13 min read

Financial Audit: Definition, Types, and Best Practices

Financial audit coming up? This guide explains what it is, how it works, and shares tips to prepare and improve your results.

Annual audits have a reputation for being long, stressful, and paperwork-heavy. But the reality is they sit right at the crossroads of trust and accountability. The global audit services market is massive, worth $238 billion in 2024 and is projected to reach $309,94 billion by 2029. That scale alone shows how central financial audits are to business health worldwide.

It’s not just about compliance—it’s about reputation. In the S&P 500, companies paid an average of $343 in audit fees per $1 million of revenue in 2022, a 7% drop from the year before. Costs are shifting, but expectations keep climbing. And the pressure is real: regulators found that nearly 46% of audits inspected in 2023 had deficiencies, up from 40% the year before.

Behind those numbers are familiar pain points: receipts that don’t match purchase orders, delayed approvals, scattered records, and manual reconciliations that stretch audits into weeks. These issues don’t just slow teams down; they increase risk and weaken trust with stakeholders.

To help break it down further, we’ve prepared a guide on the definition, types of financial audits, and best practices to help teams stay ahead—efficiently, accurately, and with full confidence in their numbers.

Read on to find out:

What is a financial audit?

4 key stages of a financial audit

What is reviewed under a financial audit?

Key documents reviewed during audits

Types of financial audits

How to prepare for a financial audit: Checklist

Most common audit findings and how to handle them

Benefits of financial audits

Challenges of financial audits

Frequently asked questions about the financial audit

What is a financial audit?

A financial audit is a detailed review of a company’s financial statements and accounts to confirm they're accurate and complete. During the financial audit process, a neutral external auditor reviews your financial records and supporting documents to ensure everything aligns with and follows the appropriate accounting standards. Once they've wrapped up, they issue their official opinion—ideally confirming your historical data is clean, accurate, and worthy of guiding smart decisions.

The main goal? To give stakeholders, investors, lenders, regulators, and your management team confidence that your financial statements actually represent what's happening in your company. Think of it as a stamp of approval that says, "Yes, these numbers are legit."

4 key stages of a financial audit

While the exact financial audit process can vary, a financial audit typically unfolds in four stages. It begins with planning, where the company engages a Certified Public Accountant (CPA) or Certified Internal Auditor (CIA) to define the audit’s scope, timeline, and procedures. The next stage is gathering financial information, during which auditors collect the necessary statements, ledgers, and supporting documents to assess the accuracy of financial reporting.

Once the information is assembled, the testing phase begins. Here, auditors review transactions, verify account balances, and evaluate the effectiveness of internal controls to ensure reliability. The financial audit process concludes with reporting, where the auditor issues a formal report that presents their opinion on the company’s financial integrity and the strength of its controls.

What is reviewed under a financial audit?

Here’s an outline of what auditors examine as part of their review:

- Financial transactions and account balances: Auditors take a close look at all the transactions made during the accounting period. They also double-check the account balances to ensure everything has been recorded correctly.

- Internal documents and processes: Auditors review internal controls, accounting procedures, and supporting records. As part of the audit financial process, they test how reliable these systems are in practice.

- IRS documents: Part of the audit involves ensuring the company complies with tax rules. That means reviewing tax returns, exemptions, and other IRS-related documents.

- Financial commitments: Auditors also take stock of the company’s obligations—such as loans, employee benefits, or lease agreements—to get a full picture of what it owes.

- Financial statements: Finally, auditors review past financial statements to see where the company stands financially. All of this ties back to checking whether the reporting is accurate and reliable. This step is the core of what a financial audit is.

