9 min read

Automated Invoice Processing with OCR: How It Works and Why Use It

Discover the fundamentals of automated invoice processing with OCR: how the combo works, what advantages it offers, and solutions for AP challenges.

According to market projections, the invoice processing software market is poised for significant growth in the coming years. By 2030, it is estimated to surpass USD 4.6 billion, exhibiting a CAGR of 8.5% from 2023.

This indicates a growing recognition among businesses of the importance of streamlining their accounts payable using automation tools, particularly those integrated with OCR technology.

In this article, we will delve into the driving factors behind the surging demand for invoice processing solutions, uncover the key benefits they offer, and shed light on the role OCR technology plays in transforming the accounting process.

Keep reading to find out:

- What Is Automated Invoice Processing?

- Commonly Encountered Manual Invoice Processing Challenges

- Benefits of Automated Invoice Processing

- What Is OCR and How Does It Work?

- How OCR Further Enhances Digital Invoicing

- Why Companies Choose OCR with Precoro

- Frequently Asked Questions

What Is Automated Invoice Processing?

Automated invoice processing refers to the use of technology and software solutions to streamline the accounts payable processes. This approach significantly reduces the need for human intervention, encompassing invoice receipt, reconciliation, and approval.

In the traditional sense, invoice processing is a labor-intensive task that requires receiving physical invoices, manually entering data into accounting systems, and routing bills for approval and payment. The process is time-consuming, error-prone, and often leads to delays in payments.

On the other hand, with e-invoicing, businesses leverage technologies like Optical Character Recognition (OCR) and automated 3-way matching to improve and speed up the billing cycle.

Here's a breakdown of the typical steps involved in automated invoice processing:

- Invoices are received and converted into a digital format using scanning techniques.

- Once the invoices are digitized, OCR extracts key information from the invoices, such as the vendor name, invoice number, date, line items, etc.

- The user creates the invoices based on the recognized data.

- The procurement system defines if the invoices should match the POs or receipts and routes bills through predefined approval workflows. This involves sending the invoices to stakeholders for approval and providing notifications to facilitate the process.

- Stakeholders approve the invoices through the software or email.

- Invoice information is integrated with the organization's accounting or ERP system.

- The accounts payable department processes approved invoices for payments.

Commonly Encountered Manual Invoice Processing Challenges

According to the Institute of Financial Operations & Leadership, only 9% of AP departments were fully automated in 2022. However, that figure is expected to increase significantly in just a few years. In fact, around two-thirds of finance professionals foresee their accounts payable team achieving full automation by 2025. This growing trend towards automation is driven by the numerous manual invoicing challenges that organizations encounter regularly. Let’s look at some examples:

Time-Consuming and Paper-Based Processes

Manual invoice processing often relies on paper-based documentation. Physical bills need to be collected, sorted, and stored, requiring extra administrative effort, staff, and physical space.

Moreover, invoicing is a complex process that involves multiple steps, including entering invoice details into a spreadsheet, routing invoices for approval, processing payment, and auditing. When done manually, each step requires a considerable amount of time, especially when there is a large volume of invoices to handle.

Matching Issues

2-way and 3-way matching demands meticulous attention to detail and thorough verification to detect any discrepancies. However, when faced with a heavy workload, the chances of overlooking mistakes in the documents increase significantly. In some cases, the AP department may even end up paying an invoice without receiving the corresponding goods.

Lack of consistent standardized formats for documents can also lead to incorrect or unmatching data. Different suppliers submit invoices in their own format, making it difficult to accurately match the required information.

To make matters worse, personnel often find themselves under immense time pressure to process incoming invoices very quickly. This urgency can result in rushing through the matching process, further increasing the likelihood of overlooking important details.

Lost Invoices

Paper invoices pose a significant risk of getting lost amidst the transportation process or getting buried in a sea of paperwork within the office. The consequence of missing invoices is that the AP department cannot process payments until they are retrieved. Locating these lost invoices consumes valuable time and adds undue stress for the AP staff. Moreover, such delays in payment adversely impact the cash flow of your suppliers and strain your relationship with them.

