13 min read

Spend Under Management in Procurement: An Essential Guide

Explore how spend under management helps reduce costs, prevent fraud, and unlock savings. A practical guide for CFOs and procurement leaders.

When too much spend slips past contracts or approved processes, costs go up, bargaining power with suppliers gets weaker, and important data disappears. Recent benchmarks show the gap: most organizations manage around 70% of their spend, which is better than before, but still far from world-class. The top procurement teams manage well over 90%, while less mature ones stay closer to 60%. That difference shows just how effective procurement can be when it’s done right.

The opportunity is clear. Focusing on spend under management procurement means fewer off-contract purchases, stronger compliance, better forecasting, and more long-term value from suppliers. That’s what this guide is about—what SUM really means, why it matters, and how to bring more spend under control.

Find out more about:

What is spend under management?

What are the spend under management KPIs?

How to calculate spend under management

Example: Calculating Spend Under Management (SUM)

Spend management vs. expense management: What’s the difference?

Total spend vs. spend under management: What’s the difference?

What are the challenges of spend under management?

What are the benefits of spend under management in procurement?

How to increase spend under management

How to achieve spend under management in your organization

Frequently asked questions about spend under management

What is spend under management?

Spend Under Management (SUM) or spend under contract is the percentage of an organization’s total spend that is actively managed through procurement processes, approved suppliers, and contracts in line with category management principles.

SUM shows how well a business controls and optimizes its spend. It cuts out redundancies, improves efficiency, and drives greater value and savings. In contrast, unmanaged or maverick spend happens outside approved systems, weakens oversight, and raises costs.

