13 min read

QuickBooks Online Reconciliation 101: How to Reconcile, Undo, and Fix Discrepancies

Follow a step-by-step guide to QuickBooks reconciliation. Learn how to reconcile accounts, fix discrepancies, and undo reconciliations if needed.

Bank reconciliation is often easy to postpone, especially when it’s done manually: after all, who wants to spend hours poring over bank statements and internal financial records? Ignorance certainly isn’t bliss, though, when it comes to reconciling accounts: 59% of accountants make several mistakes each month, all of which could result in missing payments and, in more extreme cases, fraud.

Accounting solutions like QuickBooks Online simplify this crucial but undeniably time-consuming step. During QuickBooks reconciliation, the system loads all transactions already recorded in the account since the last reconciliation and automatically calculates the difference between the statement ending balance and the transactions you select.

If everything lines up with the bank statement, the leftover amount is zero. If it doesn’t, you can review missing, duplicated, or incorrectly recorded items and fix them before completing the reconciliation. And with Precoro’s integration, purchasing data syncs automatically to QuickBooks, no manual entry needed.

Although quite intuitive, QuickBooks can be difficult to master if you dive in headfirst. In this guide, you’ll learn how to complete and how to undo a reconciliation in QuickBooks Online. Plus, read on for insights on how to fix discrepancies in reconciliation data.

Read on to discover:

What is reconciliation?

How to reconcile in QuickBooks Online

How to find the reconciliation report in QuickBooks Online

Can I finish the reconciliation if the difference isn’t zero?

Reasons for QuickBooks reconciliation discrepancies

How to undo bank reconciliation in QuickBooks Online

FAQs about reconciliation in QuickBooks Online

Integrate QuickBooks Online with Precoro

What is reconciliation?

Bank reconciliation is a crucial bookkeeping process that verifies whether the records in QuickBooks Online (or any other accounting software, for that matter) match the bank statements. Every charge, deposit, interest, or transaction on a bank statement has to be reflected in the accounting system and internal records. Reconciliation should be a regular practice: perform it at least once a month to keep accounting records auditable and on track.

Consistent reconciliation helps surface discrepancies early, when they’re easier to investigate and correct. The earlier you spot discrepancies, the better. Besides accuracy, reconciliation also helps you understand where money goes over time. After all, you have the opportunity to review each transaction from a specific period and reassess the company's spending patterns.

