12 min read

Top 5 Accounting Systems for Nonprofits

Our list of the best nonprofit accounting software, chosen for their features, usability, and reputations.

Nonprofit organizations face unique challenges in accounting since they have to track donations in addition to invoices and payroll—and with extra focus on transparency, given the nature of the work. Cobbling these together for end-of-year reporting is especially daunting if nonprofit staff and volunteers have to create financial statements from scratch and switch between different spreadsheets to manage everything.

However, nonprofit accounting software helps organizations save time and resources while safeguarding accounting reports from errors. To help you decide on the best bookkeeping system for your organization, we’ve compiled a list of trusted solutions suitable for nonprofits of various sizes.

Keep reading to learn:

- How is nonprofit accounting unique?

- What attributes should accounting software for nonprofits have?

- 5 Best accounting software for nonprofits

- Frequently Asked Questions

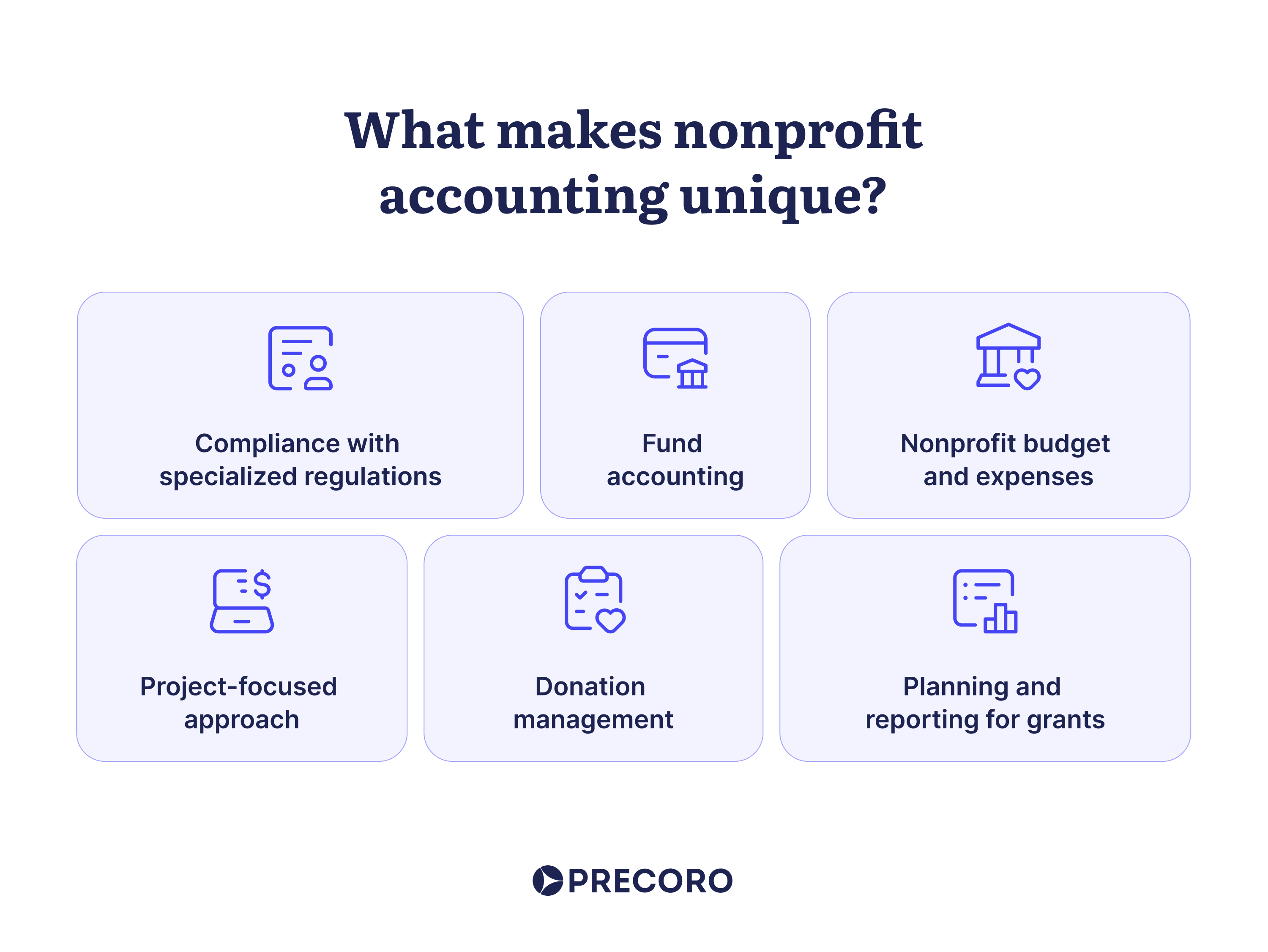

How is nonprofit accounting unique?

Nonprofit organizations have unique requirements and operate under different conditions compared to for-profit companies. These disparities are determined by:

-

Project-focused approach: While general accounting focuses on the amount of profit made, nonprofit accounting is more about expense tracking. Nonprofits exist to fulfill a specific mission or cause, such as providing social services, supporting education, or promoting environmental conservation. Therefore, they focus on accounting for specific projects to better assess the fulfillment of their programs and initiatives.

-

Fund accounting: Nonprofits have accounts held in the form of funds, which they receive from donations, grants, and membership fees. They are often designated for specific projects or programs. Thus, these funds must be tracked and reported separately with individual income statements and balance sheet reports.

-

Donation management: Nonprofit organizations must track donations, which can come from credit cards, debit cards, bank transfers, cash, or checks. Volunteers or staff members must constantly monitor bank accounts and transactions from apps like Fundly or DonorPerfect.

-