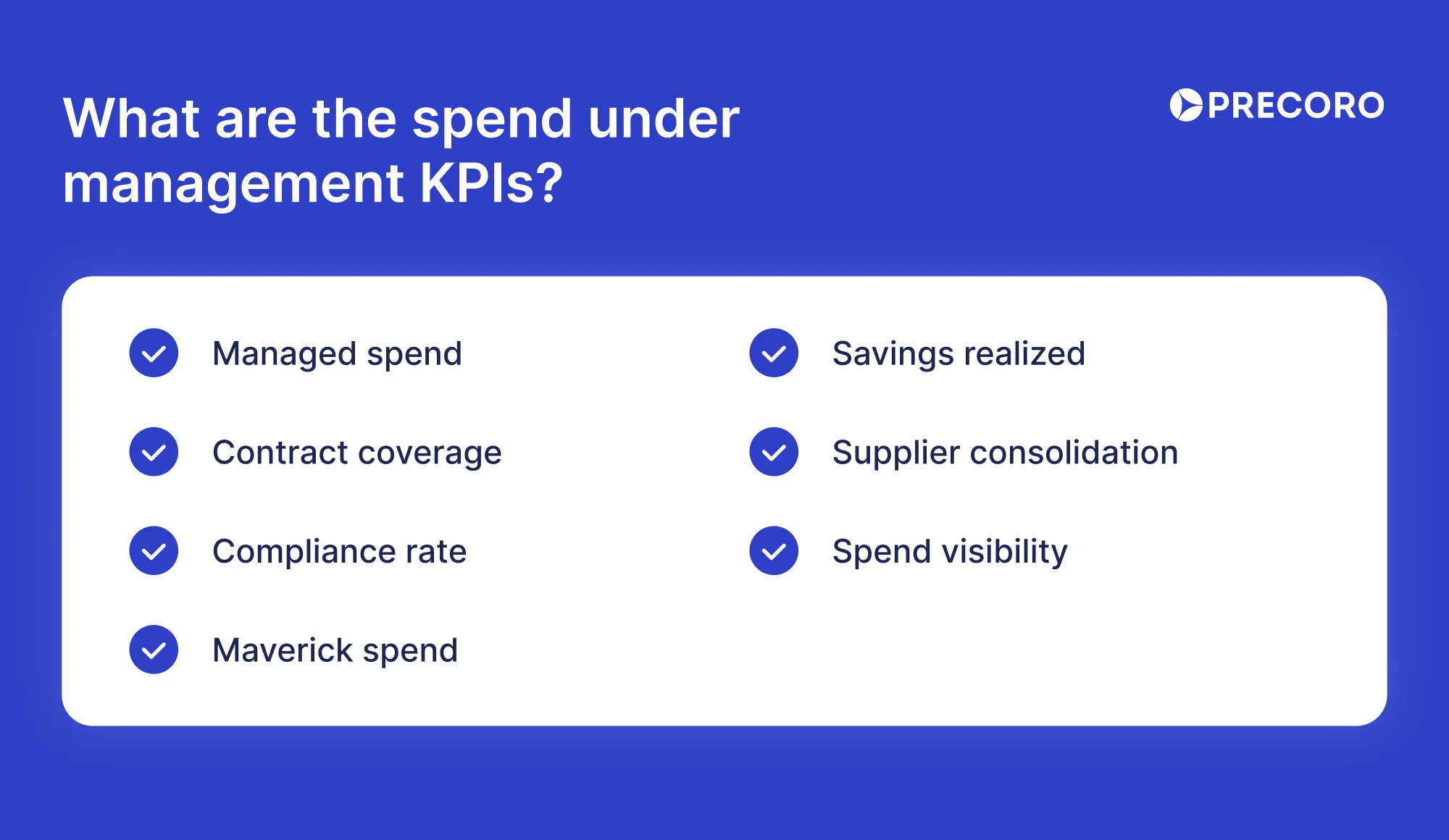

What are the spend under management KPIs?

Spend under management KPIs show how effectively an organization controls and optimizes its purchasing. The most common ones are:

- Managed spend %: Share of total spend covered by procurement or contracts. It indicates the reach of procurement control.

- Contract coverage: % of spend categories or suppliers under valid agreements. Higher contract coverage ensures pricing, terms, and compliance controls are applied.

- Compliance rate: Percentage of purchases complying with procurement policies and contract terms.

- Maverick spend %: Portion of spend happening outside procurement oversight. Lower maverick spend signals better enforcement and process adherence.

- Savings realized: Cost reductions achieved compared to baseline or unmanaged spend. This KPI includes negotiated discounts, process efficiencies, and supplier consolidation.

- Supplier consolidation: Degree of supplier consolidation.

- Spend visibility: The extent to which spend data is complete, accurate, and available in real time.

How to calculate spend under management

There are three main steps to work out the SUM:

First, gather your data. Pull your information on both total spend and managed spend. Look at your ERP, procurement tools, accounts payable, contract systems, and expense reports. At the same time, decide what you’ll count as managed spend—for most companies, that’s purchases through approved suppliers, spend that runs through procurement, and anything actively tracked and optimized.

Second, make sure the data is accurate. Cross-check numbers across systems, run internal audits, and fix any discrepancies between finance and procurement. Don’t forget smaller categories, such as subscriptions or low-value repeat purchases—those often get overlooked but still matter.

Third, apply the formula. Once you’ve got reliable data, the calculation is straightforward:

SUM = (Managed spend ÷ Total spend) x 100

Some businesses tweak this by excluding unmanageable costs, such as taxes, or by calculating the SUM for specific departments or projects to get more detail.

Example: Calculating Spend Under Management (SUM)

Step 1. Define total spend

Suppose a company’s total annual spend is $120 million.This amount includes all direct, indirect, and operational costs.

Step 2. Identify addressable spend

Not all costs can be managed by procurement (e.g., salaries, taxes, statutory fees, intercompany transfers). Let’s say $60 million is addressable spend.

Step 3. Determine managed spend

From that $60 million, identify the portion that goes through procurement processes, contracts, or approved suppliers:

- $20M through approved contracts for raw materials

- $15M through preferred IT vendors

- $7M on marketing services with negotiated agreements

- $3M on travel suppliers under framework contracts

Total managed spend = $45 million

Step 4. Apply the formula

SUM = (Managed spend ÷ Addressable spend)×100=(45M ÷ 60M)×100=75%

Step 5. The results interpretation

This company has 75% of its addressable spend under management.

- The remaining 25% ($15M) is unmanaged spend, likely consisting of maverick or ad-hoc purchases.

- Procurement can focus on that $15M to raise the Spend Under Management, reduce risks, and unlock additional savings.