Long Approvals

In average-sized companies that receive between 3000 and 5000 invoices per month, the processing time for a single invoice can be as long as 25 days. This extended duration of the accounts payable process is often caused by the reliance on manual invoice approvals.

When there are multiple levels of hierarchy in the approval process and each invoice needs to pass through several individuals, it may create bottlenecks that slow down the overall workflow. For example, if a manager who needs to approve an invoice is on vacation or a business trip, the invoice may get stuck in the approval queue until their return. Plus, bottlenecks may be caused by the large personnel workload, invoice disputes, or misplaced bills.

Duplicate Payments

Duplication is a recurring issue that often arises due to unpaid supplier invoices, vendor mistakes, and even fraud. When a payment is delayed, suppliers often send a second invoice, causing the AP team to process both bills – and spend twice the amount.

Duplicate invoices can also be caused by mistakes made during the transaction process. This can happen if someone inadvertently enters the same invoice for payment multiple times or fails to properly mark it as closed.

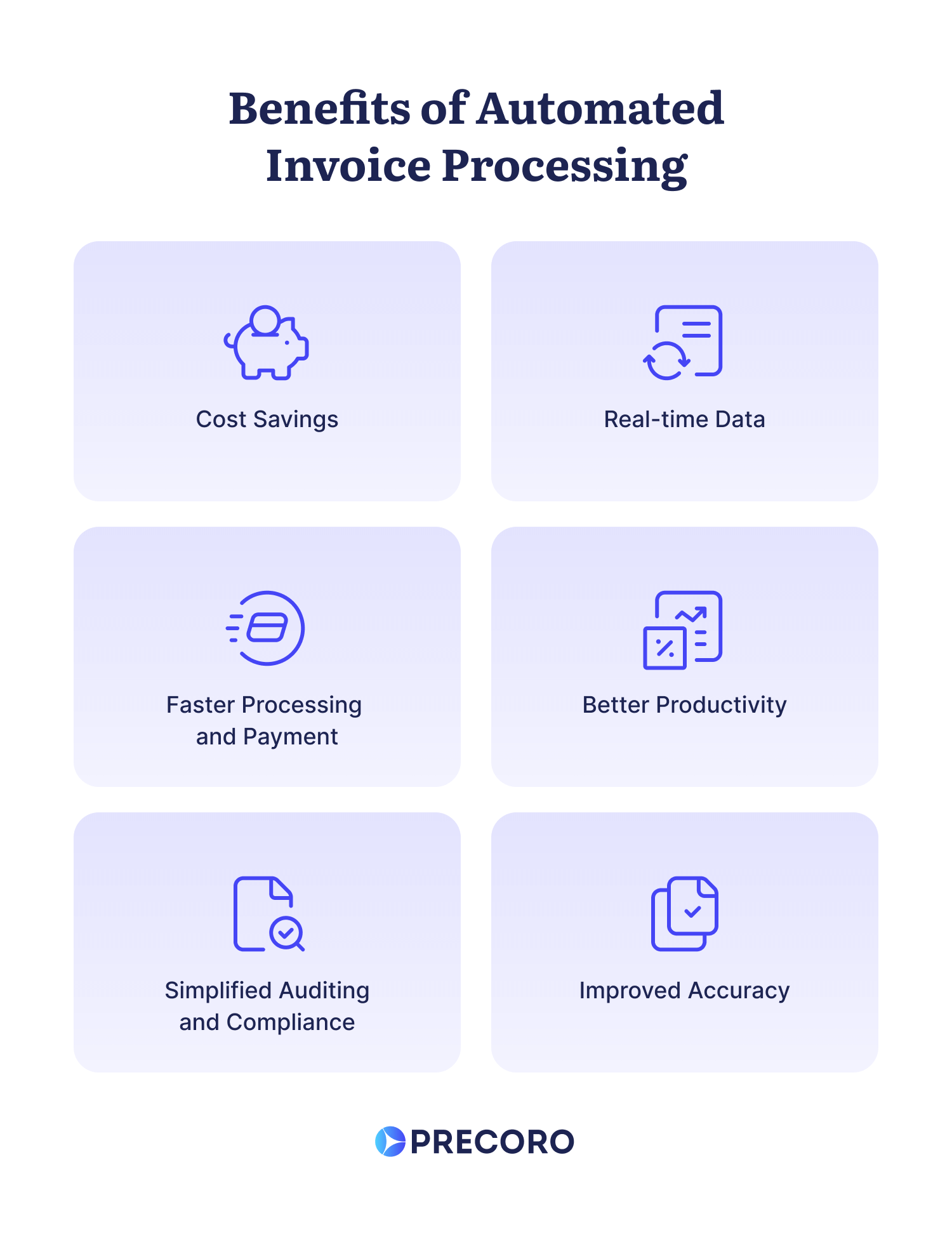

Benefits of Automated Invoice Processing

By leveraging automation, businesses can effectively address the above challenges while simultaneously reaping numerous benefits. Let's delve into these benefits in detail:

Cost Savings

Digitization eliminates the need for physical storage space, reduces paper usage, and minimizes printing costs associated with traditional invoices. Additionally, electronic invoices can be processed and approved faster, accelerating the payment cycle and potentially enabling early payment discounts.

Real-time Data

Invoice processing solutions provide real-time document information, which offers several advantages for various stakeholders. Requesters can conveniently track the status of their orders, the accounts payable department gains visibility into upcoming payments, and senior executives can monitor how their teams perform. The availability of data simplifies and expedites decision-making processes, eliminating the need to chase after information.