How to reconcile in QuickBooks Online

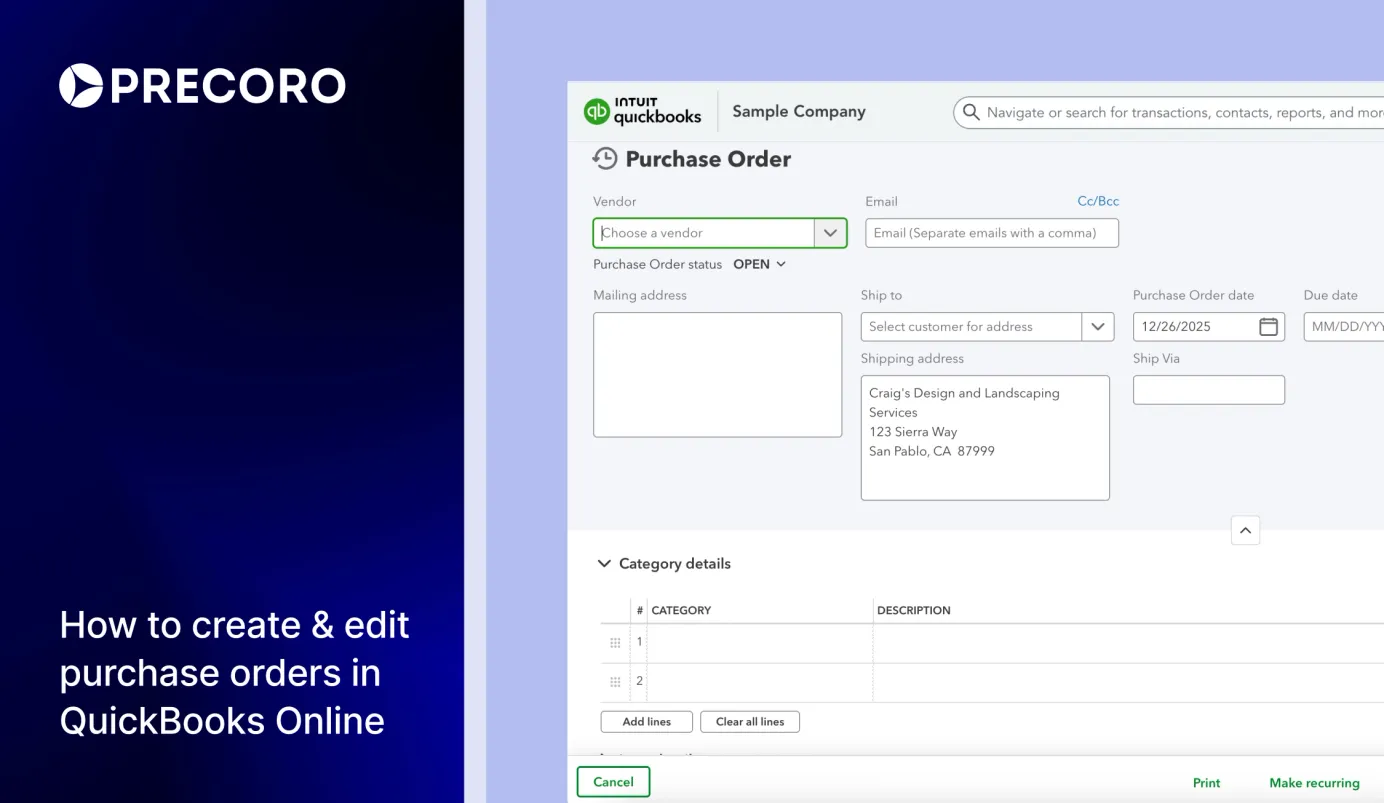

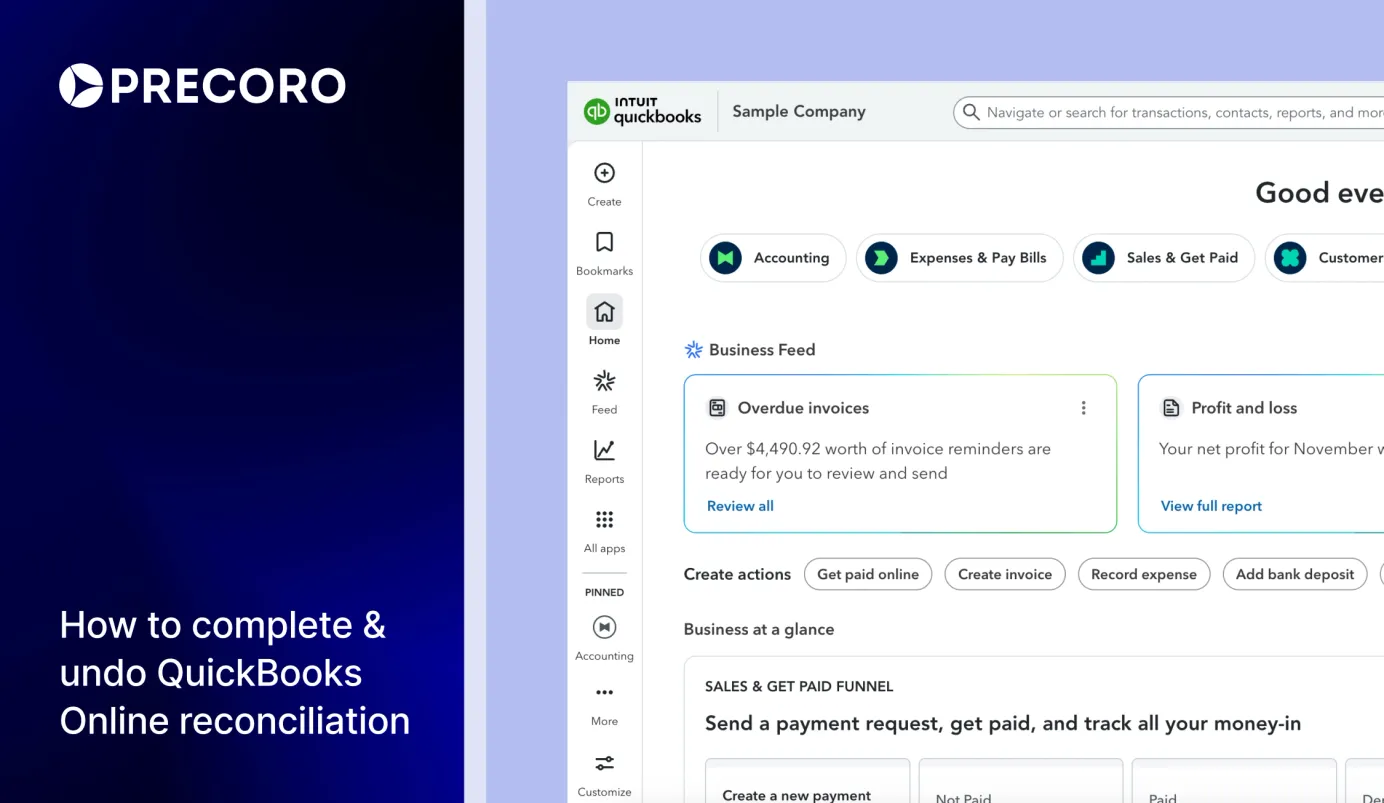

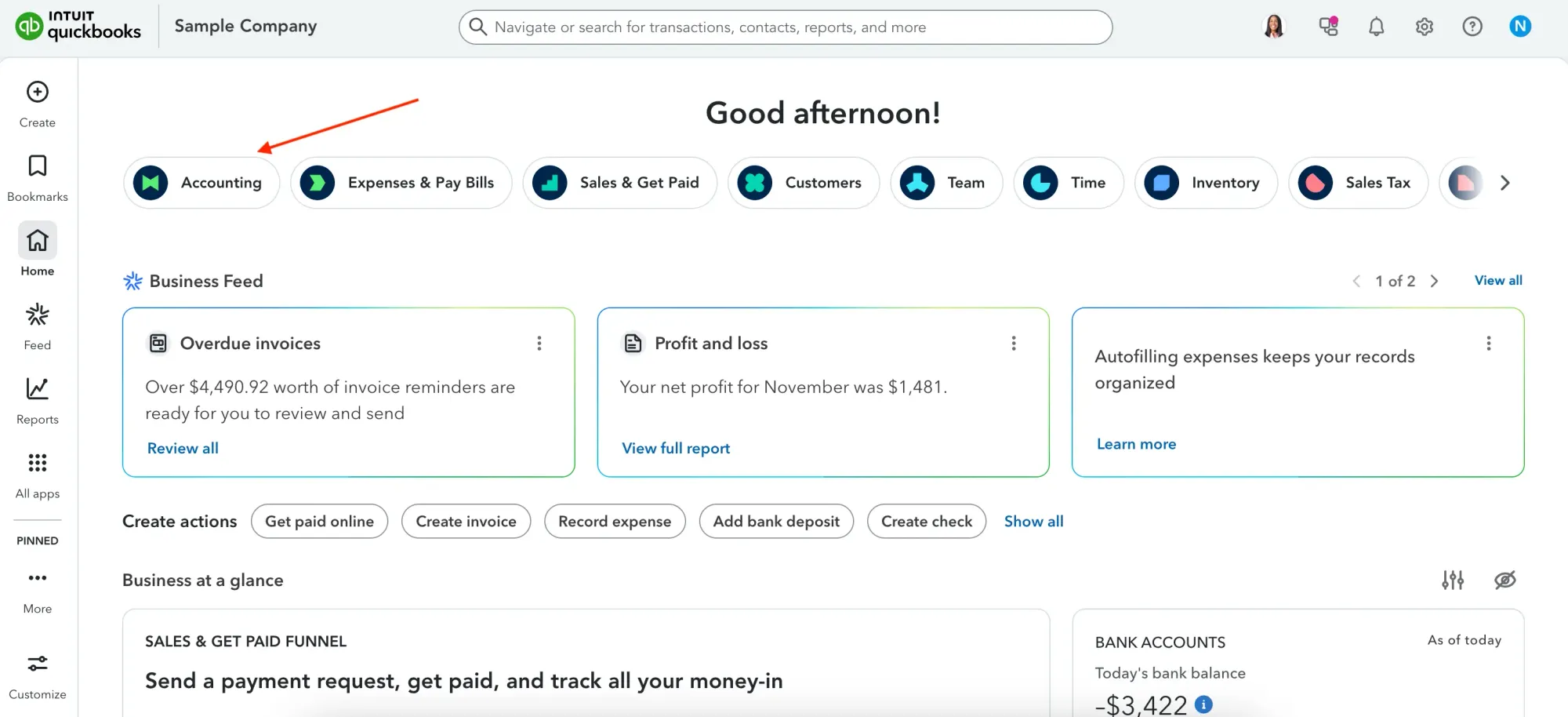

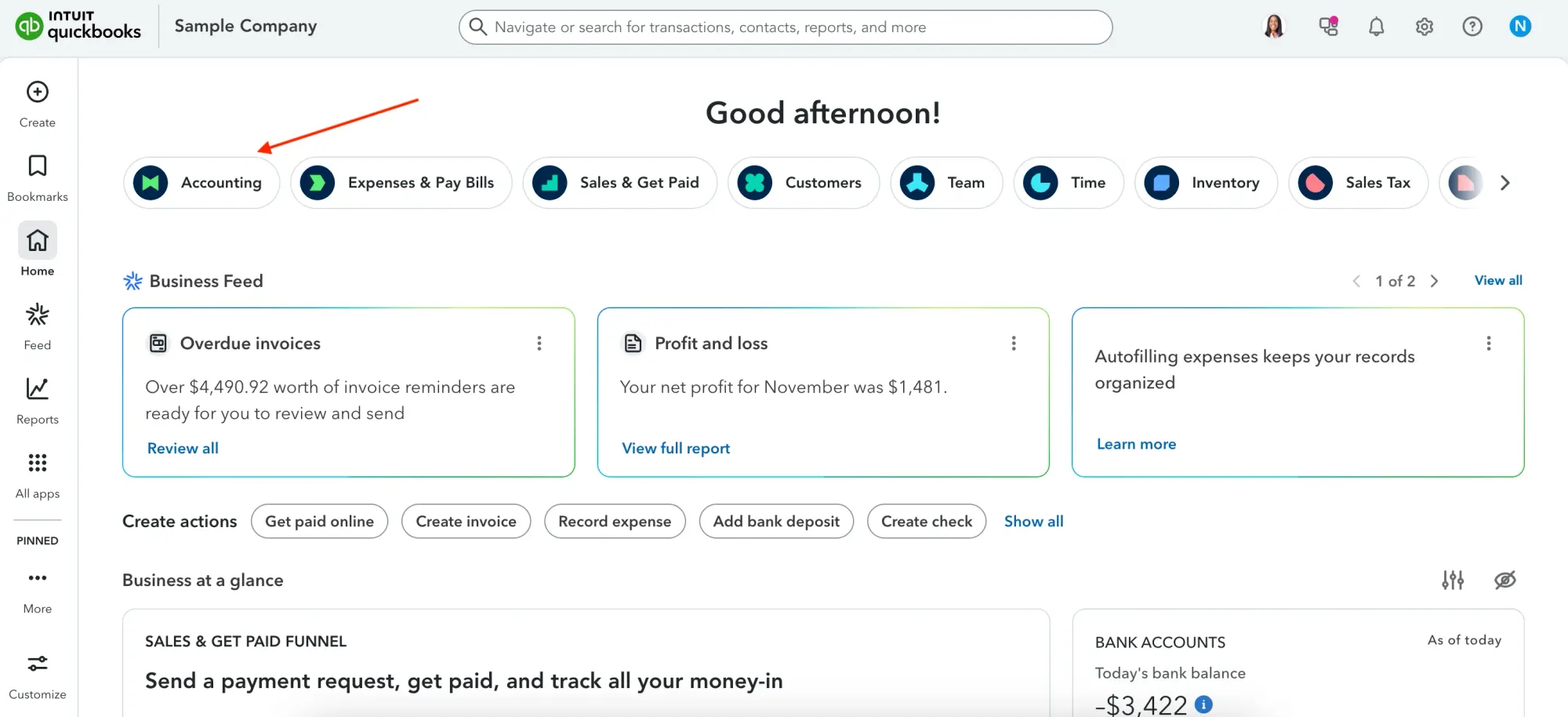

- First, let’s find the QuickBooks Online bank reconciliation option. There are several ways to do this:

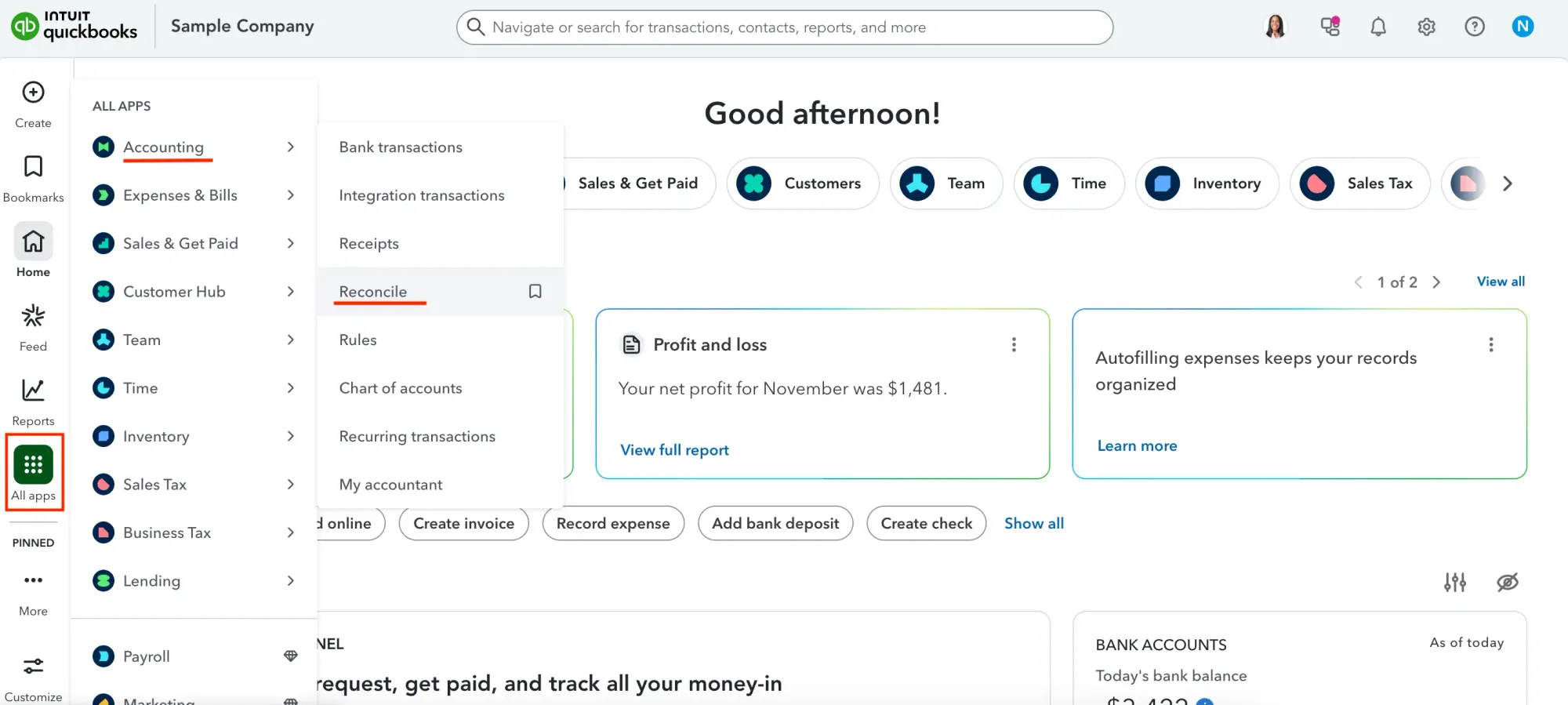

- On the home page, click on the Accounting tab and select Reconcile from the sidebar navigation.

- Select All Apps in the sidebar, then click Accounting, and finally, Reconcile.

