19 min read

Invoice Reconciliation: What It Is, Benefits, and How to Reconcile Invoices

Understand how invoice reconciliation works, its benefits, and the best practices to reduce errors and speed up your AP process.

When every step of humankind tends to be automated, 56% of businesses still rely on spreadsheets for reconciliation, which, no surprise, makes them prone to errors and delays. But with money on the line, you can't afford to make even the slightest of mistakes.

Invoice reconciliation prevents that. It catches issues before they hit your cash flow and answers the core question: Does this invoice match what we ordered, received, and agreed to pay?

In this guide, we’ll explore the definition of invoice reconciliation, how it works, key benefits, and challenges you need to know.

Read on to find out:

What is invoice reconciliation?

How to reconcile invoices in 8 steps

Benefits of regular invoice reconciliation

Challenges of invoice reconciliation

How Precoro can put automated invoice reconciliation into action

Take invoice reconciliation beyond routine bookkeeping with Precoro

Frequently asked questions about invoice reconciliation

What is invoice reconciliation?

Invoice reconciliation is an accounting process in which businesses compare invoices against purchase orders and delivery receipts to verify their accuracy before making payments. It helps catch errors, prevent overpayments or duplicates, and keep your financial records accurate.

How to reconcile invoices in 8 steps

Step 1: Gather and review invoices

Pull together all invoices from vendors for the specified timeframe and review them to ensure the invoice number, vendor details, and date are accurate.

Step 2: Match invoices with POs or delivery receipts

If your company uses purchase orders, check each invoice against the matching PO to make sure the billed goods or services align with what was ordered. Review the quantities, prices, and items carefully to ensure they match the PO.

If you have delivery receipts or receiving reports, use them as well to verify that the products or services were actually delivered.

Step 3: Check for discrepancies

Compare the amounts on the invoice with the agreed-upon prices and quantities. Watch for discrepancies such as quantity mismatches, calculation errors, or improper pricing.

If you struggle to reconcile the numbers, make a checklist as part of the invoice reconciliation process flow. It could include the following questions:

- Are there any additional charges, such as shipping or handling?

- Are any credits or adjustments missing?

- Has the invoice been modified during the reconciliation process?

- Is there a vendor dispute that could explain the differences between documents?

These questions will guide you through, so you can see clearly how to do invoice reconciliation when the numbers don’t line up.

Step 4: Find the mismatches and resolve them

If you find any differences between documents during invoice reconciliation, first identify the cause. Resolve internal issues, such as data entry errors or missing internal documents, on your side. If the discrepancy involves the supplier (for example, incorrect quantities, prices, or missing items), contact them to clarify and correct the invoice. Make sure all communication is documented so that any adjustments can be traced.

Step 5: Make a record in your accounting system

Once reconciliation of invoices is done and discrepancies are cleared, update your accounting system with the final numbers. Make sure accounts payable include the correct amounts, payments, and necessary adjustments.

Step 6: Secure all required approvals

Depending on your company’s procedures, you may need approval for the reconciled invoice before payment. This step often requires a manager or a finance team member to confirm that the invoice complies with internal policies.

Step 7: Proceed with the payment process

After approval, pay the reconciled invoice using your company’s standard payment method and the terms agreed with the vendor.

Step 8: Record all findings and modifications

Finally, ensure that you maintain complete documentation of the invoice reconciliation process, its supporting documents, and any adjustments. These records are important for audits, particularly during tax season.

Note!

With so many steps to manage, businesses often turn to automated invoice reconciliation tools to speed up the process and cut down on mistakes.

Example of invoice reconciliation

A medium-sized manufacturing company receives an invoice for $75,000 from its main raw materials supplier for a recent delivery of steel components.

To reconcile the invoice, the company follows these steps:

Step 1: The finance team collects the invoice, purchase order, and delivery receipt related to the order.

Step 2: They verify the invoice details, including the supplier's name, invoice date, and invoice number.

Step 3: They carefully compare invoice items, quantities, and prices to the purchase order to ensure they match — a key part of PO-based invoice reconciliation.

Step 4: Then, they check the delivery receipt to confirm the actual quantities of steel components received.

Step 5: Finally, the team discovers a discrepancy — the invoice lists 150 units, but only 140 units were received per the delivery receipt.

The finance team reaches out to the supplier, who agrees with the shortfall and sends a corrected invoice for $70,000.

The team updates the accounting records, moves the revised invoice through the normal approval steps, and processes the payment. They also document all details and conversations for audit-ready invoice reconciliation.

This way, the company pays only for what it actually receives, keeps its records accurate, and maintains a solid relationship with the supplier through clear communication.

