12 min read

T-Accounts: Meaning, Examples, Benefits, And Recording

Learn what T-accounts are in accounting with clear T-account examples, key benefits, and a simple guide to transaction recording.

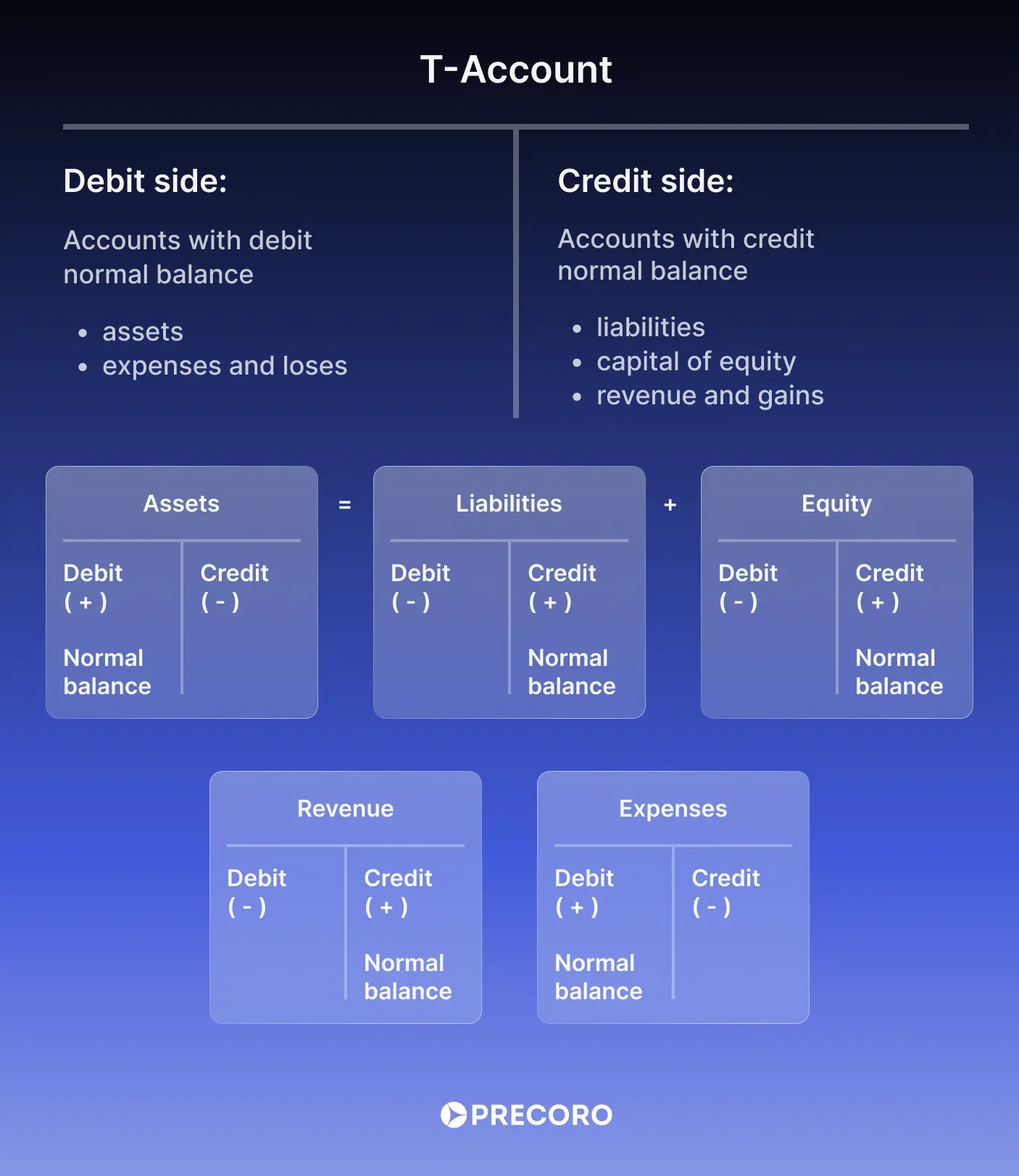

T-accounts are simple, T-shaped diagrams used in double-entry bookkeeping to represent individual accounts such as Cash, Sales, or Rent Expense. They record each transaction as a debit on the left side and a credit on the right, making it easy to see how funds move and to calculate the account’s balance. In general, assets and expenses increase with debits on the left, while liabilities, equity, and revenue increase with credits on the right.

