14 min read

How to Do Procurement Benchmarking: A Practical Guide

Discover how to do procurement benchmarking effectively to find savings, improve supplier performance, and cut cycle time.

You know the feeling: invoices pile up, purchase orders cross your desk, and yet you’re never quite sure you’re getting the best deal. Most benchmarking feels abstract: numbers pulled from reports or industry surveys that don’t reflect your reality. But when you use procurement best practices benchmarks and look at spend through the lens of aggregation — combining it across suppliers and departments — you suddenly see opportunities that were invisible before.

In our guide, we will uncover the most practical steps for procurement benchmarking to achieve procurement excellence.

Read on to find out:

What is benchmarking in procurement?

How to benchmark procurement: Best practices

Benefits of procurement benchmarking

Challenges in procurement benchmarking

Wrapping up

FAQs

What is benchmarking in procurement?

Procurement benchmarking is the process of evaluating a company’s procurement performance against industry best practices, standards, or competitors. Although often used interchangeably with supplier performance measurement or management, it goes beyond simple evaluation. Procurement benchmarking provides measurable insights into procurement effectiveness and identifies opportunities for improvement.

Benchmarking helps organizations set realistic goals, use resources efficiently, and stay competitive by learning from industry leaders. It allows procurement teams to shift from operational tasks to strategic impact, aligned with business objectives.

Types of procurement benchmarking

Organizations can take different benchmarking paths depending on what they want to uncover — from quick internal wins to long-term strategic insights. Basically, there are seven main types of benchmarking:

Internal benchmarking compares procurement performance across departments, business units, or regions within the same organization, helping teams spot internal best practices and scale them company-wide. Many companies use procurement benchmarking tools to track these differences in real time and create a clear picture of where improvements can be made.

Competitive benchmarking looks outward, measuring procurement performance against direct competitors to understand market position and highlight areas where others may be pulling ahead. By referencing procurement industry benchmarks, organizations can see how their cost savings, supplier performance, and cycle times stack up against the market.

Functional benchmarking goes beyond industry boundaries, comparing procurement processes with high-performing organizations in other sectors to learn from best-in-class approaches. Thus, teams can uncover procurement best practices benchmarks that can be adapted internally.

Generic benchmarking focuses on core procurement activities common to all organizations — such as purchase-to-pay process or supplier onboarding — regardless of industry. Many teams track these efforts using procurement benchmarking tools to ensure improvements are measurable and consistent.

Performance benchmarking zeroes in on measurable outcomes like cost savings, cycle times, spend under management, and supplier performance, comparing results against peers or industry norms.

Strategic benchmarking takes a long-term view, evaluating procurement strategies, operating models, and supplier relationships to understand how leading organizations elevate procurement into a strategic function.

Each approach answers different questions, and the strongest benchmarking programs blend several of them to gain a well-rounded view of procurement performance and improvement potential.