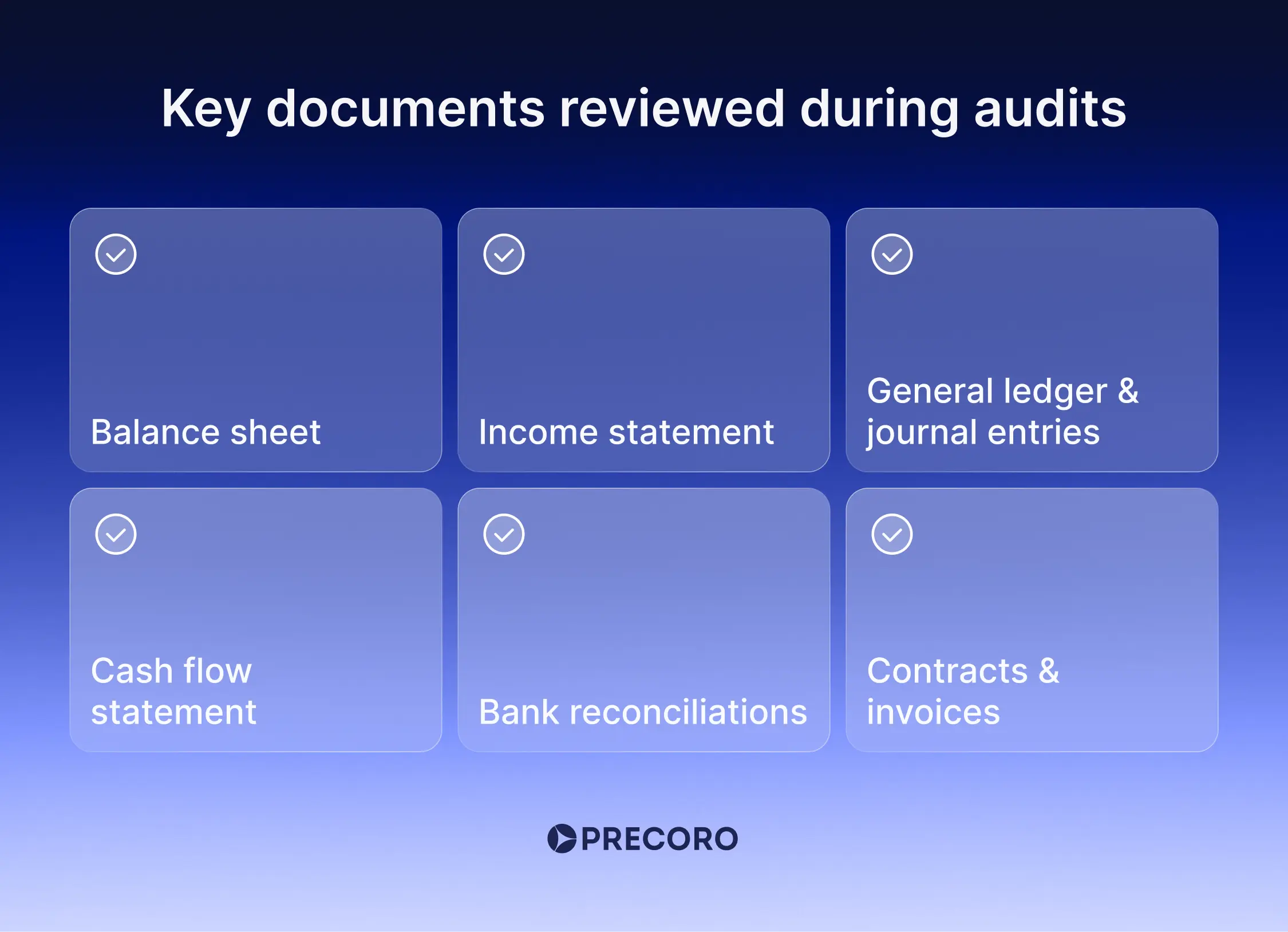

Key documents reviewed during audits

To issue their opinion, auditors review a broad set of financial documents.

Balance sheet

Shows what the company owns and what it owes at a specific point in time. Auditors use it to confirm the value of assets, debts, and equity balances, which is a fundamental step in financial audit procedures.

Income statement

Also known as the profit and loss statement, it summarizes earnings and expenses over a set period. Auditors review it to see if income is recorded correctly and costs are matched properly.

Cash flow statement

Tracks the movement of cash in and out of the business. Auditors check it to understand how money is being generated and spent.

General ledger & journal entries

These detailed accounting records support all figures in the financial statements. Auditors trace transactions here to confirm accuracy, timing, and classification, which strengthens the reliability of the financial statement audit.

Bank reconciliations

Reports that show how the company’s bank balances line up with its accounting records. They help auditors spot timing gaps or missing entries.

Contracts & invoices

Supporting documents that prove revenue and expenses come from real agreements. Auditors compare these against the books to make sure the terms match what’s been recorded.

Types of financial audits

There are three key types of financial audits—IRS audits, internal audits, and external audits. Read on to see how each one strengthens transparency and compliance.