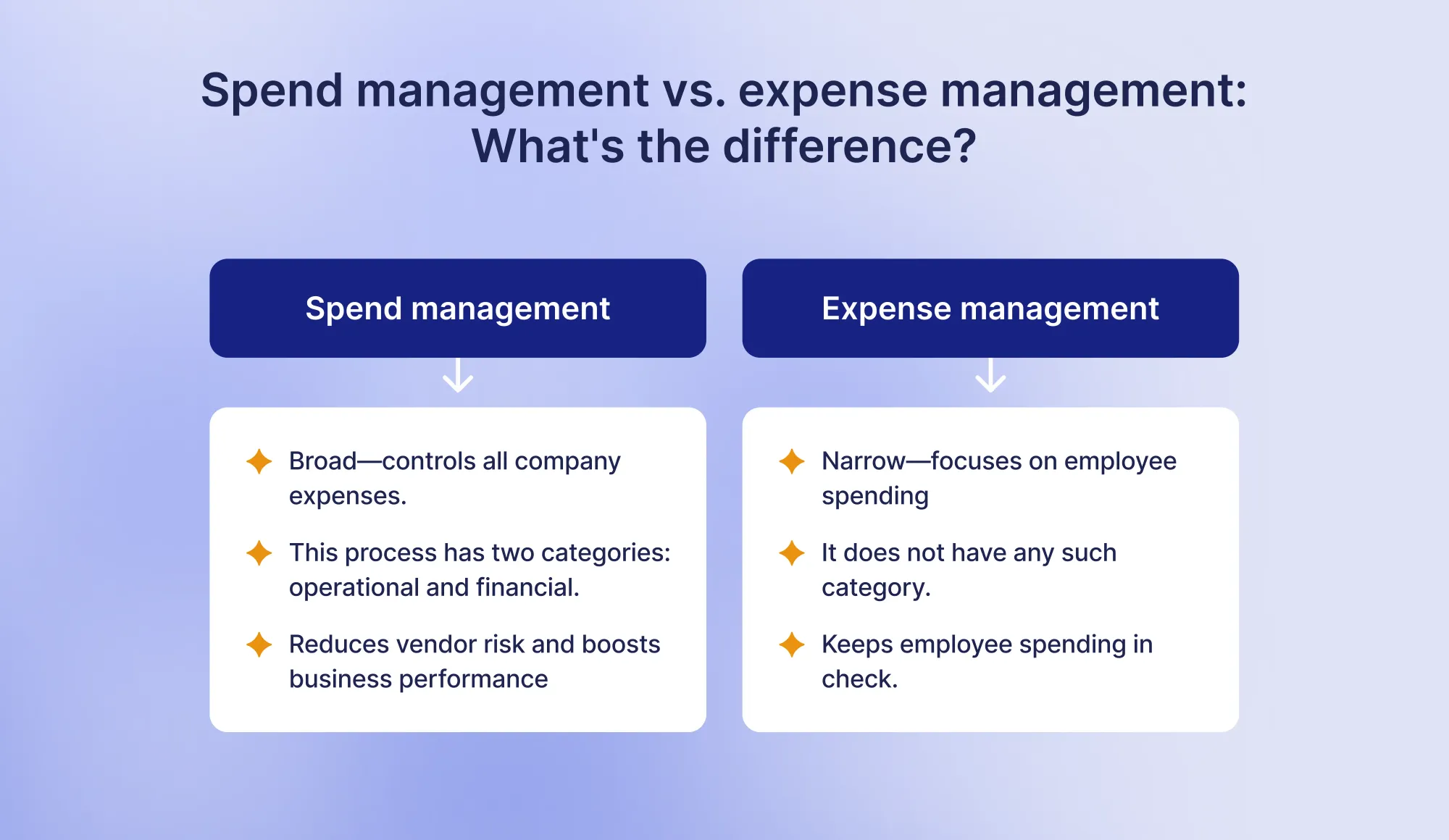

Spend management vs. expense management: What’s the difference?

Spend management and expense management often get mixed up, but they serve different purposes. Let’s look at what sets them apart.

