14 min read

Accounts Payable Ledger: Meaning, Examples, and Tips to Manage

Learn what an accounts payable ledger is, see practical examples, and discover expert tips to manage it efficiently for better financial control.

No one talks about the AP ledger—until it’s wrong. Then the month-end turns into a multi-day fire drill. Spreadsheets confuse everyone, blame bounces between teams, and leadership questions every number on the report.

Actually, no wonder. Since 86% of small and medium businesses manually enter invoice data, errors and delays are prone to happen. Manual approvals make the process even slower: they take 8 to 15 days and cost about $15 per invoice.

But it doesn’t have to be this way. In this article, you’ll learn what an AP ledger is in a nutshell, its benefits, and tips to manage it effectively with the help of automation and centralization.

Find out more about:

What is an accounts payable ledger?

When accounts payable ledgers are used

Examples of accounts payable ledger

Key components of an accounts payable ledger

How to manage accounts payable ledger effectively

Advantages of the accounts payable ledger

Accounts payable ledger challenges and tips to overcome them

Frequently asked questions about accounts payable ledger

From spreadsheets to Precoro: The AP ledger upgrade you need

What is an accounts payable ledger?

An accounts payable (AP) ledger, also called a creditor’s ledger, is a detailed financial record of all unpaid debts a business owes to its suppliers. For example, a $5,000 office supply purchase made on credit is recorded here until the invoice is paid.

This ledger is part of the general ledger and focuses on short-term liabilities. It lists transactions chronologically with vendor names, invoice numbers, due dates, amounts owed, and payment statuses. An AP ledger helps businesses manage cash flow, schedule timely payments, and maintain accurate financial records.

When accounts payable ledgers are used

The AP ledger is updated whenever there’s an accounts payable transaction. Entries are usually made by an AP clerk, a bookkeeper, or an automated system.

Common entries:

- Purchases from vendors

- Payments to vendors

Less common entries:

- Error corrections.

- Returns (refunds for returned items).

- Price corrections (invoice pricing changes).

- Early payment discounts.

- Late payment penalties.

Examples of accounts payable ledger

Scenario 1. Basic AP ledger.

MediCare Clinic purchases medical supplies and services from three different vendors: Vendor A, Vendor B, and Vendor C. Each vendor sends invoices with varying amounts and payment due dates. To manage these transactions, MediCare maintains an accounts payable ledger.

MediCare Clinic keeps a detailed record of all bills, including the date, vendor, invoice number, description of the purchase, the amount, payment status, and due dates. This table helps them easily see which bills from Vendor A and Vendor B still need to be paid and that Vendor C has already been paid on time. This accounts payable ledger example shows how organized tracking helps the clinic avoid late payments, manage cash flow efficiently, and maintain strong, reliable vendor relationships.