Compliance with specialized regulations: Nonprofits must adhere to specific regulatory and reporting standards, such as those set by the Financial Accounting Standards Board (FASB) and the Internal Revenue Service (IRS) for American nonprofit organizations. For example, such requirements include FAS 116 (Accounting for Contributions Received and Contributions Made) and FAS 117 (Financial Statements of Not-for-Profit Organizations) standards. Another key consideration for nonprofits is Form 990, the tax return document that tax-exempt organizations complete each year and file with the IRS.

-

Nonprofit budget and expenses: Donations and grants received by nonprofits often have specific restrictions on how they can be used. Therefore, it is crucial for nonprofits to carefully manage these restricted funds when budgeting. They need to allocate money to core programs and activities, administrative expenses (like rent and utilities), and fundraising expenses (such as marketing, events, and donor outreach). Nonprofits also need to justify any overhead spending that doesn’t directly support their mission, which means they usually have limited funds available for software solutions.

-

Planning and reporting for grants: Nonprofits must adhere to specific requirements and reporting obligations outlined by grantors when managing grant funds. Planning for specific grants involves developing a detailed proposal that outlines the project or program to be funded by the grant. This includes defining goals, objectives, activities, timelines, budgets, and expected outcomes. Nonprofits also have to ensure compliance with grant terms and conditions, including allowable expenses, reporting deadlines, and performance benchmarks. Moreover, they also have to present transparent financial reporting to donors and board members.

Higher employee turnover, lower salaries, non-tech-savvy staff, and limited resources add to the challenges many nonprofits face when advocating for the adoption of new accounting or project management technology. There's always an option to outsource accounts payable. However, when nonprofit organizations choose to manage the accounting tasks with a specialized system, they reap several key benefits:

- Complete Transparency: Donors and stakeholders expect transparency regarding fund usage. Accounting software provides detailed financial statements and reports, enhancing accountability and building trust with supporters.

- Time Savings: Streamlined and automated tasks such as bookkeeping, invoicing, and bank reconciliation save valuable hours. Additionally, using accounting software for financial statements significantly reduces the likelihood of errors.

- Improved Financial Planning: Real-time budget tracking and an overview of past expenses enable better financial planning. Nonprofits can use this data to plan their budgets and forecast future expenses more effectively.

