11 min read

What Are Duplicate Invoices, How to Spot & Prevent

Discover what causes duplicate invoices and the best techniques and tools to spot and stop them before they lead to payment issues.

The AP workflow may seem bulletproof—until a duplicate invoice hits the budget. Whether it's a vendor follow-up email or an OCR hiccup, these duplicates can slip past even the most alert teams.

Some rely on manual entry and fall short due to human mistakes and work overload. Others rely on ERP duplicate checkers, but these systems only scan invoice numbers, not the amounts. Consequently, you might wire the payment twice before noticing the error. The result? Spend leakages and reputational damage.

To prevent this, it's essential to understand the meaning of duplicate invoices and rely on automation for accurate invoice matching.

Precoro gives you full access to features like invoice management and matching capabilities that help prevent duplicate invoices.

Keep reading to learn:

What are duplicate invoices?

How duplicate invoices happen

Non-fraudulent causes of duplicate invoices

Fraudulent tactics of duplicate invoices

How invoice duplicates harm your finances

Steps to identify a duplicate invoice

How does AI help to detect duplicate invoices?

Why does ERP fail to detect duplicate invoices?

Steps to avoid duplicate invoice payments

Frequently asked questions about duplicate invoices

Duplicate invoices explained

Duplicate or double invoices are identical or near-identical copies of an original invoice, typically sharing core details such as the invoice number, date, and amount. They occur due to errors, such as system glitches, manual entry mistakes, or vendor resubmissions. However, duplicate invoices may also signal deliberate fraud, where slight variations like altered dates or descriptions are used to bypass controls and secure multiple payments for a single transaction.

How duplicate invoices happen

Duplicate invoices may seem like minor errors, but they can quickly add up, impacting both your operational costs and your vendor relationships. Let's break down the main scenarios of how duplicate invoices happen.