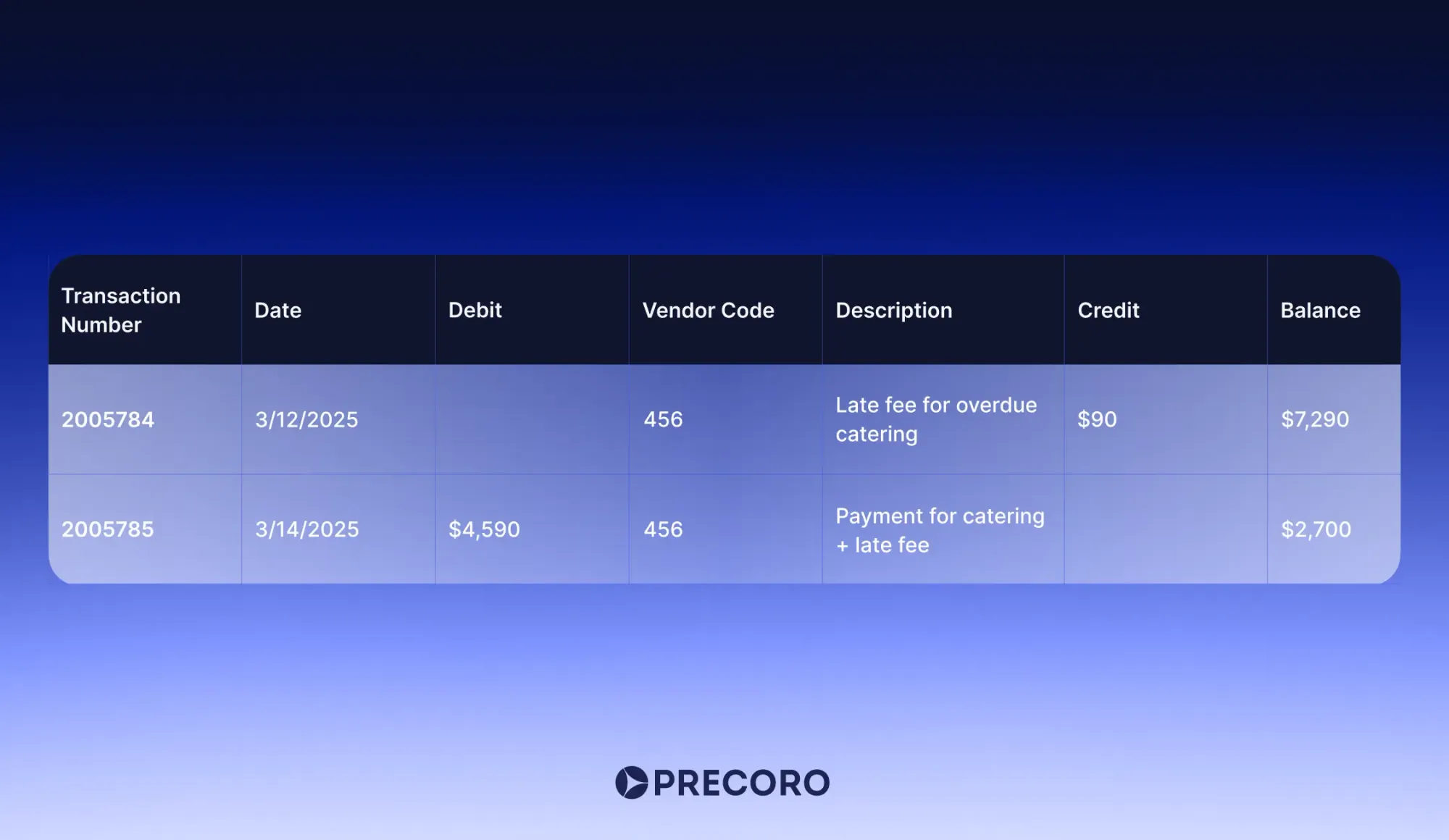

Scenario 2. Late payment penalty.

On January 5, 2025, you booked catering services with a payment deadline of February 5, 2025. However, as of March 10, 2025, the $4,500 invoice remained unpaid. Per the contract terms, a $90 late fee applies to payments overdue by more than 30 days. On March 12, 2025, you received an additional invoice for this late fee.

Two days later, on March 14, 2025, you settled both the original $4,500 invoice and the $90 late fee, making a total payment of $4,590.

The AP ledger would record:

- Increase accounts payable by $90 for the late fee on 3/12/2025.

- Record a $4,590 payment (covering the $4,500 catering invoice plus the $90 late fee) on 3/14/2025.

In this accounts payable ledger example, each entry not only records the invoice details like date, vendor, and amount but also tracks any additional charges and applies payments, reducing the outstanding balance accordingly.

Key components of an accounts payable ledger

Similar to the general ledger, an accounts payable ledger is structured as a table where rows record transactions and columns capture related data.