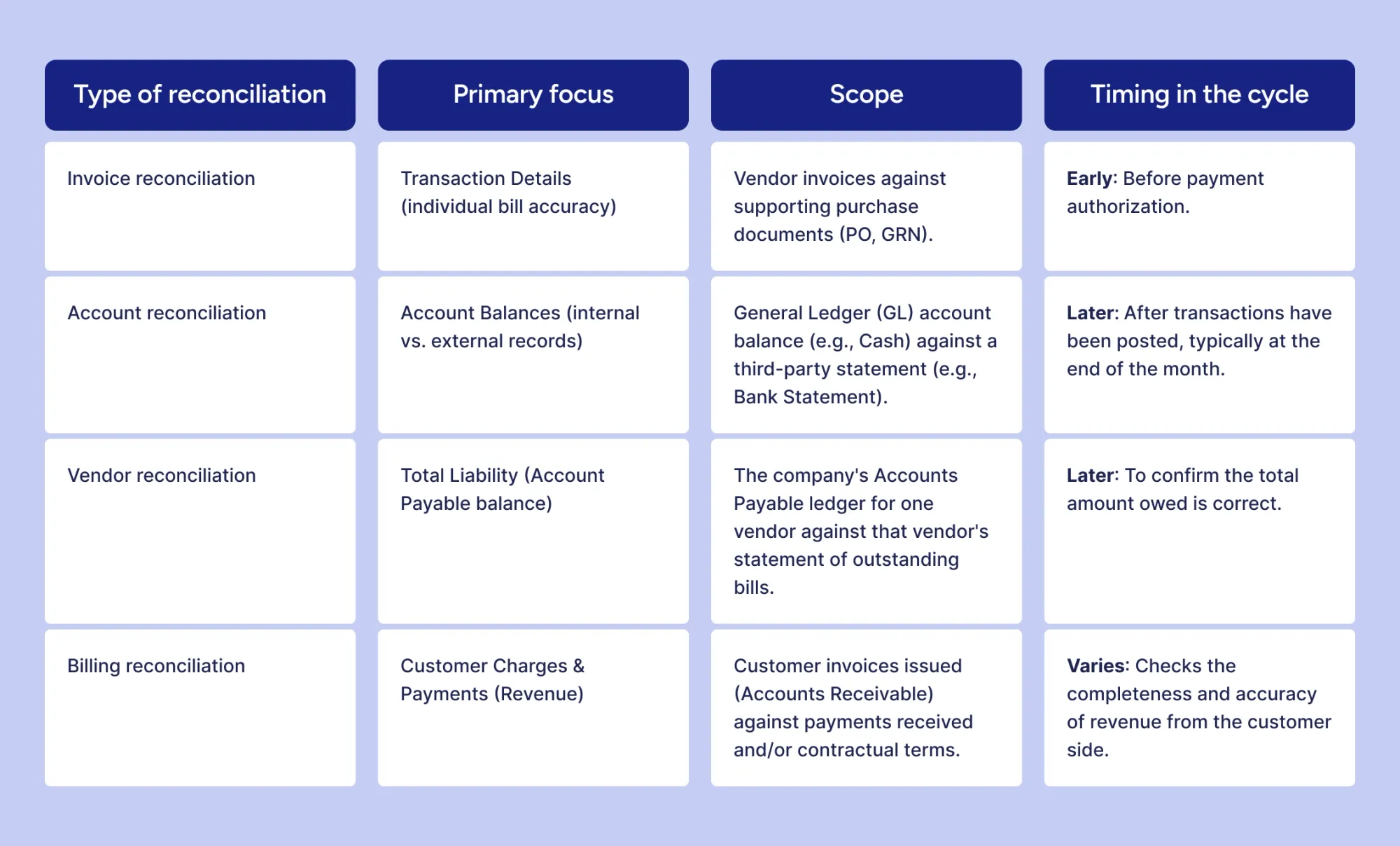

Types of reconciliation

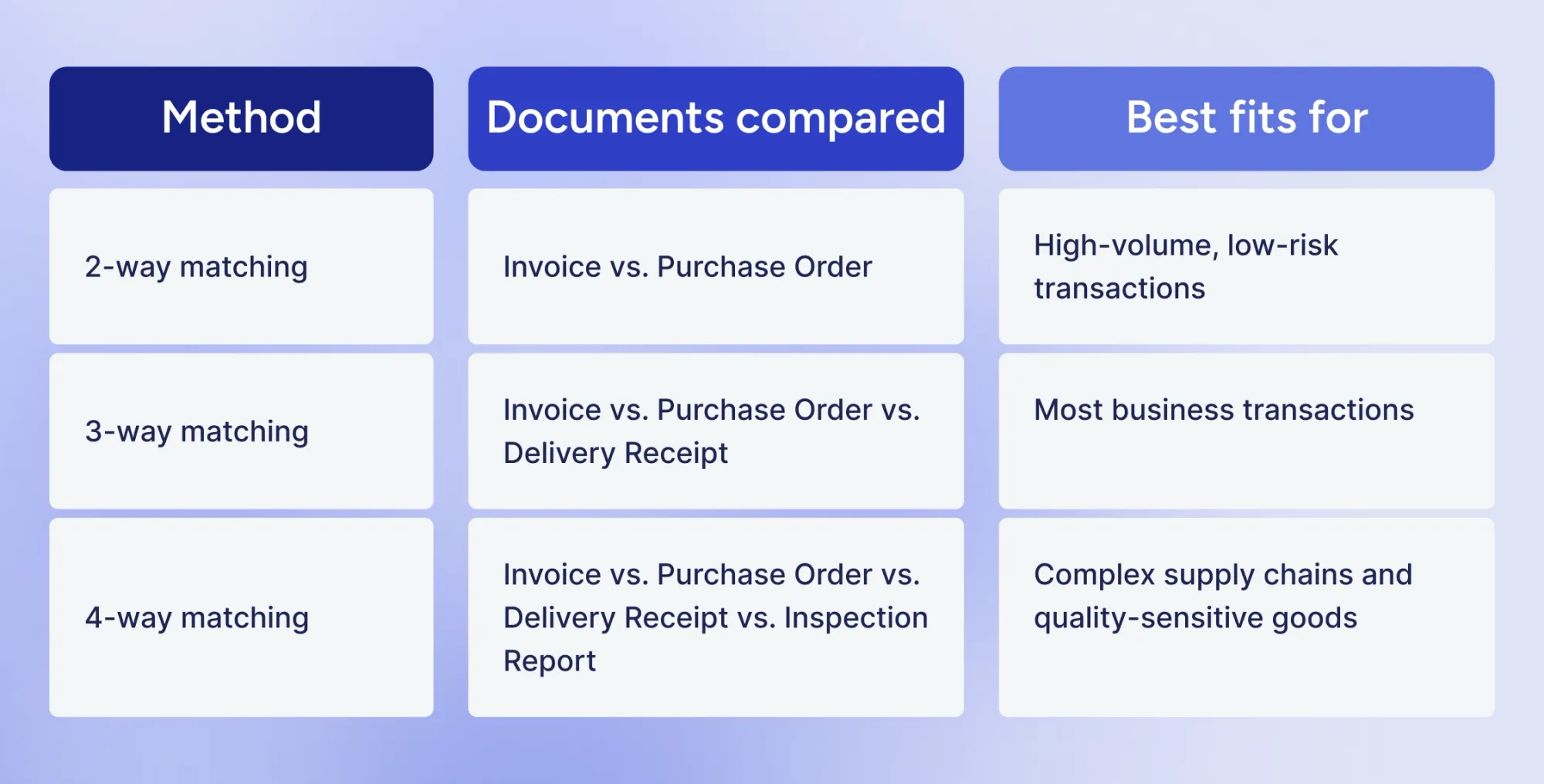

Key invoice reconciliation approaches

Invoice reconciliation acts as a financial checkpoint that verifies a vendor’s invoice is correct and valid before payment. Based on the purchase’s size or complexity, companies may use these invoice reconciliation approaches:

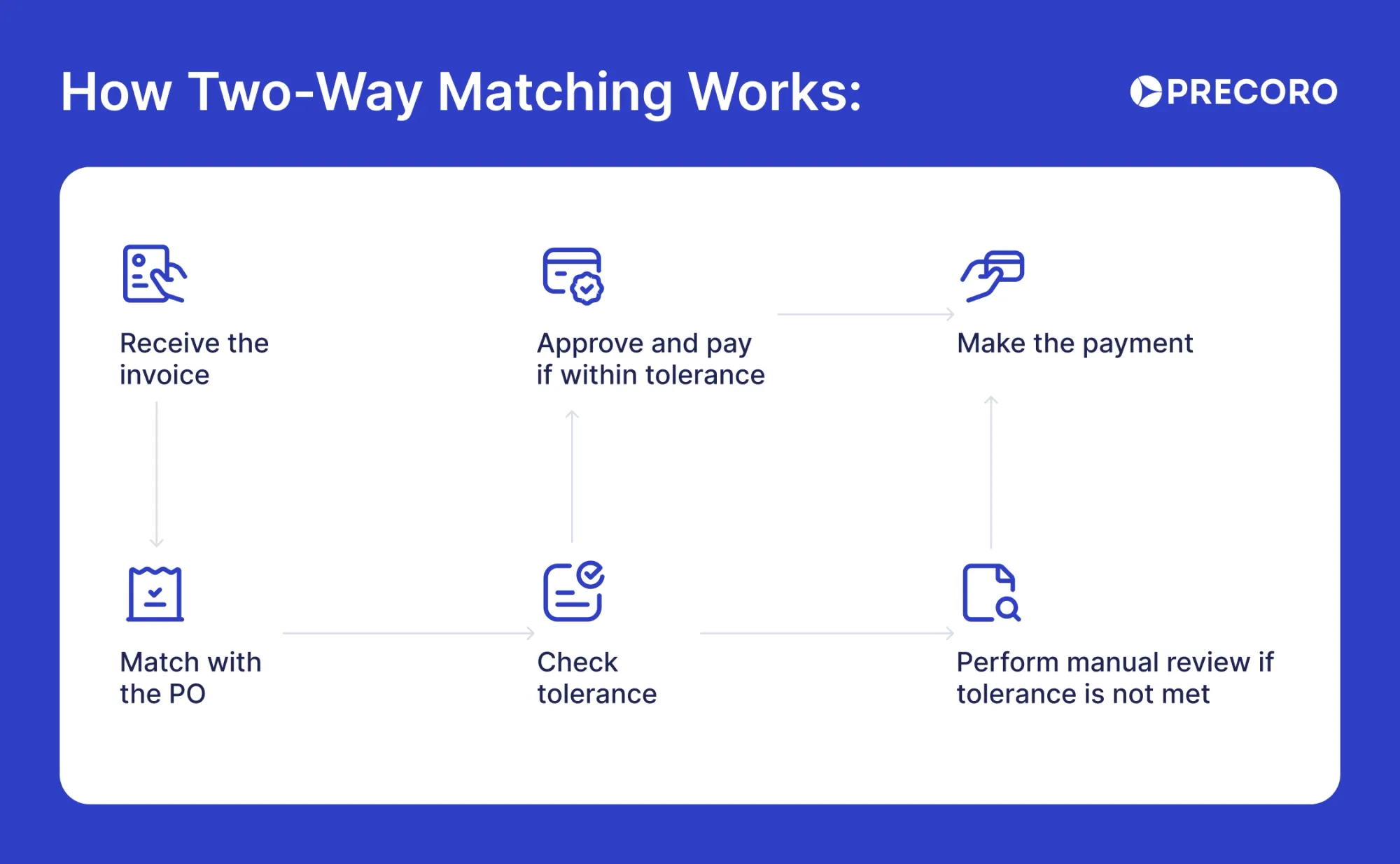

Two-way matching (PO ↔ Invoice)

It’s the simplest method of invoice reconciliation, since it’s less administratively heavy. Two-way matching is commonly used in service-based businesses for purchases that don’t involve physical goods, such as software subscriptions, cleaning, or consulting. It verifies your invoices against the purchase order to confirm that unit prices and quantities match what was agreed upon.

Quick snapshot of how 2-way matching works:

The PO is issued to the supplier (shows items, quantities, prices). —> The supplier sends an invoice. —> AP verifies that the invoice details (item, price, quantity) match the PO. —> If aligned, payment is approved.

Note!

However, it also has limitations: there is no confirmation that goods or services were actually received, which makes this method more vulnerable to overbilling, incorrect quantities, and fraudulent invoices.

Because of these risks, it’s not well-suited for inventory-related or high-value purchases.