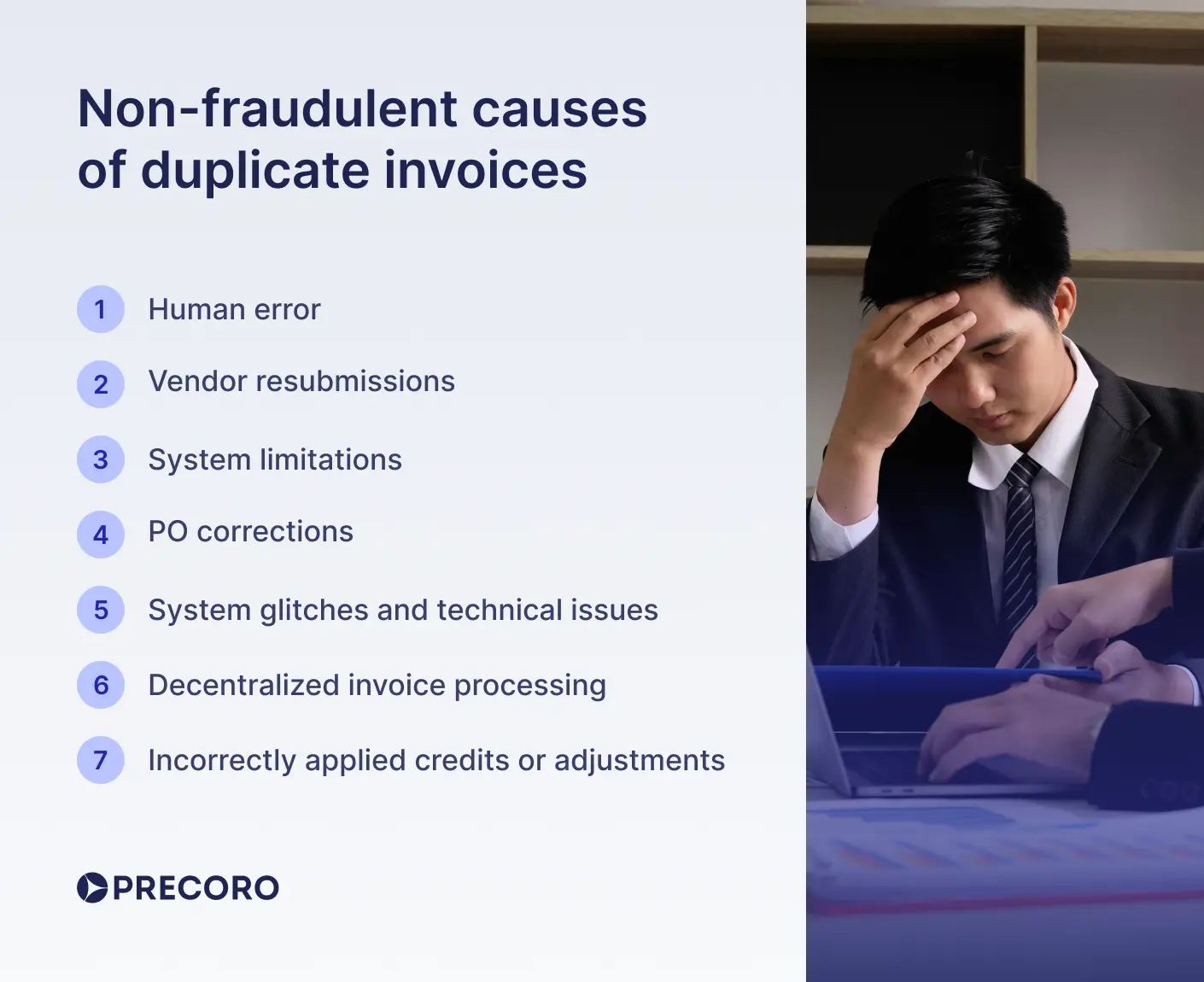

Non-fraudulent causes of duplicate invoices

When invoices double up, it's usually because of a simple data entry mistake or system error. Here's how it happens:

- Human error: High invoice volumes in manual workflows lead to accidental duplicates. AP workers might inadvertently enter the exact invoice details twice, especially if data entry is rushed or the records are unclear.

- Vendor resubmissions: Vendors may resend invoices if they have not received a receipt or payment confirmation or if the original invoice was misplaced or lost. Without a tracking system, both versions may be processed.

- System limitations: AP automation tools may miss double invoicing and near-duplicates if OCR misreads details. For example, it may mistake similar characters, such as "8" and "B."

- PO corrections: An invoice can be resubmitted with a revised purchase order number, while all other fields remain the same.

- System glitches and technical issues: Outdated duplicate payment software, integration errors, or network issues can cause duplicate invoice records within the accounting system.

- Decentralized invoice processing: When multiple departments handle invoices independently, the same invoice may be processed by different teams, each unaware of the other’s actions.

- Incorrectly applied credits or adjustments: If a credit note or adjustment is misapplied, the original invoice can be paid in full, even though a partial payment was intended.