External audit

An external audit is done by an outside firm or a certified public accountant. It’s usually required by investors, banks, or regulators to ensure the company’s financial statements are accurate.

Internal audit

An internal financial audit is when a company’s staff or audit team reviews operations to assess controls, risk management, and processes. It helps spot weaknesses early on, so management can address them before they become major issues.

IRS or government audit

This type of financial statement audit is conducted by government agencies, such as the IRS in the U.S. The goal is to verify that the company has adhered to all tax rules and accurately reported its income. If not, the business could end up paying more in taxes or penalties.

How to prepare for a financial audit: Checklist

Audits don’t have to be chaotic. With upfront planning and organized preparation, you can make the audit process smooth and routine. Use this checklist to guide you step-by-step.

Pre-audit planning (4-6 weeks before)

The first stage is all about preparation. Here’s what to focus on several weeks ahead of the audit.

Administrative setup

Confirm audit dates and scope with auditors. Designate a primary contact person, prepare a workspace with adequate facilities, and make sure to notify relevant staff about the audit schedule.

Document organization

Gather and organize all financial records by category. Create an index of document locations and make copies of critical documents as backups.

Core financial statements include:

- Trial balance as of audit date

- General ledger for the audit period

- Monthly financial statements

- Prior year audited statements

Cash and banking

Compile bank statements with reconciliations, cash journals, and petty cash records. Be sure to document any unusual transactions or bank transfers so they can be easily explained during a finance audit.

Revenue and expenses

Organize sales invoices with contracts, A/R aging reports, and revenue recognition policies. In addition, collect vendor invoices with purchase orders, A/P aging, expense reports, and payroll records.

Tax and regulatory

Collect and organize:

- Tax returns and correspondence

- Regulatory filings and certificates

- Board meeting minutes

Legal documentation

Assemble major contracts, legal correspondence, insurance policies, and loan agreements.

Policies and analysis

Prepare your accounting policies manual and internal control documentation. Complete reconciliations for major accounts and analyze significant variances. It’s important to document unusual transactions and prepare a management representation letter to support transparency in the finance audit process.

Final preparation (1-2 weeks before)

With the groundwork complete, it’s time to shift into the final steps:

Quality review

Review all materials for accuracy and completeness. Test mathematical calculations and verify cross-references.

Communication

Define who does what during the audit, get your team ready for the questions auditors might ask, and make sure managers are available with schedules and setup finalized.

Contingency planning

Identify potential issues and prepare explanations. Maintain contact information for vendors, banks, and legal counsel.

Note!

Regular internal reviews help identify problems before the formal process starts, ultimately ensuring a smoother annual audit experience.

Most common audit findings and how to handle them

Financial statement audits can be eye-opening, but they don’t have to be painful. Understanding where problems usually arise—and preparing for them in advance—makes financial audit procedures smoother and far less stressful.

Missing documentation

Every transaction needs proof. Missing receipts, invoices, or contracts weaken the audit trail and can undermine accuracy. Set up a centralized document management system to ensure records are clearly organized. This simple step is a cornerstone of good financial audit procedures that keeps everything easy to find when you need it.

Inaccurate financials

When expenses end up in the wrong category or entries hit the wrong accounts, both the income statement and balance sheet get thrown off. That kind of inaccuracy leads to compliance issues and misguided decisions from leadership. At its core, the financial audit meaning comes down to checking for exactly these kinds of errors—verifying that the numbers reflect reality. Strong accounting policies, regular staff training, and automated checks reduce the chances of mistakes and improve reliability.

Unreconciled entries

If your ledger and bank account don’t match, it signals potential issues. These mismatches may be caused by timing delays, omissions, or even typos. Performing regular reconciliations and investigating discrepancies ensures that your books remain accurate, as required by good financial audit procedures, rather than being patched together.

Lack of internal controls

When one person takes full control—creates payments, approves them, and records transactions—mistakes can slip through, and fraud may go undetected. This setup goes directly against the financial audit meaning, which centers on transparency, accuracy, and accountability. Dual control solves this by involving at least two people in each transaction. Even in small teams, duty rotation, approval checklists, and software with built-in controls reduce risk and keep financial records dependable.

Inadequate inventory controls

If you don’t know exactly what you have in stock—or how much it’s worth—audits will quickly uncover the problem. Missing, overstated, or poorly tracked inventory can throw off your numbers. Regular counts, solid recordkeeping, and clear tracking of how goods move in and out of your business make a huge difference. That’s why an inventory management tool also simplifies the financial audit process and keeps your data clean.