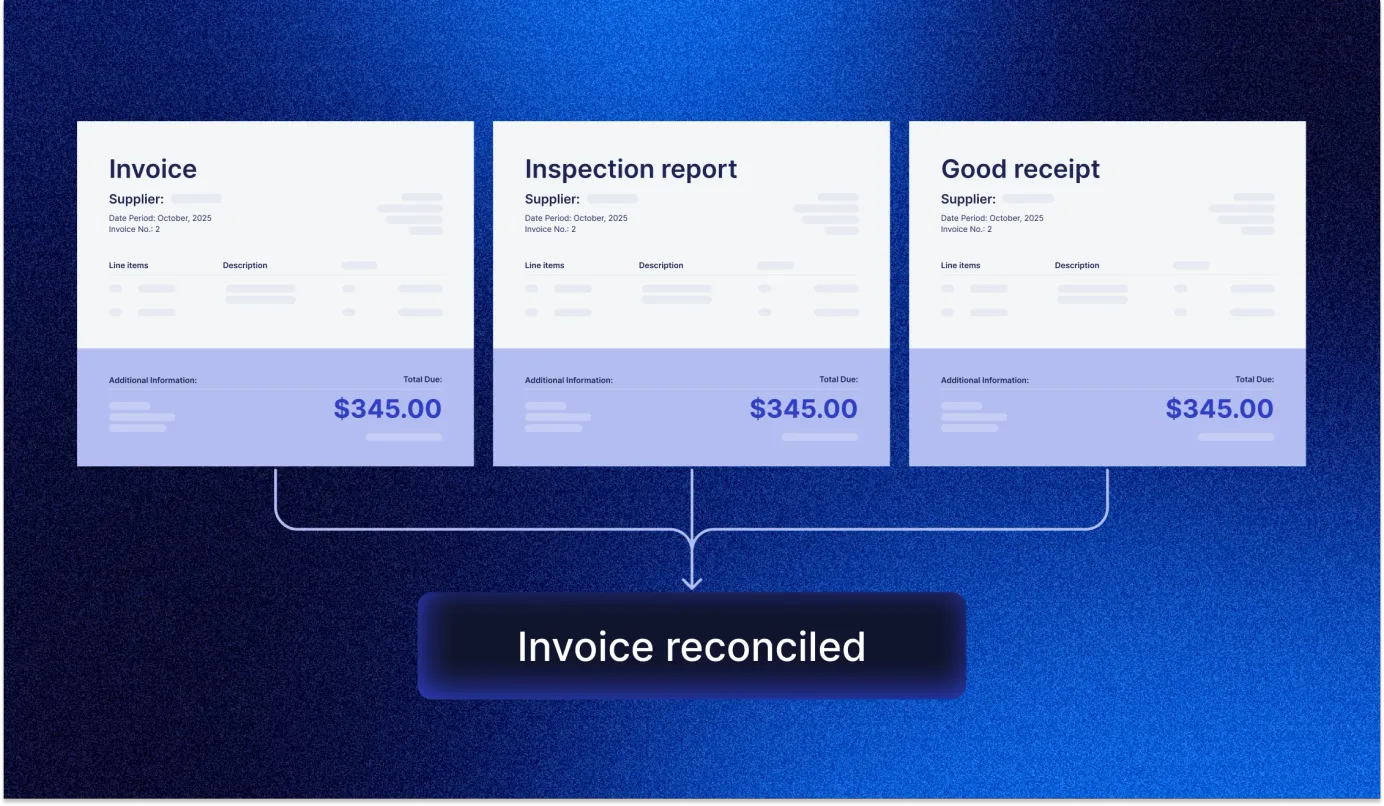

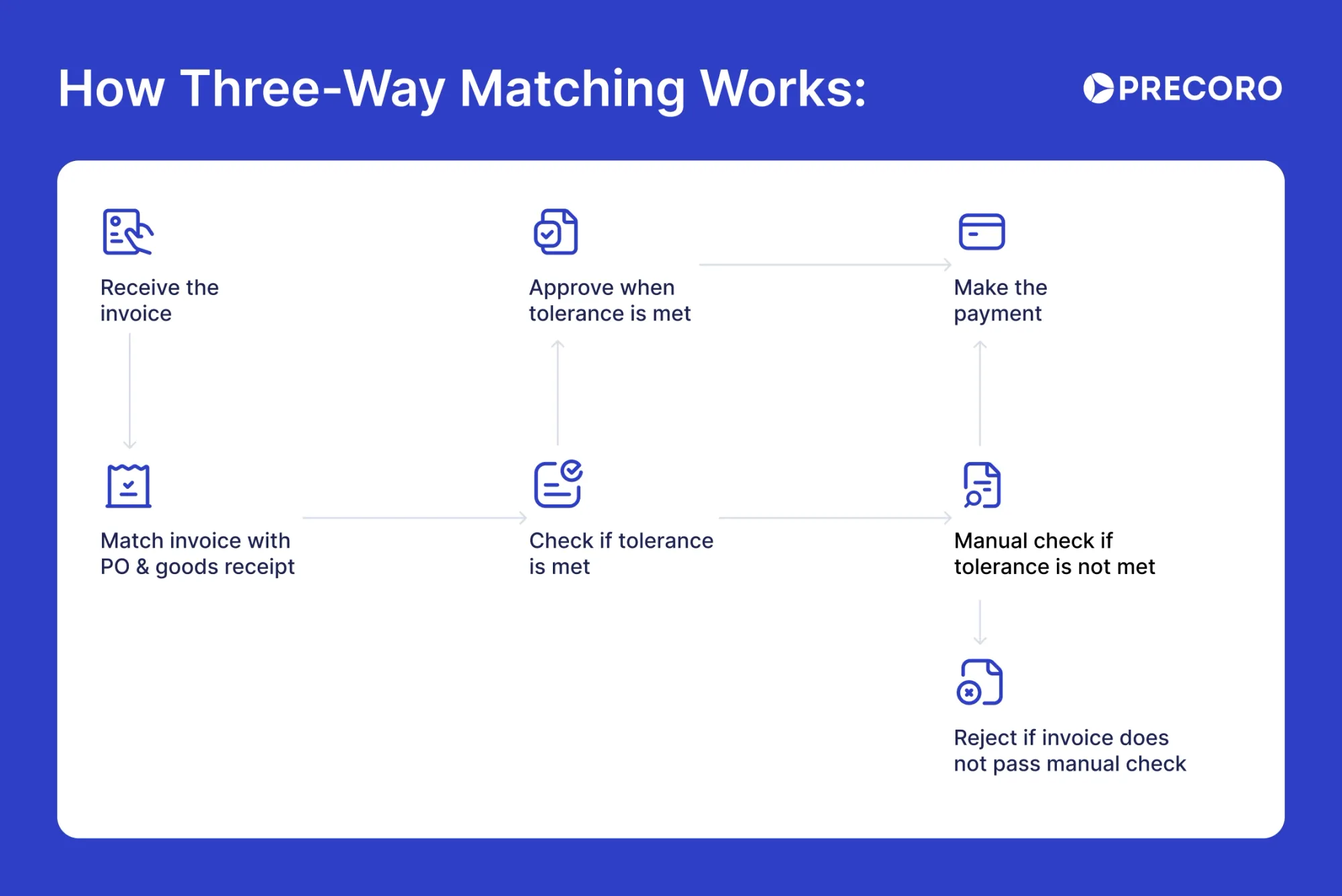

Three-way matching (PO ↔ Goods Receipt ↔ Invoice)

It’s the most common method of invoice reconciliation for retailers, wholesalers, and manufacturers in inventory-tracking environments, particularly those with medium- to high-value purchase volumes.