Keep reading to learn:

What is a T-account?

How to record the T-accounts

Common mistakes when recording T-accounts

Types of T-accounts

T-account examples

Advantages of T-accounts

Challenges of T-accounts

Comparing T-accounts to accounting books and statements

Frequently asked questions about T-account

What is a T-account?

In accounting, a "T-account" is a term used for financial records that apply double-entry bookkeeping. As for the T-account definition, the name comes from the T shape used to separate entries: a large letter T is drawn, with the account title written above the top line. Debits are placed to the left, and credits are to the right of the vertical line. A T-account is also referred to as a general ledger account.

Key takeaways

- A T-account is an informal term for financial records that apply double-entry bookkeeping.

- A T-account has three sections. The account name is placed at the top. On the left, you enter debits; on the right, credits.

- Each T-account displays only one account.

- The T-account directs accountants on how to enter values in the ledger to balance revenues and expenses.

How to record the T-accounts

To record a T-account, first identify the accounts affected by the transaction. Then, draw a large "T" shape for each account and write the account name above the horizontal line. Enter the debit amount on the left side and the credit amount on the right side of the T, based on the nature of the transaction.

After recording the amounts, subtract the smaller total from the larger total to calculate the account balance.

In an asset account, a debit entry on the left side represents an increase, while a credit entry on the right side represents a decrease. For example, when a business receives cash, it debits the cash (asset) account; when it pays out cash, it credits the cash account.

For liability and shareholders' equity accounts, the effect is reversed: a debit entry on the left decreases the account, while a credit entry on the right increases it.

If we look at the most basic T-accounts example, when a company issues shares worth $200,000, it records an increase in its asset account (cash) and a corresponding increase in its equity account.

T-accounts can also be used to record changes to income statement accounts, such as revenues and expenses. For revenue accounts, debit entries decrease the account, while credit entries increase it. Conversely, debit entries increase the account for expense accounts, and credit entries decrease it.

To maintain balance, repeat this process for all accounts involved in the transaction. The visual representation below tracks each account's debit and credit flow.

Note!

Many assume "debit = money out" and "credit = money in." In fact, debit increases assets and expenses but decreases liabilities and equity. This abstract concept is a major barrier to intuitive understanding.

Common mistakes when recording T-accounts

T-accounts are an effective way to visualize transactions, but they’re not foolproof. Common pitfalls include:

- Misplacing debits and credits: Reversing the sides can distort account balances.

- Missing adjusting entries: Without them, financial reports may show inaccurate figures.

- Omitting transactions: Unrecorded entries won’t appear in ledgers or statements.

- Failing to balance accounts: An unbalanced T-account often signals a double-entry error.

Regular reviews and reconciliations help catch these mistakes and keep records accurate.

Types of T-accounts

T-accounts are a proper visual representation of many types of balance activities. Some common types of T-account representations are:

- Assets: Cash transactions, accounts receivable, physical inventory, hard assets like furniture, or technical assets, such as computers and phones.

- Liabilities: Accounts payable, loans, and notes payable.

- Revenue: Receipt of payment from customers for goods or services.

- Expenses: Costs incurred to run the business, such as rent, supplies, insurance coverage, incidentals, travel, and utilities.

- Equity: The conversion of company funds into financial instruments, such as shares sold as part of employee stock purchase plans (ESPP) or incentive shares.

T-account examples

Theory only gets you so far. The real value of T-accounts lies in how they reflect actual business activities. Below are five sample transactions that Company XYZ records in May:

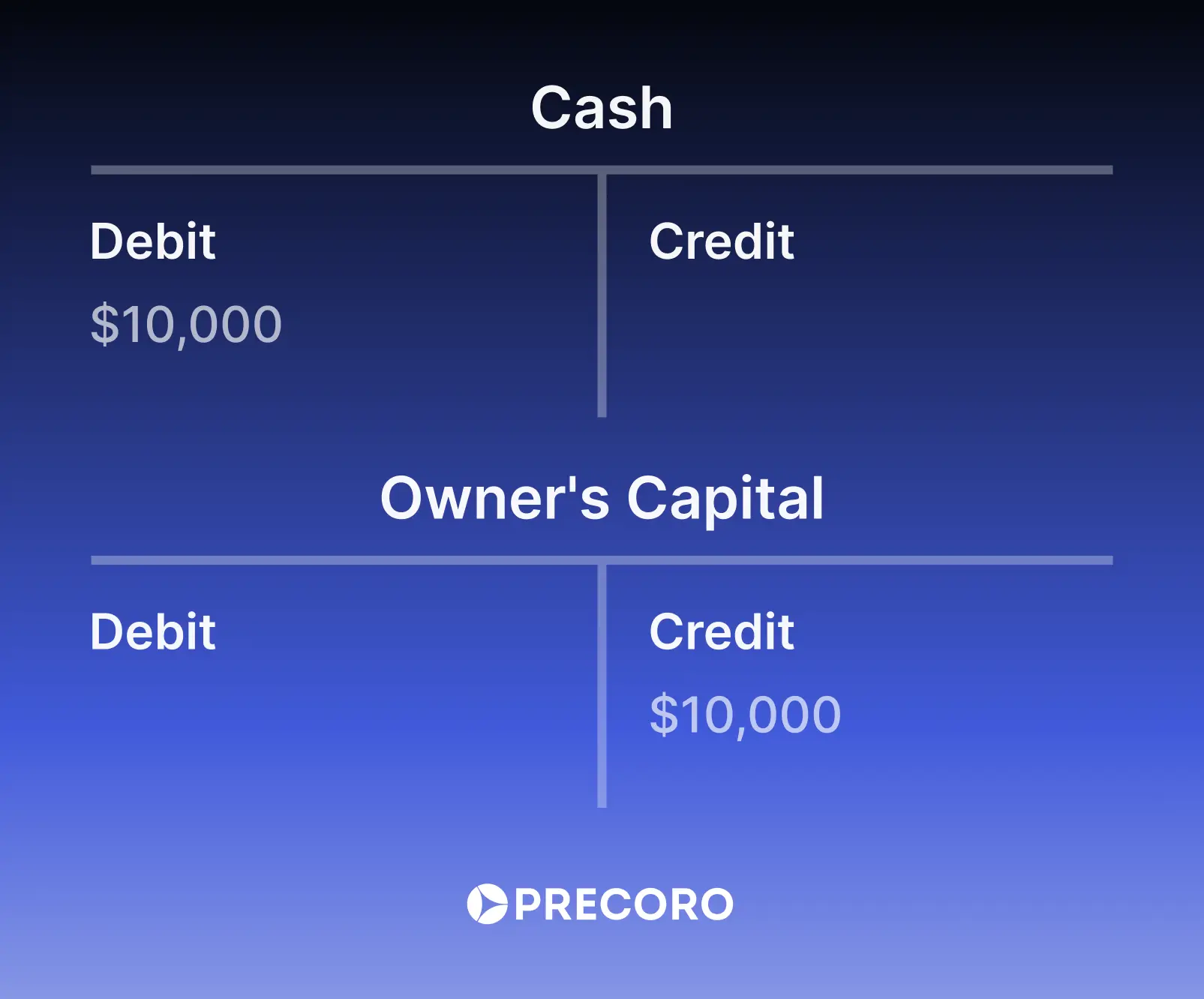

Owner’s investment

The owner of Company XYZ injects $10,000 into the business, increasing both Cash (asset) and the Owner’s Сapital (equity).

- The Cash account is debited $10,000 to reflect the increase in assets.

- The Owner’s Сapital account is credited $10,000 to show the owner’s equity contribution.

This double-entry balances the T-accounting equation, with total debits equal to total credits.

Purchasing equipment on account

The company purchases equipment worth $4,800 on account, increasing Equipment (asset) and Accounts Payable T-account (liability).

- The Equipment account is debited $4,800 to reflect the increase in assets.

- The T-account for Accounts Payable is credited $4,800 to show the increase in liabilities.

This double-entry T-account example ensures the accounting equation stays balanced, with total debits equal to total credits.

Service revenue earned but uncollected (On credit)

On May 10th, Company XYZ invoices a client for $300 worth of service, with payment due within 20 days. This increases Accounts Receivable and Repair Service Revenue.