- Date: When the invoice was issued or the payment was made (e.g., 06/10/2022, 02/01/2025)

- Invoice number: A special code for each bill (e.g., AW35, T-104)

- Supplier or vendor name/code: The name or code of the creditor (e.g., Metalwork Supply Co.; Vendor Code 124)

- Transaction description: Details about what you bought or paid for (e.g., Resupply of Product X; Purchase of office supplies)

- Credit (invoice amount): How much the payable increases when goods or services are received (e.g., $25,000, $500)

- Debit (payment amount): How much the payable decreases when you pay (e.g., $5,000, $500)

- Balance due: Running total of what remains payable after each transaction (e.g., $17,000, $1,500)

- Due date: When payment is expected (e.g., 06/30/2022, 07/31/2022)

For deeper reporting, you can also add:

- Transaction number: A unique code for each deal or payment (e.g., 1004512, 1004556).

- Sub-account name and number: Labels and codes for splitting AP into smaller categories (e.g., "Office Supplies AP," account no. 201-01).

- Reference code: A code that sorts transactions by team, office, or project. Typically used for detailed internal reporting (e.g., "HR Dept," "NY Office," or project code "PRJ-2025").

How to manage accounts payable ledger effectively

First off, go digital and automate where you can. Manual invoice processing is a headache—think stacks of paper, lost receipts, and typos that mess up your books. Use tools like QuickBooks, Precoro, or Bill.com to scan invoices, pull data with OCR tech, and sync financial records seamlessly.

Automation cuts errors by a ton and lets you see what you owe in real time. It’s like having a super-organized assistant who never sleeps. This also ensures that your general ledger accounts payable stays accurate, because the right data flows in automatically.

Next, keep your ledger centralized. Having one place for all your AP data—vendor details, invoices, payment statuses—makes life so much easier. Cloud-based platforms are great for this because you can access them anywhere, and they serve as a single source of truth. No more hunting through emails or spreadsheets to figure out if you paid that supplier.

Just make sure you’ve got consistent naming or coding for invoices, like by vendor or expense type, so nothing gets lost in the shuffle. If you’re unsure how this structure works in practice, the accounts payable ledger definition is basically a detailed record of every outstanding bill, payment, and vendor transaction tied to your AP function.

Tap into approval workflows. Set clear rules on who reviews and okays invoices—maybe department heads sign off, then finance cuts the check. AP software can automate this, routing invoices to the right people and flagging anything overdue. It’s like putting guardrails on your process to stop rogue payments or delays that annoy vendors. With well-designed workflows, your general ledger accounts payable will reflect up-to-date, authorized transactions every time.

Don’t sleep on negotiating with vendors. Chat with them to get payment terms that fit your cash flow, like stretching net 30 to net 60 if you need breathing room. Also, look for early payment discounts—some vendors offer 2% off if you pay within 10 days. That adds up fast. Building such rapport means they’re more likely to work with you if cash gets tight. And remember, per the accounts payable ledger definition, every discount, adjustment, and partial payment still needs to be recorded clearly so your balances stay correct.

Reconcile your accounts payable general ledger regularly—ideally weekly—to catch double payments or missed invoices before they become big problems. Most AP tools offer dashboards that clearly show what’s due, when, and how it impacts your cash flow. Staying on top of invoices and payments keeps your books clean and your stress levels low.

Finally, tap into analytics. Look for patterns, such as vendors you’re always paying late or similar goods that you order from different suppliers. Use that to negotiate better deals or switch suppliers. Some tools even predict cash flow crunches so that you can plan payments like a chess master, not a firefighter.