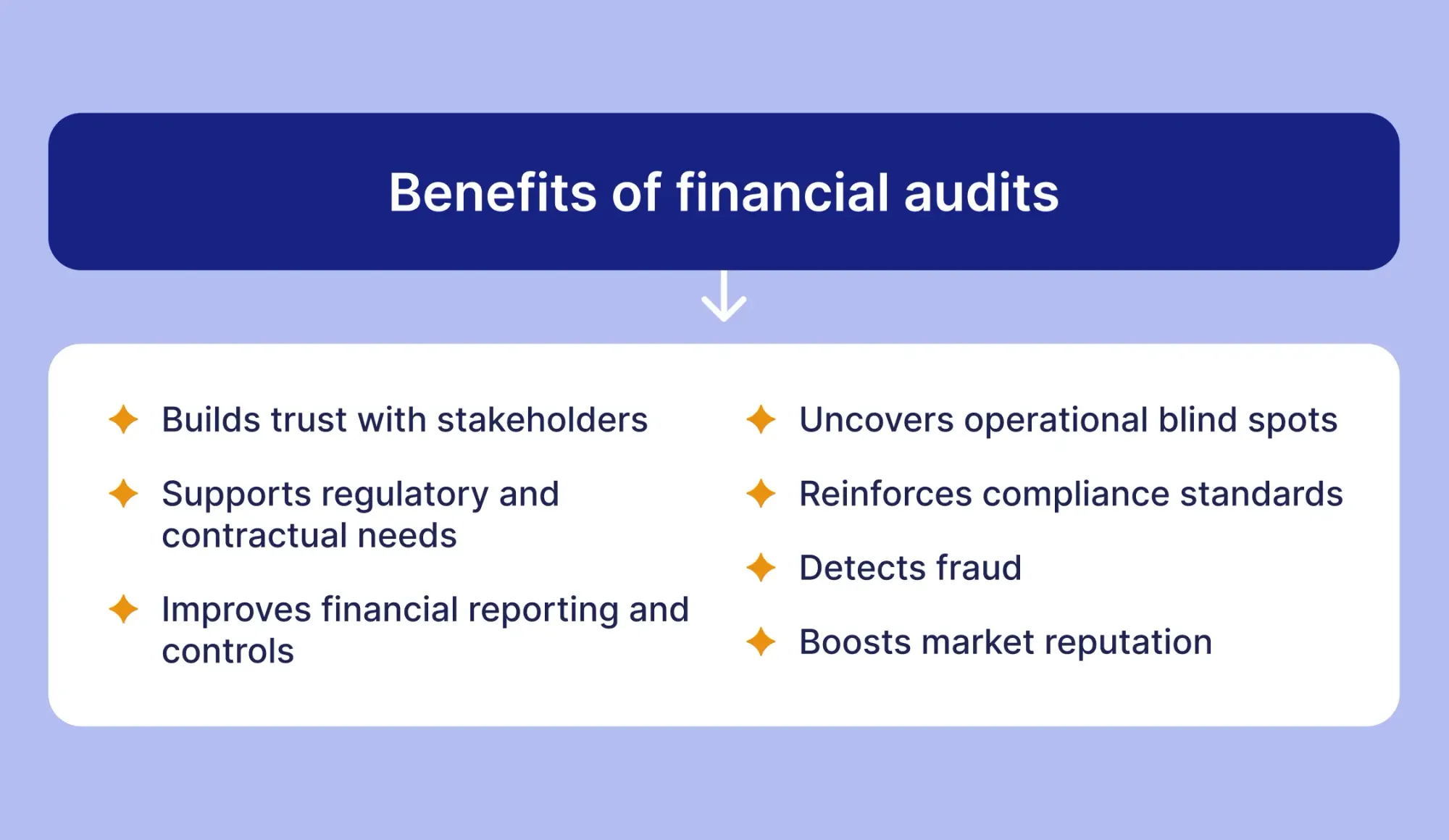

Benefits of financial audits

While often seen as a requirement, audits are also an opportunity to drive improvements. See how financial auditing benefits companies.

Builds trust with stakeholders.