Faster Processing and Payment

With automation, there is no need for back-and-forth emails during the invoice approval process. Vendors can directly submit their bills into the accounts payable system or users can leverage OCR technology – which we will delve deeper into later in the article – to capture paper invoices accurately and effortlessly.

Once the bills are in the system, the software automatically matches them with the corresponding purchase order and routes them to the relevant approvers. This streamlined accounting process ensures faster invoice payments, leading to improved cash management and stronger supplier relationships.

Better Productivity

Invoice automation software is designed to streamline the process of creating, managing, and processing invoices. Automating manual processes and repetitive tasks significantly improves productivity and efficiency in accounts payable departments and finance teams. Employees have more time to focus on value-added activities, like analyzing financial data, identifying cost-saving opportunities, and engaging in strategic decision-making.

Simplified Auditing and Compliance

Digitalization allows companies to have a centralized and searchable document repository for invoices and their supporting documents, such as purchase orders and receipts. Auditors can easily access and review bills, ensuring compliance with regulatory requirements and internal policies.

Additionally, invoice processing systems can be integrated with an ERP or accounting platform. Integrating lets users sync locations, budgets, POs, bills, and vendor data between the solutions, facilitating reconciliation and reporting.

Improved Accuracy

AP automation software plays a crucial role in minimizing the risk of human errors within invoice processing. The integration of OCR technology into the accounts payable process enables accurate data capture and reduces potential mistakes that commonly occur during manual data entry, like incorrect data input, misplaced bills, or duplicate payments.