- Cost Efficiency: Automation of routine tasks and improved accuracy reduce administrative costs, allowing nonprofits to allocate more resources toward mission-driven activities.

Let’s explore the capabilities and attributes that accounting software must have to meet nonprofit needs.

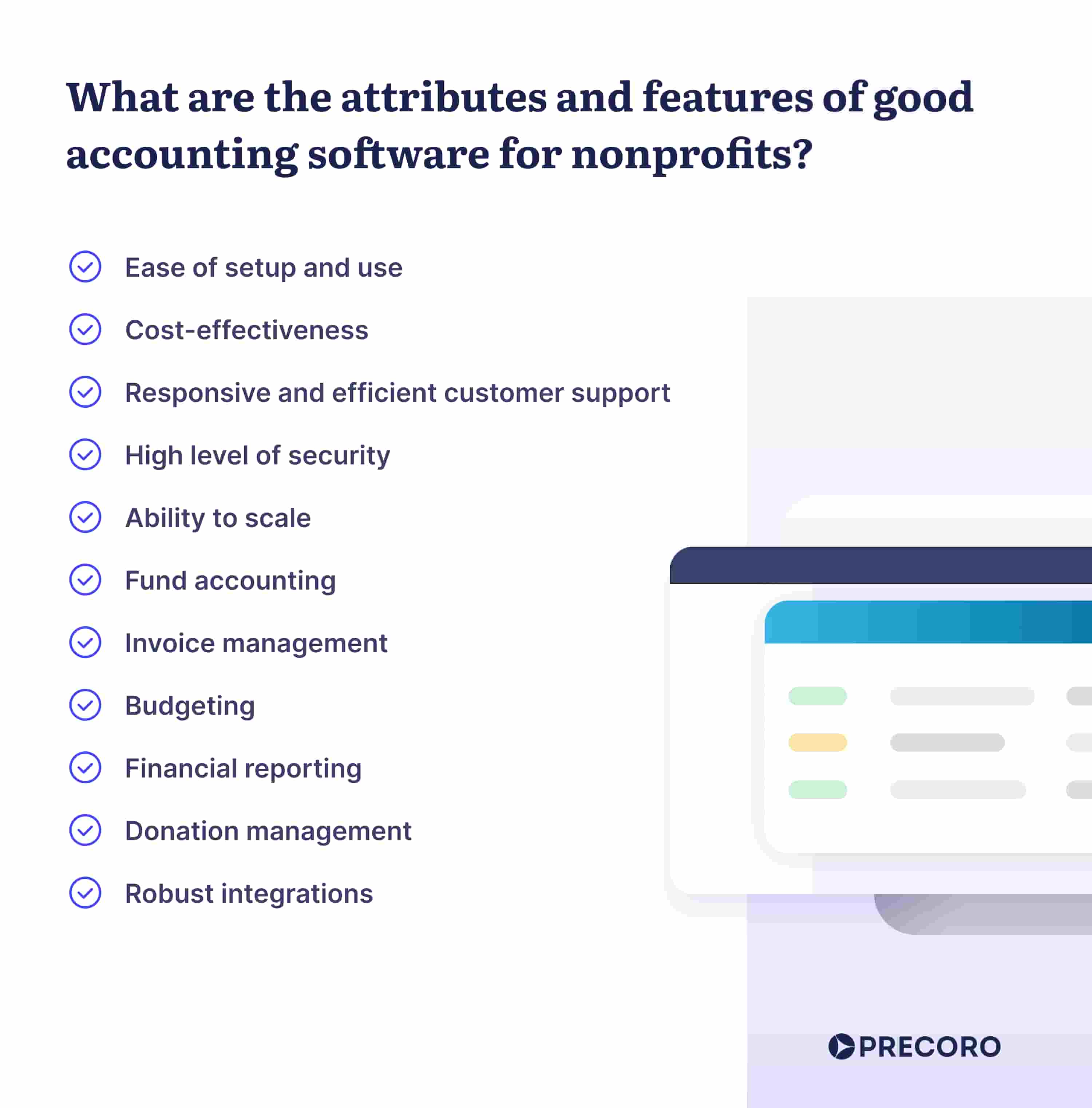

What attributes should accounting software for nonprofits have?