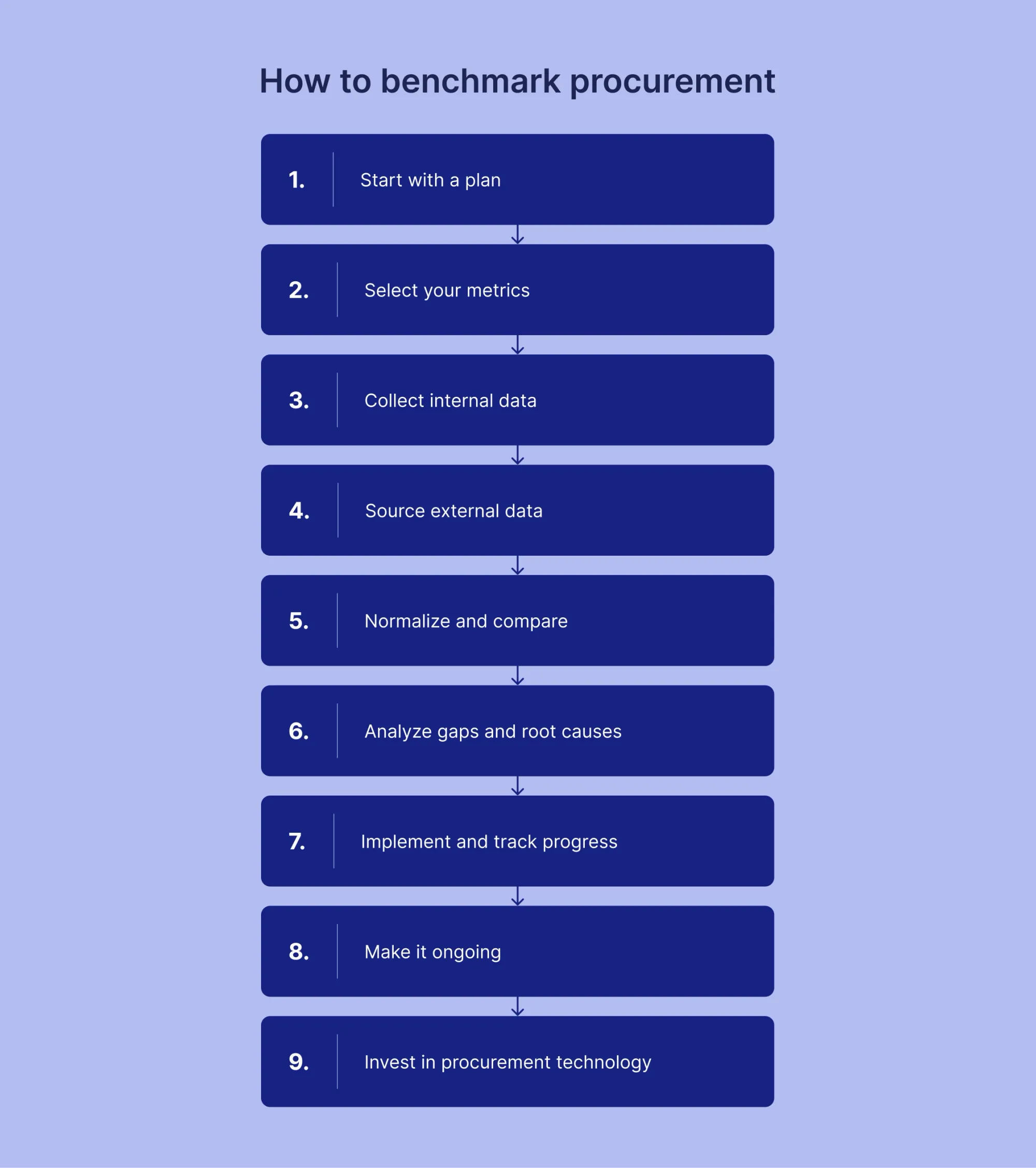

How to benchmark procurement: Best practices

There is no one-size-fits-all set of procurement benchmarks. However, this guidance provides a framework so you can choose relevant steps and metrics to build a tailored procurement benchmarking process for your unique business needs.

1. Start with a plan

- First, understand what benchmarking in procurement is and decide what you want to achieve. Identify key procurement benchmarks that matter most to your current cost savings, supplier performance, and overall procurement effectiveness.

- Next, formalize these benchmarks and track them consistently. Many teams document findings in a procurement benchmarking report, making it easier to spot trends and act on insights.

- Get procurement tools to analyze performance, spend, and compliance data for actionable takeaways.

- Translate insights into specific initiatives with clear owners, timelines, resources, and success metrics.

- Finally, prioritize actions using procurement savings benchmarks. Quick wins build momentum, while longer-term initiatives drive strategic procurement improvements.

Note!

Don't outsource benchmarking decisions to generic industry averages. Your procurement team is best positioned to define what should be measured and why. Start here to get your priorities straight:

- Which procurement benchmarks are most important for our current workflows?

- Should we establish new procurement benchmarks to measure potential process changes?

- What benchmarks have the greatest value for our internal and external stakeholders? To what degree, if at all, should these benchmarks be customized for each stakeholder?

- What's the proper scope — enough for insights but not so many that measuring overwhelms action?

- How specific should benchmarks be to balance broad utility with contextual relevance?

- What data sources and tools should we use for analysis, including AI spend benchmarking tools for procurement?

- Will benchmarking be a standalone system or integrated into our broader business processes?

- How will we measure the effectiveness of best practices and the benchmarking process itself?

- How can we minimize benchmarking costs?

- What processes need updating to apply benchmarking insights to continuous improvement?

