12 min read

Spend Aggregation 101: How to Centralize and Optimize Corporate Spend

Watch spend aggregation improve compliance, accuracy, and cost control across your organization.

You never really feel the pain until the true cost of a purchase order hits you. Depending on how manual your process is, one PO can run anywhere from $50 to over $1,000. With hundreds of thousands issued annually, and an industry average around $217 per order, the costs add up fast.

At scale, this translates to millions spent on administrative work that adds no direct value. For example, for a mid-sized enterprise issuing 250,000 POs annually, the administrative cost can total $54 million per year (250,000 × $217 = $54,250,000).

We’ve seen this a lot, especially across manufacturing, retail, and logistics firms, before they adopted Precoro. And automation alone won’t fix it. If you automate chaos, you just get faster chaos.

Aggregation fixes the math. When teams consolidate similar orders across departments and locations, they buy larger volumes from fewer suppliers, ship less often, and track fewer invoices. As a result, costs drop, approvals speed up, and procurement finally runs on reliable data instead of fragmented spreadsheets.

In the next section, we’ll unpack how spend aggregation works in practice, what it takes to implement spend aggregation, and what measurable results procurement and finance leaders can expect once it’s embedded in their process.

Read on to learn more:

What is spend aggregation?

How to calculate spend aggregation

How to implement spend aggregation

Benefits of spend aggregation

Spend aggregation challenges

Frequently asked questions about spend aggregation

What is spend aggregation?

Spend aggregation is the process of consolidating purchasing data and transactions from every department, location, and subsidiary into a single, structured view. It helps procurement and finance teams cut costs through volume purchasing, spot overlapping orders, consolidate duplicate suppliers, and strengthen compliance across all procurement workflows.

Put simply, aggregation means turning ten small invoices into one, which translates to fewer transactions, faster approvals, cleaner records.

How to calculate spend aggregation

Here is a simple way to calculate spend aggregation:

- Identify total spend across units: Gather procurement spend data across all departments, locations, and categories for a specific period. Build a complete picture of organizational spend before proceeding with aggregation.

- Clean data: Standardize supplier names, remove duplicates, and correct inconsistencies across systems. Clean data ensures that your aggregate spend reporting is accurate and reliable, allowing you to make confident decisions based on real performance, not flawed information.

- Classify spend: Categorize the cleaned data using a consistent taxonomy — by supplier, product, or service category, department, or business unit. Proper classification highlights inefficiencies and redundant suppliers across your aggregate spend, giving procurement teams the clarity they need to optimize sourcing strategies.

- Calculate the number of suppliers: Count distinct suppliers that provide similar goods or services across individual units before aggregation. Establish a baseline to measure consolidation later.

- Calculate the number of suppliers after aggregation: Count distinct suppliers again after order aggregation across units. Use this comparison to assess the reduction achieved through aggregation.

- Compare spend concentration: Measure the proportion of total spend consolidated with fewer suppliers. Evaluate how aggregation improves purchasing power, pricing, and administrative efficiency.

- Calculate aggregation ratio:

Aggregation ratio = (Aggregated spend ÷ Total spend) × 100%

Where:

- Aggregated Spend is the sum of spend consolidated under preferred suppliers or categories.

- Total Spend is the entire procurement spend considered.

Note!

A higher ratio means more spend is aggregated under fewer suppliers.