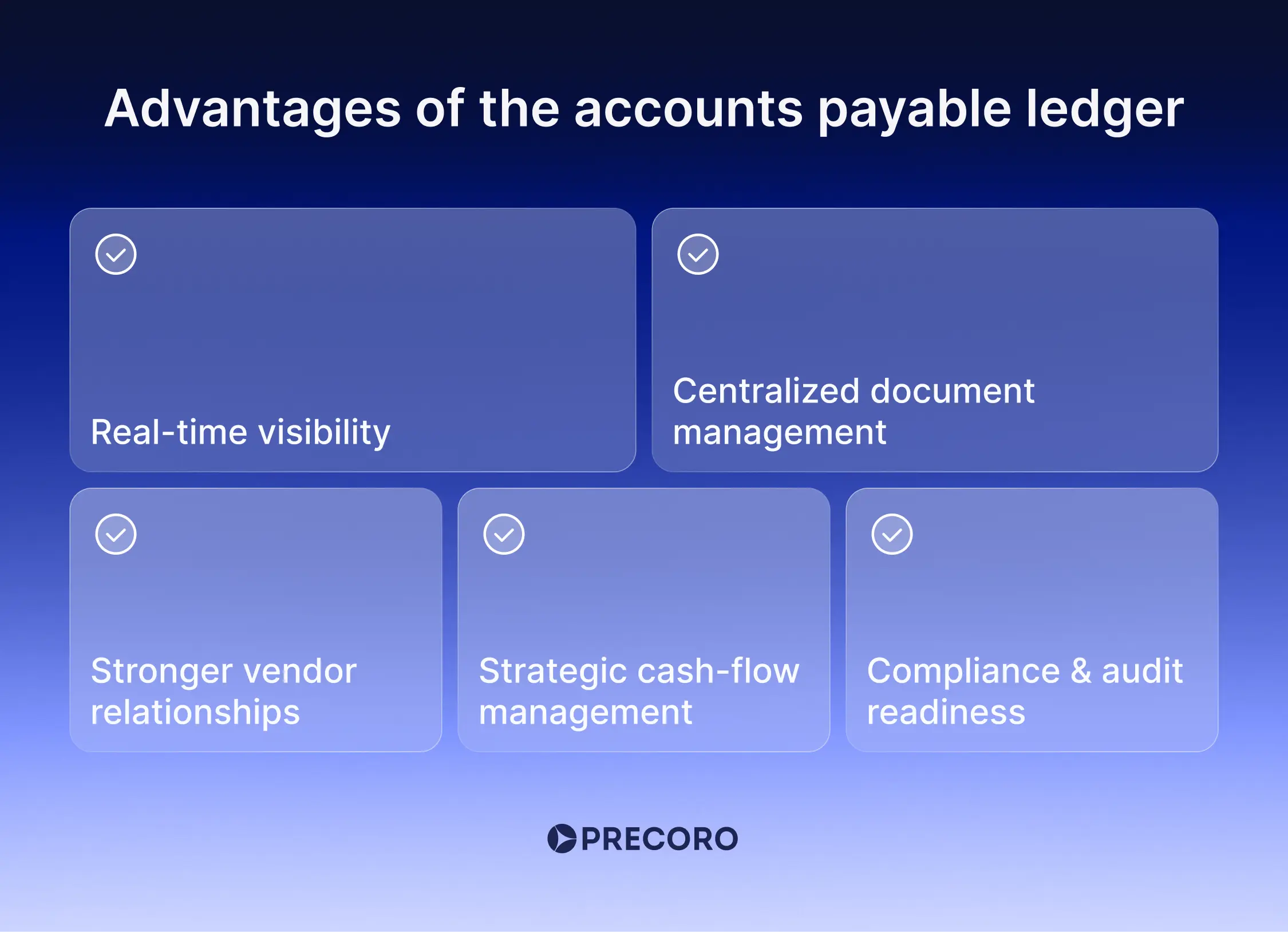

Advantages of the accounts payable ledger

Here’s what you gain from using an accounts payable ledger.

Real-time visibility

Your AP ledger should give you a live feed of what’s owed, to whom, and when. No more scrambling for missing invoices or wondering if you’ve got enough cash for next week. In Precoro, customizable dashboards and on-demand aging reports update the moment an invoice clears each approval step. You get instant clarity on upcoming cash needs and vendor balances.

