11 min read

How Does Purchase Order Financing Work?

Read about the purchase order financing process, its pros and cons, and how it can help a company land big orders to grow the business.

Once in a while, a company receives a customer order that’s too large to fulfill with available inventory. Replenishing inventory immediately would require a substantial cash injection, which isn’t always an option. That’s when small business owners seek assistance with purchase order financing. Other companies that might be interested in PO financing include startups or seasonal businesses.

In this article, we'll discuss how purchase order financing works and which companies can benefit from it. We will also explore the pros and cons of PO financing, go over potential challenges associated with it, and discuss best practices.

Continue to find out more, or jump right to the section you are most interested in:

- What is purchase order financing?

- Who is involved in PO financing?

- The process of purchase order financing

- Is PO financing costly?

- Pros and cons of PO financing for your company

- Potential challenges of purchase order financing

- Best practices to make the most out of PO financing

What is Purchase Order Financing?

Purchase order financing is a form of short-term funding. It helps a business fulfill large customer orders when it doesn’t have sufficient inventory or cash in circulation or can’t afford to dip into its cash reserves. PO financing is a financial instrument for businesses that seek to fulfill large orders without straining their cash flow.

It’s a solution for small businesses that have more orders from their customers than they can complete with currently available inventory or cash. Basically, the third-party lender acts as a middleman and pays the business’s supplier for the approved goods needed to fulfill customers’ orders.

This way, the business can fulfill the customers’ orders even with limited resources available. Let’s look closer into the role of each involved party and the details of the PO financing process.

Who Is Involved in Purchase Order Financing?

There are four parties involved in the purchase order financing process:

- The borrowing company — the business that needs to borrow the money in order to complete the customer’s order.

- The customer — the party who wants to buy the goods or services from the borrowing company.

- The supplier — the company that has the necessary goods to fulfill the customer’s order.

- The financing company or the lender — the third-party company that opens the line of credit and offers to pay the supplier in return for a fee or interest from the borrowing company.