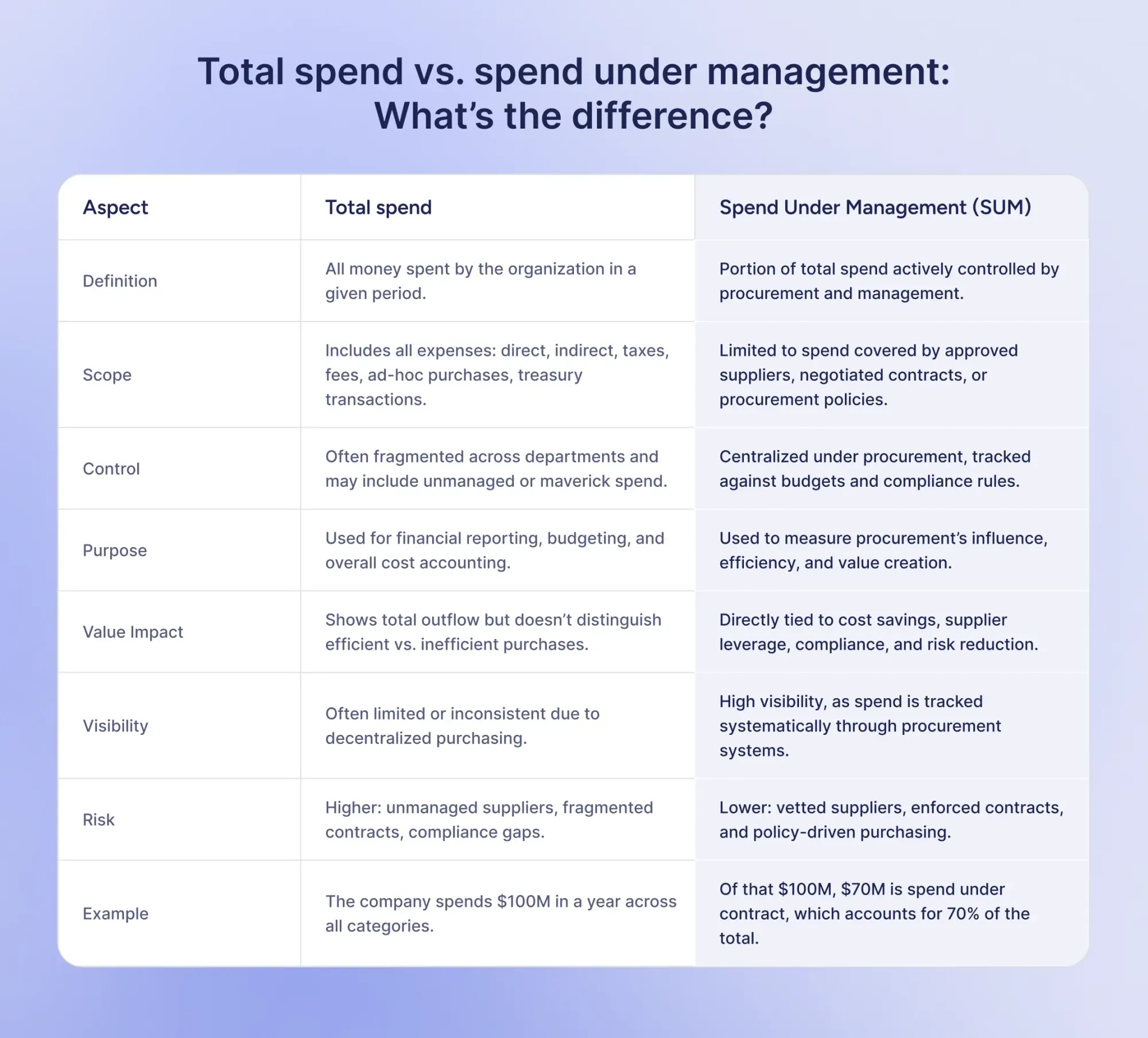

Total spend vs. spend under management: What’s the difference?

Total spend is everything the organization spends. Spend under management is the part of that total that is strategically managed, tracked, and optimized. The difference is explained in detail below:

What are the challenges of spend under management?

Every business runs differently, and that means the challenges with spend under management can vary. Still, most organizations run into a few common issues.

Lack of clear data

You can’t understand your spend under management unless you first understand your overall spending. Too often, this information lives in different systems, and pulling it together becomes a messy, error-prone process.

The solution is to strengthen your data infrastructure. That could mean using your current tools better or adopting new ones, but either way, you need full visibility into what’s going through procurement before you can improve your SUM.

Resistance to change

Getting more spend under management usually means changing established processes. Sometimes, the existing process is too easy—with little oversight, employees may freely spend on things outside procurement. Adding more checkpoints helps control spending, but it can also slow things down and frustrate staff.

To reduce pushback, the process should be designed with employees in mind. Tools like procurement cards or virtual cards let you keep control without piling on too much extra work.