These questions show you what to measure, how to measure it, and how to manage improvements and evaluation. Many teams consolidate these answers into a procurement benchmarking report for reference and decision-making.

2. Select your metrics

Choose metrics across different performance dimensions to establish meaningful procurement benchmarks:

- Cost metrics: Total cost savings, cost avoidance, purchase price variance, total cost of ownership.

- Efficiency metrics: Procurement cycle time, PO processing cost, requisition-to-PO time, invoice processing time.

- Quality metrics: Supplier defect rates, on-time delivery performance, contract compliance percentage.

- Strategic metrics: Spend under management, supplier consolidation ratio, strategic sourcing coverage, e-procurement adoption rate.

- Organizational metrics: Procurement staff as a percentage of total employees, procurement cost as a percentage of revenue.

3. Collect internal data

Gather baseline data from your own systems. Extract information from your ERP, procurement software, contract management systems, and financial records. Ensure the data spans a meaningful period (typically 12 months) and is consistently categorized and measured. This step will help establish clear procurement benchmarks and track progress over time.

4. Source external data

Obtain comparison data through industry associations and reports (ISM, CIPS), research firms (Gartner, Deloitte, Hackett Group), peer networks, consultants who aggregate anonymized client data, or public filings and analyst reports for publicly traded companies.

5. Normalize and compare

Ensure you're making fair comparisons by accounting for differences in company size, industry, geographic complexity, and organizational maturity. Calculate ratios and percentages rather than absolute numbers where appropriate.

6. Analyze gaps and root causes

Identify where you're underperforming or excelling. More importantly, investigate why gaps exist. Look at differences in processes, technology, skills, organizational design, and strategic priorities. The "why" behind performance differences is where actionable insights emerge.

7. Implement and track progress

Execute your improvement plans while regularly monitoring key procurement benchmarking metrics. Use dashboards to visualize progress and share updates with stakeholders. Be prepared to adjust your approach based on what you learn during implementation.

8. Make it ongoing

Schedule regular benchmarking cycles (annually or semi-annually) to track improvement and stay current with evolving practices. As you mature, your benchmarking can become more sophisticated, exploring emerging areas such as sustainability, innovation, and risk management.

9. Invest in procurement technology

Having a clear plan and knowing what to measure is just the start. To get full value from procurement benchmarks, you need digital tools to turn raw data into actionable insights, optimized processes, and maximum ROI. Manual, paper-based workflows can’t keep up with today’s data volume.

With a solution like Precoro, your procurement team gains centralized, cloud-based data management, real-time analytics, and automation. This combination improves transparency, accuracy, and efficiency, reduces costs, and minimizes human error. Automated workflows and integrated analytics make continuous improvement and benchmarking easier to manage, monitor, and scale across projects, departments, and business units.

By connecting internal and external data sources, procurement can uncover opportunities for savings, efficiency, and risk reduction. Vast amounts of data become a strategic asset rather than a burden, enabling procurement to lead value creation across the organization.

If you wonder how organizations manage purchasing today and what top performers do differently, get the free Procurement Benchmarking Report 2025. It’s created for businesses operating in Construction, Logistics, Manufacturing, Retail, Technology, Education, Healthcare, and Biotech industries.

Top 10 KPIs for procurement benchmarking

From cost savings to supplier performance, procurement teams can monitor an overwhelming number of metrics. Best-in-class organizations source 67.4% of addressable spend compared to 43.6% for averages, and enable 61.7% of suppliers versus 44.2%.

To make benchmarking practical and meaningful, we’ve narrowed the focus to 10 core benchmarks:

1. Cost savings and cost avoidance

- Cost savings (hard savings): Reductions that show up directly on the P&L statement (e.g., paying $90 this year for a part that cost $100 last year).

- Cost avoidance (soft savings): Actions that prevent future costs (e.g., negotiating out a price increase or getting free value-added services).

- Benchmark goal: Modern procurement teams aim for 3% to 7% annual hard savings.

2. Purchase Order (PO) cycle time

- Explanation: The duration from the moment a purchase requisition is submitted to when the PO is transmitted to the supplier.

- Significance: This procurement benchmark measures the "red tape" in your organization. A high cycle time usually points to an over-complicated approval hierarchy or a lack of automation.