Compliance & audit readiness

An audit-proof ledger means no more late-night searches for missing invoices or panicked compliance checks. You stay compliant with tax laws and internal policies without breaking a sweat. In Precoro, there are end-to-end procurement audit trails with timestamps, role-based approvals, and secure, digital document storage—so you can pull every invoice and track each approval in seconds.

Stronger vendor relationships

Nothing builds trust faster than paying on time and staying on the same page. A transparent accounts payable general ledger gives you the confidence to negotiate better terms and avoid awkward disputes. Precoro’s Supplier Portal lets vendors submit invoices, track their statuses, and chat directly with your team. Everyone knows exactly where they stand.

Strategic cash-flow management

Your AP ledger isn’t just a record—it’s a forecasting tool. Knowing upcoming payables lets you optimize payment timing, maximize early-pay discounts, and smooth out cash-flow swings. Precoro’s built-in spend analytics, budget enforcement rules, and automated approval workflows ensure you never miss an early-payment opportunity or overcommit your working capital.

Centralized document management

Hunting down signed invoices and receipts across email threads or filing cabinets is a giant time-suck. With Precoro, every document lives in one secure, centralized cloud repository. Automated indexing and smart tagging help you locate any invoice or PO with just a few clicks.

All in all, your AP ledger is what keeps the numbers straight, the books accurate, and the finances running smoothly.