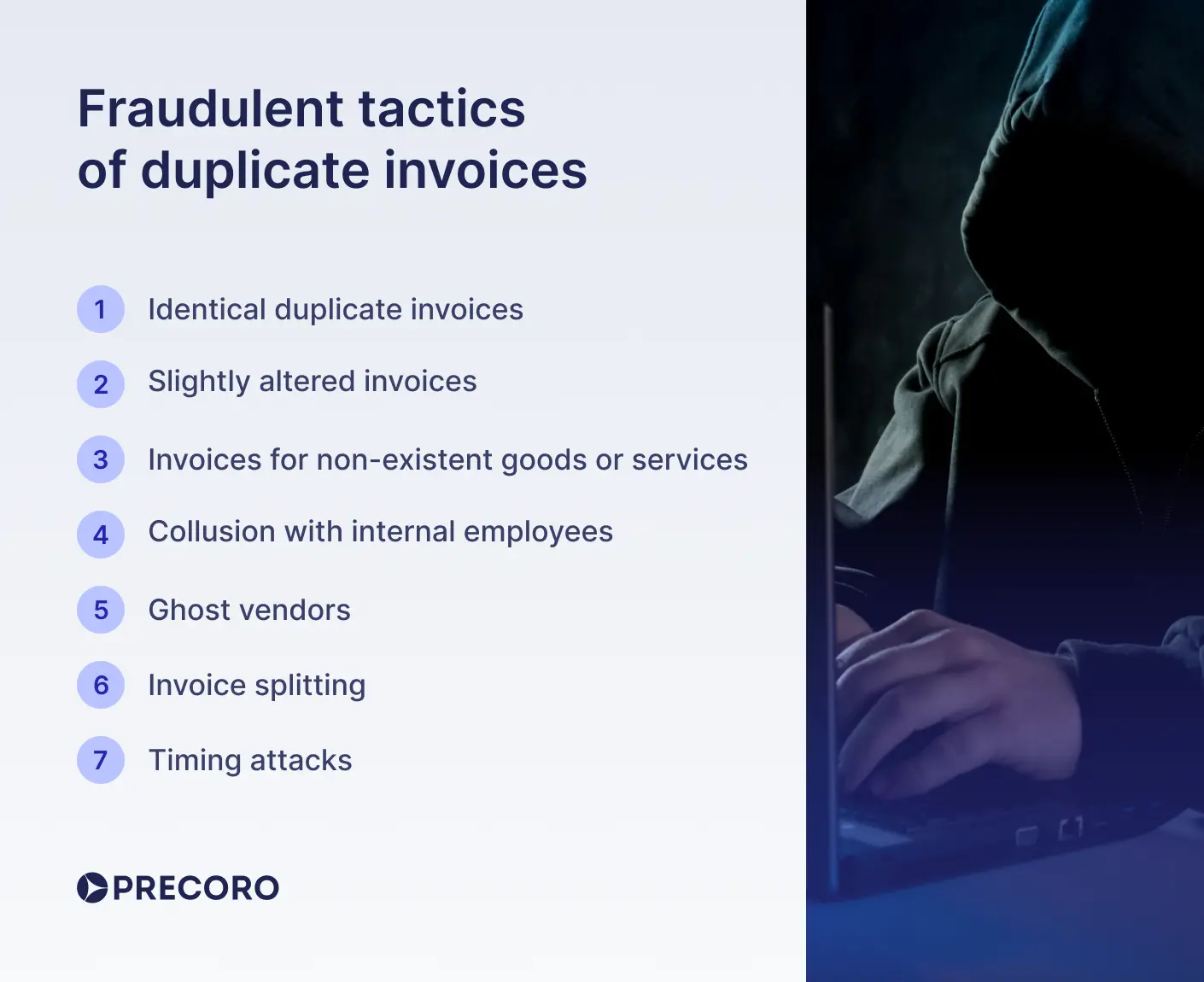

Fraudulent tactics of duplicate invoices

Unlike system or human error, fraudulent duplicates are intentional. They often rely on small changes or timing to bypass internal checks. Among the most common ways scammers craft fake duplicate invoices are the following:

- Identical duplicate invoices: A vendor might simply resubmit the exact same invoice, hoping it will be processed again.

- Slightly altered invoices: Fraudulent actors might change minor details on the invoice, such as the date, invoice number (with a slight variation), or even the amount, to make it appear as a new, distinct invoice.

- Invoices for non-existent goods or services: While not strictly a duplicate of a legitimate invoice, a fraudster might create entirely fictitious invoices that resemble genuine ones. They may even send multiple versions with slight variations to increase the chances of payment.

- Collusion with internal employees: In more complex scenarios, external vendors might collude with employees within the purchasing or accounts payable departments to approve and pay duplicate or fraudulent invoices.

- Ghost vendors: A fake vendor profile is created to submit false invoices under thresholds that don’t require multiple approvals.

- Invoice splitting: A high-value invoice is divided into smaller ones to sidestep higher approval requirements.

- Timing attacks: Fraudulent invoices are often submitted during high-volume periods, such as the month-end close when oversight is more likely to slip.

Unintentional or not, double invoices lead to overpayments and vendor confusion if not identified and addressed promptly.