No evaluation of current suppliers

Suppliers play a bigger role in spend under management than many realize. Their systems and practices affect how visible and reliable your spend data is. For instance, if a supplier only takes checks or has long processing times, your data may be incomplete just when you need it.

That’s why supplier evaluations should go beyond cost and cover how they impact your overall operations. If a supplier leaves you with gaps in your spend data, it might be time to rethink the relationship.

What are the benefits of spend under management in procurement?

More SUM means better savings, stronger compliance, and improved efficiency. Companies that expand SUM see measurable impact today and long-term market strength tomorrow. Here’s a breakdown of the benefits.

Increased cost savings

With purchase consolidation in hand, you can unlock volume discounts, standardize processes, and reduce maverick spend or duplicate orders. Better spend visibility lets procurement negotiate stronger deals and ensure that agreed-upon rates and contract conditions are adhered to, while driving compliance.

For example, Delta centralized its indirect spend processes and used source-to-pay tools to drive compliance and visibility. One notable result: by consolidating hotel suppliers, Delta saved $11 million on hotel room costs in just three months.

Improved supplier relationships

As spend under management increases, companies naturally concentrate their purchasing with a core group of suppliers. This focused approach transforms relationships from transactional to strategic. With more spend flowing through managed channels, suppliers gain predictable business volumes, which encourages them to invest more in the partnership.

The benefits are two-sided:

- Preferential treatment and better service levels as suppliers prioritize customers with larger, consistent contracts.

- Higher compliance and trust, since spend is transparent and aligned with agreed terms.

- Innovation sharing, where suppliers are more willing to co-develop solutions or offer early access to new products.

For example, NWLPS rolled out a Supplier Relationship Management (SRM) framework to shift from purely transactional supplier interactions to more strategic, collaborative partnerships.

Over time, as more spend flowed through managed contracts under that SRM approach, NWLPS was able to deepen relationships with key suppliers, foster innovation, improve service levels, and create mutual value.

Enhanced risk management

When more spend is under management, companies gain better control over their supply chains. It means suppliers are vetted carefully, their performance is tracked, and audits happen regularly. This level of control helps spot problems early—before they turn into serious financial, operational, or compliance risks.

Better strategic decision-making

Managing more spend also gives procurement teams and leaders access to richer data. With a clear view of spending patterns, they can identify trends, forecast more accurately, and align procurement strategies with broader business goals, such as expanding into new markets.

For instance, Algorythma, a tech firm in the UAE, switched to Precoro to digitize its procurement and bring more of its spend under management.

They moved to a paperless purchasing operation, reduced manual errors (30% error rate reduced toward zero), and improved spend reporting and decision-making.

Through that higher managed spend, they gained much better visibility into supplier performance, compliance, and procurement risk exposure. As a result, procurement and leadership could spot anomalies, enforce controls, and make more strategic supplier choices.

