5 min read

How to Record Fixed Assets in QuickBooks Online

Check out this short guide to learn what is a fixed asset in QuickBooks Online, how it works, and how to record fixed assets in your QBO accounting system.

QuickBooks Online is progressive SMB’s top choice for managing payments, invoices, and expenses.

This software can become an integral part of the bookkeeping process, but things can get challenging when it comes to tracking purchases of tangible assets.

So if you’re looking for a way to record fixed assets in QBO, the Precoro team has prepared this handy guide for you.

Keep reading to find out:

- What is a Fixed Asset in QuickBooks Online?

- How to Add a Fixed Asset Item in QuickBooks?

- Order Approval and Tracking with Precoro Integration

- Frequently Asked Questions

What is a Fixed Asset in QuickBooks Online?

A fixed asset (also referred to as long-term, noncurrent, or capital asset) in QuickBooks means a physically present tangible asset that cannot quickly be converted into cash.

It's a relatively permanent resource of a company used in business operations to generate income, unlike parts of the inventory for reselling.

The cost of such assets is recorded on a balance sheet rather than an expense on the income statement, as they're expected to be used over multiple periods.

Fixed assets would be recorded as PP&E, which stands for property, plant, and equipment.

They are also subject to wear & tear (aside from the land assets), which decreases their value over time. This process is called depreciation.

That's why businesses periodically transfer a capitalized cost's portion on the balance sheet to an expense on the income statement.

Registering purchases as fixed assets can be beneficial for companies with more than one reporting period.

Examples of fixed assets include:

- Real estate

- Computers

- Office equipment

- Software

- Machinery

- Vehicles

Recording fixed assets allows you to monitor depreciation and mileage (for vehilcles), equipment's location and serial numbers, warranty information, and other essential data.

Fixed assets is a crucial but often overlooked part of tracking your finances, managing expenses, and efficiently filing tax reports by the end of the reporting period.

Types of fixed assets you can manually add in QuickBooks

- Buildings: facilities owned by a company;

- Furniture & fixtures: chairs, tables, filing cabinets, cubicle walls, etc;

- Improvements: money spent on labor and materials used to improve your company property;

- Land: purchased cost of land. Also, it is regarded as costs spent on land improvements;

- Long-term office equipment: equipment which has a useful life of greater than one year;

- Tools, machinery, and equipment: equipment for work outside the office which has a useful life of greater than one year.

How to Add a Fixed Asset Item in QuickBooks?

- Open the Fixed Asset Item List

- Add a New Item

- Select Account

- Input Purchase Information

- Fill in the Asset Information

- Save and Close

On the menu bar, click List > Fixed Asset Item List.

Click the Item button in the lower-left corner of the list. In the pop-up menu, select New. Next, fill in the Asset Name/Number field.

Then, pick the fixed asset account you'll use to track the asset's value from the Asset Account drop-down.

Don't see the right fixed asset account? Just create it on the go by entering a new account name and pressing Enter.

In the Purchase Information section, add purchase terms and specify if the item is new or used with a click of a button.

Pick the date of the asset's purchase in the Date field input. Optionally, you can also identify the vendor.

In the Asset Information section, describe the item using the Asset Description box or the Notes section.

Here you can specify the fixed asset location, the purchase order (PO) and serial number, and the warranty expiration date.

Click the OK button below to save and close the New Item window. If you want to add another item click Next.

How to Create a Fixed Asset Account

You could also start with creating an asset account. QBO will automatically track the current value and depreciation of your asset when creating the account.

To do so, follow these steps:

- Go to Settings, then click Chart of Accounts.

- Choose New.

- From the Account Type dropdown, pick Fixed Assets or Other Assets.

- From the Detail Type dropdown, click the option that best suits your asset.

- Input the account's name, then tick the Track depreciation of this asset checkbox.

- Enter the starting value of your asset in the Original cost field and the as of date. Leace this blank if recording the loan.

- When you're finished, click Save and Close.

How to Record a Fixed Asset Purchase in QuickBooks

To make sure you've recorded the fixed asset item purchase in your books, follow the instructions below:

- Go to Banking > Write Checks.

- Then, select the Items tab.

- Select an empty field under the Item column and click the drop-down menu.

- Scroll down the item list and select the fixed asset item(s) for this purchase.

- Now, QuickBooks will automatically specify the purchase amount in the check.

Note that you can pick more than one fixed asset item for the same transaction.

Something you need to know about creating fixed assets in QuickBooks Online

QuickBooks allows tracking depreciation or amortization (depending on asset type) of a specific asset.

You can also use general tracking for all assets (intangible/physical).

Use Accumulated Amortization to track how much of the tangible assets you write off over their useful life. This type means physical assets that you can touch.

Examples: buildings, equipment, vehicles, car equipment, land, office furniture.

Use Accumulated Depreciation for tracking the distribution of the cost of an intangible asset over its useful life. This type means not physical assets.