How invoice duplicates harm your finances

Duplicate invoices can seriously harm your finances in multiple ways. Studies show that approximately 1% of all invoices are paid more than once. For small to midsize businesses (SMBs), this can mean about six duplicate invoices per month, each averaging $2,034, totaling up to $12,000 in potential monthly losses if not detected. For larger organizations, duplicate payments may account for 0.8–2% of total outgoing payments, which could translate to millions in wasted spend annually.

The impact goes beyond just direct financial loss. Duplicate payments strain cash flow, making it harder to meet other financial obligations and potentially forcing businesses to delay legitimate payments. They also waste time and resources, as accounts payable teams must identify, investigate, and resolve these errors, which leads to operational inefficiencies and backlogs.

Financial records become distorted, complicating expense tracking, budgeting, and profitability analysis and increasing the risk of failed audits and compliance issues. Additionally, duplicate invoices can open the door to fraud, as malicious actors may exploit weak controls to submit altered or fake invoices.

Vendor relationships can also suffer if duplicate payments cause delays or disputes, potentially damaging trust and long-term partnerships.

In summary, invoice duplicates drain cash, waste time, increase the risk of fraud, harm vendor relationships, and impact financial reporting. That's why the prevention of duplicate payments is crucial for any business.

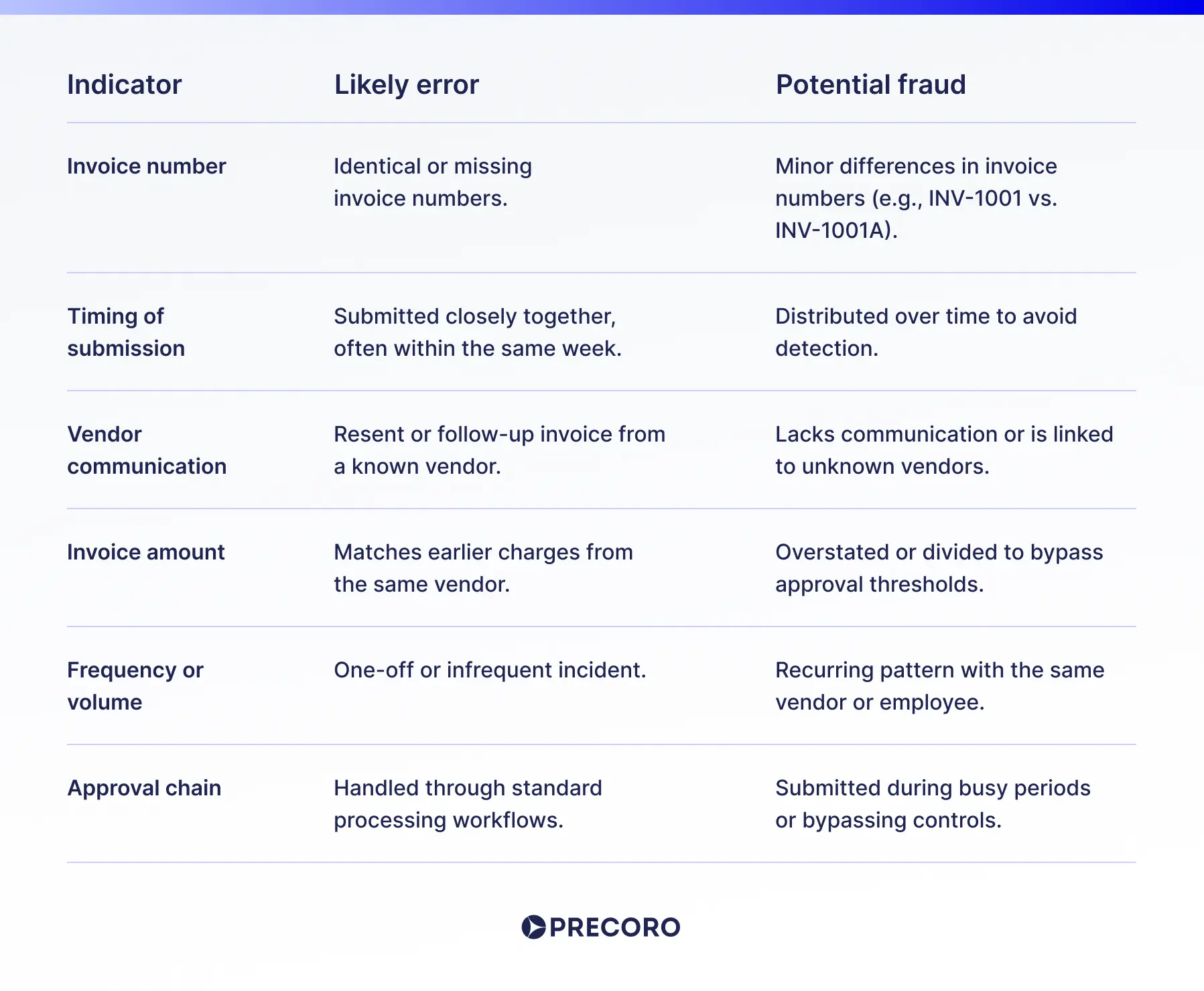

Duplicate invoice vs fraud invoices: How to spot the difference

Not all duplicate invoices are created equal—some are simple errors, and others are calculated moves. All the differences are explained below:

Note!

One hint alone doesn’t prove intent, but together, they flag records to examine.

Steps to identify a duplicate invoice

Catch duplicates before they hit your ledger: combine automated fuzzy matching, payment audits, and manual verification for foolproof detection.

1. Import and consolidate invoice data

Gather all invoice data from your accounting systems, ERP, or spreadsheets into a single dataset for analysis.

2. Standardize invoice numbers

Convert all invoice numbers to uppercase to catch case-sensitive duplicates (e.g., “inv123” vs. “INV123”).Strip out all special characters (like dashes, slashes, or spaces) from invoice numbers using regular expressions, so “INV-123” and “INV 123” become “INV123”.Trim leading and trailing spaces and replace multiple spaces within invoice numbers with a single space.

3. Normalize vendor names and dates

Standardize vendor names (e.g., remove abbreviations or extra spaces) and ensure all dates use the same format.

