of materials and goods is the essence of the supply chain. The next group of metrics evaluates the performance of a company’s logistics networks.

Delivered on time and in full (OTIF)

One of the key metrics, OTIF provides a comprehensive overview of delivery success by revealing what percentage of the orders are delivered on time and in full. An order is considered delivered in full if the product meets the quantity and quality requirements, and “on time” speaks for itself.

OTIF is calculated as a ratio of orders delivered on time and in full divided by the total of delivered orders.

Receiving a product on time and up to the expected standard is the main objective for the customer placing the order, so higher OTIF ratio means higher customer satisfaction.

For a more detailed understanding of delivery success, companies can introduce separate ratios for on-time delivery and damage-free delivery.

By keeping track of on-time deliveries and recognizing regular delivery lags for specific product types or locations, companies can identify the issues and fix them, or inform potential customers about possible delays due to factors that are out of their hands.

The same goes for delivering products damage-free. Out of many shipments, it’s practically inevitable that some products get harmed along the way. But it’s important to have a clear overview of the reasons, scale, and frequency of damage.

Shipment damages can be caused by unpredictable circumstances, but also by insufficient packaging, problematic transportation procedures, and careless delivery partners. If the product damage is not monitored and spirals out of control, it can seriously worsen customer relationships and compromise budget.

On-time shipping

For a delivery to be made on time, it needs to go out on time. On-time shipping is a metric that evaluates how many orders are shipped on or before the scheduled departure.

The metric is a ratio of the number of items shipped on time divided by the total of shipped items.

On-time shipping coupled with strategic route planning is especially important for companies with global reach who operate within complex international shipping or freight networks. Such companies might be especially susceptible to supply chain disruptions around the globe. Thus, shipping on time and planning are stand for risk minimization.

Pick & pack cycle time

This metric quantifies the shipment preparation process by measuring the time from an employee picking up the item from the shelf to the moment packing is completed.

The pick and pack cycle time can reveal the weak spots in the warehouse arrangements by analyzing the steps of finding the item, taking it to the packaging station, and having it wrapped up and boxed for shipping.

If any part of this preparation process takes longer than it should, it’s a sign that the manager should reevaluate the workflow, technology, and employee competencies.

One of the most critical issues that often causes delays in the pick and pack cycle is the incorrect selection of items. Low order picking accuracy might be an outcome of the poor stock organization and can be improved by grouping similar items in the warehouse, using special codes (such as SKU), and introducing automation solutions.

Freight and shipping cost per unit

Shipping or freighting costs constitute a substantial part of the overall supply chain costs. Businesses search for the most cost-effective option to deliver goods from the warehouse to the final customer.

The metric of freight and shipping cost per unit measures overall shipping costs divided by the number of shipped units. “The unit” is specified based on the product type and delivery method.

This metric is the basis for understanding how economically the goods are currently shipped and if there’s room for savings. Understanding the past, current, and projected freight and shipping costs per unit is also helpful for negotiating adequate contracts with delivery companies.

Warehousing costs

Measuring warehousing costs is important for ensuring sufficient high-quality storage space for a reasonable price.

Compartmentalizing the general warehousing cost is the first step towards recognizing unwanted expenditures and cutting them to align with the supply chain budget. General warehousing costs are made of the following components:

- Warehouse rent

- Utility bills

- Equipment costs (purchase, leasing, service)

- Material for storing the items

- Inventory software

- Labor costs

Required expenses might vary for different warehouses within one supply chain, especially on account of location and product types. Therefore, regular reviews allow management to keep track of storage cost efficiency and lets them select the best warehousing partner or allocate premises on the company grounds.

Customer Order Fulfillment Metrics

Another way to look at supply chain efficiency is through the prism of customer order success. There are several metrics for evaluating data about orders.

Perfect customer order

This metric measures the percentage of error-free orders a company ships to customers. An order is typically considered perfect when it has been delivered to the right place, at the right time, with the right product, in the right quantity, in the right condition, and with the correct documents included.

The easiest way to measure the perfect order ratio is to calculate the percentage of orders that meet the individual criteria during a defined period and then cross-reference the numbers:

(% delivered to the right place) x (% delivered on time) x (% containing the right product) x (% with the right product quantity) x (% with the goods in the right condition) x (% with the correct documents included)Customer order fill and backorders

The next metric indicates the percentage of customer orders a company can ship immediately, without having to restock or lose orders. It’s a ratio calculated as the total number of immediately shipped orders divided by the total of orders.

The opposite of the order fill rate is the backorder rate, which reflects the percentage of offers that cannot be fulfilled immediately after a customer places them. It’s calculated by dividing the number of orders that cannot immediately be shipped by the total of orders.

These two metrics are useful for the business to understand how well they can predict customer demand and estimate the required stock of goods. Higher order fill rate and lower backorder rate are symptomatic for precise estimation. If, however, the backorder rate is high, it means that the company does not have enough product in stock available immediately and might have to consider strategic inventory improvements.

Customer order cycle time

This metric tracks the time from the moment a company receives a customer’s order until the delivery is completed. It’s calculated by subtraction:

the actual delivery date – order placement dateThe perfect cycle time highly depends on the countries of production and delivery, as well as on the product type. Stakeholders typically estimate the perfect order cycle time they aspire to achieve for each specific type of product on the selected market.