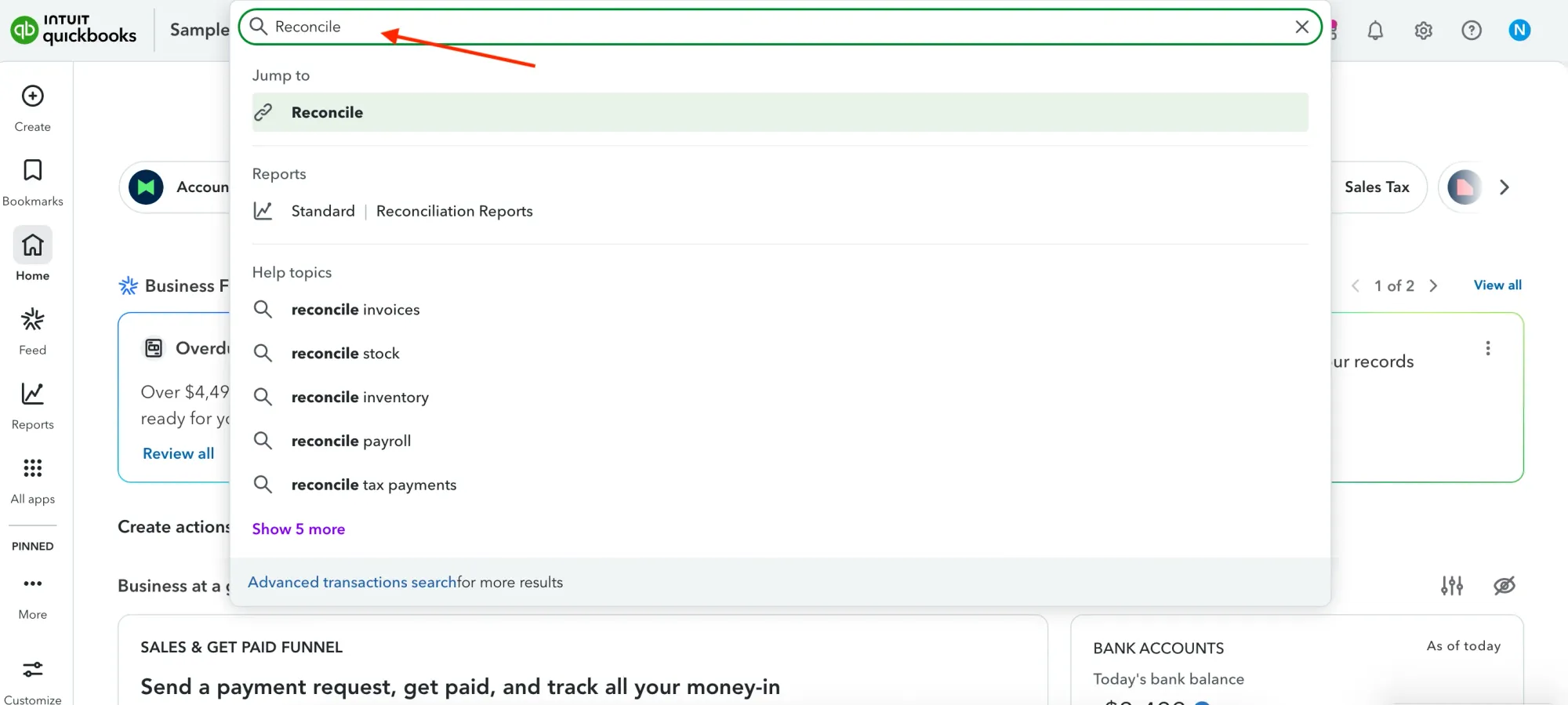

- Type Reconcile into the search bar at the top of the page and click on the option that appears.

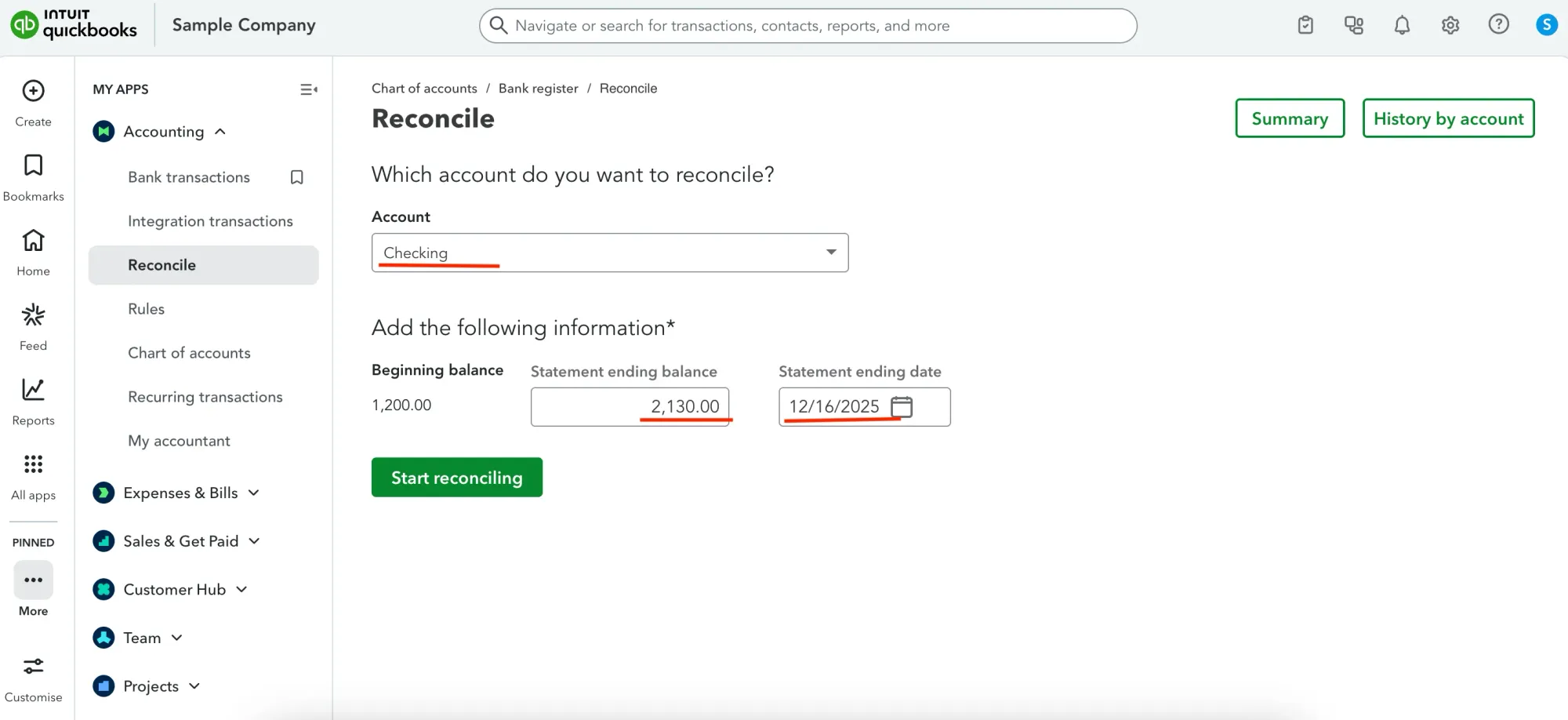

- Once the Reconcile menu opens, choose the account you want to reconcile (in our case, Checking). Make sure it’s the same account mentioned on your statement.

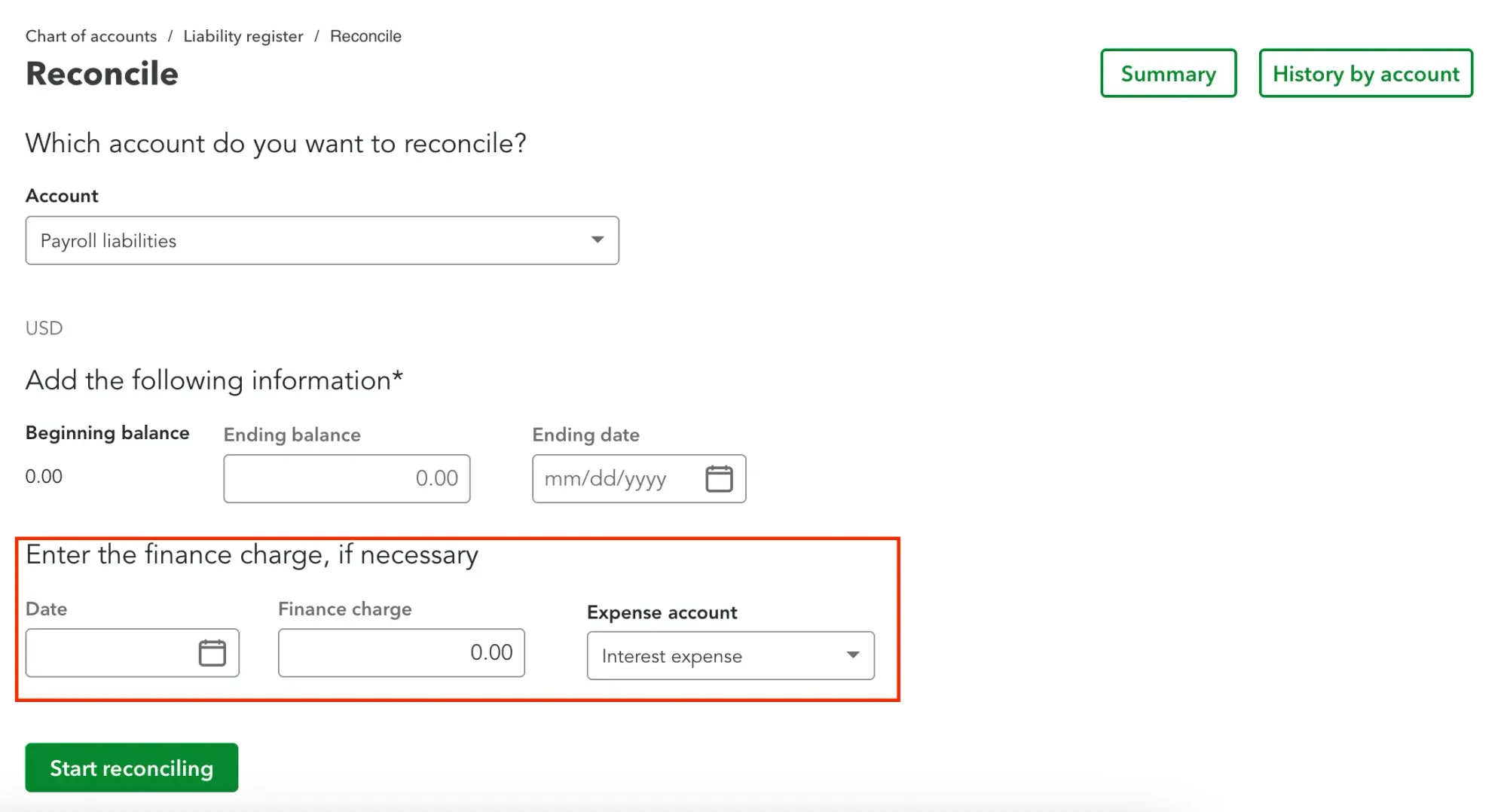

- Review the opening balance and make sure it matches your statement. Enter the Ending balance from your bank statement and the Ending date in the appropriate fields.

- If necessary, enter the service charge, interest amount, or finance charge (this depends on the type of account). This option is available for all accounts except for the Bank and Equity types.

- Click Start reconciling.