4. Identify exact duplicates

Sort your data by vendor, invoice number, and amount.Use your analysis tool (Excel, KNIME, SQL) to flag records where these fields match exactly.

5. Detect near-duplicates

Create a new column with just the invoice month (ignore the day) and check for invoices from the same vendor with the same amount and similar invoice numbers within that month.Use fuzzy matching algorithms to catch minor variations in invoice numbers (e.g., “INV1021” vs. “INV102I”).

6. Cross-check with payment records

Compare flagged invoices against payment records to confirm if any have already been paid.

7. Review and report

Manually review flagged invoices for supporting documents and discrepancies. Export a ranked list of potential duplicates for further investigation and resolution.

How does AI help to detect duplicate invoices?

AI-driven AP automation within the duplicate payment software detects duplicate invoices more quickly and accurately than traditional ERP systems. It scans invoice details, such as number, vendor, date, and amount, compares them to existing records, and identifies exact and near duplicates. The system also checks line items, catching duplicates even when invoice numbers are mistyped or vendors submit altered invoices.

Machine learning models train on historical data and spot subtle errors and fraud. These models improve over time and integrate with financial systems, providing real-time alerts and detailed reports.

AI also detects spending anomalies by analyzing trends in vendor payments. It helps catch double invoicing, especially from small or one-time vendors. By automating detection, AI reduces manual work, strengthens financial controls, and recovers at least 1% of lost spend due to fraud or mistakes.

Can your ERP spot duplicate invoices—and where does it fall short?

Typically, ERPs detect duplicate invoices based on checks on the invoice number, vendor name, date, and amount. However, this is not enough to detect duplicate invoices, and many such duplicates slip through the cracks.

Why does ERP fail to detect duplicate invoices?

ERPs alone can't entirely prevent spend leakage from duplicate invoices. They miss duplicates when vendors use different invoice numbers or manual errors occur during data entry. Here are the key reasons ERPs fail to detect duplicates:

Invoice number. A vendor system error can result in invoices with different numbers but identical amounts and items, which ERPs may miss. For example, ‘TNA9876’ and ‘TAN9876’ may be flagged as separate invoices, which can go unnoticed unless manually verified. Manual entry errors or multiple invoice sources without OCR automation compound this issue, leading to missed duplicates and potential overpayments.