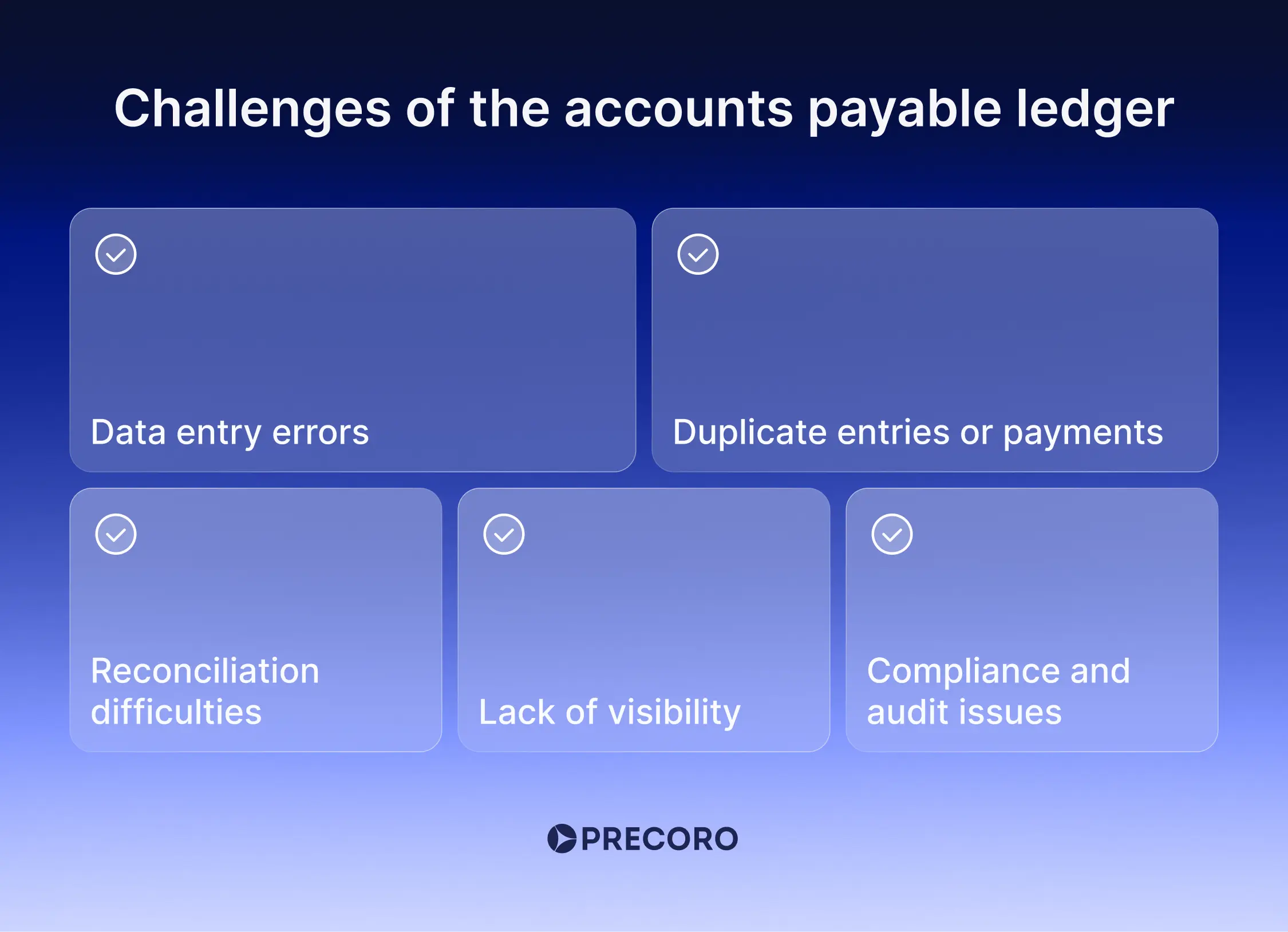

Accounts payable ledger challenges and tips to overcome them

Accounts payable sounds simple enough—log invoices, post them, pay on time. But in practice, small errors and process gaps can snowball into late fees, supplier disputes, and a messy month-end close. Let’s look at the common challenges and how to address them before they turn into bigger problems.

Data entry errors

Manual input leaves room for typos, incorrect amounts, and mismatched vendor details. A single misplaced digit in an invoice number or amount can throw off reconciliations or trigger overpayment.

How to manage:

Automate what you can: start with OCR to capture invoice data, apply validation rules, and always, always do a three-way match—compare the PO, invoice, and receipt. Policies plus tech prevent most mistakes from reaching the ledger.

Duplicate entries or payments

They arrive quietly—one invoice by email, the same one by post, and sometimes a “just checking” resend from the vendor. Without controls in place, you can easily pay twice.

How to manage:

Turn on duplicate detection in your ERP or procurement software to compare vendor ID, invoice number, and amount. Make it standard practice to search for an invoice before adding it, and direct all suppliers to one submission channel to reduce duplication.

Reconciliation difficulties

Trying to line up your AP ledger with the general ledger and bank statements can feel endless. One small mismatch—maybe a timing difference or a duplicate entry—and suddenly you’re knee-deep in spreadsheets, hunting ghost transactions.

How to manage:

Lean into procurement automation. Make sure your tools connect and sync data automatically, so information flows smoothly between systems. Integrations reduce manual updates and keep your departments aligned. As a result, your team spends less time on grunt work and more time spotting trends.

Lack of visibility

When AP data is scattered in inboxes or siloed spreadsheets, forecasting expenses becomes guesswork, and vendor relationships go stale. You’re flying blind on cash flow and missing negotiation leverage.

How to manage:

Centralize everything into a single AP platform that offers clean dashboards—think vendor-level spend, aging buckets, and upcoming liabilities. Use alerts for big invoices or unusual spikes so nothing slips past you.

Compliance and audit issues

Incomplete or outdated ledger entries are audit nightmares. Missing invoice numbers, unclear payment statuses, or last-minute corrections raise red flags and can cost you extra hours or even penalties during reviews.

How to manage:

Treat your ledger like a living document. Require key fields—invoice ID, date, amount, and status—before approval. Add automation to mark each action with a timestamped audit trail. Moreover, regularly review and archive older entries so your auditors (and your future self) can trace every penny without breaking a sweat.

Frequently asked questions about accounts payable ledger

Typically, an accounts payable ledger is a structured table or spreadsheet that records all transactions with suppliers and includes invoice details, dates, amounts due, and payment statuses.