A short cycle means that a company is responsive to the customers orders and the delivery process is efficient. If the cycle is long, it’s worth investigating to understand whether the problem is caused by an insufficient stock of the product, logistics challenges, or poor supply chain management.

Days sales outstanding (DSO)

This metric reveals how long it takes for the company to generate revenue from the customers for the goods or services sold.

Days sales outstanding are calculated for a specific period of time (can be a month, a quarter, or a year) in the following way:

(accounts receivable / net credit sales) x number of daysExpectations for the DSO vary greatly across industries and depend heavily on the size of the business. For example, relatively long payment periods are typical for the financial industry, while in agriculture fast payments are preferred. Also, fast payments and stable cash flow are a lot more important for small businesses than for large corporations with significant financial assets and credit lines.

When compared to the company’s standard, a lower DSO means a more accelerated cash flow and a higher DSO means that the company sells to the customers on credit more often. With DSO much higher than the referenced standard, there might be a large number of accounts receivable and a lack of cash available for immediate allocation.

Return reasons

This metric reveals all the reasons why customers choose to return the products and highlights the most common reason.

These reasons might be anything from product defects to poor delivery performance. By understanding the key concerns of the customers, stakeholders can assess weak spots within production and distribution processes.

Correcting these flaws can decrease the return rate, minimize financial losses, improve the company’s reputation, stimulate customer loyalty, and boost sales in the long run.

General Supply Chain Quality Metrics

Finally, there are several metrics for evaluating the supply chain as a whole. They provide an overview of the general quality of the supply chain.

Cash-to-cash cycle time (C2C)

Also known as cash conversion, this metric estimates how much time passes between sending cash to the supplier to pay for materials and ultimately receiving cash from the customer for the finished product.

C2C is a comprehensive metric that combines three other supply chain measurables: days inventory outstanding (DIO), days sales outstanding (DSO), and days payable outstanding (DPO). Cash-to-cash cycle time is calculated as:

DIO + DSO – DPOThe shorter the cycle is, the faster the company can turn its investments into revenue, meaning better cash flow.

Supply chain cycle time

This metric is insightful for tracking the end-to-end procurement efficiency of the company’s supply chain. It’s an estimation of the time it would take to fulfill a customer’s order if the inventory levels were at zero at the moment of order placement.

Supply chain cycle time encompasses all three legs of the supply chain: getting raw materials from the suppliers, production, and distribution. The supply chain cycle time is calculated by adding the longest possible lead times for each stage of the company’s supply chain.

Short cycle time, as compared to the market standard, is an indicator of an efficient, well-managed, and agile supply chain.

Supply chain costs

This metric evaluates the costs stemming from supply chain management. These costs can include any payments related to sourcing and purchasing supplies, product storage and delivery, managing teams, planning, etc.

By analyzing costs regularly, stakeholders can quickly identify areas where they can optimize supply chain expenditures – in other words, cut costs. Ultimately, the business strives to increase its profits and one of the ways to do so is by reducing costs where possible.

However, it’s important to analyze the numbers critically and evaluate how cost reduction in one leg of the supply chain can affect the whole cycle. For instance, saving some money by avoiding inventory software subscription might result in a mess on the warehouse shelves, and subsequently might mean paying more for express delivery to meet the customer's expectations. This could be very counterproductive.

Gross margin return on investment (GMROI)

Companies in every sector strive to generate a respectable return on investment, or ROI. Gross margin return on investment reveals how much money a company’s inventory generates above its cost. It’s calculated as gross profit divided by the average inventory cost.

By analyzing this metric, stakeholders can gain useful insights into which inventory items are performing well and are worth further investment, and then adjust the funding. By doing so regularly, decision-makers stay agile enough to react to recent market shifts and ensure consistent ROI, which is one of the strongest indicators of stable business growth.

To Sum Up

When collected and analyzed regularly, supply chain metrics enable companies to monitor their supply chain performance and act swiftly to correct any flaws and streamline workflows.

The right metrics can provide actionable insights into how efficiently a company manages the flow of materials, goods, and services at all stages.

To collect and process data for calculating the supply chain metrics, progressive companies implement specialized software for each stage of the supply chain. For instance, Precoro helps streamline the procurement stage workflows, vendor management, and analytics to ensure that cooperation with suppliers is transparent and well-documented. Give it a try by booking a demo.

FAQ

What are the main categories of supply chain metrics?

Key categories to track supply chain metrics include inventory, logistics, customer order fulfillment, and general quality. These categories refer to different stages of the supply chain.

How are supply chain metrics typically expressed?

Supply chain metrics are measured as ratios or numbers. Ratio metrics include, for example, perfect order rate, OTIF, and inventory accuracy, and are typically presented as percentages. Number metrics can be measured in days, like DIO, DSO, or DPO, or cash amounts like warehousing costs.

Why are supply chain metrics important?

Continuously tracking these metrics can reveal weaknesses of the established workflows at each step of the supply chain. By recognizing potential issues in time, stakeholders can adjust the workflows to streamline the supply chain processes and meet customer demand. That ultimately leads to higher revenue.