Invoice line items. A vendor might send two invoices for the same transaction with different line items, either due to an error or as a reminder within 30 days. In such cases, the ERP may fail to detect the duplicate. For example, a vendor could send two invoices for a printer, one listing it as "EchoJet Pro X300" and the other as "Laser EchoJet Pro Printer."

Different vendor codes. A vendor may be set up with two different codes, increasing the risk of duplicate payments. For example, an invoice from the same vendor listed as "ABC Supplies" and "ABCSuppliers" could be booked and paid twice.

Invoice line item descriptions. Since ERPs and procurement automation tools don't digitize line item descriptions, duplicates may go undetected. For example, one invoice might list "Canon EOS 5D Mark IV," and the other "Canon Digital SLR Camera, Model T7," both referring to the same type of camera.

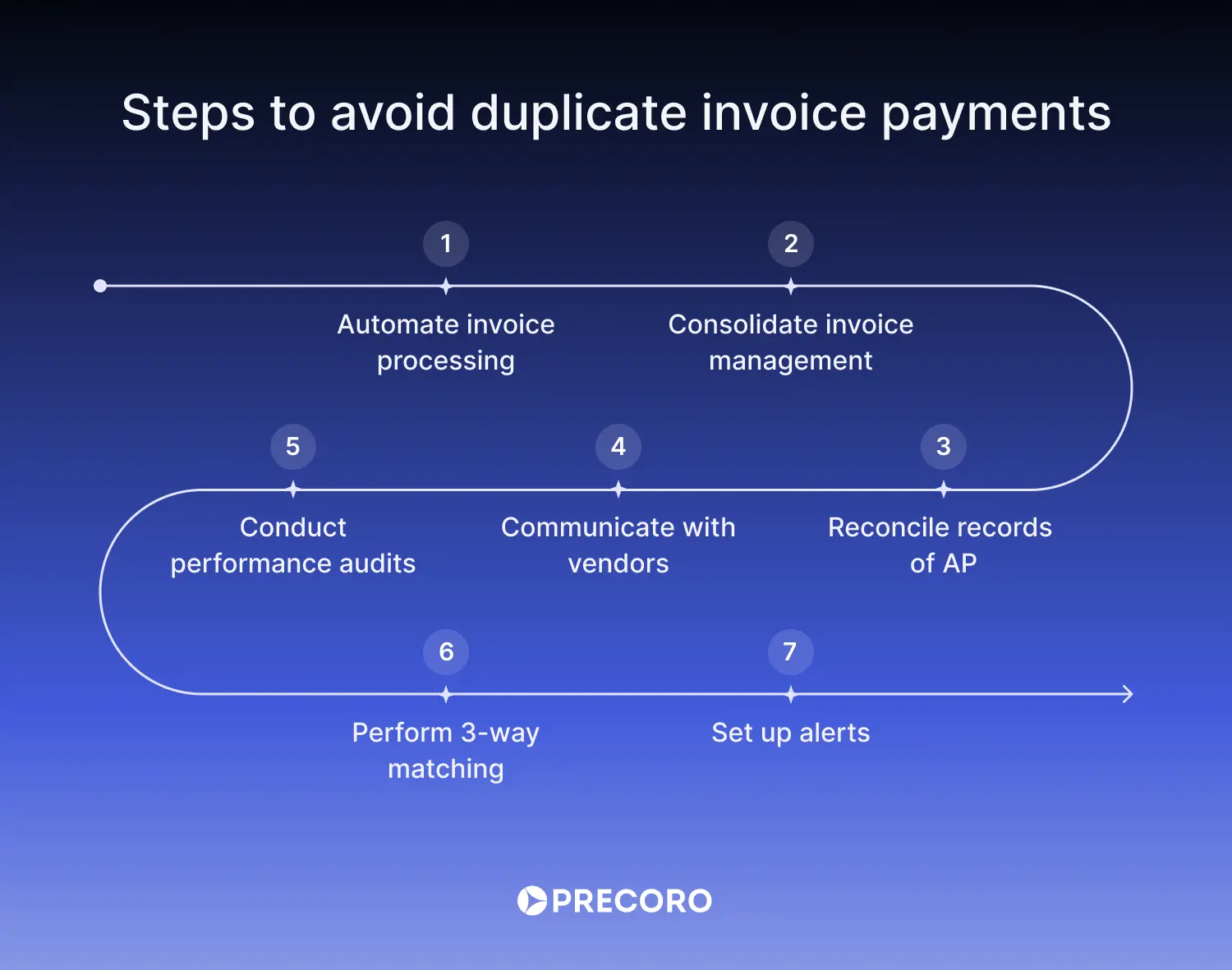

Steps to avoid duplicate invoice payments

Since you know the duplicate invoice meaning and its roots, now it's time to uncover steps that businesses can take to prevent them. Spoiler: It’s always a good idea to start with automation.

- Automate invoice processing to cut human error. Accounts payable software helps prevent duplicate payments early.

- Consolidate invoice management to centralize invoice reception to avoid duplicate payments from multiple sources.

- Reconcile records of accounts payable with vendor statements monthly to resolve duplicates quickly.

- Communicate with vendors and clearly explain invoice management to suppliers to avoid procurement confusion.

- Conduct performance audits for AP regularly to detect and correct duplicate invoice issues.

- Perform 3-way matching to verify invoices against purchase orders and receive reports before payment to detect duplicates quickly.

- Set up alerts to flag double invoicing by number, amount, or date for review and action.

Frequently asked questions about duplicate invoices

AP automation helps to prevent duplicate payments. It reduces human error, improves invoice cross-checking, and hardens protocols to catch duplicate payment attempts.

A repeating invoice, also known as a recurring invoice, charges clients for identical products or services on a fixed schedule (e.g., weekly, monthly, or annually). This type of invoice applies to ongoing services or product purchases.