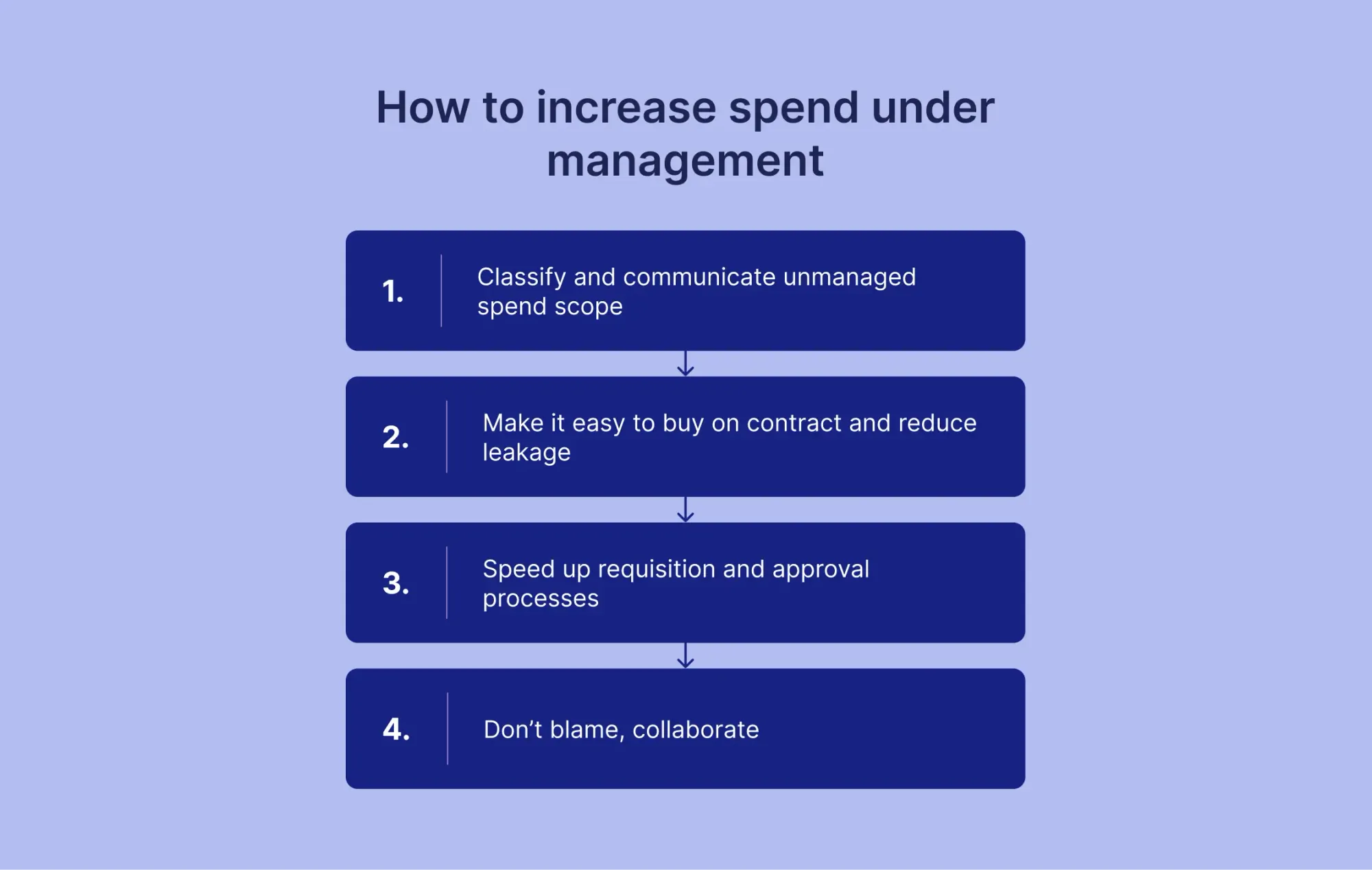

How to increase spend under management

Organizations often face challenges with unmanaged spend, which weakens control, disrupts budgets, and reduces visibility. A focused approach to spend under management procurement helps solve these issues by bringing spend into formal processes, ensuring compliance, and strengthening supplier relationships.

1. Classify and communicate unmanaged spend scope

First, identify where unmanaged spend occurs. Use spend analysis to map categories by supplier, department, or project.

- What to do: Highlight high-risk categories of unmanaged spend (e.g., marketing services, IT subscriptions, travel).

- Why it matters: Clear visibility allows these categories to be consolidated into managed contracts, which strengthens supplier influence and reduces waste.

- Example: A company may discover that multiple teams are purchasing software licenses separately. But consolidation brings improvements in action—it pulls spending into one managed contract to secure discounts and prevent duplication.

2. Make it easy to buy on contract and reduce leakage

Leakage occurs when employees purchase outside contracts due to unclear terms or slow processes.

- What to do: Track committed spend in real time, enforce supplier catalogs, and keep terms accessible.

- Why it matters: Employees don’t intend to create leakage; they simply want speed and clarity. Thus, make contracts easy to use and keep spend under management locked in within managed channels.

- Example: Embedding negotiated supplier catalogs directly into an e-procurement platform allows staff to buy approved goods quickly, preventing off-contract purchases.

3. Speed up requisition and approval processes

Complicated approvals often push employees to bypass procurement.

- What to do: Cut unnecessary steps, automate routine requests, ensure P2P solutions are mobile-friendly so managers can approve on the go.

- Why it matters: When the process is faster and easier, employees are more likely to follow it. Reduced bottlenecks also cuts procurement cycle time.

- Example: A company implemented automated approvals for purchase requests and reduced the requisition-to-final approval cycle by up to 50%.