- Accounts Receivable is debited $300 to record the amount the client owes (asset increase).

- Repair Service Revenue is credited $300 to recognize the revenue earned.

This double-entry ensures the accounting T-account equation remains balanced.

Service revenue earned and collected

Company XYZ provides and collects $2,000 in cash for repair services, increasing both Cash (asset) and Service Revenue (revenue).

- The Cash account is debited $2,000 to reflect the increase in assets.

- The Service Revenue account is credited $2,000 to record the earned revenue.

This entry balances the accounting T-account equation by increasing assets and revenues.

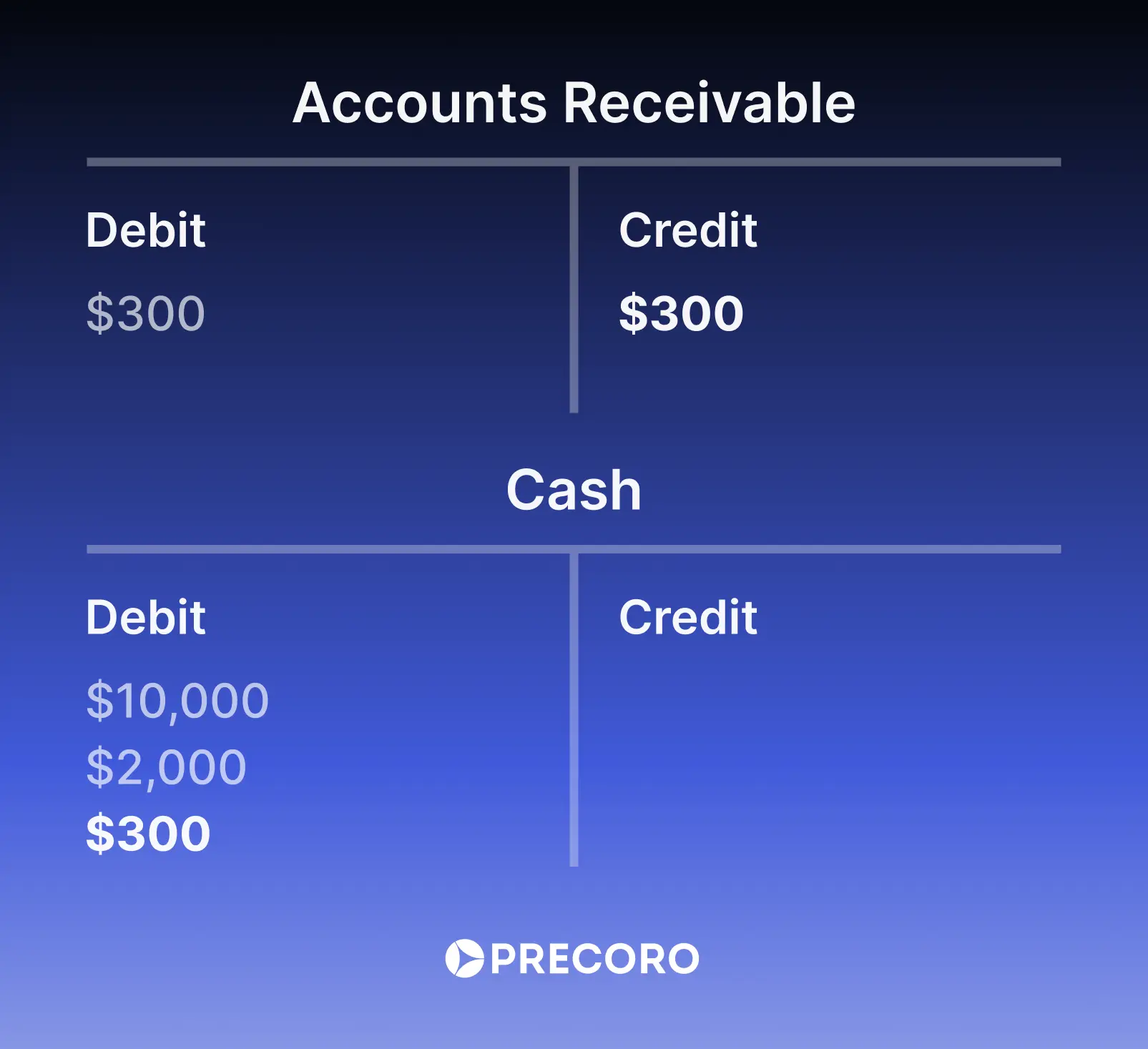

Received payment for billed services

On May 15th, clients paid the $300 invoice billed on May 10th. Cash increased, and Accounts Receivable decreased.