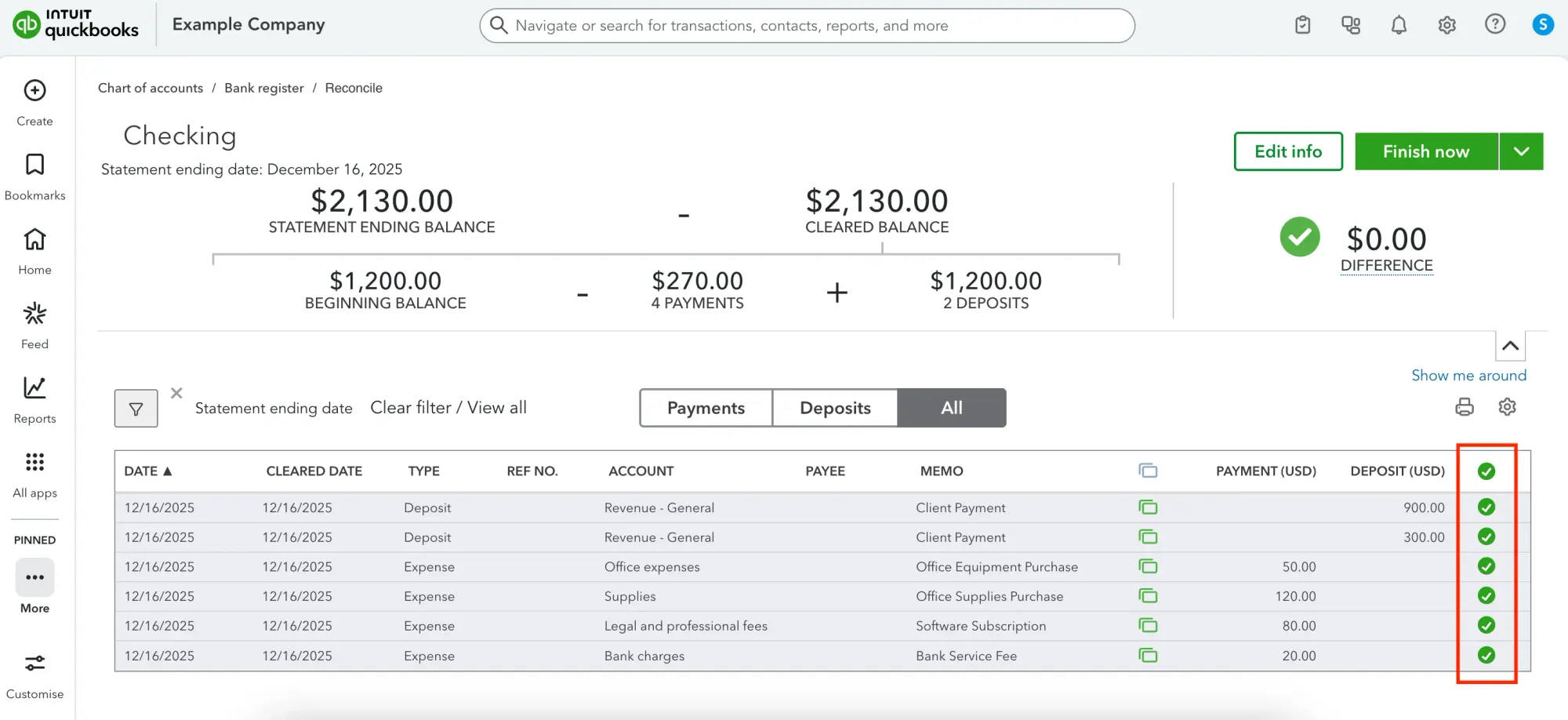

- You’ll then be automatically redirected to the reconciliation workspace for the selected account, where you’ll see a list of transactions split into payments and deposits. These are the transactions QuickBooks has recorded for the account since the last reconciliation. Go through the list and check off each transaction that appears on your bank statement.

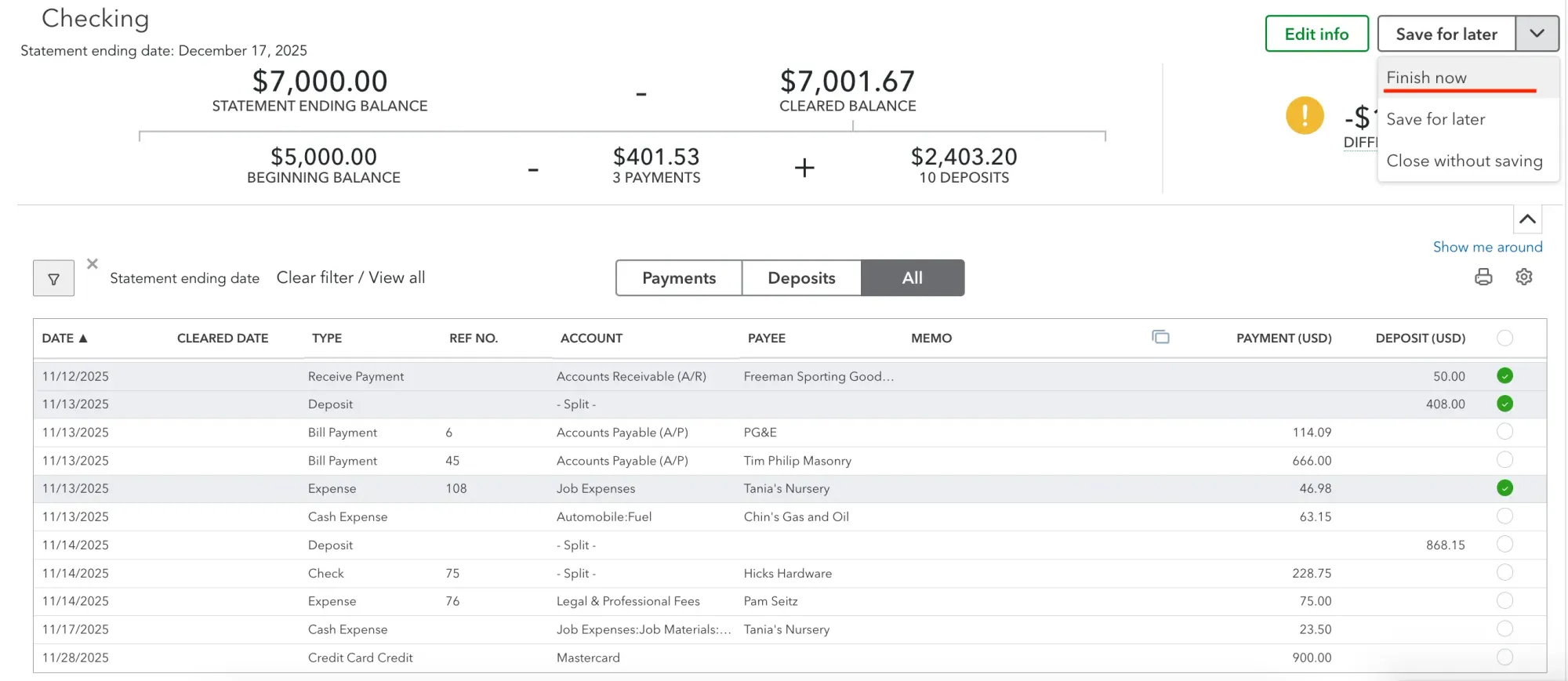

- As you select transactions, QuickBooks updates the Difference amount at the top of the screen. This number shows how far QuickBooks is from matching the statement balance. The difference must reach 0.00. If it doesn’t, there’s a chance your QBO records have duplicate or missing transactions.

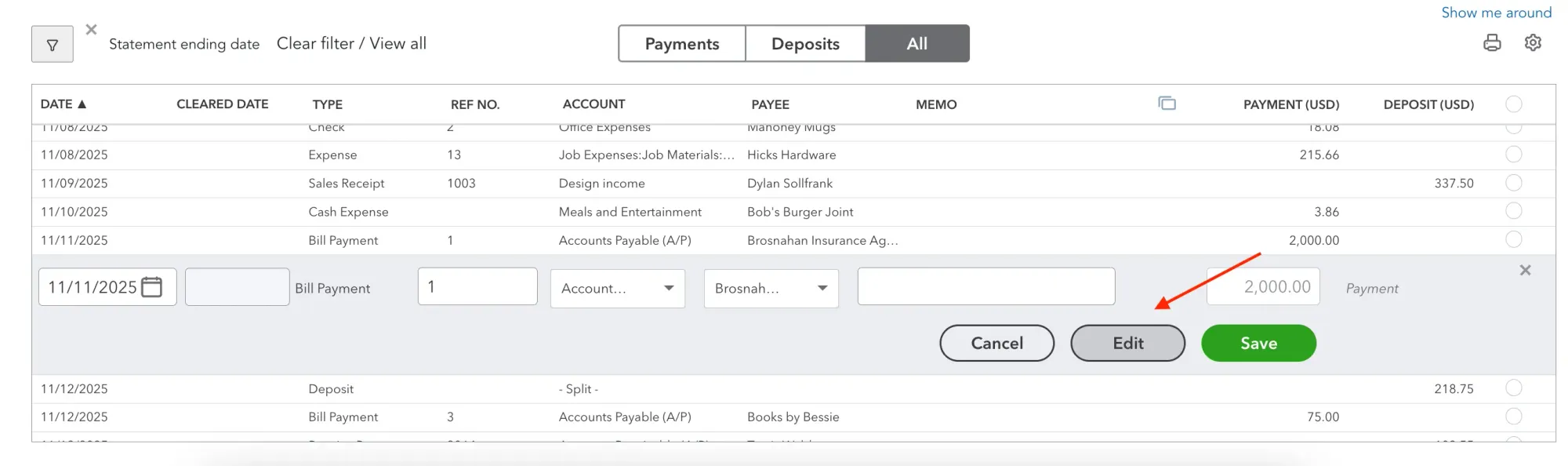

- If any transaction seems off (for example, the amount is different from the statement), click twice on it, select Edit, and make any changes you need.

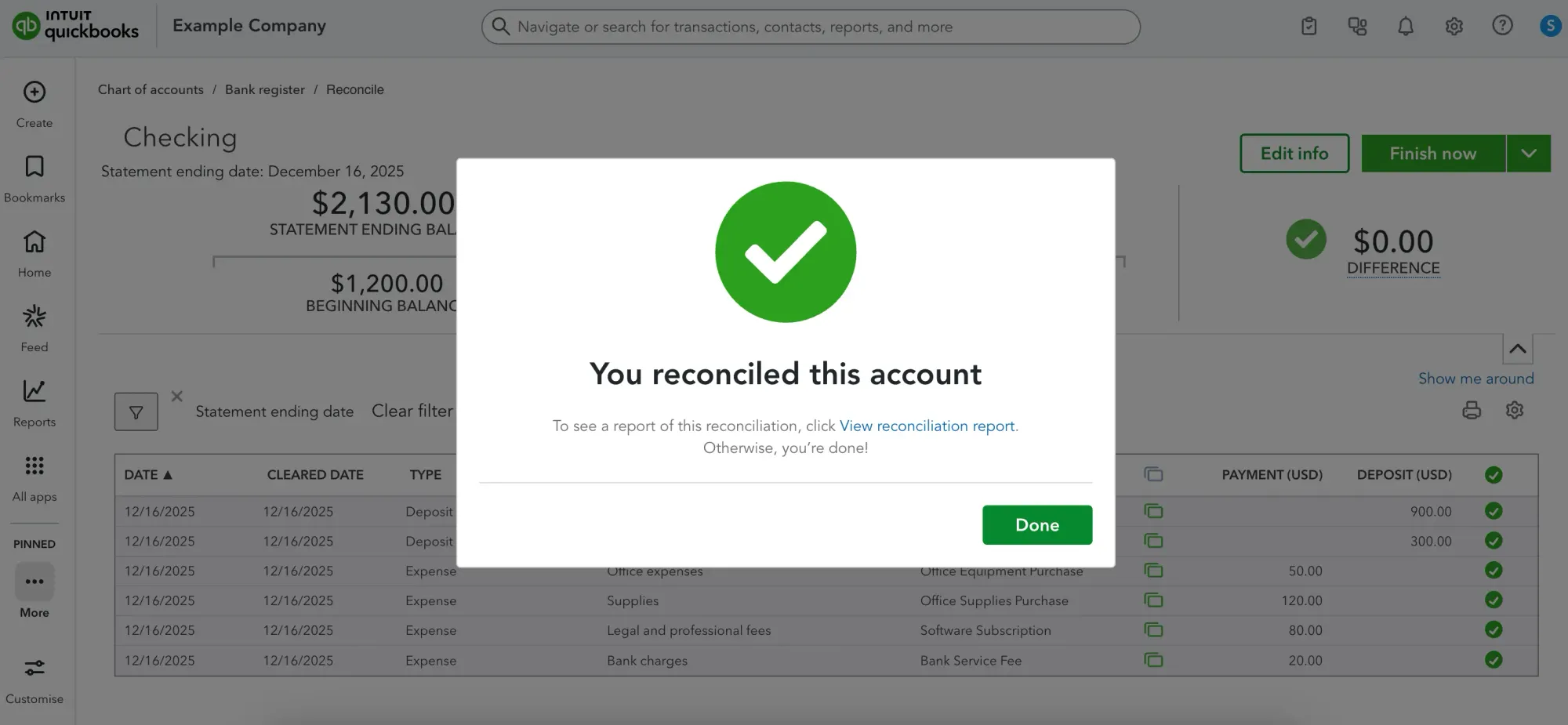

- Once the difference reaches zero and everything is in order, click Finish now to complete the reconciliation.