4. Don’t blame, collaborate

Blaming stakeholders for unmanaged spend creates pushback and resistance.

- What to do: Engage stakeholders openly, provide training, and frame procurement as a partner.

- Why it matters: Collaboration builds trust, raises compliance, and supports higher spend under management across the organization.

- Example: NWLPS moved away from transactional blame toward partnership. They engaged suppliers in joint planning, shared performance data, and built trust that reduced resistance and improved compliance.

SUM is not the magic pill, yet a focus on visibility, simplicity, and collaboration brings real results. With each step, you can expand the share of spend under management, cut costs, strengthen supplier relationships, and achieve stronger business performance for your organization.

Start with clear steps: make contracts easily accessible, simplify approval workflows, and build trust with stakeholders. That will be enough to lay the ground for first-class procurement.

How to achieve spend under management in your organization

Getting more spend under management doesn’t happen overnight. It takes a mix of the right tools, clear processes, and smart supplier relationships. Here are some practical steps:

- Use technology

E-procurement, spend analytics, and supplier management tools make the whole process smoother. They give you real-time visibility, automate routine work, and improve control. - Analyze your spend

Start with a detailed spend analysis. It identifies where money is going, highlights savings opportunities, and helps track how well procurement processes are working. - Set clear policies

Strong procurement policies and procedures keep purchasing consistent and transparent. They reduce risks and make sure everyone follows the same rules. - Put controls in place

Internal checks and system-based controls stop waste, errors, and fraud, and make sure spending stays aligned with business goals. - Work closely with suppliers

Building stronger relationships with preferred vendors and using pre-negotiated contracts often leads to better pricing, volume discounts, and even early access to innovations.

Taken together, these steps give organizations greater control, reduce costs, and unlock real value.

Frequently asked questions about spend under management

To calculate the spend under management (SUM), divide the amount of spend actively managed by total organizational spend, then multiply by 100. The formula is: SUM=(Managed Spend / Total Spend)×100

Unmanaged spend falls into three categories:

- Tail spend: Small, non-project expenses, such as supplies, services, and travel. Individually, they are minor, but add up significantly.

- Maverick spend: Purchases made outside the procurement process (e.g., corporate cards, expense reports), often bypassing contracts.

- Treasury spend: Large, non-procurement transactions like foreign exchange (FOREX) or offshore supplier payments.

Spend under management (SUM) is not the same as an organization’s total spend, as it excludes unmanaged or off-contract purchases. It’s not just influenced spend, since procurement must actively manage, contract, and track it. SUM is not always 100% of spend, as some categories, such as specialized services or regulatory fees, fall outside its scope. It’s not limited to savings but also reflects governance, visibility, and control. SUM is not static—it shifts with procurement maturity, compliance, and technology adoption.

More spend under management means lower costs, stronger controls, increased supplier influence, and greater financial resilience. When purchases go through procurement and negotiated contracts, organizations gain better pricing, reduce maverick spend, and consolidate suppliers.

How can Precoro help your organization optimize spend under management?

Complexity truly kills your ability to manage spend. The idea behind what is spend under management comes down to one simple principle: visibility before money leaves the business. With Precoro, you get to know who is buying what, when, and for how much—before the spend is committed.

Visibility only works if everyone uses the tool

Precoro funnels all requests into a central system, so you won’t lose track of any purchases. All requests live in one place, guided by forms (with required fields) and tied to catalogs with approved items and vendors.

Teams bypass procurement → chaos

Using a standardized intake process, Precoro prevents backdoor purchases by guiding users to approved items and workflows. You can configure workflows with thresholds, parallel or sequential steps, notifications, and automatic rejections when rules are violated.

No visibility into committed spend → forecasting errors

With Precoro, you see what’s already committed (purchase orders, pending orders) even before invoices flow through. Precoro ensures only invoices tied to approved POs are processed, reducing off-contract spending and duplication.

Without visibility, CFOs and procurement can’t prevent overspending

Real-time budget checks and alerts in Precoro help flag requests that exceed limits or violate policies. The system shows remaining budgets, flags over-budget requests, and stops unauthorized spending before it occurs. You get dashboards and reports by supplier, department, category, or project—letting you track trends, discover leakage, and refine strategy.

No standard workflows → inconsistent requests, approval gaps, spend leakage

Precoro enables customizable workflows so every request follows a consistent, enforced path.