- The Cash account is debited $300 to record the increase in cash.

- The Accounts Receivable account is credited $300 to reflect the decrease as payment is received.

This entry ensures the accounting T-account equation remains balanced by recording the cash collection and reducing the receivable.

The T-account adjustments for the transaction would look like this:

Payment of employee wages

Paid employee wages earned in May, $1,200. Wages Expense increases, and Cash decreases.

- The Wages Expense account is debited $1,200 to record the expense, which decreases owner’s equity.

- The Cash account is credited $1,200 to reflect the decreased assets due to the payment.

This entry of the T-account example properly records the wage expense and cash outflow, keeping the accounting equation balanced.

Payment of utilities

Paid $100 for May utilities. Utility Expense increases, and Cash decreases.

- The Utility Expense account is debited $100 to record the expense, which decreases owner’s equity.

- The Cash account is credited $100 to reflect the decrease in assets due to the payment.

This entry accurately records the utility expense and the cash outflow, maintaining the balance in the t-account accounting equation.

Advantages of T-accounts

T-accounts cut through the accounting clutter and give you a clean, visual snapshot of how transactions affect your books in real time. Key benefits of T-accounts include:

- Visual clarity and financial transparency

T-accounts provide a clear, visual layout of transactions and make it easier to track debits and credits and understand financial flows at a glance. This transparency benefits both businesses and auditors. - Error detection and accuracy

T-account accounting offers a balanced structure that helps identify recording errors and enhances the accuracy of financial statements by ensuring that debits and credits match. - Simplification and ease of use

T-accounts simplify organizing and tracking financial data across assets, liabilities, equity, revenue, and expenses. Their straightforward format is accessible to both beginners and experienced accountants. - Educational value

They serve as effective teaching tools by visually illustrating how transactions impact different accounts. - Support for adjusting entries

Changes in account balances are clearly displayed. Therefore, it's easier to prepare and adjust entries. - Actionable financial insights

These accounts highlight outliers and spending patterns, enable better estimation of cash needs, and support informed financial decision-making. - Universal applicability

Adopted by businesses of all sizes, T-accounts align with international accounting standards and serve as a versatile tool across various accounting systems.

Challenges of T-accounts

While T-accounts offer many benefits, they also come with some limitations, especially in modern accounting:

- Time-consuming and costly

Manually maintaining T-accounts is impractical for large businesses with many transactions. It requires dedicated manpower and becomes expensive and inefficient compared to automated systems. - Requires careful review

Because T-accounts depend on manual entries, they must be double-checked regularly to ensure accuracy and catch errors early. - Prone to human error

Errors can occur when transactions are recorded incorrectly, such as entering amounts on the wrong side, mistyping numbers, or forgetting to record transactions altogether. These mistakes affect financial reports unless they are carefully reviewed. - Omissions are undetectable

If a transaction is completely omitted, the double-entry system using T-accounts cannot detect this since it only ensures that debits equal credits, not that all transactions are recorded. - Incorrect transaction categorization

Misclassifying transactions (e.g., expenses vs. capital costs) doesn’t affect account balances but can lead to inaccurate financial statements, which are usually identified only during audits. - Limited use in daily operations

Businesses rarely use T-accounts for everyday transaction processing. Instead, companies often rely on ledgers and accounting software that automate and streamline bookkeeping.

Note!

Although double-entry accounting has some drawbacks, it is indispensable for most businesses because it produces comprehensive financial statements. These statements allow for historical financial comparisons, help manage expenses efficiently, and assist in future strategic decision-making.

Comparing T-accounts to accounting books and statements

T-accounts offer a fast, visual layout of how debits and credits play out. Financial statements, on the other hand, organize all of that info into structured, regulated reports that stand up to scrutiny. Put simply, where T-accounts stop, accounting books begin. See the comprehensive comparison of T-account vs. accounting books below:

T-account vs. balance sheet

T-accounts are logs of individual transactions that show how each entry affects assets, liabilities, or equity. Balance sheets skip this process and present the end result—what the company owns, owes, and retains.