Duplicate invoices (accidental) occur due to errors such as double entries, system glitches, or vendor oversights, costing small to medium-sized companies up to $12,000 per month in overpayments. Fraudulent invoices (deliberate) involve fake vendors, altered details, or intentional duplicates to steal funds, which can lead to legal and reputational harm.

You can automate duplicate invoice detection with the centralized accounting system. It can flag matching invoice numbers, amounts, or vendor details. Set custom rules to spot potential duplicates based on your company’s patterns. Explore advanced solutions with machine learning to catch subtle invoice variations that traditional systems might miss.

No. A duplicate invoice is an identical copy of a prior entry and must be flagged for review before any payment is issued.

Key takeaways

Duplicate invoices are bills submitted more than once for the same transaction. They can result from clerical mistakes (such as entering the same invoice twice) or from system errors that process a document multiple times. If not detected, duplicate invoices may cause overpayments, create tension with suppliers, and lead to inaccuracies in financial records.

To reduce these issues, businesses rely on accounts payable automation, clear communication with vendors, and standardized processes. Although duplicate invoices may still be legally valid, organizations must identify and resolve them to avoid unnecessary costs.

Prevent duplicate invoices with Precoro

Duplicate invoices stem from manual, slow, or fragmented accounts payable processes. Precoro prevents these errors by automating invoice handling, streamlining approvals, and integrating with your accounting systems.

Why Precoro?

- Automation: AI-powered OCR extracts invoice data, assigns GL codes, and cuts manual errors for clean records.

- Workflows: Automated routing with layered rules, reminders, and real-time tracking ensures fast and accurate approvals.

- Integration: Syncs with QuickBooks, Xero, NetSuite, and other platforms to prevent duplicate entries.

- Duplicate payment prevention: 3-way matching compares invoices to purchase orders (POs) and receipts, while filters and alerts flag duplicates by SKU, number, or amount.

- Status tracking: Clear statuses (such as 'Draft', 'Pending', 'Approved', 'Matching', 'Paid', etc.) provide complete visibility to catch issues early.