Example calculation

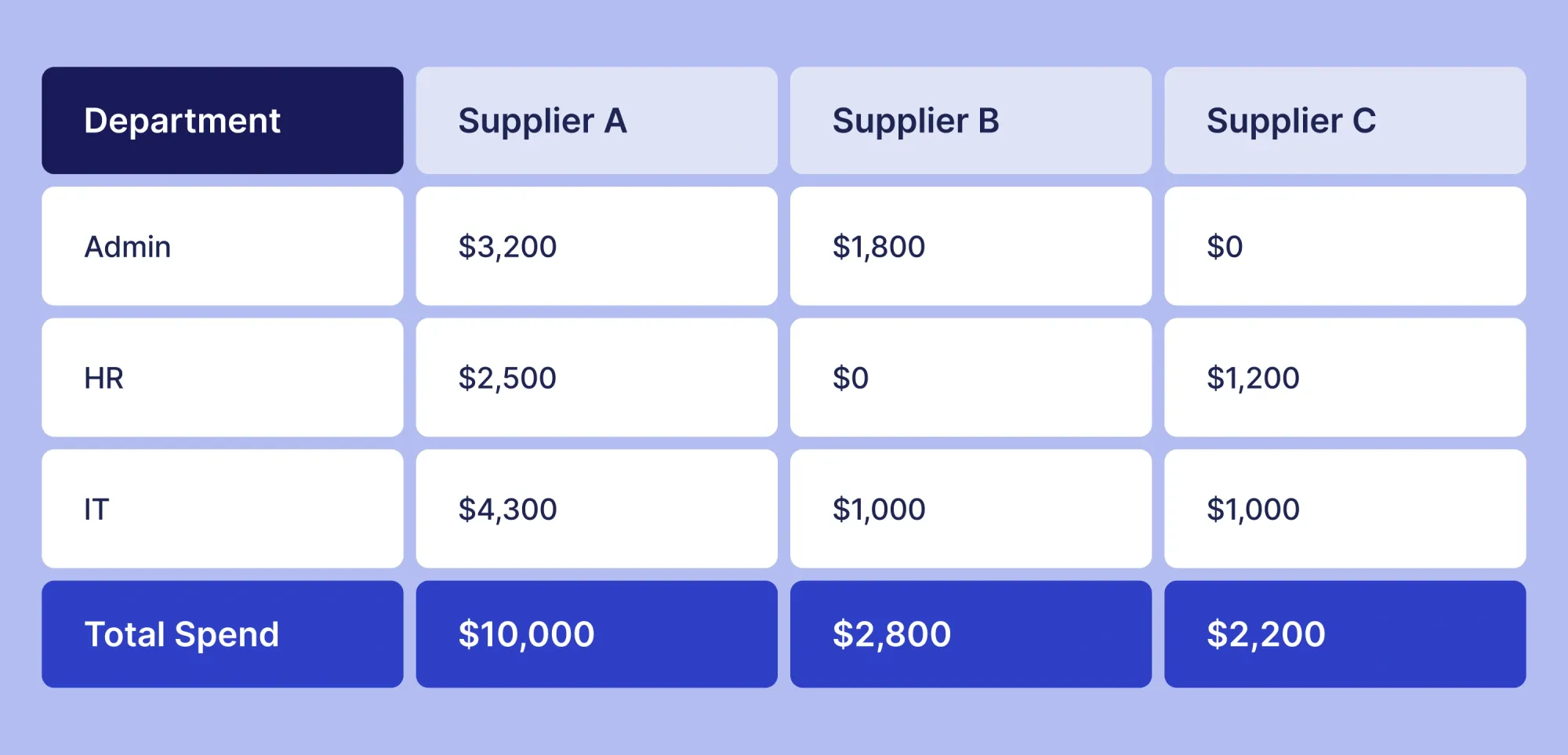

Here's a simple example of how an organization might calculate spend aggregation for office cleaning services across three departments:

Step 1: Identify total spend across units: $10,000 (Supplier A), $2,800 (Supplier B), and $2,200 (Supplier C) for a total of $15,000.

Step 2: Clean and classify data to ensure supplier names are consistent, and categorize supplier and department spend.

Step 3: Calculate distinct suppliers before aggregation — 3 suppliers.

Step 4: After aggregation, the procurement team decides to keep Suppliers A and C. Supplier C remains because it provides specialized maintenance and calibration services essential for equipment uptime, while Supplier B is phased out to consolidate spend and improve leverage with A and C.

Revised spend:

Step 5: Calculate aggregation ratio:

So if aggregated spend is $12,000 (A) + $2,200 (C) = $14,200 and total initial spend was $15,000, then the aggregation ratio is:

(14 200 ÷ 15 000) x 100 = 94, 67%

This shows strongly effective spend consolidation after supplier rationalization.

How to implement spend aggregation

1. Centralize procurement data

The foundation of spend aggregation is visibility. You can’t control what you can’t see.

When procurement data is scattered across spreadsheets, emails, and disconnected ERP modules, you lose track of what’s being bought, at what price, and by whom. That’s how overspending hides.

Centralizing this data allows you to:

- Track total aggregate spend by category, supplier, and department.

- Identify redundant purchases and noncompliant buys.

- Improve forecasting and control of working capital.