First and foremost, accounting software for nonprofits should be easy to set up and use. Nonprofit employees may have limited tech skills, so an intuitive interface and user-friendly functionality are crucial. The software should save time, not consume it.

Another key factor is cost-effectiveness, which is even more important to nonprofit companies than to their for-profit counterparts. Luckily, some software providers offer discounts or special rates for nonprofit organizations. It’s also important to choose a vendor that clearly outlines any additional fees or costs associated with the software.

It’s impossible to overestimate the importance of responsive and efficient customer support. To fully benefit from the system and harness all of its useful features, the nonprofit org will need the software’s customer success team on its side. They should be easily available and ready to answer any questions, tweak the system’s settings, and provide personalized training sessions.

Security is another key consideration. To protect sensitive financial information, software should conform to major regional compliance standards, such as GDPR, SOC 2, and/or CCPA. Additionally, a system should allow role-based access to control who can view and edit financial data.

One more less obvious factor to consider is the software’s ability to scale. A system may seem fine now but it’s important to think a few steps ahead. What happens when the organization hires more staff, incurs more expenses, and increases the number of donors and projects? It makes sense to select a program that comes with upgrades that will allow the organization to continue using the same software, rather than uprooting all their data and inputting it into a new program later.

As for the exact features, the needs of a nonprofit organization depend on its size and scope of work. Smaller nonprofits may not need as many bells and whistles as larger ones. However, there are some capabilities that will be extremely useful for all nonprofits.

- Fund accounting, which provides companies with complete visibility into expenses by fund or program.

- Invoice management that helps nonprofits track vendor invoices, stay on top of deadlines, and verify invoices before issuing payments.

- Budgeting with the ability to create separate budgets for different projects and track budget availability in real time.

- Financial reporting with the ability to generate clear and accurate financial statements for public disclosure, along with specialized reports for different stakeholders, such as donors and board members.

- Donation management that provides transparency into donations to each project, ideally with bank reconciliations.

- Integrations with important tools like customer relationship management (CRM) systems, payroll tools, procurement software, and donation apps.

Now let’s explore reliable and efficient accounting systems for nonprofits.

5 Best accounting software for nonprofits

Nonprofits have different needs based on the complexity of their processes, the volume of transactions, and the company’s size. We included a range of providers to ensure that both small nonprofits seeking basic functionality and global organizations requiring advanced features can find a suitable solution.

Accounts by Software 4 Nonprofits

Works best for: small businesses with basic accounting needs

The best thing about Accounts by Software 4 Nonprofits is that it’s very easy to use and can be onboarded in a matter of hours. Another perk of this accounting software is its affordability, as it's intended for nonprofits with 1-5 users logged in at a time. Accounts costs only $129-$199 per year, depending on the version. The program offers basic features necessary to manage a small nonprofit, such as:

- Fund accounting

- Budget creation and tracking

- Custom chart of accounts

- Nonprofit financial statements generation

There are two versions of the program — desktop Accounts Standard, available only on Microsoft Windows, and the OnDemand version, which also works on Macs. Each version supports five organizations/databases. There’s also a 30-day trial period available to try out the system.

Limitations

- A limited number of users can be logged in at the time.

- You need to buy a separate program for donor management

- No mobile app

Zoho Books

Works best for: small and medium-sized nonprofits

Zoho Books is online accounting software for small organizations that can be accessed from iOS, Android, or Windows devices. It offers the following features:

- Fund accounting

- Expense management

- Inventory tracking

- Invoice creation

- Report generation

Even though it’s not exclusively for nonprofits, Zoho Books has two nonprofit modules as free add-ons: Donor Management and Volunteer Portal. They allow nonprofits to keep a database of donors, send payment receipts to donors, and notify volunteers when creating events near them. It’s also possible to accept donations in different currencies, but that would require Zoho Checkout, which costs $9 per month.