This method validates both what was ordered and what was physically received to reduce the risk of paying for items not received. Plus, 3-way matching provides better inventory control and the strongest protection against billing reconciliation errors and fraud.

Quick snapshot of how 3-way matching works:

A PO is created and sent to the supplier. —> Goods arrive at the warehouse/store; the receiving team prepares documents for the quantities received in a report.

—> The supplier sends an invoice. —> First, the AP checks PO vs. invoice to see whether the ordered items were billed correctly. Then, the team compares receiving report vs. invoice to determine whether the billed items were actually delivered.

Note!

3-way matching can be more time-consuming, since it requires coordination between procurement, receiving, and AP. So, without automation, it can slow down payments.

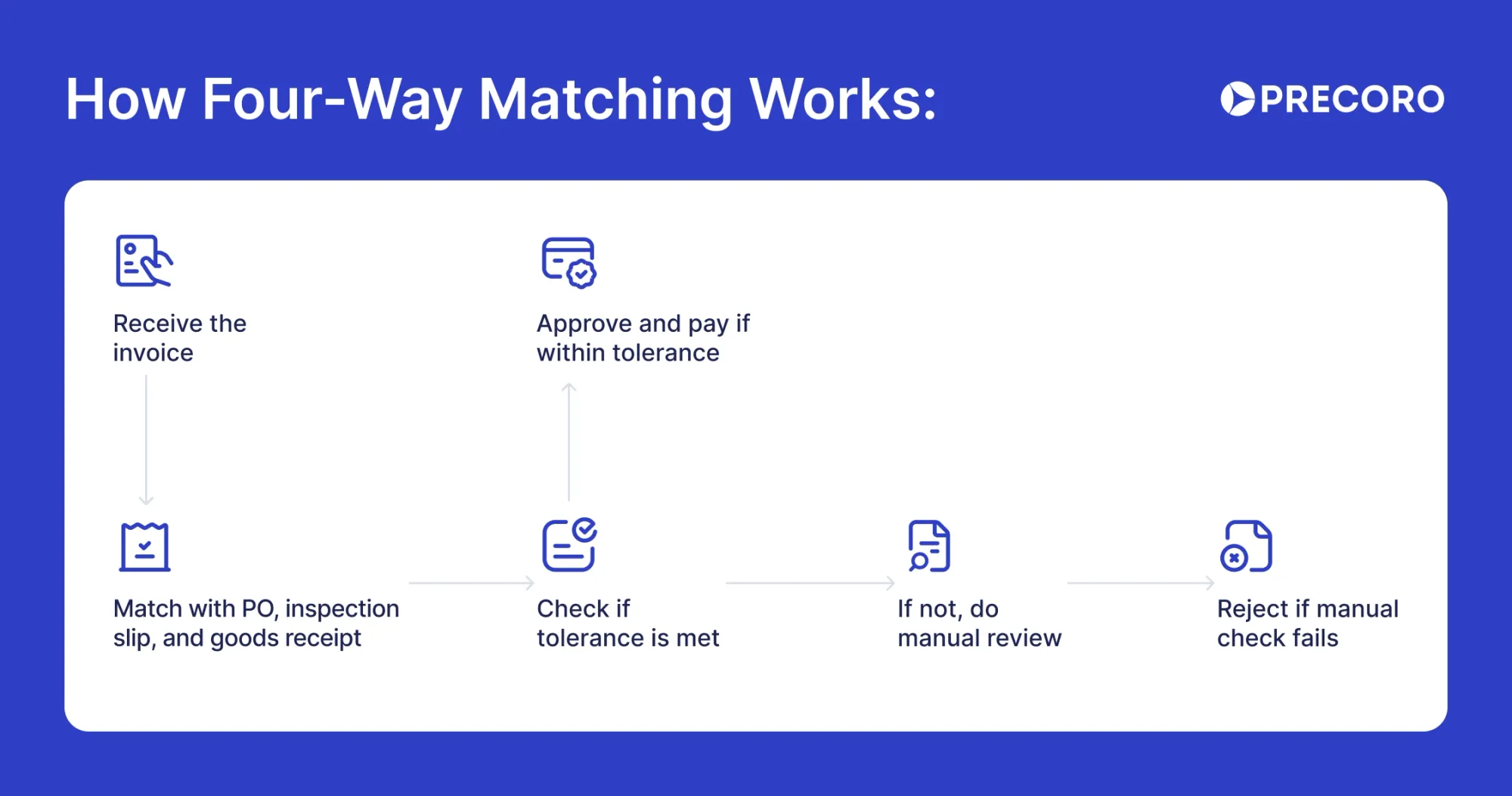

Four-way matching (PO ↔ Goods Receipt ↔ Invoice ↔ Inspection Report)

Four-way matching is the most detailed method for reconciling an invoice. Since this process involves all four documents, it’s ideal for large or unusual purchases. Examples include facility upgrades or specialized equipment in the aerospace industry, electronics manufacturing, pharmaceuticals, or food processing.