The AP ledger shows:

- Who you owe (the vendors).

- How much you owe them.

- When the payments are due.

- Which payments are still pending.

- Which ones have already been paid.

The general ledger is the main record of all company transactions. It includes all accounts—assets, debts, equity, income, and expenses—and shows the full financial picture. The accounts payable ledger is a subsidiary record that lists what the company owes each supplier, with details like invoice numbers, amounts owed, and payment statuses. It supports the accounts payable account in the general ledger.

An accounts payable ledger shows what the company owes to suppliers when it buys supplies on credit and has not paid yet. An accounts receivable ledger shows what customers owe the company when they buy products on credit and have not paid yet. In short, accounts payable is for money to pay, and accounts receivable is for money to collect.

Yes, but manual AP ledgers (in Excel or paper records) are prone to errors and inefficiency. Most businesses use accounting software like SAP, QuickBooks, or Oracle NetSuite for automation.

With Precoro, every invoice goes straight into the system, links to the right purchase order, and passes through approval before it reaches the ledger. This keeps records accurate and up to date. Precoro also helps manage suppliers, supports multiple currencies, and links with accounting software for a complete, error-free view.

From spreadsheets to Precoro: The AP ledger upgrade you need

A well-maintained AP ledger is no longer just a back-office chore—it’s a measurable business advantage. Industry procurement intelligence shows that manual invoice processing can cost around $15–$16 per invoice, while automation can bring that down to as low as $3, an 80% cost reduction.

Productivity jumps are equally striking—manual teams process five invoices per hour, while automation boosts that to 30 invoices per hour and saves 70–80% in time. And yet, 68% of AP teams still manually key invoices, with only 20% fully automated, which leaves substantial room for improvement.

Take Capital City Public Charter School, for example. Before they switched to Precoro, they were dealing with a lot of the usual challenges—paper forms, manual approvals, and occasional duplicate invoices. It worked, but it wasn’t exactly smooth sailing and made their accounts payable process slower and less transparent than they wanted.

The takeaway? Your AP ledger can be way more than just paperwork you have to keep up with. With the right tools, it can actually help you save money, speed things up, keep cash flowing better, and build stronger relationships with your vendors.

That’s where Precoro comes in. It's a cloud-based platform that puts all your payables data in one place. It gives finance teams real-time access to invoices, payment statuses, and vendor details. By integrating purchasing, approvals, and invoice matching into a single system, Precoro eliminates the need for cumbersome spreadsheets and disconnected tools.

Its automation features—like AI-powered OCR, duplicate invoice detection, and automatic three-way matching—cut down on mistakes and speed up processing from days to hours. Moreover, built-in approval flows ensure every invoice is appropriately reviewed to help you with compliance and audits.

Better vendor management

Precoro helps growing companies manage suppliers more easily. It stores vendor data, tracks payment history, and supports better negotiations. You can onboard vendors with custom forms, keep contracts and catalogs in one place, and work together on orders and invoices in the Supplier Portal. With Precoro, you can easily track:

- Supplier responses to your RFPs.

- Supplier certificates and compliance documents.

- Contract expiration dates.

- Spending by supplier and category.

Smart dashboards

Precoro turns your AP ledger into a tool for smart decisions. You can see:

- Total spending across all business units.

- Supplier-specific costs.

- Custom reports based on your needs.

- User activity and approval delays.

Easy integrations

Precoro works with popular accounting software: Sage 300 and Sage Intact, Exact Online і Microsoft Dynamics 365 Business Central, QuickBooks, Xero, and NetSuite.

After all, Precoro is not a magic pill; it’s a platform designed to help you make better decisions that improve your bottom line.

Ready for total transparency and centralized control?

Stop drowning in spreadsheets and see every payable in real time in one place! Precoro uses AI-powered OCR to scan invoices, matches them automatically with POs and receipts, and syncs data in real time with your ERP or accounting software.