How to find the reconciliation report in QuickBooks Online

Every time you finish reconciling, QuickBooks Online generates a reconciliation report you can use for future reference. It shows a brief summary, dates of reconciliation, payments, deposits, and a clickable list of transactions. Click on any entry, and you’ll be redirected to the specific transaction in QBO bank reconciliation. To find the report, follow these steps:

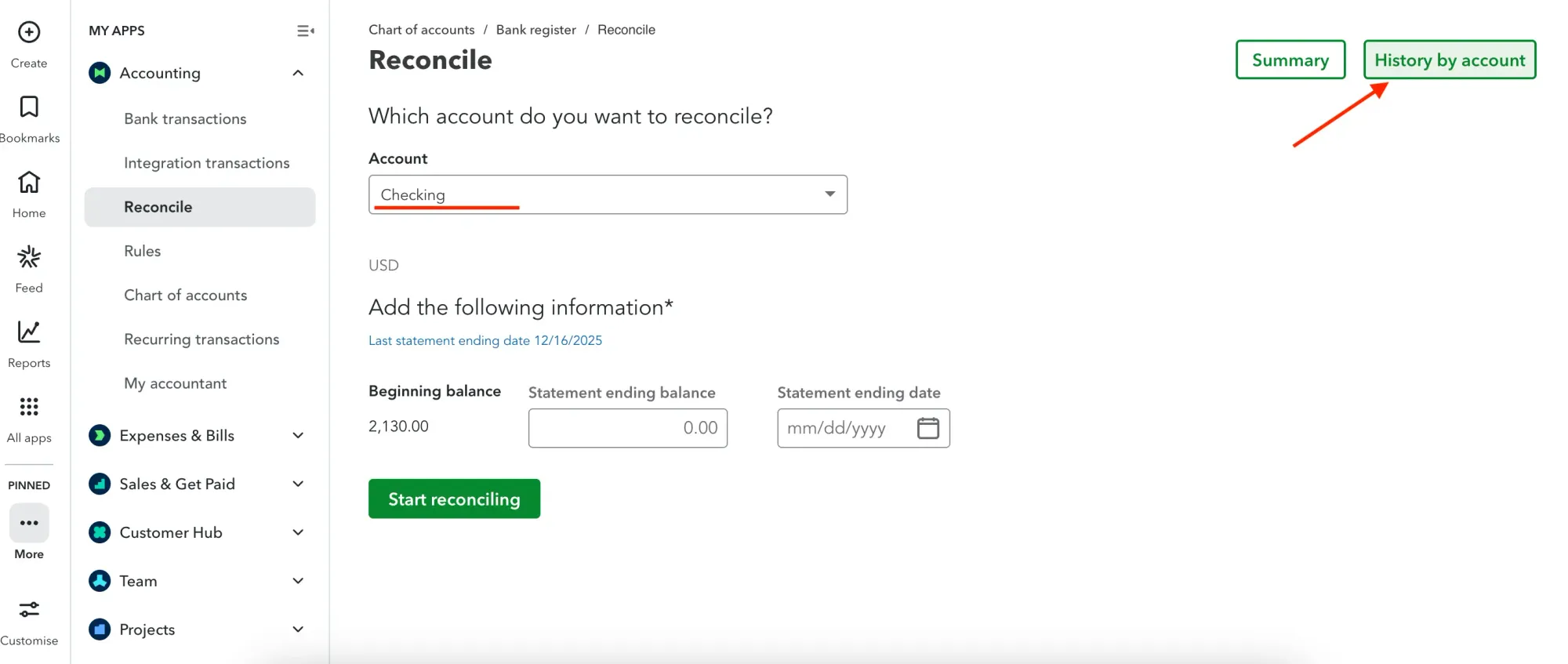

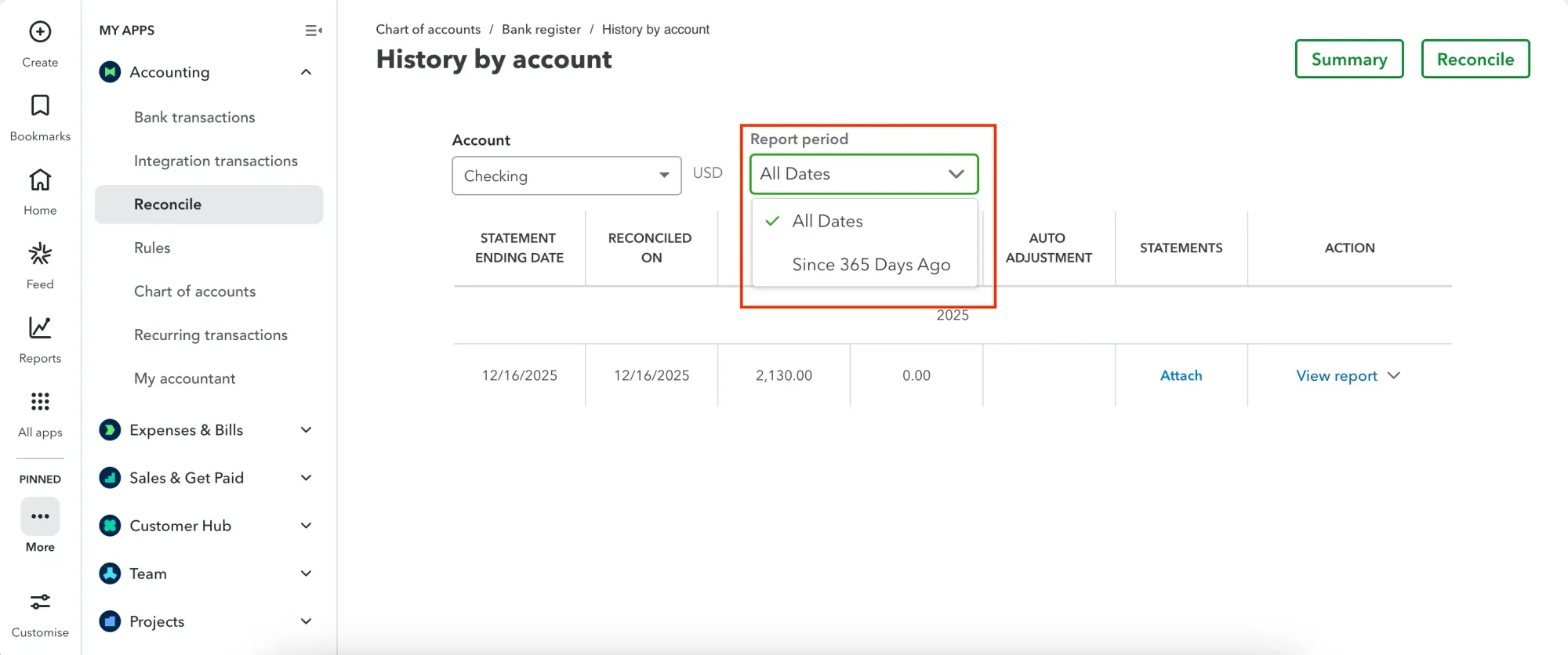

- Click Reconcile in the navigation sidebar on your left. From the Account dropdown, select the account you’ve already reconciled. Next, click History by account in the upper-right corner of the screen. This action opens a list of past QuickBooks reconciliations for that account.

- Use the date filter Report period to choose the timeframe for the reconciliations you want to see in the document, such as All Dates or Since 365 Days Ago.

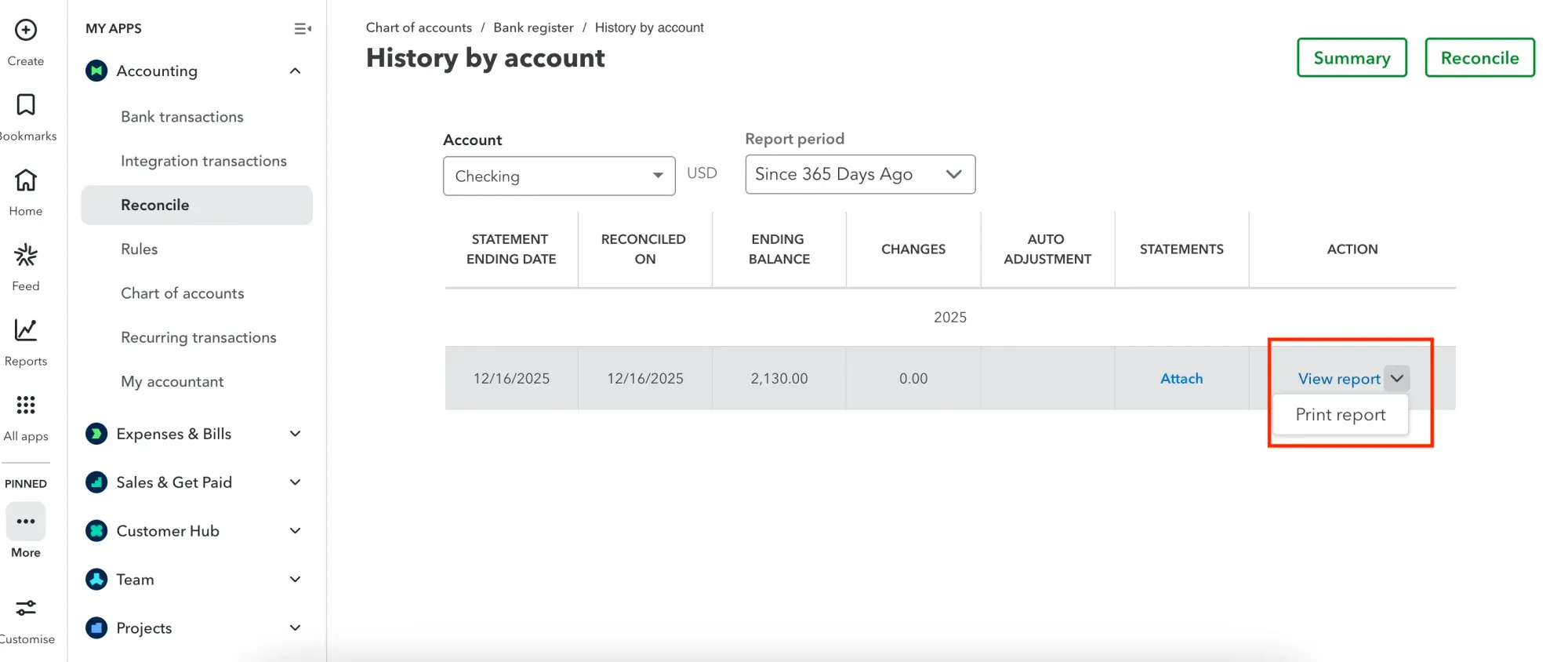

- Select View report under the Action column. If you need a copy of a QBO bank reconciliation report, click the arrow next to the View report to download or print it.