Another benefit is that it offers mobile apps for Apple and Android devices, allowing users to manage accounting on the go. Medium and large companies can also use other programs from Zoho, such as Zoho Grants, Zoho Creator, Zoho Campaigns, and Zoho Social, which cater to nonprofits for grant and scholarship management, social media management, email marketing, and web development.

Companies can also try out a free 14-day trial. Zoho books is free for organizations with annual revenue under 50K USD. Additionally, Zoho Books offers registered charities, trusts, and societies a 15% discount on the original pricing.

Limitations

- There may be a steep learning curve for nonprofit staff members unfamiliar with the technology

- When it comes to integrations, there may be limitations or challenges with some third-party apps

- Limited number of users for all pricing plans

- Requires a separate subscription for receiving donations

- No Form 990 filing capabilities

Aplos

Works best for: medium-sized nonprofit groups and faith-based organizations

Aplos is a straightforward cloud-based solution for small to medium-sized nonprofits and churches. It offers three plans: Lite for $59.25/month, Core for $74.25/month, and Advanced starting at $189/month (prices are for new customers). Each plan provides:

- Fund accounting

- Custom chart of accounts

- Donation and gift tracking

- Nonprofit financial statements, donation reporting, and budget reports

- Simplified IRS Form 990 completion

- Grant funds tracking across projects

- People CRM database

- Website builder tailored for online fundraising

The Core plan also includes recurring transactions, pledge tracking, budgeting, and partner integrations. The Advanced plan adds budgeting by fund, fixed asset tracking, multi-location management, and more. Organizations can test it out with a 15-day free trial and get 10% off with an annual subscription. An additional benefit is that expert nonprofit bookkeepers at Aplos can handle an organization’s accounting and financial reports for extra pricing.

Limitations

- Lacks a mobile app

- Adding additional users requires a fee

- Doesn’t include built-in payroll (but offers an integration for that)

Intuit QuickBooks

Works best for: large or growing organizations that need advanced capabilities

Quickbooks is an accounting software package that offers versions well-suitable for nonprofits — QuickBooks Enterprise and QuickBooks Online. One of the main benefits of Quickbooks is that it combines ease of use for those new to accounting with a wide array of features for technically savvy users.

QuickBooks Enterprise Nonprofit is the advanced desktop version of the program with the following capabilities:

- Finance tracking

- Fund accounting

- Bank reconciliation

- Donor list management

- Budgeting by program

- Donor and grant reporting

- Personalized acknowledgment letters and receipts

Even though there are cheaper programs for nonprofits, QuickBooks Enterprise Nonprofit is a perfect match for organizations that need comprehensive accounting services. Smaller organizations and charities with more basic accounting needs can use QuickBooks Online, with plans that start as low as $30 per month ($9 for new users in the first three months). Additionally, upgrades to the Gold, Platinum, or Diamond plans allow nonprofit companies to pay their staff directly through QuickBooks.

What’s also great about Quickbooks Online is that staff can connect from anywhere, anytime as it’s a cloud-based software. Plus, users can manage accounting on the go with its comprehensive mobile app. As for QuickBooks Enterprise Nonprofit, it’s a locally installed software and it does not have the same flexibility—unless a company is ready to pay extra for cloud service.

QuickBooks offers discounted products for nonprofits through TechSoup, a nonprofit tech marketplace. 30-day free trials are also available for Quickbooks products. Additionally, organizations can get matched with a QuickBooks-certified bookkeeper who can help keep their books up to date.

QuickBooks Online Plus stands out with its valuable features, such as location and class tracking, which are crucial for organizing activities by the fund and projects. The advanced plan is recommended for those needing accommodation for more than five users. QuickBooks Enterprise Nonprofit caters to larger organizations, offering specialized features like donation and church management and a customized nonprofit chart of accounts.

QuickBooks integrates with many other programs, including apps commonly used by nonprofits, such as Kindful donor management software and Precoro procurement software. Nonprofits can leverage the latter to simplify procurement and manage suppliers, purchase orders, invoices, receipts, budgets, and expenses in one system. Precoro is also partnered with TechSoup and offers nonprofits a discount on all pricing plans.