When investors, banks, or board members see results backed by an independent financial auditing, they place greater trust in the numbers. That trust often translates into easier access to funding, credit, and strategic support.

Supports regulatory and contractual needs.

Many regulators, insurers, and lenders insist on audited reports. A positive audit record helps clear approvals faster and avoid unnecessary hold-ups in compliance checks.

Improves financial reporting and controls.

Financial auditing sharpens the quality of financial records. Errors get corrected, reporting gaps close, and internal controls become stronger, laying the groundwork for more reliable data in the future.

Uncovers operational blind spots.

Through close review, auditors may reveal hidden costs, slow processes, or inefficiencies. These findings can prompt business improvements.

Reinforces compliance standards.

Financial auditing helps ensure that a company complies with accounting standards (like GAAP or IFRS) and industry regulations. Non-compliance can lead to penalties and legal issues, so an audit helps avoid these risks.

Detects fraud.

An audit can detect internal fraud or unauthorized fund transfers. Regular third-party reviews reduce the likelihood of such risks by holding employees accountable.

Boosts market reputation.

For a public company, audited statements signal transparency and reliability. They reassure investors and increase their willingness to commit capital.

Challenges of financial audits

While financial audits are highly valuable, they do come with a few challenges. They often demand considerable time and resources, as teams need to prepare detailed documentation and work closely with financial auditors. Depending on the company’s size and complexity, audits can also be expensive, not only due to auditor fees but also because of process improvements that may follow.

Additionally, the process can sometimes disrupt day-to-day operations, especially when extensive checks of records and internal controls are required. And finally, it’s important to remember that audits provide reasonable assurance, not absolute certainty—some risks may still fall outside their scope.

Frequently asked questions about the financial audit

For public companies, yes, an external audit is mandatory since they need to meet accounting standards. Internal financial audits, though, aren’t required by law, but most companies still run them regularly to verify their financial records and prepare for the external audit.

It depends on the type of audit. Internal financial audits can happen as often as the company wants—monthly, quarterly, or yearly. External audits, though, are typically done once a year, usually at the end of the financial year.

The timeline varies. For smaller companies, it may take a few weeks. For bigger ones, it could stretch to a few months. Typically, most audits take about three months from start to finish.

During an audit, a financial auditor examines a company’s records—such as the balance sheet, income statement, and cash flow statement—to ensure they are accurate and comply with accounting standards. The process includes reviewing internal controls, verifying transactions, and testing financial data to detect errors or fraud. Ultimately, the financial auditor’s role is to determine whether the financial statements fairly represent the company’s financial condition and to issue an opinion on their reliability.

No, an audit report isn’t one-size-fits-all. It changes with each company’s situation—the standards they follow, the documentation they provide, and any red flags the auditor identifies.

No. An audit only provides “reasonable assurance,” which means a strong level of confidence, but not a guarantee, that the financial statements are free from significant errors or fraud.

Precoro: your shortcut to stress-free audits

Audits shouldn’t feel like uphill battles. In the concept of what a financial audit is, think about what auditors usually need. In most cases, they look for:

- Clear documentation.

- Traceable approval flows.

- Consistency across reports.

- Quick access to supporting materials.

Precoro brings all of this together in one place. Every purchase order, invoice, and contract is stored with a complete audit trail. No chasing receipts, no missing links, just verifiable records in a few clicks.

Beyond compliance, Precoro protects margins and ensures only approved invoices get paid, preventing duplicates, fraud, maverick and tail spend. The transparency that comes with this setup of financial internal audit is huge. Consolidated demand secures better discounts, while automation reduces manual work, lowers reliance on ERP licenses, and removes the need for extra headcount. Real-time forecasting and visibility also bring clarity to cash flow and prevent late budget surprises.

Ultimately, financial audits drag on because data is scattered; Precoro makes them faster, more reliable, and far less costly. And the benefits last well beyond audit season—driving efficiency, strengthening supplier strategies, and building long-term financial resilience.

To show your stakeholders that you are serious about transparency and efficiency, calculate your savings with AP automation. With Precoro, that mindset of sustainable financial health goes a long way toward building credibility and resilience.

Ready to take the pain out of audits?

Cut audit prep from weeks to minutes. Precoro automates invoice capture, connects every transaction to the right PO and receipt, and syncs it all with your ERP. The outcome: cleaner books, faster audits, and less time wasted on manual checks. Ready to save time and cost on your next audit?