- Benchmark goal: World-class organizations achieve cycle times of 24–48 hours or less.

3. Supplier On-Time Delivery (OTD) rate

- Explanation: The ratio of orders received on or before the promised date versus the total orders placed.

- Significance: Critical for inventory management. If OTD is low, you are forced to carry safety stock, which ties up cash.

- Benchmark goal: Aim for >95% for critical suppliers.

4. Spend Under Management (SUM)

- Explanation: The percentage of total enterprise spend that is actively overseen and negotiated by the procurement department.

- Significance: This is the ultimate measure of procurement's "reach." If SUM is low, maverick spend (unauthorized spending) is likely high, leading to lost savings.

- Benchmark goal: Highly strategic teams manage >80% of total spend.

5. Procurement ROI

- Explanation: Calculated by dividing the total annual savings by the total cost of running the procurement department (salaries, tools, rent).

- Significance: This procurement benchmark justifies the department's existence. It proves that for every dollar invested in the team, they return several more to the company.

- Benchmark goal: A standard "strong" ROI is 7:1 to 10:1.

6. Contract compliance rate

- Explanation: Tracks whether purchases are being made using the contracts and vendors that procurement negotiated.

- Significance: Negotiating a 20% discount is useless if employees continue to buy from non-contracted vendors at full price.

- Benchmark goal: Target >85% compliance to ensure negotiated savings are reflected in the bottom line.

7. Supplier defect rate

- Explanation: The percentage of goods or materials that fail to meet quality standards upon delivery.

- Significance: Often measured in Parts Per Million (PPM). High defect rates cause production delays and administrative headaches (RMAs and returns).

- Benchmark goal: Varies by industry, but typically <1% (or extremely low PPM in manufacturing).

8. Procurement cost as a % of revenue

- Explanation: The total operating cost of the procurement function divided by the total revenue of the company.

- Significance: This measures lean efficiency. It tells you if your procurement team is "overstaffed" or "under-resourced" relative to the size of the business.

- Benchmark goal: Typically ranges between 0.5% and 1%.

9. E-procurement adoption rate

- Explanation: The percentage of total transactions (or spend) processed through digital procurement software rather than manual paperwork/email.

- Significance: High adoption leads to better data accuracy, faster PO cycles, and lower cost per invoice.

- Benchmark goal: Aim for >90% of transactions to be digital, reflecting the broader shift toward digital payments as the market is projected to reach $59.56B by 2027

10. Supplier lead time

- Explanation: The total time from when a PO is sent to when the goods are physically received at the warehouse.

- Significance: Longer lead times decrease your company's agility. Monitoring this metric allows you to identify which suppliers are slowing down your supply chain.

- Benchmark goal: Continuous reduction; comparing current lead times against the industry average for that specific category.