Quick snapshot of how to do invoice reconciliation in a 4-way matching approach:

Procurement issues a PO. —> Goods arrive —> Receiving team prepares a receiving report. —> Quality/inspection team performs tests and creates an inspection report confirming that all items are correct, undamaged, and meet quality specifications. —> Invoice comes from the supplier. —> AP matches all four documents before releasing payment.

Note!

Four-way matching is the most time- and resource-intensive reconciliation of invoices, especially since it requires specialized inspection or testing steps. As a result, it can delay payment without automation.

Note!

Most businesses start with manual three-way matching as their standard approach, adding automation later to handle higher transaction volumes of invoices.

Benefits of regular invoice reconciliation

Invoice reconciliation isn't a magic pill, yet many finance leaders highlight its numerous advantages, especially for financial accuracy. Here are the most common ones:

Financial accuracy and integrity

Regular reconciliation of invoices ensures that financial records are accurate and reflect true business expenses. It prevents overpayments, double payments, and pricing errors by matching invoices against purchase orders and receiving documents. Accurate records facilitate reliable budgeting, financial reporting, and audit readiness.

Cash flow management and fraud prevention

By catching discrepancies early, businesses gain better control over cash flow, make timely payments, and avoid delays or penalties. Invoice reconciliation serves as a safeguard against fraud as it helps identify and flag unauthorized or inflated invoices, thereby protecting company assets.

Strengthened vendor relationships

Timely and accurate invoice review fosters trust with suppliers, leads to smoother transactions, and strengthens negotiation power for better terms or discounts. Additionally, quick resolution of discrepancies lifts vendor satisfaction and supports long-term partnerships.

Efficiency and compliance

Automation and systematic reconciliation cut manual effort, save time, and boost the efficiency of the overall invoice reconciliation process flow. Moreover, regular reconciliations support compliance with tax and financial regulations, reduce legal risks, and ensure audit readiness, thereby aiding funding and scaling opportunities.

Challenges of invoice reconciliation

Even though reconciliation is key in accounts receivable and payable, plenty of organizations lack the resources to manage it. With business growth, minor issues snowball and turn into bigger setbacks. Watch out for:

High volumes of transactions

Large numbers of invoices can easily overwhelm manual teams, leading to backlogs and late payments that put pressure on vendor relationships.

How to fix: Use batch review periods and set rules that prioritize invoices by amount or due date. Automation can simplify routine and repetitive work, and external support can cover overflow during peak periods — especially helpful when invoice reconciliation demands spike.

Manual data entry errors

Even minor entry mistakes, when spread across documents, can lead to incorrect payments, additional work, and delays.

How to fix: Use OCR tools to capture invoice details automatically and add checks that highlight unusual or duplicate amounts. Equip staff with training on frequent error patterns to reduce repeated issues.

Mismatches of data format

Vendors often submit invoices in different formats, which disrupts automated matching and slows the entire process.

How to fix: Provide standard invoice templates during vendor onboarding and set up mapping rules for the most common variations. Intelligent document tools can automatically adjust to different layouts.

Missing POs

Some invoices arrive without matching purchase orders, which blocks standard approval steps and delays payment.

How to fix: Enforce PO requirements through procurement policies and create exception paths for urgent purchases. When needed, use contracts or other documents as alternate proof.

Gaps in system integration

When platforms don't sync as they should, staff must manually transfer data, which adds time and increases the likelihood of errors.

How to fix: Adopt reconciliation tools that link directly with your ERP and set up automated data flows between procurement and accounting systems.

How Precoro can put automated invoice reconciliation into action

With an automated procure-to-pay solution like Precoro, every reconciliation step happens the moment a purchase is made. Month-end cleanup disappears — there are no duplicate records, no mismatched data, and no time-consuming manual checks.

Below is a comparison of the five key steps in invoice reconciliation before and after automation.

1. Get organized

| Without Precoro | With Precoro |

|---|---|

| Manual reconciliation turns “getting organized” into its own project. Teams spend hours gathering invoices from different sources — paper, email, portals — and cross-checking them against transactions. They also hunt for missing documents, incorrect coding, and spreadsheet errors that accumulate over the month. | With Precoro, all documents live in one platform. Purchase orders and invoices are created in the same system, and if they don’t match, the request is automatically blocked — no approval, no payment. Precoro syncs with your accounting, ERP, and FP&A tools to keep financial data accurate without any manual effort. You can instantly filter by vendor, category, or status and track every transaction from purchase to payment. |

2. Match

| Without Precoro | With Precoro |

|---|---|

| Matching requires line-by-line comparison to confirm that each invoice aligns with internal records. Discrepancies are common and often stem from incorrect dates, miscoded payments, inconsistent bank data, or simple typos. | Precoro automatically matches invoices, purchase orders, receipts, and payments. Payment terms and vendor details are stored in one place, reducing errors and preventing mismatched payments. If documents do not align, the workflow simply stops until the issue is resolved—before money is sent. |

3. Mark off each line

| Without Precoro | With Precoro |

|---|---|

| Reviewers manually check off each matched transaction and leave the remaining entries for deeper review. | Since Precoro enforces matching during the purchasing process, only validated transactions move forward. There’s nothing left to mark off at month-end. |