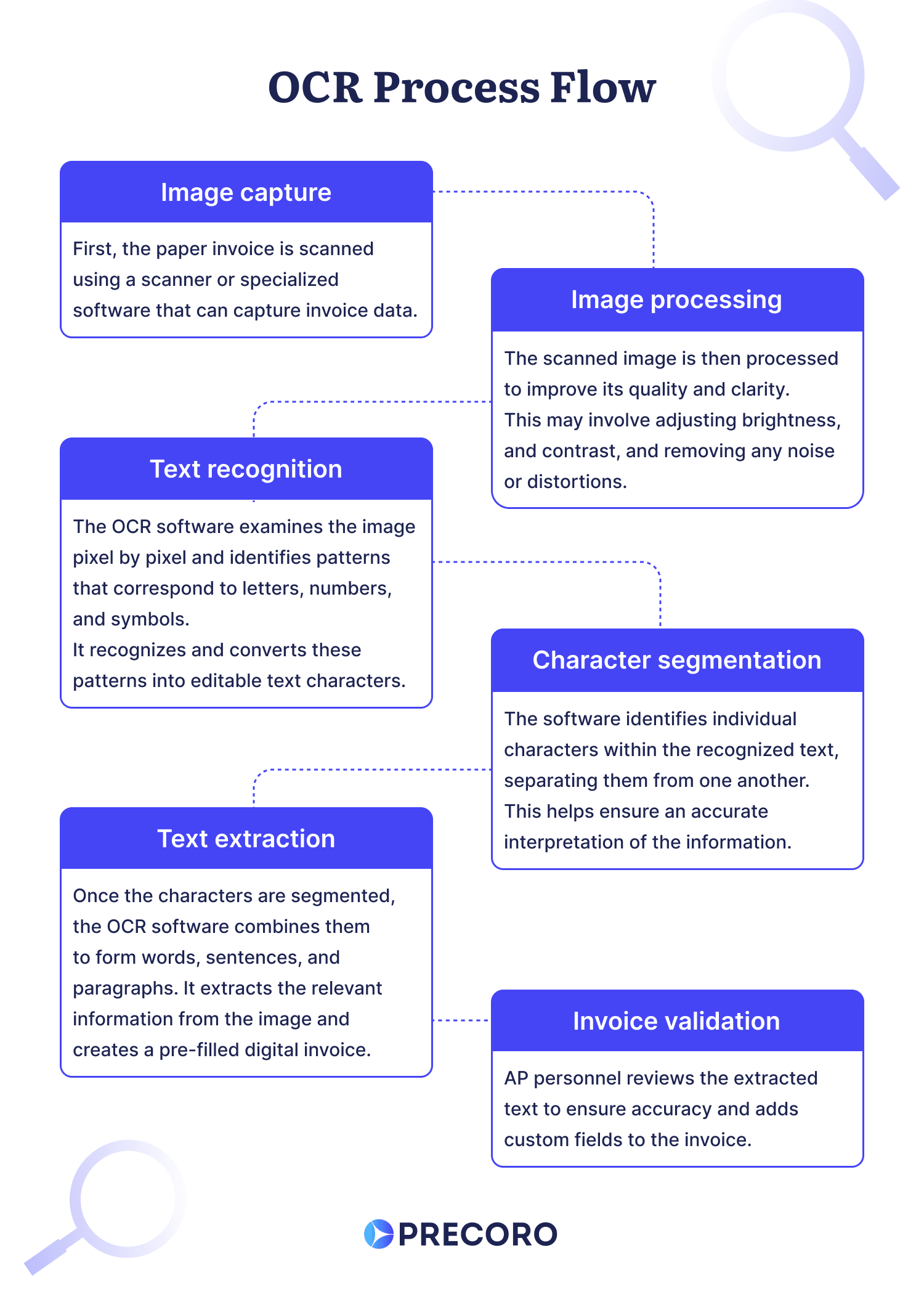

What Is OCR and How Does It Work?

Optical Character Recognition, or OCR, is a technology that helps computers "read" and understand text from images or scanned documents.

Imagine you have a paper invoice that you want to process digitally. OCR software can take that image of the invoice and extract the information from it, like the invoice number, vendor details, item descriptions, quantities, and prices. It does this by recognizing the characters and words in the image and converting them into editable and searchable text.

Here's how invoice processing with OCR typically goes:

The time it takes to get through this process can range from a few minutes to a few hours, depending on various factors. Invoices with clear images and well-structured layouts can be processed relatively quickly. However, if an invoice is complex or poorly scanned, it may take additional time to ensure accuracy. Moreover, the desired level of accuracy also affects the speed of the OCR. Generally, allocating more time allows for a more precise data extraction outcome.