Can I finish the reconciliation if the difference isn’t zero?

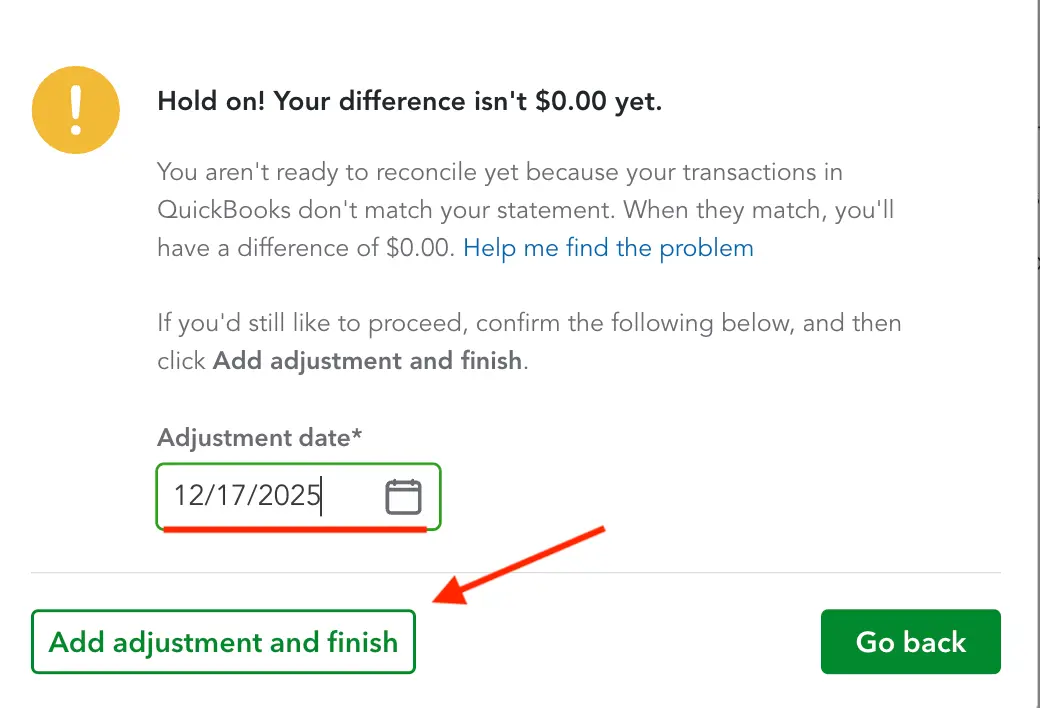

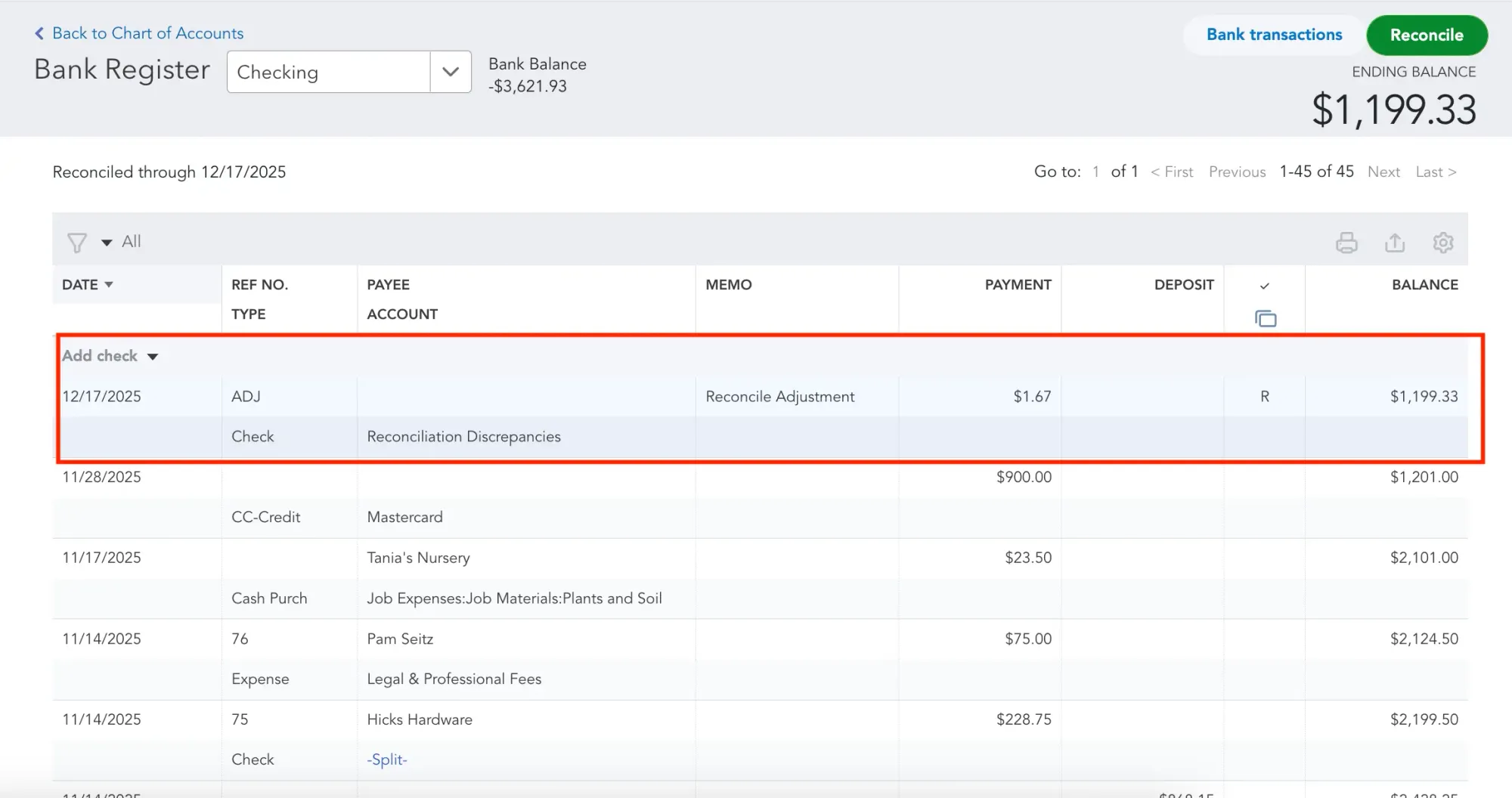

Although it goes against standard accounting practices, QuickBooks Online allows you to finalize the reconciliation even if the bank statement and QuickBooks records don’t fully match. You can create an adjusting entry, which will bring the difference to zero and complete the QBO bank reconciliation. This functionality comes in handy when you can’t identify the source of the discrepancy.

Important: Use this option only if the amount is relatively small and you're confident it’s just a minor error. Always consult with the company’s accountant before adding an adjusting entry to make sure it won’t cause issues down the line.

Here’s how to add an adjusting entry to your reconciliation:

- During reconciliation, after you’ve reviewed all transaction entries, click on an arrow next to Save for later and select Finish now.

- QuickBooks Online will notify you that the difference isn’t zero and will prompt you to create an adjusting entry. Select an adjustment date and click Add adjustment and finish. The system will then create a new entry and force reconciliation to complete. The entry will be categorized either as an expense, if it's negative, or an income, if it's positive.

- Both the QuickBooks reconciliation report and the reconciled account will now have an additional entry, Reconciliation discrepancy, which you can edit if needed.

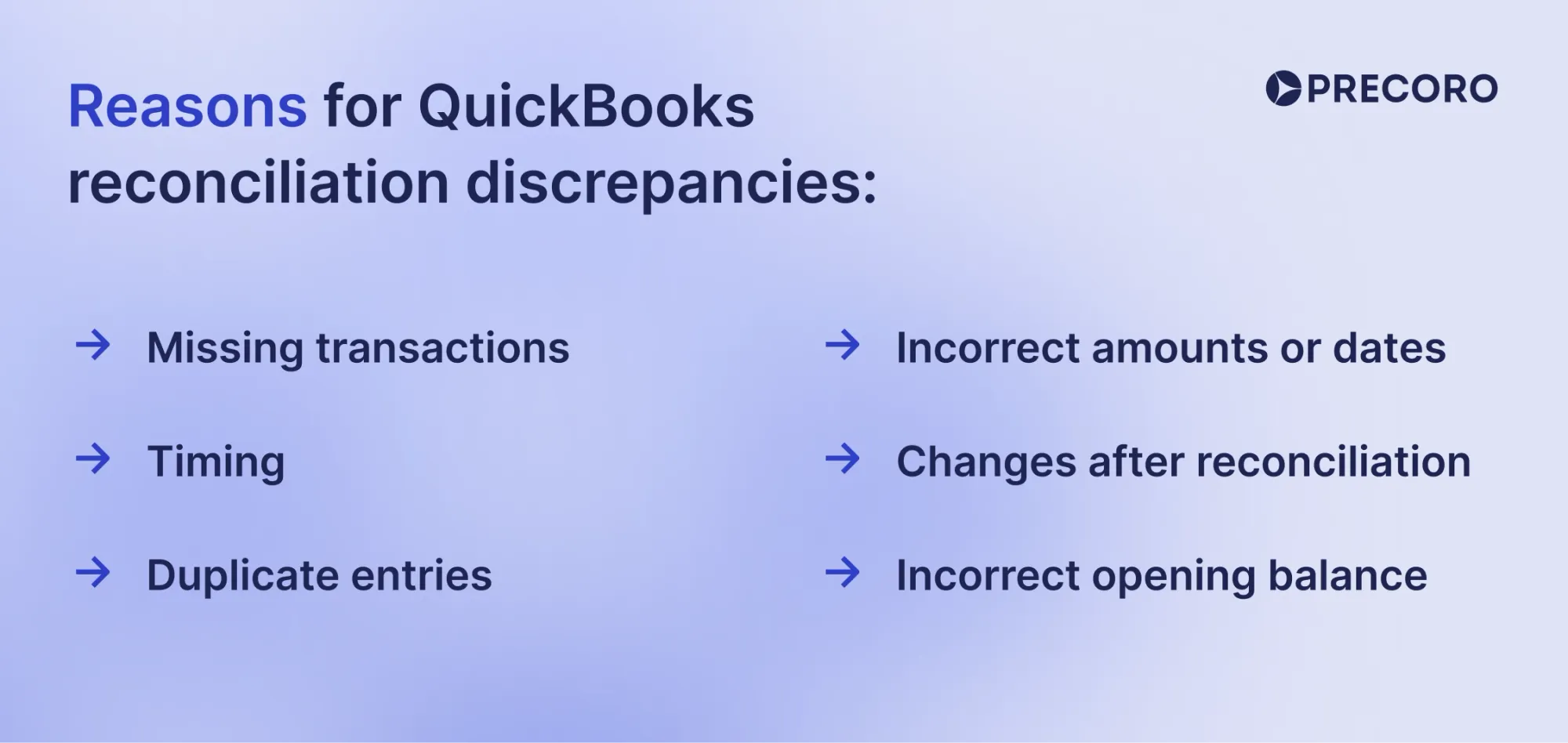

Reasons for QuickBooks reconciliation discrepancies

Discrepancies in QuickBooks Online usually happen when the transactions in the system don’t fully match the bank statement from a specific period. If you’re struggling to bring down the difference in QBO reconciliation to zero, look for these common issues:

- Missing transactions: Even the most diligent accountants sometimes slip. Look for transactions that appear on the bank statement but weren’t imported into QuickBooks. If that’s the case, enter the transaction and restart reconciliation.