4. Research discrepancies

| Without Precoro | With Precoro |

|---|---|

| Any item that doesn’t match requires additional time, outreach, and research to identify the root of the issue. | All discrepancies are clearly marked, so there's no need to guess what's wrong. Precoro stops mismatched or incomplete transactions before they move forward, but the underlying discrepancies still require follow-up with the supplier. |

5. Add up invoices

| Without Precoro | With Precoro |

|---|---|

| Teams double-check totals by vendor to confirm that paid amounts match invoice statements. Any difference leads to more reconciliation work. | Because Precoro validates documents and matches payments automatically, extra accuracy checks are no longer needed. |

Learn how to create an invoice from a PO and match it in minutes, not hours.

Compliance and documentation in invoice reconciliation

Reconciliation helps you prevent financial mistakes, but it also has to align with key tax and regulatory requirements such as GST, TDS, audit trails, and SOX.

- GST: Match sales invoices with GSTR-1 and GSTR-3B and purchase invoices with GSTR-2A/2B to avoid filing errors or losing input tax credit.

- TDS: Show the correct TDS rate and section on each invoice to prevent disputes or miscalculations.

- Audit trail: Record every issue and its resolution. These notes serve as essential proof during audits.

- SOX requirements: If your company falls under SOX, follow stricter controls such as approval hierarchies, segregation of duties, and system-generated activity logs.

This level of documentation ensures accuracy, compliance, and full transparency across your reconciliation process.

Take invoice reconciliation beyond routine bookkeeping with Precoro

You’ve seen it before: invoice reconciliation is broken at most companies, yet the lack of discipline in finance teams isn’t the reason. It’s because reconciliation happens too late. By the time an invoice arrives, upstream issues like missing approvals, off-platform purchases, or incorrect vendor data have already created mismatches that finance must sort out manually. Without standardized intake, the entire workflow — from PO creation to receiving, matching, and finally reconciliation — is filled with preventable errors.

The solution lies in standardized and guided intake. You should know who buys what, when, and for how much before the invoice arrives.

Precoro fixes reconciliation by fixing the process that leads to it:

- Standardized intake: Every purchase request enters through a single, guided flow — no more ad-hoc channels.

- Structured data from the start: Required fields, item details, budget codes, and vendor info are captured correctly upfront.

- Approved vendor and item catalogs: Requesters choose from compliant options, which means no rogue suppliers or mismatched data.

- Automated approval workflows: No more missing or delayed approvals; every request is approved before spend is committed.

- Accurate PO generation: Clean intake automatically produces correct POs and enables flawless 2- or 3-way matching.

- Real-time visibility: Finance sees commitments before invoices appear, improving forecasting and spend control.

- Only approved invoices hit the ERP: Precoro ensures clean, compliant data flows to downstream systems.

With clean intake and accurate POs, reconciliation becomes smooth and predictable rather than a month-end scramble. Precoro goes beyond speeding up the process; it prevents the problems that make reconciliation painful in the first place, giving finance teams clarity, control, and time back. Simply integrate with the tool you already use, such as QuickBooks Online, Xero, NetSuite, Microsoft Dynamics 365 Business Central, Sage Intacct, Sage 300, and Sage 50 UK. Then, watch Precoro work, time after time.

Frequently asked questions about invoice reconciliation

Companies should reconcile invoices to verify that every payment is accurate and tied to the correct goods or services. The reconciliation procedure helps prevent overpayments, duplication, and fraud. It also maintains clean and audit-ready financial records.

To reconcile invoices, first collect all relevant documents, such as invoices, purchase orders, and delivery receipts for the same period, and cross-check each transaction. Match invoice details with purchase orders and receipts to confirm quantities, prices, and terms. If any discrepancies appear, contact the supplier and correct the records accordingly. Then, update the accounting system to ensure all payments reflect accurate data. Finally, record the whole reconciliation process for audit purposes.

Invoice reconciliation ensures that a vendor’s invoice matches the purchase order and delivery receipt before payment is made. For example, if you ordered 50 units at $10 each, the invoice must also show 50 units at $10 and confirm receipt of the goods.

Account reconciliation compares internal records with external statements after transactions post. For example, you match your cash ledger with the bank statement to confirm deposits, withdrawals, and the balance at the end of the period.

In short, invoice reconciliation verifies vendor charges upfront, while account reconciliation confirms account accuracy afterward.

Billing reconciliation checks that all billing data — from contracts and CRM records to invoices and ERP revenue entries — matches across systems. Invoice reconciliation is a narrower process that verifies each invoice aligns with its corresponding purchase order, delivery receipt, and payment record.

In short, billing reconciliation ensures end-to-end billing consistency, while invoice reconciliation confirms invoice-level accuracy.

AI for data extraction, blockchain for secure verification, RPA for automated matching, and cloud platforms for real-time access are key technologies transforming the invoice reconciliation process.

Ready to cut invoice errors for good?

See how Precoro automates reconciliation from PO to payment.