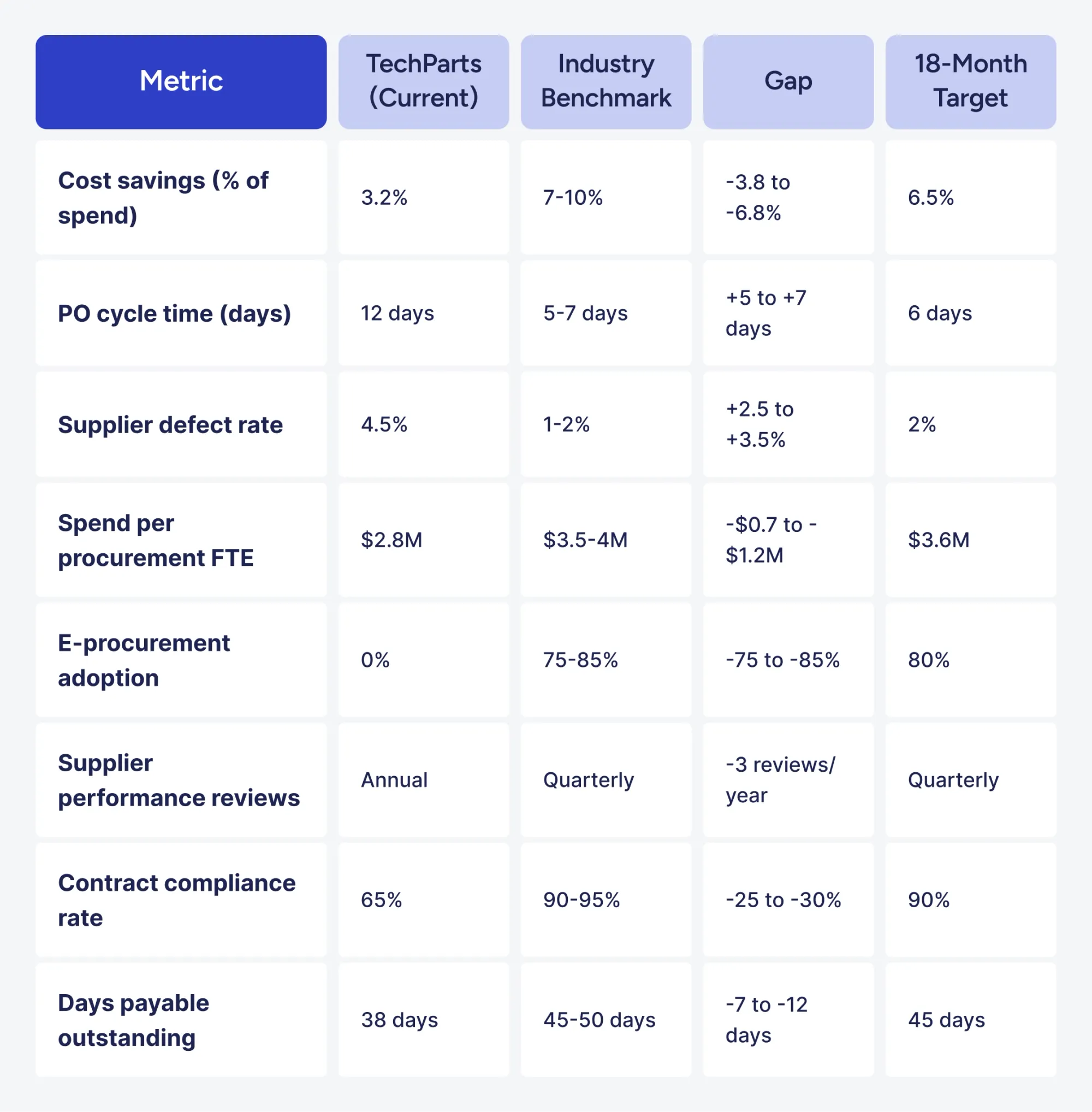

Procurement benchmarking example scenario

TechParts Manufacturing is a 500-employee company producing automotive components. Annual procurement spend: $45M. Its current pain points include high costs and lengthy procurement cycle times.

TechParts focused its procurement benchmarking on four key metrics: cost savings as a percentage of total spend, PO cycle time, supplier defect rates, and procurement staff productivity measured by spend per FTE.

Internal data showed cost savings at 3.2%, PO cycle time at 12 days, supplier defect rate at 4.5%, and spend per FTE at $2.8 million. To provide context, the team used benchmarks from industry associations like the Automotive Industry Action Group, consultancy reports from Hackett Group and Deloitte, peer companies of similar size, and regional manufacturing networks.

Comparison revealed gaps: industry averages show cost savings of 7–10%, PO cycle time of 5–7 days, defect rates of 1–2%, and spend per FTE of $3.5–4 million. Root cause analysis identified manual approvals, limited supplier management, a lack of an e-procurement system, minimal analytics, and reactive sourcing.

To address these, TechParts developed an action plan that includes an e-procurement platform within six months, automatic approvals for orders under $10,000, supplier scorecards, strategic sourcing training, and category management for the top five spend categories. The 18-month targets are: 6.5% cost savings, a PO cycle time of 6 days, a 2% defect rate, and a spend per FTE of $3.6 million, providing a structured path to measurable procurement improvements.

Key results:

- Benchmarking revealed major process gaps at TechParts.

- Leadership approved $400,000 for procurement improvements.

- Projected annual savings: $1.8 million.

Benefits of procurement benchmarking

Benchmarking in procurement has a few advantages:

- Identifies cost reduction opportunities. Comparing your spending against procurement savings benchmarks helps you spot areas where you're overpaying and gives you data-driven leverage in supplier negotiations.