With Precoro, all purchase requests, approvals, purchase orders, and invoices live in one system. It integrates with ERPs like NetSuite, QuickBooks, and Xero, giving finance teams real-time access to consolidated spend data. This visibility turns fragmented activity into actionable insights and helps organizations understand spend aggregation meaning beyond theory — as a measurable, data-driven advantage.

2. Consolidate your supplier base

With centralized procurement data, the next logical step is to categorize and aggregate spend. This process usually highlights inefficiencies — such as departments buying the same goods from multiple vendors at varying prices. For example, a simple review of office supply purchases may uncover several duplicate supplier relationships across sites. This is a typical situation where purchases were never centralized or brought under full procurement control.

With Precoro, supplier data is unified across the organization. You can benchmark supplier performance, track order volumes, and identify overlapping vendors. Procurement teams can then consolidate purchasing with preferred suppliers, increasing leverage and ensuring a stronger aggregate purchase price that reflects true buying power.

3. Speed up communication across teams

Treat spend aggregation as a continuous, collaborative effort — not a project. Communication gaps between procurement, finance, and operations directly lead to leakage: slow approvals, noncompliant purchases, and budget drift.

Harvard Business Review research shows that companies with effective communication achieve 53% more cost savings, proving alignment drives efficiency.

With Precoro, all communication happens in context: inside the purchase request, PO, or invoice itself. Comments, approval routing, and notifications are built into the workflow, ensuring stakeholders don’t rely on separate email chains or manual follow-ups. Approvals happen faster, and accountability becomes transparent — an essential foundation for understanding spend aggregation meaning in practice.

4. Monitor supplier performance

Once aggregate spend is established, supplier relationships move from tactical to strategic assets and liabilities. Concentrated supplier bases increase exposure to disruptions, compliance failures, and ESG violations that can directly affect profitability. Mitigating this risk requires systematic supplier vetting, ongoing performance monitoring, and clear accountability across the supply base.

Aggregating spend only pays off if suppliers deliver consistently. With fewer, more strategic suppliers, performance becomes a direct financial variable.

Establish measurable KPIs, such as delivery time, product quality, and invoice accuracy, and track them against every order.

Analyze supplier performance using real-time data on order fulfillment in Precoro, pricing consistency, and approval lead time. The system flags deviations early, helping procurement teams renegotiate terms or switch vendors before performance issues turn into cost overruns.

5. Manage third-party risk

As supplier dependency increases, so does exposure. Financial instability, regulatory noncompliance, or ESG violations can disrupt operations and damage reputation.

Risk mitigation requires transparency — knowing who your suppliers are, what they deliver, and whether they meet internal and external standards.

With Precoro, every supplier record includes attached documentation, the approval status, and transaction history. Combined with approval controls and audit trails, this provides a verifiable source of truth for compliance and governance.

6. Continuously refine aggregation strategy

Markets shift. Suppliers change pricing. Teams evolve. Aggregation isn’t a one-time initiative — it’s a cycle of ongoing optimization.

Reassess your categories regularly. Reanalyze pricing trends. Revisit approval thresholds and catalogs.

In Precoro, spend dashboards and analytics allow you to slice data by department, supplier, or category. You can instantly see where consolidation or renegotiation can save money. Because configuration is no-code, finance and procurement leaders can make these adjustments without IT support. Organizations succeed when they’re proactive in implementing spend aggregation as part of an adaptable procurement strategy.

Benefits of spend aggregation

Spend aggregation brings several big advantages for organizations that want to make their procurement more efficient and cut down on costs. Here’s a quick rundown of what it offers:

Cost savings through volume discounts: When you combine spending across teams or locations, you’ve got more buying power. That means better prices, better supplier terms, and solid volume discounts. Suppliers are always more open to giving great deals when they’re working with one big buyer instead of a bunch of small ones.

Simpler procurement and logistics: Fewer suppliers and fewer orders make everything run more smoothly. Less paperwork, fewer invoices, fewer headaches. It cuts down on the admin grind and frees people up to focus on what actually moves the business forward.

Stronger supplier relationships: When you deal with a smaller number of key suppliers, you can actually build real partnerships. You get more reliability, more collaboration, and fewer last-minute surprises. It’s easier to work together, solve problems, and even innovate. Over time, this approach enhances cost aggregation by creating consistent pricing and shared planning between both sides.

Better visibility and control: Centralized data makes it easier to track spend, spot savings, and manage supplier performance. You can see where the money’s going, spot waste, stop off-contract spending, and track how suppliers are performing — all in one view. This transparency is a core benefit of effective cost aggregation systems.