Examples: organizational costs, patents, trademarks, franchise agreements, bond issue cost.

Order Approval and Tracking with Precoro Integration

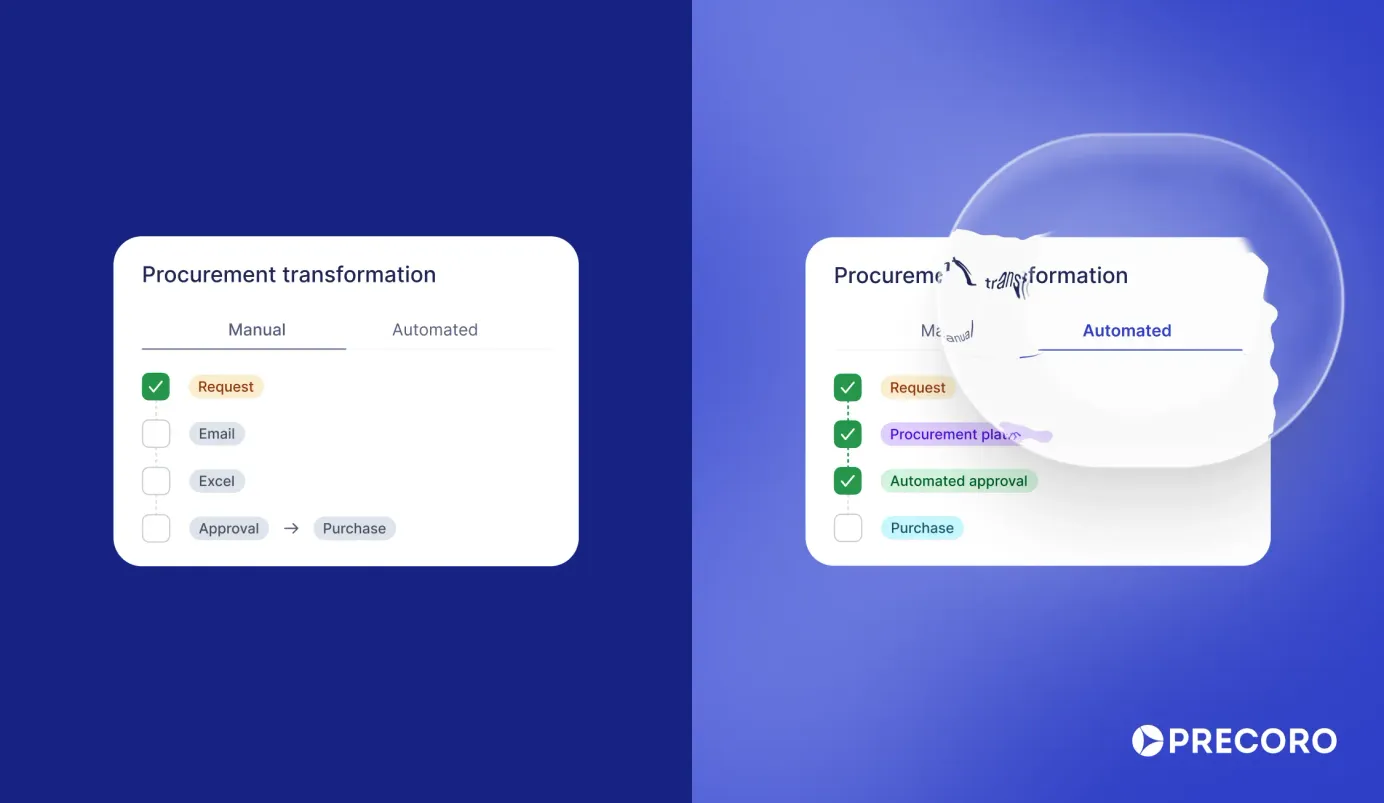

Fixed assets are usually expensive, so those types of purchases might require multi-level approvals.

Precoro's approval workflow can help you flawlessly manage purchases of this type and quickly approve them via email or from your mobile phone.

You can enhance the general procurement process by tracking your order from request to fulfillment with Precoro.

It's possible to set up categories for any goods, including tangible and intangible assets.

Manage orders, approvals, and expenses in Precoro and automatically sync all the data with QuickBooks for accounting with our direct integration to QBO.

Got questions about the Precoro + QBO integration? Contact us to find out more.

Here are some other QuickBooks guides you may find useful:

Frequently Asked Questions

A fixed asset refers to a physical asset that a business owns and uses to generate income, such as buildings, machinery, vehicles, and furniture.

To calculate the fixed asset turnover ratio, divide the net sales by the average fixed assets. Net sales represents the total revenue generated by the company, while average fixed assets are calculated by adding the beginning and ending fixed asset balances and dividing by two.

The ideal ratio may vary by industry, but generally, a higher ratio is preferred as it suggests higher efficiency in asset utilization.