- Timing: If a transaction was recorded in QuickBooks, either manually or through an import, but wasn’t processed by the bank by the statement end date, it may appear on the next statement.

- Duplicate entries: Some transactions may be logged in twice, especially if QuickBooks is linked to your bank account and you still manually import files.

- Incorrect amounts or dates: A transaction was entered with the wrong amount or date, so QuickBooks doesn’t automatically include it in this reconciliation period.

- Changes after reconciliation: Any transaction that was deleted or went through the QBO undo bank reconciliation process may set the entire account out of balance.

- Incorrect opening balance: If you entered the wrong opening balance from the start, the difference can carry forward to every future reconciliation.

How to fix discrepancies in QuickBooks Online

Review the transactions listed in the QuickBooks reconciliation screen and compare them line by line with your bank statement. Only check transactions that appear on the statement for that period.

If something is missing, add it to QuickBooks Online before continuing. Bank fees and interest charges are especially easy to miss and might not have been recorded earlier. If you notice duplicates or incorrect amounts, open the transaction, correct the issue, and then return to the reconciliation. And with Precoro connected to QuickBooks Online, approved invoices and expenses are synced automatically, so there’s less missing or incomplete data.

If the difference still isn’t zero, consider checking the transaction dates. A transaction dated outside the statement period shouldn’t be included in the current reconciliation, but it might slip in if it was entered incorrectly. Adjust the date if it’s wrong, or leave the transaction unchecked so it can be reconciled later. If the transaction was reconciled under the incorrect timeframe, many users start asking a common question for QBO: how to undo bank reconciliation.

Finally, confirm that the statement ending balance and date you entered match the bank statement exactly. If the discrepancy is still there, consider cross-checking the bank statement with the company’s internal ledgers and other financial records.

How to undo bank reconciliation in QuickBooks Online

Sometimes you need to walk back on QuickBooks reconciliation. Maybe you reconciled the wrong account, or maybe you used the wrong bank statement. Whatever the reason, there are two main ways to undo reconciliation in QuickBooks Online: revert it entirely as an accountant, if your company uses QuickBooks Online Accountant, or unreconcile individual transactions one by one.

If you need to undo bank reconciliation in QuickBooks Online for a larger number of past transactions, fixing them individually might take more time than it’s worth. In that case, your best option is to start from scratch: reconcile again with the correct information or account. However, if you want to alter only several transactions, no need to start over. Here’s how to unreconcile in QuickBooks:

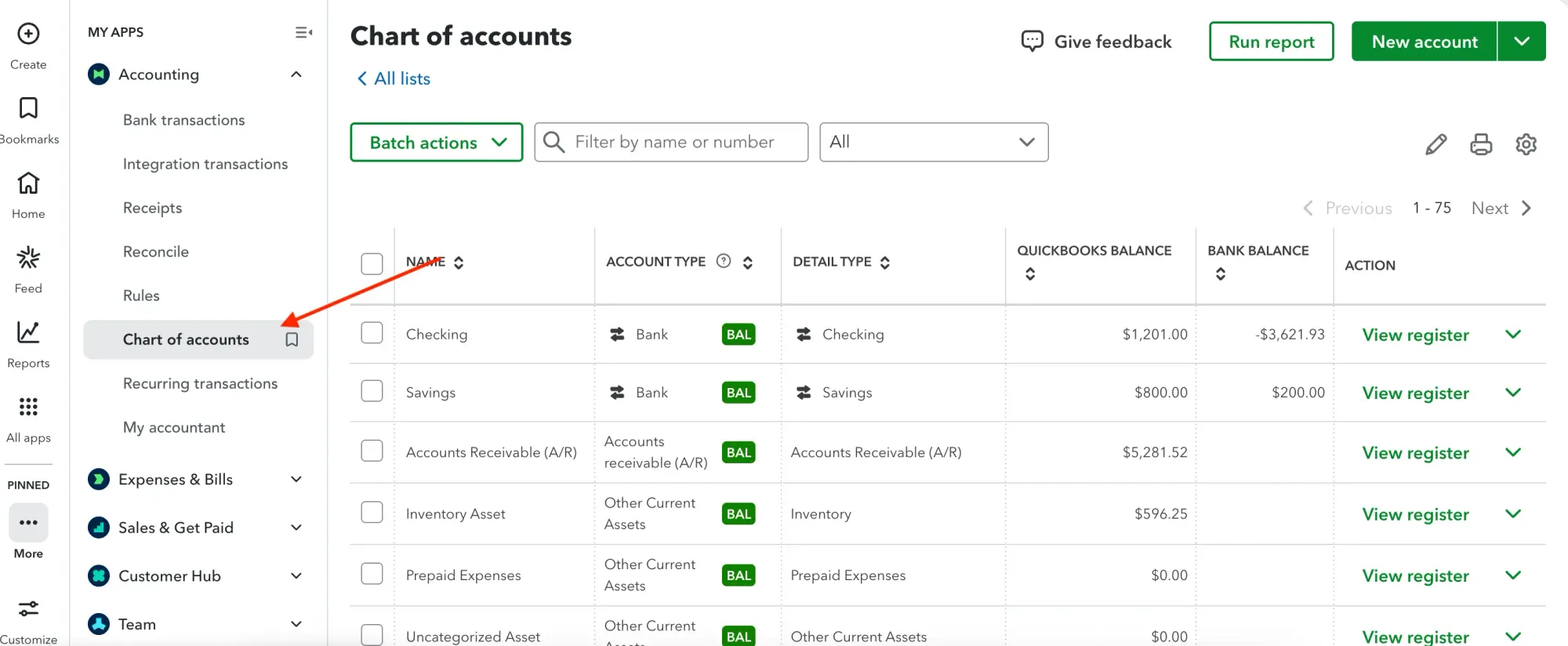

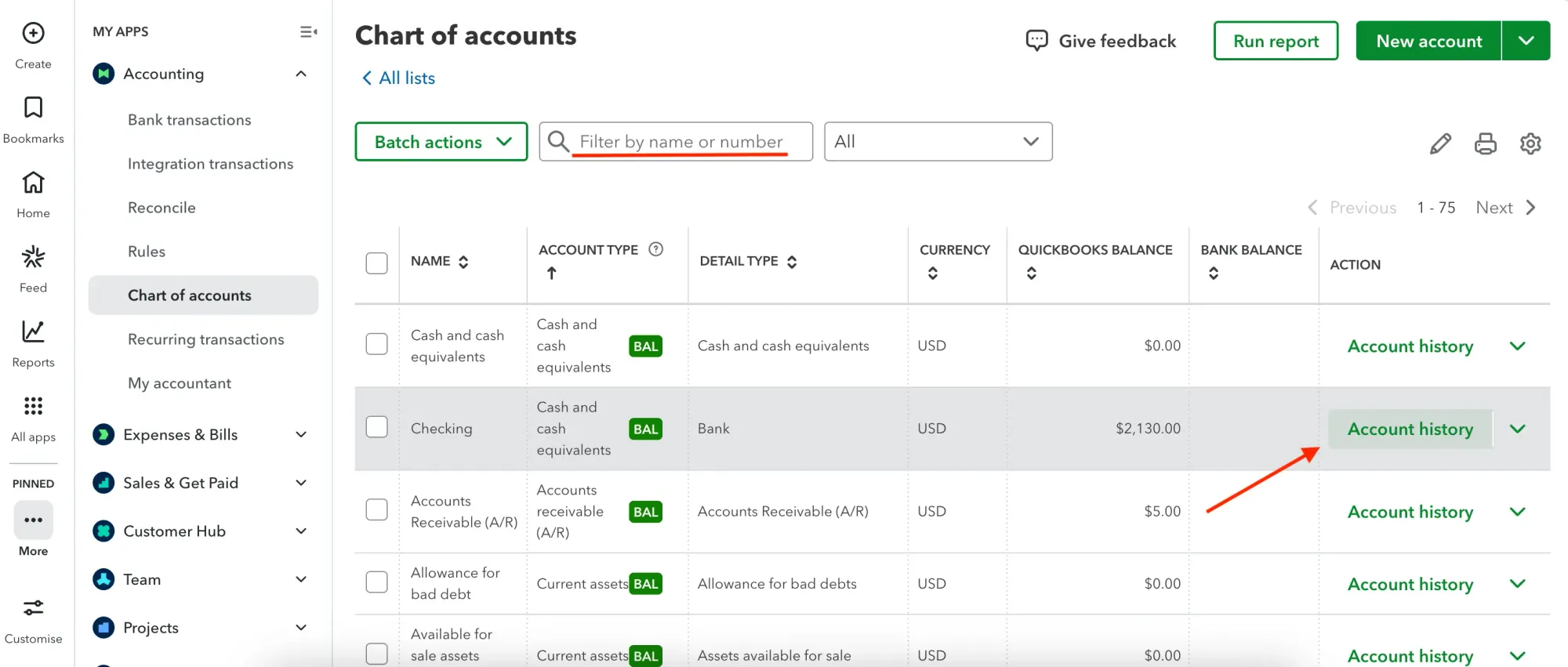

- On the main dashboard, select Accounting.

- Go to the Chart of Accounts menu in the left-hand sidebar.

- Scroll down to the account you’ve previously reconciled. For easier navigation, use Filter by name and number at the top of the page. Once you’ve found the account, select Account History under the Action column on the right. You’ll be redirected to a list of transactions for that specific account.