The Process of Purchase Order Financing

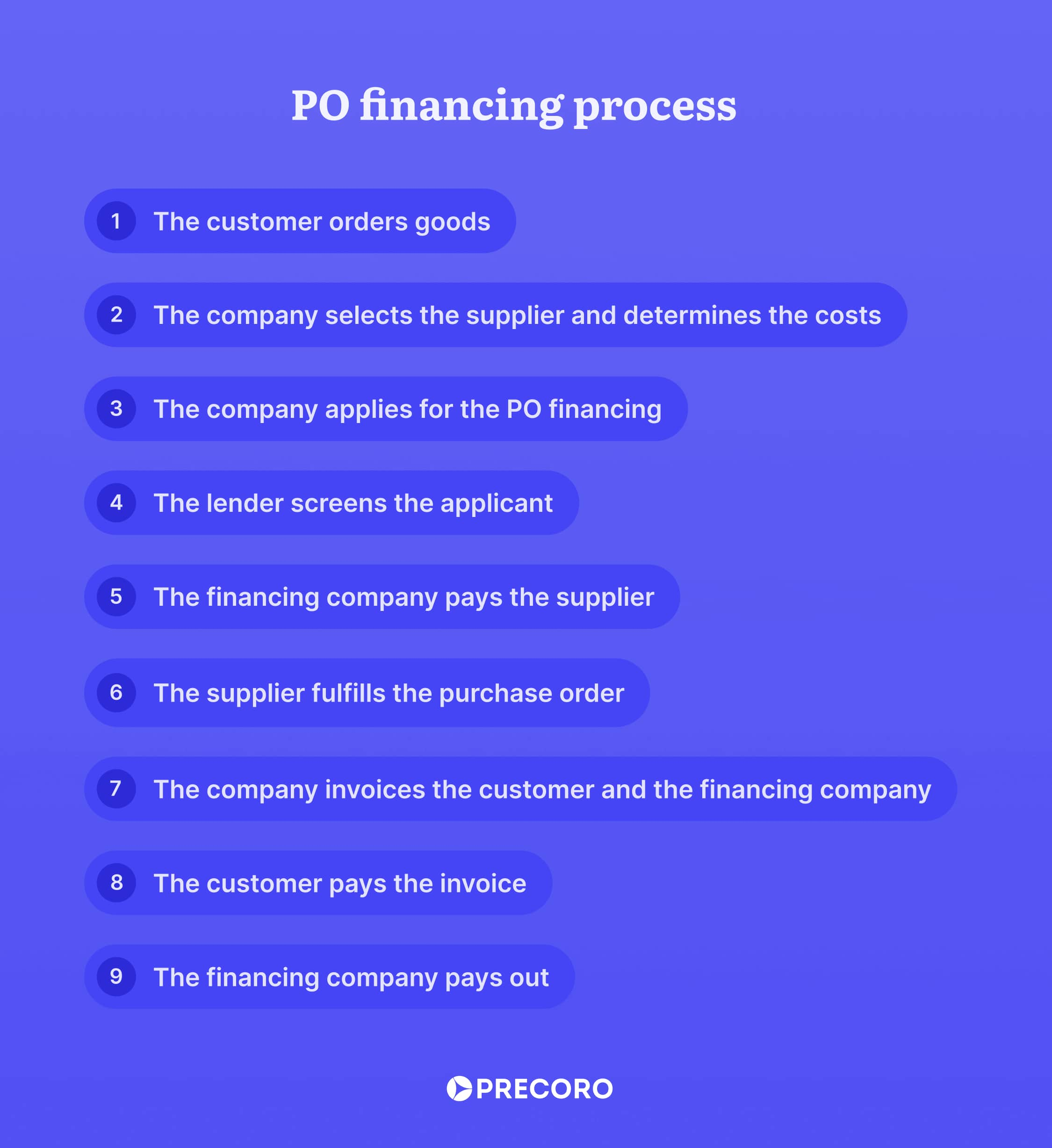

The purchase order financing process is standardized and can be applied for companies with different ownership structures or at different stages of growth. The PO financing process can be split into nine steps:

- The customer orders goods from the company. If the order is too large for the company to fulfill with available inventory or cash, it initiates the PO financing process.

- The company selects the supplier and determines the costs. The company decides what items it needs to obtain to fulfill the customer’s order. Upon comparing the suppliers’ offers, the company selects one and calculates the total cost of the purchase from the supplier. Based on the determined cost, the company decides whether it needs to apply for purchase order financing.

- The company applies for PO financing. If the costs needed to fulfill the customer’s order exceed the company’s capabilities, the company turns to a third-party lender for help with financing the purchase order.

- The lender screens the applicant. Upon receiving the company’s application, the financing company checks the backgrounds of all involved parties. It checks the qualifications of the applying company, confirms the track record and reputation of the selected supplier, and verifies the customer’s creditworthiness. Based on the screening outcome, the financing company approves the funding — either in full or only for a percentage of the requested amount.

- The financing company pays the supplier. Once the request for PO financing is approved, the lender pays the supplier. Payment doesn’t have to be in cash and can come in different forms. Financing companies often pay suppliers with a letter of credit — an official confirmation from the bank that the funds will be transferred as soon as certain steps are completed. These typically include shipping the goods or delivering services and providing proof of completion.

- The supplier fulfills the purchase order. The supplier prepares the requested goods and delivers them directly to the customer.

- The company invoices the customer and the financing partner. Once the customer receives their order, the company sends them the invoice for the ordered goods. The company also sends the invoice to the lender.

- The customer pays the invoice. The customer invoice states that the payment should be made directly to the lender, so the customer sends the payment directly to the PO financing company.

- The financing company pays out. Upon receiving the payment from the customer, the financing company deducts its fee and pays the remaining amount to the company.

Using purchase order software is the most efficient way to complete these nine steps quickly and effectively.

Is PO Financing Costly?

Lending parties typically charge a fee for PO financing; the fee can range from 1% to 6% and is calculated from the total supplier’s cost on a monthly basis, typically per 30 days. Depending on the custom agreement between the parties, these fees can be either fixed or dynamic.

If the fee is fixed (for instance 3%) then the borrowing company would pay the purchasing order financing company $3,000 from the $100,000 supplier’s PO in the first month and $6,000 if it takes the customer two months to pay for the order.

However, companies that finance purchase orders can also use a system in which the fee is fixed at a higher rate for the first 30 days, then at a lower rate until the customer pays.

While the fees might seem low when calculated monthly, their annual purchase rate can be significantly higher. Calculating the APR is important for the borrowing company to understand the total cost of PO financing and estimate its profitability.

Will PO Financing Work for Your Company? Pros and Cons

Purchase order financing can help companies that are struggling to pay their suppliers to fulfill large customer orders. Fulfilling large orders, in turn, can be an important factor contributing to business growth.

However, it’s important to realize that PO financing isn’t a universal solution for every situation. The borrowing company should evaluate each customer order to determine whether PO financing will be more profitable than just declining the order. Let’s look at some of the pros and cons of purchase order financing.

Pros

- PO financing enables companies with smaller inventory or cash reserves to take on customer orders they wouldn’t be able to accept otherwise.

- It is relatively easy to qualify for PO financing compared to a classic financial loan, especially after establishing a good relationship with the financing company.

- PO financing is available to new companies and startups that are growing rapidly but have no credit history. Unlike many traditional lenders, PO financing institutions don’t require the company to be in business for at least a year as long as the supplier and the customer are trustworthy.

- It’s a fast financing option that can be approved in days. Unlike classic bank loans which may take weeks or months of negotiations.

Cons

- Purchase order financing can be quite expensive. Even if the monthly fees — typically ranging from 1% to 6% — don’t seem too high, they can be quite discouraging when calculated into APR.

- The company has less control over the customer’s order, as the lending partner manages some of the most important steps of ordering: paying the supplier and collecting the payment from the customer. This poses a risk of the whole process not being managed in compliance with the company policy and standards.