Top procurement functions achieve 8–12% cost savings of total spend using benchmarking insights to improve sourcing and negotiations. - Enhances supplier relationships. Understanding standard supplier benchmarking helps you set fair expectations in contracts and identify which suppliers are truly underperforming versus meeting industry norms.

- Improves operational efficiency. Measuring procurement cycle times, order accuracy, and processing costs against procurement industry benchmarks reveals bottlenecks and shows where process improvements will have the most impact.

- Supports better decision-making. Benchmark data provides objective, data-driven insights that help procurement teams make informed choices about processes, suppliers, and resource allocation.

- Enhances competitiveness. Staying informed about market trends and competitor practices ensures your organization maintains strong positioning in supplier negotiations and procurement strategies.

Knowing where your contract compliance (~80–90% for best-in-class companies) and supplier performance stand vs. peers helps you avoid being outpaced by competitors. - Validates strategic investments. Data from procurement benchmarking services can illustrate how new technology or process changes can bring your organization in line with — or ahead of — competitors.

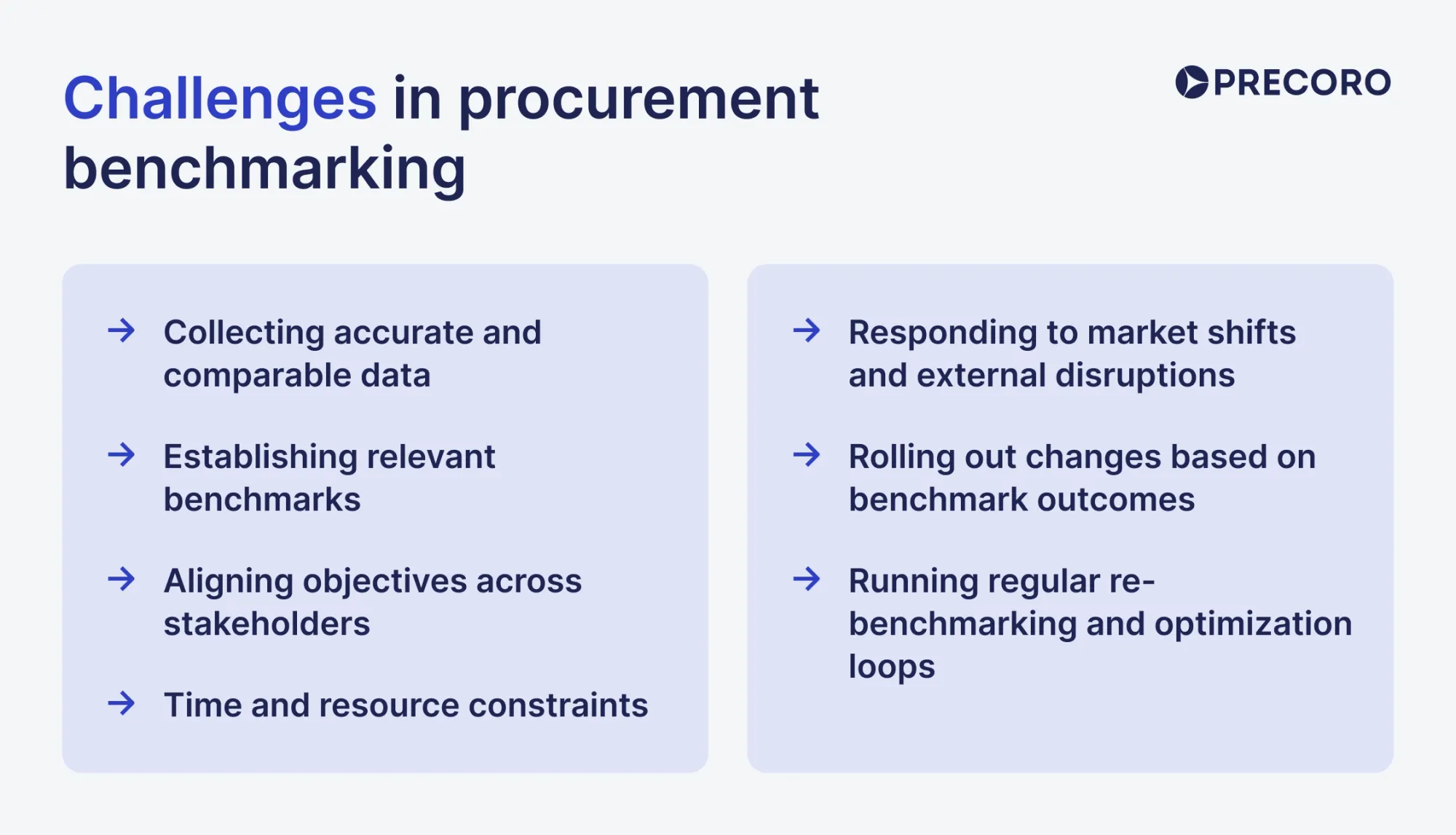

Challenges in procurement benchmarking

While benchmarking offers significant benefits, organizations also face several obstacles when implementing effective practices:

- Collecting accurate and comparable data. It's challenging to gather consistent data across companies because organizations track procurement activities differently, and some are unwilling to share information due to confidentiality concerns.

- Establishing relevant benchmarks. Identifying procurement benchmarks that align with your organization's strategic goals requires a thorough understanding of industry standards and the most useful metrics.

- Aligning objectives across stakeholders. Securing consensus among stakeholders from various departments and levels on benchmarking objectives and methods is critical to ensure focused efforts and actionable results supported across the organization.

- Time and resource constraints. Companies must invest significant time to identify benchmarking partners, collect and analyze data, and implement changes, which can be especially challenging for smaller organizations with limited resources.

- Responding to market shifts and external disruptions. Organizations must remain agile and adapt procurement benchmarking to reflect industry shifts, global disruptions, technological advancements, and regulatory changes to keep benchmarks relevant.

- Rolling out changes based on benchmark outcomes. To implement improvements identified through benchmarking, companies must adjust processes, train staff, and handle resistance to change.