T-account vs. ledger

While T-accounts and ledgers both record financial transactions, they serve different purposes. T-accounts are simple, visual tools that illustrate how individual transactions affect a specific account and show debits on the left and credits on the right. They’re typically used for learning, troubleshooting, or quick analysis.

Ledgers, on the other hand, are formal, detailed records of all financial transactions across accounts. They include dates and running balances and are maintained for official accounting purposes.

While T-accounts help visualize transaction flow, ledgers are the authoritative source used in reports and audits. In practice, accountants rely on ledgers for final records and use T-accounts occasionally to explain or investigate specific issues.

T-account vs. trial balance

T-accounts track the balances and transactions of individual accounts, while a trial balance summary verifies the overall accuracy of a company’s financial records. A trial balance report summarizes all account balances from the general ledger, listing both debit and credit amounts.

It ensures that total debits equal total credits and confirms that all transactions have been properly recorded. This report is typically prepared at the end of an accounting period before financial statements are generated.

T-account vs. journal entry

Journal entries are the official, chronological records of all financial transactions. Each entry lists the accounts affected, the corresponding debit and credit amounts, and the transaction date. They serve as the foundation of the accounting system and capture events as they happen.

T-accounts, in contrast, are visual tools used to analyze how transactions impact individual accounts. Shaped like a “T,” they separate debits (left side) and credits (right side) to show how each entry alters a specific account’s balance.

In essence, journal entries document the what and when, while T-accounts help visualize the how within each account.

Frequently asked questions about T-account

An accounts payable T-account tracks what a company owes. Credits on the right increase the liability (invoices received), and debits on the left decrease it (payments made). T-accounts help keep the books balanced by showing all payables and payments clearly.

All debit entries are placed on the left side of the T-account, and all credit entries are placed on the right side of the T-account. Add up all the debit entries to find the total debits, and add up all the credit entries to find the total credits. Then subtract the total debits from the total credits; if the result is positive, the account has a debit balance, and if the result is negative, the account has a credit balance.

A single-entry accounting system records each financial transaction only once, which does not provide enough detail for the T-account’s visual format. In contrast, a double-entry system records every transaction twice—once as a debit and once as a credit—allowing T-accounts to separate and display these entries. This makes T-accounts an effective tool for businesses using double-entry accounting to track and distinguish debits and credits accurately.

Yes, similar to journal entries, T-accounts should always balance. The debit entries recorded on the left side of a T-account must be equal to the credit entries on the right side. If they don’t balance, it’s important to double-check your books, as this usually indicates an accounting error that needs correction.

T-accounts, a basic accounting tool, support procurement by showing spending patterns, recording transactions, and ensuring accurate financial records. They link procurement to financial goals, monitor budgets, and verify invoices precisely.

Use Precoro to streamline accounts payable

Whether you’re mastering the basics or exploring new strategies to optimize your accounts payable process, true expertise means keeping your focus both on the end goal and the challenges that could slow you down. The numbers in your company’s financial statements show the overall picture but reveal only a glimpse of the full story.

Take control of your procurement and T-account for accounts payable with Precoro—a powerful platform designed to centralize, simplify, and accelerate your financial workflows. Prevent manual errors, reduce approval delays, and gain full visibility into your spending across all business units.

Key Precoro features:

- Automated purchase orders & Invoices: Create and manage purchase orders and invoices with 90% less manual effort.

- AI-powered OCR: Extract invoice data instantly with over 95% accuracy and get rid of data entry errors.

- Approval workflows: Configure custom approval workflows that reduce approval times by up to 3.5x.

- Three-way matching: Automatically match purchase orders, invoices, and receipts to prevent overpayments.

- Spend visibility: Gain real-time insights into budgets and expenses across departments and locations.

- Integrations: Seamlessly connects with popular accounting and ERP systems, including QuickBooks, NetSuite, and Xero.

- Mobile access: Approve requests and track spending from anywhere with Precoro’s mobile app.

Streamline your accounts payable T-account, improve cash flow, and make smarter purchasing decisions with Precoro—the solution that keeps your financial operations running smoothly.