- There is less predictability in the total cost of the purchase order. The amount that the lender deducts in fees depends on how fast the customer pays. Therefore, the total cost of the PO and ultimate profit depend on the customer’s creditworthiness.

- PO financing can impact the company’s reputation. The customer knows they are paying the third-party lender, not the company they ordered from. This may cause the customers to consider that the company has cash flow problems and doubt the business stability.

Potential Challenges of Purchase Order Financing

Purchase order financing can be a lifeline for businesses facing cash flow constraints. When cash is limited, minimizing risks of financial losses or process inefficiencies is especially crucial. Therefore, it's important to understand and anticipate potential challenges associated with PO financing. Let’s go over the key ones.

Qualification Requirements

When considering a PO financing applicant, the lenders assess the creditworthiness of both the buying company and the selling supplier, as well as the transaction characteristics. For instance, financing companies might require that the products in the purchase order are intended for resale or further distribution, not for manufacturing another product or providing a service to the customer. The PO should also meet several thresholds — such as total value (typically starting from $50,000) and gross profit margin (starting from 15%). The financing company might also require the customer’s order to be non-cancelable.

Businesses with limited credit history should also be aware that they might not meet the lender’s criteria. Purchase order financing is usually not available for the first sale of the company. A transactional track record is important to prove that the borrowing company has an established supply chain and delivery channels. It’s also important to evaluate the selected suppliers and ensure they qualify for the PO financing.

Transaction Complexity

Since PO financing transactions involve several parties, managing relationships between all of them and ensuring compliance with every agreement along the way can be quite challenging. And it can be particularly difficult for businesses with little or no experience in supply chain management.

Complex transactions can be especially precarious if done manually, as there’s a risk of human errors and significant delays in processing documents and payments. Companies that implement procurement automation tools like Precoro to process purchase orders face little to no risk of losing track of the transaction.

Best Practices to Make the Most Out of PO Financing

To effectively navigate the challenges associated with purchase order financing, businesses can implement specific practices tailored to their needs, sizes, and capabilities. Businesses should design workflows that take into account specific company-related factors such as the number of employees, customers, and suppliers, as well as organizational structure and process automation capabilities.

Evaluate Supplier Relationships

When applying for purchase order financing, companies should choose suppliers carefully and assess their reliability, capacity, and ability to fulfill orders on time and in full. Strong supplier relationships are crucial for successful PO financing.

Dedicated procurement software can be an irreplaceable tool both for evaluating the suppliers’ trustworthiness and ensuring these business relationships grow stronger. Precoro, for instance, offers a centralized database of current purchase orders and provides a complete history of all POs completed with any given supplier. In addition to this, when daily processes are automated, it’s easier to distinguish potential issues that stem from misunderstandings or contract breaches.

Negotiate Favorable Terms

Before committing to purchase order financing, companies must ensure they fully understand the costs and terms associated with the financing arrangement. This includes fees, interest rates, repayment terms, and any other conditions that may impact the overall cost of financing.

Companies can negotiate favorable terms with lenders and suppliers that align with their business needs and financial objectives. Such negotiations can result, for example, in lower fees or interest rates from lenders, better pricing offers from suppliers, and extending payment periods.

Larger Orders with Less Cash

Purchase order financing can be a valuable tool for businesses seeking to fulfill large orders even when they don’t have sufficient inventory or enough cash in circulation. By utilizing this option of purchase order funding, companies can ensure they seize opportunities of large orders and grow their operations rapidly.

However, it's essential to evaluate all the pros and cons of the financing arrangement before committing to it. Borrowing companies need to understand the costs and terms of the financing and negotiating favorable terms with all involved parties. This way, they can leverage purchase order financing effectively to support their growth and success in the competitive markets.

FAQs

Purchase order financing is a form of short-term funding that companies can use to fulfill large customer orders. It’s a solution for small businesses that have more orders from their customers than they can complete with currently available inventory or cash. In PO financing, a third-party financing company helps to pay for the goods needed to fulfill a customer’s order.

A company that wants funding for a PO can turn to a third-party financing company, also known as a lender. Alender acts as a middleman and pays the company’s supplier instead of the company itself. The lender then receives payment from the customer, deducts its fee, and transfers the rest of the money to the borrowing company.

Purchase order financing helps companies land orders they can’t accept otherwise due to inventory or cash limitations. It’s relatively easy to qualify for PO financing, and this financing option can be approved in days. At the same time, PO financing is quite expensive, especially when considering the APR of lenders’ fees. In addition to this, with PO financing, companies lose some control over the ordering process and risk a negative impact on the business’s reputation.

Depending on when exactly and at which step of the business operations a company needs financing, there are several possible financing options to consider. These might be, for example, PO financing, invoice financing or factoring, asset-based lending, business lines of credit, traditional term loans, or loans from non-bank lenders.

Curious about Precoro? Let's chat!