How OCR Further Enhances Digital Invoicing

While automation alone offers significant improvements, integrating OCR technology into an AP automation system unlocks its true potential. According to Straits Research, the OCR market is expected to reach USD 39.655 million by 2030 at a CAGR of 16% during the period of 2022-2030. This growth can be attributed to the increasing adoption of automation solutions and the growing recognition of data's importance in achieving business success. When data is in digital format, it becomes easier to distribute, access, and store.

The growing recognition and adoption of OCR technology in the field of invoicing can be attributed to several reasons, including:

- It frees AP from manually inputting invoice data into a procurement, accounting, or ERP system.

- It reduces the chances of errors that can occur during invoice data entry.

- It recognizes and extracts data from various invoice formats, including paper invoices, scanned images, and PDF files.

- It reduces labor expenditures required for invoice processing.

- It digitizes a large number of documents in a short period.

Why Companies Choose OCR with Precoro

With Precoro's OCR capabilities, companies can digitize data from both invoice images and PDF attachments. Our tool uses Google’s custom extractor with generative AI to achieve maximum accuracy and speed while processing documents.

Users can upload vendor invoices through email or directly to the "OCR inbox" page. This initiates the recognition process, allowing users to focus on other tasks while the OCR system extracts the necessary data, maps relevant fields, and generates pre-filled invoices.

The status of each attachment sent for recognition can be monitored on the "OCR Inbox" page. Additionally, the system sends users email notifications when the data extraction and invoice generation are completed. This seamless workflow ensures that users are promptly informed when their drafts are ready for review.

Precoro's OCR feature also provides the flexibility to create new invoices from scratch or based on relevant purchase orders. The system automatically recognizes and suggests the corresponding purchase order that can be matched with the invoice.

OCR in Precoro not only recognizes such data as vendor name and issue date but also individual items within an invoice. That saves a considerable amount of time due to not having to manually enter each item into the system.

Once the processed documents are reviewed and accepted, they can be sent through pre-established approval workflows and 2-way or 3-way matching. Afterward, they can be audited, reported, and seamlessly integrated into accounting or ERP systems like QuickBooks Online, Xero, or NetSuite.

If you'd like to learn more about how Precoro can help you boost AP processes, book a personalized demo call with our experts:

Frequently Asked Questions

OCR significantly reduces manual data entry, but it doesn't completely eliminate it. The effectiveness of OCR in capturing invoice details varies depending on the specific solution chosen. Certain providers may prioritize speedy invoice capture but compromise on the accuracy of the resulting data. Consequently, additional time is required to fix mistakes or fill in missing info. On the other hand, platforms like Precoro provide over 90% precision in capturing invoice data, thus requiring only a little time to validate the end result.

OCR technology can extract various types of information from invoices, including:

- Invoice number

- Vendor details

- Invoice date

- Due date

- Line items (description, quantity, unit price, total amount)

- Taxes and discounts

- Total amount due

- Purchase order number (if applicable)

Yes. Advanced OCR systems use machine learning algorithms and artificial intelligence to adapt to varying invoice templates. However, it is important to note that OCR performance can be affected by the quality of the scanned image and the complexity of the invoice layout.

Reputable OCR software vendors implement robust security measures to protect sensitive financial data. Encryption, access controls, and compliance with industry standards (e.g., GDPR) ensure that data is safe from unauthorized access or breaches.

In a Nutshell

Automated invoice processing refers to the use of technology to optimize the accounts payable workflow. It involves automating various tasks and steps in the invoicing process, such as data capture, validation, approval workflows, and payment reconciliation.

OCR, as a part of the invoice process automation, takes care of probably one of the most frustrating tasks for every AP representative — data entry. It works by scanning the bills, extracting relevant information, and automatically inputting it into the company's accounting system.

OCR helps organizations save time and effort, particularly during peak billing periods when the volume of invoices is high. It enables faster processing and turnaround times, allowing accounts payable teams to manage invoices more efficiently. As a result, organizations can take advantage of early payment discounts and avoid late payment penalties.

Overall, automated invoice processing software with OCR addresses the challenges associated with manual invoicing, streamlining the entire procurement process and benefiting all parties involved.