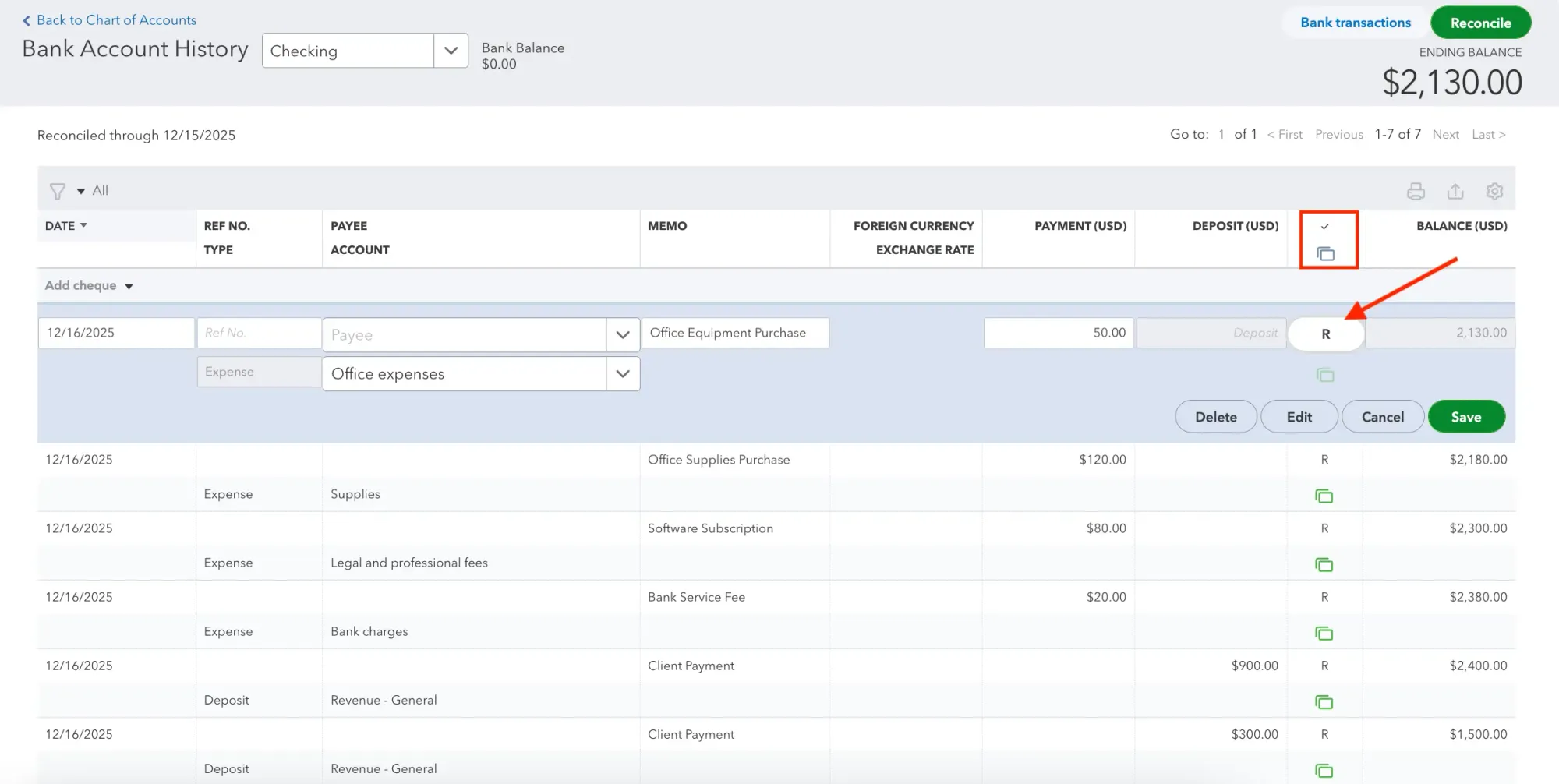

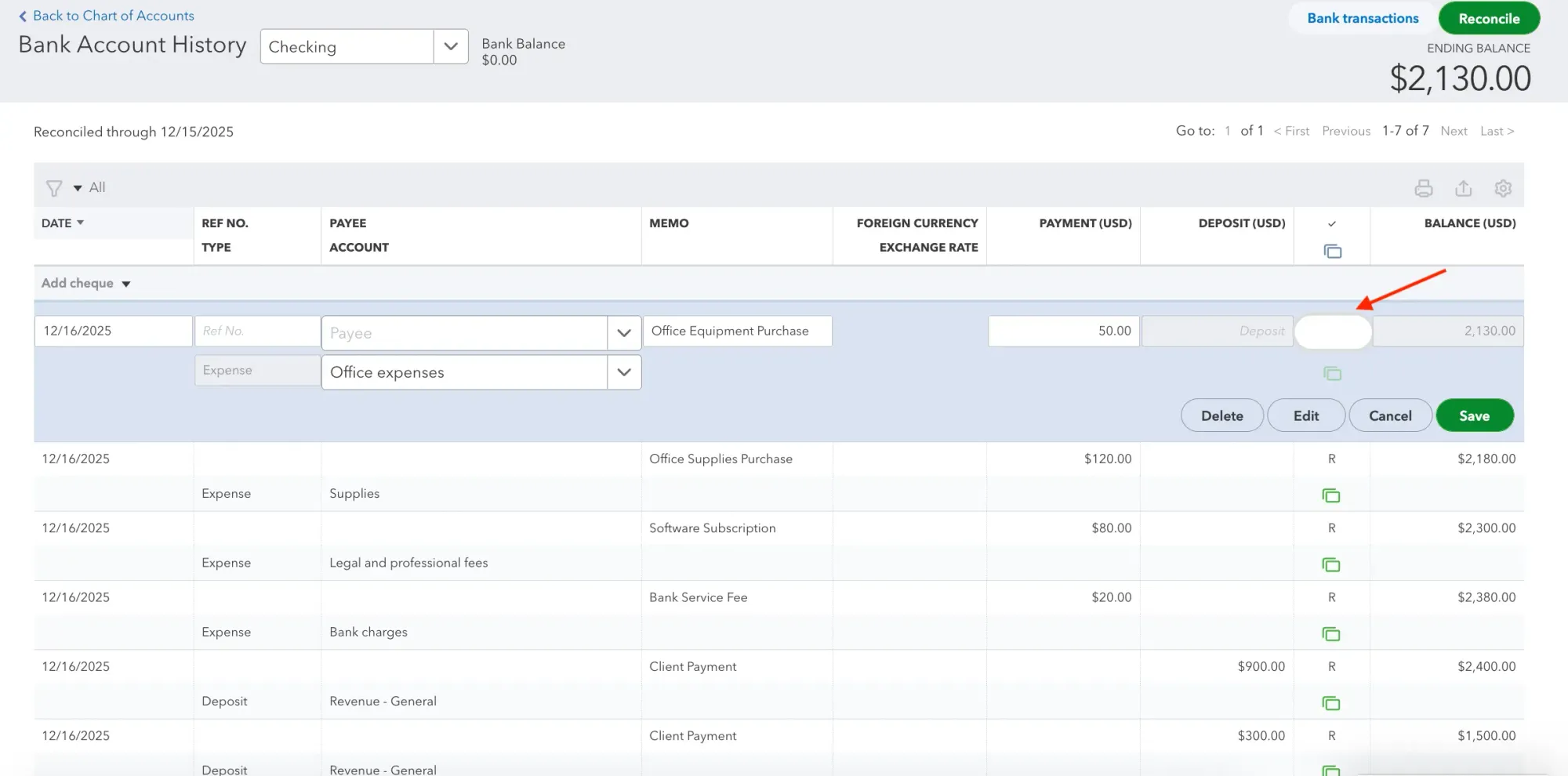

- In the Reconciliation status column (Check ✔️), you can see if the transaction is reconciled: it will be marked with an R. There are three options for the box: R, C, and blank, meaning Reconciled, Cleared, and Unreconciled accordingly. Find the transaction you want QuickBooks to undo the reconciliation of and click on it to expand.

- Click the R repeatedly until the field is blank: when the box is empty, reconciliation is undone.

- Click Save to undo the reconciliation.

As you can see, how to undo reconciliation in QuickBooks Online depends on your account setup. Keep in mind that undoing a reconciliation might put your account out of balance and lead to confusion and discrepancies the next time you try to reconcile. The system will repeatedly ask you for confirmation before unreconciling.

Everything you need to know about reconciliation in QuickBooks Online

To complete the QuickBooks Online bank reconciliation, compare your records with the bank statement for a specific period. Enter the statement’s ending balance and date, then check off transactions in QuickBooks Online that appear on the statement. When learning how to reconcile in QuickBooks, keep in mind that the system may pre-check transactions based on the balance and date you enter, but you still need to verify them against the actual bank statement. When everything matches, and the difference is zero, you can finish the reconciliation.

In QuickBooks Online, the balance shown in the system and the balance on your bank statement don’t always match because they’re based on different information and timing. Some transactions may exist in QuickBooks but haven’t cleared the bank yet, while others may appear on the statement before they’re recorded in QuickBooks. Balances can also differ if transactions were duplicated, entered with incorrect dates or amounts, or changed after a previous reconciliation.

The QuickBooks bank reconciliation summary appears at the top of the reconciliation report, which QuickBooks Online generates after you reconcile an account. The summary shows the statement opening and ending balance, the number of cleared payments and deposits, and their respective amounts. The reconciliation report goes into more detail on the reconciliation and can further be used during audits or internal reviews.

If your company uses QuickBooks Online Accountant, your accountant can undo the entire reconciliation, so you don’t have to start from scratch. If not, then you either have to unreconcile each individual transaction in the specific account menu or reconcile again. Note that with the QuickBooks undo reconciliation process for any transaction, you can set the account out of balance.

No. Reconciliation in the system is designed to be straightforward, just as with learning how to reconcile in QuickBooks Online. The process is guided, and most of the work involves reviewing and confirming transactions. That said, reconciliation mostly depends on how accurate and complete your records are before you start. If you enter transactions consistently and keep accounts up to date, reconciliation is usually quick. It becomes more time-consuming only when transactions are missing, duplicated, misdated, or edited, in which case you might need to learn how to undo reconciliation in QuickBooks Online to fix the issue properly.

Integrate QuickBooks Online with Precoro

How to reconcile in QuickBooks depends heavily on one thing: whether transactions reach QBO accurately, on time, and with the right context. Precoro’s integration with QuickBooks Online is designed to support exactly that and more.

With the integration in place, you get a perfect two-way sync between accounting and procurement. All purchasing data, from vendor details and purchase orders to the chart of accounts and invoices, updates automatically between QuickBooks Online and Precoro. And with the Bill.com support, you can create POs in Precoro, send approved invoices to QBO, and then pay them through Bill.com.

This setup doesn’t replace reconciliation in QBO (and it shouldn’t). Moreover, you still need to match transactions to your bank statements. What Precoro changes is the quality of the reconciled data.

Because invoices are already approved by the time they reach QBO, your teams are less likely to encounter missing transactions or duplicates during the reconciliation process. Transactions already have all the necessary details, including amounts, taxes, and accounts assigned.

QuickBooks Online remains the system where reconciliation happens. Precoro’s role is to make sure the data entering QuickBooks is structured, approved, and ready, so reconciliation becomes a confirmation step, not an investigation.