More strategic procurement value: By cutting down on busywork, procurement teams get time back to focus on the bigger picture — strategy, supplier development, and ensuring everything aligns with company goals.

Operational efficiency gains: Aggregating spend reduces duplication and speeds up processes. Approvals move quicker, teams collaborate better, and everything just runs a little smoother.

Spend aggregation challenges

To centralize its spending, it sounds great on paper: more savings, better visibility, and stronger control. But in reality, it’s not always easy. There are a few common bumps along the way that almost every organization faces — subtle spend aggregation problems that slow things down before the benefits can fully shine through. Let’s walk through them.

Departmental resistance. Teams worry they’ll lose control or flexibility. The best way to fix that is to show how centralization actually helps them through faster aggregate spend reporting, easier access to data, and fewer manual steps. Once they experience the benefits firsthand, one of the biggest spend aggregation challenges quickly turns into a success story.

Data fragmentation. Information sits in a dozen places — different ERPs, spreadsheets, email chains — and no one has the full picture. The fix is integration. Without it, even the best-intentioned systems can fall victim to hidden spend aggregation problems that slow decisions and blur visibility.

That’s what happened at Electra, a fast-growing electric mobility startup. They brought in Precoro to manage procurement. Within days, everyone could finally see where the money was going. One manager said, “At my previous workplace, using SAP, it took me a year to get expenditure data. At Electra, it took five days — and with Precoro, I had it all in five minutes.”

That’s how you win people over: not with promises, but with results they can feel right away.

Low contract compliance. Most employees don’t ignore policies on purpose; it’s just that the process feels confusing or slow. Simplifying it and providing some training usually makes compliance happen naturally. Addressing such issues early helps minimize future spend aggregation challenges.

Vendor dependency. Some worry that consolidating spend means depending too much on a few vendors. The answer is to take a category-based approach — combine where it makes sense, but keep flexibility where it counts.

Frequently asked questions about spend aggregation

Automation makes processes faster and smoother — less paperwork, fewer mistakes, and quicker approvals. Aggregation, on the other hand, makes spending smarter; it combines spending or purchases to get better prices and reduce costs. You need both, but aggregation saves money directly.

You can’t analyze what you can’t see — so spend aggregation comes first, pulling all your spend information together. Spend analysis then examines that combined data to make smarter buying and budgeting decisions.

Not always. Highly specialized or low-volume purchases often benefit less from aggregation due to unique specifications and fewer suppliers. Procurement teams need to segment spend categories to identify where aggregation delivers the best ROI.

Cost aggregation is the process of adding up individual costs from different tasks, activities, or sources to determine the total cost of a project or operation. It helps create an overall budget and ensures all expenses are accounted for.

Aggregated invoicing, also known as summary or consolidated invoicing, is the process of combining multiple customer purchases or orders over a given period into a single invoice. Instead of sending separate invoices for each transaction, businesses group them to simplify and aggregate billing and payments for both parties.

Sending separate invoices for every purchase can be messy and time-consuming. When you aggregate invoices, you group multiple transactions into one. That means less paperwork, faster payments, and fewer missed invoices. It’s easier for your team to manage — and your customers appreciate the simplicity.

Wrapping up

Automation can make an inefficient process faster, but it can't fix a broken one. True spend aggregation starts with centralization. When every location, department, and business unit follows one structured process, you finally get the visibility and control you’ve been missing.

Thus, you turn scattered data into clear insights, combine demand for better buying power, and replace messy workflows with ones that are fast, consistent, and compliant. The payoff? Less manual work — and more time to focus on what really matters.

With Precoro, this all happens naturally. It just combines structure, visibility, and automation:

- Multi-location workflows keep every branch aligned under one process.

- Customizable approval routes ensure compliance without slowing operations.

- Guided intake forms standardize requests and prevent data errors.

- Built-in budgets and catalogs per team simplify purchasing and maintain control.

- Centralized vendor database and onboarding reduce supplier duplication and improve data accuracy.

- Real-time reporting and dashboards give finance and procurement a single lens on spend.

- Integrations and punchouts connect your ERP, accounting, and e-commerce systems for full transparency.

- Role-based access and cross-department collaboration maintain order while the company scales operations.

Bring your spend together, take control, and let Precoro turn every purchase into progress.