- Running regular re-benchmarking and optimization loops. Benchmarking is a continuous effort rather than a one-time activity, which can be challenging as market conditions and industry best practices evolve.

Wrapping up

Procurement benchmarking is not just about measuring efficiency — it’s about identifying gaps, opportunities, and best practices that drive strategic value. In the context of visibility and control, benchmarking focuses on how well an organization captures, tracks, and manages spend before it affects the bottom line.Complexity and fragmented processes reduce the percentage of spend under management, making it difficult to compare performance against industry standards or competitors. When teams bypass procurement or requests are inconsistent, organizations experience last-minute chaos, overspending, and inaccurate forecasting. Benchmarking these areas highlights weaknesses in intake processes, workflow compliance, and spend visibility, providing a roadmap for improvement.

By using a procurement benchmark approach to evaluate intake and visibility processes, organizations can identify gaps in spend management, compliance, and workflow efficiency. Insights from procurement industry benchmarks help procurement teams implement structured processes, improve forecasting, prevent overspending, and transform procurement from a reactive function into a strategic driver of business value.

In essence, benchmarking visibility and control ensures that every dollar spent aligns with organizational policies, drives ROI, and positions procurement as a central, proactive function that delivers measurable impact.

Frequently asked questions about procurement benchmarking

Companies should invest in procurement benchmarking during strategic shifts, such as expansions, mergers, high-spend growth, process inefficiencies, or supplier risks, to uncover savings, address gaps proactively, and boost competitiveness.

Core types include internal (comparing own units), competitive (against rivals), functional (best-in-class functions), generic process (specific workflows), and customer (against expectations).

Focus on cost savings, cost avoidance, spend under management, on-time delivery, supplier scores, cycle times, compliance, and ROI for full coverage.

Run strategic benchmarking annually, operational reviews quarterly, and high-risk supplier benchmarking every six months, adjusting for business and market dynamics.

Price benchmarking in procurement compares purchase prices to market rates, competitors, or historical data to identify overpayments, enhance negotiations, and secure optimal terms.

A typical process spans 4-12 weeks, with internal benchmarks faster and external analyses longer due to data collection.

A standard procurement benchmarking workflow typically includes defining objectives and KPIs, gathering and cleansing internal data, sourcing benchmarks, analyzing gaps and root causes, developing action plans, and monitoring progress for continuous improvement.

Apply procurement benchmarks with Precoro and move from industry averages to controlled, data-driven procurement.