Limitations

- Free trial unavailable on Enterprise

- You must pay an additional fee to get remote access on the Enterprise edition

- There are a limited number of users for each plan

- An extra fee for payroll services

- No workflow automation exists in lower-tiered plans for Quickbooks Online

Xero

Works best for: growing organizations that need in-depth and customizable financial reporting

Xero is a cloud-based accounting platform that, while not designed specifically for nonprofits, is widely used by them due to its intuitive interface and simple setup process. It provides complete customization options and robust reporting capabilities across different projects, allowing you to compare actual reports with alternative scenarios to enhance planning and strategy. Other notable features include:

- Cash management

- Donation tracking

- Rich financial reporting with customization capabilities

- Professional quote creation tools

- Multi-entity management

- Customizable chart of accounts

Xero also offers a mobile app for on-the-go access. Its strength lies in the extensive integrations with over 1,000 third-party apps. For example, it’s integrated with Infoodle, which allows, and Gusto, which streamlines staff payroll processes. Like Quickbooks Online, Xero also has integration with Precoro.

Every Xero plan includes features such as payment acceptance, reporting, file storage, contact management, and tax calculation. Pricing varies from $29/month to $62/month, depending on the selected plan. Advanced plans provide additional benefits like bulk transaction reconciliation, increased bill pay limits, analytics tools, and project tracking capabilities.

Limitations

- There are limited nonprofit-specific features

- Lower-tier plans do not have analytics or bill-tracking

- No Form 990 filing guidance

- Payroll requires an additional fee

Frequently Asked Questions

Nonprofit accounting focuses on managing donations and grants and adheres to specific reporting standards. These standards often demand detailed reports on individual projects to guarantee compliance and appropriate fund utilization. Consequently, nonprofits adopt fund accounting practices, which involve meticulously tracking and analyzing financial resources allocated for specific purposes. This ensures that funds are utilized in accordance with donor restrictions and organizational goals.

Accrual reporting is generally considered the best for nonprofits as it provides a more accurate financial picture and meets reporting requirements. This method involves recording income and expenses when they are earned or incurred, not when cash is exchanged.

GAAP (Generally Accepted Accounting Principles) is a set of standards and guidelines for financial reporting that promotes consistency and transparency in financial statements. The GAAP requirements for nonprofits include honoring donor restrictions on funding, following the revenue recognition principle, allocating expenses by function, and completing detailed financial statements.

Nonprofit accounting software is accounting software that is tailored to the financial management needs of nonprofit organizations. Such software typically includes features for donation tracking, grant and expense management, strict budget planning and generation of detailed financial reports.

There’s no one-size-fits-all solution when it comes to bookkeeping software for nonprofits. The choice of software depends on factors such as the organization’s size, volume of operations, and specific needs. Small nonprofits may find Accounts by Software 4 Nonprofits and Zoho Books suitable, while midsize companies might benefit from Aplos or Xero. For larger organizations, Intuit QuickBooks is often the preferred choice.

Choose the right software based on your needs

Implementing nonprofit bookkeeping software is an efficient and simplified way for nonprofits to manage donations, track expenses, measure financial performance, and prepare financial reports. However, to choose the right software for your nonprofit, it’s beneficial to start by answering these questions:

- Is the system easy to learn?

- How many users do you need to set up?

- How much money is available for the system?

- What specialized features will you need? (Donor management, Form 990 filing, custom reports, asset management?)

- Is there reliable customer support?

- Does it integrate with other tools in your stack?

- How secure is the system?

It’s extremely helpful to check out the customer reviews on software review sites. Additionally, before purchasing, consider requesting free trials and demos to have hands-on software experience and to assess the usability, functionality, and interface of different accounting systems for nonprofits.

It’s also wise to consider whether the software can scale with your nonprofit’s growth and evolving needs. Future requirements, such as additional users, advanced modules, or increased data volume, should be evaluated to ensure the software remains effective in the long run.